Home > Analyses > Industrials > Eaton Corporation plc

Eaton Corporation powers the world’s infrastructure with vital electrical and industrial components that keep homes, businesses, and transportation systems running smoothly. It dominates the industrial machinery sector through cutting-edge products in power management, aerospace, and vehicle systems. Known for engineering excellence and innovation, Eaton continuously adapts to evolving energy demands. As 2026 unfolds, I ask: does Eaton’s robust market position still translate into compelling investment value amid shifting industry dynamics?

Table of contents

Business Model & Company Overview

Eaton Corporation plc, founded in 1911 and headquartered in Dublin, Ireland, stands as a power management leader in industrial machinery. It delivers a comprehensive ecosystem spanning electrical, aerospace, vehicle, and eMobility segments. This integrated approach fuels critical infrastructure and mobility solutions worldwide, reflecting a core mission to optimize energy and operational efficiency.

The company’s revenue engine balances hardware—such as electrical components and aerospace pumps—with software and recurring services like power reliability and after-market support. Eaton’s strategic footprint spans the Americas, Europe, and Asia, enabling it to capture diverse industrial demand. Its robust economic moat lies in deep sector expertise and broad product integration, positioning it to shape the future of global power management.

Financial Performance & Fundamental Metrics

I will analyze Eaton Corporation plc’s income statement, key financial ratios, and dividend payout policy to assess its fundamental strength and shareholder value creation.

Income Statement

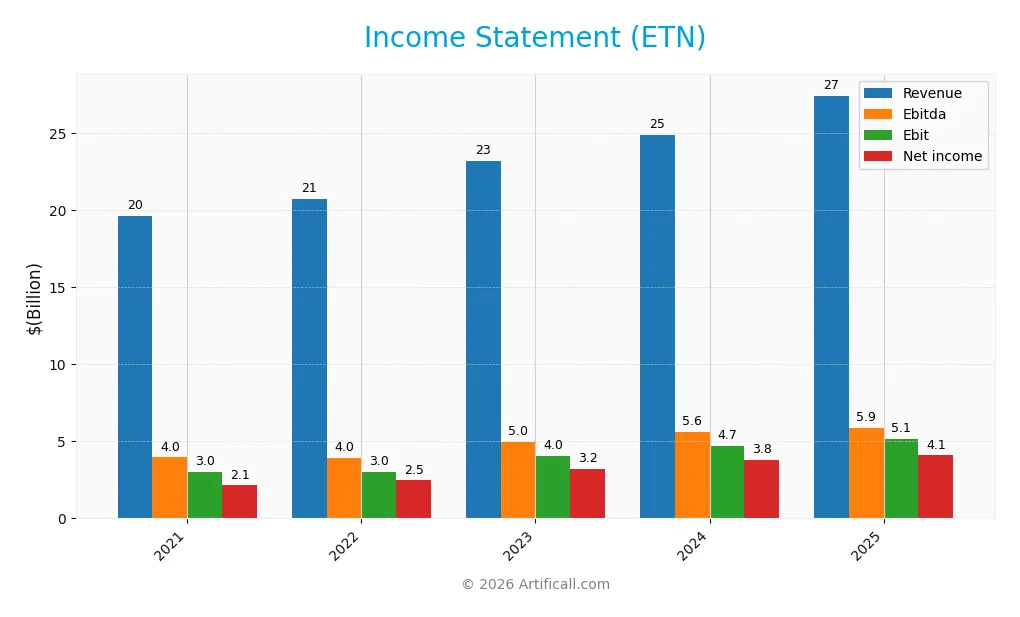

The table below summarizes Eaton Corporation plc’s key income statement figures for fiscal years 2021 through 2025, reflecting trends in revenue, expenses, and profitability.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 19.6B | 20.8B | 23.2B | 24.9B | 27.4B |

