Home > Analyses > Technology > Dayforce Inc

Dayforce Inc. transforms how organizations manage their workforce by integrating human resources, payroll, benefits, and talent management into a unified cloud platform. As a prominent player in the software application industry, Dayforce’s flagship product revolutionizes operational efficiency for businesses worldwide, earning a reputation for innovation and reliability. With its leadership firmly established, the critical question for investors is whether Dayforce’s solid fundamentals and market influence continue to support its current valuation and growth trajectory.

Table of contents

Business Model & Company Overview

Dayforce Inc, founded in 2013 and headquartered in Minneapolis, Minnesota, is a leading player in the human capital management (HCM) software industry. Its core business revolves around a comprehensive cloud platform, Dayforce, which integrates human resources, payroll, benefits, workforce, and talent management into a seamless ecosystem. This unified approach positions the company as a pivotal enabler of workforce optimization across the United States, Canada, and international markets.

The company’s revenue engine balances cloud-based software subscriptions with specialized payroll and HR services, including Powerpay for small businesses and Bureau payroll solutions. Dayforce’s strategic footprint spans the Americas, Europe, and Asia, leveraging direct sales and third-party channels to capture diverse market segments. Its competitive advantage lies in delivering an all-in-one platform that strengthens customer retention and scalability, establishing a robust economic moat that shapes the future of workforce management.

Financial Performance & Fundamental Metrics

This section provides a clear analysis of Dayforce Inc’s income statement, key financial ratios, and dividend payout policy to guide your investment decisions.

Income Statement

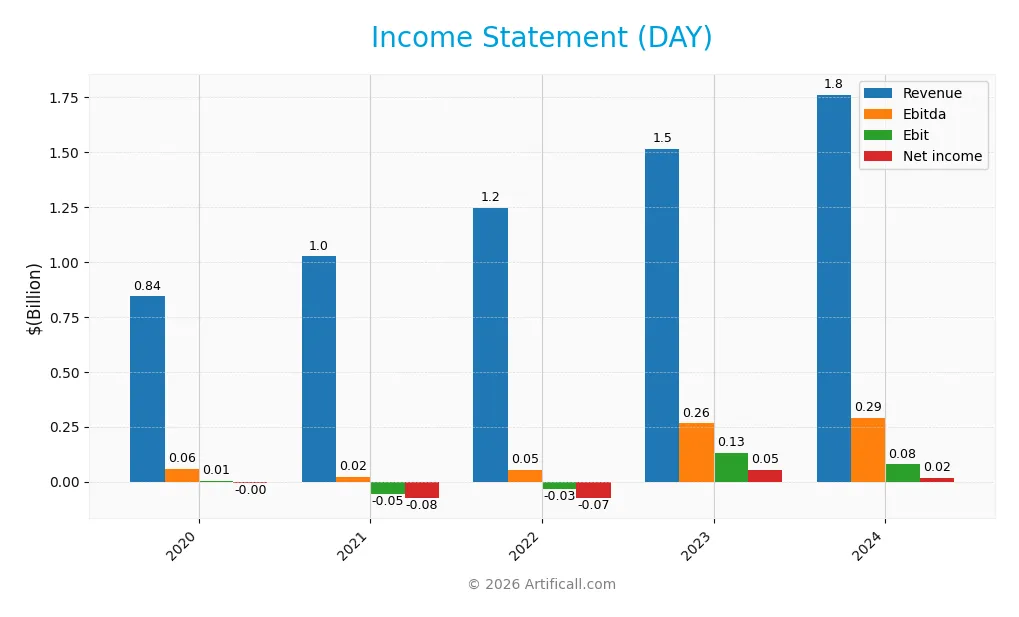

Below is Dayforce Inc’s Income Statement for fiscal years 2020 through 2024, reflecting key financial metrics in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 843M | 1.02B | 1.25B | 1.51B | 1.76B |

