Home > Analyses > Healthcare > Edwards Lifesciences Corporation

Edwards Lifesciences transforms cardiac care with its cutting-edge heart valve technologies and critical care monitoring systems. The company dominates the medical devices sector by pioneering minimally invasive transcatheter valve replacements and innovative surgical solutions. Renowned for combining precision engineering with clinical excellence, Edwards shapes patient outcomes worldwide. As the healthcare landscape evolves, I assess whether Edwards’ robust innovation pipeline and market position justify its current valuation and growth prospects.

Table of contents

Business Model & Company Overview

Edwards Lifesciences Corporation, founded in 1958 and based in Irvine, California, stands as a leader in the medical devices sector. The company’s core mission centers on innovating treatments for structural heart disease and critical care monitoring. Its portfolio forms a cohesive ecosystem of transcatheter heart valve replacements, repairs, and surgical solutions, addressing complex cardiovascular conditions with minimally invasive technologies.

The company generates revenue through a balanced mix of high-value hardware and recurring software services, including its advanced hemodynamic monitoring systems and predictive software. Edwards maintains strategic market positions across the Americas, Europe, and Asia, leveraging a direct sales force and distributors. Its durable competitive advantage lies in a robust economic moat created by cutting-edge innovation and comprehensive clinical integration.

Financial Performance & Fundamental Metrics

I analyze Edwards Lifesciences Corporation’s income statement, key financial ratios, and dividend payout strategy to assess its overall financial health and shareholder value.

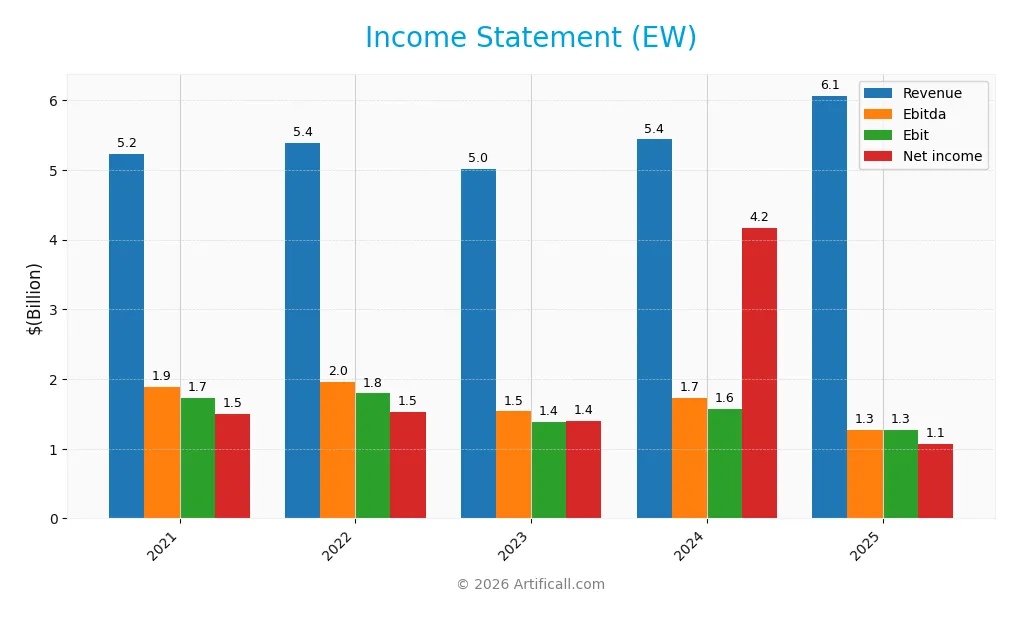

Income Statement

The table below summarizes Edwards Lifesciences Corporation’s key income statement figures for fiscal years 2021 through 2025.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 5.23B | 5.38B | 5.01B | 5.44B | 6.07B |