| Cost of Revenue | 13.3B | 13.8B | 14.8B | 15.4B | 17.1B |

| Operating Expenses | 3.4B | 3.7B | 4.4B | 4.6B | 5.1B |

| Gross Profit | 6.3B | 6.9B | 8.4B | 9.5B | 10.3B |

| EBITDA | 4.0B | 4.0B | 5.0B | 5.6B | 5.9B |

| EBIT | 3.0B | 3.0B | 4.0B | 4.7B | 5.1B |

| Interest Expense | 144M | 88M | 208M | 144M | 264M |

| Net Income | 2.1B | 2.5B | 3.2B | 3.8B | 4.1B |

| EPS | 5.38 | 6.18 | 8.06 | 9.54 | 10.49 |

| Filing Date | 2022-02-23 | 2023-02-23 | 2024-02-29 | 2025-02-27 | 2026-02-03 |

Income Statement Evolution

Eaton Corporation’s revenue grew steadily from $19.6B in 2021 to $27.4B in 2025, a 40% increase over five years. Net income nearly doubled, rising from $2.1B to $4.1B. Margins improved consistently, with gross margin at 37.6% and EBIT margin reaching 18.8% in 2025, reflecting enhanced operational efficiency.

Is the Income Statement Favorable?

The 2025 income statement shows solid fundamentals with $27.4B revenue and $4.1B net income. EBIT margin of 18.8% and net margin near 15% indicate strong profitability. Interest expense remains low at under 1% of revenue. Despite a slight dip in net margin growth last year, overall metrics and 92.9% favorable indicators confirm a robust financial profile.

Financial Ratios

The table below presents Eaton Corporation plc’s key financial ratios from 2021 to 2025, offering insight into profitability, efficiency, liquidity, leverage, and dividend metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 11% | 12% | 14% | 15% | 15% |

| ROE | 13.1% | 14.5% | 16.9% | 20.5% | 21.1% |

| ROIC | 7.4% | 9.5% | 10.6% | 13.0% | 13.1% |

| P/E | 32.1 | 25.4 | 29.9 | 34.8 | 30.2 |

| P/B | 4.20 | 3.67 | 5.05 | 7.14 | 6.37 |

| Current Ratio | 1.04 | 1.38 | 1.51 | 1.50 | 1.32 |

| Quick Ratio | 0.63 | 0.84 | 1.02 | 0.96 | 0.81 |

| D/E | 0.54 | 0.53 | 0.51 | 0.53 | 0.54 |

| Debt-to-Assets | 26% | 26% | 26% | 26% | 26% |

| Interest Coverage | 19.9 | 36.8 | 19.2 | 33.8 | 19.8 |

| Asset Turnover | 0.58 | 0.59 | 0.60 | 0.65 | 0.67 |

| Fixed Asset Turnover | 5.60 | 5.58 | 5.55 | 5.49 | 5.40 |

| Dividend Yield | 1.77% | 2.08% | 1.43% | 1.14% | 1.31% |

Evolution of Financial Ratios

Eaton’s Return on Equity (ROE) steadily improved from 13.1% in 2021 to 21.1% in 2025, signaling enhanced profitability. The Current Ratio fluctuated but remained close to 1.3–1.5, indicating stable liquidity. Debt-to-Equity Ratio hovered around 0.5, reflecting consistent leverage management over the period.

Are the Financial Ratios Favorable?

In 2025, Eaton shows favorable profitability with a 14.9% net margin and a 21.1% ROE, outpacing many peers. Its debt-to-assets ratio at 25.5% and interest coverage near 19.5x indicate strong solvency. However, valuation ratios like P/E at 30.2 and P/B at 6.4 appear stretched. Liquidity ratios remain neutral, balancing between risk and stability. Overall, the ratios are slightly favorable.

Shareholder Return Policy

Eaton Corporation plc maintains a dividend payout ratio near 40%, with dividend per share steadily rising from $3.06 in 2021 to $4.16 in 2025. The annual dividend yield hovers around 1.3%, supported by manageable payout coverage indicated by free cash flow ratios in prior years.

