Home > Analyses > Utilities > Dominion Energy, Inc.

Dominion Energy, Inc. powers millions of homes and businesses across multiple states, playing a pivotal role in daily life and economic stability. As a leading utility company, it blends extensive electric and gas distribution networks with a growing portfolio of renewable energy assets, earning a reputation for innovation and reliability. Yet, as the energy landscape evolves, I ask: does Dominion’s current financial and operational strength justify its market valuation and future growth potential?

Table of contents

Business Model & Company Overview

Dominion Energy, Inc., founded in 1983 and headquartered in Richmond, Virginia, is a leading player in the regulated electric industry in the United States. Its integrated ecosystem spans electricity generation, transmission, and distribution alongside natural gas sales and storage, serving over 6.9M customers across Virginia, North Carolina, South Carolina, and multiple other states. This comprehensive approach connects traditional and renewable energy assets, underpinning its core mission to deliver reliable energy solutions.

The company’s revenue engine balances regulated electric and gas operations with nonregulated renewable projects and long-term contracted assets, creating diversified income streams. Dominion’s extensive infrastructure includes 30.2GW of electric capacity and nearly 185,000 miles of combined transmission and distribution lines, supporting a strategic footprint across the Americas. Its robust asset base and regulated market presence establish a durable economic moat, positioning Dominion as a defining force in shaping the future of energy.

Financial Performance & Fundamental Metrics

In this section, I analyze Dominion Energy, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its overall financial health and stability.

Income Statement

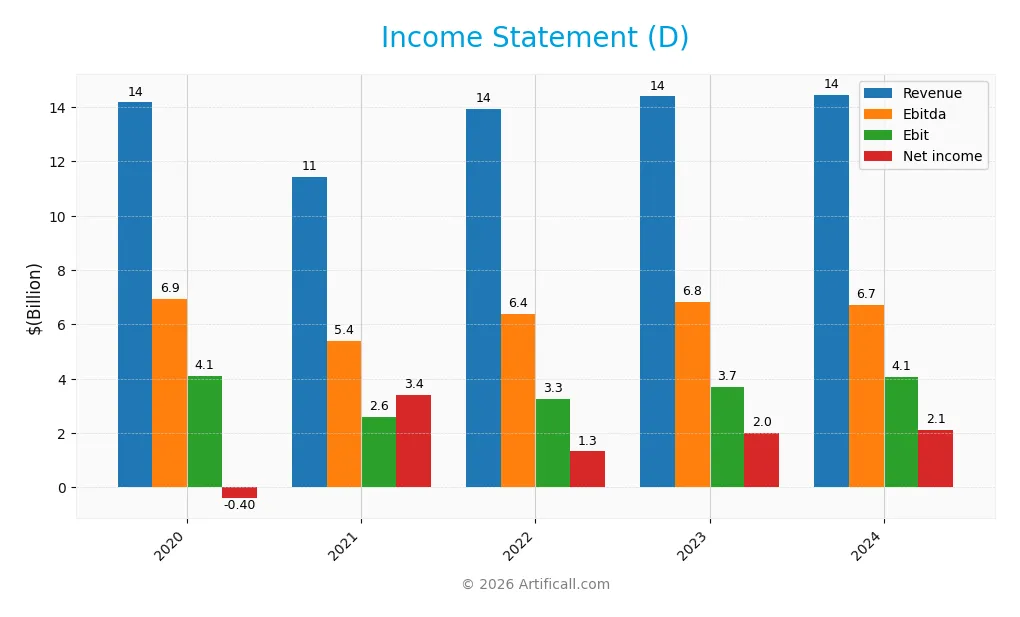

The table below presents Dominion Energy, Inc.’s key income statement figures for the fiscal years 2020 through 2024, showing trends in revenue, profitability, and earnings per share.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 14.17B | 11.42B | 13.94B | 14.39B | 14.46B |

