Home > Analyses > Utilities > Entergy Corporation

Entergy Corporation powers millions of homes and businesses across the southern United States, shaping daily life through reliable electricity delivery. As a key player in the regulated electric industry, Entergy operates a diverse portfolio of generation assets, including nuclear, gas, coal, hydro, and solar power, supporting 3 million utility customers. Renowned for its innovation and commitment to sustainability, the company balances traditional and renewable energy sources. The question now is whether Entergy’s solid fundamentals and strategic positioning continue to justify its current market valuation and growth prospects.

Table of contents

Business Model & Company Overview

Entergy Corporation, founded in 1913 and headquartered in New Orleans, Louisiana, stands as a dominant player in the regulated electric industry. Its core mission revolves around producing and distributing electricity through a comprehensive ecosystem that spans gas, nuclear, coal, hydro, and solar power sources. Serving 3M utility customers across Arkansas, Louisiana, Mississippi, and Texas, Entergy integrates utility operations with wholesale power generation, including ownership of nuclear and non-nuclear plants totaling about 26,000 MW capacity.

The company’s revenue engine balances regulated utility services with wholesale commodity sales, creating steady cash flow from retail electricity distribution and power plant operations. Entergy’s strategic footprint in the U.S. South supports its stable market position, with utility and wholesale segments driving value through diverse energy sources. Its economic moat is reinforced by regulated market access and a broad generation portfolio, positioning it as a key influencer in shaping the future of regional power infrastructure.

Financial Performance & Fundamental Metrics

In this section, I analyze Entergy Corporation’s income statement, key financial ratios, and dividend payout policy to assess its financial health and investment appeal.

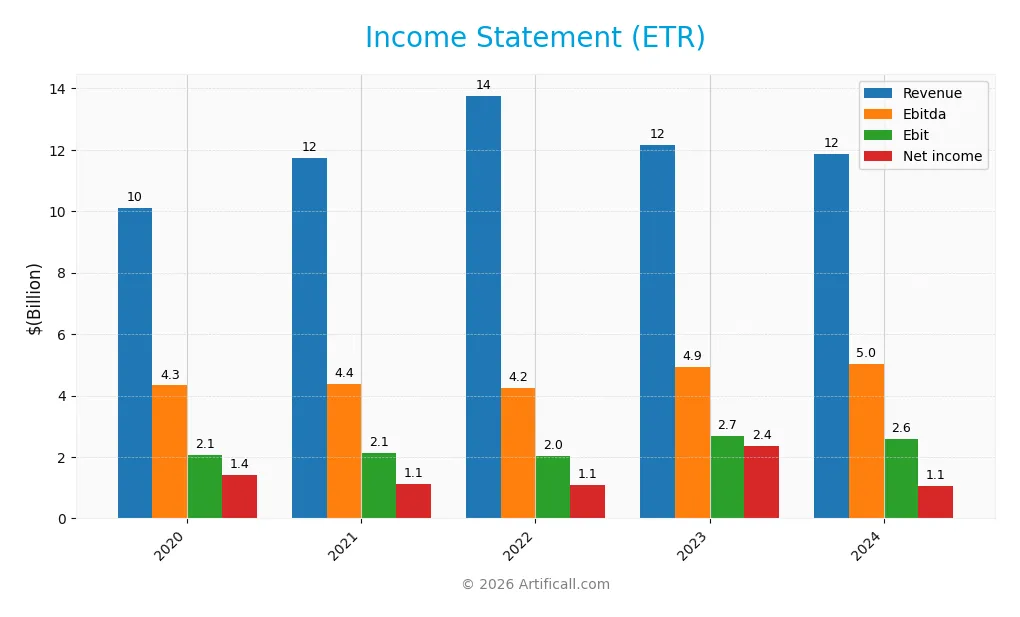

Income Statement

The table below presents Entergy Corporation’s key income statement figures for the fiscal years 2020 through 2024, reported in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 10.1B | 11.7B | 13.8B | 12.1B | 11.9B |

