Home > Analyses > Energy > Energy Fuels Inc.

Energy Fuels Inc. powers the future by harnessing uranium, a critical fuel for clean nuclear energy that shapes global power grids and advances environmental goals. As a dominant player in the uranium sector, Energy Fuels operates key mining and recovery projects across the United States, renowned for its operational expertise and strategic asset portfolio. With increasing demand for sustainable energy sources, the company’s ability to deliver consistent growth and innovation prompts a closer look at whether its current valuation reflects its long-term potential.

Table of contents

Business Model & Company Overview

Energy Fuels Inc., founded in 1987 and headquartered in Lakewood, Colorado, is a leading player in the uranium industry. The company’s core mission revolves around a comprehensive ecosystem of uranium extraction, recovery, and exploration across multiple U.S. sites, including Wyoming, Texas, and Utah. Its portfolio spans conventional and in situ recovery projects, supported by strategic assets like the White Mesa Mill, underscoring its dominant market position.

The company’s revenue engine balances mining operations with project development and evaluation across key American states, generating value from both physical uranium production and future resource potential. With a focus primarily on the U.S. market, Energy Fuels leverages its extensive property base and operational expertise to maintain a robust presence. Its competitive advantage lies in integrated production capabilities and regulatory footholds, positioning it to influence the uranium sector’s trajectory.

Financial Performance & Fundamental Metrics

I will analyze Energy Fuels Inc.’s income statement, key financial ratios, and dividend payout policy to provide a comprehensive view of its financial health.

Income Statement

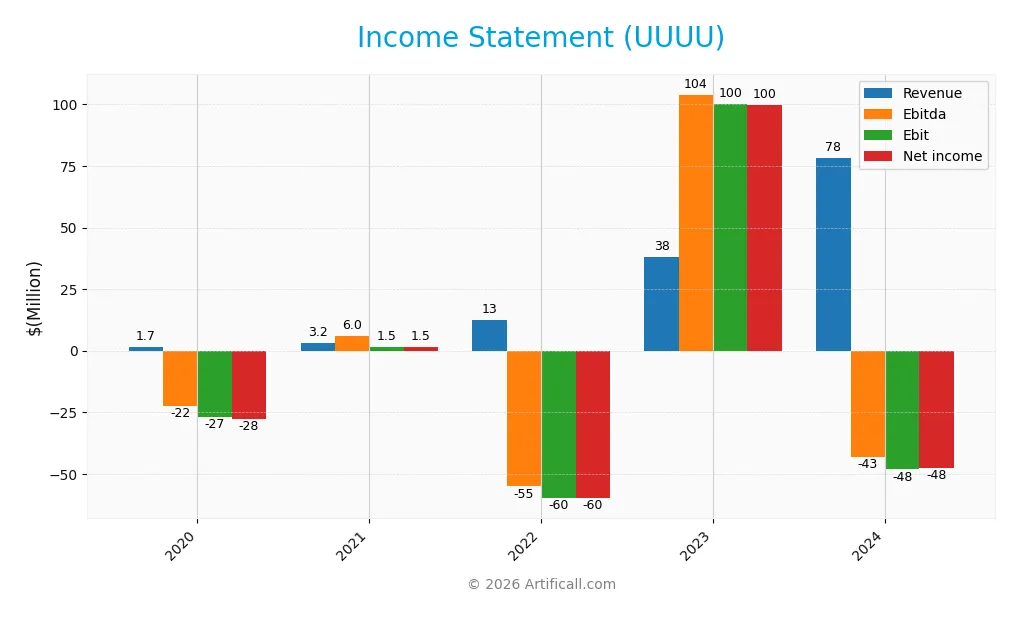

Below is the income statement for Energy Fuels Inc. (ticker: UUUU) over the last five fiscal years, showing key financial metrics in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 1.66M | 3.18M | 12.52M | 37.93M | 78.11M |

