Home > Analyses > Technology > Dell Technologies Inc.

Dell Technologies Inc. powers the digital backbone of businesses and individuals worldwide, shaping how we connect, work, and innovate every day. As a dominant force in computer hardware and IT solutions, Dell’s portfolio spans from cutting-edge servers and storage to client devices and cloud software, backed by a strong reputation for quality and technological leadership. With evolving market dynamics and fierce competition, I examine whether Dell’s current fundamentals still support its growth potential and justify its market valuation.

Table of contents

Business Model & Company Overview

Dell Technologies Inc., founded in 1984 and headquartered in Round Rock, Texas, stands as a dominant player in the computer hardware industry. Its integrated ecosystem spans infrastructure solutions, client devices, and VMware’s cloud and security software, delivering a cohesive mission to modernize IT environments worldwide. This broad portfolio enables Dell to serve diverse customer needs, from traditional storage and servers to hybrid cloud management and digital workspaces.

The company’s revenue engine balances sales of desktops, notebooks, servers, and networking hardware with recurring software and service contracts across the Americas, Europe, and Asia. Dell’s Infrastructure Solutions Group and Client Solutions Group combine with VMware’s cloud offerings to fuel steady growth through hardware sales complemented by software and support services. This blend creates a competitive advantage by embedding Dell deeply into enterprise IT operations, shaping the future of digital transformation.

Financial Performance & Fundamental Metrics

I will analyze Dell Technologies Inc.’s income statement, key financial ratios, and dividend payout policy to provide a clear view of its fundamental health.

Income Statement

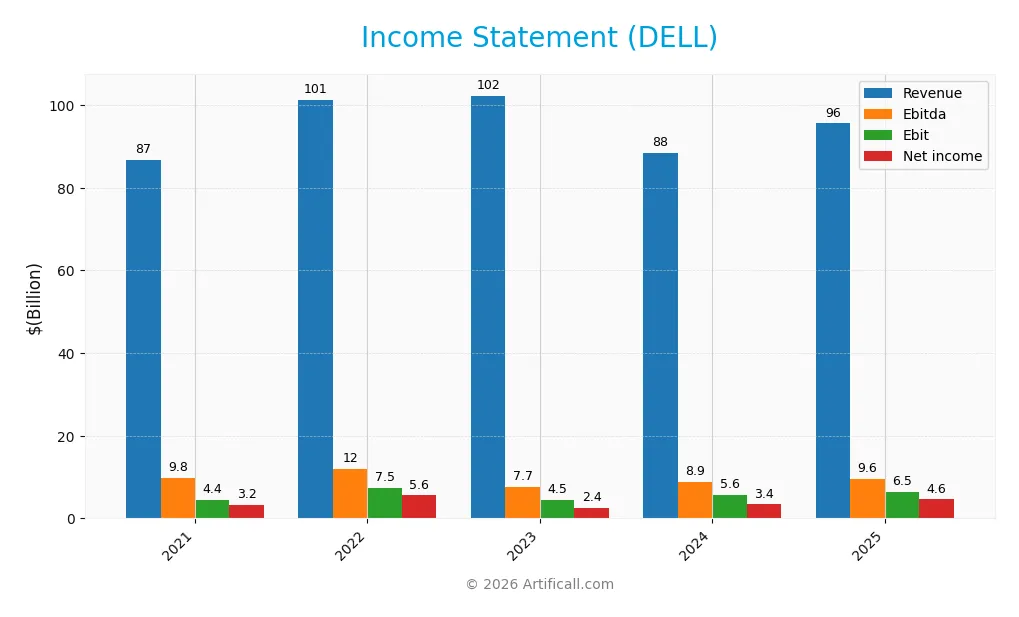

The following table summarizes Dell Technologies Inc.’s key income statement items over the past five fiscal years, providing a clear view of the company’s financial performance.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 86.7B | 101.2B | 102.3B | 88.4B | 95.6B |