| Cost of Revenue | 5.7B | 6.9B | 8.5B | 6.8B | 6.1B |

| Operating Expenses | 2.7B | 3.0B | 3.2B | 2.7B | 3.1B |

| Gross Profit | 4.5B | 4.9B | 5.3B | 5.3B | 5.7B |

| EBITDA | 4.3B | 4.4B | 4.2B | 4.9B | 5.0B |

| EBIT | 2.1B | 2.1B | 2.0B | 2.7B | 2.6B |

| Interest Expense | 786M | 835M | 988M | 1.0B | 1.2B |

| Net Income | 1.4B | 1.1B | 1.1B | 2.4B | 1.1B |

| EPS | 3.47 | 2.79 | 2.7 | 5.57 | 2.47 |

| Filing Date | 2021-02-26 | 2022-02-25 | 2023-02-24 | 2024-02-23 | 2025-02-18 |

Income Statement Evolution

Entergy Corporation’s revenue showed a 17.46% increase over the 2020-2024 period but declined by 2.2% in the most recent year, reflecting a slowdown. Gross profit improved by 7.67% last year with a stable gross margin at 48.3%, while EBIT and net income margins deteriorated, with EBIT margin favorable at 21.83% but net margin falling 54.07% year-on-year.

Is the Income Statement Favorable?

In 2024, Entergy reported $11.88B in revenue and $1.06B net income, with net margin at 8.93%, which remains favorable despite a sharp decline from 2023. Operating expenses and interest costs weighed on profitability, contributing to a 3.18% EBIT decline. The fundamentals reflect challenges in sustaining net income growth, leading to an overall unfavorable income statement assessment.

Financial Ratios

The table below presents key financial ratios for Entergy Corporation (ETR) over the fiscal years 2020 to 2024, offering a snapshot of profitability, liquidity, leverage, and market valuation:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 13.9% | 9.53% | 7.97% | 19.4% | 8.93% |

| ROE | 12.9% | 9.61% | 8.44% | 16.1% | 7.02% |

| ROIC | 3.28% | 2.84% | 3.70% | 4.63% | 3.20% |

| P/E | 14.2 | 20.2 | 21.0 | 9.06 | 30.6 |

| P/B | 1.83 | 1.95 | 1.77 | 1.46 | 2.14 |

| Current Ratio | 0.65 | 0.59 | 0.64 | 0.57 | 0.72 |

| Quick Ratio | 0.49 | 0.39 | 0.43 | 0.32 | 0.43 |

| D/E | 2.20 | 2.33 | 2.06 | 1.79 | 1.91 |

| Debt-to-Assets | 41.2% | 45.6% | 45.6% | 44.0% | 44.6% |

| Interest Coverage | 2.25 | 2.21 | 2.08 | 2.60 | 2.30 |

| Asset Turnover | 0.17 | 0.20 | 0.23 | 0.20 | 0.18 |

| Fixed Asset Turnover | 0.26 | 0.28 | 0.32 | 0.27 | 0.25 |

| Dividend Yield | 3.84% | 3.50% | 3.74% | 4.37% | 3.08% |

Evolution of Financial Ratios

Entergy Corporation’s Return on Equity (ROE) declined from 16.1% in 2023 to 7.0% in 2024, indicating a slowdown in profitability. The Current Ratio improved slightly to 0.72 in 2024 from 0.57 in 2023 but remains below the standard threshold of 1. The Debt-to-Equity Ratio increased to 1.91 in 2024, reflecting a higher leverage level compared to previous years. Profitability margins showed mixed trends, with net margins falling to 8.9%.

Are the Financial Ratios Favorable?

In 2024, Entergy exhibits an overall unfavorable financial ratio profile. Profitability ratios such as ROE (7.0%) and Return on Invested Capital (3.2%) are deemed unfavorable, while net margin (8.9%) is neutral. Liquidity ratios, including Current Ratio (0.72) and Quick Ratio (0.43), are also unfavorable, signaling tight short-term financial flexibility. Leverage remains high with a Debt-to-Equity of 1.91, classified as unfavorable. However, dividend yield at 3.08% and the Weighted Average Cost of Capital (WACC) at 5.51% are favorable, though the majority of ratios suggest caution.

Shareholder Return Policy

Entergy Corporation pays consistent dividends, with a payout ratio nearing 94% in 2024 and a dividend yield around 3.1%. Dividend coverage by free cash flow is weak, as free cash flow remains negative, indicating potential sustainability risks. The company does not engage in share buybacks.

This high payout ratio amid negative free cash flow suggests pressure on cash resources, which may challenge long-term dividend stability. While the policy provides steady income, the lack of buybacks and weak cash flow coverage call for cautious monitoring regarding sustainable shareholder value creation.

