In a world increasingly driven by data, Elastic N.V. transforms how businesses harness information, making complex data accessible and actionable. As a key player in the software application industry, Elastic’s flagship products, including Elasticsearch and Kibana, empower organizations to glean insights from vast amounts of information in real-time. Known for its innovation and quality, the company stands at the forefront of the multi-cloud environment revolution. As we delve into Elastic’s financials, we must consider whether its robust fundamentals still align with its current market valuation and growth trajectory.

Table of contents

Company Description

Elastic N.V. (ticker: ESTC), founded in 2012 and headquartered in Mountain View, California, is a leading player in the software application sector, specializing in search technology solutions. The company primarily offers its flagship Elastic Stack, a robust suite of software products designed for data ingestion, storage, and analysis across multi-cloud environments. This portfolio includes Elasticsearch, Kibana, Beats, and Logstash, which together support a wide range of applications from app search to logging and performance monitoring. With a market capitalization of approximately $7.87B, Elastic is well-positioned to influence industry standards through innovation and a commitment to enhancing data search and analytics capabilities across various sectors.

Fundamental Analysis

In this section, I will conduct a fundamental analysis of Elastic N.V. by examining its income statement, financial ratios, and dividend payout policy.

Income Statement

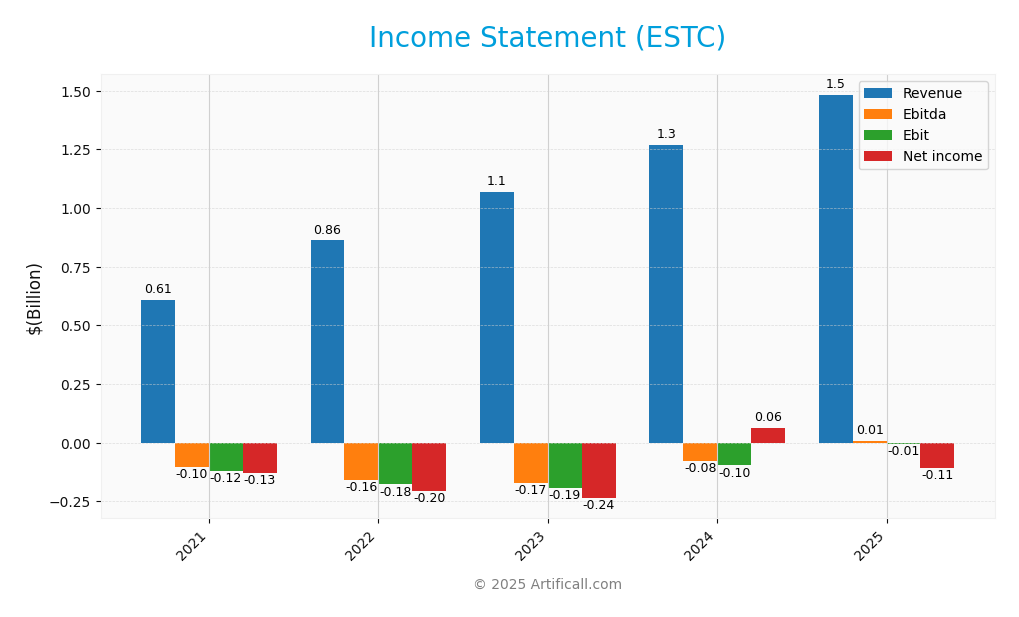

The following table presents the Income Statement for Elastic N.V. (ESTC) over the past five fiscal years, showcasing key financial metrics.

| Metric | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Revenue | 608M | 862M | 1.069B | 1.267B | 1.483B |

