Home > Analyses > Consumer Cyclical > eBay Inc.

eBay Inc. revolutionizes the way millions buy and sell by seamlessly connecting global buyers and sellers through its dynamic online marketplace. As a pioneer in specialty retail, eBay’s flagship platform and mobile apps offer unmatched convenience and reach, fostering a vibrant ecosystem of commerce. Known for its innovation and broad market influence, the company continues to evolve in a competitive digital landscape. The key question for investors now is whether eBay’s solid fundamentals and strategic initiatives still justify its current valuation and growth outlook.

Table of contents

Business Model & Company Overview

eBay Inc., founded in 1995 and headquartered in San Jose, California, is a dominant force in the specialty retail sector through its marketplace platforms. Its ecosystem connects buyers and sellers globally via ebay.com and mobile apps, integrating online, mobile, and offline channels. This cohesive approach facilitates a seamless commerce experience across a diverse range of participants including retailers, distributors, and auctioneers, reinforcing its leadership in digital marketplaces.

The company’s revenue engine thrives on transaction fees and value-added services that power its marketplace, balancing the platform’s accessibility with robust monetization. eBay maintains a strategic presence across the Americas, Europe, and Asia, tapping into diverse markets to drive growth. Its enduring competitive advantage lies in its expansive network effect, creating an economic moat that solidifies its role in shaping the future of global e-commerce.

Financial Performance & Fundamental Metrics

This section provides a clear analysis of eBay Inc.’s income statement, key financial ratios, and dividend payout policy to guide informed investment decisions.

Income Statement

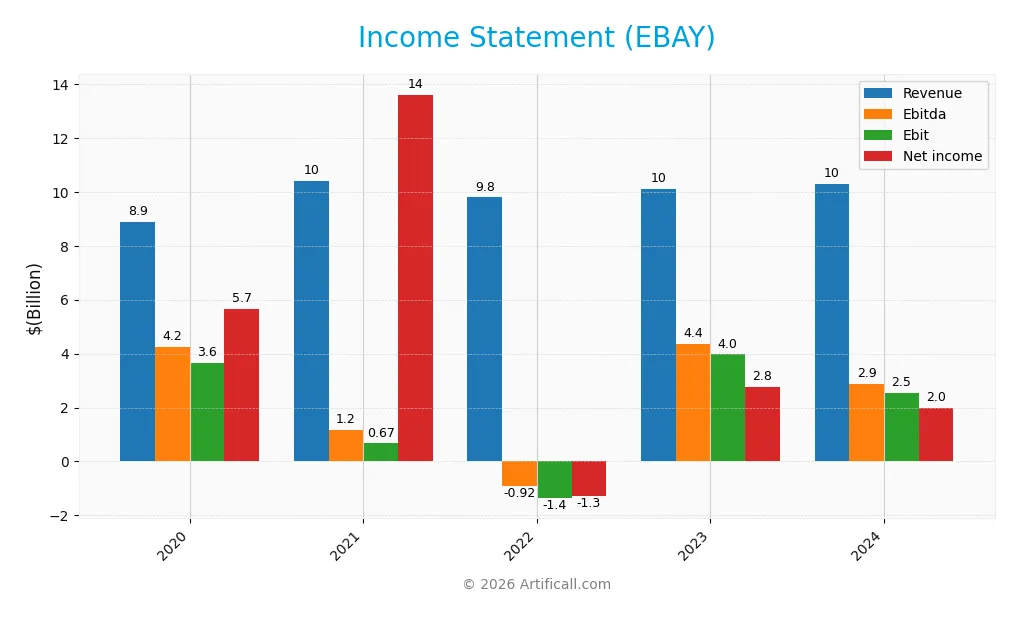

The table below presents eBay Inc.’s key income statement figures for the fiscal years 2020 through 2024, reported in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 8.89B | 10.42B | 9.80B | 10.11B | 10.28B |

