Home > Analyses > Utilities > Edison International

Edison International powers the lives of 15 million customers across California, making it a cornerstone of the state’s energy landscape. With extensive transmission and distribution networks, the company stands out as a leader in the regulated electric utility sector, known for its commitment to reliable service and innovative energy solutions. As the energy industry evolves, the key question remains: does Edison International’s current market position and financial health support continued growth and shareholder value?

Table of contents

Business Model & Company Overview

Edison International, founded in 1886 and headquartered in Rosemead, California, stands as a dominant player in the regulated electric industry. Through its subsidiaries, it operates an extensive electricity ecosystem delivering power to 15M customers across Southern, Central, and Coastal California. Its integrated infrastructure includes over 70,000 circuit-miles of overhead and underground lines and 800 substations, supporting residential, commercial, and industrial energy needs with a focus on reliability and scale.

The company’s revenue engine is anchored in the generation and distribution of electric power, balancing regulated utility operations with energy solutions for commercial users. Its transmission and distribution systems form the backbone of its service offering, creating steady cash flows across key US markets. This entrenched infrastructure and customer base form a robust economic moat, positioning Edison International as a pivotal force shaping the future of energy delivery in California.

Financial Performance & Fundamental Metrics

This section analyzes Edison International’s income statement, key financial ratios, and dividend payout policy to provide a clear view of its fundamental health.

Income Statement

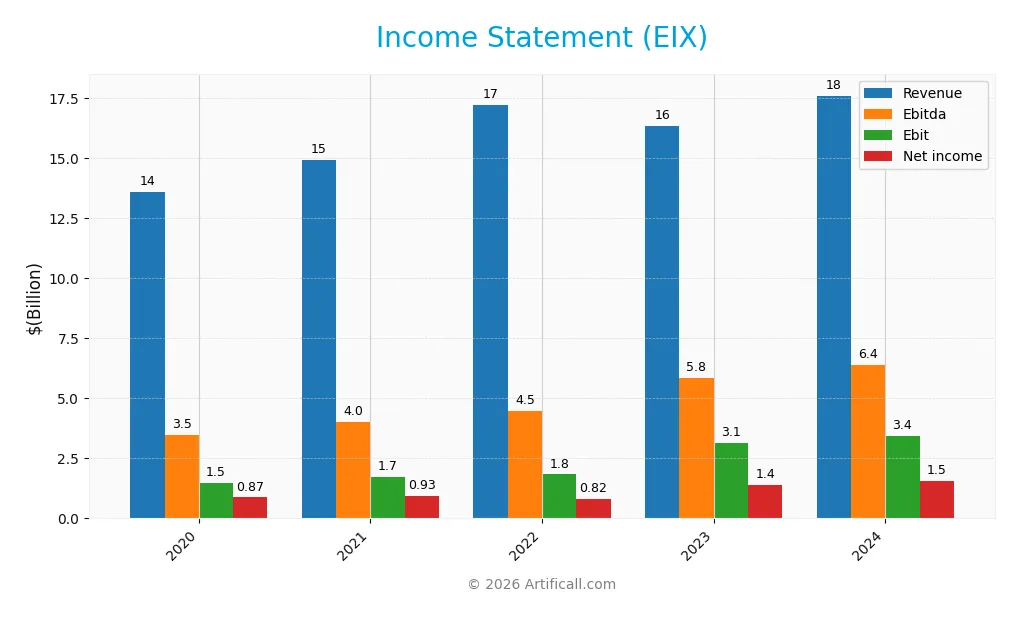

Below is Edison International’s income statement summary for the fiscal years 2020 through 2024, reflecting key financial performance metrics in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 13.6B | 14.9B | 17.2B | 16.3B | 17.6B |

| Cost of Revenue | 8.5B | 9.2B | 11.1B | 9.6B | 10.4B |

| Operating Expenses | 3.8B | 4.2B | 4.6B | 4.1B | 4.3B |

| Gross Profit | 5.0B | 5.7B | 6.1B | 6.7B | 7.2B |

| EBITDA | 3.5B | 4.0B | 4.5B | 5.8B | 6.4B |

| EBIT | 1.5B | 1.7B | 1.8B | 3.1B | 3.4B |

| Interest Expense | 902M | 925M | 1.2B | 1.6B | 1.9B |

| Net Income | 871M | 925M | 824M | 1.4B | 1.5B |

| EPS | 1.98 | 2.00 | 1.61 | 3.13 | 3.33 |

| Filing Date | 2021-02-25 | 2022-02-24 | 2023-02-23 | 2024-02-22 | 2025-02-27 |

Income Statement Evolution

From 2020 to 2024, Edison International’s revenue increased by 29.6% to $17.6B, showing healthy growth. Net income surged 77.5%, reflecting improved profitability. Gross margin stood at a favorable 41.0%, while EBIT margin reached 19.5%, both indicating efficient cost control. Net margin growth of 36.9% confirms enhanced bottom-line performance despite a slight margin pressure from interest expenses.

