Home > Analyses > Technology > DocuSign, Inc.

DocuSign, Inc. revolutionizes how agreements are made, transforming paper-heavy processes into seamless digital experiences that touch millions of daily transactions worldwide. As a pioneer in electronic signature software, DocuSign leads the application software industry with innovative solutions that simplify contract lifecycle management, powered increasingly by AI-driven insights. Renowned for its robust, secure platform and broad enterprise adoption, the company’s trajectory prompts an important question: does its current valuation fully reflect the growth potential and evolving market demands ahead?

Table of contents

Business Model & Company Overview

DocuSign, Inc., founded in 2003 and headquartered in San Francisco, CA, leads the software application sector with its comprehensive electronic signature ecosystem. Its solutions streamline digital agreements by integrating e-signature, contract lifecycle management (CLM), AI-driven insights, and industry-specific modules, forming a seamless platform for businesses worldwide. This cohesive approach enables enterprises, commercial firms, and small businesses to prepare, sign, and manage agreements efficiently across various sectors.

The company’s revenue engine balances software subscriptions with cloud-based services and AI-enhanced contract tools, positioning it strongly in the Americas, Europe, and Asia markets. Its offerings include Salesforce integrations, remote online notary services, and compliance-focused modules, driving recurring revenue and customer retention. DocuSign’s competitive advantage lies in its robust platform and broad global footprint, securing its role in shaping the future of digital transaction management.

Financial Performance & Fundamental Metrics

In this section, I analyze DocuSign, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its overall financial health and investment potential.

Income Statement

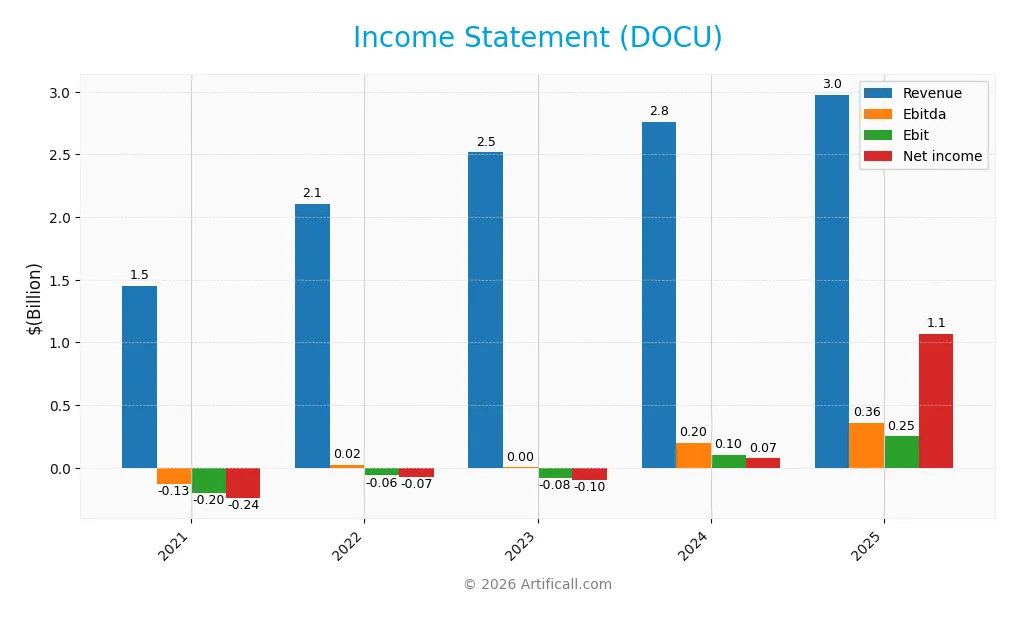

The following table presents DocuSign, Inc.’s key income statement metrics for fiscal years 2021 through 2025, reflecting the company’s financial performance over this period.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 1.45B | 2.11B | 2.52B | 2.76B | 2.98B |

