Home > Analyses > Real Estate > Crown Castle Inc.

Crown Castle powers the backbone of America’s wireless communication, shaping how millions connect daily. It commands a vast network of 40,000 cell towers and 80,000 route miles of fiber, fueling the digital economy with critical infrastructure. Renowned for its innovation and scale, Crown Castle has become indispensable to carriers and businesses alike. As 5G expands and data demands soar, I ask: does Crown Castle’s financial strength still justify its premium valuation and growth prospects?

Table of contents

Business Model & Company Overview

Crown Castle Inc., founded in 1998 and headquartered in Houston, TX, commands a dominant position as a specialty REIT in U.S. communications infrastructure. It manages a cohesive ecosystem of over 40,000 cell towers and 80,000 route miles of fiber, enabling seamless connectivity across major urban and rural markets. This infrastructure underpins the flow of data, technology, and wireless services vital to businesses and communities nationwide.

The company’s revenue engine balances leasing its vast network of towers with advanced fiber solutions and small cell deployments, generating stable, recurring cash flows. Crown Castle’s strategic footprint spans the entire U.S., connecting key markets in the Americas with infrastructure that supports the digital economy. Its economic moat lies in the scale and exclusivity of its network, critical for shaping the future of wireless communications.

Financial Performance & Fundamental Metrics

I analyze Crown Castle Inc.’s income statement, key financial ratios, and dividend payout policy to assess its profitability, efficiency, and shareholder returns.

Income Statement

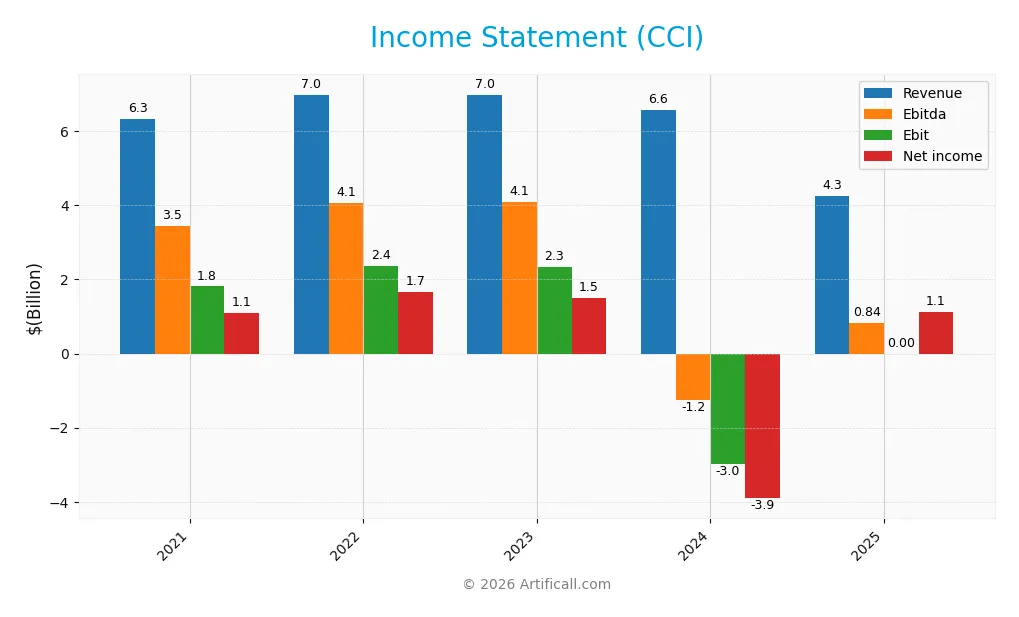

The table below summarizes Crown Castle Inc.’s key income statement figures for fiscal years 2021 through 2025 in USD.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 6.34B | 6.99B | 6.98B | 6.57B | 4.26B |