Is the Income Statement Favorable?

In 2024, Edison International reported a 7.7% revenue rise to $17.6B and a 9.8% EBIT growth to $3.4B, underpinning solid operational momentum. The net margin remained favorable at 8.8%, though interest expense accounted for 10.6% of revenue, an unfavorable factor. Overall, the income statement fundamentals appear favorable, supported by strong margin improvements and consistent earnings per share growth.

Financial Ratios

The following table presents key financial ratios for Edison International (ticker: EIX) over the fiscal years 2020 to 2024, illustrating profitability, efficiency, liquidity, leverage, and shareholder returns:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 6.4% | 6.2% | 4.8% | 8.6% | 8.8% |

| ROE | 6.2% | 5.8% | 5.3% | 9.1% | 9.9% |

| ROIC | 1.9% | 2.1% | 2.0% | 3.2% | 3.6% |

| P/E | 26.9 | 28.0 | 29.4 | 19.5 | 19.9 |

| P/B | 1.7 | 1.6 | 1.6 | 1.8 | 2.0 |

| Current Ratio | 0.49 | 0.64 | 0.68 | 0.79 | 0.85 |

| Quick Ratio | 0.45 | 0.59 | 0.64 | 0.73 | 0.78 |

| D/E | 1.7 | 1.9 | 2.1 | 2.3 | 2.4 |

| Debt-to-Assets | 35% | 40% | 42% | 43% | 44% |

| Interest Coverage | 1.3 | 1.6 | 1.3 | 1.6 | 1.6 |

| Asset Turnover | 0.20 | 0.20 | 0.22 | 0.20 | 0.21 |

| Fixed Asset Turnover | 0.28 | 0.28 | 0.31 | 0.29 | 0.29 |

| Dividend Yield | 4.0% | 3.9% | 4.7% | 4.5% | 4.2% |

Evolution of Financial Ratios

From 2020 to 2024, Edison International’s Return on Equity (ROE) showed a fluctuating but overall upward trend, reaching 9.93% in 2024, though still considered unfavorable. The Current Ratio improved modestly from 0.49 to 0.85 but remains below the ideal threshold, indicating weak liquidity. The Debt-to-Equity Ratio steadily increased, peaking at 2.43 in 2024, reflecting higher leverage and financial risk. Profitability margins showed some stability, with net profit margin near 8.8% in 2024.

Are the Financial Ratios Favorable?

In 2024, Edison International’s profitability is neutral with an 8.78% net margin, but ROE and return on invested capital are unfavorable, suggesting limited efficiency in generating shareholder returns. Liquidity ratios, including current and quick ratios, are unfavorable, indicating potential short-term solvency concerns. Leverage remains high with a debt-to-equity ratio of 2.43, also unfavorable. Market valuation ratios such as price-to-earnings and price-to-book are neutral, while dividend yield at 4.17% is favorable. Overall, the financial ratios assessment is predominantly unfavorable.

Shareholder Return Policy

Edison International maintains a consistent dividend policy with a payout ratio near 83%, yielding around 4.17% annually. Despite steady dividends per share growth, free cash flow coverage is negative, indicating distributions and share buybacks may rely on external financing. The company supports returns with share repurchases, though free cash flow deficits and high leverage suggest potential sustainability risks. Overall, the current distribution approach shows a commitment to shareholder returns but warrants close monitoring for long-term viability.