| Cost of Revenue | 501M | 642M | 773M | 867M | 948M |

| Operating Expenses | 334M | 418M | 499M | 513M | 708M |

| Gross Profit | 341M | 382M | 473M | 647M | 812M |

| EBITDA | 57M | 23M | 55M | 265M | 288M |

| EBIT | 5.1M | -54M | -34M | 132M | 78M |

| Interest Expense | 25M | 36M | 29M | 36M | 41M |

| Net Income | -4.0M | -75M | -73M | 55M | 18M |

| EPS | -0.03 | -0.50 | -0.48 | 0.35 | 0.11 |

| Filing Date | 2021-02-26 | 2022-02-28 | 2023-11-13 | 2024-02-28 | 2025-02-28 |

Income Statement Evolution

Dayforce Inc’s revenue grew significantly by 16.27% from 2023 to 2024, continuing an overall positive trend with a 108.9% increase since 2020. Gross profit rose sharply by 25.61% last year, enhancing gross margin to a favorable 46.14%. However, EBIT declined 40.8% and the net margin contracted by 71.59%, signaling margin pressure despite top-line growth. Operating expenses increased in line with revenue, impacting profitability.

Is the Income Statement Favorable?

In 2024, Dayforce generated $1.76B in revenue with a net income of $18.1M, reflecting a modest net margin of 1.03%, classified as neutral. EBIT margin stood at 4.44%, also neutral, while interest expenses remained favorable at 2.31% of revenue. Despite strong revenue and gross profit growth, earnings and margins weakened compared to the prior year. Overall, the income statement fundamentals appear generally favorable, supported by robust top-line expansion and improving gross profitability, but tempered by declining earnings performance.

Financial Ratios

The following table presents key financial ratios for Dayforce Inc over recent fiscal years, offering insights into profitability, liquidity, leverage, and market valuation:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | -0.5% | -7.4% | -5.9% | 3.6% | 1.0% |

| ROE | -0.2% | -3.4% | -3.5% | 2.3% | 0.7% |

| ROIC | 0.05% | -0.9% | -0.8% | 2.1% | 1.3% |

| P/E | -3910 | -208 | -134 | 190 | 633 |

| P/B | 7.45 | 7.05 | 4.65 | 4.35 | 4.50 |

| Current Ratio | 1.07 | 1.11 | 1.07 | 1.12 | 1.13 |

| Quick Ratio | 1.07 | 1.11 | 1.07 | 1.12 | 1.13 |

| D/E | 0.34 | 0.53 | 0.59 | 0.52 | 0.48 |

| Debt-to-Assets | 11% | 16% | 15% | 14% | 14% |

| Interest Coverage | 0.31 | -0.99 | -0.90 | 3.69 | 2.56 |

| Asset Turnover | 0.13 | 0.14 | 0.15 | 0.17 | 0.19 |

| Fixed Asset Turnover | 5.13 | 6.50 | 6.26 | 6.60 | 7.46 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Evolution of Financial Ratios

Dayforce Inc’s Return on Equity (ROE) has remained low and unfavorable at 0.71% in 2024, showing limited improvement over prior years. The Current Ratio was stable around 1.1 to 1.13, indicating steady but moderate liquidity. The Debt-to-Equity Ratio declined to 0.48 in 2024, reflecting a modest reduction in leverage. Profitability margins, including net margin at 1.03%, remain weak, signaling persistent challenges in generating strong profits.

Are the Financial Ratios Favorable?

In 2024, Dayforce’s financial ratios present a generally unfavorable profile. Profitability measures like net margin and ROE are low, while the price-to-earnings ratio is extremely high at 633, suggesting overvaluation or weak earnings. Liquidity ratios show neutrality to favorability, with a quick ratio of 1.13 and current ratio near 1.13. Leverage ratios, including debt-to-equity at 0.48 and debt-to-assets at 13.5%, are favorable. Asset turnover is low, indicating efficiency issues, and the company pays no dividends. Overall, 57% of key ratios are unfavorable, 29% favorable, and 14% neutral, resulting in a broadly unfavorable financial stance.

Shareholder Return Policy

Dayforce Inc does not pay dividends, reflecting its focus on reinvestment and growth rather than immediate shareholder payouts. The company maintains a zero dividend payout ratio with no dividend yield, which aligns with its operational strategy and financial metrics over recent years.

Despite the absence of dividends, there is no indication of share buyback programs. This approach suggests a prioritization of capital for development or expansion rather than direct shareholder distributions, supporting potential long-term value creation under current conditions.

