Home > Analyses > Technology > D-Wave Quantum Inc.

D-Wave Quantum Inc. is revolutionizing the future of computing by making quantum technology accessible and practical across industries. As a pioneer in quantum hardware and software, D-Wave leads with its cutting-edge Advantage quantum computer and a comprehensive ecosystem including cloud services and professional onboarding. Renowned for innovation and real-world applications in AI, cybersecurity, and drug discovery, the company stands at the forefront of a technological paradigm shift. But does D-Wave’s current market position truly reflect its growth potential and fundamental strength?

Table of contents

Business Model & Company Overview

D-Wave Quantum Inc., founded in 2020 and headquartered in Burnaby, Canada, stands as a pioneer in the quantum computing sector. The company delivers a cohesive ecosystem of quantum computing systems, software, and services, including its flagship Advantage quantum computer, the Ocean programming tools, and the Leap cloud-based platform. This integrated approach supports diverse industries like artificial intelligence, drug discovery, and financial modeling, positioning D-Wave as a leader in cutting-edge technology innovation.

The company’s revenue engine balances hardware sales with recurring software and service subscriptions, including professional onboarding and hybrid solver access. With a market cap of 9.4B USD, D-Wave maintains strategic reach across the Americas, Europe, and Asia. Its competitive advantage lies in its unique quantum solutions that drive value across multiple sectors, securing a durable economic moat and shaping the future landscape of computing technology.

Financial Performance & Fundamental Metrics

I will analyze D-Wave Quantum Inc.’s income statement, key financial ratios, and dividend payout policy to assess its overall financial health and investment potential.

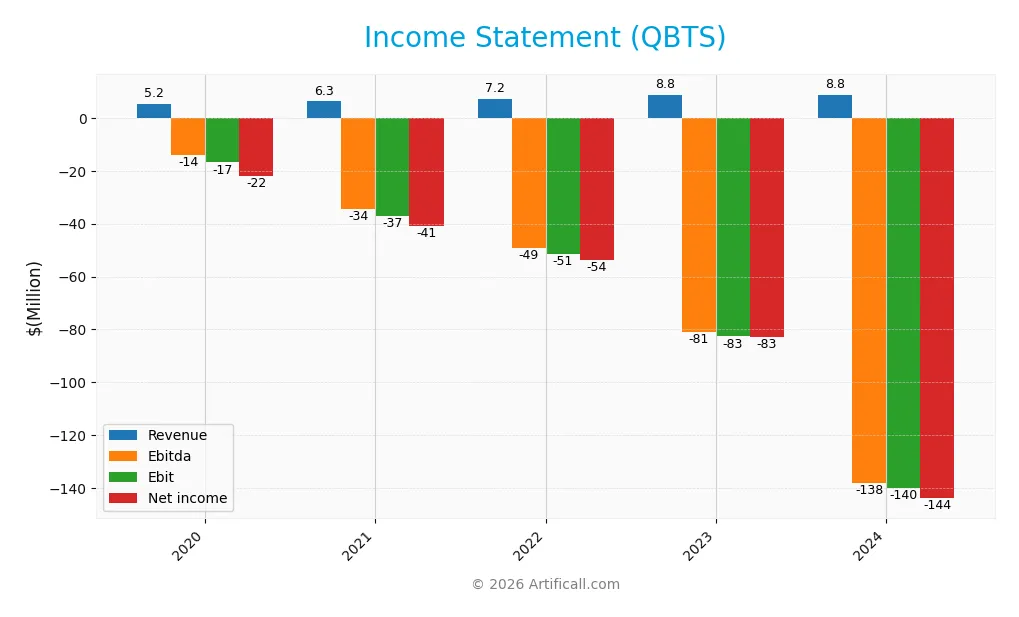

Income Statement

The table below summarizes D-Wave Quantum Inc. (QBTS) key income statement figures for the fiscal years 2020 through 2024, expressed in USD and scaled to thousands where appropriate.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 5.16M | 6.28M | 7.17M | 8.76M | 8.83M |

