Home > Analyses > Consumer Defensive > Dollar Tree, Inc.

Dollar Tree, Inc. transforms everyday shopping by offering unbeatable value across thousands of stores, making affordable essentials accessible to millions. As a dominant force in the discount retail sector, its flagship Dollar Tree and Family Dollar brands combine fixed-price simplicity with a vast product mix, from consumables to seasonal goods. Renowned for operational efficiency and market influence, Dollar Tree’s ability to adapt drives its growth. Yet, investors must ask: do its solid fundamentals still support its current valuation and future expansion?

Table of contents

Business Model & Company Overview

Dollar Tree, Inc., founded in 1986 and headquartered in Chesapeake, Virginia, stands as a dominant player in the discount variety retail sector. Operating two main segments—Dollar Tree and Family Dollar—the company delivers a cohesive ecosystem of fixed-price and general merchandise stores. Its product range spans consumables, household goods, apparel, and seasonal items, serving millions of customers through over 16,000 stores across the U.S. and Canada.

The company’s revenue engine balances retail sales from its extensive brick-and-mortar footprint with efficient distribution via 28 centers across North America. Dollar Tree’s strategic presence in the Americas, coupled with its diverse product offerings, underpins steady cash flow and market resilience. This robust operational model creates a significant economic moat, positioning Dollar Tree as a key architect of the discount retail landscape’s future.

Financial Performance & Fundamental Metrics

In this section, I analyze Dollar Tree, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its overall financial health and investment potential.

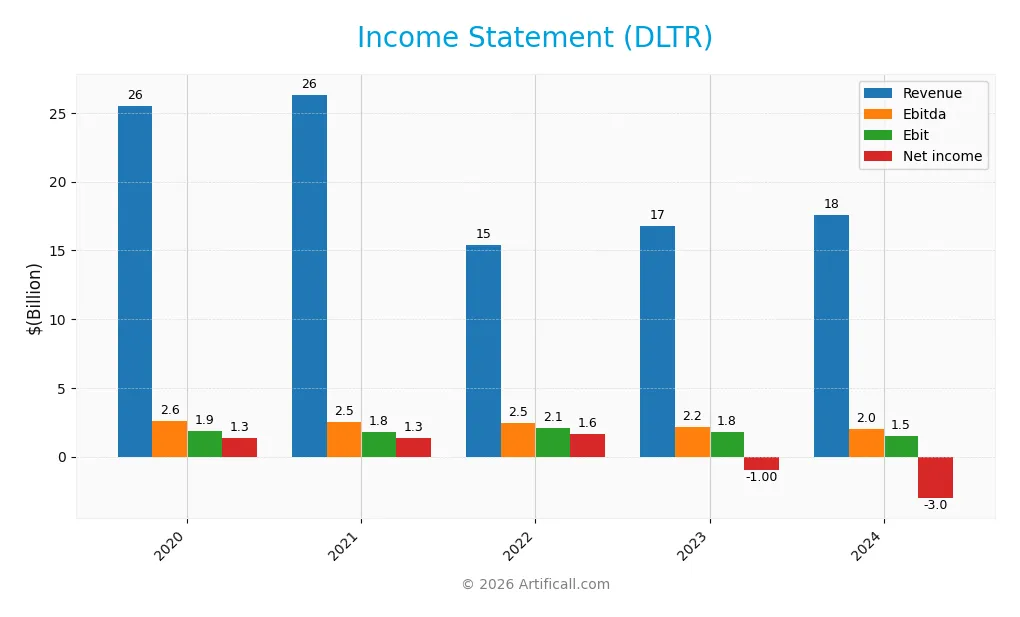

Income Statement

The table below summarizes Dollar Tree, Inc.’s key income statement figures over the past five fiscal years, providing a clear view of revenue, expenses, and profitability trends.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 25.5B | 26.3B | 15.4B | 16.8B | 17.6B |

