Home > Analyses > Industrials > EMCOR Group, Inc.

EMCOR Group, Inc. powers the infrastructure that keeps modern industries and communities running smoothly, from electrical systems to complex mechanical services. As a key player in engineering and construction, EMCOR combines innovation with extensive expertise, delivering comprehensive solutions across the U.S. and U.K. Renowned for its quality and operational excellence, the company continues to expand its influence in critical sectors. The question now is whether EMCOR’s solid fundamentals still support its premium market valuation and growth prospects.

Table of contents

Business Model & Company Overview

EMCOR Group, Inc., founded in 1987 and headquartered in Norwalk, Connecticut, stands as a leader in the engineering and construction sector. With 40,400 employees, it delivers a comprehensive ecosystem of electrical and mechanical construction alongside extensive facilities services. Its core mission weaves together power transmission, energy solutions, HVAC, fire protection, and industrial services for diverse industries, forming an integrated platform that supports complex infrastructure and operational needs.

The company’s revenue engine balances project-based construction with recurring facility management and maintenance services, driving steady cash flow across the Americas, Europe, and Asia. EMCOR’s strategic footprint enables it to serve commercial, government, and industrial clients globally. This diversified model, combining hardware installation with ongoing service contracts, fortifies its competitive advantage and economic moat, positioning EMCOR as a vital architect of the future industrial landscape.

Financial Performance & Fundamental Metrics

In this section, I analyze EMCOR Group, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its overall financial health.

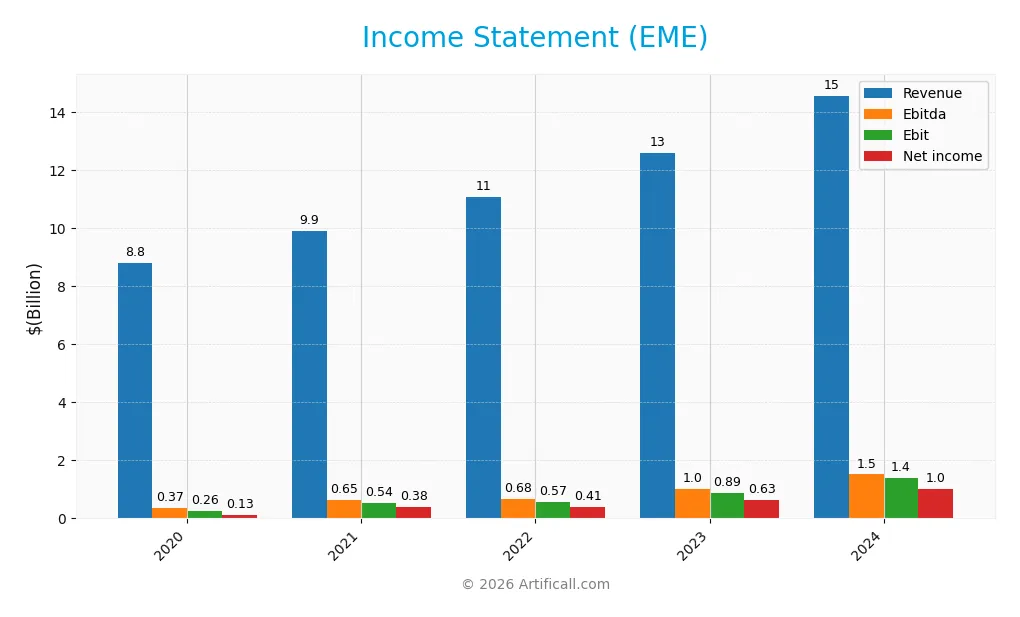

Income Statement

The table below presents EMCOR Group, Inc.’s key income statement figures for fiscal years 2020 through 2024, reflecting revenues, expenses, and profitability metrics in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 8.8B | 9.9B | 11.1B | 12.6B | 14.6B |

| Cost of Revenue | 7.4B | 8.4B | 9.5B | 10.5B | 11.8B |

| Operating Expenses | 1.1B | 971M | 1.0B | 1.2B | 1.4B |

| Gross Profit | 1.4B | 1.5B | 1.6B | 2.1B | 2.8B |

| EBITDA | 368M | 648M | 681M | 1.0B | 1.5B |

| EBIT | 261M | 535M | 572M | 890M | 1.4B |

| Interest Expense | 9.0M | 6.1M | 13.2M | 17.2M | 3.8M |

| Net Income | 133M | 384M | 406M | 633M | 1.0B |

| EPS | 2.41 | 7.09 | 8.13 | 13.37 | 21.61 |

| Filing Date | 2021-02-25 | 2022-02-24 | 2023-02-23 | 2024-02-28 | 2025-02-26 |

Income Statement Evolution

From 2020 to 2024, EMCOR Group, Inc. (EME) exhibited strong growth in revenue, increasing by 65.58% overall, with a notable 15.76% rise in the last year. Net income surged even more dramatically, up 657.58% over the period, reflecting a substantial improvement in profitability. Margins showed mixed trends: gross and EBIT margins remained neutral at 18.98% and 9.48%, respectively, while net margin expanded favorably to 6.91%.