| Cost of Revenue | 915K | 1.75M | 2.92M | 4.14M | 3.26M |

| Operating Expenses | 35.7M | 43.5M | 63.7M | 85.2M | 82.8M |

| Gross Profit | 4.25M | 4.53M | 4.25M | 4.62M | 5.56M |

| EBITDA | -14.1M | -34.4M | -49.0M | -80.8M | -138.1M |

| EBIT | -16.8M | -37.0M | -51.4M | -82.7M | -140.0M |

| Interest Expense | 5.18M | 4.01M | 2.34M | 2.16M | 3.90M |

| Net Income | -21.97M | -40.97M | -53.70M | -82.72M | -143.9M |

| EPS | -0.20 | -0.33 | -0.45 | -0.60 | -0.75 |

| Filing Date | 2020-12-31 | 2021-12-31 | 2022-12-31 | 2024-03-29 | 2025-03-14 |

Income Statement Evolution

D-Wave Quantum Inc. saw revenue increase by 71.07% from 2020 to 2024, though growth slowed to 0.79% in the last year. Gross profit improved by 20.36% year-over-year, supporting a favorable gross margin of 63.02%. However, net income declined sharply by 554.98% overall, with net margin and EBIT margin deteriorating significantly, indicating persistent profitability challenges.

Is the Income Statement Favorable?

In 2024, the company reported a net loss of $144M and an EBIT loss of $140M, reflecting unfavorable net and EBIT margins of -1630% and -1586%, respectively. Interest expenses consumed 44.15% of revenue, further pressuring results. Despite stable revenue and improved gross profit, operating expenses remain high relative to sales, leading to an overall unfavorable income statement with weak fundamentals for profitability.

Financial Ratios

The following table summarizes key financial ratios for D-Wave Quantum Inc. (QBTS) over recent fiscal years, providing insights into profitability, valuation, liquidity, leverage, and operational efficiency:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | -4.26% | -6.53% | -7.49% | -9.44% | -16.30% |

| ROE | -0.67 | 2.23 | 1.82 | 3.38 | -2.30 |

| ROIC | -0.84 | -1.84 | -4.04 | -1.61 | -0.45 |

| P/E | -52.01 | -30.04 | -3.21 | -1.47 | -11.22 |

| P/B | 34.91 | -67.06 | -5.85 | -4.96 | 25.76 |

| Current Ratio | 3.45 | 1.53 | 0.87 | 4.18 | 6.14 |

| Quick Ratio | 3.24 | 1.33 | 0.73 | 4.00 | 6.08 |

| D/E | 0.14 | -2.15 | -1.44 | -2.97 | 0.61 |

| Debt-to-Assets | 9.82% | 134% | 157% | 122% | 19.20% |

| Interest Coverage | -6.08 | -9.71 | -25.46 | -37.38 | -19.82 |

| Asset Turnover | 0.11 | 0.21 | 0.27 | 0.15 | 0.04 |

| Fixed Asset Turnover | 0.88 | 0.53 | 0.63 | 0.81 | 0.77 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Evolution of Financial Ratios

From 2020 to 2024, D-Wave Quantum Inc.’s Return on Equity (ROE) showed significant volatility, ending at a deeply negative -229.67% in 2024, indicating deteriorated profitability. The Current Ratio improved markedly, reaching 6.14 in 2024, suggesting increased short-term liquidity. The Debt-to-Equity Ratio remained relatively stable around 0.61 in 2024, reflecting a moderate leverage position amid fluctuating profitability metrics.

Are the Financial Ratios Favorable?

In 2024, profitability ratios like net margin (-1629.99%) and ROE were strongly unfavorable, highlighting persistent losses. Liquidity showed mixed signals: a high Current Ratio (6.14) deemed unfavorable, but a Quick Ratio of 6.08 was favorable. Leverage ratios were neutral to favorable, with Debt-to-Equity at 0.61 and Debt-to-Assets at 19.2%. Efficiency ratios, including asset and fixed asset turnover, were unfavorable, while market valuation ratios presented a mixed picture, with an unfavorable Price-to-Book of 25.76 but a favorable Price-to-Earnings ratio of -11.22. Overall, 71.43% of ratios were unfavorable, leading to a negative global assessment.

Shareholder Return Policy

D-Wave Quantum Inc. (QBTS) does not pay dividends, reflecting its persistent net losses from 2020 to 2024 and focus on reinvestment. The absence of payouts aligns with a strategy prioritizing growth and R&D in a high-tech sector.

The company has no share buyback programs, consistent with its negative free cash flow and operating cash flow margins. This approach supports sustainable long-term value creation by conserving capital for development rather than returning cash to shareholders.