| Cost of Revenue | 1.80B | 2.65B | 2.68B | 2.83B | 2.88B |

| Operating Expenses | 4.46B | 4.85B | 4.77B | 5.34B | 5.09B |

| Gross Profit | 7.10B | 7.77B | 7.12B | 7.28B | 7.40B |

| EBITDA | 4.23B | 1.17B | -924M | 4.37B | 2.86B |

| EBIT | 3.65B | 667M | -1.37B | 3.97B | 2.54B |

| Interest Expense | 304M | 269M | 235M | 263M | 259M |

| Net Income | 5.67B | 13.61B | -1.27B | 2.77B | 1.98B |

| EPS | 7.98 | 20.87 | -2.28 | 5.22 | 3.98 |

| Filing Date | 2021-02-04 | 2022-02-24 | 2023-05-12 | 2024-05-29 | 2025-02-27 |

Income Statement Evolution

Between 2020 and 2024, eBay’s revenue grew by 15.62%, showing steady top-line expansion despite a slight 1.69% decline in growth last year. However, net income dropped significantly over the period by 65.15%, with a 29.81% decline in net margin in the latest year. Gross margin remained stable and favorable at nearly 72%, while EBIT margin fell sharply by 36.1% last year, signaling pressure on operating profitability.

Is the Income Statement Favorable?

In 2024, eBay reported $10.3B in revenue and a net income of $1.98B, yielding a 19.2% net margin—favorable by industry standards. Interest expenses remained low at 2.52% of revenue, supporting financial stability. Yet, the sharp drops in EBIT and net margin growth, along with a 24.1% EPS decline, highlight challenges in profitability and earnings quality. Overall, the income statement fundamentals appear unfavorable, reflecting mixed operational efficiencies and earnings pressures.

Financial Ratios

The table below presents key financial ratios for eBay Inc. over the fiscal years 2020 to 2024, providing insights into profitability, leverage, liquidity, and valuation metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 63.7% | 130.6% | -12.96% | 27.36% | 19.21% |

| ROE | 159.1% | 139.2% | -24.6% | 43.3% | 38.3% |

| ROIC | 12.7% | 7.9% | 10.5% | 8.1% | 13.4% |

| P/E | 6.30 | 3.19 | -18.24 | 8.36 | 15.56 |

| P/B | 10.0 | 4.43 | 4.49 | 3.61 | 5.96 |

| Current Ratio | 1.80 | 1.97 | 2.18 | 2.44 | 1.24 |

| Quick Ratio | 1.80 | 1.97 | 2.18 | 2.44 | 1.24 |

| D/E | 2.31 | 0.96 | 1.83 | 1.29 | 1.52 |

| Debt-to-Assets | 42.5% | 35.4% | 45.2% | 38.1% | 40.6% |

| Interest Coverage | 8.67 | 10.87 | 10.0 | 7.38 | 8.95 |

| Asset Turnover | 0.46 | 0.39 | 0.47 | 0.47 | 0.53 |

| Fixed Asset Turnover | 5.16 | 6.83 | 5.59 | 5.82 | 6.08 |

| Dividend Yield | 1.25% | 1.07% | 2.11% | 2.28% | 1.73% |

Evolution of Financial Ratios

From 2020 to 2024, eBay’s Return on Equity (ROE) showed volatility, peaking above 150% in 2020 and dropping to 38.3% in 2024, indicating a stabilization after a period of high profitability. The Current Ratio declined from around 1.8 in 2020 to 1.24 in 2024, suggesting reduced short-term liquidity. Meanwhile, the Debt-to-Equity Ratio increased from below 1.0 in 2021 to 1.52 in 2024, reflecting a higher reliance on debt financing over the period.

Are the Financial Ratios Favorable?

In 2024, eBay’s profitability ratios, including a 19.2% net margin and 38.3% ROE, are rated favorable, indicating solid earnings relative to equity and sales. Liquidity is mixed, with a neutral Current Ratio of 1.24 but a favorable Quick Ratio, suggesting adequate short-term asset coverage. Leverage ratios such as a 1.52 Debt-to-Equity are unfavorable, signaling increased financial risk. Asset turnover and dividend yield show neutral to favorable status, while valuation multiples present a neutral to unfavorable view overall, resulting in a slightly favorable global ratio assessment.