Is the Income Statement Favorable?

The 2024 income statement reveals a favorable financial position with a 15.76% revenue increase and a 32.34% gross profit growth, signaling effective top-line expansion and cost control. EBIT grew 55.18%, indicating improved operational efficiency despite an unfavorable rise in operating expenses relative to revenue. Interest expenses remain low at 0.03% of revenue, supporting profitability. Overall, 78.57% of the income statement metrics are positive, confirming generally favorable fundamentals.

Financial Ratios

The following table presents key financial ratios for EMCOR Group, Inc. (EME) over the fiscal years 2020 to 2024, offering insight into profitability, liquidity, leverage, and efficiency:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 1.51% | 3.87% | 3.67% | 5.03% | 6.91% |

| ROE | 6.48% | 17.03% | 20.58% | 25.63% | 34.28% |

| ROIC | 4.55% | 12.20% | 14.39% | 20.04% | 26.97% |

| P/E | 37.97 | 17.96 | 18.21 | 16.12 | 21.01 |

| P/B | 2.46 | 3.06 | 3.75 | 4.13 | 7.20 |

| Current Ratio | 1.44 | 1.44 | 1.26 | 1.26 | 1.30 |

| Quick Ratio | 1.42 | 1.41 | 1.23 | 1.23 | 1.27 |

| D/E | 0.26 | 0.24 | 0.27 | 0.14 | 0.12 |

| Debt-to-Assets | 10.58% | 9.93% | 9.69% | 5.22% | 4.52% |

| Interest Coverage | 28.51 | 87.43 | 42.80 | 50.92 | 355.88 |

| Asset Turnover | 1.74 | 1.82 | 2.00 | 1.90 | 1.89 |

| Fixed Asset Turnover | 21.96 | 23.99 | 26.01 | 25.69 | 27.82 |

| Dividend Yield | 0.35% | 0.41% | 0.37% | 0.32% | 0.21% |

Evolution of Financial Ratios

EMCOR Group, Inc. saw a steady improvement in Return on Equity (ROE), rising from 6.48% in 2020 to 34.28% in 2024, indicating enhanced profitability. The Current Ratio remained relatively stable around 1.3, suggesting consistent liquidity management. Meanwhile, the Debt-to-Equity Ratio decreased from 0.26 in 2020 to 0.12 in 2024, reflecting reduced leverage and improved financial risk profile.

Are the Financial Ratios Favorable?

In 2024, EMCOR’s financial ratios present a generally favorable picture with ROE at 34.28% and Return on Invested Capital (ROIC) at 26.97%, demonstrating strong profitability. Liquidity ratios such as the quick ratio at 1.27 and a low debt-to-assets ratio of 4.52% reinforce solid financial health. However, the price-to-book ratio of 7.2 and a dividend yield of 0.21% are viewed as unfavorable, while the price-to-earnings ratio of 21.01 remains neutral. Overall, 57.14% of key ratios are favorable, supporting a positive financial stance.

Shareholder Return Policy

EMCOR Group, Inc. pays dividends with a low payout ratio around 4-7%, and dividend per share has steadily increased from $0.32 in 2020 to $0.93 in 2024. The annual dividend yield remains modest near 0.2%, supported by strong free cash flow coverage close to 95%, indicating a sustainable distribution.

The company also engages in share buybacks, complementing dividends in returning capital to shareholders. This balanced approach, combining dividends with buybacks and backed by solid cash flows, suggests a shareholder return policy designed to support sustainable long-term value creation without risking excessive distributions or repurchases.