| Cost of Revenue | 161M | 232M | 297M | 330M | 380M |

| Operating Expenses | 577M | 804M | 992M | 1.067B | 1.158B |

| Gross Profit | 447M | 630M | 772M | 937M | 1.103B |

| EBITDA | -104M | -157M | -171M | -78.6M | 6M |

| EBIT | -121M | -177M | -192M | -97M | -6.3M |

| Interest Expense | 0.185M | 0.207M | 0.252M | 0.261M | 0.253M |

| Net Income | -129M | -204M | -236M | 62M | -108M |

| EPS | -1.48 | -2.20 | -2.47 | 0.62 | -1.04 |

| Filing Date | 2021-06-25 | 2022-06-21 | 2023-06-16 | 2024-06-14 | 2025-06-10 |

Interpretation of Income Statement

Over the past five years, Elastic N.V. has demonstrated significant revenue growth, increasing from 608M in 2021 to 1.483B in 2025. However, despite this growth, net income has fluctuated, with a notable profit in 2024 (62M) followed by a return to losses in 2025 (-108M). Margins have remained under pressure, particularly operating expenses, which have consistently increased. The most recent year saw a drastic improvement in EBITDA, indicating a potential turnaround in operational efficiency, although the company still reported a negative EBIT and net income, suggesting ongoing challenges.

Financial Ratios

The table below summarizes the financial ratios for Elastic N.V. (ESTC) across the available fiscal years.

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | -21.27% | -23.64% | -22.09% | 4.87% | -7.29% |

| ROE | -28.71% | -49.07% | -59.20% | 8.36% | -11.66% |

| ROIC | -25.90% | -16.87% | -22.96% | 4.72% | -11.80% |

| P/E | -81.27 | -34.57 | -22.89 | 165.03 | -82.65 |

| P/B | 23.33 | 16.96 | 13.55 | 13.80 | 9.64 |

| Current Ratio | 1.42 | 1.96 | 1.78 | 1.76 | 1.92 |

| Quick Ratio | 1.42 | 1.96 | 1.78 | 1.76 | 1.92 |

| D/E | 0.06 | 1.43 | 1.49 | 0.80 | 0.64 |

| Debt-to-Assets | 2.90% | 36.17% | 34.08% | 26.47% | 22.95% |

| Interest Coverage | -699.88 | -43.09 | -31.23 | -4.97 | -2.17 |

| Asset Turnover | 0.63 | 0.52 | 0.61 | 0.57 | – |

| Fixed Asset Turnover | 17.72 | 26.42 | 42.61 | 48.82 | 51.28 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Interpretation of Financial Ratios

Elastic N.V. (ESTC) displays mixed financial health based on its 2025 ratios. The current ratio stands at 1.92, indicating good liquidity, while the quick ratio mirrors this strength. However, profitability ratios reveal significant concerns: the net profit margin is at -7.29%, suggesting ongoing losses. The solvency ratio is negative at -0.06, raising worries about the company’s long-term viability. Efficiency ratios show a receivables turnover of 3.95, which is reasonable, yet the debt-to-equity ratio is 0.64, indicating a moderate level of debt relative to equity. Overall, while liquidity appears robust, the company faces challenges in profitability and solvency.

Evolution of Financial Ratios

Over the past five years, Elastic N.V.’s financial ratios have shown a concerning trend, with profitability consistently in the negative territory and solvency declining significantly, suggesting deteriorating financial performance and increased risk in the face of ongoing operational challenges.

Distribution Policy

Elastic N.V. (ESTC) currently does not pay dividends, reflecting its focus on reinvestment and growth strategies. The company is in a high-growth phase, prioritizing research and development over shareholder distributions. Notably, ESTC engages in share buybacks, which can help return value to shareholders but also carries risks of unsustainable capital allocation. This approach, while potentially beneficial for long-term value creation, requires careful monitoring of financial performance and market conditions.

Sector Analysis

Elastic N.V. operates in the Software – Application industry, offering innovative search and analytics solutions through its Elastic Stack, positioning itself against competitors like Splunk and Datadog.

Strategic Positioning

Elastic N.V. (ESTC) holds a significant market share in the software application industry, particularly with its Elastic Stack products, which are essential for data ingestion, search, and analytics. In a competitive landscape dominated by giants like Microsoft and Amazon, Elastic faces continuous pressure to innovate, especially as technological disruptions in cloud computing and AI evolve. The company’s ability to adapt and enhance its offerings is crucial for maintaining its position. With a market cap of $7.87B and a beta of 0.951, Elastic displays a relatively stable stock performance, although investor vigilance is advised given the fast-paced nature of the industry.

