Home > Analyses > Basic Materials > Ecolab Inc.

Ecolab Inc. safeguards the health and efficiency of countless industries daily by delivering essential water, hygiene, and infection prevention solutions worldwide. Its unmatched expertise spans manufacturing, food processing, healthcare, and hospitality, making Ecolab a cornerstone in specialty chemicals with a reputation for innovation and reliability. As global demand for sustainable sanitation and safety intensifies, I’m keen to examine whether Ecolab’s robust fundamentals still support its premium market valuation and growth prospects.

Table of contents

Business Model & Company Overview

Ecolab Inc., founded in 1923 and headquartered in Saint Paul, Minnesota, dominates the specialty chemicals industry with a comprehensive ecosystem of water, hygiene, and infection prevention solutions. Its integrated approach spans Global Industrial, Institutional & Specialty, and Healthcare & Life Sciences segments, creating a unified mission to safeguard health and enhance operational efficiency across diverse sectors.

Ecolab’s revenue engine balances advanced chemical products with recurring service contracts, including pest elimination and real-time resource management. Its strategic footprint spans the Americas, Europe, and Asia, serving manufacturing, hospitality, healthcare, and more. This competitive advantage cements its economic moat, positioning Ecolab as a pivotal force shaping global sanitation and sustainability standards.

Financial Performance & Fundamental Metrics

I will analyze Ecolab Inc.’s income statement, key financial ratios, and dividend payout policy to assess its core financial health and shareholder value approach.

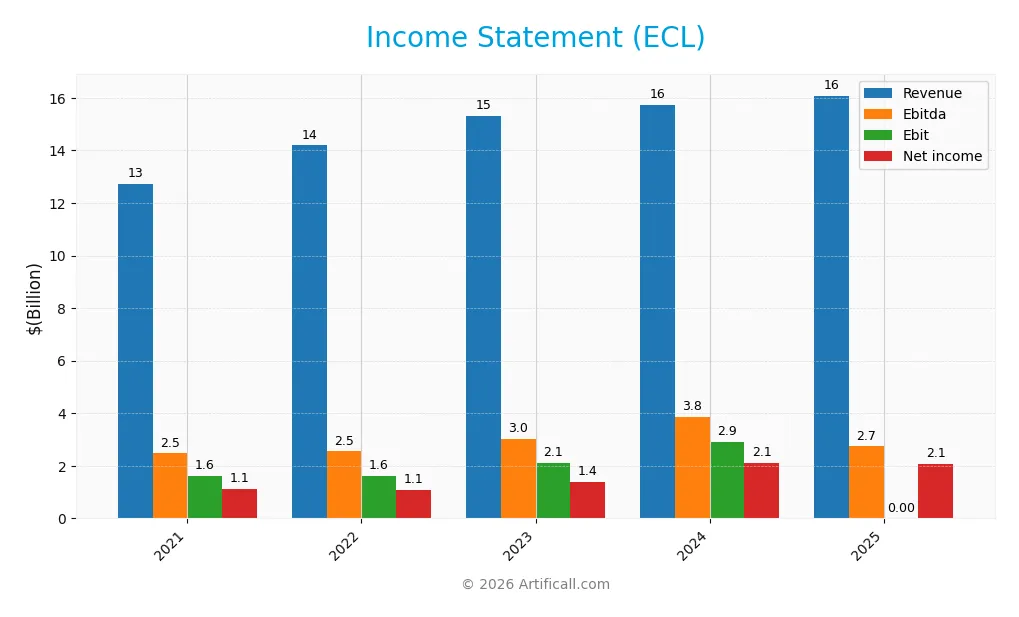

Income Statement

Below is Ecolab Inc.’s income statement for fiscal years 2021 through 2025, reflecting key profitability and expense metrics in USD.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 12.7B | 14.2B | 15.3B | 15.7B | 16.1B |