The company also engages in share buybacks, complementing its dividend policy. This balanced approach suggests Eaton prioritizes sustainable shareholder returns while managing capital allocation prudently. The consistent dividend growth alongside buybacks aligns with long-term value creation without excessive distribution risks.

Score analysis

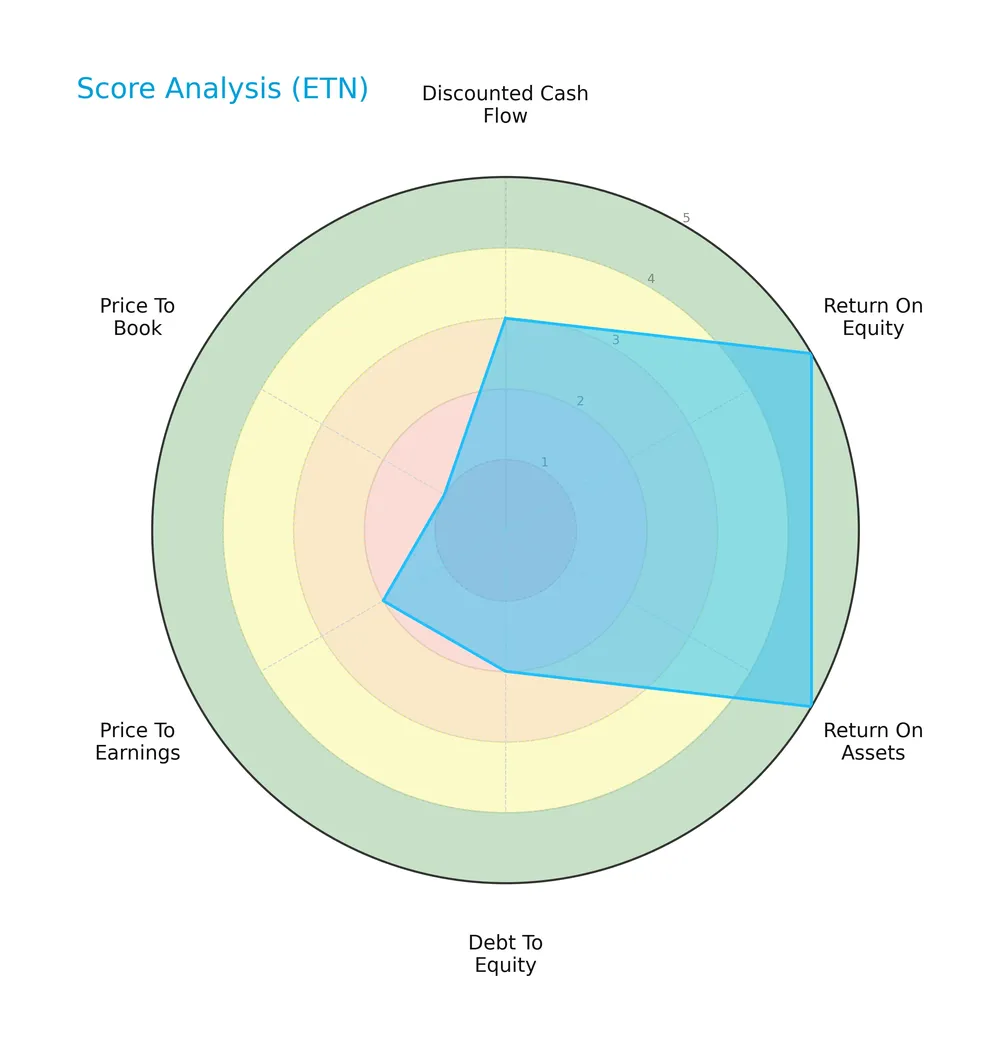

Here is a radar chart summarizing Eaton Corporation plc’s key financial scores for a comprehensive overview:

Eaton exhibits very favorable returns on equity and assets, scoring 5 in both. However, its debt-to-equity, price-to-earnings, and price-to-book scores lag behind, reflecting moderate to very unfavorable valuation and leverage metrics.