Revenue by Segment

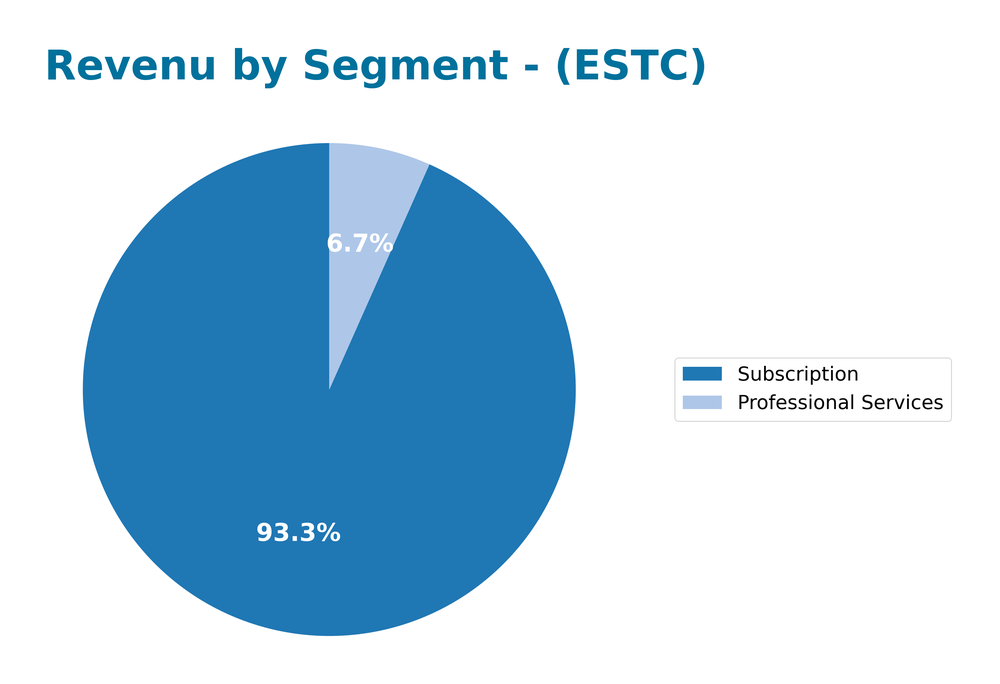

The pie chart illustrates Elastic N.V.’s revenue distribution by segment for the fiscal year ending April 30, 2025.

In FY 2025, Elastic’s revenue from the Subscription segment reached 1.38B, marking a significant increase from 1.18B in FY 2024. Conversely, Professional Services generated 98.8M, up from 90.7M the previous year. The Subscription segment continues to be the primary revenue driver, reflecting the company’s shift towards recurring revenue models. While growth in Subscription has accelerated, the Professional Services segment, while growing, poses a risk due to its lower contribution to total revenue, highlighting the importance of maintaining robust margins in a competitive landscape.

Key Products

Below is a summary of key products offered by Elastic N.V., showcasing their primary solutions designed for various data management and analysis needs.

| Product | Description |

|---|---|

| Elasticsearch | A distributed, real-time search and analytics engine that handles diverse data types including textual, numerical, and geospatial data. |

| Kibana | A powerful user interface that provides visualization and management capabilities for data within the Elastic Stack. |

| Beats | Lightweight data shippers designed for efficient data transfer from edge machines to Elasticsearch or Logstash. |

| Elastic Agent | An integrated host protection and management service that simplifies monitoring and securing environments. |

| Logstash | A data processing pipeline that ingests data from various sources and transforms it for output to Elasticsearch or other storage systems. |

| App Search | A specialized solution that enhances search functionality within applications, providing tailored search experiences. |

| Workplace Search | A comprehensive search solution that allows users to search across various data sources and applications seamlessly. |

| APM (Application Performance Management) | Tools designed to monitor and optimize application performance, ensuring a smooth user experience. |

| Synthetic Monitoring | A proactive monitoring solution that simulates user interactions to identify potential issues before they affect end users. |

These products collectively enhance data handling capabilities, enabling organizations to derive insights and make informed decisions.