| Cost of Revenue | 364M | 466M | 536M | 573M | 622M |

| Operating Expenses | 1.26B | 1.70B | 2.07B | 2.16B | 2.16B |

| Gross Profit | 1.09B | 1.64B | 1.98B | 2.19B | 2.36B |

| EBITDA | -128M | 21.4M | 2.76M | 196M | 357M |

| EBIT | -199M | -60.5M | -83.5M | 101M | 249M |

| Interest Expense | 30.8M | 6.44M | 6.39M | 6.84M | 1.55M |

| Net Income | -243M | -70.0M | -97.5M | 74.4M | 1.07B |

| EPS | -1.31 | -0.36 | -0.49 | 0.36 | 5.23 |

| Filing Date | 2021-03-31 | 2022-03-25 | 2023-03-27 | 2024-03-21 | 2025-03-18 |

Income Statement Evolution

DocuSign, Inc. experienced robust revenue growth from 2021 to 2025, with a 105% increase overall, and a 7.8% rise from 2024 to 2025, reflecting steady expansion. Net income surged significantly, growing over 538% across the period, driven by strong margin improvements. Gross margin remained favorable at 79.1%, while EBIT margin stayed neutral at 8.4%, indicating stable operational profitability.

Is the Income Statement Favorable?

The 2025 income statement shows a net income of $1.07B and a net margin of 35.9%, both marking substantial improvements from the prior year. EBIT grew by 148%, supported by controlled operating expenses relative to revenue growth. Interest expenses remain minimal at 0.05% of revenue. Overall, the fundamentals in 2025 are considered favorable, reflecting enhanced profitability and efficient cost management.

Financial Ratios

The table below summarizes key financial ratios for DocuSign, Inc. over the fiscal years 2021 to 2025, reflecting profitability, valuation, liquidity, leverage, and operational efficiency:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | -16.7% | -3.3% | -3.9% | 2.7% | 35.9% |

| ROE | -74.7% | -25.4% | -15.8% | 6.5% | 53.3% |

| ROIC | -13.4% | -5.1% | -5.7% | 1.9% | 9.1% |

| P/E | -176 | -353 | -125 | 168 | 19 |

| P/B | 131 | 90 | 20 | 11 | 9.9 |

| Current Ratio | 1.06 | 0.96 | 0.74 | 0.94 | 0.81 |

| Quick Ratio | 1.06 | 0.96 | 0.74 | 0.94 | 0.81 |

| D/E | 2.81 | 3.20 | 1.44 | 0.13 | 0.06 |

| Debt-to-Assets | 39.2% | 34.7% | 29.5% | 4.8% | 3.1% |

| Interest Coverage | -5.6 | -9.6 | -13.8 | 4.6 | 129 |

| Asset Turnover | 0.62 | 0.83 | 0.84 | 0.93 | 0.74 |

| Fixed Asset Turnover | 4.48 | 6.78 | 7.37 | 7.50 | 7.28 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Evolution of Financial Ratios

DocuSign’s Return on Equity (ROE) has markedly improved from negative values in 2021-2023 to a strong 53.32% in 2025, reflecting a significant turnaround in profitability. However, the Current Ratio has declined from above 1.0 in earlier years to 0.81 in 2025, indicating reduced short-term liquidity. The Debt-to-Equity Ratio has decreased substantially, reaching a low 0.06, signaling a conservative leverage position.

Are the Financial Ratios Favorable?

In 2025, profitability ratios like net margin (35.87%) and ROE (53.32%) are favorable, demonstrating robust earnings efficiency. Liquidity metrics show mixed signals: a low Current Ratio (0.81) is unfavorable, while the Quick Ratio is neutral. Leverage ratios including debt-to-equity (0.06) and debt-to-assets (3.1%) are favorable, suggesting low financial risk. Market value indicators such as Price-to-Book (9.87) and dividend yield (0%) are unfavorable. Overall, ratios present a slightly favorable financial profile.

Shareholder Return Policy

DocuSign, Inc. does not pay dividends, reflecting a strategy focused on reinvestment and growth, supported by positive net income in recent years. The absence of dividend payouts aligns with its emphasis on expanding operations and innovation rather than immediate shareholder distributions.

The company does not engage in share buybacks either, indicating a conservative approach to capital returns. This lack of direct shareholder returns may support sustainable long-term value creation if reinvestments drive continued profitability and market share growth.

