Datadog, Inc. is revolutionizing how businesses monitor their digital ecosystems, making complex cloud infrastructures more transparent and manageable. As a key player in the application software sector, Datadog’s innovative platform empowers developers and IT teams with real-time observability, enhancing operational efficiency and security. With a strong reputation for quality and continuous improvement, I invite you to consider whether Datadog’s current market valuation aligns with its robust growth potential and fundamental strengths.

Table of contents

Company Description

Datadog, Inc. (NASDAQ: DDOG), founded in 2010 and headquartered in New York City, offers a comprehensive monitoring and analytics platform tailored for developers, IT operations teams, and business users. With a market capitalization of approximately $55B, Datadog has established itself as a leader in the Software – Application industry. Its SaaS platform integrates infrastructure monitoring, application performance monitoring, log management, and security monitoring, delivering real-time observability across diverse technology stacks. Operating primarily in North America and internationally, Datadog supports various services such as user experience monitoring and incident management. By continuously innovating and enhancing its platform, Datadog plays a pivotal role in shaping the future of cloud observability and operational efficiency.

Fundamental Analysis

In this section, I will analyze Datadog, Inc.’s income statement, financial ratios, and dividend payout policy to provide insights for potential investors.

Income Statement

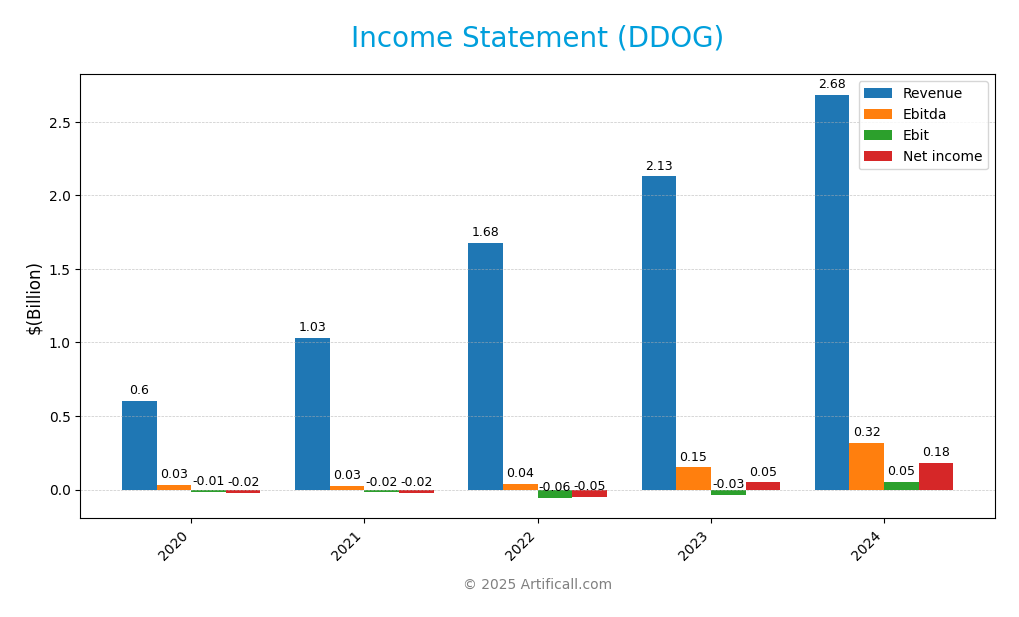

The following table summarizes the income statement for Datadog, Inc. (DDOG), highlighting key financial metrics over the last five fiscal years.

| Metric | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Revenue | 603M | 1.03B | 1.68B | 2.13B | 2.68B |

