Home > Analyses > Energy > EOG Resources, Inc.

EOG Resources, Inc. powers the energy needs that fuel our modern world, shaping daily life through its exploration and production of oil and natural gas. As a dominant player in the U.S. energy sector, EOG is renowned for its operational efficiency and innovative techniques that maximize resource extraction, primarily in Texas and New Mexico. With a strong market presence and a prudent approach to reserves management, the key question now is whether EOG’s solid fundamentals support its current valuation and promise sustainable growth in a transitioning energy landscape.

Table of contents

Business Model & Company Overview

EOG Resources, Inc., founded in 1985 and headquartered in Houston, Texas, stands as a dominant player in the Oil & Gas Exploration & Production sector. The company’s core mission revolves around exploring, developing, producing, and marketing crude oil, natural gas, and natural gas liquids, creating a cohesive energy ecosystem across key producing regions in the US and Trinidad and Tobago. With 3,747 million barrels of oil equivalent in net proved reserves, EOG commands a robust presence in its industry.

EOG’s revenue engine balances upstream activities, leveraging its extensive reserves primarily in crude oil and natural gas liquids, to generate consistent cash flows. Its operations span strategic markets across the Americas, including Texas and New Mexico, and extend into Caribbean territories, reinforcing its global footprint. The company’s competitive advantage lies in its efficient resource base and market positioning, securing a significant economic moat in shaping the future of energy production.

Financial Performance & Fundamental Metrics

In this section, I analyze EOG Resources, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its overall financial health and stability.

Income Statement

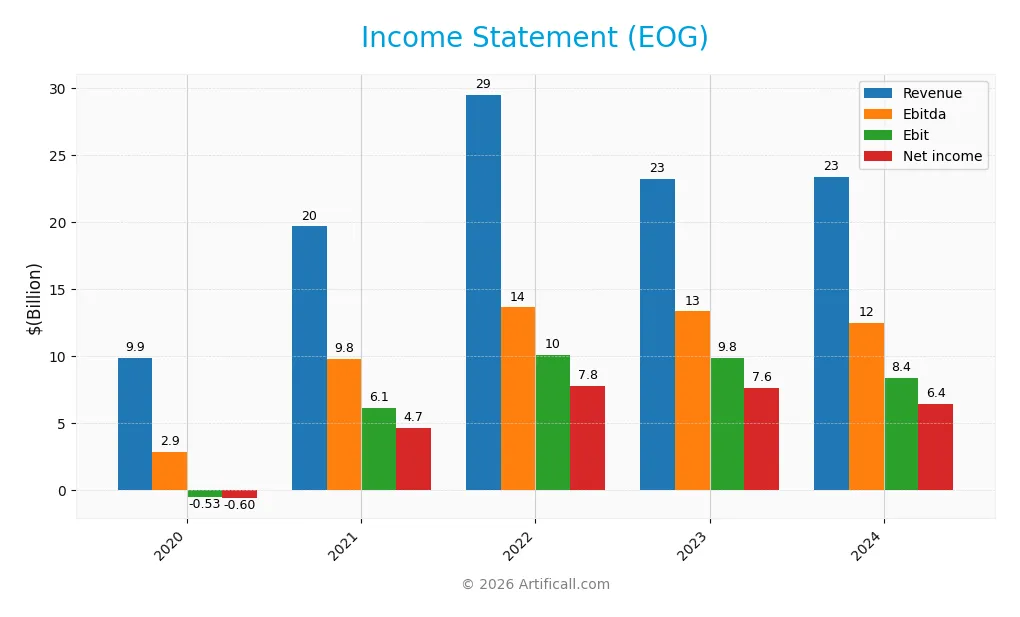

The following table summarizes EOG Resources, Inc.’s key income statement figures for the fiscal years 2020 through 2024, reflecting revenue, expenses, profits, and earnings per share.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 9.9B | 19.7B | 29.5B | 23.2B | 23.4B |