| Cost of Revenue | 0 | 6.29M | 12.67M | 22.12M | 61.11M |

| Operating Expenses | 26.29M | 32.32M | 44.78M | 48.17M | 54.17M |

| Gross Profit | 1.66M | -3.10M | -0.15M | 15.80M | 17.00M |

| EBITDA | -22.31M | 5.97M | -55.12M | 104.0M | -43.02M |

| EBIT | -26.92M | 1.50M | -59.94M | 100.03M | -48.21M |

| Interest Expense | 0.95M | 0.05M | 0.17M | 0.00M | 0.00M |

| Net Income | -27.78M | 1.53M | -59.85M | 99.86M | -47.77M |

| EPS | -0.24 | -0.0051 | -0.57 | 0.63 | -0.28 |

| Filing Date | 2021-03-22 | 2022-03-31 | 2023-03-08 | 2024-06-28 | 2025-02-26 |

Income Statement Evolution

Energy Fuels Inc. experienced a significant revenue increase of 105.95% from 2023 to 2024, continuing a strong overall growth trend of 4611.34% since 2020. Despite this, net income declined by 71.97% over the period and further dropped 123.22% in the last year. Gross margins improved slightly to a favorable 21.76%, while EBIT and net margins remained deeply negative, reflecting persistent profitability challenges.

Is the Income Statement Favorable?

In 2024, Energy Fuels posted a revenue of 78.1M USD but incurred a net loss of 47.8M USD, translating to negative margins: EBIT margin at -61.72% and net margin at -61.15%. Interest expenses were negligible, which is positive, yet operating expenses grew proportionally with revenue. The mixed signals with improving top-line and gross profit but deteriorating bottom-line results yield a neutral overall assessment of the income statement fundamentals.

Financial Ratios

The following table presents key financial ratios for Energy Fuels Inc. (ticker: UUUU) over the fiscal years 2020 to 2024, illustrating profitability, valuation, liquidity, leverage, and efficiency metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | -16.75% | 0.48% | -4.78% | 2.63% | -61.15% |

| ROE | -18.06% | 0.53% | -24.89% | 26.61% | -9.05% |

| ROIC | -14.38% | -11.44% | -17.60% | -8.24% | -6.67% |

| P/E | -18.58 | 741.32 | -16.33 | 11.46 | -18.47 |

| P/B | 3.36 | 3.92 | 4.06 | 3.05 | 1.67 |

| Current Ratio | 4.26 | 24.42 | 7.28 | 22.46 | 3.88 |

| Quick Ratio | 2.02 | 19.38 | 5.23 | 18.71 | 2.76 |

| D/E | 0.0049 | 0.0016 | 0.0057 | 0.0035 | 0.0041 |

| Debt-to-Assets | 0.41% | 0.15% | 0.50% | 0.33% | 0.36% |

| Interest Coverage | -25.87 | -656.02 | -270.71 | 0 | 0 |

| Asset Turnover | 0.009 | 0.010 | 0.046 | 0.094 | 0.128 |

| Fixed Asset Turnover | 0.015 | 0.030 | 0.128 | 0.258 | 1.42 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Evolution of Financial Ratios

Energy Fuels Inc. (UUUU) experienced a declining trend in Return on Equity (ROE), moving from positive in 2023 to -9.05% in 2024, indicating weakening profitability. The Current Ratio dropped sharply from 22.46 in 2023 to 3.88 in 2024, reflecting reduced short-term liquidity. The Debt-to-Equity Ratio remained very low and stable around 0.004, suggesting minimal financial leverage throughout the period.

Are the Financial Ratios Favorable?

In 2024, profitability ratios such as net margin (-61.15%) and ROE (-9.05%) were unfavorable, signaling earnings challenges. Liquidity showed mixed signals: the quick ratio was favorable at 2.76, but the current ratio was unfavorable at 3.88. Leverage ratios, including debt-to-equity (0.0) and debt-to-assets (0.36%), were favorable, indicating low debt risk. Efficiency metrics like asset turnover (0.13) were unfavorable, while market valuation ratios presented a neutral to favorable picture, leading to a generally unfavorable overall financial ratio evaluation.