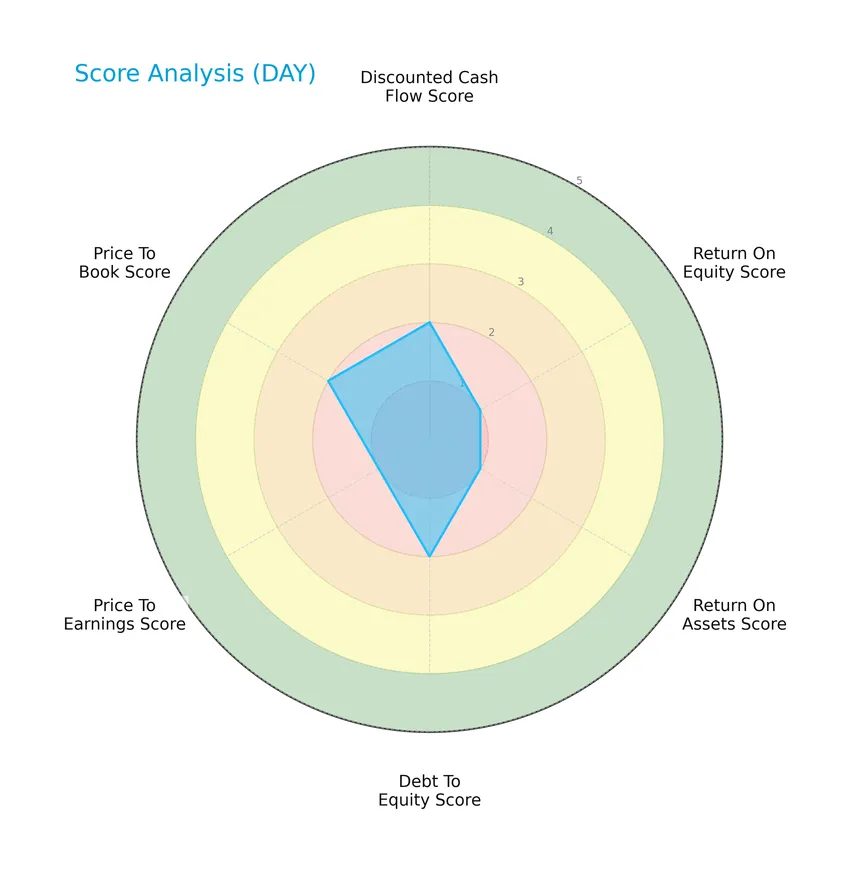

Score analysis

The following radar chart illustrates the company’s various financial scores to provide a comprehensive overview:

Dayforce Inc shows a mixed financial profile with moderate scores in discounted cash flow, debt to equity, and price to book metrics, while profitability and valuation indicators such as return on equity, return on assets, and price to earnings remain very unfavorable.

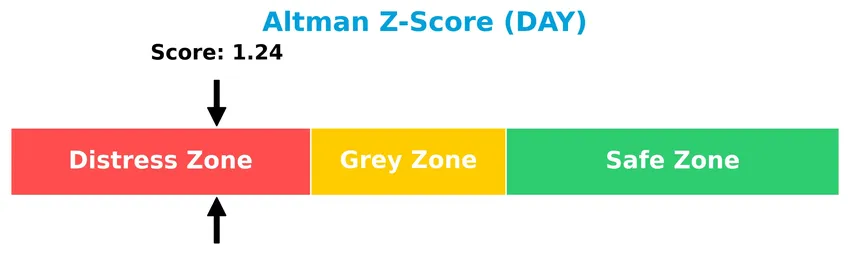

Analysis of the company’s bankruptcy risk

The Altman Z-Score places Dayforce Inc in the distress zone, indicating a high probability of financial distress and potential risk of bankruptcy:

Is the company in good financial health?

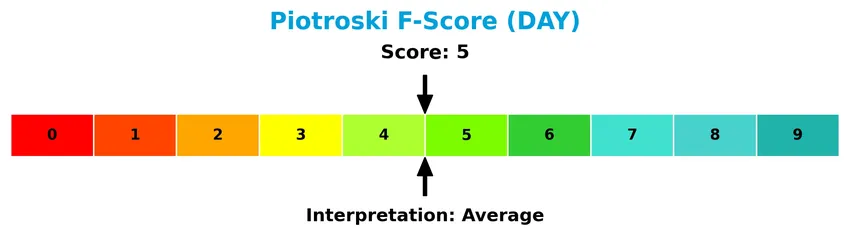

The Piotroski Score diagram provides insight into the company’s financial strength based on nine key criteria:

With a Piotroski Score of 5, Dayforce Inc reflects an average financial health status, suggesting moderate operational and financial performance without clear strong or weak signals.

