Home > Analyses > Consumer Defensive > Diageo plc

Diageo plc transforms social moments worldwide by crafting some of the most iconic spirits and beverages. As a dominant force in the global alcohol industry, it boasts flagship brands like Johnnie Walker, Smirnoff, and Guinness, renowned for quality and innovation. With a diverse portfolio spanning numerous markets, Diageo influences consumer tastes and lifestyle trends. The key question now is whether its strong fundamentals continue to support its current valuation and future growth prospects.

Table of contents

Business Model & Company Overview

Diageo plc, founded in 1886 and headquartered in London, stands as a dominant force in the Beverages – Wineries & Distilleries industry. Its extensive portfolio forms a cohesive ecosystem of iconic alcoholic brands, including Johnnie Walker, Smirnoff, and Guinness, spanning scotch, whisky, vodka, tequila, and more. This broad offering supports its core mission of delivering premium beverage experiences worldwide, positioning it as a leader in consumer preference and market reach.

The company’s revenue engine balances strong sales of its diverse spirits and beer portfolio with a strategic global footprint across North America, Europe, Asia, and emerging markets. This geographic diversity underpins steady cash flows and resilience. Diageo’s ability to blend heritage brands with innovation secures its competitive advantage, reinforcing a robust economic moat that continues to shape the future of the global beverage industry.

Financial Performance & Fundamental Metrics

This section provides an overview of Diageo plc’s income statement, key financial ratios, and dividend payout policy to support informed investment decisions.

Income Statement

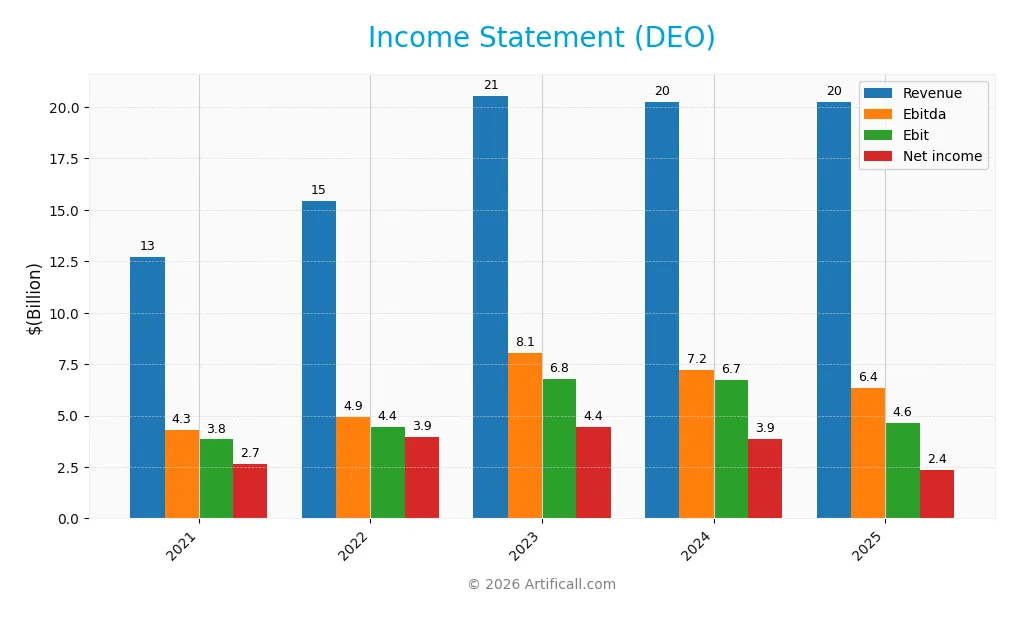

The table below summarizes Diageo plc’s key income statement figures for fiscal years 2021 through 2025, reported in USD for the latest three years.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 12.7B | 15.5B | 20.6B | 20.3B | 20.2B |