| Cost of Revenue | 17.7B | 18.6B | 9.6B | 10.8B | 11.3B |

| Operating Expenses | 5.9B | 5.9B | 3.7B | 4.2B | 4.8B |

| Gross Profit | 7.8B | 7.7B | 5.8B | 6.0B | 6.3B |

| EBITDA | 2.6B | 2.5B | 2.5B | 2.2B | 2.0B |

| EBIT | 1.9B | 1.8B | 2.1B | 1.8B | 1.5B |

| Interest Expense | 147M | 179M | 127M | 113M | 108M |

| Net Income | 1.3B | 1.3B | 1.6B | -998M | -3.0B |

| EPS | 5.68 | 5.83 | 7.24 | -4.55 | -14.05 |

| Filing Date | 2021-03-16 | 2022-03-15 | 2023-03-10 | 2024-03-20 | 2025-03-26 |

Income Statement Evolution

Dollar Tree, Inc. experienced a revenue increase of 4.75% from 2023 to 2024, with gross profit growing similarly by 4.56%, reflecting stable gross margins around 35.8%. However, EBIT declined by 15.97%, and operating expenses grew at the same pace as revenue, putting pressure on profitability. Net income and EPS saw sharp declines, indicating deteriorating bottom-line performance in the period.

Is the Income Statement Favorable?

The 2024 income statement reveals mixed fundamentals. While the gross margin and interest expense ratio remain favorable, EBIT margin stands neutral, and net margin is significantly negative at -17.24%, reflecting substantial losses driven by discontinued operations. Overall, the income statement is evaluated as unfavorable, with significant declines in net income growth and EPS, signaling challenges in maintaining profitability despite modest revenue growth.

Financial Ratios

The table below summarizes key financial ratios for Dollar Tree, Inc. over the fiscal years 2020 to 2024, providing an overview of profitability, valuation, liquidity, leverage, and efficiency metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 5.3% | 5.0% | 10.5% | -5.9% | -17.2% |

| ROE | 18.4% | 17.2% | 18.5% | -13.7% | -76.2% |

| ROIC | 8.0% | 7.8% | 7.9% | 7.4% | 9.2% |

| P/E | 17.9 | 22.1 | 20.8 | -30.5 | -5.2 |

| P/B | 3.3 | 3.8 | 3.8 | 4.2 | 4.0 |

| Current Ratio | 1.35 | 1.34 | 1.51 | 1.31 | 1.06 |

| Quick Ratio | 0.44 | 0.30 | 0.22 | 0.77 | 0.75 |

| D/E | 1.32 | 1.29 | 1.16 | 1.01 | 1.97 |

| Debt-to-Assets | 46.6% | 45.9% | 44.0% | 33.5% | 42.0% |

| Interest Coverage | 12.8 | 10.1 | 16.5 | 15.8 | 13.6 |

| Asset Turnover | 1.23 | 1.21 | 0.67 | 0.76 | 0.94 |

| Fixed Asset Turnover | 2.44 | 2.41 | 1.35 | 2.24 | 2.03 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Evolution of Financial Ratios

Dollar Tree, Inc. experienced a significant decline in Return on Equity (ROE), dropping from a positive 18.5% in 2022 to a sharply negative -76.2% in 2024. The Current Ratio decreased from 1.51 in 2022 to 1.06 in 2024, indicating reduced short-term liquidity. Meanwhile, the Debt-to-Equity Ratio nearly doubled from about 1.16 in 2022 to 1.97 in 2024, reflecting increased leverage. Profitability margins showed volatility, with net margin turning negative in 2024.

Are the Financial Ratios Favorable?

In 2024, Dollar Tree’s profitability ratios, including net margin (-17.24%) and ROE (-76.18%), are unfavorable, reflecting operational challenges. Liquidity ratios are mixed, with a neutral Current Ratio (1.06) but an unfavorable Quick Ratio (0.75). Leverage is elevated, as the Debt-to-Equity Ratio (1.97) is unfavorable, while debt to assets is neutral at 42%. Interest coverage is favorable at 13.87, indicating manageable debt servicing. Market valuation ratios show a negative P/E but an unfavorable Price-to-Book ratio (3.98). Overall, the financial ratios present a slightly unfavorable profile.