| Cost of Revenue | 66.5B | 79.3B | 79.6B | 67.4B | 74.3B |

| Operating Expenses | 16.5B | 17.2B | 16.9B | 15.7B | 15.0B |

| Gross Profit | 20.1B | 21.9B | 22.7B | 21.1B | 21.3B |

| EBITDA | 9.8B | 12.0B | 7.7B | 8.9B | 9.6B |

| EBIT | 4.4B | 7.5B | 4.5B | 5.6B | 6.5B |

| Interest Expense | 2.1B | 1.5B | 1.3B | 1.5B | 1.4B |

| Net Income | 3.2B | 5.6B | 2.4B | 3.4B | 4.6B |

| EPS | 4.37 | 7.30 | 3.33 | 4.71 | 6.51 |

| Filing Date | 2021-03-26 | 2022-03-24 | 2023-03-30 | 2024-03-25 | 2025-03-25 |

Income Statement Evolution

From 2021 to 2025, Dell Technologies Inc. showed a consistent revenue growth, averaging 10.27% over the period, with an 8.08% increase in the latest year. Net income growth was even stronger, up 41.29% overall and 25.41% in the last year. Gross margins remained stable around 22%, while EBIT and net margins showed slight improvements, indicating better operational efficiency.

Is the Income Statement Favorable?

The 2025 income statement reflects generally favorable fundamentals. Revenue rose to $95.6B, with gross profit holding steady at $21.3B, and operating expenses growing proportionally. EBIT margin is neutral at 6.76%, but net margin improved to 4.81%. Interest expenses are well contained at 1.48% of revenue. Overall, 78.57% of income statement metrics are favorable, with no unfavorable indicators, supporting a positive view on the company’s profitability and growth trajectory.

Financial Ratios

The following table presents key financial ratios for Dell Technologies Inc. over the fiscal years 2021 to 2025, illustrating profitability, valuation, liquidity, leverage, efficiency, and dividend metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | 3.7% | 5.5% | 2.4% | 3.8% | 4.8% |

| ROE | 1.1% | -3.3% | -0.8% | -1.5% | -3.1% |

| ROIC | 4.6% | 9.2% | 9.7% | 11.0% | 14.7% |

| P/E | 8.6 | 7.8 | 12.2 | 18.0 | 15.7 |

| P/B | 9.4 | -25.7 | -9.5 | -27.4 | -48.7 |

| Current Ratio | 0.80 | 0.80 | 0.82 | 0.74 | 0.78 |

| Quick Ratio | 0.74 | 0.70 | 0.73 | 0.67 | 0.63 |

| D/E | 14.0 | -16.0 | -9.5 | -11.7 | -16.6 |

| Debt-to-Assets | 33.6% | 29.1% | 33.0% | 31.7% | 30.8% |

| Interest Coverage | 1.8 | 3.0 | 4.5 | 3.6 | 4.4 |

| Asset Turnover | 0.70 | 1.09 | 1.14 | 1.08 | 1.20 |

| Fixed Asset Turnover | 17.9 | 18.7 | 16.5 | 13.7 | 15.1 |

| Dividend Yield | 0.0% | 0.0% | 3.2% | 1.8% | 1.8% |

Evolution of Financial Ratios

Between 2021 and 2025, Dell Technologies Inc. showed fluctuating trends in key financial ratios. Return on Equity (ROE) shifted from a positive 1.1% in 2021 to a negative -309.85% in 2025, indicating growing challenges in profitability. The Current Ratio remained consistently below 1, around 0.78 in 2025, reflecting liquidity constraints. The Debt-to-Equity Ratio was negative in 2025, signaling an unusual capital structure trend.

Are the Financial Ratios Favorable?

In 2025, Dell’s profitability ratios like net margin (4.81%) and ROE (-309.85%) were unfavorable, while Return on Invested Capital (14.71%) was favorable. Liquidity ratios, such as the current ratio (0.78) and quick ratio (0.63), were unfavorable, implying limited short-term asset coverage. Efficiency ratios like asset turnover (1.2) and fixed asset turnover (15.08) were favorable. Leverage showed mixed signals with a favorable negative debt-to-equity (-16.58) but neutral debt-to-assets (30.81%). Market valuation ratios, including price-to-earnings (15.71) and dividend yield (1.77%), held neutral stances. Overall, the ratio profile was slightly favorable.

Shareholder Return Policy

Dell Technologies Inc. pays dividends with a payout ratio near 28%, a steady dividend per share increase to $1.83 in 2025, and a yield around 1.77%. Share buybacks are also part of the policy, supported by free cash flow coverage above 40%, indicating a balanced approach to returns.