Score analysis

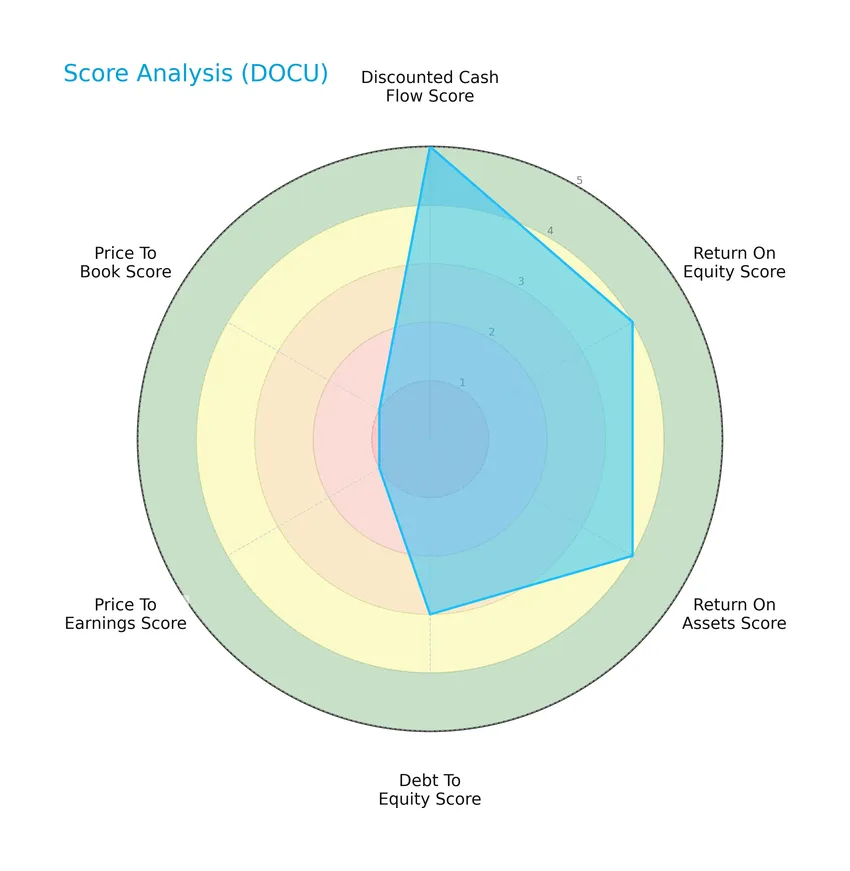

The following radar chart presents an overview of DocuSign, Inc.’s key financial scores, highlighting strengths and weaknesses across several valuation and profitability metrics:

DocuSign shows a very favorable discounted cash flow score of 5 and favorable returns with scores of 4 for both equity and assets. Its debt-to-equity ratio is moderate at 3, while valuation metrics such as price-to-earnings and price-to-book scores are very unfavorable at 1 each, indicating potential market pricing concerns.

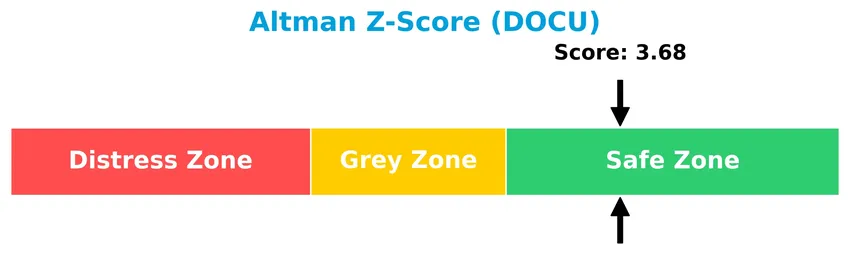

Analysis of the company’s bankruptcy risk

DocuSign’s Altman Z-Score places it comfortably in the safe zone, suggesting a low risk of bankruptcy and financial distress:

Is the company in good financial health?

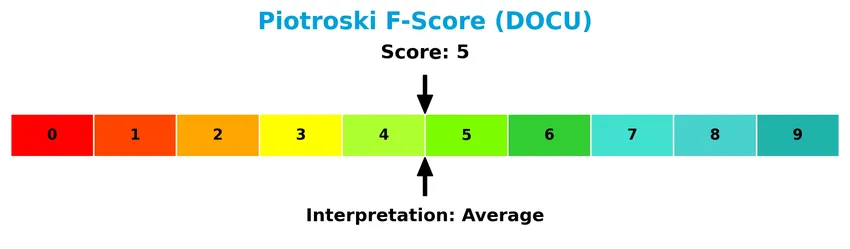

The Piotroski Score diagram below illustrates DocuSign’s financial health based on key accounting criteria:

With a Piotroski Score of 5, DocuSign is considered to have average financial health. This indicates moderate strength in profitability, leverage, liquidity, and operational efficiency, but not a definitive indicator of strong financial robustness.

Competitive Landscape & Sector Positioning

This sector analysis will examine DocuSign, Inc.’s strategic positioning, revenue by segment, key products, and main competitors. I will assess whether DocuSign holds a competitive advantage within the software application industry.