| Cost of Revenue | 1.23B | 1.17B | 1.04B | 1.12B | 1.33B |

| Operating Expenses | 2.40B | 2.51B | 2.55B | 2.94B | 3.10B |

| Gross Profit | 4.01B | 4.22B | 3.97B | 4.32B | 4.74B |

| EBITDA | 1.89B | 1.96B | 1.53B | 1.72B | 1.27B |

| EBIT | 1.73B | 1.79B | 1.39B | 1.57B | 1.27B |

| Interest Expense | 24.8M | 26.2M | 17.6M | 19.8M | 0 |

| Net Income | 1.50B | 1.52B | 1.40B | 4.17B | 1.07B |

| EPS | 2.41 | 2.46 | 2.31 | 6.98 | 1.84 |

| Filing Date | 2022-02-14 | 2023-02-13 | 2024-02-12 | 2025-02-28 | 2026-02-10 |

Income Statement Evolution

Edwards Lifesciences’ revenue grew steadily by 15.96% over 2021-2025, with a favorable 11.55% increase in 2025 alone. Gross margin remained strong at 78.13%, supporting consistent profitability. However, net income declined by 28.58% overall, reflecting margin compression and a sharp 76.95% drop in net margin growth in 2025.

Is the Income Statement Favorable?

In 2025, revenue reached $6.07B with a gross profit of $4.74B, maintaining a solid 78% gross margin. Despite an 18.81% EBIT decline and weaker net income growth, margins stayed favorable with a 17.69% net margin. Interest expenses were zero, supporting a healthy capital structure. Overall, fundamentals remain favorable but show signs of margin pressure.

Financial Ratios

The following table summarizes key financial ratios for Edwards Lifesciences Corporation (EW) from 2021 to 2025, providing a clear view of its profitability, valuation, liquidity, leverage, and efficiency metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 29% | 28% | 28% | 767%* | 18% |

| ROE | 26% | 26% | 21% | 42% | 0% |

| ROIC | 19% | 20% | 15% | 11% | 0% |

| P/E | 54 | 30 | 33 | 11 | 46 |

| P/B | 14 | 8 | 7 | 4 | 0 |

| Current Ratio | 3.1 | 3.0 | 3.4 | 4.2 | 0 |

| Quick Ratio | 2.4 | 2.2 | 2.6 | 3.5 | 0 |

| D/E | 0.12 | 0.12 | 0.10 | 0.07 | 0 |

| Debt-to-Assets | 8% | 8% | 7% | 5% | 0% |

| Interest Coverage | 65 | 65 | 81 | 70 | 0 |

| Asset Turnover | 0.62 | 0.65 | 0.54 | 0.42 | 0 |

| Fixed Asset Turnover | 3.2 | 3.1 | 3.0 | 3.0 | 0 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

*The 2024 net margin value appears anomalously high and likely requires further verification. Zero or missing values indicate data was unavailable or not reported for that year.

Evolution of Financial Ratios

Edwards Lifesciences’ Return on Equity (ROE) declined sharply to 0% in 2025 from a high of 41.75% in 2024, indicating a loss of profitability momentum. The Current Ratio shifted to an unavailable zero in 2025 after consistently strong liquidity above 3.0 in prior years. Debt-to-Equity Ratio improved to 0 in 2025, suggesting reduced leverage or data omission. Profitability showed mixed signals with net margin favorable but operating margins negative in 2025.

Are the Financial Ratios Fovorable?

The 2025 ratios present a mixed picture. Profitability is partially favorable with a solid 17.7% net margin but zero ROE and ROIC flag concerns on capital returns. Liquidity ratios are reported as zero, which is unfavorable, while leverage ratios such as debt-to-equity and debt-to-assets are favorable at zero. Market valuation appears stretched with a high P/E of 46.4, marked as unfavorable. Overall, 35.7% of ratios are favorable versus 57.1% unfavorable, leading to an unfavorable global ratio assessment.