| Cost of Revenue | 4.9B | 5.3B | 4.9B | 4.9B | 5.7B |

| Operating Expenses | 5.5B | 8.2B | 14.7B | 8.6B | 9.6B |

| Gross Profit | 5.0B | 14.3B | 24.6B | 18.2B | 17.7B |

| EBITDA | 2.9B | 9.8B | 13.6B | 13.3B | 12.5B |

| EBIT | -534M | 6.1B | 10.1B | 9.8B | 8.4B |

| Interest Expense | 205M | 178M | 179M | 148M | 138M |

| Net Income | -605M | 4.7B | 7.8B | 7.6B | 6.4B |

| EPS | -1.04 | 8.03 | 13.31 | 13.07 | 11.31 |

| Filing Date | 2021-02-25 | 2022-02-24 | 2023-02-23 | 2024-02-22 | 2025-02-27 |

Income Statement Evolution

Between 2020 and 2024, EOG Resources, Inc. experienced strong overall growth, with revenue rising by 137% and net income surging over 1150%. However, the most recent year saw a slowdown, with revenue increasing only 0.85% and net income declining 16.4%. Margins remain robust despite this, with a gross margin of 75.7% and a net margin of 27.4%, though margin growth has recently weakened.

Is the Income Statement Favorable?

The 2024 income statement shows a mixed picture: solid revenue of $23.4B and a high net margin of 27.4% indicate sound fundamentals. Yet, profitability metrics declined year-over-year, including a 15% drop in EBIT and a 13.5% fall in EPS. Interest expenses remain low at 0.59% of revenue, supporting financial stability. Overall, the fundamentals lean favorable but with caution warranted due to recent margin and profit contraction.

Financial Ratios

The table below summarizes key financial ratios for EOG Resources, Inc. over recent fiscal years, providing insight into profitability, liquidity, leverage, and valuation metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | -6.1% | 23.7% | 26.3% | 32.8% | 27.4% |

| ROE | -3.0% | 21.0% | 31.3% | 27.0% | 21.8% |

| ROIC | -1.3% | 13.9% | 20.9% | 18.7% | 14.8% |

| P/E | -47.7 | 11.1 | 9.7 | 9.3 | 10.8 |

| P/B | 1.42 | 2.33 | 3.05 | 2.50 | 2.36 |

| Current Ratio | 1.69 | 2.12 | 1.90 | 2.44 | 2.10 |

| Quick Ratio | 1.51 | 1.98 | 1.71 | 2.13 | 1.91 |

| D/E | 0.33 | 0.27 | 0.24 | 0.15 | 0.17 |

| Debt-to-Assets | 18.9% | 15.4% | 14.4% | 9.5% | 10.7% |

| Interest Coverage | -2.7 | 34.3 | 55.7 | 64.9 | 58.6 |

| Asset Turnover | 0.28 | 0.51 | 0.71 | 0.53 | 0.50 |

| Fixed Asset Turnover | 0.35 | 0.69 | 1.00 | 0.72 | 0.68 |

| Dividend Yield | 2.8% | 5.2% | 6.8% | 4.8% | 3.0% |

Evolution of Financial Ratios

From 2020 to 2024, EOG Resources, Inc. showed a recovery in profitability with Return on Equity (ROE) rising from negative to 21.82% in 2024. The Current Ratio improved from 1.69 to 2.10, indicating stronger liquidity. The Debt-to-Equity Ratio decreased from 0.33 in 2020 to 0.17 in 2024, reflecting reduced leverage and enhanced financial stability.

Are the Financial Ratios Favorable?

In 2024, EOG’s profitability ratios such as net margin (27.39%) and ROE (21.82%) are favorable, supported by a strong interest coverage ratio of 60.55. Liquidity is robust with a current ratio of 2.1 and quick ratio of 1.91, while leverage remains low at a debt-to-equity of 0.17 and debt-to-assets of 10.74%. Efficiency ratios like asset turnover (0.5) and fixed asset turnover (0.68) are unfavorable. Overall, 78.57% of ratios are favorable, indicating a very favorable financial position.

Shareholder Return Policy

EOG Resources, Inc. maintains a dividend payout ratio around 33%, with a 2024 dividend per share of 3.69 USD and a yield near 3.0%. The company balances dividends with capital expenditures, supported by free cash flow coverage, while engaging in share buybacks to enhance shareholder value.

This distribution approach appears sustainable given EOG’s solid profitability and cash flow metrics, alongside prudent leverage levels. The combination of dividends and buybacks reflects a measured policy aiming to support long-term shareholder returns without risking financial flexibility.