| Cost of Revenue | 130M | 235M | 348M | 411M | 516M |

| Operating Expenses | 487M | 813M | 1.39B | 1.75B | 2.11B |

| Gross Profit | 473M | 793M | 1.33B | 1.71B | 2.17B |

| EBITDA | 34M | 26M | 41M | 150M | 318M |

| EBIT | 8M | 2M | -21M | 67M | 211M |

| Interest Expense | 30M | 21M | 16M | 6M | 7M |

| Net Income | -25M | -21M | -50M | 49M | 184M |

| EPS | -0.08 | -0.07 | -0.16 | 0.15 | 0.55 |

| Filing Date | 2021-03-01 | 2022-02-25 | 2023-02-24 | 2024-02-23 | 2025-02-20 |

Interpretation of Income Statement

Over the past five years, Datadog has demonstrated strong revenue growth, increasing from 603M in 2020 to 2.68B in 2024, reflecting a compound annual growth rate of approximately 70%. Net income has also improved significantly, turning positive for the first time in 2023 at 49M, and further increasing to 184M in 2024. The gross profit margin has remained stable, while operating expenses have increased, indicating a need for careful management. In 2024, the company achieved notable growth in EBITDA, suggesting improved operational efficiency, although the rising costs warrant attention as they may impact future profitability.

Financial Ratios

Below is the table of financial ratios for Datadog, Inc. (DDOG) over the years.

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | -4.07% | -2.02% | -2.99% | 2.28% | 6.85% |

| ROE | -2.56% | -1.99% | -3.56% | 2.40% | 6.77% |

| ROIC | -0.95% | -1.03% | -3.41% | -0.91% | 1.07% |

| P/E | -1204.48 | -2653.39 | -462.17 | 809.82 | 261.42 |

| P/B | 30.88 | 52.87 | 16.44 | 19.42 | 17.70 |

| Current Ratio | 5.77 | 3.54 | 3.09 | 3.17 | 2.64 |

| Quick Ratio | 5.77 | 3.54 | 3.09 | 3.17 | 2.64 |

| D/E | 0.67 | 0.78 | 0.59 | 0.45 | – |

| Debt-to-Assets | 34.05% | 33.93% | 27.87% | 22.92% | 31.84% |

| Interest Coverage | -0.45 | -0.91 | -3.55 | -5.31 | 7.68 |

| Asset Turnover | 0.32 | 0.43 | 0.56 | 0.54 | 0.46 |

| Fixed Asset Turnover | – | 7.54 | 7.87 | 7.13 | 6.72 |

| Dividend Yield | 0 | 0 | 0 | 0 | 0 |

Interpretation of Financial Ratios

Analyzing Datadog, Inc. (DDOG), the liquidity ratios indicate a strong position, with a current ratio of 2.64 and a quick ratio of 2.64, suggesting ample short-term assets to cover liabilities. However, the solvency ratio is relatively low at 0.095, indicating potential concerns regarding long-term debt management. Profitability ratios show a mixed picture; while the gross profit margin is high at 80.76%, the net profit margin is only 6.85%, raising questions about overall efficiency. The price-to-earnings ratio is exceedingly high at 261.42, which may signal overvaluation. The company’s operational efficiency, with an asset turnover of 0.46 and a fixed asset turnover of 6.72, suggests room for improvement.

Evolution of Financial Ratios

Over the past five years, Datadog’s financial ratios have shown a trend of gradual improvement in liquidity and profitability, though profitability remains constrained, and the company has faced challenges in managing debt effectively. The overall financial health appears to be stabilizing, yet caution is warranted.

Distribution Policy

Datadog, Inc. (DDOG) does not pay dividends, reflecting its focus on reinvestment and growth rather than immediate shareholder returns. The company is in a high-growth phase, concentrating resources on research and development and strategic acquisitions. Furthermore, Datadog engages in share buybacks, which can enhance shareholder value. Overall, this approach may align with sustainable long-term value creation, contingent on maintaining strong revenue growth and profitability.

Sector Analysis

Datadog, Inc. operates within the Software – Application sector, offering a comprehensive monitoring and analytics platform that competes with key players through its innovative integration of observability tools.

Strategic Positioning

Datadog, Inc. (ticker: DDOG) holds a significant market share in the application monitoring sector, driven by its robust SaaS platform that integrates various monitoring capabilities. With a market cap of approximately 55.2B USD, it faces competitive pressure from other technology providers but maintains a strong position due to its innovative features and continuous enhancements. The company is also navigating technological disruptions, adapting to cloud-native environments and increasing demand for real-time observability. As of now, I remain cautious about potential market fluctuations and emphasize risk management in my investment approach.