Shareholder Return Policy

Edwards Lifesciences Corporation does not pay dividends, reflecting its reinvestment strategy and focus on growth. The absence of dividend payouts aligns with its financial profile, which shows positive net income but prioritizes capital allocation to innovation and expansion.

The company does not currently engage in share buybacks either, indicating a preference to retain earnings for internal use. This policy supports long-term value creation by emphasizing sustainable growth rather than immediate shareholder distributions.

Score analysis

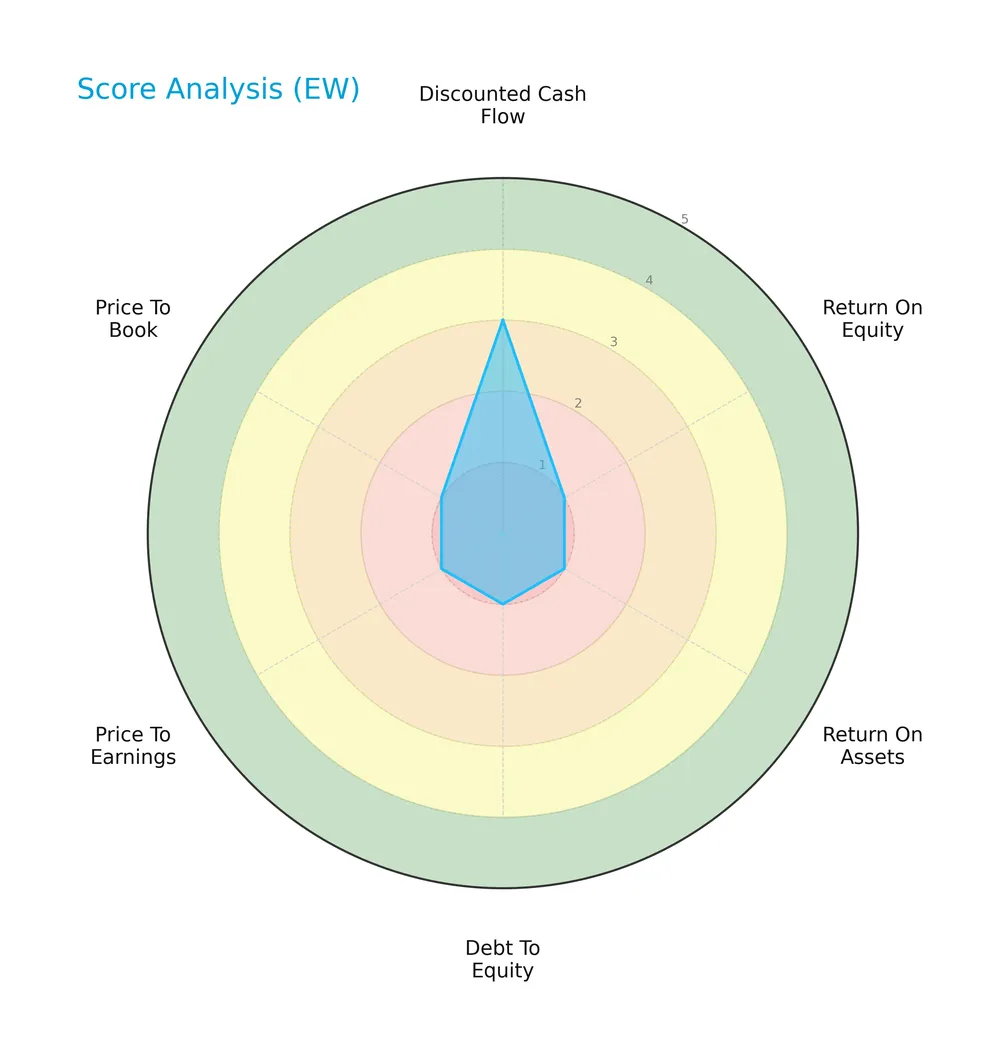

The following radar chart displays key financial scores evaluating Edwards Lifesciences Corporation’s valuation and profitability metrics:

The discounted cash flow score is moderate at 3, but all other metrics—including return on equity, return on assets, debt to equity, price to earnings, and price to book—score very unfavorable at 1, indicating broad weaknesses in profitability and valuation.