Shareholder Return Policy

Dollar Tree, Inc. (DLTR) does not pay dividends, reflecting its negative net income in recent fiscal years and likely prioritizing reinvestment or growth strategies. The company has no dividend payout ratio or yield, and there is no indication of share buyback programs.

This absence of shareholder distributions aligns with a focus on long-term value creation through operational improvements and cash flow generation, as free cash flow remains positive despite losses. The policy appears consistent with sustaining growth and financial flexibility rather than immediate shareholder returns.

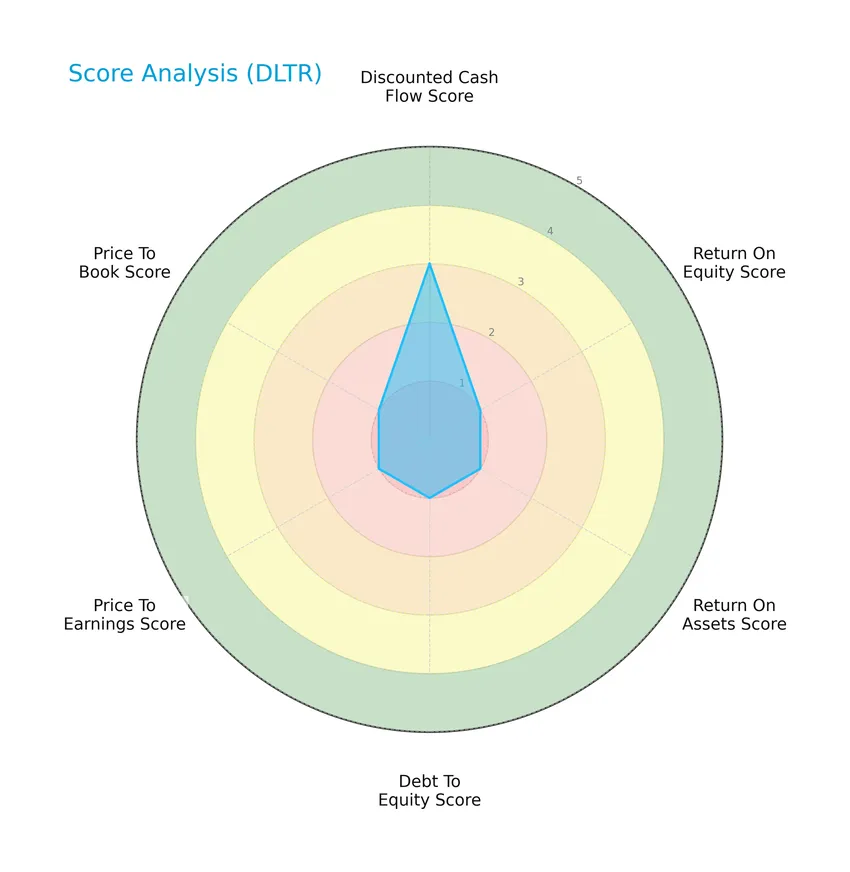

Score analysis

The following radar chart illustrates Dollar Tree, Inc.’s key financial scores, providing a snapshot of its valuation and performance metrics:

Dollar Tree, Inc. shows a moderate discounted cash flow score of 3, while all other scores—including return on equity, return on assets, debt to equity, price to earnings, and price to book—are rated very unfavorable at 1, indicating challenges across profitability and valuation measures.

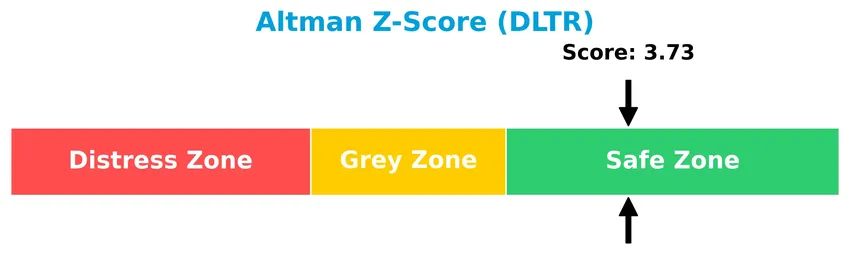

Analysis of the company’s bankruptcy risk

Dollar Tree, Inc. is positioned in the safe zone according to its Altman Z-Score, reflecting a low risk of bankruptcy and stable financial footing:

