Home > Analyses > Consumer Cyclical > Domino’s Pizza, Inc.

Domino’s Pizza, Inc. transforms how millions satisfy their cravings daily, setting the pace in the global pizza delivery market. With a robust portfolio spanning U.S. stores, international franchises, and an integrated supply chain, Domino’s is synonymous with innovation and convenience in the restaurant sector. Its leadership in technology-driven ordering and delivery efficiency distinguishes it from competitors. As we analyze its current fundamentals, the key question remains: does Domino’s valuation still reflect its growth potential in an evolving consumer landscape?

Table of contents

Business Model & Company Overview

Domino’s Pizza, Inc., founded in 1960 and headquartered in Ann Arbor, Michigan, stands as a dominant player in the global pizza industry. With approximately 18,800 stores spanning 90 markets, the company delivers a cohesive ecosystem of oven-baked pizzas, sandwiches, pasta, and complementary sides through both company-owned and franchised outlets. This extensive footprint underscores its mission to provide convenient, quality food experiences worldwide.

The company’s revenue engine balances sales from its U.S. Stores, International Franchise, and Supply Chain segments, blending direct retail with recurring franchise royalties and supply logistics. Its strategic presence across the Americas, Europe, and Asia supports diversified growth and resilience. Domino’s robust operational model and global scale form a powerful economic moat, shaping the future of fast-food delivery and customer engagement.

Financial Performance & Fundamental Metrics

In this section, I analyze Domino’s Pizza, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its financial health and investment potential.

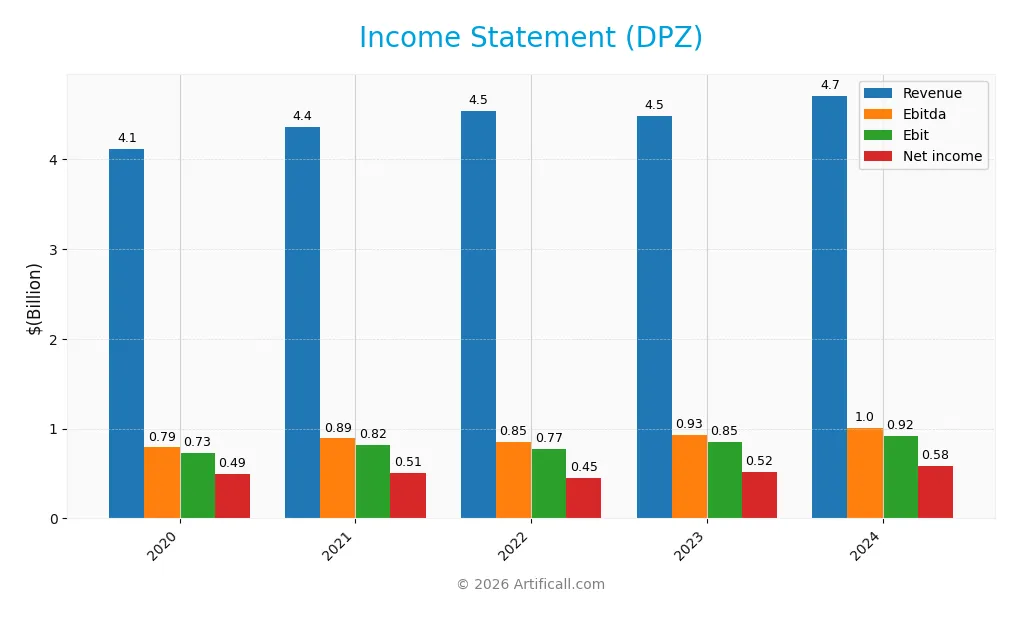

Income Statement

Below is the income statement for Domino’s Pizza, Inc. (DPZ) over the last five fiscal years, showing key financial performance metrics in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 4.12B | 4.36B | 4.54B | 4.48B | 4.71B |

