Home > Analyses > Technology > CrowdStrike Holdings, Inc.

CrowdStrike revolutionizes cybersecurity by delivering real-time, cloud-native protection that safeguards millions of endpoints and cloud workloads globally. As a pioneering leader in the software infrastructure sector, its flagship Falcon platform combines threat intelligence, identity protection, and managed services to outpace evolving cyber threats. Known for innovation and robust market influence, CrowdStrike stands at the forefront of digital defense. The key question now: does its current valuation fully reflect its growth potential amid intensifying industry competition?

Table of contents

Business Model & Company Overview

CrowdStrike Holdings, Inc., founded in 2011 and headquartered in Austin, Texas, stands as a leader in the software infrastructure industry. Its core mission revolves around delivering a unified ecosystem of cloud-based protection across endpoints, cloud workloads, identity, and data. Through its Falcon platform and cloud modules, CrowdStrike integrates threat intelligence, managed security services, and Zero Trust identity protection, forming a comprehensive defense framework for enterprises worldwide.

The company’s revenue engine is primarily subscription-driven, leveraging direct sales and a robust channel partner network across the Americas, Europe, and Asia. By blending software with recurring cloud services, CrowdStrike ensures steady cash flow while scaling its global footprint. Its strategic positioning and advanced cybersecurity capabilities create a durable economic moat, reinforcing its role as a pivotal force shaping the future of digital security.

Financial Performance & Fundamental Metrics

In this section, I analyze CrowdStrike Holdings, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its fundamental strength and growth potential.

Income Statement

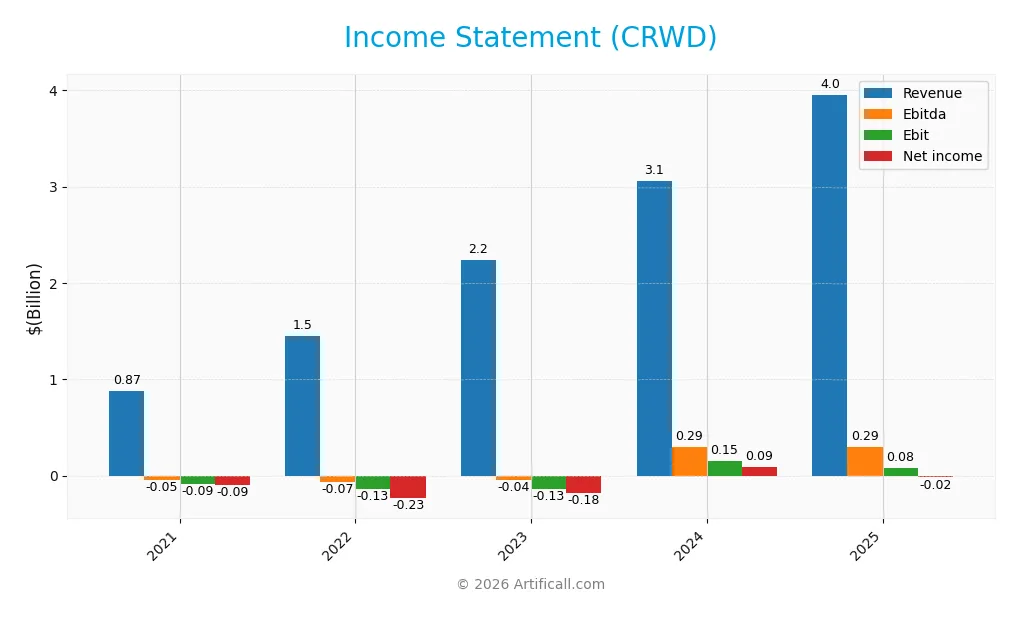

The table below presents key financial results for CrowdStrike Holdings, Inc. over the last five fiscal years, highlighting revenue, expenses, profitability, and earnings per share.