| Cost of Revenue | 6.87B | 6.01B | 7.56B | 7.44B | 7.54B |

| Operating Expenses | 5.25B | 3.42B | 4.94B | 3.54B | 3.68B |

| Gross Profit | 7.30B | 5.41B | 6.38B | 6.96B | 6.92B |

| EBITDA | 6.94B | 5.39B | 6.37B | 6.82B | 6.71B |

| EBIT | 4.10B | 2.61B | 3.26B | 3.69B | 4.07B |

| Interest Expense | 1.38B | 1.29B | 1.00B | 1.67B | 1.89B |

| Net Income | -401M | 3.40B | 1.32B | 1.99B | 2.12B |

| EPS | -0.50 | 3.99 | 1.19 | 2.38 | 2.44 |

| Filing Date | 2021-02-25 | 2022-02-24 | 2023-02-21 | 2024-02-23 | 2025-02-27 |

Income Statement Evolution

Dominion Energy’s revenue showed minimal growth of 0.46% from 2023 to 2024, and a modest 2.03% over the five-year period, indicating slow top-line expansion. Net income, however, surged significantly, growing 629.68% overall and 6.03% in the last year, supported by improved net margins rising by 619.16%. Gross profit slightly declined by 0.52% in the latest year, with margins remaining relatively stable.

Is the Income Statement Favorable?

In 2024, Dominion Energy reported a gross margin of 47.87% and an EBIT margin of 28.14%, both classified as favorable, while net margin was at 14.69%. Despite an unfavorable interest expense ratio at 13.05%, the net margin and EPS growth rates were positive, reflecting improved profitability. Overall, 64.29% of income statement metrics were favorable, supporting a generally favorable view of the company’s financial fundamentals for the year.

Financial Ratios

The table below summarizes key financial ratios for Dominion Energy, Inc. over the fiscal years 2020 to 2024, providing insight into profitability, valuation, liquidity, leverage, and efficiency:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | -2.8% | 29.8% | 9.5% | 13.9% | 14.7% |

| ROE | -1.5% | 12.4% | 4.8% | 7.2% | 7.8% |

| ROIC | 2.2% | 2.1% | 1.2% | 2.8% | 2.9% |

| P/E | -156 | 18.7 | 38.2 | 19.0 | 21.3 |

| P/B | 2.39 | 2.32 | 1.83 | 1.37 | 1.66 |

| Current Ratio | 0.64 | 0.84 | 0.73 | 1.04 | 0.71 |

| Quick Ratio | 0.49 | 0.65 | 0.62 | 0.97 | 0.52 |

| D/E | 1.42 | 1.49 | 1.49 | 1.61 | 1.53 |

| Debt-to-Assets | 38.6% | 40.7% | 39.3% | 40.6% | 40.8% |

| Interest Coverage | 1.49 | 1.54 | 1.43 | 2.04 | 1.72 |

| Asset Turnover | 0.15 | 0.11 | 0.13 | 0.13 | 0.14 |

| Fixed Asset Turnover | 0.24 | 0.19 | 0.27 | 0.24 | 0.21 |

| Dividend Yield | 4.6% | 3.2% | 4.4% | 5.9% | 5.0% |

Evolution of Financial Ratios

Dominion Energy’s Return on Equity (ROE) showed a decline from 12.45% in 2021 to 7.79% in 2024, indicating reduced profitability. The Current Ratio decreased significantly from 1.04 in 2023 to 0.71 in 2024, signaling lower short-term liquidity. Meanwhile, the Debt-to-Equity Ratio remained elevated around 1.5, reflecting persistent leverage and financial risk stability over the period.

Are the Financial Ratios Favorable?

In 2024, Dominion Energy’s profitability ratios were mixed: net margin was favorable at 14.69%, but ROE and ROIC were unfavorable, reflecting weaker returns. Liquidity ratios, including current (0.71) and quick ratio (0.52), were unfavorable, suggesting limited short-term asset coverage. Leverage remained high with a debt-to-equity ratio of 1.53, unfavorable for risk-averse investors. Market valuation ratios such as PE (21.28) and PB (1.66) were neutral, while dividend yield (4.95%) was favorable, indicating some income appeal despite operational and financial constraints. Overall, the ratios paint a slightly unfavorable picture.

Shareholder Return Policy

Dominion Energy maintains a consistent dividend policy with a payout ratio slightly above 100%, indicating dividends may exceed net income, supported partially by cash flow but with negative free cash flow coverage. Dividend yield has fluctuated between 3.2% and 5.9%, with share buybacks not explicitly reported.

This payout approach suggests a commitment to returning capital to shareholders, yet the reliance on cash beyond free cash flow and elevated payout ratios could pose sustainability risks. The policy balances shareholder returns with financial leverage, warranting cautious monitoring for long-term value stability.