Shareholder Return Policy

Energy Fuels Inc. (UUUU) does not pay dividends, reflecting its negative net income and ongoing reinvestment needs. The company’s consistent dividend payout ratio and yield are zero, with no evidence of share buyback programs in recent years.

This approach aligns with a growth and development phase, prioritizing capital allocation towards operations and expansion rather than immediate shareholder distributions. The policy supports long-term value creation but may present risks if profitability and cash flow improvements are not realized.

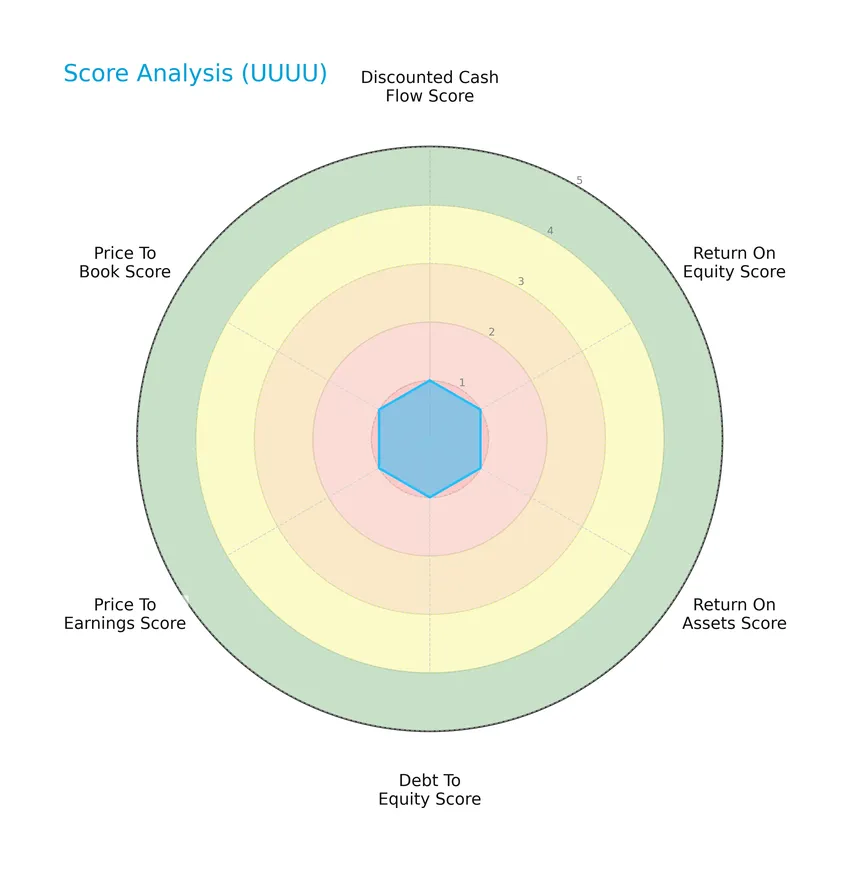

Score analysis

The following radar chart illustrates the company’s performance across key financial metrics:

Energy Fuels Inc. scores very low across all evaluated metrics, including discounted cash flow, return on equity, return on assets, debt to equity, price to earnings, and price to book, each rated as very unfavorable with a score of 1.

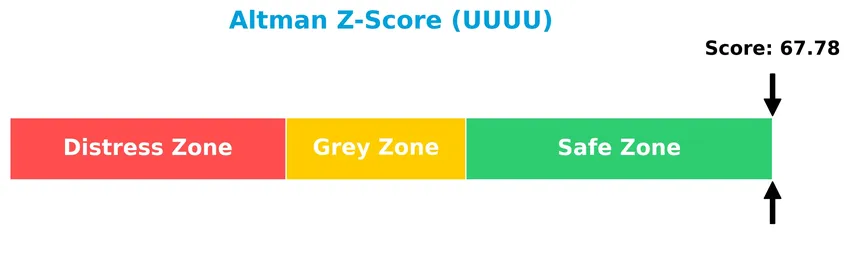

Analysis of the company’s bankruptcy risk

The Altman Z-Score indicates that the company is well within the safe zone, suggesting a very low risk of bankruptcy:

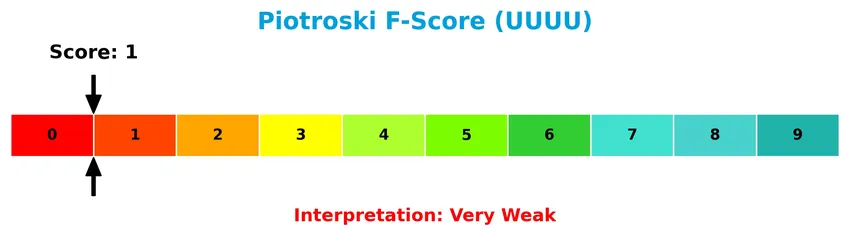

Is the company in good financial health?

The Piotroski Score diagram provides insight into the company’s financial strength according to nine fundamental criteria:

With a very weak Piotroski Score of 1, Energy Fuels Inc. currently demonstrates poor financial health, indicating limited strength in profitability, leverage, liquidity, and operational efficiency.

Competitive Landscape & Sector Positioning

This section presents an analysis of Energy Fuels Inc.’s strategic positioning, revenue segments, key products, and main competitors within the uranium industry. I will assess whether Energy Fuels Inc. holds a competitive advantage over its peers in this sector.

Strategic Positioning

Energy Fuels Inc. focuses on uranium extraction and recovery primarily within the United States, operating multiple projects across Wyoming, Texas, Utah, Arizona, New Mexico, and Colorado, with limited international exposure. Its product portfolio is concentrated on conventional and in situ uranium recovery and related mineral properties.

Key Products & Brands

The following table presents Energy Fuels Inc.’s main products and operating assets:

| Product | Description |

|---|---|

| Nichols Ranch Project | Uranium extraction and recovery site located in Wyoming, part of the company’s conventional uranium operations. |

| Jane Dough Property | Uranium mining property situated in Wyoming, involved in exploration and recovery activities. |

| Hank Project | Uranium mining project in Wyoming focusing on conventional uranium recovery. |

| Alta Mesa Project | Uranium extraction site located in Texas, contributing to the company’s uranium production portfolio. |

| White Mesa Mill | Uranium processing mill located in Utah, used for milling and refining uranium ore. |

| Uranium and Uranium/Vanadium Properties | Various exploration, permitting, and evaluation stage projects in Utah, Wyoming, Arizona, New Mexico, and Colorado. |

Energy Fuels Inc. operates multiple uranium extraction and recovery projects across several US states, complemented by a processing mill, supporting its position in the uranium industry.

Main Competitors

Energy Fuels Inc. operates among 10 main competitors in the uranium industry; the table below lists the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Cameco Corporation | 39.8B |

| NexGen Energy Ltd. | 6.0B |

| Uranium Energy Corp. | 5.6B |

| Centrus Energy Corp. | 4.2B |

| Energy Fuels Inc. | 3.5B |

| Denison Mines Corp. | 2.4B |

| Ur-Energy Inc. | 507M |

| IsoEnergy Ltd. | 499M |

| Uranium Royalty Corp. | 471M |

| enCore Energy Corp. | 464M |

Energy Fuels Inc. ranks 5th in market capitalization among uranium companies, holding about 15.2% of Cameco Corporation’s scale, the sector leader. The company’s market cap is below the average of the top 10 competitors but remains above the sector median, with a notable 29.8% gap separating it from the next larger competitor.

Does Energy Fuels Inc. have a competitive advantage?

Energy Fuels Inc. currently does not present a strong competitive advantage as its return on invested capital (ROIC) is significantly below its weighted average cost of capital (WACC), indicating value destruction despite a growing ROIC trend. The company’s income statement shows mixed performance with favorable revenue growth but unfavorable net margins and earnings per share, reflecting ongoing profitability challenges.

Looking ahead, Energy Fuels benefits from a diversified uranium asset base across multiple U.S. states, including several projects in exploration and permitting stages, which may offer growth opportunities. Expansion into new uranium markets and potential advancements in extraction technologies could improve future performance, although risks remain given the current financial and operational metrics.