| Cost of Revenue | 5.0B | 6.0B | 8.3B | 8.1B | 8.1B |

| Operating Expenses | 3.96B | 5.07B | 6.72B | 6.20B | 7.84B |

| Gross Profit | 7.7B | 9.5B | 12.3B | 12.2B | 12.2B |

| EBITDA | 4.28B | 4.94B | 8.06B | 7.24B | 6.36B |

| EBIT | 3.84B | 4.45B | 6.76B | 6.75B | 4.64B |

| Interest Expense | 0.50B | 0.63B | 1.12B | 1.29B | 1.04B |

| Net Income | 2.66B | 3.94B | 4.45B | 3.87B | 2.35B |

| EPS | 4.56 | 6.80 | 7.84 | 6.92 | 4.24 |

| Filing Date | 2021-06-30 | 2022-06-30 | 2023-06-30 | 2024-08-01 | 2025-08-14 |

Income Statement Evolution

Between 2021 and 2025, Diageo plc’s revenue showed a favorable overall growth of 59%, reaching $20.2B in 2025, although it slightly declined by 0.12% from 2024 to 2025. Net income, conversely, declined by 11.5% over the period and more sharply by 39.1% in the last year. Despite this, gross margin remained favorable at 60.13%, while net margin contracted to 11.63%, signaling margin pressure alongside falling profitability.

Is the Income Statement Favorable?

The 2025 income statement reveals challenges with a 31.2% decline in EBIT and a significant drop in EPS by 38.7%, reflecting deteriorating earnings quality. Interest expense remains a neutral factor at 5.12% of revenue, but the overall income statement evaluation is unfavorable due to declining profits and margins. While revenue growth is stable, the continuing erosion of net income and margins suggests underlying operational and cost management issues that weigh on the company’s fundamentals.

Financial Ratios

Below is a table summarizing key financial ratios for Diageo plc (ticker: DEO) over recent fiscal years:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 21% | 26% | 22% | 19% | 12% |

| ROE | 39% | 51% | 45% | 39% | 21% |

| ROIC | 11% | 11% | 12% | 12% | 7% |

| P/E | 30.4 | 21.0 | 22.1 | 18.2 | 23.8 |

| P/B | 11.7 | 10.6 | 10.0 | 7.0 | 5.1 |

| Current Ratio | 1.60 | 1.53 | 1.63 | 1.53 | 1.63 |

| Quick Ratio | 0.76 | 0.69 | 0.62 | 0.55 | 0.64 |

| D/E | 2.14 | 2.05 | 2.11 | 2.14 | 2.20 |

| Debt-to-Assets | 46% | 44% | 46% | 47% | 49% |

| Interest Coverage | 7.52 | 6.97 | 4.95 | 4.67 | 4.19 |

| Asset Turnover | 0.40 | 0.42 | 0.46 | 0.45 | 0.41 |

| Fixed Asset Turnover | 2.63 | 2.64 | 2.66 | 2.38 | 2.12 |

| Dividend Yield | 2.0% | 2.1% | 2.3% | 3.4% | 4.1% |

Evolution of Financial Ratios

Diageo plc’s Return on Equity (ROE) showed a declining trend from 50.53% in 2022 to 21.23% in 2025, indicating reduced profitability. The Current Ratio slightly improved from approximately 1.53 to 1.63, reflecting stable liquidity. The Debt-to-Equity Ratio increased modestly, remaining above 2.0, suggesting consistent but elevated leverage over the period.

Are the Financial Ratios Fovorable?

In 2025, profitability ratios like net margin (11.63%) and ROE (21.23%) were favorable, while return on invested capital (7.47%) was neutral. Liquidity appeared mixed with a favorable current ratio (1.63) but an unfavorable quick ratio (0.64). Leverage was unfavorable with a debt-to-equity ratio of 2.2, and asset turnover was also unfavorable at 0.41. Market valuation ratios showed neutrality for PE (23.8) and unfavorable for PB (5.05). Overall, the financial ratios are slightly favorable.

Shareholder Return Policy

Diageo plc maintains a high dividend payout ratio near 98%, with a steadily increasing dividend per share reaching 4.14 USD in 2025 and a yield above 4%. The dividend payments are largely covered by free cash flow, supported by moderate share buybacks, indicating a focus on returning cash to shareholders.