Competitive Landscape & Sector Positioning

This sector analysis will examine Dayforce Inc’s strategic positioning, revenue by segment, key products, main competitors, and competitive advantages. I will assess whether Dayforce holds a competitive advantage over its rivals in the software application industry.

Strategic Positioning

Dayforce Inc focuses on a diversified product portfolio centered on cloud-based human capital management solutions, including Dayforce and Powerpay, serving both large enterprises and small businesses. Geographically, it generates most revenue from the US, with significant contributions from Canada and other countries, reflecting a balanced North American and international presence.

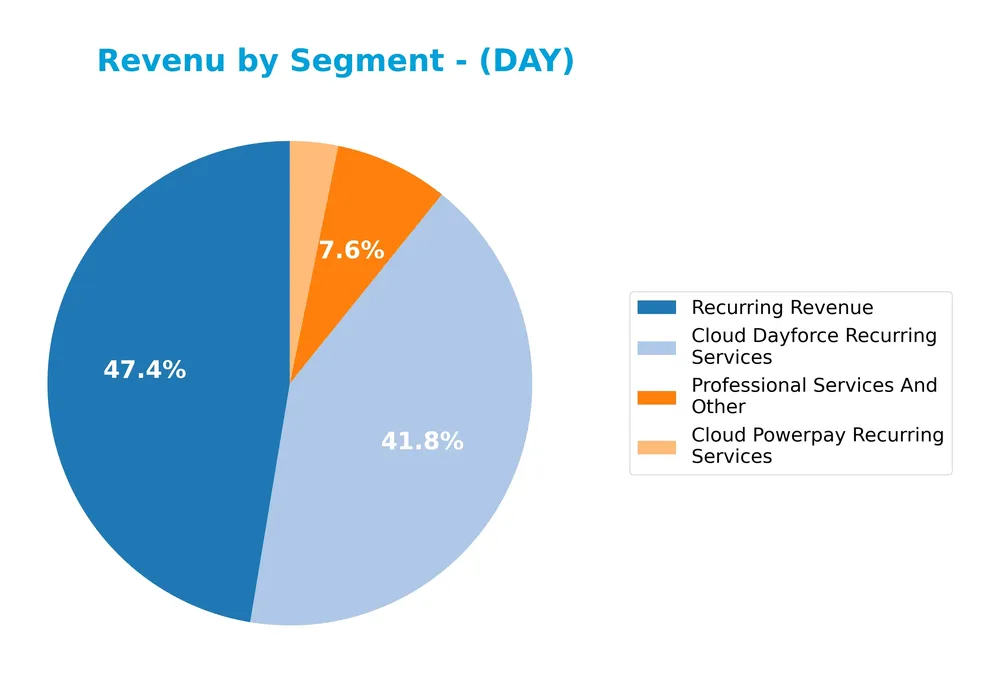

Revenue by Segment

This pie chart displays Dayforce Inc’s revenue breakdown by segment for fiscal years 2023 and 2024, highlighting contributions from recurring services and professional services.

The overall trend shows growth in all segments from 2023 to 2024, with total recurring revenue rising from 1.30B to 1.52B. Cloud Dayforce Recurring Services remain the dominant revenue driver, increasing from 1.11B to 1.34B, while Cloud Powerpay Recurring Services and Professional Services have more modest but steady growth. The 2024 data indicates a healthy acceleration in recurring revenues, reducing concentration risk by maintaining diverse income streams.

Key Products & Brands

The table below highlights Dayforce Inc’s main products and brands along with their core features:

| Product | Description |

|---|---|

| Dayforce | A cloud human capital management (HCM) platform offering HR, payroll, benefits, workforce, and talent management. |

| Powerpay | A cloud HR and payroll solution targeting the small business market. |

| Bureau Solutions | Payroll and payroll-related services provided to clients. |

Dayforce Inc’s product portfolio centers on cloud-based HCM solutions, with Dayforce as its flagship platform complemented by Powerpay for smaller businesses and bureau payroll services. These offerings generate the majority of the company’s recurring revenue.