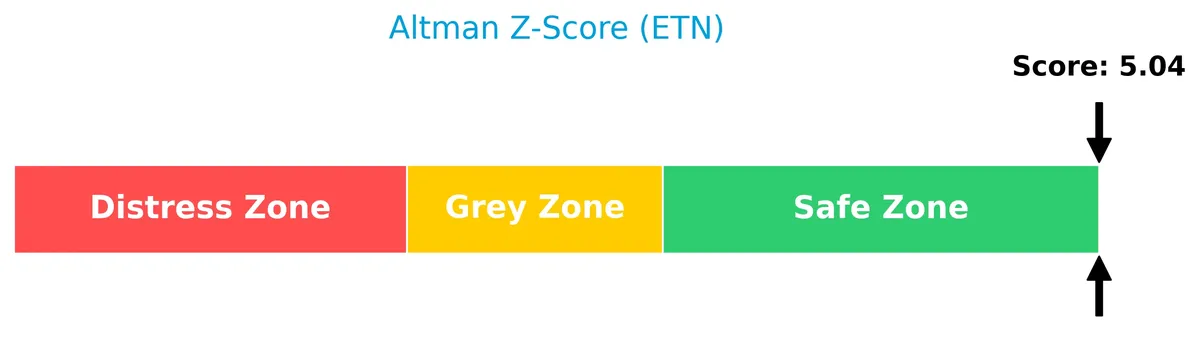

Analysis of the company’s bankruptcy risk

The Altman Z-Score places Eaton comfortably in the safe zone, indicating a low risk of bankruptcy and strong financial stability:

Is the company in good financial health?

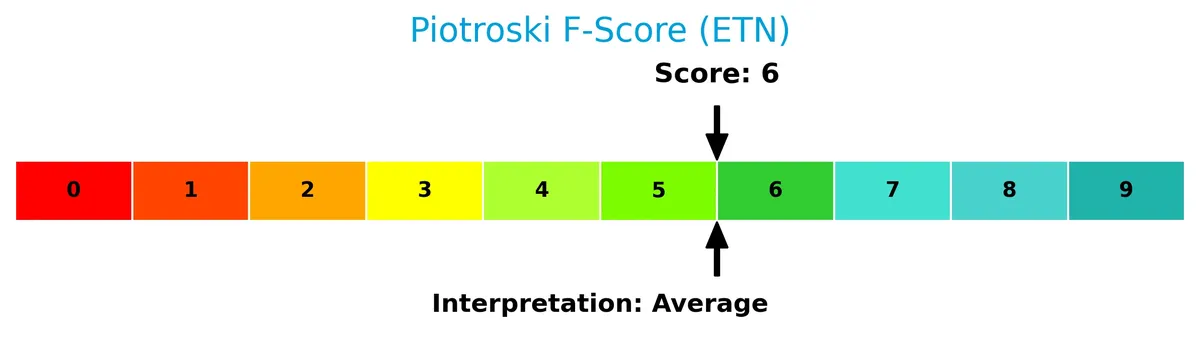

The Piotroski Score diagram provides insight into Eaton’s financial strength based on nine key criteria:

With a score of 6 classified as average, Eaton shows reasonable financial health but does not reach the threshold of very strong financial stability.

Competitive Landscape & Sector Positioning

This analysis reviews Eaton Corporation plc’s strategic positioning, revenue segments, key products, and main competitors. I will assess whether Eaton holds a competitive advantage over its industry peers.