Score analysis

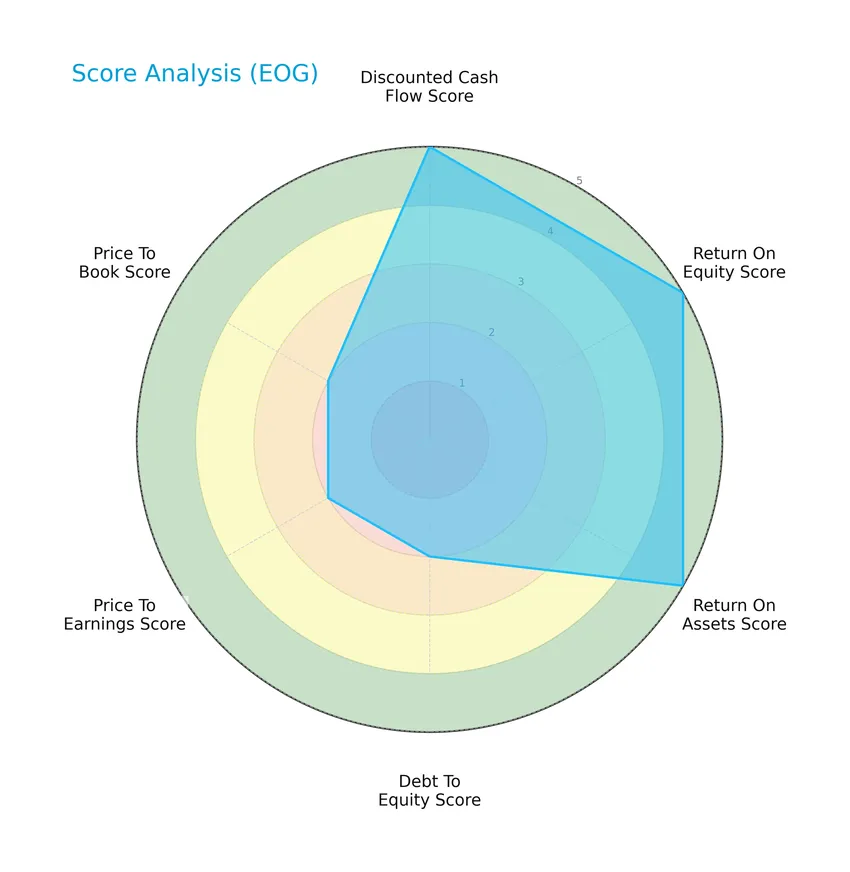

The following radar chart presents an overview of key financial scores for EOG Resources, Inc.:

EOG Resources shows very favorable scores in discounted cash flow, return on equity, and return on assets, each rated 5. However, debt to equity, price to earnings, and price to book scores are moderate at 2, indicating some caution in valuation and leverage metrics.

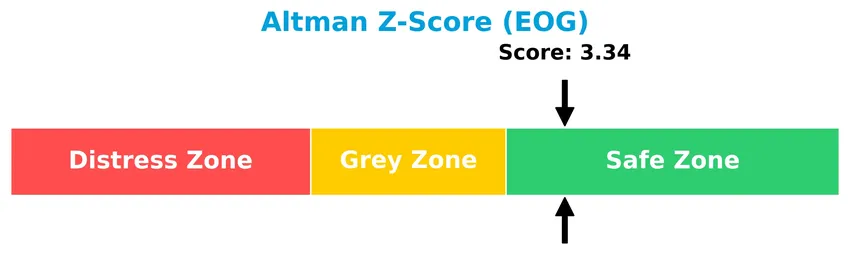

Analysis of the company’s bankruptcy risk

EOG Resources’ Altman Z-Score of 3.34 places it securely in the safe zone, indicating a low risk of bankruptcy based on its financial ratios:

Is the company in good financial health?

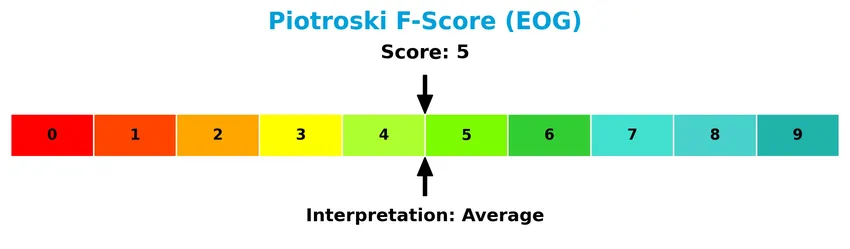

This Piotroski diagram illustrates the company’s financial health based on a score of 5:

With a Piotroski score of 5, EOG Resources is considered to have average financial strength, reflecting a balanced mix of positive and neutral financial indicators.