Comparisons with competitors

Check out how we compare the company to its competitors:

SWOT Analysis

This SWOT analysis highlights Energy Fuels Inc.’s key internal and external factors to inform strategic investment decisions.

Strengths

- Strong revenue growth 4611% over 5 years

- No debt, low debt-to-assets ratio 0.36%

- Strategic U.S.-based uranium assets

Weaknesses

- Negative net margin -61.15%

- Unfavorable EBIT margin -61.72%

- Very weak Piotroski score of 1

Opportunities

- Growing demand for clean nuclear energy

- Expansion potential in U.S. uranium market

- Increasing ROIC trend indicating improving profitability

Threats

- High beta 1.85 implies stock volatility

- Regulatory risks in uranium industry

- Competitive pressures from alternative energy sources

Energy Fuels exhibits robust top-line growth and solid asset positioning but struggles with profitability and financial health indicators. The improving ROIC and uranium market growth present upside potential, yet investors should remain cautious of volatility and sector-specific risks when considering exposure.

Stock Price Action Analysis

The following weekly chart illustrates Energy Fuels Inc. (UUUU) stock price movements over the past 12 months, highlighting key price levels and volatility patterns:

Trend Analysis

Over the past 12 months, Energy Fuels Inc. stock price increased by 289.31%, indicating a strong bullish trend with price acceleration. The stock showed notable volatility with a standard deviation of 4.96, reaching a high of 25.5 and a low of 3.45. Recent months confirm sustained upward momentum.

Volume Analysis

Trading volume is increasing, with buyers accounting for 61.09% of total volume, suggesting buyer-driven activity. In the recent period from November 2025 to January 2026, buyer dominance slightly decreased to 55.37%, indicating a modest reduction in buying pressure but continued market participation.

Target Prices

The consensus target prices for Energy Fuels Inc. suggest moderate upside potential.

| Target High | Target Low | Consensus |

|---|---|---|

| 26.75 | 13 | 19.88 |

Analysts expect the stock to trade between $13 and $26.75, with an average target near $19.88, indicating cautious optimism about future performance.

Analyst & Consumer Opinions

This section examines recent analyst ratings and consumer feedback regarding Energy Fuels Inc. (UUUU) performance and reputation.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Stock Grades

The following table presents recent verified stock grades for Energy Fuels Inc., reflecting expert analyst opinions over the past several months:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B. Riley Securities | Maintain | Buy | 2026-01-20 |

| HC Wainwright & Co. | Maintain | Buy | 2026-01-09 |

| Roth Capital | Downgrade | Sell | 2025-11-05 |

| HC Wainwright & Co. | Maintain | Buy | 2025-11-04 |

| HC Wainwright & Co. | Maintain | Buy | 2025-10-21 |

| B. Riley Securities | Maintain | Buy | 2025-10-08 |

| HC Wainwright & Co. | Maintain | Buy | 2025-09-17 |

| HC Wainwright & Co. | Maintain | Buy | 2025-08-08 |

| Canaccord Genuity | Maintain | Buy | 2025-07-02 |

| HC Wainwright & Co. | Maintain | Buy | 2025-05-09 |

Overall, most analysts have maintained a consistent Buy rating on Energy Fuels Inc., with only one notable downgrade to Sell by Roth Capital in late 2025. The consensus remains positive with six Buy ratings supporting the stock.

Consumer Opinions

Energy Fuels Inc. garners mixed reactions from its consumer base, reflecting both appreciation and concerns about its operations and market presence.

| Positive Reviews | Negative Reviews |

|---|---|

| Strong commitment to sustainable uranium production. | Concerns about fluctuating stock performance. |

| Transparent communication regarding environmental impact. | Limited diversification in product offerings. |

| Competitive pricing compared to industry peers. | Occasional delays in project timelines. |

Overall, consumers appreciate Energy Fuels Inc.’s dedication to sustainability and transparency but express caution about its stock volatility and project execution delays, suggesting a need for improved operational consistency.