| Cost of Revenue | 7.5B | 8.8B | 9.1B | 8.9B | 0 |

| Operating Expenses | 3.5B | 3.8B | 4.0B | 4.2B | 4.3B |

| Gross Profit | 5.2B | 5.4B | 6.2B | 6.8B | 0 |

| EBITDA | 2.5B | 2.5B | 3.0B | 3.8B | 2.7B |

| EBIT | 1.6B | 1.6B | 2.1B | 2.9B | 0 |

| Interest Expense | 216M | 264M | 355M | 338M | 241M |

| Net Income | 1.1B | 1.1B | 1.4B | 2.1B | 2.1B |

| EPS | 3.95 | 3.83 | 4.82 | 7.43 | 7.33 |

| Filing Date | 2022-02-25 | 2023-02-24 | 2024-02-23 | 2025-02-21 | 2026-02-10 |

Income Statement Evolution

Between 2021 and 2025, Ecolab Inc. grew revenue by 26.3%, reflecting steady top-line expansion. Net income surged 83.7%, outpacing revenue growth and lifting net margins by 45.5%. However, the latest year showed a slowdown with 2.2% revenue growth and a 3.8% decline in net margin, indicating some margin pressure. Operating expenses grew in line with revenue.

Is the Income Statement Favorable?

In 2025, Ecolab posted $16.1B revenue and $2.1B net income, yielding a net margin of 12.9%, which remains favorable versus historical averages. Interest expense was well-controlled at 1.5% of revenue, supporting profitability. Yet, gross and EBIT margins registered as unfavorable, signaling cost structure challenges. Overall, the income statement presents a neutral fundamental stance with mixed margin signals.

Financial Ratios

The table below presents key financial ratios for Ecolab Inc. over the last five fiscal years, providing insight into profitability, valuation, liquidity, leverage, and efficiency metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 8.9% | 7.7% | 8.96% | 13.4% | 12.9% |

| ROE | 15.6% | 15.1% | 17.1% | 24.1% | 21.2% |

| ROIC | 7.5% | 7.4% | 9.4% | 11.8% | 11.2% |

| P/E | 59.4 | 38.0 | 41.2 | 31.5 | 35.8 |

| P/B | 9.3 | 5.7 | 7.0 | 7.6 | 7.6 |

| Current Ratio | 1.32 | 1.30 | 1.30 | 1.26 | 1.08 |

| Quick Ratio | 0.90 | 0.88 | 0.95 | 0.95 | 0.81 |

| D/E | 1.27 | 1.25 | 1.09 | 0.95 | 0.90 |

| Debt-to-Assets | 43.2% | 42.1% | 40.0% | 37.0% | 35.8% |

| Interest Coverage | 7.8x | 6.1x | 6.1x | 7.7x | 11.4x |

| Asset Turnover | 0.60 | 0.66 | 0.70 | 0.70 | 0.65 |

| Fixed Asset Turnover | 3.46 | 3.79 | 3.80 | 3.52 | 3.19 |

| Dividend Yield | 0.84% | 1.45% | 1.09% | 1.00% | 1.02% |

Evolution of Financial Ratios

Return on Equity (ROE) improved steadily from 15.1% in 2022 to 21.2% in 2025, reflecting rising profitability. The Current Ratio declined from 1.30 to 1.08, indicating reduced liquidity but remaining above 1. Debt-to-Equity ratio decreased from 1.25 to 0.90, signaling a moderate deleveraging trend. Profit margins showed gradual improvement, supporting earnings stability.

Are the Financial Ratios Fovorable?

Profitability ratios like ROE (21.2%) and net margin (12.9%) are favorable, outperforming typical sector benchmarks. Liquidity ratios such as Current Ratio (1.08) and Quick Ratio (0.81) are neutral, suggesting adequate but tightening short-term financial flexibility. Leverage metrics including Debt-to-Equity (0.9) and Debt-to-Assets (35.8%) also rank neutral. Valuation ratios like P/E (35.8) and P/B (7.6) appear unfavorable, possibly indicating stretched market expectations. Overall, the financial ratios are slightly favorable.