| Cost of Revenue | 1.99B | 2.07B | 1.98B | 1.85B | 0 |

| Operating Expenses | 2.35B | 2.49B | 2.63B | 7.66B | 2.19B |

| Gross Profit | 4.35B | 4.92B | 5.00B | 4.72B | 0 |

| EBITDA | 3.46B | 4.07B | 4.10B | -1.24B | 837M |

| EBIT | 1.81B | 2.36B | 2.35B | -2.98B | 0 |

| Interest Expense | 632M | 673M | 821M | 900M | 972M |

| Net Income | 1.10B | 1.68B | 1.50B | -3.90B | 1.14B |

| EPS | 2.54 | 3.87 | 3.46 | -8.98 | 2.61 |

| Filing Date | 2022-02-22 | 2023-02-24 | 2024-02-23 | 2025-03-14 | 2026-02-04 |

Income Statement Evolution

From 2021 to 2025, Crown Castle’s revenue declined by 33%, with a sharp 35% drop in the last year. Gross profit vanished in 2025, reflecting zero gross margin. Despite these setbacks, net income grew slightly overall, supported by a 54% improvement in net margin, signaling better profitability control amid revenue contraction.

Is the Income Statement Favorable?

In 2025, fundamentals show mixed signals. Revenue and gross profit collapsed, yet net margin surged to 26.6%, driven by sharply reduced interest expenses and operating expenses aligned with lower sales. EBITDA turned positive after losses in 2024, and EPS nearly doubled. This suggests operational improvements, but the drastic revenue drop remains a significant risk factor.

Financial Ratios

The following table presents key financial ratios for Crown Castle Inc. (CCI) over the past five fiscal years, illustrating profitability, liquidity, leverage, and valuation metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 18% | 17% | 24% | 22% | -59% |

| ROE | 11% | 13% | 22% | 24% | 29% |

| ROIC | 5% | 5% | 6% | 6% | -9% |

| P/E | 64 | 82 | 35 | 33 | -10 |

| P/B | 7.1 | 10.9 | 7.9 | 7.8 | -296 |

| Current Ratio | 0.56 | 0.62 | 0.45 | 0.40 | 0.50 |

| Quick Ratio | 0.56 | 0.62 | 0.45 | 0.40 | 0.50 |

| D/E | 2.7 | 3.3 | 3.8 | 4.5 | -223 |

| Debt-to-Assets | 66% | 69% | 72% | 75% | 90% |

| Interest Coverage | 0 | 3.2 | 3.6 | 2.9 | -3.3 |

| Asset Turnover | 0.15 | 0.16 | 0.18 | 0.18 | 0.20 |

| Fixed Asset Turnover | 0.27 | 0.29 | 0.32 | 0.32 | 0.31 |

| Dividend Yield | 3.3% | 2.6% | 4.4% | 5.4% | 6.9% |

Evolution of Financial Ratios

Crown Castle’s Return on Equity (ROE) surged dramatically in 2024, contrasting with prior years’ modest levels. Meanwhile, the Current Ratio showed some fluctuation but remained below 1, signaling persistent liquidity constraints. The Debt-to-Equity Ratio shifted to a negative extreme in 2024, indicating volatility and unusual capital structure changes. Profitability deteriorated sharply in 2024, reversing prior stable margins.

Are the Financial Ratios Fovorable?

In 2024, profitability ratios such as net margin and return on invested capital were unfavorable, despite an exceptionally high ROE. Liquidity measures, including current and quick ratios, remained below 1, flagging weak short-term financial health. Leverage ratios, especially debt to assets, were unfavorable, reflecting high indebtedness. Market valuation metrics like price-to-earnings and price-to-book ratios were favorable, while dividend yield was neutral. Overall, the ratio profile is predominantly unfavorable.

Shareholder Return Policy

Crown Castle Inc. maintains a consistent dividend payout with a yield near 6.9% in 2024, supported by dividend coverage at roughly 74% of combined dividend and capital expenditure. The dividend payout ratio is negative due to net losses, signaling potential sustainability concerns.

The company also engages in share buybacks, complementing shareholder returns despite operating losses. This distribution approach appears aimed at balancing cash returns and reinvestment, though negative earnings and high leverage present risks to long-term value stability.