Score analysis

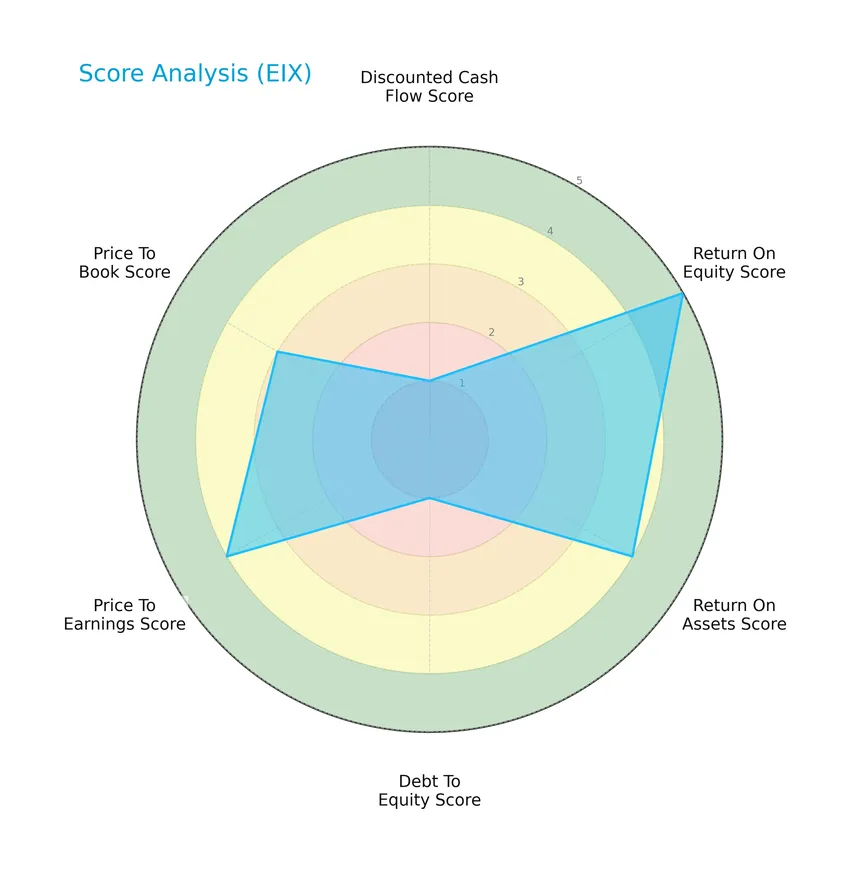

The following radar chart illustrates Edison International’s key financial scores, providing a snapshot of its valuation and performance metrics:

Edison International shows a strong return on equity (5) and favorable return on assets (4), while discounted cash flow and debt-to-equity scores are very unfavorable (1 each). Price-to-earnings is favorable (4), and price-to-book is moderate (3), reflecting mixed financial signals.

Analysis of the company’s bankruptcy risk

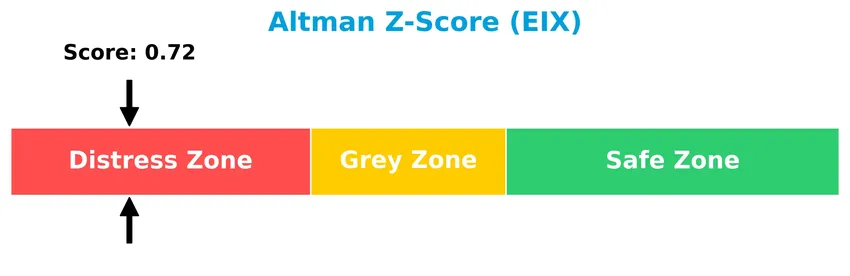

Edison International’s Altman Z-Score places it in the distress zone, indicating a high risk of financial distress and potential bankruptcy:

Is the company in good financial health?

The Piotroski Score diagram below highlights Edison International’s financial health based on nine key criteria:

With a Piotroski Score of 6, Edison International is considered to have average financial strength, suggesting moderate financial health but room for improvement.

Competitive Landscape & Sector Positioning

This sector analysis will examine Edison International’s strategic positioning, revenue by segment, key products, main competitors, and competitive advantages. I will assess whether the company holds a competitive advantage over its industry peers based on these factors.

Strategic Positioning

Edison International primarily focuses on regulated electric utility services, delivering electricity to 15M customers mainly in California, with revenues dominated by its Electric Utility segment (~$10.6B in 2011). The company maintains a concentrated geographic exposure and product portfolio centered on electricity generation and distribution.

Revenue by Segment

This pie chart displays Edison International’s revenue distribution by segment for fiscal year 2011, highlighting the company’s main business areas and their relative contributions.

In 2011, Edison International’s revenue was predominantly driven by the Electric Utility segment, which generated 10.6B USD, showing a growth from 9.98B USD in 2010. Competitive Power Generation contributed 2.19B USD but experienced a decline from 2.43B USD the previous year. The “Parent And Other” segment reported a small negative figure and is excluded from analysis. The data suggests a concentration in Electric Utility with a slight slowdown in Competitive Power Generation.

Key Products & Brands

The table below summarizes Edison International’s main products and brands by business segment:

| Product | Description |

|---|---|

| Electric Utility | Generation and distribution of electric power to 15M customers across Southern, Central, and Coastal California, including transmission lines (55 kV to 500 kV) and approximately 70,000 circuit-miles of overhead and underground distribution lines with 800 substations. |

| Competitive Power Generation | Power generation sold competitively outside the regulated utility business, contributing significant revenue to the company. |

| Parent And Other | Corporate and other activities not directly related to core electric utility or generation operations, showing minor negative revenue impact. |

Edison International’s key offerings center on regulated electric utility services in California and competitive power generation, reflecting a diversified energy portfolio within the utilities sector.