Main Competitors

There are 33 competitors in the Technology sector’s Software – Application industry; below are the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Salesforce, Inc. | 242.5B |

| Shopify Inc. | 209.6B |

| AppLovin Corporation | 209.0B |

| Intuit Inc. | 175.2B |

| Uber Technologies, Inc. | 172.2B |

| ServiceNow, Inc. | 153.0B |

| Cadence Design Systems, Inc. | 84.5B |

| Snowflake Inc. | 73.4B |

| Autodesk, Inc. | 61.2B |

| Workday, Inc. | 54.9B |

Dayforce Inc ranks 22nd among 33 competitors, with a market cap only 4.58% that of the leader, Salesforce, Inc. It sits below both the average market cap of the top 10 competitors (143.6B) and the median market cap of the sector (18.8B). The company is narrowly ahead of its closest competitor above by 0.32%, indicating a tight competitive position in the mid-tier segment.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does DAY have a competitive advantage?

Dayforce Inc currently does not demonstrate a strong competitive advantage, as its return on invested capital (ROIC) is below its weighted average cost of capital (WACC), indicating value destruction despite a growing ROIC trend. The company’s income statement shows a favorable overall financial performance with significant revenue and net income growth over the 2020-2024 period, but recent margins and earnings growth have been mixed.

Looking ahead, Dayforce is positioned in the human capital management software industry with its cloud-based platforms like Dayforce and Powerpay, serving markets in the US, Canada, and internationally. Expansion opportunities may arise from new product innovations and broader market penetration, supported by its direct and third-party sales channels.

SWOT Analysis

This SWOT analysis highlights the key internal and external factors affecting Dayforce Inc to guide strategic investment decisions.

Strengths

- Strong revenue growth (16.3% YoY)

- Robust cloud HCM platform

- Expanding international presence

Weaknesses

- Low net margin (1.03%)

- High PE ratio (633) indicating overvaluation

- Moderate interest coverage ratio (1.93)

Opportunities

- Growing demand for cloud-based HR solutions

- Expansion into small business payroll market

- Increasing adoption of workforce management tools

Threats

- Intense competition in software industry

- Economic downturn impacting tech spending

- Regulatory changes affecting payroll services

Overall, Dayforce shows strong growth potential driven by its cloud platform and expanding markets but faces profitability challenges and valuation risks. Strategic focus should balance growth initiatives with improving operational efficiency to enhance shareholder value.

Stock Price Action Analysis

The following weekly stock chart for Dayforce Inc illustrates price movements and key levels over the past 12 months:

Trend Analysis

Over the past 12 months, Dayforce Inc’s stock price rose by 1.71%, indicating a bullish trend with deceleration in momentum. The price ranged between a low of 49.46 and a high of 81.14. Volatility remains elevated, with a standard deviation of 7.82, suggesting swings despite the modest upward direction.

Volume Analysis

Trading volume over the last three months shows a slightly buyer-driven market, with buyers accounting for 57.39% of activity. Volume is increasing, reflecting growing market participation and a cautious optimism among investors supporting the stock.

Target Prices

The consensus target price for Dayforce Inc (DAY) suggests a steady outlook among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 70 | 70 | 70 |

All available analyst projections align at a target price of 70, indicating a unified expectation of the stock’s valuation.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews the latest analyst ratings and consumer feedback on Dayforce Inc to gauge market sentiment.

Stock Grades

Here is a summary of recent analyst grade changes for Dayforce Inc from recognized financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Hold | 2025-10-30 |

| Stifel | Downgrade | Hold | 2025-09-19 |

| Citigroup | Downgrade | Neutral | 2025-09-17 |

| Wells Fargo | Upgrade | Equal Weight | 2025-08-22 |

| BMO Capital | Downgrade | Market Perform | 2025-08-22 |

| Keybanc | Downgrade | Sector Weight | 2025-08-22 |

| Needham | Downgrade | Hold | 2025-08-22 |

| Barclays | Maintain | Equal Weight | 2025-08-22 |

| Deutsche Bank | Maintain | Hold | 2025-08-22 |

| Jefferies | Maintain | Hold | 2025-08-21 |

The overall trend shows a predominance of hold or neutral ratings with several downgrades from buy or outperform statuses, indicating a cautious stance among analysts. No strong buy or sell recommendations are present, reflecting moderate consensus around the stock.