Score analysis

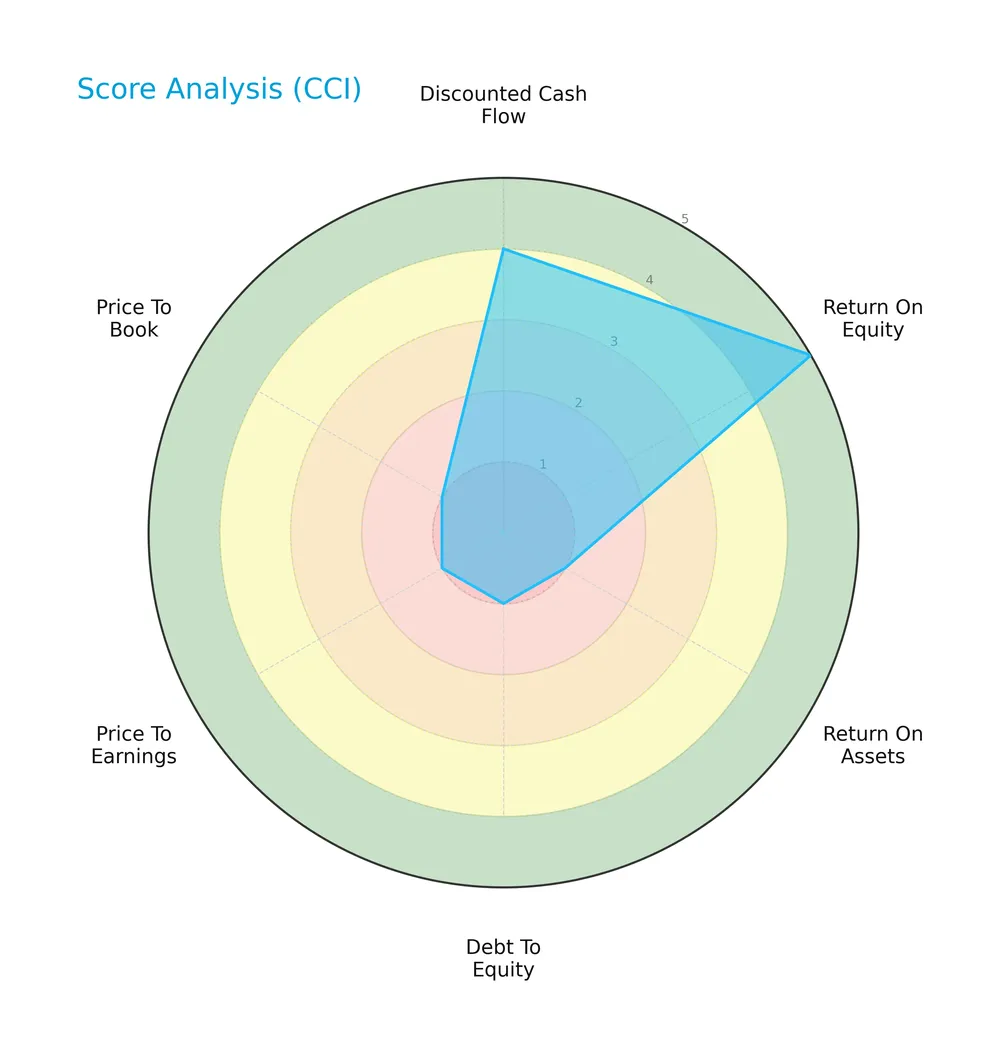

The following radar chart illustrates Crown Castle Inc.’s valuation and financial performance scores across key metrics:

Crown Castle shows a mixed profile with a very favorable return on equity and a favorable discounted cash flow score. However, return on assets, debt to equity, price to earnings, and price to book scores are very unfavorable, indicating financial and valuation concerns.

