Home > Analyses > Technology > Domo, Inc.

Domo, Inc. transforms how organizations harness data by delivering real-time insights from the C-suite to frontline employees through its cloud-based business intelligence platform. As an innovator in the software application industry, Domo leads with a reputation for connecting people, systems, and data seamlessly, empowering smarter decision-making on any device. With its evolving technology and global reach, the key question remains: does Domo’s current performance and growth trajectory justify its valuation for discerning investors?

Table of contents

Business Model & Company Overview

Domo, Inc., founded in 2010 and headquartered in American Fork, Utah, commands a notable position in the software application industry with a market cap of approximately 244M USD. Its cloud-based business intelligence platform creates a unified ecosystem that connects CEOs to frontline employees, integrating people, data, and systems across organizations. This cohesive mission enhances real-time decision-making and operational management via smartphone access, reflecting its commitment to seamless, data-driven business operations.

The company’s revenue engine hinges on its software platform, delivering recurring value by enabling digital transformation for clients across the Americas, Japan, and other international markets. With 888 full-time employees, Domo leverages its presence in key regions to sustain growth and innovation. Its competitive advantage lies in providing a comprehensive, real-time analytics solution, establishing a durable economic moat that reinforces its role in shaping the future of enterprise data management.

Financial Performance & Fundamental Metrics

In this section, I analyze Domo, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its overall financial health and investment potential.

Income Statement

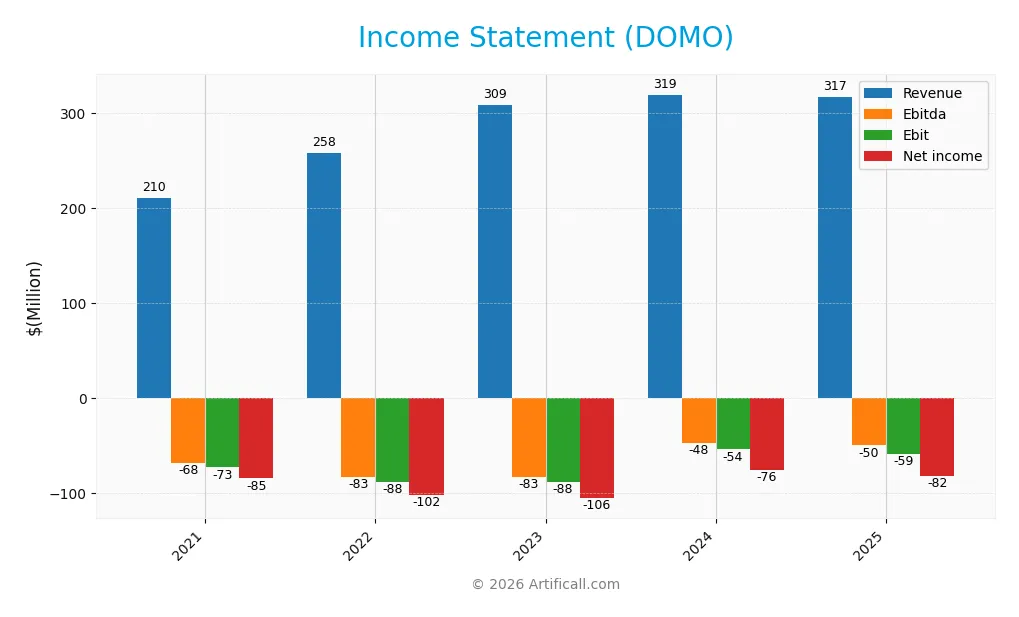

The table below presents Domo, Inc.’s key income statement figures for fiscal years 2021 through 2025, providing a clear view of revenue, expenses, and profitability trends.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 210.2M | 258.0M | 308.6M | 319.0M | 317.0M |