Shareholder Return Policy

Ecolab Inc. maintains a consistent dividend policy with a payout ratio around 31-55% and a dividend yield near 1%. Dividends per share have steadily increased from $1.98 in 2021 to $2.68 in 2025. The company also conducts share buybacks, supporting shareholder returns.

The dividend payout is covered by free cash flow, indicating sustainable distributions. However, the payout ratio’s upper range nearing 55% warrants monitoring for potential risks. Overall, this balanced approach aligns with steady, long-term shareholder value creation.

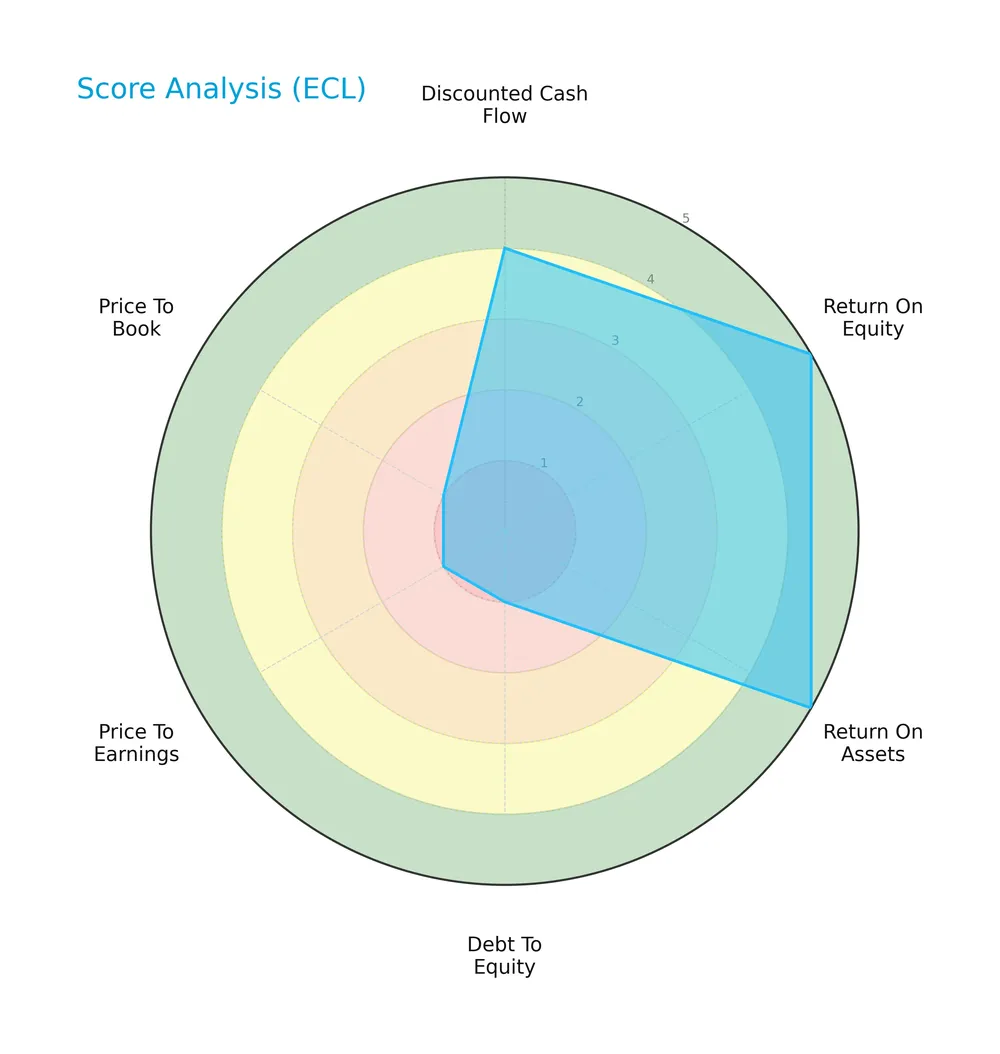

Score analysis

The radar chart below visualizes key financial scores for a comprehensive evaluation of Ecolab Inc.:

Ecolab scores very favorably on return on equity and assets, with a strong discounted cash flow rating. However, its debt-to-equity, price-to-earnings, and price-to-book scores remain very unfavorable, signaling valuation and leverage concerns.