Main Competitors

There are 23 competitors in the Regulated Electric industry; below are the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| NextEra Energy, Inc. | 169B |

| The Southern Company | 96B |

| Duke Energy Corporation | 91B |

| American Electric Power Company, Inc. | 62B |

| Dominion Energy, Inc. | 51B |

| Exelon Corporation | 44B |

| Xcel Energy Inc. | 44B |

| Entergy Corporation | 42B |

| Public Service Enterprise Group Incorporated | 40B |

| Consolidated Edison, Inc. | 36B |

Edison International ranks 18th among 23 competitors, with a market cap approximately 13.9% the size of the leader, NextEra Energy. The company is positioned below both the average market cap of the top 10 competitors (67.5B) and the sector median (34B). It maintains a 7.28% market cap gap to the next competitor above, indicating a moderate distance from its closest rival.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does Edison International have a competitive advantage?

Edison International currently shows a slightly unfavorable competitive advantage as its return on invested capital (ROIC) is below its weighted average cost of capital (WACC), indicating value destruction despite growing profitability. The company’s income statement performance is mostly favorable, with strong margins and consistent growth in revenue, net income, and earnings per share over the 2020-2024 period.

Looking forward, Edison International’s extensive transmission and distribution infrastructure serving 15 million customers in California positions it to capitalize on new energy solutions and market opportunities. The company’s ability to increase its ROIC trend suggests improving operational efficiency, which could support future value creation in an evolving regulated electric industry.

SWOT Analysis

This SWOT analysis highlights Edison International’s key internal and external factors to guide strategic decisions and investment evaluations.

Strengths

- Strong market presence in California

- Favorable gross and EBIT margins

- Consistent dividend yield at 4.17%

Weaknesses

- High interest expense at 10.62%

- Low liquidity ratios (current 0.85, quick 0.78)

- Weak return on equity at 9.93%

Opportunities

- Growing ROIC trend indicating improving profitability

- Expansion in energy solutions for commercial users

- Increasing net income and EPS growth over 5 years

Threats

- Regulatory risks in the utility sector

- High debt-to-equity ratio at 2.43

- Competitive pressure from renewable energy providers

Edison International demonstrates stable profitability and dividend appeal but faces financial structure challenges and sector-specific risks. Strategic focus should target debt reduction and liquidity improvement while leveraging growth in energy solutions to enhance long-term value.

Stock Price Action Analysis

The following weekly stock chart illustrates Edison International’s price movements over the past 12 months, highlighting key support and resistance levels:

Trend Analysis

Over the past 12 months, Edison International’s stock price declined by 8.7%, indicating a bearish trend with accelerating downward momentum. Price volatility is significant, with a standard deviation of 12.12. The stock reached a high of 87.75 and a low of 48.32, reflecting wide price swings and increased selling pressure.

Volume Analysis

Trading volume has been increasing, with total volume exceeding 1.6B shares. Buyers represent 54.0% overall, signaling moderate buyer dominance. In the recent three months, buyer volume surged to 121M versus seller volume of 54M, showing strong buyer-driven activity and heightened investor interest.

Target Prices

Analysts present a moderate target price consensus for Edison International, reflecting cautious optimism.

| Target High | Target Low | Consensus |

|---|---|---|

| 70 | 57 | 62.6 |

The target prices suggest that analysts expect Edison International’s stock to trade moderately higher, with a balanced outlook between risk and potential reward.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section provides an overview of the latest analyst ratings and consumer feedback regarding Edison International (EIX).

Stock Grades

Here is the latest comprehensive overview of Edison International’s stock grades from reputable financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2026-01-22 |

| Wells Fargo | Downgrade | Underweight | 2026-01-20 |

| Morgan Stanley | Maintain | Underweight | 2025-12-17 |

| JP Morgan | Maintain | Neutral | 2025-12-12 |

| UBS | Maintain | Buy | 2025-12-02 |

| Ladenburg Thalmann | Maintain | Neutral | 2025-10-30 |

| Barclays | Maintain | Overweight | 2025-10-29 |

| Jefferies | Maintain | Hold | 2025-10-22 |

| Morgan Stanley | Maintain | Underweight | 2025-10-22 |

| Barclays | Maintain | Overweight | 2025-10-21 |

The grades show a mixed but generally cautious outlook, with several firms maintaining overweight or buy ratings, while others hold neutral or underweight positions. The recent downgrade from Wells Fargo contrasts with Barclays’ consistent overweight stance, indicating varied risk assessments among analysts.