| Cost of Revenue | 2.52B | 2.67B | 2.89B | 2.75B | 2.86B |

| Operating Expenses | 869M | 908M | 881M | 906M | 970M |

| Gross Profit | 1.59B | 1.69B | 1.65B | 1.73B | 1.85B |

| EBITDA | 791M | 890M | 851M | 930M | 1.01B |

| EBIT | 726M | 818M | 771M | 849M | 918M |

| Interest Expense | 172M | 191M | 198M | 196M | 196M |

| Net Income | 491M | 510M | 452M | 519M | 584M |

| EPS | 12.61 | 13.72 | 12.66 | 14.80 | 16.82 |

| Filing Date | 2021-02-25 | 2022-03-01 | 2023-02-23 | 2024-02-26 | 2025-02-24 |

Income Statement Evolution

From 2020 to 2024, Domino’s Pizza, Inc. experienced steady revenue growth of 14.31%, with a modest 5.07% increase in the last year signaling some slowdown. Net income expanded by 18.9% overall, driven by a 7.1% rise in net margin last year and a stable gross margin around 39.28%. EBIT margins improved favorably to 19.51%, reflecting enhanced operational efficiency despite slightly higher operating expenses.

Is the Income Statement Favorable?

The 2024 income statement shows generally favorable fundamentals. Revenue reached $4.71B with gross profit at $1.85B and net income of $584M, yielding a solid net margin of 12.41%. EBIT and EPS grew by 8.15% and 14.32% respectively, indicating strong profitability growth. Interest expenses remain well-managed at 4.16% of revenue. While operating expenses grew in line with revenue, the overall income statement displays robust performance and positive margin trends.

Financial Ratios

The following table presents key financial ratios for Domino’s Pizza, Inc. over the fiscal years 2020 to 2024, offering a snapshot of profitability, liquidity, leverage, and market valuation:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 12% | 12% | 10% | 12% | 12% |

| ROE | -15% | -12% | -11% | -13% | -15% |

| ROIC | 57% | 54% | 52% | 53% | 54% |

| P/E | 30.4 | 41.1 | 27.4 | 27.9 | 25.0 |

| P/B | -4.53 | -4.99 | -2.95 | -3.55 | -3.69 |

| Current Ratio | 1.85 | 1.46 | 1.47 | 1.49 | 0.56 |

| Quick Ratio | 1.70 | 1.34 | 1.32 | 1.34 | 0.52 |

| D/E | -1.32 | -1.26 | -1.25 | -1.28 | -1.31 |

| Debt-to-Assets | 2.8% | 3.2% | 3.3% | 3.1% | 3.0% |

| Interest Coverage | 4.21 | 4.08 | 3.87 | 4.17 | 4.49 |

| Asset Turnover | 2.63 | 2.61 | 2.83 | 2.67 | 2.71 |

| Fixed Asset Turnover | 7.83 | 8.15 | 8.70 | 8.75 | 9.20 |

| Dividend Yield | 0.82% | 0.66% | 1.27% | 1.17% | 1.44% |

Evolution of Financial Ratios

From 2020 to 2024, Domino’s Pizza, Inc. exhibited fluctuations in key ratios. Return on Equity (ROE) remained negative, indicating challenges in generating shareholder returns, with a slight worsening to -14.74% in 2024. The Current Ratio declined notably to 0.56 in 2024, suggesting reduced short-term liquidity. Debt-to-Equity Ratio stayed negative, reflecting a unique capital structure. Profitability margins showed relative stability, with net profit margin around 12.4% in 2024.

Are the Financial Ratios Favorable?

In 2024, Domino’s profitability ratios such as net margin (12.41%) and return on invested capital (54.1%) were favorable, while ROE was unfavorable. Liquidity ratios, including current (0.56) and quick ratios (0.52), were unfavorable, potentially signaling liquidity risk. Leverage metrics like debt-to-equity (-1.31) were favorable but debt-to-assets was unfavorable. Market valuation ratios showed mixed signals, with P/E unfavorable at 25.01 and price-to-book favorable at -3.69. Overall, the ratios are slightly favorable with a balanced view on risks and strengths.