Strategic Positioning

DocuSign, Inc. maintains a concentrated product portfolio focused on electronic signature software and related AI-driven contract lifecycle management solutions, generating over $2.9B in subscription revenue in 2025. Geographically, the company is primarily exposed to the US market, which accounted for $2.1B of its $2.9B total revenue in 2025.

Revenue by Segment

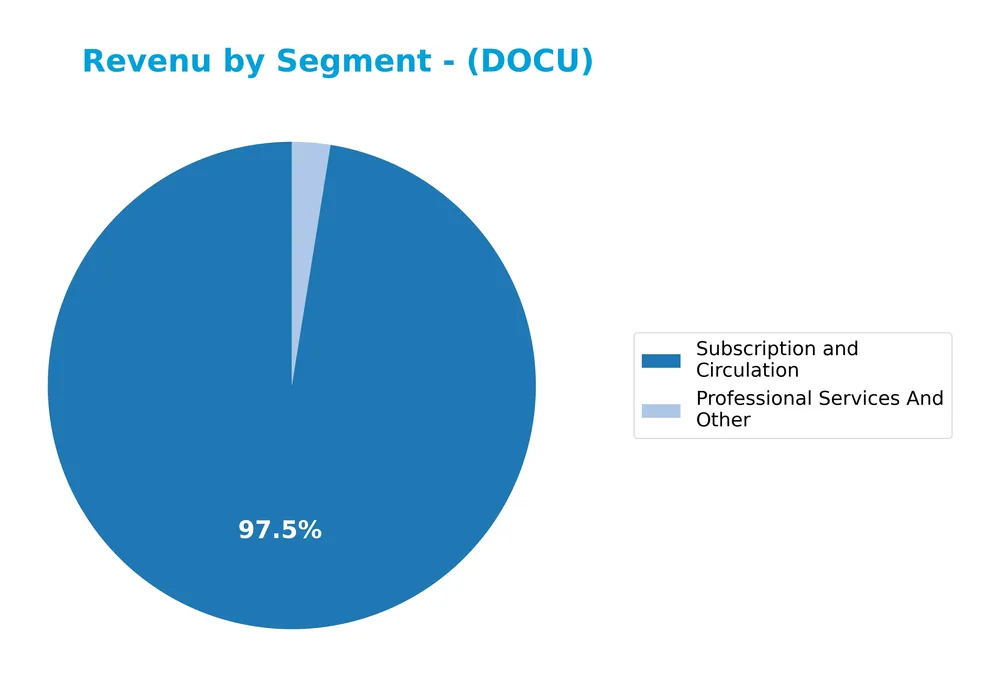

This pie chart illustrates DocuSign, Inc.’s revenue distribution across its main business segments for the fiscal year 2025, highlighting the relative contributions of each segment.

In 2025, the “Subscription and Circulation” segment remains the dominant revenue driver with $2.9B, showing continued growth from $2.7B in 2024 and a significant increase compared to earlier years. The “Professional Services And Other” segment contributes a modest $75M, stable over recent years. Notably, the “License and Service” segment has been phased out from reporting, indicating a strategic shift towards subscription-based revenue models and recurring income streams.

Key Products & Brands

The following table summarizes DocuSign, Inc.’s main products and brand offerings:

| Product | Description |

|---|---|

| eSignature | Electronic signature software enabling digital preparation, signing, and management of agreements. |

| Contract Lifecycle Management (CLM) | Automated workflows across the entire agreement process, including AI-driven contract lifecycle management (CLM+). |

| Insights | AI-powered tool to search and analyze agreements by legal concepts and clauses. |

| Gen for Salesforce | Integration allowing sales reps to generate agreements automatically within Salesforce. |

| Negotiate for Salesforce | Supports approvals, document comparisons, and version control within Salesforce. |

| Analyzer | Helps customers understand agreement content before signing. |

| Guided Forms | Interactive, step-by-step process for filling complex forms. |

| Click | Supports agreements requiring no signatures for standard terms and consents. |

| Identify | Signer identification option verifying government-issued IDs. |

| Standards-Based Signatures | Supports digital certificate-based signatures. |

| Payments | Enables collection of signatures and payments simultaneously. |

| Remote Online Notary | Uses audio-visual and identity verification technologies to enable notarization remotely. |

| Monitor | Advanced analytics tool tracking DocuSign eSignature web, mobile, and API accounts. |

| Industry-Specific Cloud Offerings | Includes Rooms for Real Estate, Rooms for Mortgage, FedRAMP-authorized eSignature for federal agencies, and life sciences compliance modules. |

DocuSign’s product portfolio centers on its eSignature platform enhanced by AI and workflow automation, with specialized offerings tailored to industries such as real estate, mortgage, government, and life sciences. Revenue is primarily driven by subscription services.