This distribution strategy appears sustainable given the company’s free cash flow generation and coverage ratios. However, the moderate dividend yield and reliance on buybacks require monitoring for long-term shareholder value, considering market and operational risks inherent to the sector.

Score analysis

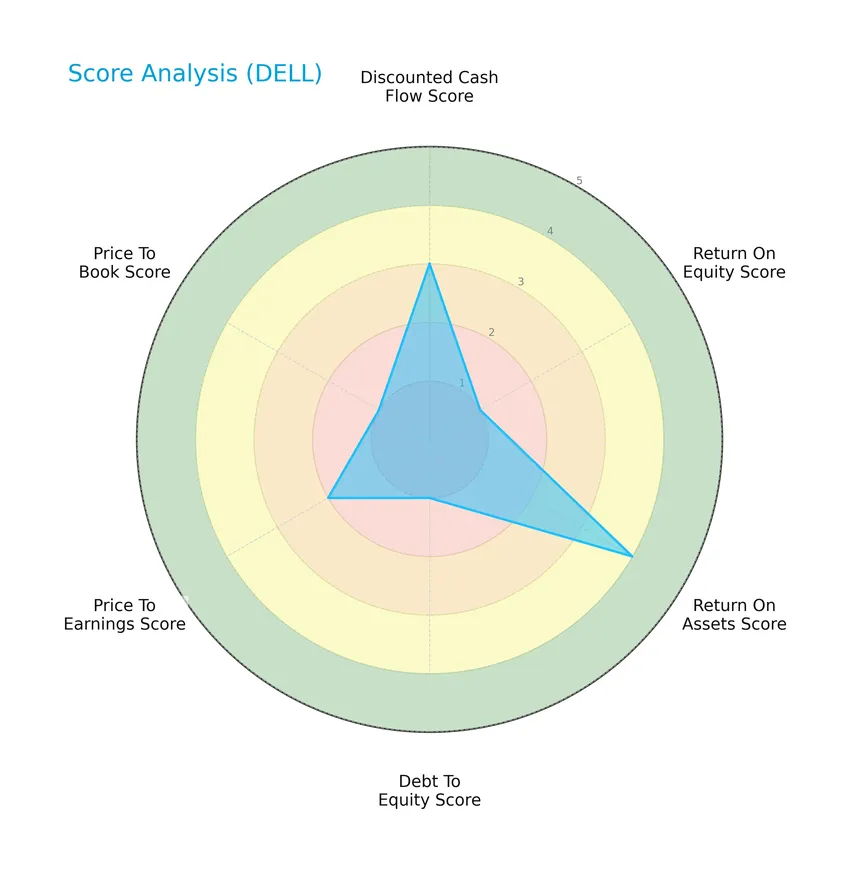

The following radar chart presents a comprehensive overview of Dell Technologies Inc.’s key financial scores:

Dell shows a moderate discounted cash flow score (3) and price-to-earnings score (2), but a very unfavorable return on equity (1), debt to equity (1), and price to book (1). Return on assets is favorable at 4, indicating mixed financial performance across these metrics.

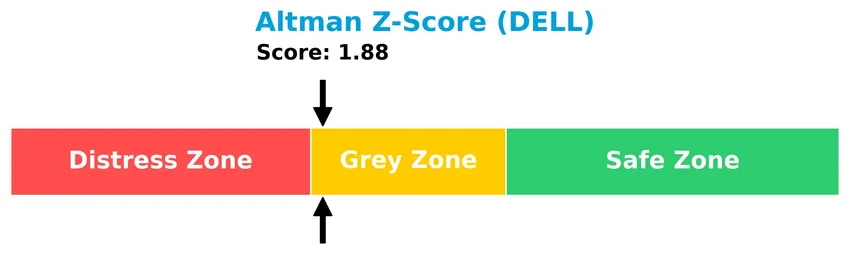

Analysis of the company’s bankruptcy risk

Dell Technologies Inc. is positioned in the grey zone of the Altman Z-Score, indicating a moderate risk of bankruptcy:

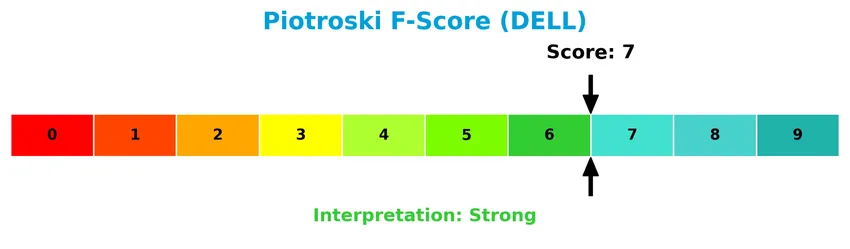

Is the company in good financial health?