While the payout ratio is elevated, the company’s consistent free cash flow coverage and dividend growth suggest a sustainable distribution policy. However, the high payout leaves limited retained earnings for reinvestment, which could pose risks if cash flows weaken, impacting long-term shareholder value creation.

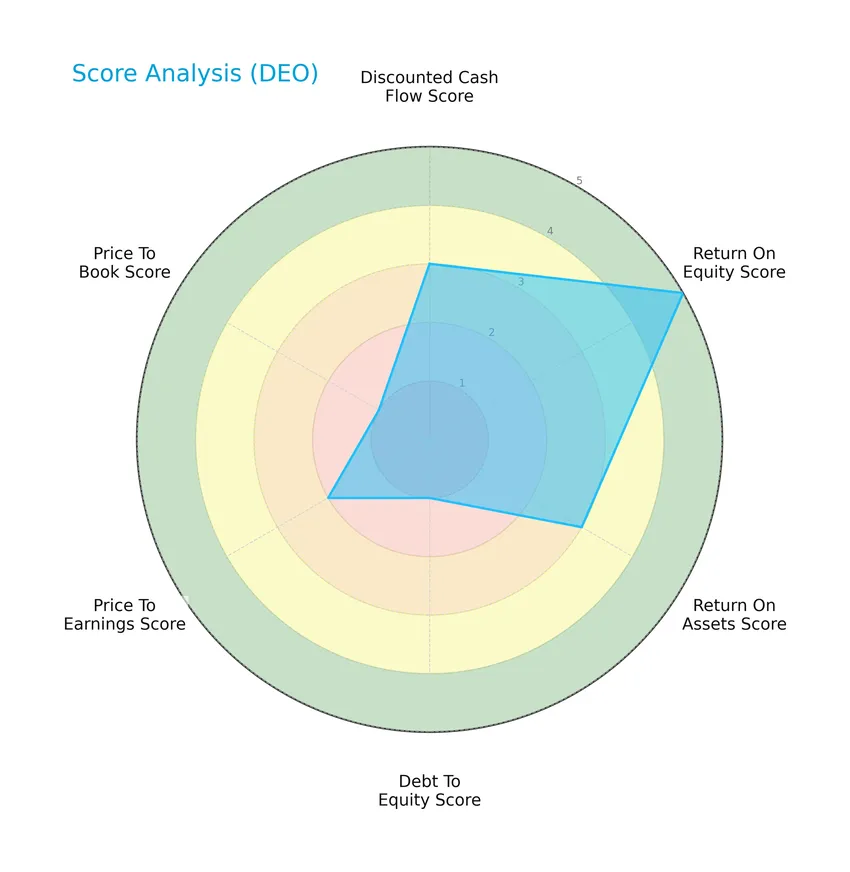

Score analysis

The radar chart below illustrates Diageo plc’s key financial scores across multiple valuation and performance metrics:

Diageo shows a mixed financial profile with a very favorable return on equity score of 5, moderate scores in discounted cash flow (3), return on assets (3), and price to earnings (2), but very unfavorable scores for debt to equity (1) and price to book (1).

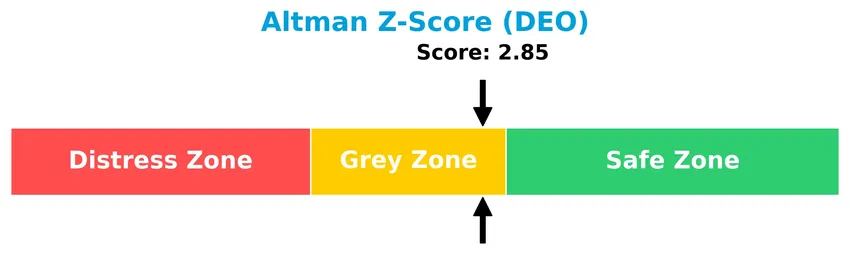

Analysis of the company’s bankruptcy risk

Diageo plc’s Altman Z-Score places the company in the grey zone, indicating a moderate risk of bankruptcy:

Is the company in good financial health?