| Cost of Revenue | 56.7M | 67.1M | 73.1M | 75.5M | 81.0M |

| Operating Expenses | 226.5M | 279.3M | 324.4M | 298.4M | 295.3M |

| Gross Profit | 153.4M | 190.8M | 235.6M | 243.5M | 236.1M |

| EBITDA | -68.3M | -83.1M | -82.9M | -47.5M | -50.0M |

| EBIT | -73.1M | -88.5M | -88.3M | -54.1M | -59.3M |

| Interest Expense | 15.3M | 14.1M | 15.5M | 0 | 19.8M |

| Net Income | -84.6M | -102.1M | -105.6M | -75.6M | -81.9M |

| EPS | -2.89 | -3.19 | -3.10 | -2.10 | -2.13 |

| Filing Date | 2021-04-01 | 2022-03-23 | 2023-03-27 | 2024-03-28 | 2025-04-04 |

Income Statement Evolution

From 2021 to 2025, Domo, Inc. experienced overall revenue growth of 50.84%, indicating an expansion in its top line. However, in the most recent year, revenue declined slightly by 0.61%. Gross profit followed a similar pattern, with a 3.07% decrease in the last year after previous gains. Margins have been mixed: gross margin remains favorable at 74.45%, while EBIT and net margins are negative and deteriorated in 2025, reflecting ongoing profitability challenges.

Is the Income Statement Favorable?

In 2025, Domo reported a 25.84% net loss margin and an EBIT margin of -18.7%, both unfavorable, showing the company is not yet profitable. Interest expense accounted for 6.25% of revenue, assessed as neutral. Despite stable operating expenses relative to revenue, the decline in revenue and earnings per share (-1.43%) signals pressure on fundamentals. Overall, the income statement is evaluated as unfavorable, with persistent losses offsetting revenue growth.

Financial Ratios

The following table presents key financial ratios for Domo, Inc. over the fiscal years 2021 to 2025, illustrating profitability, valuation, liquidity, leverage, and efficiency metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | -40% | -40% | -34% | -24% | -26% |

| ROE | 1.01 | 0.81 | 0.72 | 0.49 | 0.46 |

| ROIC | -2.13 | -7.65 | 56.14 | 7.48 | 1.95 |

| P/E | -22.9 | -14.7 | -5.0 | -5.2 | -4.0 |

| P/B | -23.2 | -11.9 | -3.6 | -2.6 | -1.8 |

| Current Ratio | 0.89 | 0.73 | 0.68 | 0.58 | 0.56 |

| Quick Ratio | 0.89 | 0.73 | 0.68 | 0.58 | 0.56 |

| D/E | -1.26 | -0.99 | -0.88 | -0.84 | -0.76 |

| Debt-to-Assets | 0.49 | 0.51 | 0.53 | 0.57 | 0.63 |

| Interest Coverage | -4.78 | -6.27 | -5.73 | 0 | -3.0 |

| Asset Turnover | 0.97 | 1.05 | 1.27 | 1.41 | 1.48 |

| Fixed Asset Turnover | 11.42 | 7.59 | 8.43 | 8.23 | 8.17 |

| Dividend Yield | 0 | 0 | 0 | 0 | 0 |

Evolution of Financial Ratios

Domo, Inc.’s Return on Equity (ROE) has shown a generally positive trend, reaching 46.23% in 2025, indicating improved profitability despite persistent net losses. The Current Ratio declined steadily from 0.89 in 2021 to 0.56 in 2025, reflecting reduced short-term liquidity. The Debt-to-Equity Ratio remained negative but improved slightly to -0.76 in 2025, signaling continued but moderated leverage concerns.

Are the Financial Ratios Fovorable?

In 2025, profitability ratios show mixed signals: ROE and Return on Invested Capital (ROIC) are favorable, while the net profit margin is unfavorable at -25.84%. Liquidity ratios, including the Current and Quick Ratios at 0.56, are unfavorable, highlighting potential short-term financial stress. Leverage metrics like Debt-to-Equity ratio are favorable, but high debt-to-assets (63.23%) and negative interest coverage (-2.99) are unfavorable. Efficiency ratios such as Asset Turnover (1.48) and Fixed Asset Turnover (8.17) are favorable, resulting in a neutral overall financial ratio assessment.