Shareholder Return Policy

eBay Inc. maintains a consistent dividend policy with a payout ratio around 27%, offering a dividend yield near 1.7% in 2024. The dividend per share has steadily increased over recent years, supported by strong free cash flow coverage. Additionally, eBay engages in share buybacks, complementing its shareholder returns.

This balanced approach of dividends and buybacks appears underpinned by robust profitability and cash flow metrics, suggesting a sustainable long-term value creation strategy. Risks linked to distribution seem moderate given the coverage ratios, indicating prudent capital allocation aligned with shareholder interests.

Score analysis

The following radar chart provides a comprehensive overview of eBay Inc.’s key financial scores across valuation, profitability, and leverage metrics:

eBay Inc. demonstrates strong profitability with high scores in return on equity (5) and return on assets (5). However, leverage indicators such as debt to equity (1) and price to book (1) are notably weak, while valuation metrics including discounted cash flow (3) and price to earnings (3) remain moderate.

Analysis of the company’s bankruptcy risk

The Altman Z-Score analysis places eBay Inc. comfortably in the safe zone, indicating a low risk of bankruptcy:

Is the company in good financial health?

The Piotroski Score diagram illustrates eBay Inc.’s financial health assessment based on nine criteria:

With a Piotroski Score of 6, eBay Inc. shows average financial strength, suggesting moderate operational efficiency and profitability but without reaching a high level of robustness.

Competitive Landscape & Sector Positioning

This sector analysis will explore eBay Inc.’s strategic positioning, revenue by segment, key products, main competitors, and competitive advantages. I will also assess whether eBay holds a competitive advantage over its rivals within the specialty retail and consumer cyclical industry.

Strategic Positioning

eBay Inc. focuses on a concentrated product portfolio dominated by its marketplace platforms, generating $8.65B in advertising and marketplace revenues in 2024. Geographically, it maintains significant exposure in the US ($5.24B), UK ($1.51B), Germany ($972M), China ($1.17B), and other regions, reflecting a balanced international presence.

Revenue by Segment

This pie chart presents eBay Inc.’s revenue distribution by segment for the fiscal year 2024, highlighting the contribution of key business areas.

In 2024, eBay’s revenue was primarily driven by the Marketplaces segment, generating 8.65B USD, while Advertising Revenues contributed 1.64B USD. The Marketplaces segment shows a notable decline compared to 2023’s 10.11B USD, indicating a slowdown. Advertising Revenues now represent a growing part of the business, suggesting a diversification trend. However, the concentration risk remains high due to Marketplaces’ dominant role.

Key Products & Brands

The table below outlines eBay Inc.’s main products and brands along with their descriptions:

| Product | Description |

|---|---|

| eBay Marketplace | Online marketplace platform including ebay.com and mobile apps, enabling users to list, buy, sell, and pay for items. |

| Advertising Revenues | Income generated from advertising services offered on eBay’s platforms. |

| Marketing Services | Services related to promotional and marketing efforts on eBay’s marketplace. |

| Payments | Payment processing services integrated within eBay’s platform. |

| StubHub | Former ticket marketplace business previously operated by eBay (reported revenues until 2019). |

eBay Inc.’s core offerings center on its online marketplace platform, supplemented by advertising, marketing, and payments services. StubHub was a notable past business segment until 2019.