Score analysis

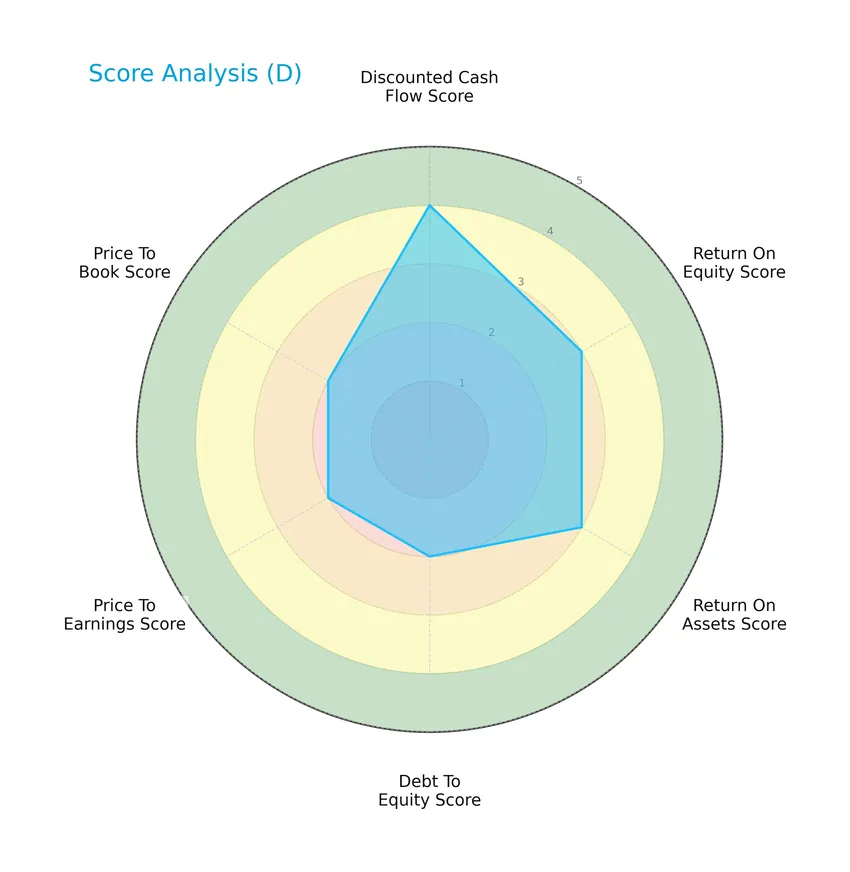

The following radar chart illustrates Dominion Energy, Inc.’s key financial scores across valuation, profitability, and leverage metrics:

Dominion Energy shows a favorable discounted cash flow score of 4, while return on equity and assets scores are moderate at 3 each. Debt to equity, price to earnings, and price to book ratios all register moderate scores of 2, indicating balanced but cautious financial metrics.

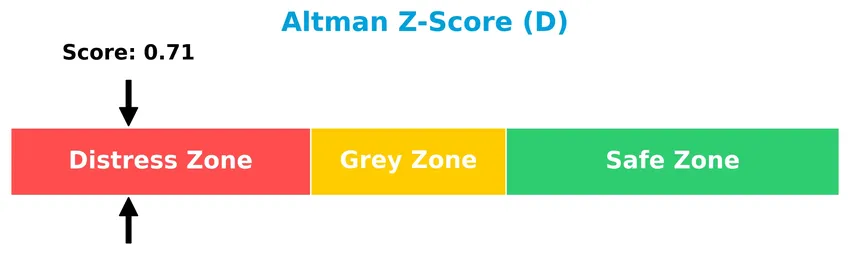

Analysis of the company’s bankruptcy risk

Dominion Energy’s Altman Z-Score places it in the distress zone, signaling a high probability of financial distress and potential bankruptcy risk:

Is the company in good financial health?

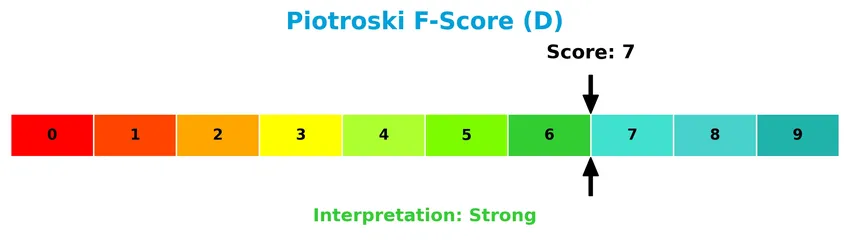

The Piotroski diagram below highlights Dominion Energy’s financial health based on nine accounting criteria:

With a Piotroski Score of 7 categorized as strong, the company demonstrates solid financial strength, suggesting effective management of profitability, leverage, liquidity, and operational efficiency.