Shareholder Return Policy

Domino’s Pizza maintains a consistent dividend payout ratio around 30–36%, with dividend per share rising from $3.13 in 2020 to $6.05 in 2024, yielding approximately 1.4% annually. Dividend payments are well covered by free cash flow, supported by a ratio near 1.9, and the company also engages in share buybacks.

The stable dividend growth combined with buybacks suggests a balanced approach to shareholder returns. Coverage by free cash flow and controlled payout ratios indicate a sustainable policy, reducing risks of over-distribution or excessive repurchases, thus supporting long-term shareholder value creation.

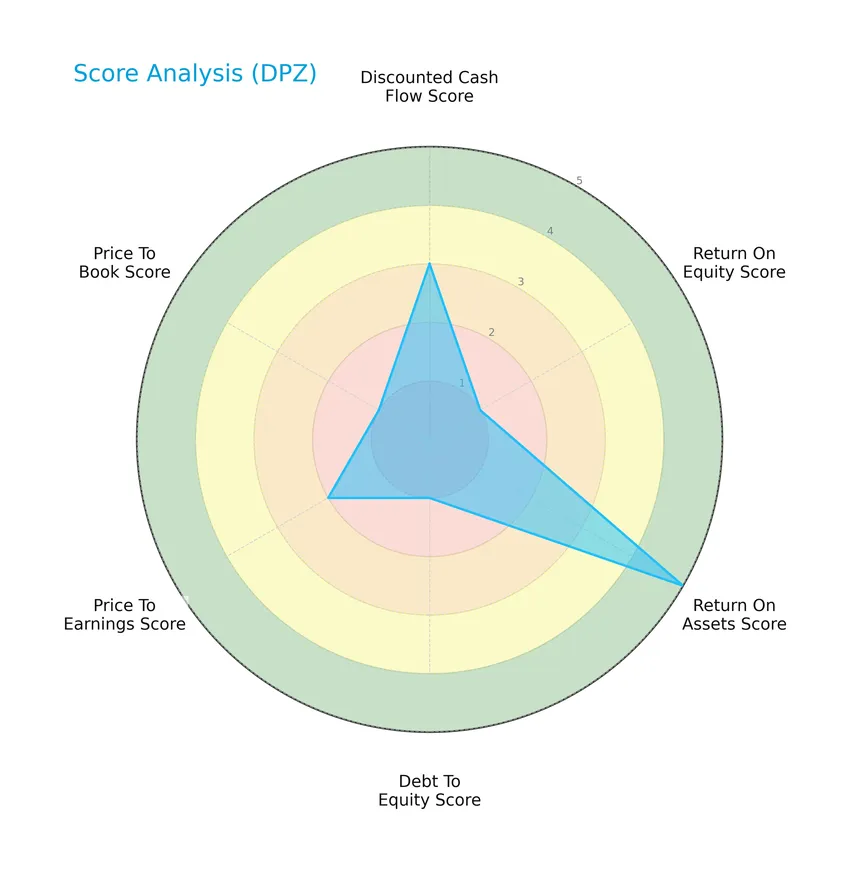

Score analysis

The following radar chart illustrates Domino’s Pizza, Inc.’s key financial scores across valuation, profitability, and leverage metrics:

Domino’s presents a mixed picture with a moderate discounted cash flow score of 3 and return on assets at a very favorable 5. However, return on equity, debt to equity, and price to book scores are very unfavorable at 1, indicating areas of concern. Price to earnings is moderate at 2.