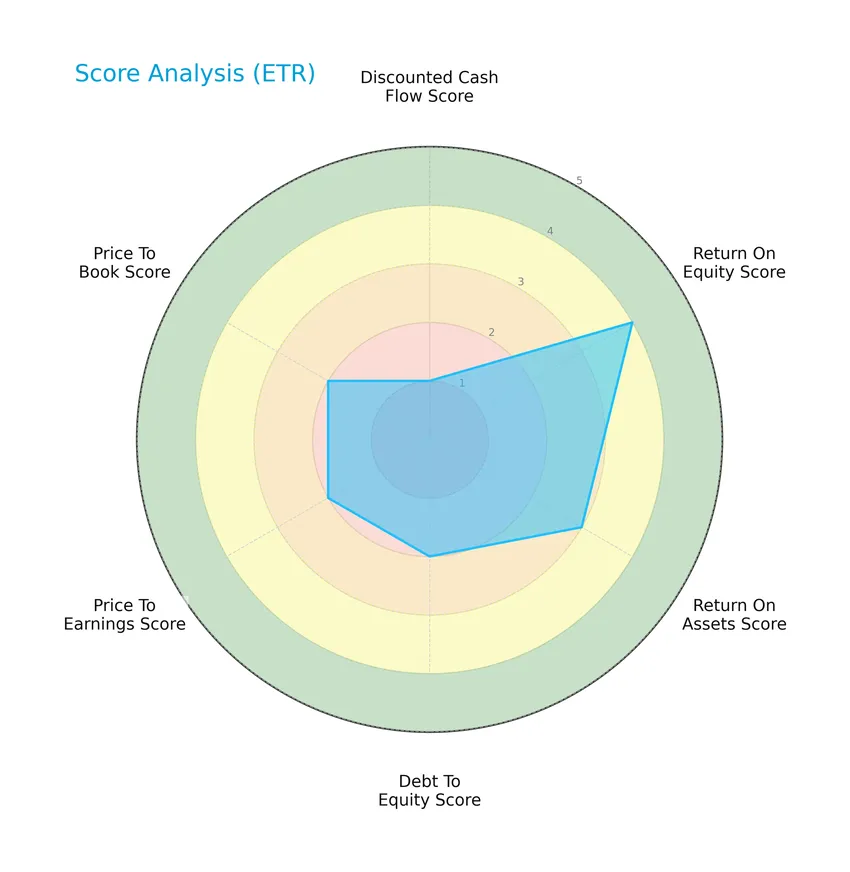

Score analysis

The radar chart below visually presents Entergy Corporation’s key financial scores across several important valuation and performance metrics:

The scores reveal a mixed financial profile with a very unfavorable discounted cash flow score of 1, but a favorable return on equity at 4. Return on assets, debt to equity, price to earnings, and price to book ratios all sit at moderate levels, suggesting balanced financial conditions.

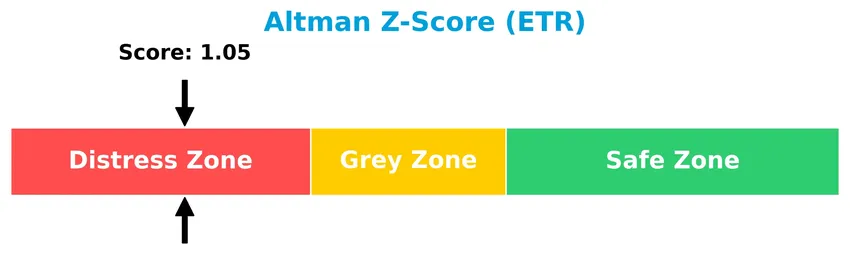

Analysis of the company’s bankruptcy risk

Entergy Corporation’s Altman Z-Score places the company in the distress zone, indicating a high risk of financial distress and potential bankruptcy:

Is the company in good financial health?

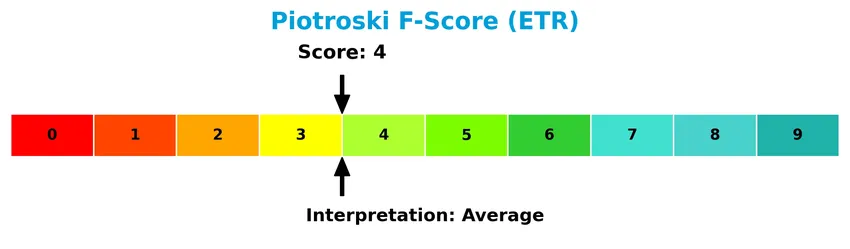

The following Piotroski diagram illustrates Entergy Corporation’s financial health based on nine criteria:

With a Piotroski score of 4, the company is in an average financial condition, showing neither strong nor weak fundamentals according to this measure.