Shareholder Return Policy

Domo, Inc. does not pay dividends, reflecting its continued negative net income and free cash flow. The company appears focused on reinvestment and growth, with no dividend payout or yield reported in recent fiscal years. No share buyback programs are indicated either. This approach suggests prioritization of long-term value creation through operational and strategic investments rather than immediate shareholder distributions.

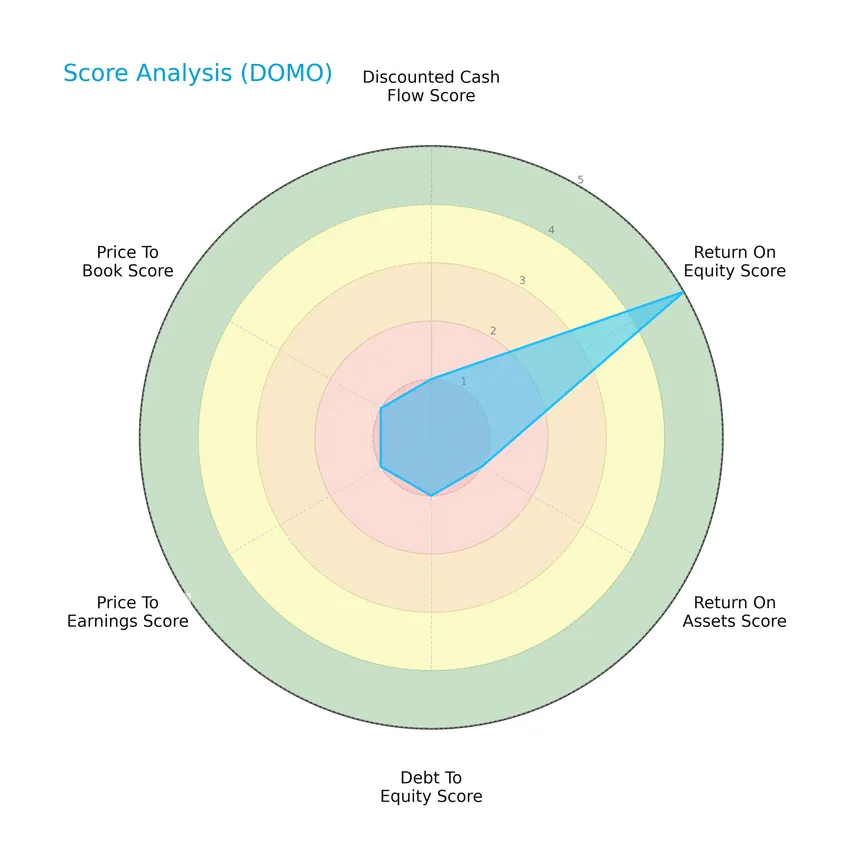

Score analysis

Here is a radar chart presenting the company’s key financial scores for a comprehensive overview:

The scores reveal a mixed financial profile: a very favorable return on equity contrasts sharply with very unfavorable ratings for discounted cash flow, return on assets, debt to equity, price to earnings, and price to book ratios.

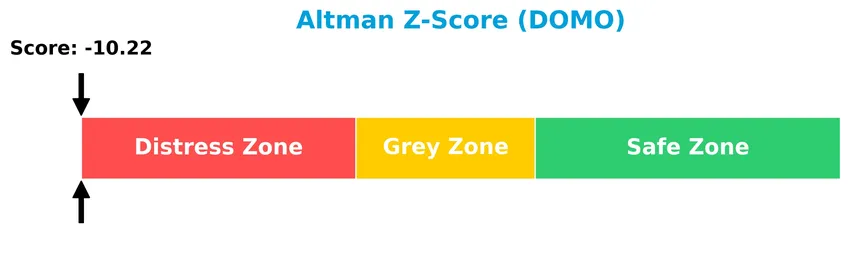

Analysis of the company’s bankruptcy risk

The Altman Z-Score indicates the company is currently in the distress zone, signaling a high risk of financial distress and potential bankruptcy:

Is the company in good financial health?