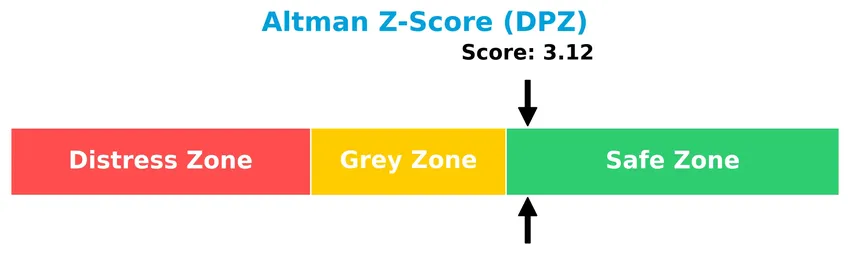

Analysis of the company’s bankruptcy risk

Domino’s Altman Z-Score of 3.12 places it in the safe zone, indicating a low risk of bankruptcy and solid financial stability:

Is the company in good financial health?

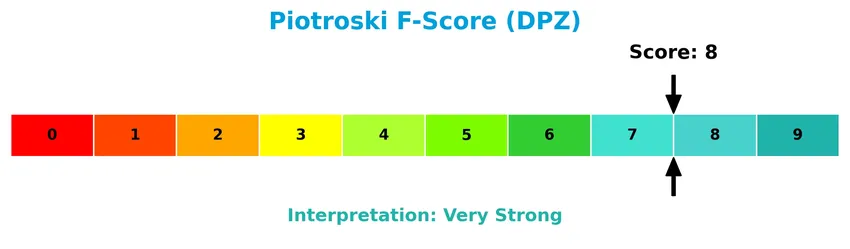

The Piotroski Score diagram shows Domino’s strong financial health with a score of 8, reflecting robust profitability, liquidity, and operational efficiency:

With a very strong Piotroski Score, Domino’s demonstrates financial strength that supports its position as a fundamentally sound company.

Competitive Landscape & Sector Positioning

This sector analysis examines Domino’s Pizza, Inc.’s strategic positioning, revenue segments, key products, and main competitors within the restaurant industry. I will assess whether Domino’s holds a competitive advantage compared to its peers.