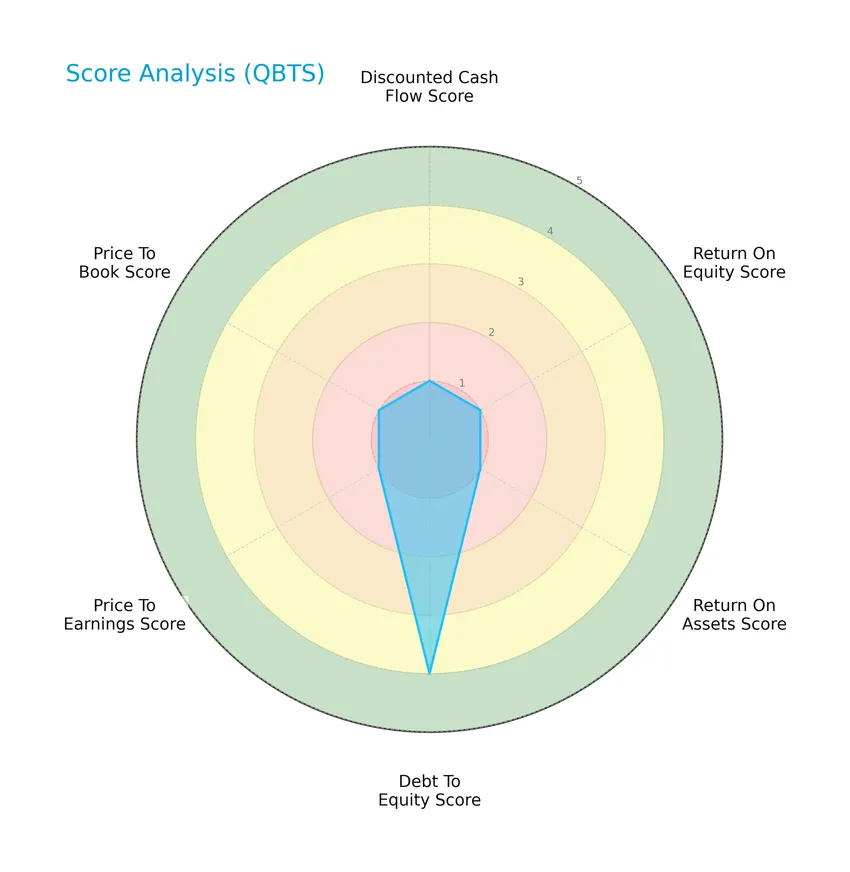

Score analysis

The following radar chart presents the company’s key financial scores across several important valuation and performance metrics:

D-Wave Quantum Inc. shows very unfavorable scores in discounted cash flow, return on equity, return on assets, price-to-earnings, and price-to-book metrics, each scoring 1. The only favorable metric is debt-to-equity, which scores 4, indicating relatively better leverage management.

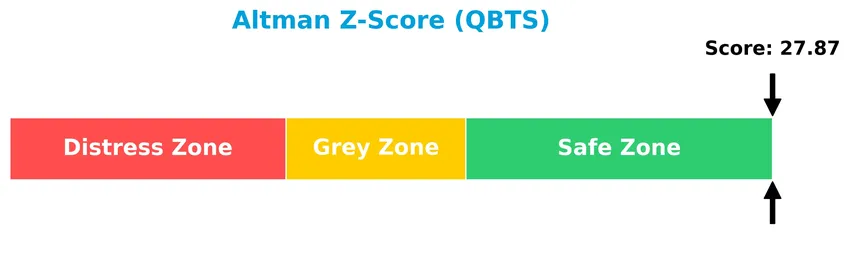

Analysis of the company’s bankruptcy risk

The Altman Z-Score for D-Wave Quantum Inc. places the company firmly in the safe zone, indicating a very low risk of bankruptcy:

Is the company in good financial health?

This diagram illustrates the Piotroski Score, which gauges the company’s financial strength based on profitability, leverage, and efficiency factors:

With a Piotroski Score of 3, D-Wave Quantum Inc. falls into the very weak category, suggesting concerns about its current financial health despite some stability indicated elsewhere.

Competitive Landscape & Sector Positioning

This sector analysis will explore D-Wave Quantum Inc.’s strategic positioning, revenue segments, key products, main competitors, competitive advantages, and SWOT elements. I will examine whether the company holds a competitive advantage over its industry peers within the technology sector.