Competitive Landscape & Sector Positioning

This sector analysis will explore Entergy Corporation’s strategic positioning, revenue segments, key products, main competitors, and competitive advantages. I will also assess whether Entergy holds a competitive edge over its industry peers.

Strategic Positioning

Entergy Corporation maintains a concentrated geographic focus on the US South, serving 3M utility customers across Arkansas, Louisiana, Mississippi, and Texas. Its diversified energy portfolio spans nuclear, gas, coal, hydro, and solar power, with revenue mainly from regulated electricity and natural gas distribution.

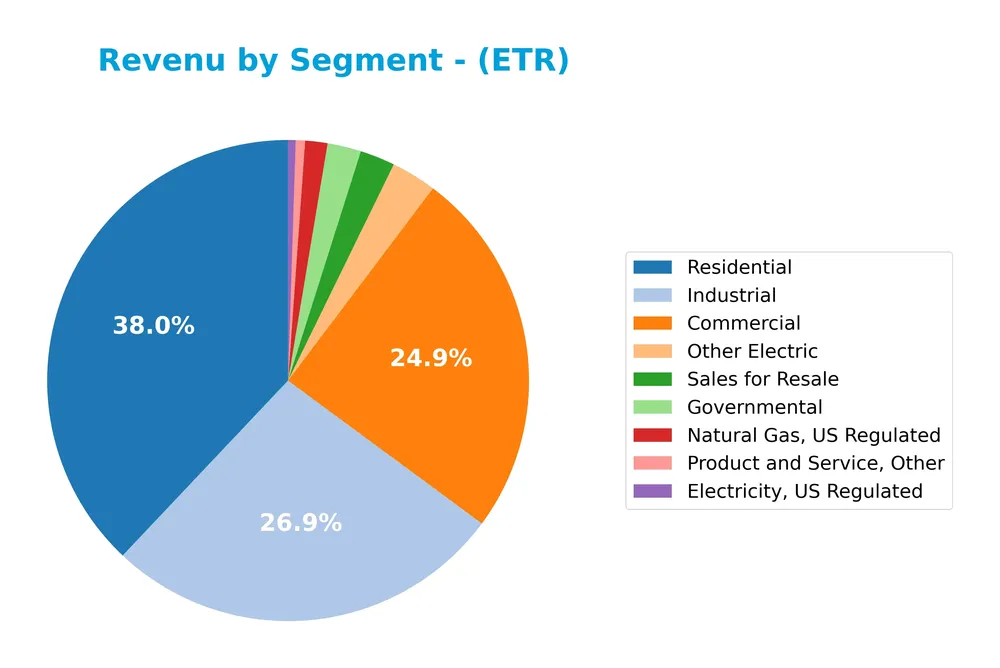

Revenue by Segment

This pie chart illustrates Entergy Corporation’s revenue distribution by segment for the fiscal year 2024, showing the contribution of each business area to the total income.

In 2024, Residential and Industrial segments are the primary revenue drivers, generating approximately 4.5B and 3.2B respectively. The Commercial segment also contributes significantly with about 3B. Smaller segments like Governmental and Other Electric add modest portions, while Sales for Resale and regulated natural gas revenues are less prominent. The recent year shows a slight concentration in Residential and Industrial revenues, indicating stable demand but a potential risk if these segments face market changes.

Key Products & Brands

The table below outlines Entergy Corporation’s key products and brands with their descriptions:

| Product | Description |

|---|---|

| Utility Segment | Generates, transmits, distributes, and sells electric power and natural gas in parts of Arkansas, Louisiana, Mississippi, and Texas, including New Orleans. |

| Entergy Wholesale Commodities | Owns, operates, and decommissions nuclear power plants; holds interests in non-nuclear plants selling power wholesale; provides services to other nuclear plant owners. |

| Electric Power Generation | Produces electricity via gas, nuclear, coal, hydro, and solar power sources with a total generating capacity of ~26,000 MW, including 6,000 MW nuclear. |

| Electricity Sales to Various Customers | Sells energy to retail power providers, utilities, electric co-operatives, power trading organizations, and other power generation firms. |

| Commercial Electricity Sales | Provides electric power to commercial customers, generating $2.95B in revenue in 2024. |

| Residential Electricity Sales | Supplies electricity to residential customers, generating $4.51B in revenue in 2024. |

| Industrial Electricity Sales | Serves industrial clients with electric power, generating $3.20B in revenue in 2024. |

| Governmental Electricity Sales | Provides electricity to governmental entities, generating $268M in revenue in 2024. |

| Natural Gas Distribution | Distributes natural gas in regulated U.S. markets, generating $178M in revenue in 2024. |

| Sales for Resale | Sells electricity in bulk for resale, generating $279M in revenue in 2024. |

Entergy’s product portfolio centers on regulated electricity and natural gas distribution through its Utility and Wholesale Commodities segments, serving diverse customer bases including residential, commercial, industrial, and governmental clients.