Competitive Landscape & Sector Positioning

This section provides an overview of the sector in which EOG Resources, Inc. operates, focusing on its strategic positioning and key business aspects. We will examine revenue breakdowns, main products, and principal competitors within the oil and gas exploration and production industry. The analysis aims to determine whether EOG Resources holds a competitive advantage over its peers.

Strategic Positioning

EOG Resources, Inc. maintains a concentrated strategic position focused on oil and natural gas exploration and production, with revenue predominantly from oil and condensate (over $13B in 2024). Geographically, it is heavily US-centric, generating approximately $23.4B in the United States and a modest $311M from Trinidad and Tobago in 2024.

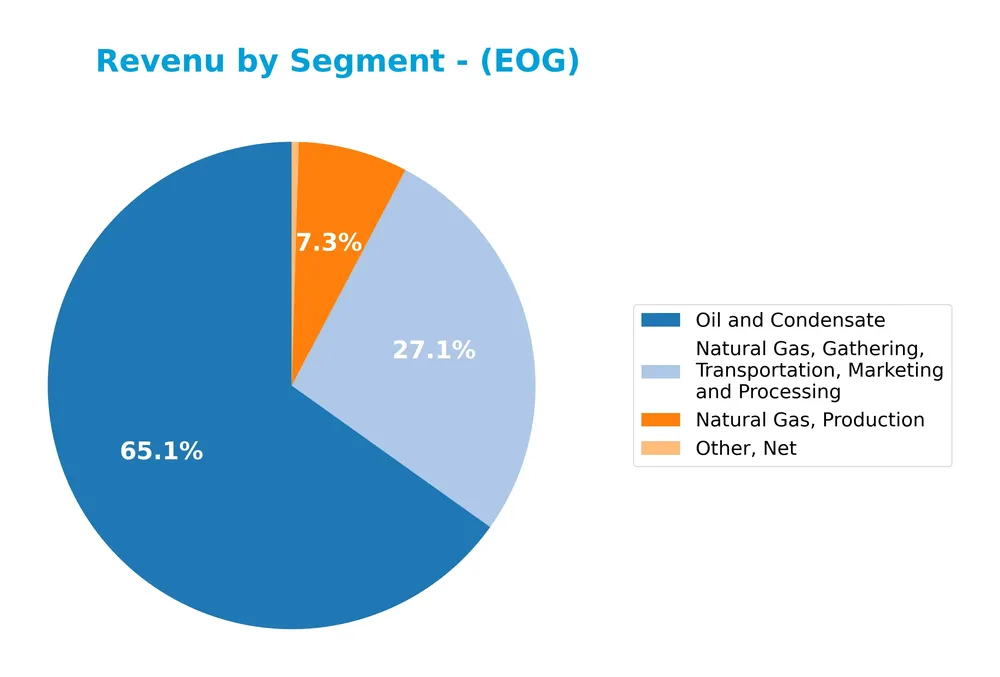

Revenue by Segment

The pie chart illustrates EOG Resources, Inc.’s revenue breakdown by segment for the fiscal year 2024, highlighting contributions from oil, natural gas, and other sources.

In 2024, Oil and Condensate remained the primary revenue driver with $13.9B, followed by Natural Gas Gathering, Transportation, Marketing and Processing at $5.8B. Natural Gas Production contributed $1.55B, while Other, Net accounted for $100M. Compared to prior years, oil revenue showed slight growth, whereas natural gas segments remained stable, indicating a consistent but concentrated revenue base primarily dependent on oil production.

Key Products & Brands

The following table presents EOG Resources, Inc.’s main products and business segments with their descriptions:

| Product | Description |

|---|---|

| Oil and Condensate | Crude oil and condensate production and marketing, the largest revenue segment in 2024 at $13.9B. |

| Natural Gas Production | Extraction and sale of natural gas, generating $1.55B in revenue for 2024. |

| Natural Gas, Gathering, Transportation, Marketing and Processing | Midstream services related to natural gas, including gathering, transportation, and processing, with $5.8B revenue in 2024. |

| Natural Gas Liquids | Production and sale of natural gas liquids, reported separately in prior years but not specified for 2024. |

| Other, Net | Miscellaneous net revenues from other activities, totaling $100M in 2024. |

EOG Resources primarily focuses on oil and condensate production, followed by significant revenues from natural gas and related midstream operations. The company’s portfolio reflects its integrated approach to oil and gas exploration, production, and marketing.