Strategic Positioning

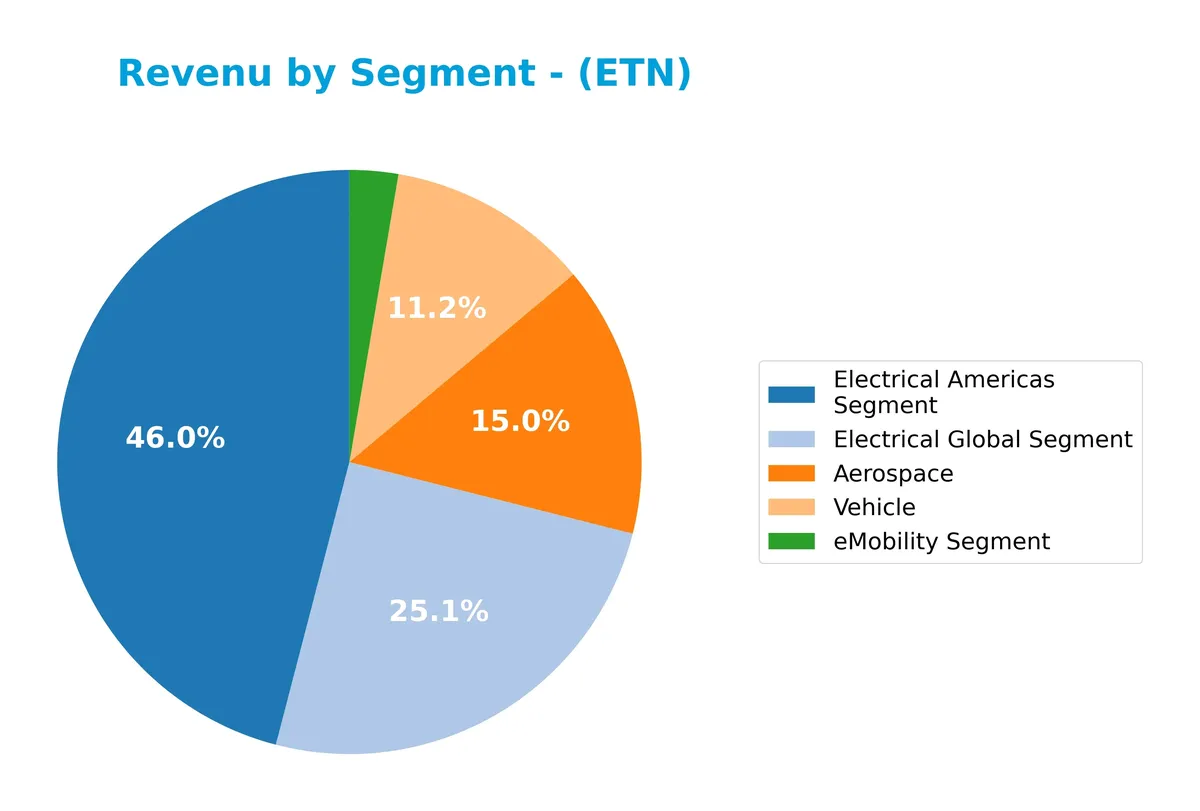

Eaton Corporation plc maintains a diversified portfolio across electrical, aerospace, vehicle, and eMobility segments, with a strong focus on Electrical Americas generating $11.4B in 2024. Geographically, the company balances exposure, with the U.S. market contributing $15.2B and significant presence in Europe ($4.5B) and Asia Pacific ($2.5B).

Revenue by Segment

This pie chart illustrates Eaton Corporation plc’s revenue distribution by segment for fiscal year 2024, highlighting the company’s diversified industrial portfolio.

Electrical Americas leads at $11.4B, showing steady growth and dominance in Eaton’s portfolio. Electrical Global follows with $6.2B, maintaining strong contribution. Aerospace increased to $3.7B, reflecting ongoing demand in aviation. Vehicle segment at $2.8B shows slight decline from prior years, while eMobility grows to $669M, signaling rising focus on electrification. The 2024 mix reveals concentration in electrical segments but also emerging growth in eMobility.