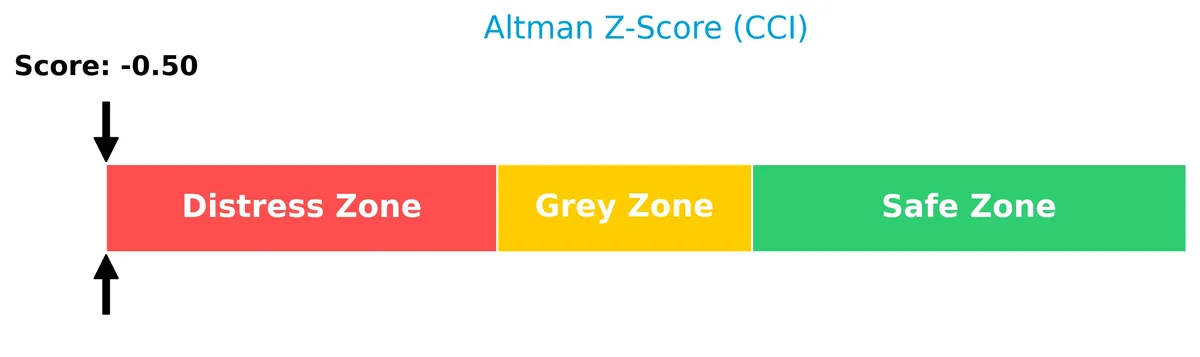

Analysis of the company’s bankruptcy risk

The Altman Z-Score places Crown Castle in the distress zone, signaling a high risk of financial distress and potential bankruptcy:

Is the company in good financial health?

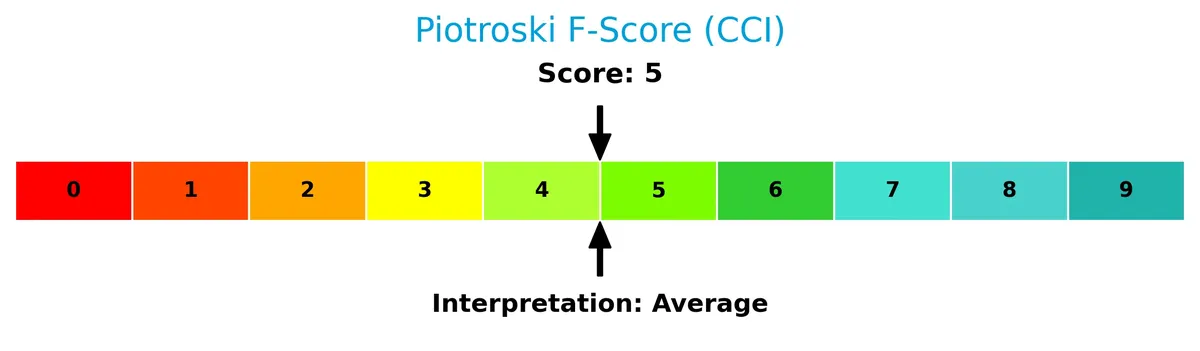

The Piotroski Score diagram offers insight into Crown Castle’s overall financial strength based on nine criteria:

With a Piotroski score of 5, Crown Castle’s financial health is average, reflecting moderate strength but room for improvement in profitability, leverage, and efficiency metrics.

Competitive Landscape & Sector Positioning

This section examines Crown Castle Inc.’s strategic position, revenue segments, key products, and main competitors. I will assess whether Crown Castle holds a competitive advantage within the specialty REIT sector.

Strategic Positioning

Crown Castle concentrates on U.S. communications infrastructure, owning 40K towers and 80K fiber route miles. Its revenue splits mainly between Towers (~$4.46B in 2024) and Fiber (~$2.11B), reflecting a focused product portfolio in wireless infrastructure within a single major geographic market.