The Piotroski Score diagram below illustrates the company’s financial health status based on nine fundamental criteria:

With a Piotroski Score of 3, the company is classified as very weak financially, reflecting concerns about profitability, liquidity, and operational efficiency.

Competitive Landscape & Sector Positioning

This section provides an overview of Domo, Inc.’s sector, including its strategic positioning and revenue breakdown. We will analyze key products, main competitors, and the company’s competitive advantages. The goal is to assess whether Domo holds a competitive edge in the dynamic software application industry.

Strategic Positioning

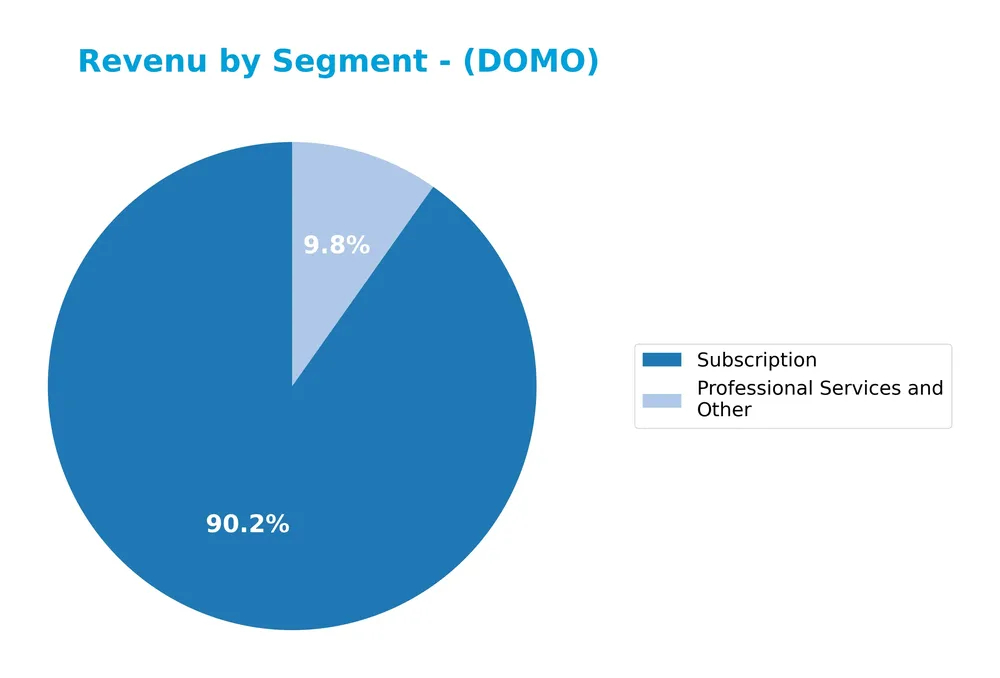

Domo, Inc. focuses on a concentrated product portfolio predominantly based on subscription services, generating $286M in 2025, complemented by professional services at $31M. Geographically, the company is primarily exposed to the United States market with $252M revenue, while maintaining smaller international operations, including Japan.

Revenue by Segment

This pie chart illustrates Domo, Inc.’s revenue distribution by segment for the fiscal year 2025, highlighting the contribution of Subscription and Professional Services and Other categories.

Subscription revenue remains the primary driver, reaching $286M in 2025, showing steady growth from $117M in 2019. Professional Services and Other generated $31M, declining slightly compared to previous years. The business continues to concentrate on subscription offerings, which have accelerated notably since 2020, indicating a strong recurring revenue model with manageable exposure to service-related volatility.