Main Competitors

There are 10 main competitors in the Oil & Gas Exploration & Production industry; below are the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| ConocoPhillips | 120.5B |

| EOG Resources, Inc. | 58.8B |

| Diamondback Energy, Inc. | 44.3B |

| Occidental Petroleum Corporation | 41.8B |

| EQT Corporation | 33.4B |

| Expand Energy Corporation | 26.1B |

| Devon Energy Corporation | 24.2B |

| Texas Pacific Land Corporation | 20.5B |

| Coterra Energy Inc. | 20.3B |

| APA Corporation | 9.0B |

EOG Resources, Inc. ranks second among its peers with a market cap at 49.1% of the leader, ConocoPhillips. It stands above both the average market cap of the top 10 competitors (approximately 39.9B) and the sector median near 29.8B. The company exhibits a significant 103.68% market cap gap above its closest competitor, highlighting its strong positioning in the sector.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does EOG have a competitive advantage?

EOG Resources, Inc. presents a competitive advantage demonstrated by a very favorable economic moat, with a ROIC exceeding WACC by approximately 8.8% and a strong upward ROIC trend of over 1200%, indicating increasing profitability and value creation. The company maintains a high gross margin of 75.7%, an EBIT margin of 35.74%, and a net margin of 27.39%, all favorable and reflecting operational efficiency in the oil and gas exploration and production sector.

Looking ahead, EOG’s principal producing areas in the United States and Trinidad and Tobago provide a solid base, with potential growth opportunities tied to sustained demand for crude oil, natural gas, and natural gas liquids. The company’s large proved reserves totaling nearly 3.75B barrels of oil equivalent support future production capabilities, positioning it to capitalize on market opportunities in these established geographic regions.

SWOT Analysis

This SWOT analysis highlights the key internal and external factors affecting EOG Resources, Inc. to guide informed investment decisions.

Strengths

- strong profitability with a 27.39% net margin

- low leverage and strong interest coverage

- durable competitive advantage with growing ROIC

Weaknesses

- recent 1-year decline in revenue and profit growth

- unfavorable asset turnover ratios

- moderate Piotroski score indicating average financial strength

Opportunities

- expanding U.S. production base

- increasing global energy demand

- potential to improve operational efficiency

Threats

- volatile oil and gas prices

- regulatory and environmental risks

- geopolitical uncertainties in key markets

Overall, EOG Resources demonstrates solid financial health and competitive positioning but faces short-term growth pressures and sector-specific risks. Strategic focus on efficiency gains and risk mitigation will be critical to sustain value creation.

Stock Price Action Analysis

The weekly stock price chart of EOG Resources, Inc. over the past 12 months shows fluctuations between key support and resistance levels:

Trend Analysis

Over the past 12 months, EOG’s stock price declined by 6.69%, indicating a bearish trend. The downward move accelerated, with volatility measured by a standard deviation of 9.05. The price ranged from a high of 136.58 to a low of 101.93, confirming notable price swings within this period.

Volume Analysis

Trading volume over the last three months has been increasing, with buyer volume slightly surpassing seller volume at 51.37%. This neutral buyer behavior suggests balanced market participation with no clear dominance, reflecting cautious investor sentiment amid recent price dynamics.

Target Prices

Analysts present a clear target price consensus for EOG Resources, Inc., reflecting moderate optimism.

| Target High | Target Low | Consensus |

|---|---|---|

| 170 | 123 | 137.33 |

The target prices suggest analysts expect EOG’s stock to trade between $123 and $170, with a consensus around $137, indicating potential upside from current levels.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines recent analyst ratings and consumer feedback regarding EOG Resources, Inc. to gauge market sentiment.

Stock Grades

Here is the latest summary of EOG Resources, Inc. stock ratings from reputable financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Equal Weight | 2026-01-23 |

| Barclays | Maintain | Equal Weight | 2026-01-21 |

| Keybanc | Downgrade | Sector Weight | 2026-01-16 |

| RBC Capital | Maintain | Outperform | 2026-01-13 |

| Bernstein | Maintain | Market Perform | 2026-01-05 |

| Citigroup | Maintain | Neutral | 2025-12-17 |

| UBS | Maintain | Buy | 2025-12-12 |

| Mizuho | Maintain | Neutral | 2025-12-12 |

| Piper Sandler | Maintain | Neutral | 2025-11-18 |

| Wells Fargo | Maintain | Overweight | 2025-11-11 |

The grades mostly indicate a hold or neutral stance with some buy and outperform ratings, reflecting cautious optimism. Recent adjustments include a slight downgrade by Keybanc, suggesting some divergence in outlook among analysts.