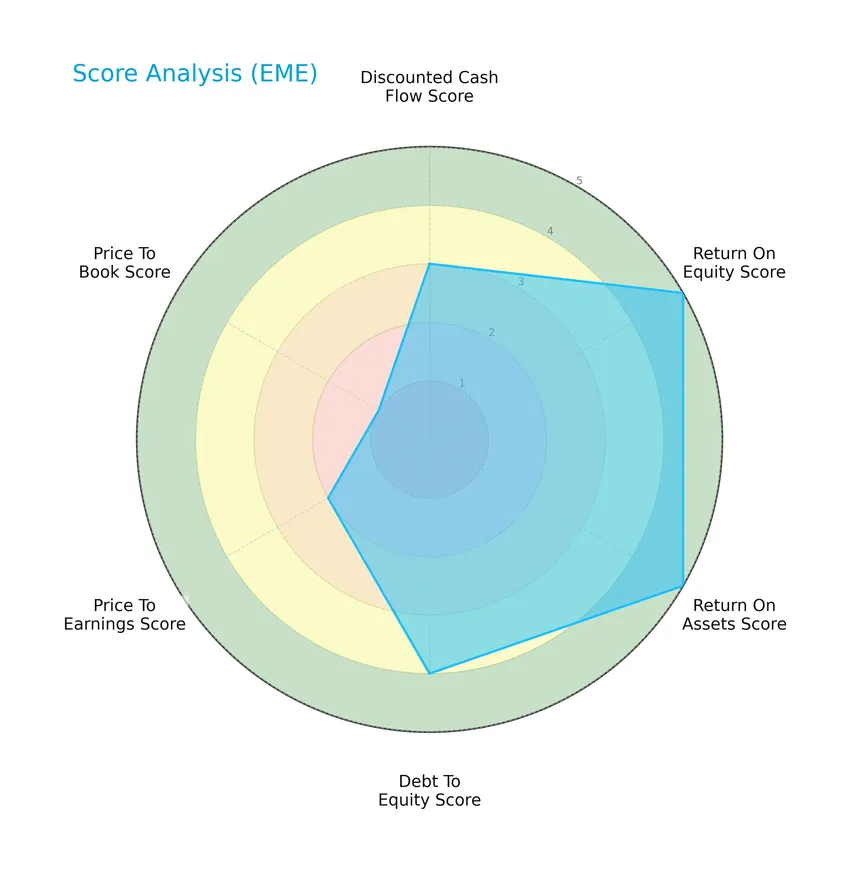

Score analysis

The following radar chart illustrates the company’s evaluation based on key financial scores:

EMCOR Group, Inc. demonstrates very favorable returns on equity and assets with scores of 5 each, supported by a favorable debt-to-equity score of 4. Moderate scores appear in discounted cash flow and price-to-earnings at 3 and 2 respectively, while the price-to-book score is very unfavorable at 1.

Analysis of the company’s bankruptcy risk

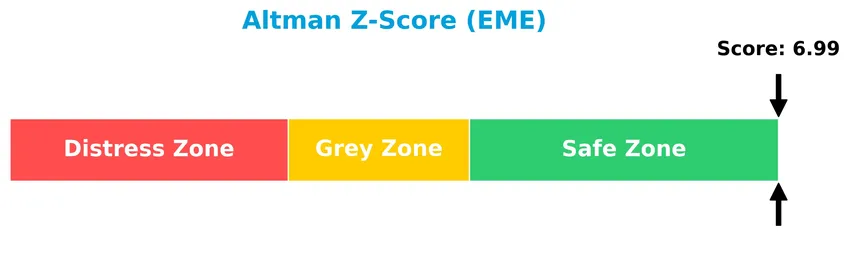

The Altman Z-Score indicates that EMCOR Group, Inc. is in the safe zone, reflecting a low risk of bankruptcy and strong financial stability:

Is the company in good financial health?

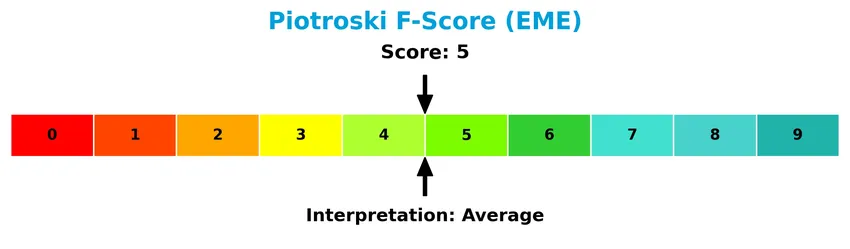

The Piotroski Score diagram provides insight into the company’s overall financial condition:

With a Piotroski Score of 5, EMCOR Group, Inc. is considered to have average financial health, suggesting moderate strength across profitability, leverage, liquidity, and efficiency metrics.