Analysis of the company’s bankruptcy risk

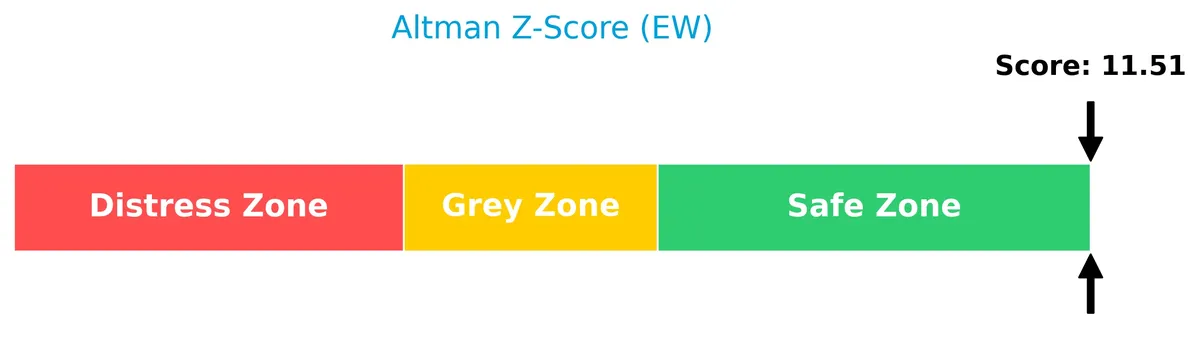

Edwards Lifesciences’ Altman Z-Score places it firmly in the safe zone, signaling a very low risk of bankruptcy and financial distress:

Is the company in good financial health?

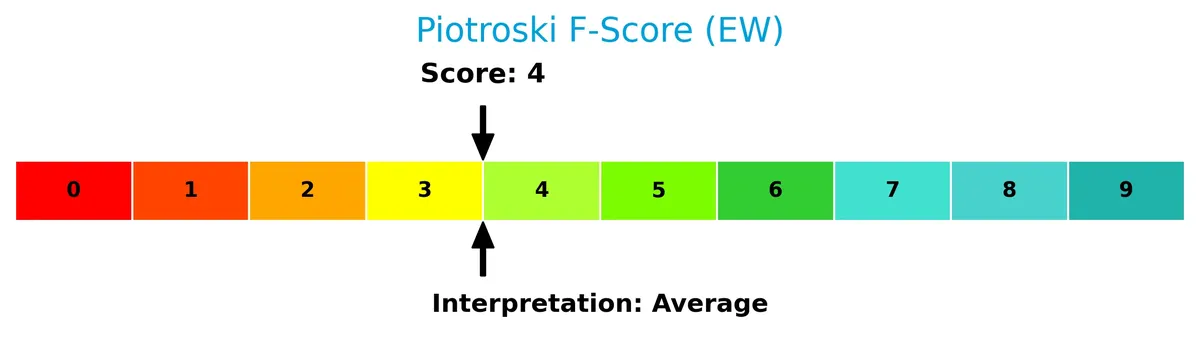

The Piotroski Score diagram summarizes the company’s financial strength based on nine accounting criteria:

With a Piotroski Score of 4, Edwards Lifesciences ranks as average, reflecting mixed financial health with room for improvement in profitability and efficiency metrics.

Competitive Landscape & Sector Positioning

This section examines Edwards Lifesciences Corporation’s strategic positioning within the medical devices sector. We analyze its revenue by segment, key products, and main competitors. The goal is to assess if Edwards maintains a competitive advantage over its peers.

Strategic Positioning

Edwards Lifesciences concentrates its portfolio on structural heart and critical care devices, with dominant transcatheter heart valve sales at $4.1B in 2024. Geographically, it focuses heavily on the U.S. ($3.2B), complemented by significant exposure in Europe ($1.3B) and Japan ($340M).