Key Products & Brands

The table below summarizes Eaton Corporation plc’s primary products and brands by segment and description:

| Product | Description |

|---|---|

| Electrical Americas | Electrical components, power distribution, wiring devices, circuit protection, utility power products, and services in the Americas. |

| Electrical Global | Similar power management and electrical products offered globally outside the Americas. |

| Aerospace | Pumps, motors, hydraulic units, valves, actuators, sensors, and other components for commercial and military aircraft. |

| Vehicle | Transmissions, clutches, hybrid power systems, superchargers, engine valves, and fuel vapor components for vehicles. |

| eMobility | Voltage inverters, converters, onboard chargers, circuit protection, vehicle controls, and hybrid power systems for commercial vehicles. |

Eaton’s product range spans industrial power management and aerospace components to automotive and eMobility systems. The Electrical Americas segment leads in revenue, reflecting strong demand in North America. The aerospace and vehicle segments complement its diversified industrial portfolio.

Main Competitors

There are 24 competitors in the Industrials sector, with the table listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Eaton Corporation plc | 127B |

| Parker-Hannifin Corporation | 114B |

| Howmet Aerospace Inc. | 85B |

| Emerson Electric Co. | 76B |

| Illinois Tool Works Inc. | 73B |

| Cummins Inc. | 72B |

| AMETEK, Inc. | 48B |

| Roper Technologies, Inc. | 47B |

| Rockwell Automation, Inc. | 45B |

| Symbotic Inc. | 36B |

Eaton Corporation plc ranks first among 24 competitors, with a market cap 8.7% larger than the next leader. It stands above both the average market cap of the top 10 (72B) and the sector median (32B). The company enjoys a 21% gap over its closest competitor, Parker-Hannifin, underscoring its dominant position.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does Eaton Corporation plc have a competitive advantage?

Eaton demonstrates a sustainable competitive advantage, creating value with ROIC exceeding WACC by 4.17% and a strong upward ROIC trend of 76.5% over 2021-2025. Its broad industrial machinery portfolio and global footprint support this favorable moat status.

Looking ahead, Eaton’s diverse segments—Electrical, Aerospace, Vehicle, and eMobility—offer growth through innovative power management and hybrid systems. Expansion in emerging markets and advanced product development underpin future opportunities in a dynamic industrial landscape.

SWOT Analysis

This SWOT analysis highlights Eaton Corporation plc’s key internal and external factors to guide strategic decisions.

Strengths

- strong global market presence

- diversified product segments

- favorable ROIC well above WACC

Weaknesses

- high price-to-book ratio

- moderate liquidity ratios

- recent slight net margin decline

Opportunities

- growth in eMobility segment

- expanding U.S. and Europe markets

- innovation in power management solutions

Threats

- competitive industrial machinery sector

- supply chain disruptions

- economic cyclicality impact on demand

Eaton’s robust profitability and global footprint position it well for growth. However, valuation concerns and margin pressures require careful cost management and innovation focus.