Risk Analysis

Below is a summary table highlighting key risks associated with Energy Fuels Inc., focusing on likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Negative net margin (-61.15%) and unfavorable ROE (-9.05%) indicate losses. | High | High |

| Market Volatility | High beta (1.848) suggests significant stock price fluctuations. | High | Medium |

| Operational Risk | Dependence on uranium extraction projects in specific US states. | Medium | Medium |

| Regulatory Risk | Uranium industry subject to stringent environmental and safety regulations. | Medium | High |

| Liquidity Risk | Current ratio favorable (3.88) but quick ratio better (2.76); mixed signals. | Medium | Medium |

| Bankruptcy Risk | Altman Z-score very high (67.78) suggests low bankruptcy risk currently. | Low | High |

| Financial Strength | Piotroski score very weak (1), indicating poor financial strength overall. | High | High |

The most critical risks are poor profitability and weak financial strength despite a strong Altman Z-score, which means investors should be cautious. The uranium sector’s regulatory environment remains a significant factor impacting Energy Fuels Inc.’s operations and valuation.

Should You Buy Energy Fuels Inc.?

Energy Fuels Inc. appears to be navigating a challenging profile with improving operational efficiency but a slightly unfavorable competitive moat indicating value destruction. Despite a manageable leverage profile and a strong Altman Z-score suggesting financial safety, the overall D+ rating and weak profitability metrics could be seen as significant caution signals.

Strength & Efficiency Pillars

Energy Fuels Inc. shows a mixed financial profile with a robust Altman Z-score of 67.78, placing it firmly in the safe zone for bankruptcy risk, which underscores its financial stability. The company benefits from a zero Debt-to-Equity ratio and a favorable debt-to-assets ratio of 0.36, supporting its low leverage position. While the Piotroski score is very weak at 1, indicating poor financial strength, the quick ratio of 2.76 suggests good short-term liquidity. However, with a return on invested capital (ROIC) of -6.67% trailing its weighted average cost of capital (WACC) at 12.56%, Energy Fuels is currently a value destroyer despite some signs of improving profitability.

Weaknesses and Drawbacks

Several metrics highlight significant weaknesses for Energy Fuels. The company’s net margin is deeply negative at -61.15%, and return on equity (ROE) is also unfavorable at -9.05%, reflecting ongoing profitability challenges. The current ratio stands at a high 3.88, which may indicate inefficient use of assets. Additionally, the price-to-earnings ratio is negative but flagged favorable due to losses, while the price-to-book ratio of 1.67 is neutral, suggesting moderate valuation concerns. The company’s interest coverage is zero, posing risks if debt levels rise. Market dynamics seem positive, with 61.09% buyer volume overall and a slightly buyer-dominant recent trend, reducing immediate selling pressure.

Our Verdict about Energy Fuels Inc.

Energy Fuels Inc. presents an unfavorable long-term fundamental profile given its negative profitability metrics and value destruction indicated by ROIC below WACC. Nonetheless, the bullish overall stock trend and recent buyer dominance suggest potential market optimism. Despite the fundamental weaknesses, this combination might appear attractive for investors with a higher risk appetite but could also suggest a cautious, wait-and-see approach for those seeking more stable entry points.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Energy Fuels to acquire Australian Strategic Materials to create new “mine-to-metal & alloy” rare-earth champion – Energy Fuels (Jan 20, 2026)

- Do You Own Energy Fuels Inc. Stock? Take a Look at This Stock Instead. – The Motley Fool (Jan 11, 2026)

- Energy Fuels Inc. (UUUU) Exceeds Guidance, Asserts Dominance as Uranium Producer – Yahoo Finance (Jan 15, 2026)

- Energy Fuels and Australian Strategic Materials Unite to Build a New Rare Earths Powerhouse for Western Markets – InvestorNews (Jan 23, 2026)

- Energy Fuels Inc (UUUU) Stock Price Down 6.87% on Jan 21 – GuruFocus (Jan 21, 2026)

For more information about Energy Fuels Inc., please visit the official website: energyfuels.com