The Piotroski F-Score diagram below illustrates Dell’s financial strength based on nine accounting criteria:

With a Piotroski score of 7, Dell is considered to have strong financial health, reflecting solid fundamentals despite some mixed score elements.

Competitive Landscape & Sector Positioning

This section provides an overview of Dell Technologies Inc.’s sector, covering strategic positioning, revenue by segment, key products, main competitors, and competitive advantages. I will assess whether Dell holds a competitive advantage over its industry peers.

Strategic Positioning

Dell Technologies Inc. maintains a diversified product portfolio across three main segments: Client Solutions, Infrastructure Solutions Group, and VMware, with revenues exceeding $140B in 2025. Geographically, it balances exposure between the U.S. ($51B) and international markets ($44.5B), reflecting a broad global footprint within the technology sector.

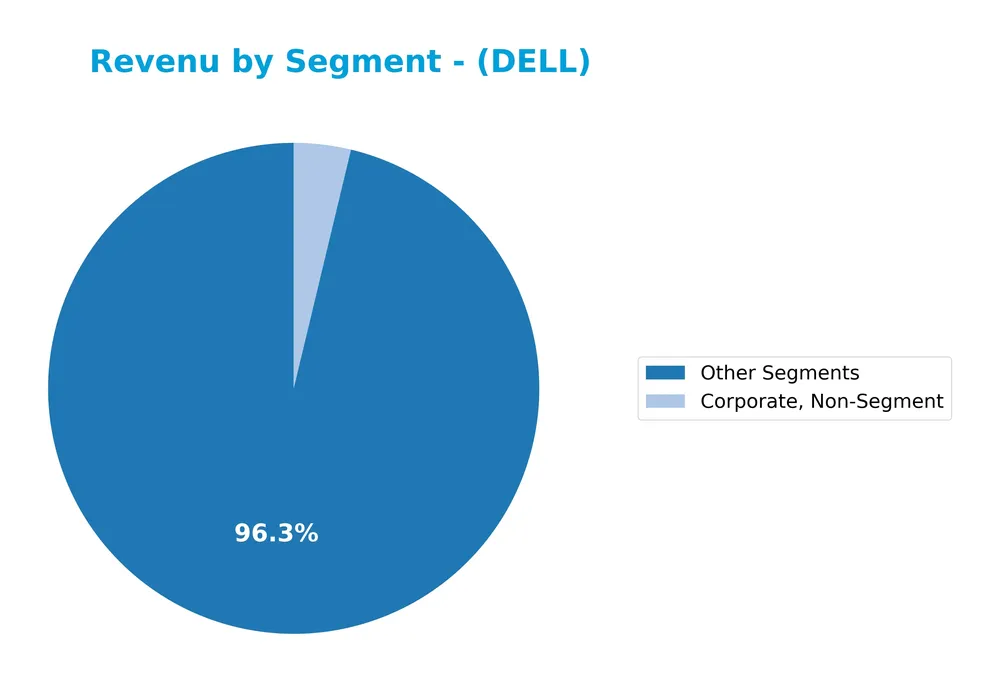

Revenue by Segment

This pie chart displays Dell Technologies Inc.’s revenue breakdown by segment for the fiscal year 2025, illustrating the composition of its business units.

In 2025, Dell’s reported revenue is heavily concentrated in “Other Segments” at 91.9B, a significant increase compared to prior years where “Client Solutions” and “Infrastructure Solutions Group” were dominant. The absence of detailed segment data for 2025 limits trend comparison, but the sharp rise in “Other Segments” suggests a major shift or reclassification. Previous years showed steady contributions from Client Solutions (~48-61B) and Infrastructure Solutions (~32-38B), indicating diversification risk if the recent concentration persists.