Consumer Opinions

Consumers express a mixed yet insightful perspective on Dayforce Inc, reflecting both satisfaction and areas for improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| “Dayforce’s user interface is intuitive and easy to navigate, making payroll processing smoother.” | “Customer support response times are often slow, causing delays in issue resolution.” |

| “Integration with other HR tools has streamlined our workforce management significantly.” | “The mobile app occasionally crashes, impacting productivity on the go.” |

| “Regular updates have improved functionality and added useful features.” | “Pricing can be high for small businesses, limiting accessibility.” |

Overall, consumers appreciate Dayforce Inc’s robust integration and user-friendly design but frequently point out concerns regarding customer support and mobile app stability. Pricing is also a noted consideration for smaller clients.

Risk Analysis

The table below summarizes the key risks associated with investing in Dayforce Inc, focusing on their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Low profitability margins and unfavorable return on equity and invested capital levels. | High | High |

| Valuation Risk | Extremely high P/E ratio (633.29) signals potential overvaluation and correction risk. | High | High |

| Bankruptcy Risk | Altman Z-Score in distress zone (1.24), indicating moderate to high bankruptcy probability. | Medium | High |

| Liquidity | Moderate current ratio (1.13) but favorable quick ratio suggests manageable short-term liquidity. | Medium | Medium |

| Debt Management | Favorable debt-to-equity (0.48) and debt-to-assets (13.52%) ratios reduce solvency risk. | Low | Medium |

| Market Volatility | Beta of 1.18 implies above-average price volatility, increasing investment risk. | Medium | Medium |

The most critical risks lie in Dayforce’s weak profitability and extremely stretched valuation, which could lead to significant price corrections. Additionally, the low Altman Z-Score warns of financial distress, warranting cautious risk management before investing.

Should You Buy Dayforce Inc?

Dayforce Inc appears to exhibit improving operational efficiency amid a slightly unfavorable competitive moat due to value destruction, while maintaining a moderate leverage profile. Despite a cautious rating of C-, the analytical interpretation suggests a nuanced investment profile warranting careful risk consideration.

Strength & Efficiency Pillars

Dayforce Inc exhibits moderate financial health with a quick ratio of 1.13 and a conservative debt-to-equity ratio of 0.48, indicating manageable leverage and liquidity. The company’s gross margin stands favorably at 46.14%, underscoring operational efficiency in cost management. However, profitability remains subdued, reflected in a net margin of just 1.03% and a return on equity of 0.71%. With a return on invested capital (ROIC) of 1.31% trailing well below its weighted average cost of capital (WACC) at 8.71%, Dayforce is not currently a value creator. The Altman Z-score of 1.24 places it in the distress zone, signaling financial vulnerability, while a Piotroski score of 5 suggests average financial strength.

Weaknesses and Drawbacks

Significant valuation concerns cloud Dayforce’s outlook, with an elevated price-to-earnings ratio of 633.29 and a price-to-book ratio of 4.5, both flagged as unfavorable, suggesting the market prices in high growth that may be hard to justify amid weak profitability. The company’s interest coverage ratio of 1.93 is below comfortable levels, raising concerns about its ability to service debt amid tightening margins. Asset turnover at 0.19 is low, indicating inefficient asset use, while the absence of dividend yield could deter income-focused investors. These factors, combined with a modest buyer dominance of 57.39% in the recent period, suggest vulnerability to market pressure despite a generally bullish stock trend.

Our Verdict about Dayforce Inc

Dayforce presents an unfavorable long-term fundamental profile, hindered by weak profitability and value destruction as indicated by ROIC under WACC. Nonetheless, the stock’s technicals show a bullish trend with increasing volume and buyer dominance, suggesting some market confidence. This juxtaposition implies that while Dayforce might appeal to those seeking growth exposure, the current elevated valuation and financial risks suggest a cautious, wait-and-see approach may be prudent for investors considering entry.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Fortive (FTV) vs Dayforce (DAY): Which Industrial Software Play Wins? – Yahoo Finance (Jan 21, 2026)

- Palmetto Grain Brokerage – – Palmetto Grain Brokerage (Jan 09, 2026)

- Dayforce Stockholders Approve Acquisition by Thoma Bravo – GlobeNewswire (Nov 12, 2025)

- Thoma Bravo Is Said to Be in Talks to Buy Software Firm Dayforce – Bloomberg (Aug 18, 2025)

- Dayforce shareholders back Thoma Bravo’s $12.3 billion take-private deal – Reuters (Nov 12, 2025)

For more information about Dayforce Inc, please visit the official website: ceridian.com