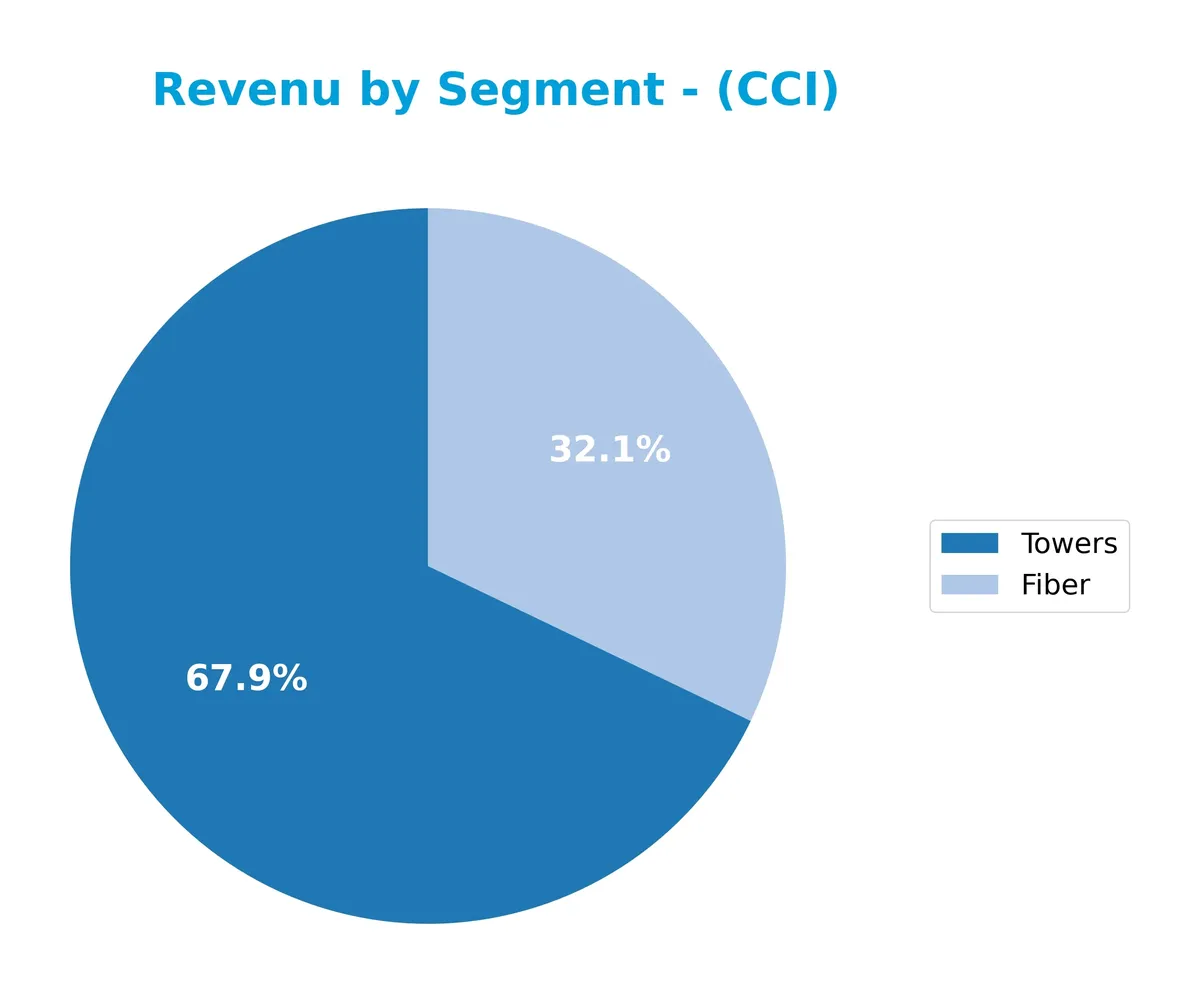

Revenue by Segment

The pie chart illustrates Crown Castle Inc.’s revenue distribution by segment for the fiscal year 2024, highlighting the relative contribution of Fiber and Towers.

Towers dominate Crown Castle’s revenue with $4.46B in 2024, showing a gradual decline from $5.01B in 2022, reflecting potential saturation or pricing pressure. Fiber contributes $2.11B, growing steadily from $1.84B in 2020 but slipping slightly from its 2023 peak of $2.25B. The business remains heavily concentrated in Towers, posing moderate concentration risk as Fiber’s growth momentum decelerates.

Key Products & Brands

The table below outlines Crown Castle’s principal products and brands driving its revenue streams:

| Product | Description |

|---|---|

| Towers | Over 40,000 cell towers leased and operated across the U.S., forming the core wireless infrastructure network. |

| Fiber | Approximately 80,000 route miles of fiber supporting small cells and fiber solutions nationwide. |

| Small Cells | Distributed antenna systems enhancing wireless coverage and capacity in dense urban areas. (Reported separately through 2018) |

Crown Castle’s revenue primarily stems from leasing and operating cell towers and extensive fiber networks. Its fiber and small cell solutions complement its tower assets, supporting growing wireless data demand across major U.S. markets.