Strategic Positioning

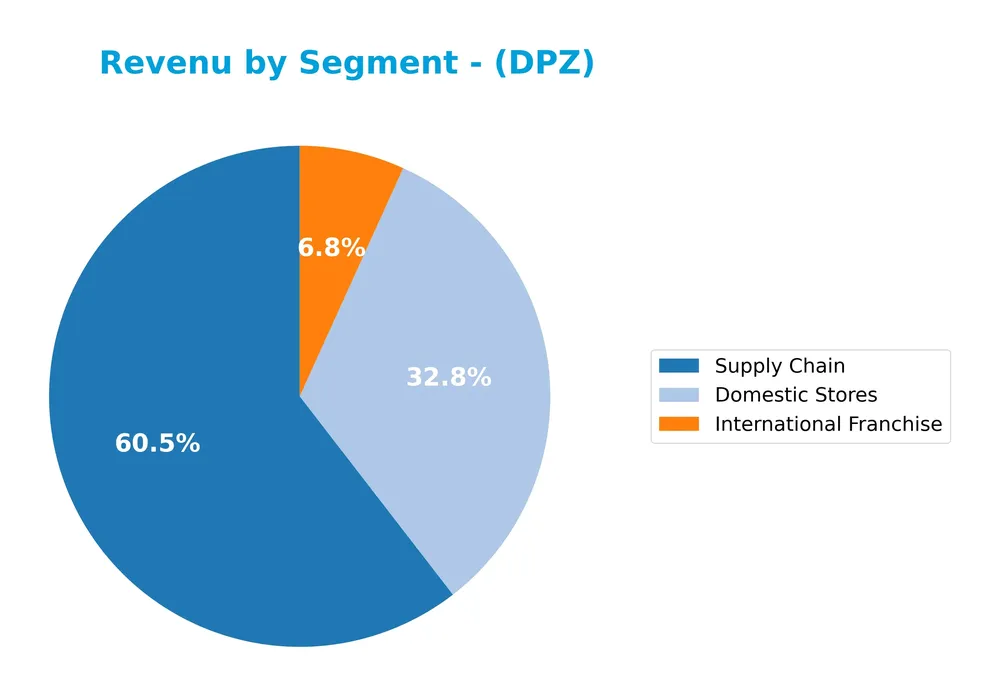

Domino’s Pizza, Inc. operates a diversified portfolio across three segments: Domestic Stores generating $1.54B, Supply Chain at $2.85B, and International Franchise with $319M in revenue for FY 2024. It maintains broad geographic exposure with approximately 18,800 stores in 90 markets, balancing company-owned and franchised operations.

Revenue by Segment

This pie chart displays Domino’s Pizza, Inc.’s revenue distribution by segment for the fiscal year 2024, illustrating the contributions of its main business areas.

In 2024, the Supply Chain segment led with $2.85B, followed by Domestic Stores at $1.54B and International Franchise at $319M. The Supply Chain segment shows steady growth, maintaining its position as the primary revenue driver. Domestic Stores also grew moderately, while International Franchise revenue increased slightly, indicating balanced expansion across markets. The concentration in Supply Chain revenue warrants attention for potential risks if market conditions shift.

Key Products & Brands

The table below summarizes Domino’s Pizza, Inc.’s main products and brand segments with brief descriptions:

| Product | Description |

|---|---|

| Domino’s Pizza | Core product offered under the Domino’s brand through company-owned and franchised stores worldwide. |

| U.S. Stores | Company-operated pizza stores in the United States generating significant revenue. |

| International Franchise | Franchise-operated stores outside the U.S., contributing to global presence and sales. |

| Supply Chain | Operations supporting supply of ingredients and materials to Domino’s stores and franchisees. |

| Oven-baked sandwiches | Complementary menu items including sandwiches offered alongside pizzas. |

| Pasta | Additional food offerings expanding the menu variety beyond pizza. |

| Boneless chicken & wings | Protein side options enhancing menu appeal and customer choice. |

| Bread and dips side items | Side dishes complementing core pizza products. |

| Desserts | Sweet menu items available as part of the Domino’s product range. |

| Soft drink products | Beverage options sold to accompany meals at Domino’s locations. |

Domino’s key products center on pizza and related food items served through company-operated and franchised stores globally. Their supply chain segment supports these operations efficiently, ensuring product quality and availability.

Main Competitors

The Consumer Cyclical Restaurants sector counts 6 competitors, with the table below listing the top 6 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| McDonald’s Corporation | 217B |

| Starbucks Corporation | 95.5B |

| Chipotle Mexican Grill, Inc. | 50.6B |

| Yum! Brands, Inc. | 41.8B |

| Darden Restaurants, Inc. | 21.8B |

| Domino’s Pizza, Inc. | 14.4B |

Domino’s Pizza ranks 6th among its 6 competitors, with a market cap representing 6.42% of the top player, McDonald’s. The company is positioned below both the average market cap of the top 10 (73.5B) and the median market cap of the sector (46.2B). Domino’s market cap is 57.07% lower than its next competitor above, Darden Restaurants.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does DPZ have a competitive advantage?

Domino’s Pizza, Inc. demonstrates a competitive advantage through strong profitability metrics, including a favorable gross margin of 39.28% and an EBIT margin of 19.51%. The company creates value with a ROIC significantly above its WACC, though its ROIC trend shows a slight decline, indicating some erosion in profitability.

Looking ahead, Domino’s continues to benefit from its extensive global footprint with approximately 18,800 stores across 90 markets. Opportunities for growth may arise from new product offerings and further international expansion, which could help sustain its competitive position in the restaurant industry.

SWOT Analysis

This SWOT analysis highlights Domino’s Pizza, Inc.’s key internal and external factors to support informed investment decisions.