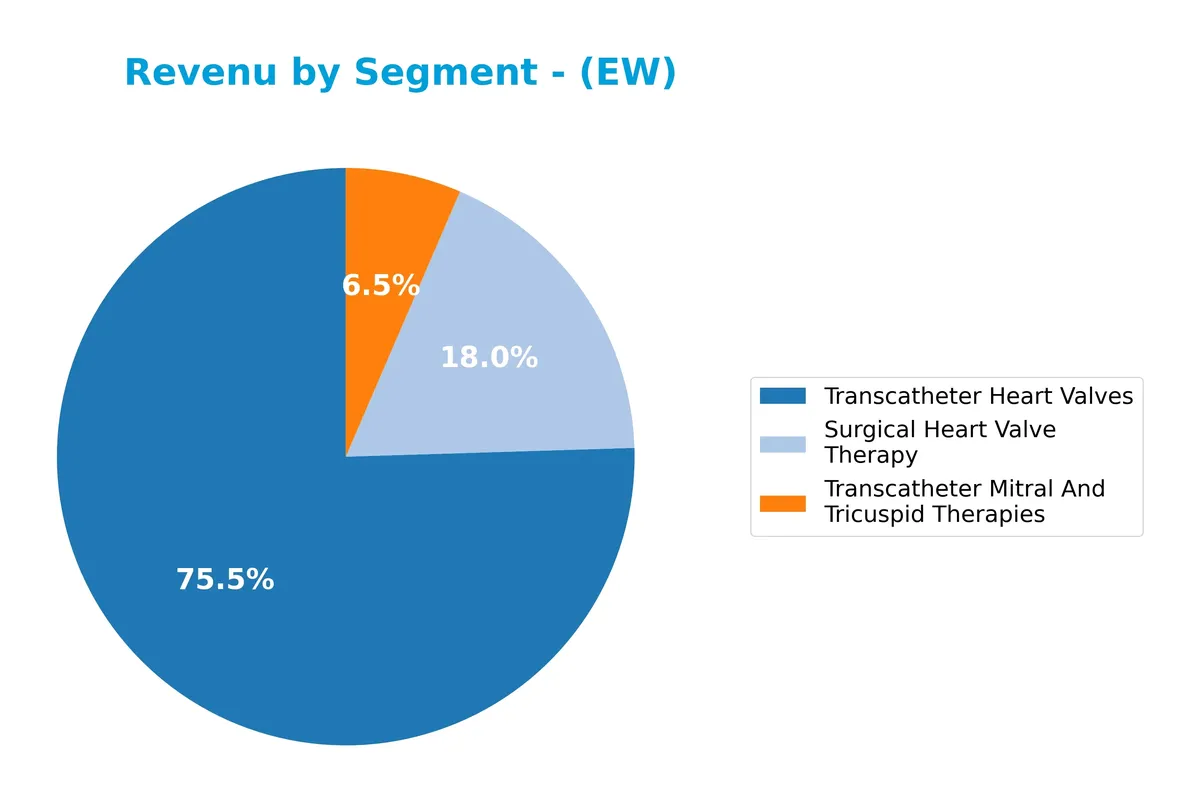

Revenue by Segment

This pie chart illustrates Edwards Lifesciences’ revenue distribution by product segment for the fiscal year 2024, highlighting key drivers in heart valve and critical care therapies.

In 2024, Transcatheter Heart Valves dominate with $4.1B, reflecting steady growth and strong market demand. Surgical Heart Valve Therapy remains significant at $981M but shows a slight decline from prior years. Transcatheter Mitral and Tricuspid Therapies, at $352M, continue to gain traction, signaling emerging growth potential. The absence of Critical Care in 2024 data may indicate strategic reallocation or reporting changes, raising a point to watch for concentration risk.