Main Competitors

The competitive landscape for Elastic N.V. in the Software – Application industry includes several notable companies that provide similar technology solutions.

| Company | Market Cap |

|---|---|

| Procore Technologies, Inc. | 11.62B |

| Dayforce Inc | 11.01B |

| Pegasystems Inc. | 10.30B |

| ServiceTitan, Inc. | 9.81B |

| Paycom Software, Inc. | 9.29B |

| InterDigital, Inc. | 9.14B |

| AppFolio, Inc. | 8.46B |

| Open Text Corporation | 8.44B |

| monday.com Ltd. | 8.03B |

| NICE Ltd. | 6.59B |

| Elastic N.V. | 7.87B |

The primary competitors of Elastic N.V. operate predominantly in the global market, focusing on various segments of software applications, including search and data management technologies.

Competitive Advantages

Elastic N.V. (ESTC) boasts several competitive advantages that position it well in the technology landscape. Its robust Elastic Stack product portfolio, which includes Elasticsearch and Kibana, enables businesses to efficiently ingest, analyze, and visualize diverse datasets. The company is actively expanding into new markets, tapping into growing demand for cloud-based solutions and enhanced data analytics. Future opportunities lie in developing innovative products that integrate AI capabilities, further solidifying its leadership in search technology and analytics. With a strong market presence and continuous enhancement of its offerings, Elastic is poised for sustained growth.

SWOT Analysis

This SWOT analysis will provide insights into the strengths, weaknesses, opportunities, and threats facing Elastic N.V. (ticker: ESTC) to better inform investment decisions.

Strengths

- Strong product portfolio

- Established market presence

- Experienced management team

Weaknesses

- Limited profitability

- High dependency on cloud services

- Competitive industry landscape

Opportunities

- Growing demand for data analytics

- Expansion into emerging markets

- Strategic partnerships

Threats

- Intense competition

- Market volatility

- Regulatory challenges

Overall, the SWOT assessment indicates that while Elastic N.V. has solid strengths and promising opportunities, it also faces significant weaknesses and threats. Investors should weigh these factors carefully when considering their investment strategy in the company.

Stock Analysis

Over the past year, Elastic N.V. (ticker: ESTC) has experienced notable fluctuations in its stock price, reflecting a bearish trend characterized by significant price declines and changing trading dynamics.

Trend Analysis

The stock has experienced a percentage change of -33.29% over the past year, indicating a bearish trend. The highest price recorded was 130.39, while the lowest was 70.04. Additionally, the trend shows deceleration, suggesting that the rate of decline is slowing down. The standard deviation of 15.03 indicates a moderate level of volatility in the stock price.

Volume Analysis

In the last three months, trading volumes have been substantial, totaling approximately 886M shares. Analysis indicates that the activity is buyer-driven, with buyer volume at 516M shares (58.28% of total volume), and this trend appears to be increasing. Recent data from September 21 to December 7 shows a buyer dominance of 62.57%, further reflecting positive investor sentiment despite the overall bearish price trend.

Analyst Opinions

Recent analyst recommendations for Elastic N.V. (ESTC) suggest a cautious stance, reflected in a rating of C- from analysts. The overall score is low, indicating concerns about the company’s financial health, particularly in return on equity and assets, which both scored 1. Analysts are pointing to a challenging market environment and suggest a hold strategy as the consensus for 2025. While some analysts see potential for growth, the prevailing sentiment remains cautious, favoring risk management over aggressive investment in ESTC at this time.

Stock Grades

Recent evaluations of Elastic N.V. (ESTC) reveal a consistent sentiment among various grading companies regarding its stock performance.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | maintain | Buy | 2025-11-24 |

| Cantor Fitzgerald | maintain | Neutral | 2025-11-21 |

| Morgan Stanley | maintain | Overweight | 2025-11-21 |

| Stifel | maintain | Buy | 2025-11-21 |

| DA Davidson | maintain | Neutral | 2025-11-21 |

| UBS | maintain | Buy | 2025-11-21 |

| Rosenblatt | maintain | Buy | 2025-11-21 |

| JP Morgan | maintain | Overweight | 2025-11-21 |

| Guggenheim | maintain | Buy | 2025-11-21 |

| B of A Securities | maintain | Neutral | 2025-11-21 |

Overall, the trend indicates a stable outlook for Elastic N.V., with several firms maintaining their “Buy” ratings, suggesting continued confidence in the company’s future performance. However, a mix of “Neutral” grades from some analysts indicates a level of caution that investors should consider.