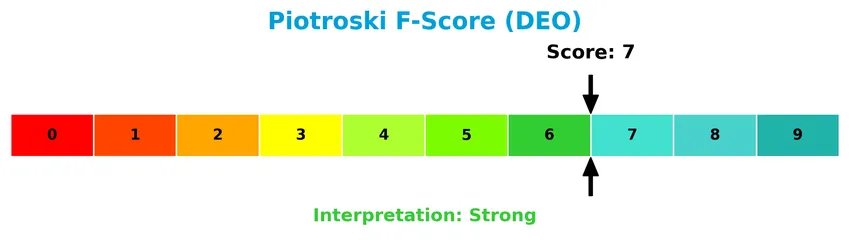

The Piotroski F-Score diagram provides insight into Diageo plc’s financial strength and operational efficiency:

With a Piotroski Score of 7, Diageo is considered to have strong financial health, reflecting solid fundamentals and operational performance.

Competitive Landscape & Sector Positioning

This sector analysis of Diageo plc will cover strategic positioning, revenue by segment, key products, main competitors, competitive advantages, and a SWOT analysis. I will assess whether Diageo holds a competitive advantage over its industry peers.

Strategic Positioning

Diageo plc maintains a diversified product portfolio dominated by spirits (£22.2B in 2025), complemented by beer (£4.5B) and ready-to-drink products (£1B). Geographically, it operates globally with significant revenues from the United States (£8.1B), Rest of World (£13.6B), India (£3.2B), and the United Kingdom (£3B), reflecting broad international exposure.

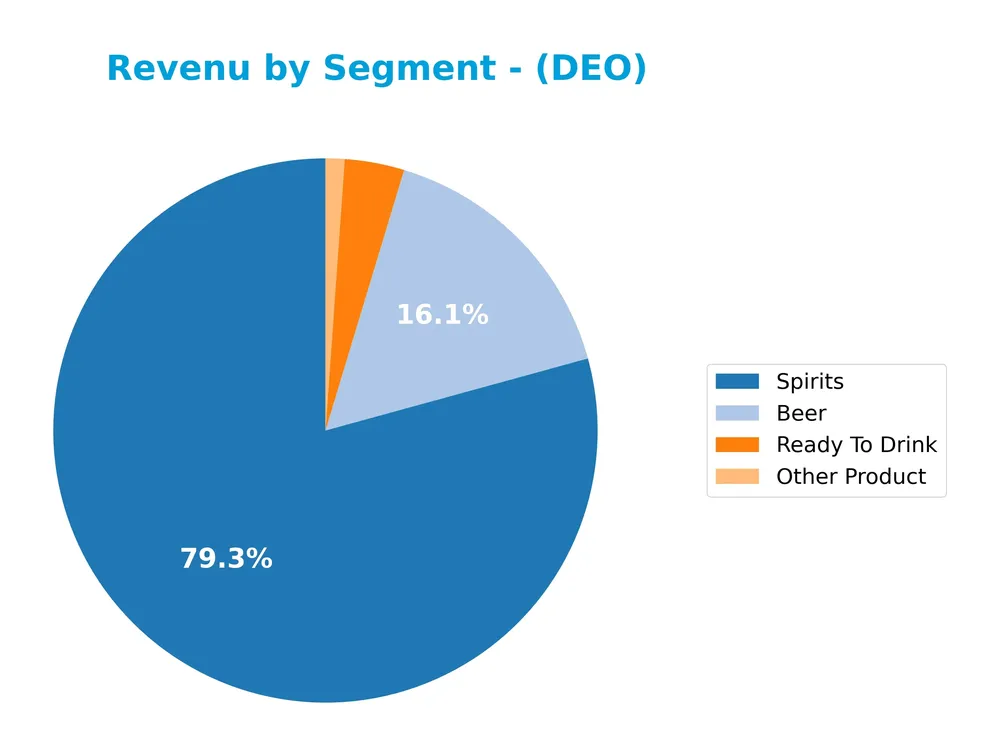

Revenue by Segment

This pie chart illustrates Diageo plc’s revenue distribution by product segment for the fiscal year 2025, highlighting the contribution of Beer, Spirits, Ready To Drink, and Other Products.