Key Products & Brands

The following table outlines Edwards Lifesciences’ key products and brands with brief descriptions:

| Product | Description |

|---|---|

| Transcatheter Heart Valves | Minimally invasive heart valve replacement products targeting aortic valve disease. |

| Transcatheter Mitral And Tricuspid Therapies | Products for minimally invasive repair and replacement of mitral and tricuspid valves. |

| Surgical Heart Valve Therapy | Surgical solutions including aortic valve replacements and pre-assembled tissue valved conduits. |

| Critical Care | Advanced hemodynamic monitoring systems and software to manage heart function and blood pressure. |

Edwards Lifesciences focuses on structural heart disease and critical care. Its portfolio emphasizes minimally invasive transcatheter therapies alongside surgical and monitoring solutions. This diversified product mix supports growth across multiple cardiovascular treatment areas.

Main Competitors

There are 10 competitors in total, with the following table listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Abbott Laboratories | 216B |

| Boston Scientific Corporation | 140B |

| Stryker Corporation | 133B |

| Medtronic plc | 123B |

| Edwards Lifesciences Corporation | 50B |

| DexCom, Inc. | 26B |

| STERIS plc | 25B |

| Insulet Corporation | 20B |

| Zimmer Biomet Holdings, Inc. | 18B |

| Align Technology, Inc. | 11B |

Edwards Lifesciences ranks 5th among its peers with a market cap at 21.55% of the leader, Abbott Laboratories. The company sits below the top 10 average market cap of 76B but above the sector median of 38B. Edwards maintains a significant 164.51% gap above its closest rival, Medtronic, highlighting a strong mid-tier positioning.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does EW have a competitive advantage?

Edwards Lifesciences Corporation demonstrates competitive strengths with a strong gross margin of 78% and favorable net margins near 18%. Its diversified product line in structural heart disease and critical care supports a stable market position.

Looking ahead, Edwards pursues growth through innovative transcatheter valve repair systems and advanced hemodynamic monitoring. Expansion in international markets, especially Europe and Japan, offers further opportunities despite recent declines in profitability metrics.

SWOT Analysis

This SWOT analysis highlights Edwards Lifesciences Corporation’s strategic position by examining its internal capabilities and external environment.

Strengths

- Strong market position in structural heart disease

- High gross margin at 78%

- Robust revenue growth of 16% over 5 years

Weaknesses

- Declining net income and EPS growth

- Unfavorable ROE and ROIC metrics

- High P/E ratio at 46.4 indicating expensive valuation

Opportunities

- Expansion in minimally invasive heart valve therapies

- Growth potential in international markets

- Innovation in critical care monitoring systems

Threats

- Intense competition in medical devices

- Regulatory risks in global markets

- Pricing pressures could impact margins

Edwards shows solid top-line momentum and strong product positioning but faces profitability and valuation challenges. The company must leverage innovation and geographic expansion while managing operational efficiency and competitive threats.