Main Competitors

There are 10 main competitors in the Specialty Retail industry, with the table below listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Amazon.com, Inc. | 2.42T |

| Alibaba Group Holding Limited | 340B |

| PDD Holdings Inc. | 159B |

| MercadoLibre, Inc. | 102B |

| eBay Inc. | 39.4B |

| Ulta Beauty, Inc. | 27.8B |

| Tractor Supply Company | 26.9B |

| Williams-Sonoma, Inc. | 23B |

| Genuine Parts Company | 17.2B |

| Best Buy Co., Inc. | 14.5B |

eBay Inc. ranks 5th among its specialty retail competitors, holding about 1.75% of the market cap of the sector leader Amazon.com, Inc. The company’s market capitalization is below the average of the top 10 competitors (317B) but remains above the median market cap for the sector (33.6B). Notably, eBay is 141.35% larger in market cap than the next closest competitor above it, indicating a significant gap in scale.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does EBAY have a competitive advantage?

eBay Inc. demonstrates a durable competitive advantage, evidenced by a ROIC that exceeds its WACC by over 4%, with a positive trend indicating growing profitability. This suggests efficient capital use and value creation for shareholders. Despite some unfavorable recent income growth metrics, the company maintains a strong position within the specialty retail sector.

Looking ahead, eBay’s established marketplace platforms and international presence offer opportunities to expand in diverse geographic markets such as the United States and emerging regions. The company’s suite of mobile apps and multiple sales channels position it well to capitalize on evolving e-commerce trends and consumer behaviors globally.

SWOT Analysis

This SWOT analysis provides a clear view of eBay Inc.’s internal strengths and weaknesses alongside external opportunities and threats to inform strategic decisions.

Strengths

- strong gross margin at 72%

- high return on equity at 38%

- durable competitive advantage with growing ROIC

Weaknesses

- declining net income and EPS over five years

- high debt-to-equity ratio at 1.52

- unfavorable price-to-book ratio at 5.96

Opportunities

- expanding international markets, especially in China and UK

- growing mobile commerce adoption

- potential to innovate payment and logistics services

Threats

- intense competition from other e-commerce platforms

- regulatory challenges in global markets

- market saturation and slowing revenue growth

Overall, eBay demonstrates solid profitability and a sustainable competitive moat, but its financial performance shows signs of pressure from declining earnings and leverage concerns. The company’s strategy should focus on leveraging growth opportunities abroad and innovation while carefully managing debt and competitive risks.

Stock Price Action Analysis

The weekly stock chart of eBay Inc. over the past 12 months displays significant price movement and trend characteristics:

Trend Analysis

Over the past 12 months, eBay’s stock price increased by 94.82%, indicating a bullish trend with acceleration. The price ranged between 48.05 and a high of 100.7, with a volatility measure of 14.16%. Recent weeks (Nov 2025 to Jan 2026) show a positive 11.71% change and moderate volatility at 4.02%, confirming sustained upward momentum.

Volume Analysis

In the last three months, trading volume has been decreasing despite strong buyer dominance at 70.91%. Buyers accounted for 172M shares versus sellers’ 71M, reflecting robust investor interest but lower overall market participation compared to earlier periods. This suggests continued confidence but with diminishing volume activity.

Target Prices

Analysts present a clear target price consensus for eBay Inc., reflecting moderate growth expectations.

| Target High | Target Low | Consensus |

|---|---|---|

| 115 | 65 | 98 |

The target prices suggest that analysts expect eBay’s stock to trade between $65 and $115, with a consensus price near $98, indicating cautious optimism.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews the latest analyst ratings and consumer feedback surrounding eBay Inc.’s market performance.

Stock Grades

Here is the latest overview of eBay Inc.’s stock grades from leading financial institutions and analysts:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Overweight | 2026-01-13 |

| Wells Fargo | Maintain | Equal Weight | 2026-01-08 |

| Truist Securities | Maintain | Hold | 2025-11-03 |

| Benchmark | Maintain | Buy | 2025-10-30 |

| Piper Sandler | Maintain | Overweight | 2025-10-30 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-30 |

| Barclays | Maintain | Overweight | 2025-10-30 |

| Cantor Fitzgerald | Maintain | Neutral | 2025-10-30 |

| UBS | Maintain | Neutral | 2025-10-30 |

| Needham | Maintain | Buy | 2025-10-30 |

The consensus among analysts shows a stable outlook with a predominance of hold and buy ratings, reflecting cautious optimism balanced by neutral stances. There is no indication of recent downgrades or upgrades, suggesting steady confidence in eBay’s market position.