Key Products & Brands

The table below outlines Dell Technologies Inc.’s primary products and business segments:

| Product | Description |

|---|---|

| Client Solutions Group | Provides desktops, workstations, notebooks, displays, projectors, software, peripherals, and related support and warranty services. |

| Infrastructure Solutions Group (ISG) | Offers storage solutions, rack, blade, tower, hyperscale servers, networking products, software, peripherals, and support services. |

| VMware | Supports hybrid and multi-cloud management, modern applications, networking, security, and digital workspaces. |

| Other Segments | Encompasses additional IT solutions, products, and services not detailed in the main segments. |

| Corporate, Non-Segment | Corporate-level activities and expenses not allocated to segments. |

Dell Technologies operates through diverse segments focusing on hardware, software, and cloud infrastructure solutions, serving a global IT customer base with integrated technology offerings.

Main Competitors

Dell Technologies Inc. operates in a competitive landscape with 12 key players, here are the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Arista Networks, Inc. | 168B |

| Dell Technologies Inc. | 86B |

| Western Digital Corporation | 65B |

| Seagate Technology Holdings plc | 61B |

| Pure Storage, Inc. | 22B |

| NetApp, Inc. | 21B |

| HP Inc. | 21B |

| Super Micro Computer, Inc. | 18B |

| IonQ, Inc. | 16B |

| D-Wave Quantum Inc. | 9B |

Dell Technologies Inc. holds the 2nd position among its 12 competitors, with a market cap at 46% of the sector leader, Arista Networks. It ranks above both the average market cap of the top 10 competitors (approximately 49B) and the median market cap in the sector (about 21B). Dell shows a significant gap of +117% to the next competitor above, highlighting a strong market position relative to its peers.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does Dell have a competitive advantage?

Dell Technologies Inc. presents a competitive advantage, demonstrated by a very favorable economic moat. Its return on invested capital (ROIC) exceeds its weighted average cost of capital (WACC) by 6.5%, with a strong upward ROIC trend of 217%, indicating efficient capital use and value creation.

Looking ahead, Dell’s future outlook includes growth opportunities in hybrid and multi-cloud services, modern applications, and IT infrastructure modernization. The company’s diversified segments, including VMware and Infrastructure Solutions Group, support its expansion in evolving technology markets.

SWOT Analysis

This SWOT analysis highlights the key internal and external factors affecting Dell Technologies Inc., assisting investors in understanding its strategic position.

Strengths

- strong revenue growth at 10.27% CAGR

- durable competitive advantage with rising ROIC

- diversified global presence with $95.5B revenue in 2025

Weaknesses

- weak current and quick ratios below 1

- negative return on equity at -310%

- moderate net margin of 4.81%

Opportunities

- expanding hybrid and multi-cloud market via VMware segment

- growing IT infrastructure modernization demand

- potential for margin improvement through operational efficiency

Threats

- intense competition in computer hardware sector

- supply chain disruptions impacting production

- economic downturns reducing IT spending

Overall, Dell shows robust growth and a solid competitive moat, but financial leverage and liquidity weaknesses require caution. The company should focus on leveraging cloud trends and improving financial resilience to sustain long-term value for investors.