Competitive Landscape & Sector Positioning

This sector analysis will explore Dominion Energy, Inc.’s strategic positioning, revenue segments, key products, and main competitors. I will assess whether the company holds a competitive advantage within the regulated electric utilities sector.

Strategic Positioning

Dominion Energy, Inc. maintains a geographically concentrated presence primarily in Virginia, North Carolina, South Carolina, Ohio, West Virginia, Utah, Wyoming, and Idaho, with a diversified product portfolio across regulated electricity, natural gas distribution, and nonregulated renewable energy operations. In 2024, revenue was dominated by Dominion Energy Virginia at $10.2B, followed by South Carolina at $3.3B and Contracted Energy at $1.1B, reflecting a focus on core regulated utilities complemented by renewable energy investments.

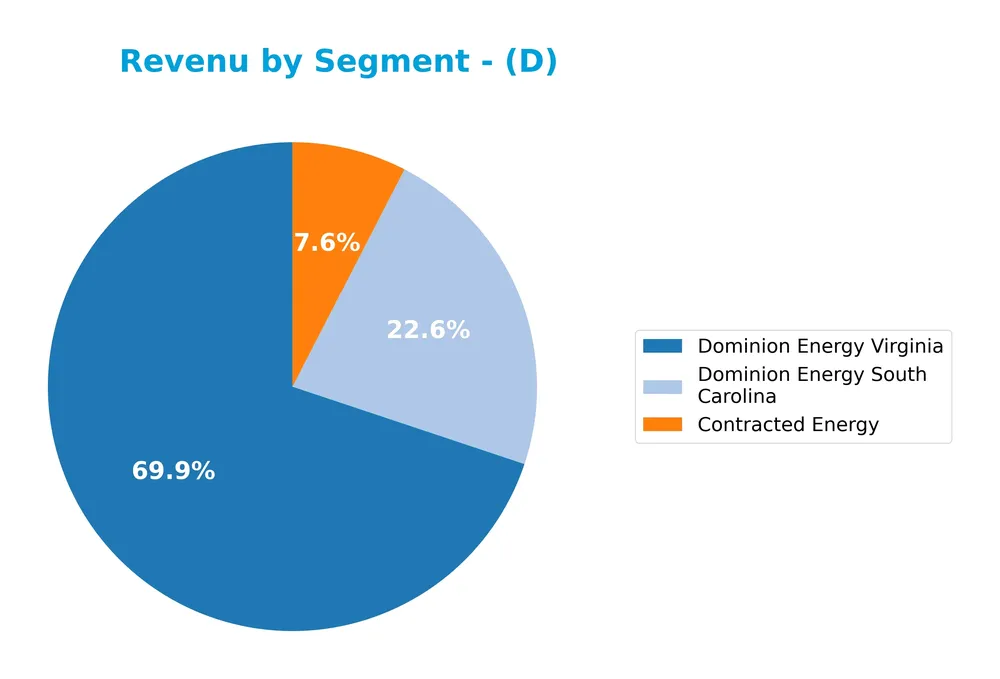

Revenue by Segment

The pie chart illustrates Dominion Energy, Inc.’s revenue distribution by segment for the fiscal year 2024, highlighting the company’s primary business areas and their relative contributions.

In 2024, Dominion Energy Virginia was the dominant revenue driver with $10.2B, followed by Dominion Energy South Carolina at $3.3B and Contracted Energy at $1.1B. The Virginia segment showed steady growth compared to prior years, reinforcing its importance. South Carolina’s revenue remained stable, while Contracted Energy exhibited a notable increase. This concentration in a few key segments suggests both strong market positions and potential exposure to regional regulatory or operational risks.

Key Products & Brands

The following table presents Dominion Energy’s primary products and segments along with their descriptions:

| Product | Description |

|---|---|

| Dominion Energy Virginia | Regulated electricity generation, transmission, and distribution serving 2.7M customers in VA and NC. |

| Gas Distribution | Regulated natural gas sales, transportation, gathering, storage, and distribution in multiple states. |

| Dominion Energy South Carolina | Electricity generation, transmission, and distribution plus natural gas distribution to 1.2M customers in SC. |

| Contracted Energy | Nonregulated long-term contracted renewable electric and solar generation, plus gas transportation and LNG operations. |

Dominion Energy operates through key regulated and nonregulated segments focused on electricity and gas services in Virginia, South Carolina, and several other states, with a growing portfolio of renewable energy assets.