Main Competitors

Entergy Corporation faces competition from 23 companies in its sector, with the table below listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| NextEra Energy, Inc. | 169B |

| The Southern Company | 96B |

| Duke Energy Corporation | 91B |

| American Electric Power Company, Inc. | 62B |

| Dominion Energy, Inc. | 51B |

| Exelon Corporation | 44B |

| Xcel Energy Inc. | 44B |

| Entergy Corporation | 42B |

| Public Service Enterprise Group Incorporated | 40B |

| Consolidated Edison, Inc. | 36B |

Entergy Corporation ranks 8th among its 23 competitors, with a market cap roughly 25% that of the leader, NextEra Energy. The company’s capitalization is below the average market cap of the top 10 competitors (67.5B) but remains above the sector median of 34B. It maintains a 6.12% market cap gap above its closest competitor, highlighting a moderate competitive buffer.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does Entergy Corporation have a competitive advantage?

Entergy Corporation does not currently present a competitive advantage, as it is shedding value with a ROIC below its WACC and a declining profitability trend, indicating value destruction. The company’s global moat status is very unfavorable, reflecting challenges in efficiently using invested capital.

Looking ahead, Entergy operates in regulated electric markets across four states and generates power from diverse sources including nuclear and renewable energy. Future opportunities may arise from expanding its electric generating capacity of approximately 26,000 MW and leveraging its presence in wholesale and utility segments.

SWOT Analysis

This SWOT analysis highlights Entergy Corporation’s current strategic position by identifying internal strengths and weaknesses alongside external opportunities and threats.

Strengths

- diversified energy mix including nuclear and renewables

- stable dividend yield at 3.08%

- established regional utility with 3M customers

Weaknesses

- declining profitability and ROIC below WACC

- high debt to equity ratio of 1.91

- weak liquidity ratios (current ratio 0.72)

Opportunities

- growing demand for clean and renewable energy

- expansion in wholesale power markets

- regulatory support for infrastructure upgrades

Threats

- regulatory and environmental compliance risks

- volatility in energy prices

- competition from alternative energy providers

Entergy’s strengths lie in its diversified generation portfolio and steady dividend, but its deteriorating profitability and financial leverage are concerns. The company should focus on leveraging renewable growth opportunities while managing regulatory and financial risks to stabilize and enhance shareholder value.

Stock Price Action Analysis

The weekly stock chart below illustrates Entergy Corporation’s price movements over the last 12 months, highlighting key highs and lows as well as recent fluctuations:

Trend Analysis

Over the past 12 months, Entergy Corporation’s stock price increased by 85.49%, indicating a clear bullish trend. The highest price reached was 97.52, and the lowest was 50.24. However, the recent trend from November 2025 to January 2026 shows a -4.12% decline, signaling a short-term bearish trend with deceleration and reduced volatility (std deviation 1.82).

Volume Analysis

In the last three months, trading volume has been decreasing overall. Despite a total volume of 1.84B shares, seller volume dominated recent activity with 97.5M shares sold versus 45.7M bought, showing a seller-driven environment with buyer dominance at only 31.92%. This suggests cautious investor sentiment and lower market participation recently.

Target Prices

The consensus target prices for Entergy Corporation (ETR) indicate a moderately optimistic outlook among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 112 | 91 | 102.75 |

Analysts expect ETR’s stock price to range between 91 and 112, with an average target around 103, reflecting cautious confidence in its future performance.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews Entergy Corporation’s recent analyst ratings alongside consumer feedback to provide a balanced perspective.

Stock Grades

The following table presents recent verified stock grades from recognized financial institutions for Entergy Corporation (ETR):

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Overweight | 2026-01-20 |

| Barclays | Maintain | Overweight | 2026-01-15 |

| Argus Research | Maintain | Buy | 2026-01-06 |

| UBS | Maintain | Buy | 2025-12-17 |

| Keybanc | Maintain | Overweight | 2025-12-12 |

| JP Morgan | Maintain | Overweight | 2025-12-11 |

| Citigroup | Maintain | Neutral | 2025-11-18 |

| Evercore ISI Group | Maintain | In Line | 2025-10-30 |

| Mizuho | Maintain | Outperform | 2025-10-27 |

| Morgan Stanley | Maintain | Equal Weight | 2025-10-22 |

The overall trend indicates a predominantly positive sentiment with several firms maintaining “Buy” or “Overweight” ratings, while a minority hold neutral or in-line assessments, reflecting cautious optimism among analysts.