Main Competitors

There are 6 competitors in the Real Estate sector for Crown Castle Inc., with the table showing the top 6 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| American Tower Corporation | 81.8B |

| Equinix, Inc. | 74.5B |

| Crown Castle Inc. | 38.6B |

| Iron Mountain Incorporated | 24.6B |

| SBA Communications Corporation | 20.7B |

| Weyerhaeuser Company | 17.2B |

Crown Castle ranks 3rd among its 6 competitors in the REIT – Specialty industry. Its market cap is 43% of the leader, American Tower Corporation. The company sits below the average market cap of the top 10 competitors (43B) but above the sector median (31.6B). It maintains a wide 111.63% gap from its closest rival above, Equinix, reflecting a significant scale difference.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does CCI have a competitive advantage?

Crown Castle Inc. presents a competitive advantage through its extensive portfolio of over 40,000 cell towers and 80,000 miles of fiber across major U.S. markets. This infrastructure supports essential wireless services and data connectivity, underpinning its market position.

Looking ahead, Crown Castle’s opportunities lie in expanding fiber solutions and small cell deployments in emerging urban areas. These developments could enhance network capacity and connectivity, positioning the company to benefit from growing demand for wireless data.

SWOT Analysis

This analysis identifies Crown Castle Inc.’s key internal and external factors shaping its strategic outlook.

Strengths

- Extensive U.S. cell tower and fiber network

- Strong net margin of 26.62%

- High dividend yield near 7%

Weaknesses

- Declining revenue trend over 5 years

- Weak current and quick ratios at 0.5

- High debt-to-assets ratio at 90%

Opportunities

- Growing 5G infrastructure demand

- Expansion potential in fiber solutions

- Increasing small cell deployments in urban areas

Threats

- Intense competition in telecom infrastructure

- Regulatory risks in real estate and telecom sectors

- Economic downturn may pressure leasing revenues

Crown Castle leverages a dominant infrastructure portfolio but faces financial leverage and liquidity challenges. Strategic focus on 5G and fiber growth can offset operational headwinds and competitive threats.

Stock Price Action Analysis

The weekly price chart reveals Crown Castle Inc.’s stock movement over the past 12 months, highlighting key price levels and trend shifts:

Trend Analysis

Over the past 12 months, CCI’s stock price declined by 23.75%, confirming a bearish trend with deceleration. The highest price reached 118.85, the lowest hit 80.65, and volatility remains elevated with an 8.22% standard deviation.

Volume Analysis

Trading volume is increasing overall, with seller volume exceeding buyer volume at 54.8%. Recent activity shows slight seller dominance at 56%, suggesting cautious investor sentiment and persistent selling pressure.

Target Prices

Analysts set a clear target consensus for Crown Castle Inc. (CCI), reflecting moderate optimism.

| Target Low | Target High | Consensus |

|---|---|---|

| 91 | 127 | 106.5 |

The target range spans from $91 to $127, with a consensus near $106.5, indicating steady confidence in CCI’s growth prospects.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines recent analyst ratings and consumer feedback related to Crown Castle Inc. (CCI) performance and reputation.

Stock Grades

Here are the latest verified stock grades from leading financial institutions for Crown Castle Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Overweight | 2026-02-05 |

| Jefferies | Maintain | Buy | 2026-02-04 |

| Keybanc | Maintain | Overweight | 2026-01-21 |

| UBS | Maintain | Buy | 2026-01-20 |

| Goldman Sachs | Maintain | Neutral | 2026-01-20 |

| Scotiabank | Maintain | Sector Perform | 2026-01-14 |

| JP Morgan | Maintain | Neutral | 2026-01-12 |

| Wells Fargo | Maintain | Overweight | 2025-12-16 |

| Barclays | Downgrade | Equal Weight | 2025-12-01 |

| Barclays | Maintain | Overweight | 2025-11-17 |

The consensus leans toward a Buy rating, with most firms maintaining positive stances. Notably, Barclays issued a recent downgrade, highlighting some divergence in outlook.