Strengths

- Strong global brand with 18,800 stores in 90 markets

- Favorable profitability margins (EBIT 19.5%, Net 12.4%)

- High ROIC at 54.1% indicating value creation

Weaknesses

- High debt-to-assets ratio at 299%

- Low current and quick ratios indicating liquidity concerns

- Unfavorable ROE at -14.7% reflecting shareholder return issues

Opportunities

- Expansion in emerging markets

- Growth in digital ordering and delivery platforms

- Product diversification beyond pizza

Threats

- Intense competition in fast-casual restaurants

- Rising input costs impacting operating expenses

- Economic downturns affecting discretionary spending

Domino’s demonstrates strong operational efficiency and global reach but faces financial leverage and liquidity challenges. Its strategy should focus on debt management, leveraging digital growth, and maintaining competitive differentiation to sustain long-term value.

Stock Price Action Analysis

The following weekly stock chart illustrates Domino’s Pizza, Inc. (DPZ) price movements over the past 100 weeks, highlighting key highs and lows:

Trend Analysis

Over the past 12 months, DPZ stock declined by 7.99%, indicating a bearish trend with accelerating downward momentum. The price fluctuated notably between a high of 521.83 and a low of 398.46, with volatility confirmed by a standard deviation of 32.82. Recent weeks show a slight 0.32% increase but with a negative slope, suggesting continued deceleration.

Volume Analysis

Trading volume has been increasing overall, with buyers accounting for 50.81% of 355.6M shares traded, signaling balanced but slightly buyer-favored activity. However, in the recent period from November 2025 to January 2026, sellers dominated with 64.51% of volume, reflecting heightened selling pressure and cautious investor sentiment.

Target Prices

Analysts present a moderately optimistic target price consensus for Domino’s Pizza, Inc.

| Target High | Target Low | Consensus |

|---|---|---|

| 535 | 370 | 464.55 |

The target prices reflect expectations of a potential upside while acknowledging some downside risk, indicating balanced analyst confidence in Domino’s future performance.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section provides an overview of analyst ratings and consumer feedback regarding Domino’s Pizza, Inc. (DPZ).

Stock Grades

The following table summarizes the latest stock grades for Domino’s Pizza, Inc. from recognized financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Equal Weight | 2026-01-22 |

| Morgan Stanley | Downgrade | Equal Weight | 2026-01-20 |

| Evercore ISI Group | Maintain | Outperform | 2026-01-08 |

| Barclays | Maintain | Underweight | 2026-01-07 |

| Stifel | Maintain | Buy | 2026-01-07 |

| TD Cowen | Downgrade | Hold | 2026-01-05 |

| BTIG | Maintain | Buy | 2025-11-14 |

| TD Cowen | Maintain | Buy | 2025-10-15 |

| BTIG | Maintain | Buy | 2025-10-15 |

| RBC Capital | Maintain | Sector Perform | 2025-10-15 |

Overall, the ratings exhibit a mix of Buy and Hold stances, with some recent downgrades from Buy to Hold or Equal Weight, indicating cautious investor sentiment. The consensus remains positive, leaning towards Buy.

Consumer Opinions

Consumer sentiment around Domino’s Pizza, Inc. (DPZ) reflects a mix of enthusiasm for convenience and taste, alongside some concerns about service consistency.

| Positive Reviews | Negative Reviews |

|---|---|

| “Fast delivery and consistently tasty pizzas.” | “Occasional delays during peak hours.” |

| “User-friendly app makes ordering easy and quick.” | “Customer service can be unresponsive at times.” |

| “Great value for the price with frequent promotions.” | “Quality varies between different locations.” |

Overall, consumers appreciate Domino’s for its speed, convenience, and affordability, but recurring issues with delivery timing and service quality at certain outlets suggest room for improvement.