Stock Price Action Analysis

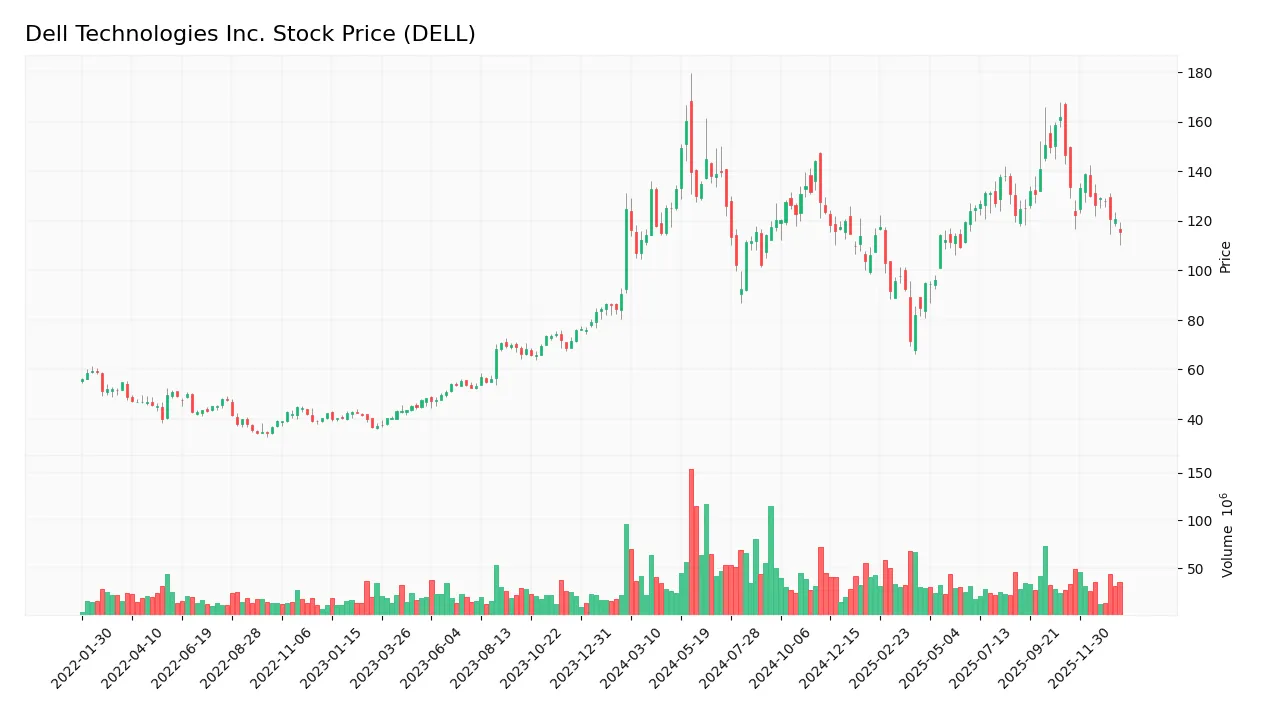

The following weekly chart illustrates Dell Technologies Inc.’s stock price movements over the past 100 weeks:

Trend Analysis

Over the past 12 months, Dell’s stock price declined by 7.35%, indicating a bearish trend. The price range fluctuated between a high of 162.01 and a low of 71.63, with a deceleration in the downward momentum. The overall volatility is notable, with a standard deviation of 16.67%, reflecting significant price swings.

Volume Analysis

In the last three months, trading volume has been decreasing, with sellers dominating at 76.76% of activity. This seller-driven volume suggests waning investor confidence and reduced market participation, reinforcing the bearish price trend observed in the recent period.

Target Prices

Analysts present a clear target consensus for Dell Technologies Inc., reflecting a moderately optimistic outlook.

| Target High | Target Low | Consensus |

|---|---|---|

| 200 | 111 | 163.67 |

The target prices suggest that analysts expect Dell’s stock to trade between 111 and 200, with a consensus around 164, indicating confidence in potential upside while acknowledging some downside risk.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines the latest analyst ratings and consumer feedback regarding Dell Technologies Inc.’s performance and reputation.

Stock Grades

Here is a summary of recent verified analyst grades for Dell Technologies Inc., illustrating current market sentiment and rating trends:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Underweight | 2026-01-20 |

| Citigroup | Maintain | Buy | 2026-01-20 |

| Barclays | Upgrade | Overweight | 2026-01-15 |

| Goldman Sachs | Maintain | Buy | 2026-01-14 |

| UBS | Maintain | Buy | 2025-11-26 |

| Morgan Stanley | Maintain | Underweight | 2025-11-26 |

| Mizuho | Maintain | Outperform | 2025-11-26 |

| B of A Securities | Maintain | Buy | 2025-11-26 |

| Barclays | Maintain | Equal Weight | 2025-11-26 |

| B of A Securities | Maintain | Buy | 2025-11-20 |

Overall, the consensus among analysts remains positive with a majority maintaining Buy or similar ratings, though Morgan Stanley consistently holds an Underweight stance, indicating some divergence in outlook. Barclays notably upgraded its rating recently, reflecting increased confidence.