Main Competitors

There are 33 competitors in the sector, with the table below showing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Salesforce, Inc. | 242.5B |

| Shopify Inc. | 209.6B |

| AppLovin Corporation | 209.0B |

| Intuit Inc. | 175.2B |

| Uber Technologies, Inc. | 172.2B |

| ServiceNow, Inc. | 153.0B |

| Cadence Design Systems, Inc. | 84.5B |

| Snowflake Inc. | 73.4B |

| Autodesk, Inc. | 61.2B |

| Workday, Inc. | 54.9B |

DocuSign, Inc. ranks 20th among 33 competitors, with a market cap approximately 4.75% that of the leading company, Salesforce. It is positioned below both the average market cap of the top 10 competitors (143.6B) and the median market cap of the sector (18.8B). DocuSign maintains a 58.3% market cap gap to its nearest competitor above, indicating a significant distance from the next strongest player.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does DOCU have a competitive advantage?

DocuSign, Inc. currently shows a slightly favorable moat status, indicating it does not yet have a clear competitive advantage but is improving profitability. The company’s return on invested capital (ROIC) remains below its weighted average cost of capital (WACC), signaling value is still being shed despite a positive ROIC growth trend.

Looking ahead, DocuSign aims to expand its product suite with AI-driven solutions for contract lifecycle management and specialized cloud offerings for industries like real estate and life sciences. These innovations and geographic revenue growth, particularly outside the US, suggest opportunities for strengthening its market position.

SWOT Analysis

This SWOT analysis highlights DocuSign, Inc.’s key internal strengths and weaknesses alongside external opportunities and threats to inform strategic decision-making.

Strengths

- Strong gross margin at 79%

- Robust net margin of 36%

- Rapid revenue growth over 5 years (+105%)

Weaknesses

- Low current ratio (0.81) indicating liquidity concerns

- High price-to-book ratio (9.87) suggesting overvaluation

- No dividend yield limits income appeal

Opportunities

- Expansion in international markets with Non-US revenue growth

- Increasing demand for AI-driven contract management

- Growth potential in regulated sectors like federal government and life sciences

Threats

- Intense competition in e-signature and contract management software

- Regulatory risks around digital signatures and data privacy

- Market volatility impacting tech sector valuations

DocuSign demonstrates strong profitability and solid growth, but liquidity and valuation metrics warrant caution. Leveraging AI innovations and international expansion can drive future growth, though investors should remain vigilant on sector competition and regulatory challenges.

Stock Price Action Analysis

The following weekly stock chart illustrates DocuSign, Inc.’s price movements over the past 100 weeks, providing insight into its volatility and key price levels:

Trend Analysis

Over the past 12 months, DocuSign’s stock price increased by 5.28%, indicating a bullish trend with a deceleration in momentum. The price moved between a low of 50.84 and a high of 106.99, showing significant volatility with a standard deviation of 12.91.

Volume Analysis

In the last three months, trading volume for DocuSign has been decreasing, with sellers dominating at 64.1% of activity. This seller-driven volume suggests cautious investor sentiment and reduced market participation during this period.

Target Prices

Analysts present a moderate bullish consensus for DocuSign, Inc. (DOCU) based on current target prices.

| Target High | Target Low | Consensus |

|---|---|---|

| 88 | 70 | 76.86 |

The target prices indicate that analysts expect DOCU’s stock to trade between 70 and 88, with an average consensus near 77, reflecting cautious optimism.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines the latest analyst ratings and consumer feedback related to DocuSign, Inc. (DOCU).

Stock Grades

Here is the latest overview of DocuSign, Inc.’s stock grades from established financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| RBC Capital | Maintain | Sector Perform | 2026-01-05 |

| RBC Capital | Maintain | Sector Perform | 2025-12-05 |

| Piper Sandler | Maintain | Neutral | 2025-12-05 |

| Wedbush | Maintain | Neutral | 2025-12-05 |

| UBS | Maintain | Neutral | 2025-12-05 |

| Evercore ISI Group | Maintain | In Line | 2025-12-05 |

| Wells Fargo | Maintain | Equal Weight | 2025-12-05 |

| JP Morgan | Maintain | Neutral | 2025-12-05 |

| Baird | Maintain | Neutral | 2025-12-05 |

| B of A Securities | Maintain | Neutral | 2025-12-05 |

The consensus across multiple reputable firms indicates a stable outlook with predominant “Neutral” or equivalent ratings, reflecting a cautious stance and suggesting no significant momentum shifts in the stock’s near-term performance.