In 2025, Spirits dominate Diageo’s revenue with £22.2B, showing slight contraction from £22.4B in 2024 but still representing the core business. Beer revenue increased to £4.5B, marking solid growth compared to previous years and signaling renewed strength. Ready To Drink products also saw an uptick to £989M, continuing a steady rise. Other Products declined to £316M, indicating a shift away from smaller segments. Overall, the portfolio remains heavily concentrated in Spirits, with Beer gaining momentum.

Key Products & Brands

The table below outlines Diageo plc’s main products and their associated brand offerings:

| Product | Description |

|---|---|

| Spirits | Includes scotch, whisky, gin, vodka, rum, raki, liqueur, tequila, Canadian whisky, American whiskey, cachaca, and brandy. |

| Beer | Encompasses beer products including cider and non-alcoholic beverages. |

| Ready To Drink | Pre-mixed alcoholic beverages offered as convenient ready-to-consume products. |

| Other Product | Miscellaneous product category not detailed in the provided data. |

| Brands | Johnnie Walker, Crown Royal, Bulleit, Buchanan’s (whiskies); Smirnoff, Cîroc, Ketel One (vodkas); Casamigos, DeLeon, Don Julio (tequilas); Captain Morgan, Baileys, Tanqueray, Guinness. |

Diageo’s portfolio centers primarily on spirits, complemented by beer and ready-to-drink products. Its diverse brand lineup spans multiple alcoholic beverage categories, supporting a global presence across several key markets.

Main Competitors

There are 4 main competitors in the Beverages – Wineries & Distilleries industry, with the table listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Diageo plc | 47.9B |

| Constellation Brands, Inc. | 24.7B |

| Brown-Forman Corporation (BF-A) | 12.4B |

| Brown-Forman Corporation (BF-B) | 12.3B |

Diageo plc ranks 1st among its competitors with a market cap 6% above the top player baseline, clearly leading the sector. It stands well above both the average market cap of the top 10 (24.4B) and the sector median (18.6B). The gap to the next competitor below is significant, exceeding 105%, highlighting Diageo’s dominant position.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does Diageo plc have a competitive advantage?

Diageo plc presents a slight competitive advantage, with a ROIC exceeding its WACC by about 3.3%, indicating value creation despite a declining profitability trend. The company maintains favorable gross and EBIT margins, supporting its position in the beverages industry.

Looking ahead, Diageo’s broad geographic reach, including significant revenue streams from the U.S., India, and the Rest of World, offers opportunities for growth. Its diverse product portfolio across multiple spirit categories positions it to capitalize on new markets and consumer trends.

SWOT Analysis

This analysis highlights Diageo plc’s key internal strengths and weaknesses alongside external opportunities and threats to inform investment decisions.

Strengths

- strong global brand portfolio

- favorable net margin of 11.63%

- solid ROE at 21.23%

Weaknesses

- recent negative revenue and earnings growth

- high debt-to-equity ratio of 2.2

- declining ROIC trend

Opportunities

- expanding in emerging markets like India

- growing demand for premium and ready-to-drink products

- potential to improve operational efficiency

Threats

- regulatory risks in alcohol industry

- competitive pressure from craft and local brands

- currency fluctuations impacting international sales

Diageo benefits from a powerful brand presence and profitability but faces challenges from recent earnings declines and high leverage. Strategic focus on emerging markets and innovation could drive growth, yet risks from regulation and competition require vigilant risk management.