Consumer Opinions

Consumer sentiment around Crown Castle Inc. reflects a mix of strong service appreciation and concerns over pricing.

| Positive Reviews | Negative Reviews |

|---|---|

| Reliable network infrastructure boosts coverage. | Pricing feels steep compared to competitors. |

| Responsive customer support resolves issues quickly. | Installation delays frustrate some customers. |

| Transparent communication during service updates. | Limited flexibility in contract terms reported. |

Overall, consumers praise Crown Castle’s dependable network and solid customer service. However, pricing and contract rigidity emerge as consistent concerns. This feedback highlights opportunities for Crown Castle to enhance customer satisfaction by addressing cost sensitivity and service agility.

Risk Analysis

The following table summarizes Crown Castle Inc.’s key risks, their likelihood, and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Financial Health | Negative net margin (-59.42%) signals operational stress. | High | High |

| Leverage | Debt-to-assets ratio at 90.46% exposes high financial risk. | High | High |

| Liquidity | Current ratio of 0.5 indicates weak short-term liquidity. | High | Medium |

| Profitability | ROIC of -9.34% versus unavailable WACC suggests poor capital efficiency. | Medium | High |

| Market Volatility | Beta near 1 (0.984) implies stock moves with the market, adding market risk. | Medium | Medium |

| Bankruptcy Risk | Altman Z-Score in distress zone (-0.5) signals potential insolvency. | High | High |

I see the most critical risks stem from Crown Castle’s high leverage and poor liquidity. The negative net margin and distressed Altman Z-Score amplify concerns about financial stability. These red flags outweigh the strong ROE and dividend yield. Investors should weigh these risks carefully against sector norms before committing capital.

Should You Buy Crown Castle Inc.?

Analytically, Crown Castle Inc. appears to exhibit mixed financial signals with weak operational efficiency and a declining return on invested capital, suggesting an eroding competitive moat. Despite substantial leverage concerns, its strong return on equity supports a moderate value creation profile, resulting in a cautious C+ rating.

Strength & Efficiency Pillars

Crown Castle Inc. shows a mixed efficiency profile. The company posts an impressive return on equity of 2934.59%, signaling strong shareholder value creation. Net margin stands at a favorable 26.62%, reflecting effective cost control despite weak gross margins. However, return on invested capital is negative at -9.34%, and Altman Z-Score is deep in the distress zone at -0.50, indicating significant financial strain. The Piotroski score of 5 suggests average financial health, but the firm’s value creation status remains uncertain due to unavailable WACC data.

Weaknesses and Drawbacks

Several red flags undermine Crown Castle’s fundamentals. Its current ratio at 0.5 signals liquidity risk and poor short-term solvency. The company carries an unfavorable debt-to-assets ratio of 90.46%, indicating excessive leverage. Price-to-earnings and price-to-book ratios are negative but marked favorable due to data anomalies, warranting caution. The stock’s bearish trend (-23.75% overall price decline) and recent seller dominance (56% sellers) highlight market pressure and weak investor sentiment. Interest coverage is effectively zero, raising serious concerns about debt servicing capacity.

Our Verdict about Crown Castle Inc.

The company’s long-term fundamental profile appears unfavorable due to liquidity and leverage risks combined with financial distress signals. Despite a bullish return on equity, the negative ROIC and Altman Z-Score suggest caution. The bearish overall and recent trends, coupled with seller dominance, imply that Crown Castle might appear risky for immediate investment. Despite pockets of strength, recent market pressure suggests a wait-and-see approach for a better entry point.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Crown Castle stock dips after soft EBITDA guidance, job cuts announced (CCI:NYSE) – Seeking Alpha (Feb 04, 2026)

- Crown Castle Inc. (NYSE: CCI) Q4 2025 earnings call transcript – MSN (Feb 05, 2026)

- Crown Castle (NYSE:CCI) Hits New 52-Week Low Following Analyst Downgrade – MarketBeat (Feb 05, 2026)

- Here’s What Key Metrics Tell Us About Crown Castle (CCI) Q4 Earnings – Yahoo Finance (Feb 04, 2026)

- Crown Castle Reports Growth But Expects to Reduce Workforce By 20 Percent – Inside Towers (Feb 05, 2026)

For more information about Crown Castle Inc., please visit the official website: crowncastle.com