Strategic Positioning

D-Wave Quantum Inc. maintains a concentrated product portfolio focused on quantum computing systems, software, and related professional services, with 2024 revenues heavily skewed towards professional services at $1.94M. Geographically, the company diversifies its exposure across North America, Europe, and Asia, with the U.S. ($2.15M), Germany ($1.89M), and Japan ($1.13M) as key markets.

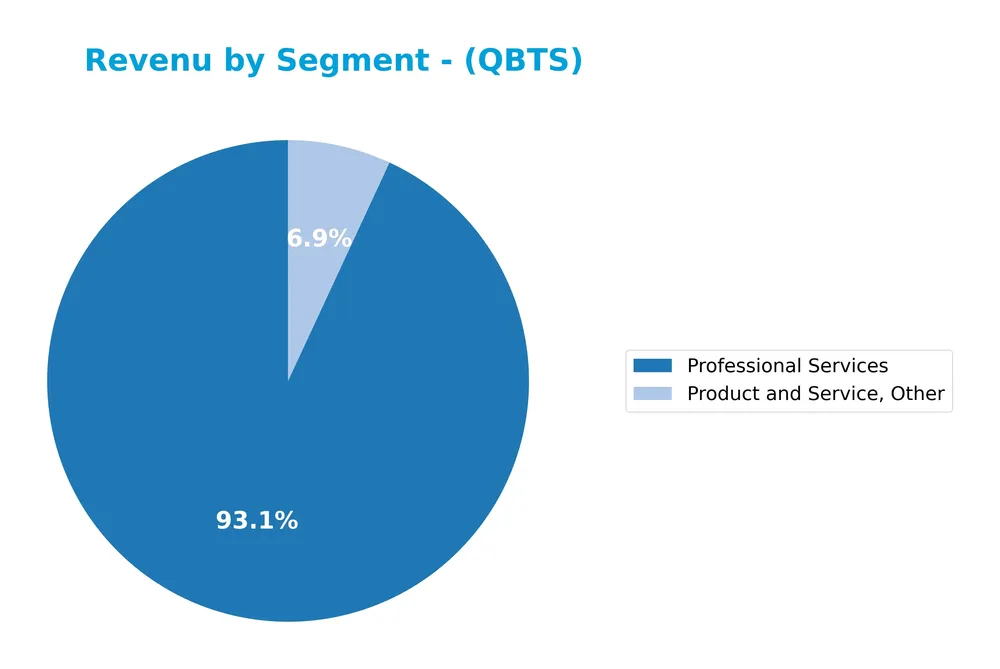

Revenue by Segment

This pie chart depicts D-Wave Quantum Inc.’s revenue breakdown by segment for the fiscal years 2022 to 2024, highlighting the contributions of Professional Services and Product and Service, Other.

The data reveals that Professional Services is the primary revenue driver, growing from 1.48M in 2022 to 3.82M in 2023 before declining to 1.94M in 2024. Meanwhile, Product and Service, Other showed a modest increase overall, from 79K in 2022 to 144K in 2024, despite a dip in 2023. The recent year shows a slowdown in Professional Services revenue, suggesting some caution in growth sustainability.

Key Products & Brands

The table below summarizes D-Wave Quantum Inc.’s main products and services offered to its clients:

| Product | Description |

|---|---|

| Advantage | Fifth-generation quantum computer providing advanced quantum computing capabilities. |

| Launch | Quantum computing onboarding service designed to help enterprises integrate quantum solutions. |

| Ocean | Open-source suite of programming tools for developing quantum applications. |

| Leap | Cloud-based service granting real-time access to live quantum computers, including Advantage and hybrid solvers. |

| D-Wave Launch | Professional service guiding enterprises from problem discovery to in-production quantum application deployment. |

| Professional Services | Consulting and support services related to quantum computing integration and deployment. |

| Product and Service, Other | Miscellaneous products and services not classified under main categories. |

D-Wave Quantum Inc. offers a range of quantum computing hardware, software, and professional services, supporting various industries with quantum solutions and cloud-based access to quantum resources.