Consumer Opinions

Consumers generally express a mix of appreciation and concern when it comes to Entergy Corporation, reflecting a balanced view of its services and reliability.

| Positive Reviews | Negative Reviews |

|---|---|

| Reliable electricity supply with minimal outages. | Customer service response times can be slow. |

| Competitive pricing compared to regional providers. | Occasional billing errors reported by some users. |

| Strong commitment to renewable energy initiatives. | Limited transparency on rate changes. |

Overall, customers value Entergy’s reliability and green energy efforts but express frustration with customer service and billing accuracy, indicating areas for operational improvement.

Risk Analysis

Below is a concise table summarizing key risks associated with Entergy Corporation based on recent financial and operational data:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Stability | Low Altman Z-Score (1.05) indicates high bankruptcy risk (distress zone). | High | High |

| Profitability | Unfavorable ROE (7.02%) and ROIC (3.2%) suggest weak returns on capital. | Medium | Medium |

| Liquidity | Current ratio (0.72) and quick ratio (0.43) below 1 indicate liquidity issues. | Medium | Medium |

| Leverage | Debt-to-equity ratio (1.91) is high, increasing financial risk. | Medium | High |

| Market Valuation | Elevated PE ratio (30.56) may imply overvaluation risk. | Medium | Medium |

| Regulatory & Industry | Exposure to regulated electric utility risks and energy market fluctuations. | Medium | High |

The most significant risks for Entergy are its financial distress signal per Altman Z-Score and high leverage, which elevate bankruptcy risk despite a stable dividend yield. Investors should monitor liquidity and profitability trends closely.

Should You Buy Entergy Corporation?

Entergy Corporation appears to be facing challenges with declining operational efficiency and a deteriorating competitive moat, as indicated by negative value creation trends and a substantial leverage profile. While profitability metrics suggest some resilience, the overall rating of B- could be seen as moderate, reflecting a cautious investment profile.

Strength & Efficiency Pillars

Entergy Corporation displays moderate profitability with a net margin of 8.93% and a return on equity (ROE) at 7.02%, though the latter is marked unfavorable. Its return on invested capital (ROIC) stands at 3.2%, trailing behind the weighted average cost of capital (WACC) of 5.51%, indicating the company is not a value creator but rather shedding value. Financial health metrics reveal caution: an Altman Z-score of 1.05 places Entergy in the distress zone, while its Piotroski score of 4 suggests average financial strength, highlighting mixed efficiency and risk signals.

Weaknesses and Drawbacks

The valuation profile is stretched, with a high price-to-earnings (P/E) ratio of 30.56 signaling a premium that may not be justified by underlying earnings performance. Leverage is elevated, reflected in a debt-to-equity ratio of 1.91 and weak liquidity ratios—current ratio at 0.72 and quick ratio at 0.43—both unfavorable, pointing to potential short-term financial strain. Moreover, recent market activity is seller-dominant, with buyers representing only 31.92%, creating headwinds that could pressure the stock price further in the near term.

Our Verdict about Entergy Corporation

Entergy’s long-term fundamental profile appears unfavorable due to persistent profitability challenges and financial distress indicators. Despite a bullish overall stock trend with an 85.49% price increase, recent seller dominance and a 4.12% price decline suggest that, despite underlying strength, investors might consider a cautious, wait-and-see approach for more favorable entry points. The company’s profile may appear appealing to value-focused investors only if operational and financial health improves.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Entergy Corporation $ETR Shares Purchased by Jennison Associates LLC – MarketBeat (Jan 24, 2026)

- What Entergy Corporation’s (NYSE:ETR) ROE Can Tell Us – Yahoo Finance (Jan 18, 2026)

- Entergy Corporation $ETR Shares Bought by UniSuper Management Pty Ltd – MarketBeat (Jan 24, 2026)

- Entergy (ETR) – Among the Best Performing Utility Stocks in 2025 – Finviz (Jan 20, 2026)

- Entergy reports third quarter 2025 financial results – Entergy (Oct 29, 2025)

For more information about Entergy Corporation, please visit the official website: entergy.com