Stock Price Action Analysis

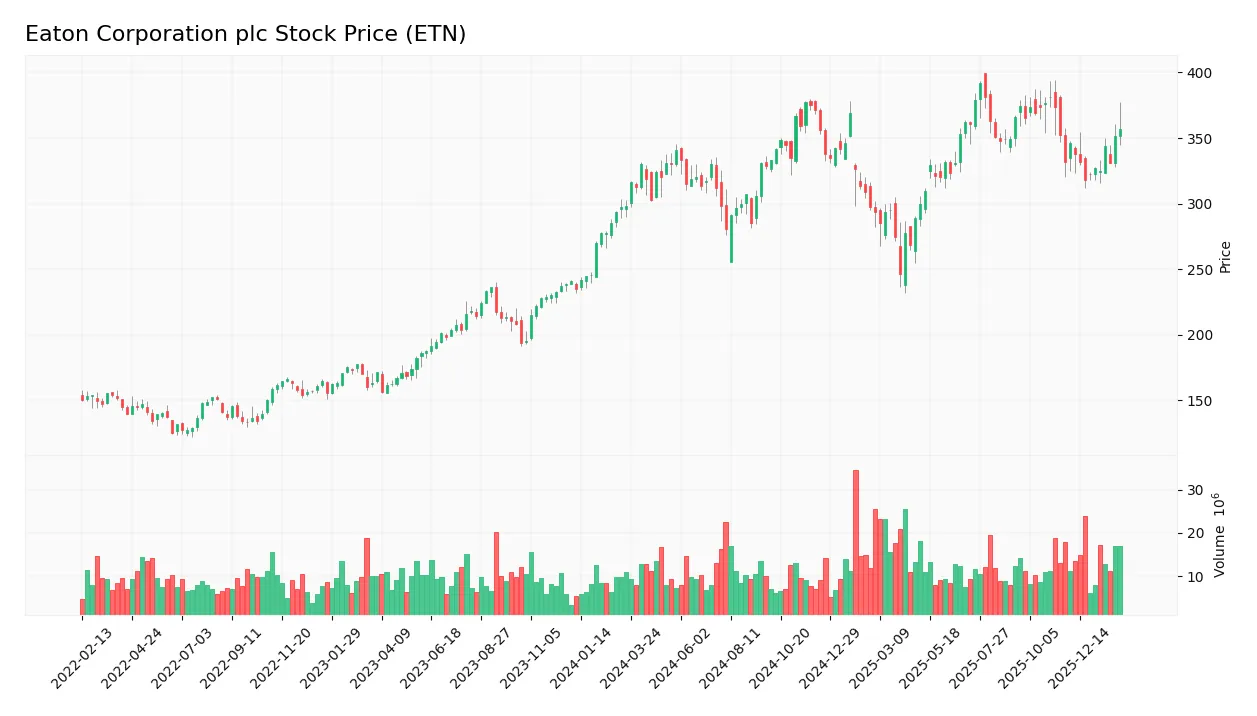

The following weekly chart illustrates Eaton Corporation plc’s stock price movement over the past 12 months, highlighting key highs and lows:

Trend Analysis

Over the past year, ETN’s stock price rose 19.83%, signaling a bullish trend with accelerating momentum. The price ranged from a low of 246.52 to a high near 392.17. Volatility remains elevated, with a standard deviation of 29.33, reflecting substantial price swings during this period.

Volume Analysis

Trading volume has increased overall, with buyers accounting for 50.82% of total activity historically. However, in the recent three months, sellers dominated 57.78% of volume, indicating slight selling pressure. This shift suggests cautious investor sentiment amid rising participation.

Target Prices

Analysts set a clear target consensus for Eaton Corporation plc, reflecting cautious optimism.

| Target Low | Target High | Consensus |

|---|---|---|

| 295 | 495 | 395.42 |

The target prices suggest a broad valuation range, with the consensus indicating moderate upside potential from current levels.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines analyst ratings and consumer feedback to provide a comprehensive view of Eaton Corporation plc’s market perception.

Stock Grades

Here is a summary of recent verified analyst grades for Eaton Corporation plc (ETN) from leading financial firms:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| HSBC | Upgrade | Buy | 2026-01-16 |

| JP Morgan | Maintain | Overweight | 2026-01-16 |

| Citigroup | Maintain | Buy | 2026-01-12 |

| Morgan Stanley | Maintain | Overweight | 2026-01-12 |

| Barclays | Maintain | Equal Weight | 2026-01-07 |

| UBS | Downgrade | Neutral | 2026-01-05 |

| Wells Fargo | Maintain | Equal Weight | 2026-02-04 |

| Wolfe Research | Upgrade | Outperform | 2025-12-09 |

| JP Morgan | Maintain | Overweight | 2025-11-06 |

The overall analyst stance on ETN leans positive with multiple Buy and Overweight ratings. However, some maintain a cautious Equal Weight or Neutral view, reflecting a mixed but generally constructive sentiment.

Consumer Opinions

Consumers express a mix of respect and frustration toward Eaton Corporation plc, reflecting its complex market position.

| Positive Reviews | Negative Reviews |

|---|---|

| Reliable product quality and durability. | Customer service response times are slow. |

| Strong innovation in energy-efficient tech. | Pricing is often higher than competitors. |

| Robust supply chain minimizes delays. | Occasional issues with product availability. |

Overall, feedback praises Eaton’s durable, innovative products but flags slower customer support and premium pricing as recurring concerns. This aligns with industry norms where quality often trades off with service speed.