Stock Price Action Analysis

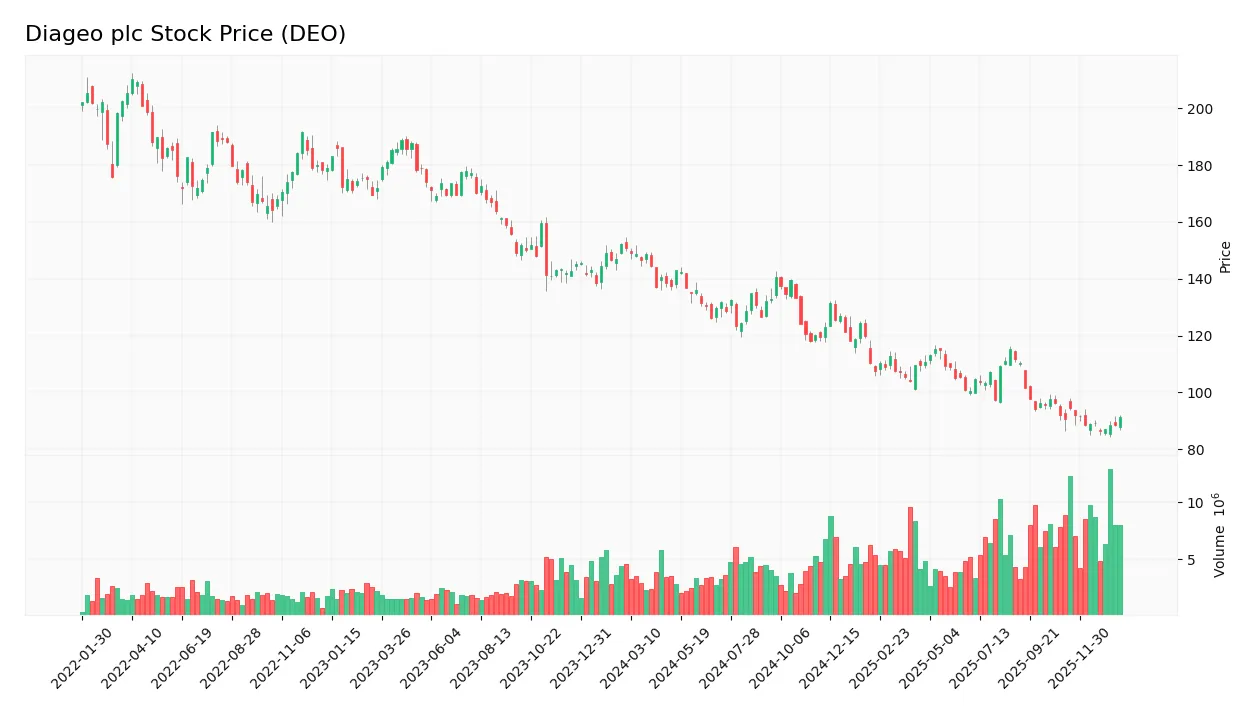

The weekly stock chart below illustrates Diageo plc’s price movements over the past 12 months, highlighting key fluctuations and recent stability:

Trend Analysis

Over the past 12 months, Diageo plc’s stock price declined by 39.29%, indicating a clear bearish trend with accelerating downward momentum. The price ranged from a high of 150.71 to a low of 86.32, showing substantial volatility with a standard deviation of 17.51. Recent weeks show a minor 0.76% increase but overall remain neutral with slight deceleration.

Volume Analysis

Trading volume has increased over the last three months, with buyer dominance at 66.37%, signaling a buyer-driven market. This rising activity suggests strengthening investor interest and participation, possibly indicating confidence returning despite the broader bearish price trend.

Target Prices

Analysts present a unified target price consensus for Diageo plc, reflecting a clear outlook.

| Target High | Target Low | Consensus |

|---|---|---|

| 124 | 124 | 124 |

The consensus target price of 124 indicates stable expectations among analysts, with no divergence between high and low estimates.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section presents an overview of analyst ratings and consumer feedback related to Diageo plc (DEO).

Stock Grades

Here is the latest summary of stock grades for Diageo plc from reputable financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Downgrade | Neutral | 2025-12-03 |

| B of A Securities | Maintain | Buy | 2025-09-26 |

| TD Cowen | Maintain | Hold | 2025-01-08 |

| Jefferies | Upgrade | Buy | 2024-12-04 |

| Citigroup | Upgrade | Buy | 2024-07-03 |

| Citigroup | Upgrade | Buy | 2024-07-02 |

| Argus Research | Downgrade | Hold | 2024-01-04 |

| Argus Research | Downgrade | Hold | 2024-01-03 |

| JP Morgan | Downgrade | Neutral | 2023-11-29 |

| JP Morgan | Downgrade | Neutral | 2023-11-28 |

The consensus across these grades points to a cautious stance, with several downgrades to Neutral and Hold, balanced by some upgrades to Buy earlier in the timeline. Overall, the trend indicates a shift toward more moderate expectations for Diageo’s stock performance.