Consumer Opinions

Consumer sentiment around eBay Inc. reflects a blend of appreciation for its vast marketplace and concerns about service consistency.

| Positive Reviews | Negative Reviews |

|---|---|

| “Great variety of products and competitive prices.” | “Customer service can be slow and unhelpful.” |

| “Easy to use platform with secure payment options.” | “Shipping times are often longer than expected.” |

| “Seller ratings help build trust when buying.” | “Occasional issues with counterfeit items.” |

Overall, consumers praise eBay for its extensive product selection and user-friendly interface, but recurring complaints focus on customer service responsiveness and occasional delivery delays.

Risk Analysis

Below is a summary table outlining the key risks associated with investing in eBay Inc., highlighting their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | eBay’s beta of 1.348 indicates above-average sensitivity to market swings, affecting share price stability. | High | Moderate |

| Leverage Risk | Debt-to-equity ratio of 1.52 is unfavorable, suggesting higher financial leverage and risk. | Moderate | High |

| Valuation Risk | Price-to-book ratio is unfavorable at 5.96, implying potential overvaluation concerns. | Moderate | Moderate |

| Competitive Risk | Intense competition in the specialty retail and e-commerce sectors could pressure margins. | Moderate | Moderate |

| Operational Risk | Dependence on maintaining platform engagement and transaction volumes exposes eBay to operational disruption. | Low | Moderate |

The most significant risks for eBay stem from its relatively high financial leverage and market volatility exposure. While its Altman Z-Score places it safely away from bankruptcy, the elevated debt level demands cautious monitoring. Additionally, valuation concerns warrant careful entry timing to avoid overpaying.

Should You Buy eBay Inc.?

eBay Inc. appears to be delivering robust profitability supported by a durable competitive moat with growing return on invested capital, while its leverage profile is marked by significant debt concerns. The overall rating suggests a B+ profile, indicating a cautiously favorable investment case.

Strength & Efficiency Pillars

eBay Inc. shows robust profitability with a net margin of 19.21% and an impressive return on equity (ROE) of 38.29%, reflecting efficient capital use. Its return on invested capital (ROIC) stands at 13.39%, comfortably surpassing the weighted average cost of capital (WACC) at 9.22%, confirming eBay as a clear value creator. The company’s financial health is solid, supported by an Altman Z-Score of 6.00, placing it securely in the safe zone, and a Piotroski score of 6, indicating average but stable fundamentals.

Weaknesses and Drawbacks

Despite strong profitability, eBay faces valuation concerns with a price-to-book (P/B) ratio at 5.96, marked as very unfavorable, suggesting the stock may be overvalued relative to its book value. Its debt-to-equity ratio of 1.52 signals elevated leverage, posing financial risk, while the current ratio of 1.24 offers only moderate liquidity protection. These factors introduce caution, as higher leverage could amplify vulnerability during market downturns or economic stress.

Our Verdict about eBay Inc.

eBay’s long-term fundamental profile appears favorable, supported by strong profitability and value creation metrics. Coupled with a bullish overall stock trend and a recent period characterized by strong buyer dominance (70.91%), the company may appear attractive for long-term exposure. Nonetheless, elevated leverage and valuation premiums suggest investors might consider a measured approach, balancing opportunity with prudent risk management.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Morgan Stanley Maintains Coverage of eBay Inc. (EBAY) – Yahoo Finance (Jan 19, 2026)

- 91,773 Shares in eBay Inc. $EBAY Purchased by Rakuten Investment Management Inc. – MarketBeat (Jan 22, 2026)

- Be for Everyone – eBay Inc. (Oct 10, 2025)

- eBay Inc. Reports Third Quarter 2025 Results – PR Newswire (Oct 29, 2025)

- TRIP vs. EBAY: Which Stock Should Value Investors Buy Now? – Yahoo Finance (Jan 23, 2026)

For more information about eBay Inc., please visit the official website: ebayinc.com