Key Products & Brands

The table below outlines Domo, Inc.’s key products and brands along with their descriptions:

| Product | Description |

|---|---|

| Subscription | Cloud-based business intelligence platform subscriptions providing real-time data access and insights. |

| Professional Services and Other | Services complementing the platform, including implementation, consulting, and additional support offerings. |

Domo, Inc.’s revenue primarily stems from subscription services of its cloud-based BI platform, complemented by professional services that enhance customer experience and platform integration.

Main Competitors

There are 33 competitors in total within the sector; below are the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Salesforce, Inc. | 242.5B |

| Shopify Inc. | 209.6B |

| AppLovin Corporation | 209.0B |

| Intuit Inc. | 175.2B |

| Uber Technologies, Inc. | 172.2B |

| ServiceNow, Inc. | 153.0B |

| Cadence Design Systems, Inc. | 84.5B |

| Snowflake Inc. | 73.4B |

| Autodesk, Inc. | 61.2B |

| Workday, Inc. | 54.9B |

Domo, Inc. ranks 32nd among 33 competitors, with a market cap only 0.1% that of Salesforce, the sector leader. The company is positioned well below both the average market cap of the top 10 competitors (143.6B) and the median market cap in the sector (18.8B). Notably, Domo has a significant 393.97% market cap gap to the next closest competitor above it, highlighting its relatively smaller scale within the industry.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does DOMO have a competitive advantage?

Domo, Inc. demonstrates a durable competitive advantage, supported by a very favorable moat status and a ROIC significantly exceeding its WACC, indicating efficient capital use and value creation. The company’s growing ROIC trend over 2021-2025 further confirms increasing profitability and sustainable competitive positioning.

Looking ahead, Domo’s cloud-based business intelligence platform serves multiple geographies, including the US, Japan, and international markets, offering real-time data access and management capabilities. This positions the company to capitalize on expanding demand for digital transformation and mobile data solutions globally.

SWOT Analysis

This SWOT analysis highlights Domo, Inc.’s key internal and external factors to guide investment decisions.

Strengths

- strong gross margin at 74.45%

- high ROIC at 194.73% indicating value creation

- durable competitive advantage with growing profitability

Weaknesses

- negative net margin at -25.84%

- low liquidity ratios (current and quick ratio at 0.56)

- weak Altman Z-Score indicating financial distress

Opportunities

- expanding cloud-based BI market

- potential for international revenue growth

- improving operational efficiency

Threats

- intense competition in software applications

- high debt-to-assets ratio at 63.23%

- macroeconomic uncertainty impacting tech spending

Overall, Domo shows strong profitability metrics and a solid moat but faces significant profitability and liquidity challenges. Strategic focus should be on improving margins and financial health while leveraging market growth opportunities.