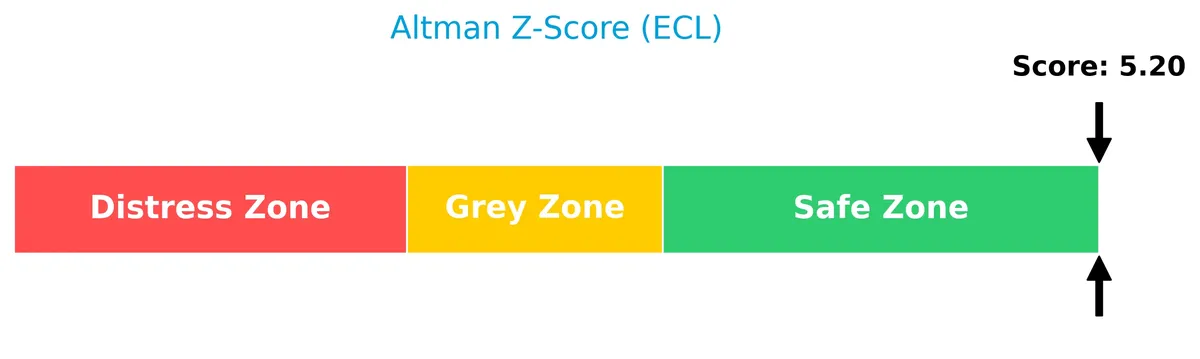

Analysis of the company’s bankruptcy risk

The Altman Z-Score places Ecolab firmly in the safe zone, indicating a low risk of bankruptcy and robust financial stability:

Is the company in good financial health?

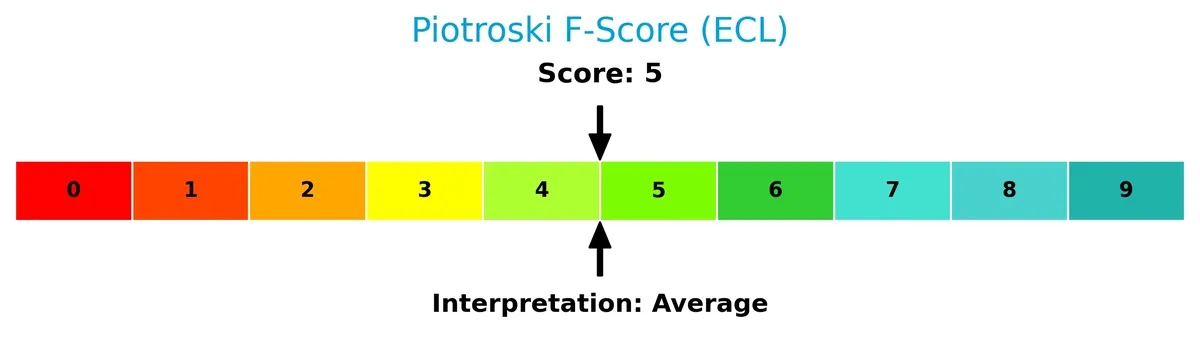

The Piotroski Score diagram offers insight into Ecolab’s financial condition based on profitability, leverage, and efficiency metrics:

With a Piotroski Score of 5, Ecolab demonstrates average financial health. This suggests moderate strength but room for improvement in operational efficiency and balance sheet quality.

Competitive Landscape & Sector Positioning

This section explores Ecolab Inc.’s strategic positioning within the specialty chemicals sector. We will analyze revenue distribution by segment, key products, and main competitors. I will assess whether Ecolab maintains a competitive advantage over its industry peers.