Competitive Landscape & Sector Positioning

This sector analysis will examine EMCOR Group, Inc.’s strategic positioning, revenue by segment, key products, main competitors, competitive advantages, and SWOT analysis. I will assess whether EMCOR holds a competitive advantage over its industry peers.

Strategic Positioning

EMCOR Group, Inc. has a concentrated geographic presence, generating over $14B in 2024 revenues primarily from the United States, with a smaller portion from the United Kingdom. Its diversified product portfolio spans electrical, mechanical, building, and industrial services, reflecting broad sector coverage within engineering and construction.

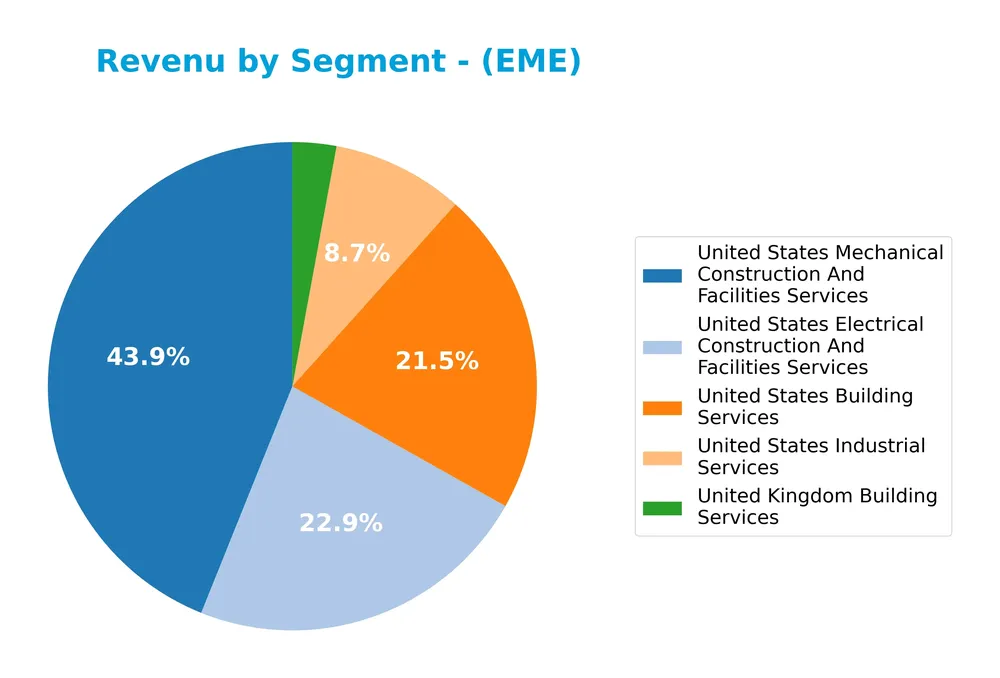

Revenue by Segment

This pie chart illustrates EMCOR Group, Inc.’s revenue distribution by business segment for the fiscal year 2024, highlighting key contributors to the company’s overall performance.

In 2024, United States Mechanical Construction And Facilities Services led with $6.5B, followed by Electrical Construction And Facilities Services at $3.4B and Building Services at $3.2B. Industrial Services and UK Building Services contributed smaller portions, $1.3B and $426M respectively. The Mechanical segment shows steady growth, indicating strong demand, while Electrical and Building Services maintain solid revenue bases. The concentration in US-based services remains significant, suggesting moderate geographic risk.

Key Products & Brands

The table below outlines EMCOR Group, Inc.’s primary products and services by segment and geography:

| Product | Description |

|---|---|

| United States Electrical Construction And Facilities Services | Design, integration, installation, operation, and maintenance of electrical power systems, lighting, instrumentation, and communication systems. |

| United States Mechanical Construction And Facilities Services | Mechanical construction and facilities services including HVAC, refrigeration, plumbing, piping, crane and rigging, steel fabrication, and welding. |

| United States Building Services | Comprehensive building operations and maintenance, facility management, janitorial, landscaping, snow removal, vendor management, and support for building systems. |

| United States Industrial Services | Industrial services catering to oil, gas, and petrochemical industries, including outage services and technical consulting. |

| United Kingdom Building Services | Building services operations and maintenance primarily in the UK covering similar activities as US building services. |

EMCOR Group operates mainly in electrical and mechanical construction, as well as building and industrial services across the US and the UK, serving commercial, government, and industrial clients.