Consumer Opinions

Consumers have varied experiences with Dell Technologies, reflecting both strong product performance and areas needing improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| Reliable build quality with durable laptops. | Customer service response times can be slow. |

| Competitive pricing for high-spec configurations. | Some users report occasional software glitches. |

| Wide range of products suited for different needs. | Limited customization options on certain models. |

| Effective warranty and support packages. | Shipping delays reported during peak seasons. |

Overall, Dell is praised for its reliable hardware and value pricing, though customer support responsiveness and occasional software issues remain common concerns among users.

Risk Analysis

Below is a summary table of key risks associated with Dell Technologies Inc., highlighting their probability and potential impact on the company’s performance:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Altman Z-Score in the grey zone (1.88) indicating moderate bankruptcy risk despite strong Piotroski score | Medium | High |

| Profitability | Unfavorable net margin (4.81%) and negative ROE (-309.85%) signaling weak returns to equity investors | High | High |

| Liquidity | Low current ratio (0.78) and quick ratio (0.63) raise concerns about short-term financial flexibility | Medium | Medium |

| Debt Management | Mixed signals with favorable debt-to-equity but neutral debt-to-assets and moderate interest coverage | Medium | Medium |

| Market Volatility | Beta of 1.112 suggests slightly above-market volatility, impacting share price stability | Medium | Medium |

| Competitive Tech | Rapid innovation in IT solutions and cloud services may pressure Dell’s market share and margins | High | High |

The most critical risks are Dell’s moderate financial distress signs and weak profitability metrics, which could challenge growth and shareholder returns. Additionally, the technology sector’s fast pace demands continuous innovation to maintain competitive advantage. Investors should monitor liquidity closely and be cautious of market volatility.

Should You Buy Dell Technologies Inc.?

Dell Technologies Inc. appears to be generating robust value creation supported by a durable competitive moat with growing profitability; however, its leverage profile could be seen as substantial, reflecting moderate financial risk, while its overall rating suggests a cautious investment profile.

Strength & Efficiency Pillars

Dell Technologies Inc. exhibits a solid value creation profile with a return on invested capital (ROIC) of 14.71% comfortably exceeding its weighted average cost of capital (WACC) at 8.18%, confirming the company as a value creator. The firm maintains a strong Piotroski score of 7, indicating robust financial health and operational efficiency. Although the Altman Z-score of 1.88 places Dell in the grey zone, suggesting moderate bankruptcy risk, its asset turnover ratios (1.2) and fixed asset turnover (15.08) are favorable, underscoring operational efficiency. These metrics collectively highlight Dell’s durable competitive advantage and improving profitability.

Weaknesses and Drawbacks

Despite these strengths, Dell faces notable challenges. Its return on equity (ROE) is deeply negative at -309.85%, signaling poor shareholder returns and potential capital inefficiency. Liquidity ratios are weak, with a current ratio of 0.78 and quick ratio of 0.63, implying potential short-term solvency concerns. The debt-to-equity ratio is negative at -16.58, an unusual figure that warrants cautious interpretation, but it aligns with the very unfavorable debt profile score. Additionally, recent market dynamics reveal seller dominance with only 23.24% buyer volume from November 2025 to January 2026, contributing to a bearish stock trend and a 21.32% price decline over that period, reflecting significant near-term market pressure.

Our Verdict about Dell Technologies Inc.

Dell’s long-term fundamental profile may appear favorable due to its value creation and strong financial scoring, particularly the Piotroski assessment. However, the recent seller-dominant trend and pronounced price decline suggest caution. Despite long-term strength, recent market pressure implies a wait-and-see stance may be prudent to secure a better entry point. Investors should weigh Dell’s improving profitability against short-term liquidity and market headwinds before committing capital.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Dell Technologies Inc. $DELL Shares Bought by Jennison Associates LLC – MarketBeat (Jan 24, 2026)

- Why Dell (DELL) Shares Are Getting Obliterated Today – Yahoo Finance (Jan 20, 2026)

- What’s Happening With Dell Stock? – Trefis (Jan 22, 2026)

- Lobbying Update: $1,480,000 of DELL TECHNOLOGIES INC lobbying was just disclosed – Quiver Quantitative (Jan 20, 2026)

- US IT hardware stocks tumble as Morgan Stanley flags slowing demand – Reuters (Jan 20, 2026)

For more information about Dell Technologies Inc., please visit the official website: delltechnologies.com