Strategic Positioning

Ecolab maintains a diversified product portfolio spanning industrial, institutional, healthcare, and pest elimination segments. Geographically, it balances strong U.S. exposure with significant revenue from Europe, Asia Pacific, and emerging markets, reflecting a broad global footprint in specialty chemicals and services.

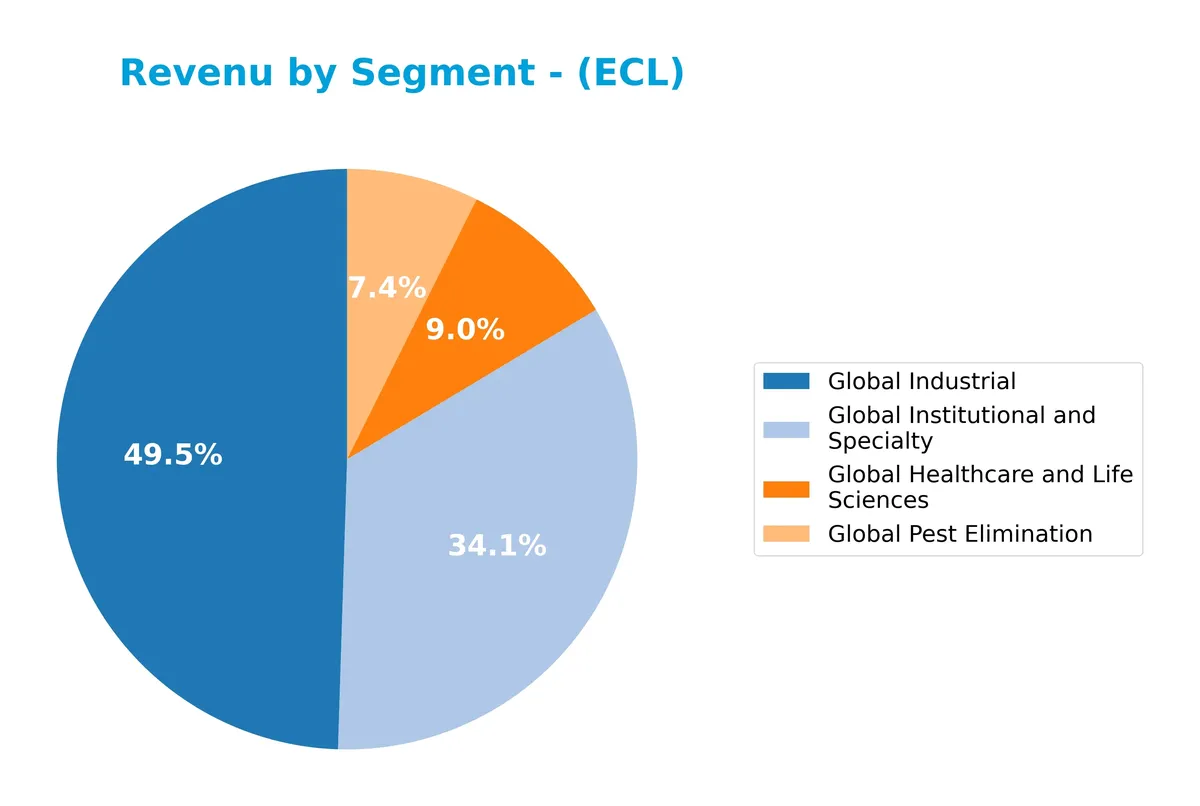

Revenue by Segment

This pie chart illustrates Ecolab Inc.’s revenue distribution across its main business segments for the fiscal year 2024.

In 2024, Global Industrial leads with $7.9B, followed by Global Institutional and Specialty at $5.4B. Global Healthcare and Life Sciences and Global Pest Elimination contribute $1.4B and $1.2B respectively. The data reveals steady growth in core industrial and institutional segments, signaling strong demand. Healthcare shows slight deceleration, warranting attention for potential concentration risk in future years.