Consumer Opinions

Consumers share a diverse range of experiences with Diageo plc, reflecting both enthusiasm and areas for improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| “Diageo offers a premium range of spirits with consistent quality.” | “Prices can be quite high compared to competitors.” |

| “Their brands have a great reputation and deliver excellent taste.” | “Limited availability of some products in local markets.” |

| “Customer service is responsive and helpful.” | “Occasional delays in shipping and delivery.” |

Overall, Diageo is praised for its strong brand portfolio and product quality, though consumers note pricing and distribution challenges as areas that could be better managed.

Risk Analysis

Below is a table summarizing the key risks facing Diageo plc, highlighting their likelihood and potential impact on the company’s performance and valuation:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Leverage | High debt-to-equity ratio (2.2) could strain finances in downturns | High | High |

| Market Valuation | Unfavorable price-to-book ratio (5.05) may limit upside | Medium | Medium |

| Liquidity | Low quick ratio (0.64) suggests short-term liquidity concerns | Medium | Medium |

| Industry Risks | Regulatory changes or shifts in consumer preferences impacting alcohol sales | Medium | High |

| Bankruptcy Risk | Altman Z-score in grey zone (2.85) indicates moderate distress risk | Medium | High |

| Profitability | Net margin favorable at 11.63%, supporting resilience | Low | Low |

The most significant risks are Diageo’s relatively high financial leverage combined with a moderate bankruptcy risk as indicated by the Altman Z-score. Despite strong profitability and a solid Piotroski score, caution is warranted given liquidity constraints and valuation concerns amid evolving market conditions.

Should You Buy Diageo plc?

Diageo plc appears to be a company with robust profitability and a slightly favorable competitive moat, supported by positive value creation despite a declining ROIC trend. While its leverage profile could be seen as substantial, the overall rating suggests a cautiously moderate investment profile.

Strength & Efficiency Pillars

Diageo plc demonstrates solid profitability with a net margin of 11.63% and a return on equity (ROE) of 21.23%, underscoring its operational efficiency. The company is a clear value creator, as its return on invested capital (ROIC) of 7.47% comfortably exceeds its weighted average cost of capital (WACC) at 4.17%. Financial health indicators are mixed but generally positive, with an Altman Z-Score of 2.85 placing it in the grey zone, while the Piotroski score of 7 signals strong financial strength. These metrics collectively support Diageo’s capability to generate shareholder value while maintaining moderate risk.

Weaknesses and Drawbacks

However, certain financial risks warrant caution. Diageo’s high debt-to-equity ratio of 2.2 and a quick ratio of 0.64 highlight leverage and liquidity concerns, potentially constraining flexibility in adverse conditions. Valuation metrics also pose challenges: a price-to-book ratio of 5.05 suggests the stock is trading at a premium relative to its book value, which may limit upside. Additionally, the company’s stock trend has been bearish, with a 39.29% decline, and overall market pressure remains, despite recent buyer dominance. These factors could translate to short-term volatility and valuation risk.

Our Verdict about Diageo plc

Diageo’s long-term fundamental profile appears favorable given its profitability and value creation status. Coupled with a strong Piotroski score, the company may appear attractive for long-term exposure. Despite this, the recent technical trend shows bearish momentum, though buyer dominance in the latest period could hint at a recovery. Therefore, while the underlying financials are solid, investors might consider a cautious approach to timing, balancing Diageo’s strengths against current market pressures.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- NorthCrest Asset Manangement LLC Cuts Position in Diageo plc $DEO – MarketBeat (Jan 20, 2026)

- Diageo plc (DEO): A Bull Case Theory – Yahoo Finance (Jan 15, 2026)

- 1 Stock I’d Buy Before DEO in 2026 – The Motley Fool (Jan 09, 2026)

- Diageo: Streamlining Through Divestments (Rating Upgrade) (NYSE:DEO) – Seeking Alpha (Jan 14, 2026)

- RBC Capital is bullish on Diageo’s ability to restore its mainstream business – MSN (Jan 06, 2026)

For more information about Diageo plc, please visit the official website: diageo.com