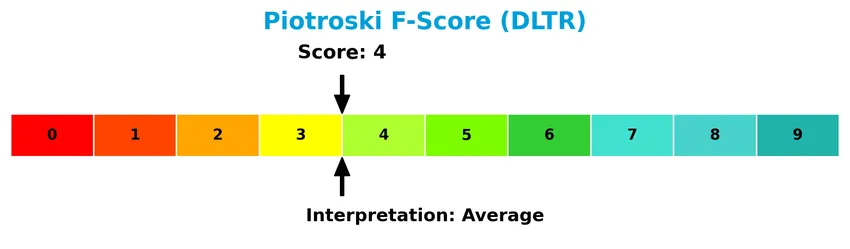

Is the company in good financial health?

The Piotroski Score diagram below presents an assessment of the company’s financial health based on nine criteria:

With a Piotroski Score of 4, Dollar Tree, Inc. falls into the average category, suggesting moderate financial strength but room for improvement in overall operational and balance sheet efficiency.

Competitive Landscape & Sector Positioning

This sector analysis will examine Dollar Tree, Inc.’s strategic positioning, revenue by segment, key products, main competitors, and competitive advantages. I will also attempt to determine whether the company holds a competitive advantage over its rivals in the discount retail industry.

Strategic Positioning

Dollar Tree, Inc. maintains a dual-segment strategy with its Dollar Tree and Family Dollar brands, focusing on discount variety and general merchandise retail in the US and Canada. This product and geographic concentration supports a stable revenue base, with growing sales in both segments, especially Dollar Tree reaching $17.6B in 2024.

Revenue by Segment

This pie chart illustrates Dollar Tree, Inc.’s revenue distribution by segment for the fiscal year 2024, highlighting the relative contributions of Dollar Tree and Family Dollar where applicable.

Over recent years, Dollar Tree has shown consistent revenue growth, reaching 17.6B USD in 2024, while Family Dollar’s revenue, last reported in 2023, stood at 13.8B USD. The Dollar Tree segment now clearly dominates the revenue mix, reflecting either a strategic focus or consolidation, as Family Dollar data is absent in 2024. This shift suggests increasing concentration risk but also indicates acceleration in the core Dollar Tree business.

Key Products & Brands

The table below outlines Dollar Tree, Inc.’s main product segments and their key offerings:

| Product | Description |

|---|---|

| Dollar Tree | Operates discount variety stores with fixed-price merchandise at $1.25, including consumables (candy, food, health and personal care), everyday household items, variety merchandise (toys, housewares, gifts, stationery), and seasonal goods (Christmas, Easter, Halloween, Valentine’s Day). As of early 2022, it operated 8,061 stores in the US and Canada and 17 distribution centers. |

| Family Dollar | Runs general merchandise discount stores offering consumables (food, beverages, tobacco, health care, household products), home products (housewares, décor, domestics), apparel and accessories, and seasonal and electronics merchandise (personal electronics, prepaid phones, stationery, toys). By early 2022, operated 8,016 stores and 11 distribution centers in the US. |

Dollar Tree, Inc.’s two core segments focus on providing value-priced goods through extensive store networks. Dollar Tree specializes in fixed-price items, while Family Dollar offers a broader range of general merchandise and apparel.

Main Competitors

There are 6 main competitors in the Discount Stores industry, with the table below listing the top 6 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Walmart Inc. | 899B |

| Costco Wholesale Corporation | 379B |

| Target Corporation | 46B |

| Dollar General Corporation | 30B |

| Dollar Tree, Inc. | 27B |

| BJ’s Wholesale Club Holdings, Inc. | 12B |

Dollar Tree, Inc. ranks 5th among its 6 competitors, with a market cap just 2.92% of the leading Walmart Inc. It is positioned below both the average market cap of the top 10 competitors (232B) and the median market cap in its sector (38B). The company maintains a 14.53% gap below the next competitor above it, Dollar General.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does DLTR have a competitive advantage?