Key Products & Brands

Ecolab’s diversified portfolio includes water treatment, cleaning, sanitizing, pest elimination, and infection prevention solutions:

| Product | Description |

|---|---|

| Global Industrial | Water treatment, process applications, cleaning, and sanitizing solutions for manufacturing and processing industries. |

| Global Institutional & Specialty | Specialized cleaning and sanitizing products for foodservice, hospitality, lodging, government, education, and retail sectors. |

| Global Healthcare & Life Sciences | Infection prevention, surgical solutions, and contamination control products for healthcare, personal care, and pharmaceuticals under brands like Ecolab, Microtek, and Anios. |

| Global Pest Elimination | Pest detection, elimination, and prevention services targeting restaurants, food processors, healthcare, hotels, and commercial customers. |

| Other | Colloidal silica for industrial applications, wash process management programs, dispensing equipment, and water and energy management services. |

Ecolab’s product lines address critical hygiene, safety, and operational efficiency needs across industrial, institutional, healthcare, and specialty sectors. This diversified mix supports stable revenue streams and broad market exposure.

Main Competitors

The sector includes 9 competitors, with this table showing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Linde plc | 200.4B |

| The Sherwin-Williams Company | 81.5B |

| Ecolab Inc. | 74.5B |

| Air Products and Chemicals, Inc. | 55.8B |

| PPG Industries, Inc. | 23.4B |

| International Flavors & Fragrances Inc. | 17.4B |

| DuPont de Nemours, Inc. | 17.1B |

| Albemarle Corporation | 16.9B |

| LyondellBasell Industries N.V. | 14.3B |

Ecolab Inc. ranks 3rd among its peers, holding 42.4% of the market cap of leader Linde plc. It stands above both the average market cap of the top 10 competitors (55.7B) and the sector median (23.4B). The company is only 4.15% behind its nearest competitor above, showing a tight race for second place.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does Ecolab have a competitive advantage?

Ecolab demonstrates a sustainable competitive advantage, consistently generating returns on invested capital 3.3% above its cost of capital. Its growing ROIC trend confirms efficient capital use and value creation.

Looking ahead, Ecolab’s diversified segments in water treatment, hygiene, and infection prevention position it well to expand in industrial, healthcare, and institutional markets globally. New solutions and geographic growth offer ongoing opportunities.

SWOT Analysis

This SWOT analysis highlights Ecolab Inc.’s core strategic factors to guide investment decisions.

Strengths

- strong ROIC well above WACC

- diversified global presence

- solid net margin of 12.9%

Weaknesses

- high valuation multiples (PE 35.8, PB 7.6)

- moderate liquidity ratios (current ratio 1.08)

- weak recent earnings growth

Opportunities

- expanding demand in healthcare and life sciences

- growing industrial water treatment markets

- digital solutions and data management services

Threats

- rising raw material costs

- regulatory pressure in chemicals sector

- intense competition and price sensitivity

Ecolab demonstrates a durable competitive advantage and value creation. However, elevated valuation and short-term earnings softness warrant caution. The company’s strategy should focus on innovation and operational efficiency to sustain growth and justify premium multiples.