Consumer Opinions

Consumers have mixed but insightful views on Edison International, reflecting both appreciation and areas for improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| Reliable energy supply with minimal outages. | Customer service response times can be slow. |

| Competitive rates compared to regional providers. | Occasional billing errors reported by some customers. |

| Commitment to renewable energy initiatives is praised. | Limited online account management features noted. |

| Transparent communication during outages and maintenance. | Some customers express concerns over rate increases. |

Overall, Edison International is valued for its dependable service and green energy efforts, though improving customer support and billing accuracy remain key challenges.

Risk Analysis

Below is a summary table outlining the main risk categories Edison International faces, along with their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Low Altman Z-Score (0.72) indicates high bankruptcy risk and financial distress. | High | High |

| Leverage & Liquidity | High debt-to-equity ratio (2.43) and low current (0.85) and quick ratios (0.78) suggest liquidity constraints. | High | Medium |

| Profitability | Unfavorable ROE (9.93%) and ROIC (3.61%) signal weak returns on investments. | Medium | Medium |

| Operational Efficiency | Low asset turnover (0.21) and fixed asset turnover (0.29) indicate inefficient asset use. | Medium | Medium |

| Dividend Stability | Favorable dividend yield (4.17%) but potential risk if cash flows weaken. | Low | Low |

| Regulatory & Market | Exposure to California’s regulated electric market and energy transition policies may pose regulatory risks. | Medium | High |

The most critical risks are the company’s financial distress signs, especially the Altman Z-Score in the distress zone, coupled with high leverage and liquidity weaknesses. These factors increase bankruptcy risk despite a stable dividend yield and favorable cost of capital. Regulatory risks tied to California’s energy policies also demand close monitoring.

Should You Buy Edison International?

Edison International appears to be navigating a challenging leverage profile with substantial net debt and a distressed Altman Z-Score, suggesting financial risk. While profitability shows signs of improvement and operational efficiency gains, its competitive moat could be seen as slightly unfavorable. Supported by a B+ rating, this profile suggests cautious value creation with moderate financial strength.

Strength & Efficiency Pillars

Edison International exhibits a mixed yet cautiously optimistic profile marked by solid profitability and moderate value creation. The company’s net margin stands at 8.78%, reflecting a stable earnings generation capability, supported by a favorable gross margin of 41.01% and an EBIT margin of 19.5%. Although the return on equity (9.93%) and return on invested capital (3.61%) are below ideal thresholds, the weighted average cost of capital (5.98%) remains lower than ROIC, signaling a marginal value creator. Its Piotroski score of 6 indicates average financial strength, while the Altman Z-score of 0.72 places Edison in the distress zone, cautioning on financial health.

Weaknesses and Drawbacks

Several financial risks temper Edison’s investment appeal. The company carries a high debt-to-equity ratio of 2.43, highlighting significant leverage concerns, further stressed by a weak current ratio of 0.85 and quick ratio of 0.78, which imply liquidity challenges. Interest coverage is low at 1.84, raising alarms about the ability to service debt comfortably. Valuation metrics are moderate with a P/E of 19.93 and P/B of 1.98, suggesting a fairly priced but not undervalued stock. Moreover, the bearish overall price trend with an 8.7% decline poses short-term market pressure despite recent buyer dominance of 69.08%.

Our Verdict about Edison International

Edison International’s long-term fundamental profile may appear unfavorable due to its financial distress signals and high leverage, despite pockets of profitability and value creation. However, the recent buyer-dominant trend and upward price movement could suggest improving market sentiment. Despite these strengths, the ongoing bearish overall trend and liquidity risks mean investors might consider a cautious, wait-and-see stance before committing, seeking a more favorable entry point aligned with improving fundamentals.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Wealth Enhancement Advisory Services LLC Has $9.09 Million Stock Position in Edison International $EIX – MarketBeat (Jan 24, 2026)

- Should Edison International’s (EIX) Wildfire Cost Securitization Shift How Investors View Its Risk Profile? – simplywall.st (Jan 21, 2026)

- Earnings Preview: What to Expect From Edison International’s Report – Yahoo Finance (Jan 21, 2026)

- Advisory for Wednesday, Feb. 18: Edison International to Hold Conference Call on Fourth Quarter and Full-Year 2025 Financial Results – Business Wire (Jan 21, 2026)

- Edison International (EIX) Downgraded by Wells Fargo Amid Fire L – GuruFocus (Jan 20, 2026)

For more information about Edison International, please visit the official website: edison.com