Stock Price Action Analysis

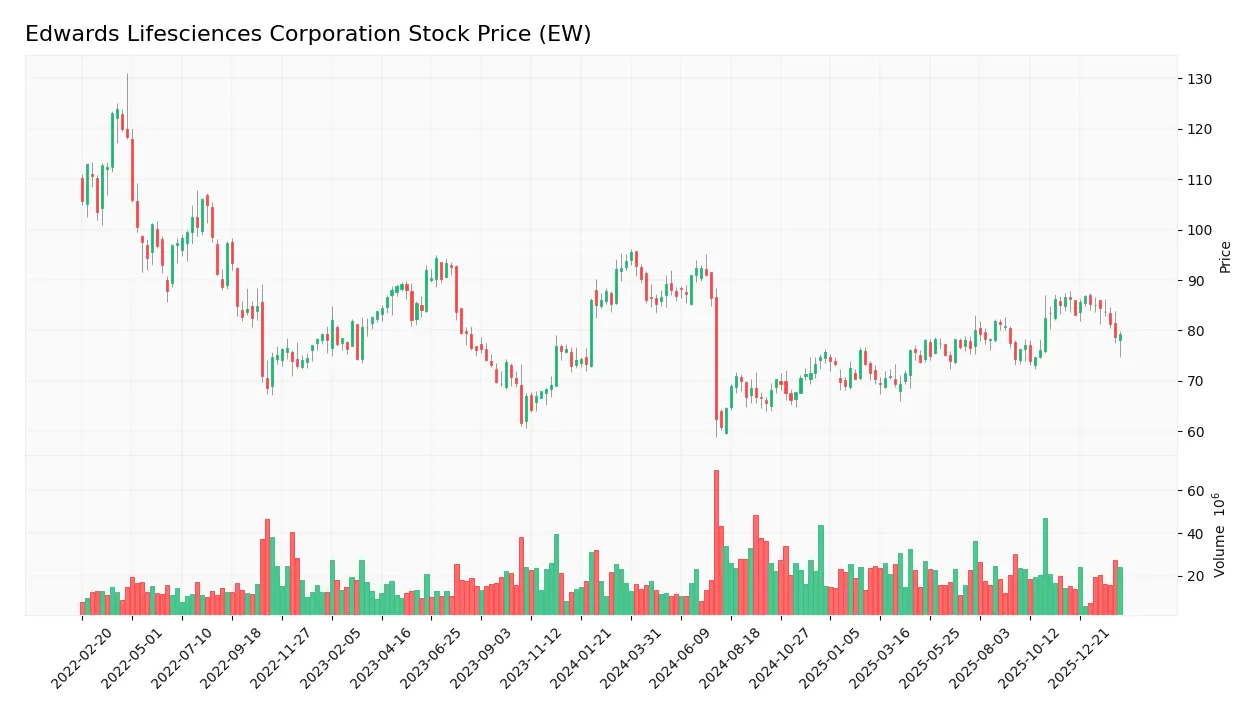

The following weekly chart details Edwards Lifesciences Corporation’s stock price movement over the past 12 months:

Trend Analysis

Over the past year, EW’s stock declined by 15.42%, indicating a bearish trend with deceleration. The price ranged between 95.56 and 60.83, with volatility reflected by a 7.99 standard deviation. Recent months show an 8.47% drop with a -0.62 slope, confirming continued negative momentum.

Volume Analysis

Trading volume totaled 2.6B shares, with a balanced buyer-seller split near 50%. However, volume is decreasing overall. Recent three-month activity is seller-driven, with buyer dominance at only 33.61%, signaling cautious or retreating investor interest.

Target Prices

Analysts set a clear target consensus for Edwards Lifesciences Corporation, reflecting moderate upside potential.

| Target Low | Target High | Consensus |

|---|---|---|

| 87 | 110 | 96.38 |

The target range suggests cautious optimism, with analysts expecting a steady valuation lift from current levels.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews Edwards Lifesciences Corporation’s analyst ratings and consumer feedback to assess market sentiment.

Stock Grades

Here are the latest verified grades from established analysts for Edwards Lifesciences Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Maintain | Overweight | 2026-02-11 |

| Truist Securities | Maintain | Hold | 2026-02-11 |

| BTIG | Maintain | Buy | 2026-02-11 |

| Wells Fargo | Maintain | Overweight | 2026-02-11 |

| Stifel | Maintain | Buy | 2026-01-20 |

| Piper Sandler | Maintain | Overweight | 2026-01-20 |

| UBS | Maintain | Neutral | 2026-01-12 |

| Barclays | Maintain | Overweight | 2026-01-12 |

| TD Cowen | Upgrade | Buy | 2026-01-09 |

| Stifel | Maintain | Buy | 2026-01-07 |

The consensus leans clearly toward a Buy rating, with most firms maintaining or upgrading their outlook. Overweights and buys dominate, reflecting steady confidence among leading analysts.