Stock Price Action Analysis

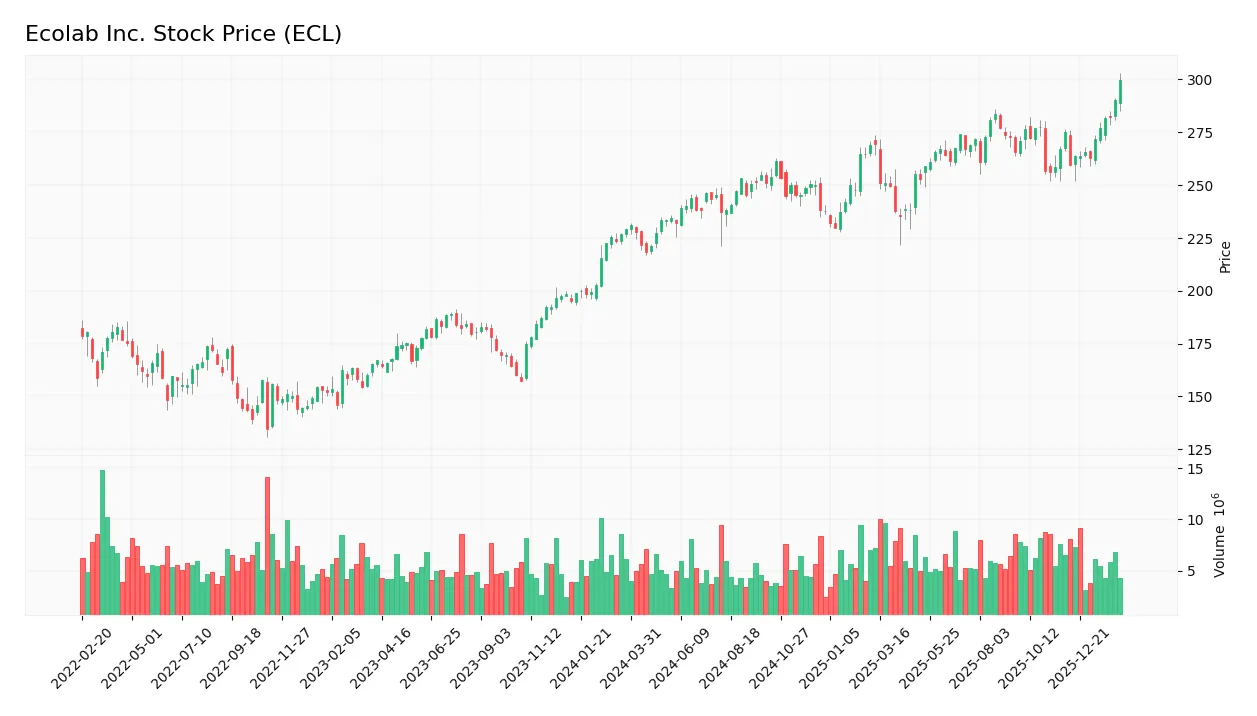

The weekly chart illustrates Ecolab Inc.’s stock price movement, highlighting key fluctuations and trend developments over the recent period:

Trend Analysis

Ecolab’s stock rose 30.68% over the past two years, confirming a bullish trend with accelerating momentum. The price ranged between 218.16 and a high of 299.62. Volatility remains elevated with a standard deviation of 16.83, indicating dynamic market interest.

Volume Analysis

Trading volume totals 692M shares, with buyer activity comprising 62.04%, and volume is increasing. The last three months show strong buyer dominance at 70.28%, signaling confident market participation and sustained demand for the stock.

Target Prices

Analysts show a confident consensus on Ecolab Inc.’s price range for 2026.

| Target Low | Target High | Consensus |

|---|---|---|

| 295 | 315 | 303.43 |

The target prices indicate moderate upside potential, reflecting steady investor confidence in Ecolab’s growth and market positioning.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines analyst ratings and consumer feedback to provide insights on Ecolab Inc.’s market perception.

Stock Grades

Below is the latest summary of Ecolab Inc. grades from recognized financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-01-21 |

| Wells Fargo | Maintain | Equal Weight | 2026-01-14 |

| UBS | Maintain | Neutral | 2026-01-07 |

| Citigroup | Maintain | Buy | 2025-12-18 |

| Evercore ISI Group | Upgrade | Outperform | 2025-11-03 |

| UBS | Maintain | Neutral | 2025-10-31 |

| Barclays | Maintain | Overweight | 2025-10-29 |

| Citigroup | Maintain | Buy | 2025-10-29 |

| Stifel | Maintain | Buy | 2025-10-29 |

| JP Morgan | Maintain | Neutral | 2025-10-29 |

The grades predominantly reflect a positive outlook, with multiple “Buy” and “Outperform” ratings. Neutral and equal weight assessments suggest some caution but no significant downgrades.