Consumer Opinions

Consumers generally appreciate DocuSign for its ease of use and efficiency but express concerns about occasional technical issues.

| Positive Reviews | Negative Reviews |

|---|---|

| Intuitive interface speeds up signing | Occasional glitches disrupt workflow |

| Reliable document security features | Customer support response times vary |

| Saves time with seamless integrations | Pricing can be high for small businesses |

Overall, users praise DocuSign for its user-friendly platform and strong security, though some mention technical hiccups and pricing as areas for improvement.

Risk Analysis

Below is a table summarizing the key risks facing DocuSign, Inc., focusing on their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Valuation | High price-to-book ratio (9.87) suggests overvaluation risk if growth slows. | Medium | High |

| Liquidity | Current ratio at 0.81 indicates potential short-term liquidity challenges. | Medium | Medium |

| Competitive Pressure | Intense competition in e-signature and contract management software markets. | High | High |

| Technological Risk | Dependence on AI and cloud infrastructure exposes DocuSign to tech failures or cyber threats. | Medium | High |

| Regulatory | Increasing data privacy and electronic signature regulations may increase compliance costs. | Medium | Medium |

| Growth Sustainability | Moderate Piotroski Score (5) signals average financial strength, raising concerns about scaling. | Medium | Medium |

The most likely and impactful risks for DocuSign are competitive pressure and valuation concerns. Despite a healthy Altman Z-Score placing the company in a safe zone, valuation multiples remain elevated, and competition in the SaaS market continues to intensify, which could pressure margins and growth going forward.

Should You Buy DocuSign, Inc.?

DocuSign appears to be improving its profitability with growing returns on capital, suggesting a slightly favorable competitive moat despite shedding value relative to WACC. Its leverage profile seems manageable, supported by a very favorable B+ rating, indicating moderate overall financial health.

Strength & Efficiency Pillars

DocuSign, Inc. demonstrates robust profitability with a net margin of 35.87% and a strong return on equity of 53.32%, underscoring effective earnings generation for shareholders. The company’s financial health remains solid, supported by an Altman Z-score of 3.68, placing it comfortably in the safe zone, and a Piotroski score of 5, indicating average financial strength. While the return on invested capital (ROIC) at 9.09% slightly exceeds the weighted average cost of capital (WACC) of 8.48%, DocuSign marginally qualifies as a value creator, signaling cautious optimism regarding its capital efficiency.

Weaknesses and Drawbacks

Despite operational strengths, DocuSign faces valuation concerns with a price-to-book ratio of 9.87, flagged as unfavorable, suggesting the stock trades at a significant premium relative to its book value. The current ratio of 0.81 indicates liquidity constraints, raising potential short-term solvency risks. Additionally, the absence of dividend yield may deter income-focused investors. Recent market activity reveals seller dominance with buyers representing only 35.9% of volume since November 2025, which, combined with a 17.56% price decline, introduces near-term volatility and investor caution.

Our Verdict about DocuSign, Inc.

DocuSign’s long-term fundamentals appear favorable, supported by strong profitability and sound financial health. However, the recent seller-dominant market pressure and elevated valuation metrics suggest a wait-and-see approach might be prudent. While the profile may appear attractive for investors prioritizing growth and operational efficiency, the current entry point carries heightened risks that could merit caution for those sensitive to short-term market dynamics.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Rakuten Investment Management Inc. Buys New Shares in Docusign Inc. $DOCU – MarketBeat (Jan 23, 2026)

- Reasons Why You Should Retain Docusign Stock in Your Portfolio – Nasdaq (Jan 21, 2026)

- Docusign Inc. (DOCU) Is a Trending Stock: Facts to Know Before Betting on It – Yahoo Finance (Jan 15, 2026)

- Docusign Announces Third Quarter Fiscal 2026 Financial Results – PR Newswire (Dec 04, 2025)

- Wealth Enhancement Advisory Services LLC Has $12.46 Million Position in Docusign Inc. $DOCU – MarketBeat (Jan 23, 2026)

For more information about DocuSign, Inc., please visit the official website: DocuSign.com