Dollar Tree, Inc. presents a competitive advantage, demonstrated by a very favorable moat status with a ROIC exceeding WACC by 3.0 points and a growing ROIC trend of 15.3% over 2020-2024, indicating durable value creation. The company’s ability to consistently earn returns above its cost of capital reflects efficient use of invested capital and increasing profitability despite some unfavorable income statement metrics.

Looking ahead, Dollar Tree’s outlook includes opportunities from its two retail segments, Dollar Tree and Family Dollar, which operate over 16,000 stores combined. The fixed-price and discount store model, along with a broad merchandise offering from consumables to seasonal goods, positions the company to potentially leverage market demand and expansion possibilities in North America.

SWOT Analysis

This SWOT analysis highlights key internal and external factors affecting Dollar Tree, Inc., guiding strategic decision-making.

Strengths

- strong market presence with 16,000+ stores

- fixed price model attracting budget shoppers

- favorable gross margin at 35.8%

Weaknesses

- negative net margin at -17.2%

- declining revenue and earnings over 5 years

- high debt-to-equity ratio near 2.0

Opportunities

- expanding private label and seasonal product lines

- growth in discount retail sector post-recession

- leveraging e-commerce and supply chain efficiencies

Threats

- intense competition from other discount retailers

- economic downturns affecting consumer spending

- rising operational and labor costs

Overall, Dollar Tree’s durable competitive advantage and scale are offset by profitability challenges and financial weaknesses. Strategic focus should prioritize margin recovery, cost control, and leveraging growth in discount retail to improve financial health.

Stock Price Action Analysis

The following weekly chart illustrates Dollar Tree, Inc. (DLTR) stock price movements over the past 100 weeks, highlighting key support and resistance levels:

Trend Analysis

Over the past 12 months, DLTR’s stock price declined by 13.15%, indicating a bearish trend with accelerating downward momentum. Volatility is significant, with a standard deviation of 22.43. The stock reached a high of 148.44 and a low of 61.41, reflecting wide price fluctuations during this period.

Volume Analysis

In the last three months, trading volume has been increasing, with buyer volume slightly dominant at 59.66%. This buyer-driven activity suggests growing investor interest and positive market participation despite the prior overall bearish price trend.

Target Prices

Analysts provide a clear target consensus for Dollar Tree, Inc., reflecting a range of potential outcomes.

| Target High | Target Low | Consensus |

|---|---|---|

| 156 | 75 | 124.38 |

The target prices suggest moderate optimism among analysts, with a consensus indicating a potential upside from current levels while accounting for downside risks.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines the recent analyst ratings and consumer feedback related to Dollar Tree, Inc. (DLTR).

Stock Grades

Here is the latest overview of Dollar Tree, Inc. stock grades from prominent financial institutions as of early 2026:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Equal Weight | 2026-01-15 |

| Barclays | Maintain | Overweight | 2026-01-08 |

| Bernstein | Maintain | Market Perform | 2026-01-05 |

| Wells Fargo | Maintain | Overweight | 2025-12-19 |

| Barclays | Maintain | Overweight | 2025-12-09 |

| Morgan Stanley | Maintain | Equal Weight | 2025-12-08 |

| UBS | Maintain | Buy | 2025-12-04 |

| Telsey Advisory Group | Maintain | Outperform | 2025-12-04 |

| B of A Securities | Maintain | Underperform | 2025-12-04 |

| Guggenheim | Maintain | Buy | 2025-12-04 |

The consensus among these firms is generally positive, with a majority maintaining buy or overweight ratings, reflecting moderate confidence in the stock. However, the presence of some hold and underperform grades indicates a balanced market view with some caution.

Consumer Opinions

Consumer sentiment about Dollar Tree, Inc. reflects a mix of appreciation for value and concerns about product quality.

| Positive Reviews | Negative Reviews |

|---|---|

| Excellent low prices make shopping easy and affordable. | Some customers report inconsistent product quality. |

| Friendly and helpful staff improve the shopping experience. | Store cleanliness varies significantly between locations. |

| Convenient locations with a wide variety of household items. | Limited availability of fresh or perishable goods. |

Overall, consumers praise Dollar Tree for its affordability and customer service, but recurring issues include product quality variability and store upkeep, which may affect shopper satisfaction.