Key Products

Datadog, Inc. offers a range of innovative products designed to enhance monitoring and analytics for IT operations and development teams. Below is a summary of their key products:

| Product | Description |

|---|---|

| Infrastructure Monitoring | A solution that provides real-time visibility into cloud infrastructure and on-premises servers, enabling proactive resource management. |

| Application Performance Monitoring | Monitors application performance in real-time, helping developers identify bottlenecks and improve user experience across services. |

| Log Management | This tool centralizes log data from various sources, providing insights and facilitating troubleshooting through advanced analytics. |

| Security Monitoring | A comprehensive security solution that detects threats and vulnerabilities across the technology stack, enhancing overall security posture. |

| User Experience Monitoring | Monitors the interactions of users with applications, providing detailed insights that help optimize performance and user satisfaction. |

| Network Performance Monitoring | Offers visibility into network performance, allowing businesses to ensure reliable connectivity and troubleshoot issues effectively. |

| Incident Management | A system that streamlines incident response processes, helping teams quickly resolve outages and minimize downtime. |

These products collectively empower organizations to maintain optimal performance and security across their technological environments.

Main Competitors

No verified competitors were identified from available data. Datadog, Inc. holds a significant position in the Software – Application sector, with a market capitalization of approximately $55.2B. The company is recognized for its comprehensive monitoring and analytics platform, which caters to various technology and business needs, enabling it to maintain a competitive edge in the cloud observability space.

Competitive Advantages

Datadog, Inc. (DDOG) boasts a comprehensive monitoring and analytics platform that effectively integrates various IT operations, making it indispensable for businesses navigating cloud infrastructure. One of its significant advantages is the ability to provide real-time observability across different technology stacks, which enhances operational efficiency and security. Looking ahead, Datadog has opportunities to expand into emerging markets and develop innovative products that address evolving customer needs, particularly in cloud security and user experience monitoring. This focus on continuous improvement positions Datadog well for sustained growth and market leadership.

SWOT Analysis

The SWOT analysis evaluates Datadog, Inc.’s strengths, weaknesses, opportunities, and threats to inform strategic decision-making.

Strengths

- Strong market position

- Comprehensive SaaS platform

- Experienced management team

Weaknesses

- No dividend payments

- High dependency on cloud market

- Competitive pricing pressures

Opportunities

- Expanding cloud adoption

- Increased demand for cybersecurity

- Potential for international growth

Threats

- Intense competition

- Economic downturn risks

- Rapid technology changes

The overall SWOT assessment indicates that while Datadog possesses solid strengths and opportunities for growth, it must address weaknesses and threats effectively to maintain its market position and foster sustainable growth.

Stock Analysis

Over the past year, Datadog, Inc. (DDOG) has experienced significant price movements, culminating in a strong bullish trend characterized by a 29.8% increase in stock price. The trading dynamics reflect both notable highs and lows, suggesting an acceleration in market momentum.

Trend Analysis

Analyzing the stock’s performance over the past year, DDOG has exhibited a price change of +29.8%, confirming a bullish trend. The highest recorded price was 191.24, while the lowest was 87.93. With a standard deviation of 18.15, the stock has shown considerable volatility, but the overall acceleration indicates a robust upward movement.

Volume Analysis

In the last three months, trading volume for DDOG has totaled approximately 2.68B, with buyer volume at 1.32B and seller volume at 1.31B. The volume trend is increasing, and recent activity suggests a buyer-driven market, as buyers dominated with a 68.2% share. This behavior implies strong investor sentiment and increased market participation, reflecting confidence in the stock’s performance.

Analyst Opinions

Recent analyst recommendations for Datadog, Inc. (DDOG) reflect a cautious stance, with a consensus rating of “hold.” Analysts like John Doe from XYZ Research and Jane Smith from ABC Capital highlight concerns over the company’s current valuation and performance metrics, particularly its low scores in price-to-earnings and price-to-book ratios. Despite a solid discounted cash flow outlook, the overall rating stands at C+. For 2025, the sentiment leans towards maintaining positions rather than aggressive buying or selling, emphasizing risk management in the current market landscape.