Main Competitors

There are 12 competitors in total, with the table below showing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Arista Networks, Inc. | 168B |

| Dell Technologies Inc. | 85.7B |

| Western Digital Corporation | 65.2B |

| Seagate Technology Holdings plc | 61.1B |

| Pure Storage, Inc. | 21.9B |

| NetApp, Inc. | 21.3B |

| HP Inc. | 20.7B |

| Super Micro Computer, Inc. | 18.4B |

| IonQ, Inc. | 15.9B |

| D-Wave Quantum Inc. | 9.1B |

D-Wave Quantum Inc. ranks 10th among its top 12 competitors, with a market cap representing 5.59% of the leader’s size. The company’s valuation is below both the average top 10 market cap of 48.7B and the sector median of 20.96B. It holds a significant 69.16% gap below its nearest competitor, IonQ, indicating a distinct separation in scale within this competitive group.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does D-Wave Quantum Inc. have a competitive advantage?

D-Wave Quantum Inc. currently does not present a strong competitive advantage, as it is shedding value with a ROIC well below its WACC, reflecting an unfavorable income statement and negative net margins. Despite this, the company shows a growing ROIC trend, indicating improving profitability over time.

Looking ahead, D-Wave offers a diverse quantum computing product suite including Advantage, Launch, Ocean, and Leap, targeting industries such as AI, materials science, and financial modeling. The company’s expansion into cloud-based quantum services and professional onboarding may open new markets and opportunities.

SWOT Analysis

This SWOT analysis highlights the key internal and external factors affecting D-Wave Quantum Inc., aiming to assist investors in understanding the company’s strategic position.

Strengths

- advanced quantum computing technology

- strong developer community

- diversified industry applications

Weaknesses

- negative net margins

- high interest expenses

- low asset turnover

Opportunities

- expanding quantum computing market

- rising demand in AI and drug discovery

- global geographic revenue growth

Threats

- intense competition in quantum tech

- technological obsolescence risk

- regulatory and cybersecurity challenges

D-Wave Quantum Inc. possesses cutting-edge technology and a growing user base but faces significant profitability challenges. The company’s strategy should focus on improving operational efficiency while capitalizing on expanding markets and mitigating competitive and regulatory risks.

Stock Price Action Analysis

The weekly stock chart of D-Wave Quantum Inc. (QBTS) illustrates price movements and volume trends over the past 12 months:

Trend Analysis

Over the past 12 months, QBTS stock price surged by 1390.12%, indicating a strong bullish trend despite a noted deceleration. The highest price reached 38.33, with a low of 0.84 and a standard deviation of 10.41 suggesting notable volatility. Recent weeks show a -13.12% decline, reflecting a short-term pullback.

Volume Analysis

In the last three months, trading volume is increasing overall, but recent activity is seller-driven with buyers accounting for 36.29% of volume. This shift to seller dominance indicates cautious investor sentiment and increased market participation favoring selling pressure.

Target Prices

Analysts present a target consensus that reflects moderate upside potential for D-Wave Quantum Inc.

| Target High | Target Low | Consensus |

|---|---|---|

| 46 | 26 | 38.88 |

The target prices suggest cautious optimism, with analysts expecting the stock to trade around 39, indicating room for growth balanced by some risk.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews recent analyst ratings and consumer feedback concerning D-Wave Quantum Inc. (QBTS).

Stock Grades

The following table summarizes the latest stock grades for D-Wave Quantum Inc. from recognized financial analysts:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Benchmark | Maintain | Buy | 2026-01-23 |

| Needham | Maintain | Buy | 2026-01-22 |

| Rosenblatt | Maintain | Buy | 2026-01-08 |

| Rosenblatt | Maintain | Buy | 2026-01-07 |

| Benchmark | Maintain | Buy | 2025-11-10 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-11-07 |

| Canaccord Genuity | Maintain | Buy | 2025-11-07 |

| Rosenblatt | Maintain | Buy | 2025-11-07 |

| B. Riley Securities | Maintain | Buy | 2025-09-22 |

| Piper Sandler | Maintain | Overweight | 2025-08-08 |

Overall, the grades consistently reflect a positive outlook, with all major analysts maintaining buy or overweight recommendations. There is a clear consensus favoring continued confidence in the stock.