Risk Analysis

Below is a summary table highlighting key risks faced by Domino’s Pizza, Inc., including their likelihood and potential impact on the company:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | High debt-to-assets ratio (299%) raises leverage concerns and liquidity risk | Medium | High |

| Profitability | Unfavorable return on equity (-14.74%) despite strong net margin | Medium | Medium |

| Market Valuation | Elevated price-to-earnings ratio (25.01) could signal overvaluation | Medium | Medium |

| Liquidity | Low current (0.56) and quick ratios (0.52) indicate potential cash flow issues | Medium | Medium |

| Competitive Risk | Intense competition in the restaurant industry impacting market share growth | High | Medium |

| Operational Risk | Reliance on franchise model may affect quality control and brand consistency | Medium | Medium |

| Economic Sensitivity | Consumer spending fluctuations in economic downturns | High | High |

The most significant risks for Domino’s are its high debt load combined with moderate liquidity constraints, which could strain financial flexibility if sales slow. However, its Altman Z-score of 3.12 places it in the safe zone, indicating low bankruptcy risk. The company’s strong Piotroski score of 8 reflects solid financial strength despite these concerns. Investors should monitor debt levels and economic conditions closely.

Should You Buy Domino’s Pizza, Inc.?

Domino’s Pizza, Inc. appears to be generating strong value creation with a slightly favorable competitive moat despite a declining ROIC trend. While its leverage profile could be seen as substantial, the overall rating of C+ suggests a very favorable risk-adjusted profile supported by robust profitability and a safe Altman Z-Score.

Strength & Efficiency Pillars

Domino’s Pizza, Inc. exhibits robust profitability with a net margin of 12.41% and an EBIT margin of 19.51%, underscoring operational efficiency. The company is a clear value creator, demonstrated by a ROIC of 54.1% significantly exceeding its WACC of 7.67%. Financial health is solid, supported by an Altman Z-Score of 3.12 placing it safely above distress thresholds, and a strong Piotroski Score of 8 indicating excellent financial strength. Asset turnover ratios (2.71) and fixed asset turnover (9.2) further confirm operational efficiency.

Weaknesses and Drawbacks

However, Domino’s faces notable challenges. The return on equity is negative at -14.74%, signaling potential inefficiencies in equity utilization. Valuation metrics present mixed signals: a P/E ratio of 25.01 suggests a premium valuation that may limit upside, while the negative P/B ratio (-3.69) is unusual and might reflect accounting complexities or impairments. Leverage indicators reveal risks, with a very unfavorable debt to assets ratio of 299.21% and weak liquidity ratios (current ratio 0.56, quick ratio 0.52), indicating potential short-term solvency pressures. Recent market behavior shows seller dominance (35.49% buyer volume) creating near-term headwinds despite increasing overall volume.

Our Verdict about Domino’s Pizza, Inc.

Domino’s Pizza presents a fundamentally favorable long-term profile backed by strong profitability and value creation. However, despite this strength, the recent seller dominance and bearish overall stock trend suggest a wait-and-see approach could be prudent for investors seeking a more attractive entry point. The mixed signals from leverage and valuation metrics imply cautious monitoring is warranted before committing to long-term exposure.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Domino’s Pizza Is Now A Fresh Buy After The Recent Dip (Rating Upgrade) (NASDAQ:DPZ) – Seeking Alpha (Jan 24, 2026)

- Rakuten Investment Management Inc. Takes Position in Domino’s Pizza Inc $DPZ – MarketBeat (Jan 22, 2026)

- What to expect from Domino’s Pizza’s next quarterly earnings report – MSN (Jan 23, 2026)

- Evercore ISI Analyst Kept an Outperform Rating on Domino’s Pizza, Inc. (DPZ) – Yahoo Finance (Jan 14, 2026)

- Domino’s® Announces Q3 2025 Earnings Webcast – Domino’s (Sep 15, 2025)

For more information about Domino’s Pizza, Inc., please visit the official website: dominos.com