Consumer Opinions

Edwards Lifesciences Corporation (EW) consistently garners strong praise for innovation but faces some concerns over pricing and service.

| Positive Reviews | Negative Reviews |

|---|---|

| “Cutting-edge heart valve technology improves lives.” | “High product cost limits accessibility.” |

| “Excellent customer support and training programs.” | “Delivery delays affect surgical schedules.” |

| “Reliable and durable medical devices.” | “Complex warranty process can be frustrating.” |

Consumers appreciate Edwards Lifesciences’ advanced technology and dependable products. However, pricing and logistical issues emerge as common pain points.

Risk Analysis

Below is a summary of key risks facing Edwards Lifesciences Corporation, classified by category, probability, and impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Metrics | Unfavorable ROE, ROIC, and liquidity ratios raise caution. | Medium | High |

| Valuation | Elevated P/E of 46.44 suggests stretched stock valuation. | High | Medium |

| Operational | Low asset turnover indicates inefficiency in asset utilization. | Medium | Medium |

| Market & Industry | Exposure to competitive pressures in medical devices sector. | Medium | Medium |

| Dividend Policy | No dividend yield limits income appeal for yield-focused investors. | High | Low |

The most pressing risks stem from valuation and profitability metrics. Edwards trades at a premium P/E despite weak returns on equity and capital. Historically in healthcare devices, sustained high multiples demand strong cash flow and innovation. I’ve observed that Edwards’ average Piotroski score of 4 signals moderate financial health, requiring close monitoring. Its safe Altman Z-score provides reassurance against bankruptcy risk. However, investors should beware the elevated valuation and operational inefficiencies as potential red flags.

Should You Buy Edwards Lifesciences Corporation?

Edwards Lifesciences appears to exhibit robust profitability supported by strong operational efficiency. While competitive moat data is unavailable and ROIC shows a declining trend, the company maintains a manageable leverage profile. Its overall rating could be seen as a cautious C-.

Strength & Efficiency Pillars

Edwards Lifesciences Corporation exhibits strong operational efficiency with a gross margin of 78.13% and an EBIT margin of 20.98%. The net margin stands at a solid 17.69%, reflecting effective cost management and pricing power. Despite these robust margins, the company suffers from an unfavorable return on equity (0%) and return on invested capital (0%), with no available WACC to confirm value creation. These figures suggest operational strength but raise concerns about capital efficiency.

Weaknesses and Drawbacks

The company faces several significant headwinds. Its high price-to-earnings ratio of 46.44 signals an expensive valuation that may deter value-oriented investors. Liquidity metrics such as current and quick ratios are unfavorable, hinting at potential short-term financial stress. Additionally, the bearish stock trend with a recent price decline of 8.47% and seller dominance at 66.39% poses near-term market pressure. These factors combined reduce the risk appetite for the stock despite operational strengths.

Our Final Verdict about Edwards Lifesciences Corporation

The Altman Z-Score at 11.51 places Edwards Lifesciences comfortably in the safe zone, alleviating immediate solvency concerns. However, the unfavorable returns on equity and capital, paired with a high valuation and bearish market sentiment, suggest caution. Despite long-term operational strength, recent price weakness and seller dominance may warrant a wait-and-see stance before considering entry.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Edwards Lifesciences Corporation (NYSE:EW) Q4 2025 earnings call transcript – MSN (Feb 11, 2026)

- Wells Fargo & Company Raises Edwards Lifesciences (NYSE:EW) Price Target to $100.00 – MarketBeat (Feb 11, 2026)

- Why The Narrative Around Edwards Lifesciences EW Is Shifting After 2026 Outlook And JenaValve Setback – Yahoo Finance (Feb 11, 2026)

- EW’s Q4 Earnings Miss Estimates, Revenues Up Y/Y, Stock Climbs – TradingView (Feb 11, 2026)

- Wells Fargo Raises Price Target for Edwards Lifesciences (EW) | EW Stock News – GuruFocus (Feb 11, 2026)

For more information about Edwards Lifesciences Corporation, please visit the official website: edwards.com