Consumer Opinions

Ecolab Inc. earns mixed consumer sentiment, reflecting its strong industry presence but also areas needing improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| Reliable product quality that enhances safety | Pricing is high compared to competitors |

| Excellent customer service and quick response | Delivery delays impact operational efficiency |

| Effective solutions that improve hygiene | Complex product range can confuse new buyers |

Overall, consumers praise Ecolab’s product effectiveness and customer support. However, recurring concerns about pricing and delivery delays suggest room to optimize client experience.

Risk Analysis

Below is a summary of key risks facing Ecolab Inc., highlighting their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Valuation Risk | Elevated P/E (35.8) and P/B (7.6) ratios suggest the stock may be overvalued compared to peers. | High | Medium |

| Liquidity Risk | Current ratio (1.08) and quick ratio (0.81) are just above minimal thresholds, indicating tight liquidity. | Medium | Medium |

| Debt Risk | Debt-to-equity ratio near 0.9 with very unfavorable debt scores implies leverage concerns. | Medium | High |

| Interest Coverage | Zero interest coverage ratio signals risk in covering debt costs if earnings fluctuate. | Medium | High |

| Market Risk | Beta near 1 indicates stock price moves closely with the market; potential volatility remains. | Medium | Medium |

| Operational Risk | Exposure to diverse industrial and healthcare sectors may face regulatory and supply chain pressures. | Medium | Medium |

Ecolab’s most significant risks stem from its high valuation multiples and debt profile. The unfavorable interest coverage ratio is a red flag, raising concerns about the company’s ability to service debt during downturns. Despite a strong Altman Z-Score placing the company in a safe zone, investors should monitor liquidity and leverage closely amid market uncertainties.

Should You Buy Ecolab Inc.?

Ecolab Inc. appears to be delivering robust profitability with a durable competitive moat, supported by a growing ROIC well above WACC. Despite a challenging leverage profile, its overall rating of B suggests a very favorable investment case with moderate risk considerations.

Strength & Efficiency Pillars

Ecolab Inc. demonstrates robust profitability with a net margin of 12.91% and a return on equity (ROE) of 21.24%. The company’s return on invested capital (ROIC) stands at 11.23%, comfortably above its weighted average cost of capital (WACC) at 7.88%. This margin of 3.35% confirms Ecolab as a clear value creator. The firm’s fixed asset turnover ratio of 3.19 signals operational efficiency, reinforcing its sustainable competitive advantage and growing profitability trend.

Weaknesses and Drawbacks

Ecolab maintains a safe solvency profile with an Altman Z-Score of 5.20, discounting bankruptcy risk. However, valuation metrics raise concerns: a high price-to-earnings ratio of 35.83 and price-to-book ratio of 7.61 suggest the stock trades at a premium. The company’s interest coverage ratio is unfavorable at 0.0, indicating potential challenges in meeting interest obligations. These factors, combined with a modest current ratio of 1.08, imply moderate leverage and liquidity risks investors should monitor closely.

Our Final Verdict about Ecolab Inc.

Ecolab’s financial health and operational efficiency suggest a solid long-term fundamental profile. The bullish overall stock trend and strong buyer dominance (70.28% in recent periods) indicate positive market sentiment. However, premium valuation metrics may warrant caution. The profile might appear attractive for long-term exposure but suggests a measured entry with attention to valuation dynamics and interest coverage concerns.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Ecolab (ECL) Q4 Earnings: How Key Metrics Compare to Wall Street Estimates – Yahoo Finance (Feb 10, 2026)

- ECL Stock Falls in Pre-Market Despite Q4 Earnings Beat, Margins Expand – TradingView (Feb 10, 2026)

- (ECL) Ecolab Inc. Expects Q1 Adjusted EPS Range $1.67 – $1.73 – marketscreener.com (Feb 10, 2026)

- Ecolab: Q4 Earnings Snapshot – WKYC (Feb 10, 2026)

- Ecolab (ECL) Tops Q4 Earnings and Revenue Estimates – Yahoo Finance (Feb 10, 2026)

For more information about Ecolab Inc., please visit the official website: ecolab.com