Target Prices

The consensus target prices for Elastic N.V. (ESTC) indicate a promising outlook from analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 134 | 76 | 108 |

Overall, analysts expect Elastic N.V. to perform within a range of 76 to 134, with a consensus target of 108.

Consumer Opinions

Consumer sentiment surrounding Elastic N.V. (ESTC) reveals a mixed but insightful perspective, showcasing both appreciation and concerns.

| Positive Reviews | Negative Reviews |

|---|---|

| “Elastic’s search capabilities are top-notch!” | “Customer support needs improvement.” |

| “User-friendly interface makes it easy to implement.” | “Pricing can be steep for small businesses.” |

| “Analytics features are robust and insightful.” | “Occasional bugs disrupt performance.” |

Overall, consumer feedback reflects a strong appreciation for Elastic’s powerful search and analytics features, while concerns about pricing and customer support are recurring weaknesses.

Risk Analysis

In evaluating Elastic N.V. (ESTC), it is essential to understand the various risks that could impact its performance and investment viability. Below is a summary of key risks to consider:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Fluctuations in demand for cloud services could impact revenue. | High | High |

| Operational Risk | Challenges in scaling operations may lead to inefficiencies. | Medium | Medium |

| Competitive Risk | Intense competition from established players in the tech space. | High | High |

| Regulatory Risk | Changes in data protection regulations may affect operations. | Medium | High |

| Financial Risk | High dependency on subscription revenue could strain finances. | Medium | Medium |

In summary, the most significant risks for ESTC are market and competitive risks, given the rapid evolution of the tech landscape and the potential for decreased demand amid economic shifts. Careful monitoring of these factors is crucial for risk management.

Should You Buy Elastic N.V.?

Elastic N.V. (ESTC) reported a revenue of 1.48B in FY 2025, indicating a growth of 17.04%. However, the company experienced a net loss of 108.11M, leading to a negative net profit margin of 7.29%. The debt-to-equity ratio stands at 0.6417, suggesting a moderate level of leverage. With a WACC of 7.93 and a return on invested capital (ROIC) of -11.80%, the company is currently destroying value. The overall rating is C-, indicating potential concerns in financial health and performance.

Favorable signals

The data presents several favorable elements for Elastic N.V. The company has demonstrated strong revenue growth of 17.04% and gross margin of 74.39%, along with a gross profit growth of 17.73%. Additionally, the operating expenses compared to revenue growth are also favorable at 17.04%. The EBIT margin growth is notably positive at 93.52%, and the interest expense is a low 1.71%. Furthermore, the current ratio stands at 1.92, indicating good short-term financial health, while the debt-to-assets ratio of 22.95% suggests manageable leverage.

Unfavorable signals

Despite the favorable indicators, there are significant unfavorable elements to consider. The EBIT margin is negative at -0.42%, and the net margin is also negative at -7.29%. Additionally, the growth in net margin is extremely negative at -249.66%, and the EPS growth stands at -276.27%. Financial ratios reflect further negativity, with a return on equity of -11.66% and a return on invested capital of -11.8%, both indicating value destruction. The price-to-earnings ratio is at -82.65, and the interest coverage ratio is negative at -0.25, which could indicate difficulty in meeting interest obligations.

Conclusion

Given that the overall opinion on the income statement is favorable, but the global ratios evaluation is unfavorable, this situation might suggest a mixed outlook. The long-term trend is bearish, indicating that it may be prudent to wait for buyers to return before making any investment decisions.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- ESTC – Elastic N.V. Latest Stock News & Market Updates – Stock Titan (Dec 02, 2025)

- Data Infrastructure Stocks Q3 In Review: Elastic (NYSE:ESTC) Vs Peers – Finviz (Dec 05, 2025)

- Bullish Analyst Sentiment on Elastic N.V. (ESTC) Holds Despite Softer Net-New Cloud Momentum – MSN (Nov 30, 2025)

- Elastic N.V. $ESTC Shares Acquired by Mackenzie Financial Corp – MarketBeat (Dec 04, 2025)

- Why Is Elastic Stock Gaining Tuesday? – Elastic (NYSE:ESTC) – Benzinga (Dec 02, 2025)

For more information about Elastic N.V., please visit the official website: elastic.co