Consumer Opinions

Consumer sentiment about D-Wave Quantum Inc. (QBTS) reflects a mix of enthusiasm for its cutting-edge technology and concerns about practical application and cost.

| Positive Reviews | Negative Reviews |

|---|---|

| “Impressive advancements in quantum computing technology.” | “High cost limits accessibility for smaller investors.” |

| “Strong leadership in the quantum industry space.” | “Product integration can be complex and time-consuming.” |

| “Innovative solutions with promising future potential.” | “Customer support response times need improvement.” |

Overall, consumers appreciate D-Wave’s technological innovation and industry leadership but express caution regarding its pricing and implementation challenges. Managing these issues will be key to broader adoption and satisfaction.

Risk Analysis

Below is a summary table of key risks associated with D-Wave Quantum Inc. that investors should consider carefully:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Persistent negative net margin (-1630%) and negative returns on equity and invested capital. | High | High |

| Market Volatility | High beta (1.56) indicates sensitivity to market swings, with recent price drop of -6.56%. | High | Medium |

| Valuation | Extremely high price-to-book ratio (25.76) suggests overvaluation risk. | Medium | Medium |

| Profitability | Negative interest coverage (-35.92) and weak asset turnover imply poor operational efficiency. | High | High |

| Innovation Risk | Dependence on emerging quantum computing technology with uncertain mass adoption timeline. | Medium | High |

| Dividend Policy | No dividends paid, reducing income appeal for yield-focused investors. | Low | Low |

The most critical risks are D-Wave’s sustained unprofitable operations and weak profitability metrics, which present a high likelihood and severe impact on shareholder value. Despite a strong Altman Z-score indicating low bankruptcy risk, the very weak Piotroski score reflects poor financial strength. Market volatility also poses a significant threat amid the company’s innovative but still nascent quantum computing sector.

Should You Buy D-Wave Quantum Inc.?

D-Wave Quantum Inc. appears to exhibit improving operational efficiency amid a slightly unfavorable moat, as it is shedding value despite growing profitability. Supported by a manageable leverage profile but very weak profitability scores, the overall rating could be seen as a cautious C-.

Strength & Efficiency Pillars

D-Wave Quantum Inc. exhibits a strong financial safety net, as reflected by an Altman Z-Score of 27.87, situating it firmly in the safe zone, which signals a low bankruptcy risk. The company’s debt-to-assets ratio of 19.2% indicates a conservative leverage position, supporting financial stability. Despite operational challenges, the quick ratio of 6.08 suggests ample liquidity to meet short-term obligations. However, profitability remains a critical issue, with a negative ROIC of -45.01% well below the WACC of 11.18%, confirming the company is currently a value destroyer rather than a creator. The Piotroski score of 3 further underscores weak financial strength.

Weaknesses and Drawbacks

Profitability metrics paint a grim picture: a net margin of -1629.99% and a return on equity of -229.67% highlight severe earnings pressure and inefficient capital use. The company carries a sky-high price-to-book ratio of 25.76, implying an expensive valuation relative to its book value, which may deter value-conscious investors. The current ratio of 6.14 is unusually high but classified as unfavorable, possibly indicating inefficient asset use or excessive inventory. Market dynamics show seller dominance over the recent period, with only 36.29% buyer participation, exerting downward pressure on the stock price and suggesting short-term headwinds despite an overall bullish trend.

Our Verdict about D-Wave Quantum Inc.

D-Wave Quantum Inc.’s long-term fundamental profile appears unfavorable due to persistent unprofitability and value destruction, despite strong liquidity and low bankruptcy risk. Although the company benefits from an overall bullish price trend, the recent period’s seller dominance and valuation concerns suggest a wait-and-see approach might be prudent. Investors may find the profile attractive only if the company can translate its liquidity strength into sustainable profitability and improve operational efficiency over time.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Rosenblatt Lifts PT on D-Wave Quantum (QBTS) Stock – Yahoo Finance (Jan 23, 2026)

- Rigetti vs. D-Wave: Which Quantum Computing Stock Is the Better Pick? – Zacks Investment Research (Jan 22, 2026)

- What the Options Market Tells Us About D-Wave Quantum – Benzinga (Jan 22, 2026)

- Quantum Computing News: D-Wave (QBTS) Is No Longer a One-Trick Quantum Stock – TipRanks (Jan 22, 2026)

- Did D-Wave’s New US$330 Million Shelf Filings and Quantum Circuits Deal Just Shift QBTS’s Investment Narrative? – Yahoo Finance (Jan 23, 2026)

For more information about D-Wave Quantum Inc., please visit the official website: dwavesys.com