Main Competitors

There are 23 competitors in the Utilities sector, with the table below listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| NextEra Energy, Inc. | 169B |

| The Southern Company | 96B |

| Duke Energy Corporation | 91B |

| American Electric Power Company, Inc. | 62B |

| Dominion Energy, Inc. | 51B |

| Exelon Corporation | 44B |

| Xcel Energy Inc. | 44B |

| Entergy Corporation | 42B |

| Public Service Enterprise Group Incorporated | 40B |

| Consolidated Edison, Inc. | 36B |

Dominion Energy ranks 5th among 23 competitors in the Regulated Electric industry. Its market cap is about 30% of the leader, NextEra Energy, Inc. The company is below the average market cap of the top 10 competitors (67.5B) but above the sector median (34B). It holds a 21.79% market cap advantage over its closest rival above, American Electric Power Company.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does Dominion Energy have a competitive advantage?

Dominion Energy currently does not present a strong competitive advantage as its return on invested capital (ROIC) is below its weighted average cost of capital (WACC), indicating value destruction despite a growing ROIC trend. The company’s profitability is improving, but overall it remains slightly unfavorable in terms of value creation.

Looking ahead, Dominion Energy’s diverse operations across regulated electric and natural gas markets, along with its nonregulated renewable energy assets and long-term contracted renewable projects, offer opportunities for growth. Expansion in renewable natural gas and solar generation could enhance future market presence and operational resilience.

SWOT Analysis

This SWOT analysis highlights Dominion Energy, Inc.’s key internal and external factors to inform strategic decisions.

Strengths

- diversified energy portfolio

- strong regulated customer base

- favorable net margin and dividend yield

Weaknesses

- high interest expense

- unfavorable liquidity ratios

- moderate debt-to-equity level

Opportunities

- expanding renewable energy contracts

- increasing ROIC trend

- growth in natural gas distribution markets

Threats

- regulatory risks in utilities sector

- competition from alternative energy sources

- financial distress risk indicated by Altman Z-Score

Dominion Energy demonstrates solid profitability and a stable customer base, yet financial leverage and liquidity pose challenges. Strategic focus on renewable energy growth and efficiency improvement is essential to mitigate regulatory and market risks.

Stock Price Action Analysis

The weekly stock chart displays Dominion Energy, Inc.’s price movements over the past 12 months, highlighting key fluctuations and trend changes:

Trend Analysis

Over the past 12 months, Dominion Energy’s stock price increased by 33.07%, indicating a bullish trend. The price ranged between a low of 44.79 and a high of 62.77, with a standard deviation of 3.89 showing moderate volatility. However, the recent trend from November 2025 to January 2026 shows a slight deceleration with a -3.22% decline and a slope of -0.2.

Volume Analysis

Trading volume over the last three months is increasing, with a total buyer volume of 212M versus seller volume of 144M, reflecting a buyer dominance of 59.59%. This slightly buyer-driven activity suggests sustained investor interest and positive market participation during the recent period.

Target Prices

The consensus target prices for Dominion Energy, Inc. indicate moderate upside potential.

| Target High | Target Low | Consensus |

|---|---|---|

| 69 | 63 | 65.86 |

Analysts expect Dominion Energy’s stock to trade in a range between $63 and $69, with a consensus price around $65.86, reflecting cautious optimism in its future performance.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines the latest analyst ratings and consumer feedback regarding Dominion Energy, Inc.’s market performance and service quality.

Stock Grades

Here is the latest overview of Dominion Energy, Inc.’s stock grades from leading financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2026-01-22 |

| Wells Fargo | Maintain | Overweight | 2026-01-20 |

| Barclays | Maintain | Overweight | 2025-12-17 |

| JP Morgan | Maintain | Underweight | 2025-12-11 |

| BMO Capital | Maintain | Market Perform | 2025-11-03 |

| Morgan Stanley | Maintain | Equal Weight | 2025-10-22 |

| Barclays | Maintain | Overweight | 2025-10-07 |

| Morgan Stanley | Maintain | Equal Weight | 2025-09-25 |

| JP Morgan | Maintain | Underweight | 2025-08-21 |

| JP Morgan | Maintain | Underweight | 2025-07-15 |

The consensus among analysts maintains a Hold rating, reflecting a balance between buy and hold recommendations, with a noticeable split between overweight and underweight grades, indicating varied perspectives on the stock’s near-term outlook.