Stock Price Action Analysis

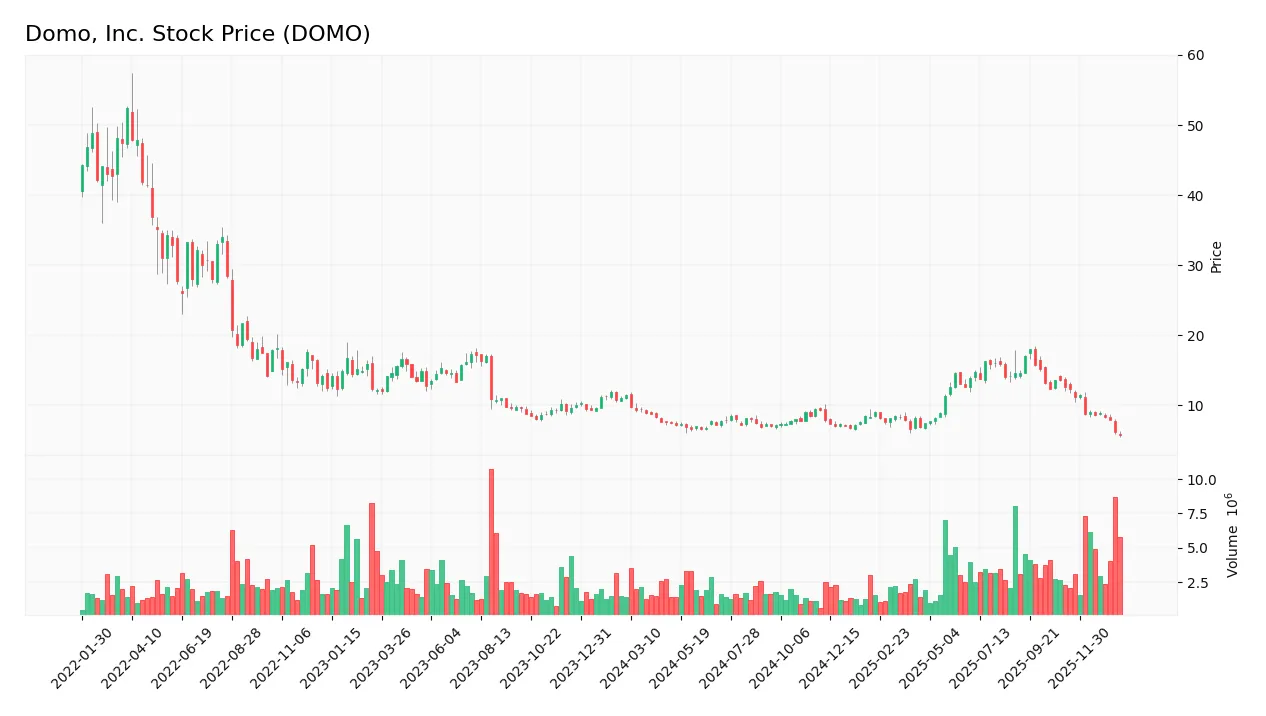

The weekly stock chart for Domo, Inc. (DOMO) over the past 12 months shows significant price fluctuations and a pronounced downward trajectory:

Trend Analysis

Over the past 12 months, DOMO’s stock price declined by 49.39%, indicating a bearish trend. The price moved from a high of 18.06 to a low of 5.83 with decelerating downward momentum. The standard deviation of 3.03 suggests moderate volatility during this period.

Volume Analysis

In the last three months, trading volume has been increasing, with seller volume significantly exceeding buyer volume (20.9% buyer dominance). This seller-driven activity implies growing bearish sentiment and heightened market participation focused on selling pressure.

Target Prices

The consensus target price for Domo, Inc. reflects moderate upside potential based on current analyst estimates.

| Target High | Target Low | Consensus |

|---|---|---|

| 13 | 10 | 11.5 |

Analysts expect Domo’s stock price to range between 10 and 13, with a consensus target around 11.5, indicating cautious optimism in the near term.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines recent analyst ratings and consumer feedback related to Domo, Inc. (DOMO) performance and reputation.

Stock Grades

Here is a summary of recent verified stock grades from reputable financial firms for Domo, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| DA Davidson | Maintain | Neutral | 2025-12-05 |

| Lake Street | Maintain | Hold | 2025-12-05 |

| TD Cowen | Maintain | Buy | 2025-12-05 |

| JMP Securities | Maintain | Market Outperform | 2025-09-10 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-08-28 |

| TD Cowen | Upgrade | Buy | 2025-08-26 |

The overall trend shows a generally positive outlook with multiple firms maintaining Buy or equivalent ratings, while others hold Neutral or Hold positions. Upgrades and consistent Overweight or Market Outperform grades suggest cautious optimism among analysts.