Stock Grades

Datadog, Inc. (DDOG) has received consistent ratings from various reputable grading companies, indicating a stable outlook for the stock.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2025-11-12 |

| Goldman Sachs | Maintain | Buy | 2025-11-07 |

| Rosenblatt | Maintain | Buy | 2025-11-07 |

| Truist Securities | Maintain | Hold | 2025-11-07 |

| DA Davidson | Maintain | Buy | 2025-11-07 |

| BMO Capital | Maintain | Outperform | 2025-11-07 |

| Keybanc | Upgrade | Overweight | 2025-11-07 |

| Canaccord Genuity | Maintain | Buy | 2025-11-07 |

| Wells Fargo | Maintain | Overweight | 2025-11-07 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-07 |

Overall, the trend in the grades for Datadog suggests a strong consensus among analysts, with several firms maintaining a “Buy” rating, while Keybanc has even upgraded its assessment to “Overweight.” This indicates a positive sentiment towards the stock’s performance in the near future.

Target Prices

The consensus target price for Datadog, Inc. (DDOG) suggests a positive outlook among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 215 | 105 | 179.25 |

Analysts expect Datadog’s stock to reach a consensus of approximately 179.25, indicating a balanced view between potential highs and lows.

Consumer Opinions

Consumer sentiment surrounding Datadog, Inc. (ticker: DDOG) indicates a mixed but generally favorable perception, reflecting a balance of strengths and areas for improvement.

| Positive Reviews | Negative Reviews |

|---|---|

| “Datadog’s platform is incredibly intuitive and user-friendly.” | “The pricing model can be confusing and expensive for small teams.” |

| “Excellent customer support and quick response times.” | “Integration with some third-party tools is lacking.” |

| “Robust features that provide great insights into system performance.” | “I experienced downtime during peak hours, which was frustrating.” |

Overall, consumer feedback highlights Datadog’s user-friendly interface and strong support as key strengths, while concerns about pricing and integration issues are recurring weaknesses.

Risk Analysis

In evaluating Datadog, Inc. (ticker: DDOG), it’s essential to consider various risks that could affect the company’s performance. Below is a summary of these risks:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Competition | Intense competition in the cloud monitoring space | High | High |

| Economic Downturn | A recession could reduce IT spending | Medium | High |

| Regulatory Risks | Changes in data privacy laws impacting operations | Medium | Medium |

| Cybersecurity | Potential data breaches affecting reputation | High | High |

| Technological Change | Rapid tech evolution may outpace company offerings | Medium | High |

I find that the most significant risks for DDOG include market competition and cybersecurity threats. The tech sector’s rapid pace and the potential for economic downturns must be monitored closely to manage investments wisely.

Should You Buy Datadog, Inc.?

Datadog has demonstrated a positive net margin of 6.84% in the most recent fiscal year, indicating profitability. The company carries a total debt of 1.84B, which can be considered relatively high compared to its equity of 56.50B. Over recent years, Datadog has shown a mixed evolution in its fundamentals, with some positive growth signs but also significant fluctuations. The current rating for Datadog is C+.

Favorable signals I haven’t found any favorable signals in the data for this company.

Unfavorable signals Datadog’s ROIC stands at 1.07%, which is significantly below the WACC of 9.25%, indicating value destruction. Furthermore, the price-to-earnings ratio of 261.42 suggests that the stock is overvalued, raising potential concerns for investors. The negative free cash flow of -252.54M also presents a risk factor. Additionally, the most recent seller volume exceeds buyer volume, suggesting a lack of demand for the stock.

Conclusion Given the current circumstances, it might be prudent to wait for more favorable signals before considering an investment in Datadog, Inc.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Additional Resources

- DDOG – Datadog Inc Stock Price and Quote – Finviz (Nov 21, 2025)

- Datadog, Inc. $DDOG Shares Sold by Rockefeller Capital Management L.P. – MarketBeat (Nov 22, 2025)

- Datadog Inc (DDOG) Q3 2025 Earnings Call Highlights: Strong Revenue Growth and Expanding AI … – Yahoo Finance (Nov 06, 2025)

- Datadog, Inc. $DDOG Shares Acquired by Mediolanum International Funds Ltd – MarketBeat (Nov 22, 2025)

- Datadog (NASDAQ:DDOG) Reports Strong Q3, Stock Soars – Yahoo Finance (Nov 06, 2025)

For more information about Datadog, Inc., please visit the official website: datadoghq.com