Consumer Opinions

Consumers have mixed feelings about Dominion Energy, Inc., reflecting both appreciation for its service reliability and concerns about pricing and customer support.

| Positive Reviews | Negative Reviews |

|---|---|

| Reliable energy supply with minimal outages. | Customer service can be slow and unresponsive. |

| Transparent billing and helpful online tools. | Rates have increased noticeably over the past year. |

| Strong commitment to renewable energy initiatives. | Limited options for flexible payment plans. |

Overall, consumers praise Dominion Energy for dependable service and green energy efforts but frequently cite issues with customer support and rising costs as areas needing improvement.

Risk Analysis

Below is a summary table highlighting key risks for Dominion Energy, Inc., including their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Low Altman Z-Score (0.71) indicates risk of financial distress and potential bankruptcy risk. | High | High |

| Debt Levels | High debt-to-equity ratio (1.53) and unfavorable interest coverage (2.16) increase financial leverage risk. | Medium | Medium |

| Liquidity | Unfavorable current ratio (0.71) and quick ratio (0.52) suggest potential short-term liquidity challenges. | Medium | Medium |

| Regulatory Risks | Operating in regulated utility sectors exposes the company to policy and regulatory changes impacting revenues. | Medium | High |

| Market Volatility | Beta of 0.699 indicates moderate sensitivity to market fluctuations but less volatile than broader market. | Low | Medium |

| Operational Risks | Large infrastructure footprint (transmission lines, gas mains) entails maintenance and operational risks. | Medium | Medium |

The most significant risks for Dominion Energy stem from its financial distress signal indicated by the low Altman Z-score and elevated debt levels, which could affect its stability amid market or regulatory shocks. Despite a strong Piotroski score, caution is warranted given liquidity constraints and sector-specific regulatory uncertainties.

Should You Buy Dominion Energy, Inc.?

Dominion Energy, Inc. appears to be navigating a complex financial profile with improving operational efficiency but a slightly unfavorable moat due to value destruction despite rising profitability. While debt levels suggest moderate leverage, the overall rating could be seen as favorable (B), reflecting cautious value creation amid distress signals.

Strength & Efficiency Pillars

Dominion Energy, Inc. exhibits solid profitability with a net margin of 14.69%, supported by a favorable gross margin of 47.87% and EBIT margin of 28.14%. The Piotroski score of 7 further underscores strong financial health, indicating robust operational efficiency and financial strength. Although the ROIC at 2.86% trails the WACC of 5.41%, signaling value destruction, the company demonstrates improving profitability trends. Financial risk signals remain moderate, but the Altman Z-Score of 0.71 places Dominion in the distress zone, warranting cautious monitoring.

Weaknesses and Drawbacks

Key concerns include Dominion’s unfavorable leverage profile, with a debt-to-equity ratio of 1.53 and weak liquidity metrics—current ratio at 0.71 and quick ratio at 0.52—highlighting potential short-term solvency risks. The company’s ROE of 7.79% is suboptimal, and asset turnover ratios are low, reflecting operational inefficiencies. Valuation metrics like a P/E of 21.28 and P/B of 1.66 are moderate but could imply limited upside. Despite a bullish long-term trend, recent deceleration and a 3.22% price decline introduce near-term uncertainty.

Our Verdict about Dominion Energy, Inc.

Dominion Energy’s fundamental profile may appear moderately favorable given its profitability and strong Piotroski score, but value destruction and financial distress signals temper enthusiasm. Coupled with a bullish yet decelerating stock trend and recent slight buyer dominance, the company suggests cautious optimism. Despite long-term strength, recent market dynamics might suggest a wait-and-see approach for a more attractive entry point.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Is Dominion Energy (D) Pricing In Too Much Stability After Its Recent 14.5% Gain? – Yahoo Finance (Jan 20, 2026)

- Dominion Energy Inc Resumes Coastal Virginia Offshore Wind Project – TradingView — Track All Markets (Jan 20, 2026)

- Dominion Energy (D) Stock Slides as Market Rises: Facts to Know Before You Trade – sharewise.com (Jan 23, 2026)

- TD Cowen Initiates Coverage of Dominion Energy (D) with Hold Recommendation – Nasdaq (Jan 09, 2026)

- Is Dominion Energy (D) Pricing Reflect Recent Offshore Wind And Asset Shift Plans? – Sahm (Jan 17, 2026)

For more information about Dominion Energy, Inc., please visit the official website: dominionenergy.com