Risk Analysis

Below is a table summarizing Eaton Corporation’s key risks, their likelihood, and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Valuation Risk | High P/E (30.24) and P/B (6.37) ratios suggest overvaluation versus sector and market averages. | Medium | High |

| Liquidity Risk | Current ratio (1.32) and quick ratio (0.81) indicate moderate short-term liquidity but some pressure. | Medium | Medium |

| Market Volatility | Beta of 1.19 implies sensitivity to market swings, increasing share price fluctuations. | High | Medium |

| Debt Management | Debt-to-assets at 25.5% is favorable, yet moderate debt/equity score signals cautious leverage use. | Low | Medium |

| Operational Risk | Exposure to industrial and aerospace segments subjects Eaton to cyclical demand and supply chain disruptions. | Medium | High |

Eaton operates in cyclical industrial sectors sensitive to economic shifts. The valuation risk stands out as most pressing given stretched multiples compared to historical norms. The company’s strong Altman Z-Score (5.04) confirms financial stability, but the average Piotroski score (6) calls for monitoring operational efficiency. Market volatility remains a constant factor amid global uncertainties.

Should You Buy Eaton Corporation plc?

Eaton appears to be a robust value creator with a durable competitive moat supported by growing ROIC well above WACC. While its leverage profile is moderate, the overall B+ rating suggests a very favorable financial health profile with manageable risks.

Strength & Efficiency Pillars

Eaton Corporation plc exhibits strong profitability with a net margin of 14.9% and a return on equity (ROE) of 21.05%. The return on invested capital (ROIC) stands at 13.14%, comfortably above the weighted average cost of capital (WACC) at 8.97%, confirming Eaton as a clear value creator. Financial health is solid, supported by an Altman Z-Score of 5.04, placing the company safely away from bankruptcy risk, while a Piotroski score of 6 indicates average but stable financial strength. These metrics reveal a company efficiently converting capital into profit with sustainable competitive advantages.

Weaknesses and Drawbacks

Despite operational strengths, Eaton faces valuation challenges. The price-to-earnings (P/E) ratio is elevated at 30.24, signaling a premium valuation that may temper upside potential. More concerning is the price-to-book (P/B) ratio of 6.37, which is very unfavorable and suggests the market prices Eaton above its net asset value, raising questions about margin of safety. Leverage metrics are moderate, with a debt-to-equity ratio of 0.54 and a current ratio of 1.32, indicating manageable but not overly conservative liquidity. Recent market behavior shows slight seller dominance, with buyers accounting for only 42.22%, hinting at short-term headwinds.

Our Verdict about Eaton Corporation plc

Eaton presents a fundamentally favorable long-term profile, underpinned by strong profitability and clear value creation. However, the premium valuation multiples and recent slight seller dominance suggest caution. Despite long-term strength, recent market pressure might suggest a wait-and-see approach for a better entry point. Investors with a focus on quality and durability could find Eaton a company worth monitoring as market dynamics evolve.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Eaton (ETN) Is Considered a Good Investment by Brokers: Is That True? – Finviz (Feb 05, 2026)

- Where Will Eaton (ETN) Stock Be in 1 Year? – AOL.com (Feb 05, 2026)

- With 83% ownership in Eaton Corporation plc (NYSE:ETN), institutional investors have a lot riding on the business – Yahoo Finance (Feb 03, 2026)

- Eaton shares slide after revenue miss, 2026 outlook trails estimates (ETN:NYSE) – Seeking Alpha (Feb 03, 2026)

- Eaton Corporation plc (NYSE:ETN) Q4 2025 earnings call transcript – MSN (Feb 03, 2026)

For more information about Eaton Corporation plc, please visit the official website: eaton.com