Consumer Opinions

Consumers have shared a mix of praise and concerns about Domo, Inc., reflecting diverse experiences with its products and services.

| Positive Reviews | Negative Reviews |

|---|---|

| Intuitive dashboard and strong data visualization tools. | Steep learning curve for new users. |

| Excellent customer support with quick response times. | Pricing can be high for small to mid-sized businesses. |

| Robust integration capabilities with various data sources. | Occasional performance lags during peak usage. |

Overall, Domo, Inc. is appreciated for its powerful analytics and responsive support, though some users find the platform complex initially and note cost concerns, especially for smaller enterprises.

Risk Analysis

Below is a summary table outlining the main risks associated with investing in Domo, Inc., highlighting their probability and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Extremely low Altman Z-Score (-10.22) indicates high bankruptcy risk. | High | Very High |

| Profitability | Negative net margin (-25.84%) despite strong ROE and ROIC signals volatility. | High | High |

| Liquidity | Low current and quick ratios (0.56) suggest weak short-term financial safety. | Medium | High |

| Leverage | High debt-to-assets ratio (63.23%) and poor interest coverage (-2.99) risk solvency issues. | High | High |

| Market Volatility | High beta (1.65) means stock price reacts strongly to market swings. | High | Medium |

| Valuation | Negative P/E and P/B ratios reflect market skepticism and valuation concerns. | Medium | Medium |

| Dividend Policy | No dividend yield, limiting income for investors seeking yield. | Low | Low |

The most critical risk for Domo is its financial distress, reflected in the very low Altman Z-Score and weak Piotroski score, signaling a significant bankruptcy probability. Additionally, high leverage and poor liquidity exacerbate solvency risks. Investors should exercise caution and consider these factors carefully before committing capital.

Should You Buy Domo, Inc.?

Domo, Inc. appears to be in a distress zone with weak profitability and a challenging leverage profile despite demonstrating a durable competitive moat supported by growing ROIC. While operational efficiency is limited, the overall rating stands at C, suggesting cautious interpretation.

Strength & Efficiency Pillars

Domo, Inc. stands out as a value creator with a remarkably high return on invested capital (ROIC) of 194.73%, well above its weighted average cost of capital (WACC) at 12.75%. This underlines the company’s ability to generate value beyond capital costs. Its return on equity (ROE) is a strong 46.23%, signaling efficient shareholder capital use. Asset turnover metrics further reinforce operational efficiency, with an asset turnover of 1.48 and fixed asset turnover at 8.17. Despite profitability challenges, these metrics highlight durable competitive advantages and growing profitability.

Weaknesses and Drawbacks

However, Domo’s financial health raises significant concerns. The Altman Z-Score of -10.22 places the company deep in the distress zone, indicating a high risk of bankruptcy. The Piotroski score is very weak at 3, reflecting poor fundamental health. Liquidity ratios are notably unfavorable, with a current ratio and quick ratio both at 0.56, suggesting potential short-term solvency issues. Market pressure is intense, as recent trading shows a seller dominance of 79.1%, contributing to a bearish stock trend with a steep 53.84% price decline over the last 3 months.

Our Verdict about Domo, Inc.

Domo’s long-term fundamental profile could appear favorable due to its exceptional capital efficiency and clear value creation. However, the recent seller dominance and deteriorating financial health suggest caution. Despite its operational strengths and competitive moat, the current market pressure might imply a wait-and-see approach for a more favorable entry point, balancing the high risks against potential rewards.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Domo: AI Is Making This Company Obsolete (NASDAQ:DOMO) – Seeking Alpha (Jan 20, 2026)

- DOMO – Domo Inc Latest Stock News & Market Updates – Stock Titan (Jan 21, 2026)

- Down 31.7% in 4 Weeks, Here’s Why Domo (DOMO) Looks Ripe for a Turnaround – Finviz (Jan 22, 2026)

- Why Domo Stock Rocketed More Than 16% Higher Today – The Motley Fool (Aug 26, 2025)

- Domo, Inc. (NASDAQ: DOMO) Q3 2026 earnings call transcript – MSN (Dec 04, 2025)

For more information about Domo, Inc., please visit the official website: domo.com