Consumer Opinions

Consumers express a mixed but generally positive sentiment towards EOG Resources, Inc., reflecting confidence in its operational capabilities while noting areas for improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| Efficient production and strong energy output. | Concerns about environmental impact and sustainability. |

| Reliable dividend payments and investor returns. | Volatility in stock price due to commodity fluctuations. |

| Transparent communication and good customer service. | Limited diversification beyond oil and gas sectors. |

Overall, consumers appreciate EOG’s efficiency and reliable returns but remain cautious about environmental issues and market volatility, indicating a need for increased sustainability efforts and strategic diversification.

Risk Analysis

Below is a table summarizing the key risks faced by EOG Resources, Inc., including likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Commodity Price Risk | Fluctuations in crude oil and natural gas prices can significantly affect revenues. | High | High |

| Regulatory Risk | Changes in environmental laws or drilling regulations could increase compliance costs. | Medium | Medium |

| Operational Risk | Challenges in exploration and production, including accidents or technical failures. | Medium | High |

| Market Demand Risk | Shifts in global energy demand, especially due to renewable alternatives, may reduce sales. | Medium | Medium |

| Geopolitical Risk | Political instability in producing regions like Trinidad and Tobago could disrupt supply. | Low | Medium |

| Financial Risk | Moderate debt-to-equity ratio and exposure to interest rate changes may affect financials. | Low | Medium |

EOG’s most critical risks come from commodity price volatility and operational challenges, both carrying high impact. Despite a strong Altman Z-score (3.34, safe zone) and favorable financial ratios, investors should monitor oil price trends and production efficiency closely.

Should You Buy EOG Resources, Inc.?

EOG Resources, Inc. appears to be delivering robust profitability with a durable competitive moat evidenced by a growing ROIC and value creation above WACC. Despite moderate leverage indicators, its overall rating of A- suggests a very favorable financial profile.

Strength & Efficiency Pillars

EOG Resources, Inc. stands out as a robust value creator, evidenced by a return on invested capital (ROIC) of 14.75% comfortably exceeding its weighted average cost of capital (WACC) at 5.96%. The company boasts strong profitability metrics, including a net margin of 27.39% and a return on equity (ROE) of 21.82%, underscoring efficient capital utilization. Financial health indicators reinforce this strength: an Altman Z-score of 3.34 places EOG in the safe zone, and a Piotroski score of 5 suggests moderate financial stability. These metrics collectively affirm EOG’s durable competitive advantage and operational efficiency.

Weaknesses and Drawbacks

Despite these strengths, EOG faces several challenges. Its asset turnover ratios are unfavorable (asset turnover at 0.5 and fixed asset turnover at 0.68), indicating potential inefficiencies in asset utilization. The valuation multiples present a moderate risk: a price-to-earnings (P/E) ratio of 10.84 is reasonable but requires monitoring, while the price-to-book (P/B) ratio of 2.36 is neutral, suggesting limited margin for valuation expansion. Additionally, the recent overall bearish stock trend with a 6.69% price decline and nearly balanced buyer-seller volumes highlight ongoing market pressure that could weigh on near-term performance.

Our Verdict about EOG Resources, Inc.

EOG Resources, Inc. presents a fundamentally favorable long-term profile, supported by strong profitability and value creation indicators. However, the recent bearish trend and moderate valuation metrics suggest caution. Despite long-term strength, recent market dynamics might encourage investors to adopt a wait-and-see approach for a better entry point, as the current environment could impose short-term volatility and uncertainty.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- EOG Resources, Inc. $EOG Shares Bought by TrueMark Investments LLC – MarketBeat (Jan 24, 2026)

- KeyBanc downgrades EOG Resources (EOG) to sector weight, RBC Capital lowers PT – MSN (Jan 24, 2026)

- Scotiabank Lowers EOG Resources (EOG) PT to $123, Cites Stable Production, Sector-Wide Adjustments – Yahoo! Finance Canada (Jan 23, 2026)

- Teacher Retirement System of Texas Has $23.40 Million Stock Position in EOG Resources, Inc. $EOG – MarketBeat (Jan 24, 2026)

- EOG Resources’ Q4 2025 Earnings: What to Expect – Barchart.com (Jan 21, 2026)

For more information about EOG Resources, Inc., please visit the official website: eogresources.com