Risk Analysis

The following table summarizes key risks associated with Dollar Tree, Inc., highlighting their likelihood and potential impact on investment decisions:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Negative net margin (-17.24%) and poor ROE (-76.18%) signal ongoing profitability challenges. | High | High |

| Leverage & Debt | High debt-to-equity ratio (1.97) and unfavorable debt scores increase financial risk. | Medium | Medium |

| Liquidity | Low quick ratio (0.75) suggests potential short-term liquidity constraints. | Medium | Medium |

| Market Valuation | Elevated price-to-book ratio (3.98) may indicate overvaluation risk. | Medium | Medium |

| Dividend Policy | No dividend yield, which may deter income-focused investors. | High | Low |

| Operational Risk | Moderate operational efficiency with asset turnover near 0.94, reflecting neutral performance. | Medium | Medium |

| Bankruptcy Risk | Altman Z-Score of 3.73 places the company in a safe zone, lowering bankruptcy probability. | Low | High (if occurs) |

The most significant risks for Dollar Tree are its sustained negative profitability and high leverage, which pose substantial threats despite a stable bankruptcy outlook. Investors should monitor these financial weaknesses carefully amid evolving retail sector dynamics.

Should You Buy Dollar Tree, Inc.?

Dollar Tree, Inc. appears to be generating value creation with a durable competitive moat supported by growing ROIC; however, profitability metrics remain weak and leverage profile substantial. Despite a safe-zone Altman Z-score, the overall rating suggests a cautious, moderate investment profile.

Strength & Efficiency Pillars

Dollar Tree, Inc. exhibits a mixed but notable financial profile. The Altman Z-Score of 3.73 places the company firmly in the safe zone, indicating low bankruptcy risk. While the Piotroski Score of 4 is only average, the firm’s ROIC of 9.17% exceeds its WACC of 6.16%, confirming that Dollar Tree is a value creator with a durable competitive advantage. Interest coverage is strong at 13.87x, signaling manageable debt servicing. Gross margin remains favorable at 35.81%, supporting operational efficiency despite challenges in profitability metrics.

Weaknesses and Drawbacks

Several key metrics raise caution. The net margin is deeply negative at -17.24%, accompanied by a sharply declining net margin growth of -427.68%, signaling profitability struggles. Return on equity is heavily unfavorable at -76.18%, reflecting losses eroding shareholder value. Leverage is elevated, with a debt-to-equity ratio of 1.97 and a weak quick ratio of 0.75, highlighting liquidity constraints. The price-to-book ratio stands at 3.98, suggesting a premium market valuation despite earnings weakness. These factors collectively pose significant risks under current market conditions.

Our Verdict about Dollar Tree, Inc.

The long-term fundamental profile of Dollar Tree appears unfavorable due to persistent profitability and leverage concerns. However, the company’s value creation indicated by ROIC exceeding WACC and a safe financial distress score provide a tempered outlook. Given the recent market trend is slightly buyer dominant with positive price momentum since late 2025, the profile may appear opportunistic but warrants caution. Despite underlying challenges, Dollar Tree could merit consideration for investors seeking a turnaround play with improving operational metrics.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Dollar Tree (DLTR) Earnings Beat Drives Margin Improvement – Yahoo Finance New Zealand (Jan 23, 2026)

- Dollar Tree, Inc. Reports Results for the Third Quarter Fiscal 2025 – Dollar Tree (Dec 03, 2025)

- Dollar Tree (DLTR) Stock Trades Down, Here Is Why – Finviz (Jan 21, 2026)

- Dollar Tree facing compressed margins, moat erosion—BNP Paribas – Seeking Alpha (Jan 21, 2026)

- Dollar Tree Stock Fell 6.2% Last Week After Aldi Announced Store Expansion – TIKR.com (Jan 21, 2026)

For more information about Dollar Tree, Inc., please visit the official website: dollartree.com