Main Competitors

There are 3 main competitors in the Industrials sector Engineering & Construction industry; below are the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Quanta Services, Inc. | 65.2B |

| Comfort Systems USA, Inc. | 35.4B |

| EMCOR Group, Inc. | 28.6B |

EMCOR Group, Inc. ranks 3rd among its main competitors, with a market cap at 47.63% of the sector leader, Quanta Services, Inc. The company is below both the average market cap of the top 10 (43.1B) and the median market cap of the sector (35.4B). It maintains a 13.91% gap below its closest competitor, Comfort Systems USA, Inc.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does EMCOR Group, Inc. have a competitive advantage?

EMCOR Group, Inc. presents a competitive advantage, demonstrated by a very favorable moat status with a ROIC significantly above WACC and a strong upward ROIC trend, indicating durable value creation and efficient capital use. The company’s diversified engineering and facilities services portfolio supports its ability to maintain profitability and competitive positioning in the US market.

Looking ahead, EMCOR’s future outlook includes opportunities in expanding energy solutions, infrastructure projects, and technical consulting services, which could drive growth in existing and new markets. The company’s ongoing investment in integrated electrical and mechanical construction services positions it well to capture emerging demand in both commercial and government sectors.

SWOT Analysis

This SWOT analysis highlights EMCOR Group, Inc.’s key internal and external factors to inform strategic investment decisions.

Strengths

- Strong revenue growth with 15.76% YoY increase

- High ROE at 34.28% indicating efficient equity use

- Durable competitive advantage with growing ROIC

- Favorable net margin growth of 37.44% and EPS growth of 61.68%

Weaknesses

- Elevated price-to-book ratio at 7.2 suggests possible overvaluation

- Dividend yield low at 0.21% limiting income appeal

- Operational expenses growing at same rate as revenue, pressuring margins

Opportunities

- Expansion of energy solutions and infrastructure projects in the US

- Increasing demand for sustainable and clean energy services

- Potential to leverage technical consulting and diagnostic services growth

Threats

- Intense competition in engineering and construction sector

- Economic downturns impacting large infrastructure spending

- Rising raw material costs and labor shortages affecting project costs

EMCOR demonstrates strong financial health and market position with significant growth and profitability metrics. However, elevated valuation and margin pressures warrant cautious monitoring. Strategic focus on innovation and expanding clean energy services can capitalize on market opportunities while mitigating sector risks.

Stock Price Action Analysis

The following weekly stock chart illustrates EMCOR Group, Inc.’s price movements over the past 12 months, highlighting key fluctuations and trend developments:

Trend Analysis

Over the past 12 months, EMCOR Group, Inc.’s stock price increased by 116.95%, indicating a strong bullish trend with accelerating momentum. The price ranged from a low of 319.99 to a high of 748.24, accompanied by a high volatility level, reflected in a standard deviation of 113. Recent weeks show a continued positive trend with a 6.91% gain since November 2025 and moderate volatility.

Volume Analysis

Trading volume over the last three months is increasing, with a total volume of approximately 25.7M shares traded. Buyer activity accounts for 51.59% of this volume, showing a neutral dominance. This balanced volume suggests cautious investor sentiment and steady market participation without clear buyer or seller control.

Target Prices

The target price consensus for EMCOR Group, Inc. indicates a positive outlook supported by analyst estimates.

| Target High | Target Low | Consensus |

|---|---|---|

| 800 | 713 | 754.33 |

Analysts expect EMCOR’s stock to trade between 713 and 800, with a consensus target near 754, suggesting moderate upside potential.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines recent analyst ratings and consumer feedback related to EMCOR Group, Inc. (EME).

Stock Grades

The latest verified analyst grades for EMCOR Group, Inc. are presented in the table below, reflecting recent consensus and individual ratings:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| DA Davidson | Maintain | Buy | 2025-10-31 |

| Stifel | Maintain | Buy | 2025-10-13 |

| Goldman Sachs | Maintain | Neutral | 2025-10-08 |

| DA Davidson | Maintain | Buy | 2025-08-01 |

| UBS | Maintain | Buy | 2025-07-25 |

| Stifel | Maintain | Buy | 2025-07-11 |

| Goldman Sachs | Maintain | Sell | 2025-07-08 |

| Stifel | Maintain | Buy | 2025-05-01 |

| Stifel | Maintain | Buy | 2025-02-27 |

| DA Davidson | Maintain | Buy | 2024-07-26 |

The overall grading trend for EMCOR Group remains predominantly positive, with multiple “Buy” ratings maintained by leading firms. However, there is some divergence, as Goldman Sachs continues to hold a “Neutral” or “Sell” stance, indicating mixed analyst sentiment.

Consumer Opinions

Consumers have expressed a mix of appreciation and criticism towards EMCOR Group, Inc., reflecting diverse experiences with the company’s services.

| Positive Reviews | Negative Reviews |

|---|---|

| “EMCOR’s project management was efficient and transparent.” | “Customer service response times were slower than expected.” |

| “The quality of workmanship exceeded my expectations.” | “Pricing was higher compared to competitors.” |

| “Safety standards on-site were clearly a priority.” | “Scheduling delays caused some project overruns.” |

Overall, EMCOR receives praise for strong project execution and safety practices, while customers point to areas for improvement in communication and cost competitiveness.

Risk Analysis

Below is a summary table highlighting the key risks associated with EMCOR Group, Inc., focusing on their nature, likelihood, and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | EMCOR’s beta of 1.174 indicates moderate sensitivity to market swings, affecting share price. | Medium | Medium |

| Valuation Risk | Unfavorable price-to-book ratio (7.2) suggests the stock may be overvalued, risking price drops. | Medium | High |

| Dividend Yield Risk | Low dividend yield (0.21%) may disappoint income-focused investors, reducing attractiveness. | Low | Low |

| Operational Risk | Exposure to industrial and construction sectors susceptible to economic cycles and disruptions. | Medium | Medium |

| Financial Stability | Strong Altman Z-Score (6.99) indicates low bankruptcy risk; however, Piotroski score (5) is average. | Low | Low |

The most significant risks for EMCOR are valuation-related due to its high price-to-book ratio, which could lead to price corrections, and market volatility given its above-average beta. Recent financial metrics reaffirm solid stability, but investors should monitor market conditions closely.

Should You Buy EMCOR Group, Inc.?

EMCOR Group, Inc. appears to be delivering robust profitability supported by a durable competitive moat with growing ROIC, suggesting strong value creation and operational efficiency. Despite some moderate valuation concerns, the company’s leverage profile seems manageable, underpinning an overall favorable A- rating.

Strength & Efficiency Pillars

EMCOR Group, Inc. exhibits robust profitability and financial health, underpinned by a return on equity (ROE) of 34.28% and a return on invested capital (ROIC) of 26.97%. With a weighted average cost of capital (WACC) at 9.31%, the company is a clear value creator, generating returns well above its capital costs. Financial stability is further confirmed by an Altman Z-score of 6.99, placing it comfortably in the safe zone, and a Piotroski score of 5, indicating average but stable fundamentals. These metrics collectively affirm EMCOR’s operational efficiency and its ability to sustain value creation over time.

Weaknesses and Drawbacks

Despite favorable fundamentals, EMCOR faces valuation and market risks. The price-to-book ratio stands at an elevated 7.2, signaling a potentially overvalued stock and exposing investors to downside risk if expectations are not met. The price-to-earnings ratio of 21.01 is moderate but still reflects some premium. Liquidity ratios such as the current ratio at 1.3 are neutral, but the company’s dividend yield is low at 0.21%, which may limit income-focused investor appeal. Additionally, the relatively balanced buyer-seller volumes in the recent period suggest neutral market pressure, requiring cautious monitoring.

Our Verdict about EMCOR Group, Inc.

EMCOR’s long-term fundamental profile appears favorable, supported by strong profitability and financial stability. The overall bullish stock trend and accelerating momentum could present attractive long-term exposure opportunities. However, recent market behavior shows neutral buyer dominance, suggesting that despite underlying strength, investors might consider a measured approach and await clearer signals before increasing exposure.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- EMCOR Group, Inc. (EME) Is a Trending Stock: Facts to Know Before Betting on It – Yahoo Finance (Jan 23, 2026)

- Emcor Group (EME) stock falls amid market uptick: What investors need to know – MSN (Jan 24, 2026)

- EMCOR Group Inc. (NYSE:EME) Passes the Caviar Cruise Quality Investing Screen – Chartmill (Jan 22, 2026)

- Is EMCOR Group’s (EME) EPS Surge and Buyback Strategy Quietly Redefining Its Long-Term Narrative? – Sahm (Jan 19, 2026)

- EMCOR Group, Inc. Declares Regular Quarterly Dividend – Business Wire (Jan 02, 2026)

For more information about EMCOR Group, Inc., please visit the official website: emcorgroup.com