| 2021 | 2022 | 2023 | 2024 | 2025 | |

|---|---|---|---|---|---|

| Revenue | 874M | 1.45B | 2.24B | 3.06B | 3.95B |

| Cost of Revenue | 230M | 383M | 601M | 756M | 991M |

| Operating Expenses | 737M | 1.21B | 1.83B | 2.30B | 3.08B |

| Gross Profit | 645M | 1.07B | 1.64B | 2.30B | 2.96B |

| EBITDA | -46M | -66M | -41M | 294M | 295M |

| EBIT | -86M | -135M | -135M | 149M | 81M |

| Interest Expense | 1.6M | 25M | 25M | 26M | 26M |

| Net Income | -93M | -235M | -183M | 89M | -19M |

| EPS | -0.43 | -1.02 | -0.78 | 0.37 | -0.08 |

| Filing Date | 2021-03-18 | 2022-03-16 | 2023-03-09 | 2024-03-07 | 2025-03-10 |

Income Statement Evolution

Between 2021 and 2025, CrowdStrike Holdings, Inc. saw revenue grow robustly by 352%, with a 29% increase in the last year alone. Gross profit mirrored this trend, rising by 29% in the most recent year, maintaining a favorable gross margin near 75%. However, operating expenses expanded at the same pace as revenue, causing EBIT to decline by 46% year-on-year and compressing net margins into negative territory.

Is the Income Statement Favorable?

In fiscal 2025, despite strong top-line growth and a solid gross margin, CrowdStrike reported a net loss of $19M and a slightly negative net margin of -0.49%, marking a deterioration from the prior year’s positive net income. Interest expenses remain low and manageable at 0.67% of revenue, while EBIT margin holds neutral at 2.04%. Overall, fundamentals show mixed signals with favorable revenue dynamics but unfavorable profitability metrics, resulting in a generally favorable income statement evaluation.

Financial Ratios

The following table presents key financial ratios for CrowdStrike Holdings, Inc. (CRWD) over the fiscal years 2021 to 2025, illustrating profitability, valuation, liquidity, leverage, and operational efficiency metrics:

| Ratios | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|

| Net Margin | -10.6% | -16.2% | -8.2% | 2.9% | -0.5% |

| ROE | -10.6% | -22.9% | -12.5% | 3.9% | -0.6% |

| ROIC | -4.9% | -6.4% | -6.5% | -0.04% | 0.7% |

| P/E | -505.5 | -174.7 | -134.7 | 781.4 | -5055.7 |

| P/B | 53.8 | 40.0 | 16.9 | 30.3 | 29.7 |

| Current Ratio | 2.56 | 1.74 | 1.64 | 1.67 | 1.67 |

| Quick Ratio | 2.56 | 1.74 | 1.64 | 1.67 | 1.67 |

| D/E | 0.89 | 0.76 | 0.54 | 0.34 | 0.24 |

| Debt-to-Assets | 28.5% | 21.4% | 15.6% | 11.9% | 9.1% |

| Interest Coverage | -59.4 | -5.6 | -7.5 | -0.08 | -4.6 |

| Asset Turnover | 0.32 | 0.40 | 0.45 | 0.46 | 0.45 |

| Fixed Asset Turnover | 4.30 | 4.97 | 4.21 | 4.57 | 4.76 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Evolution of Financial Ratios

Between 2021 and 2025, CrowdStrike Holdings, Inc. saw its Return on Equity (ROE) fluctuate from negative to slightly negative levels, with a -0.59% in 2025 indicating ongoing challenges in profitability. The Current Ratio remained stable around 1.6 to 2.5, reflecting consistent liquidity. Meanwhile, the Debt-to-Equity Ratio steadily declined from 0.89 in 2021 to 0.24 in 2025, signaling reduced leverage and improved balance sheet strength.

Are the Financial Ratios Favorable?

In 2025, liquidity ratios like Current and Quick Ratios were favorable at 1.67, indicating sound short-term financial health. Debt metrics, including Debt-to-Equity at 0.24 and Debt-to-Assets at 9.07%, also showed a favorable leverage position. However, profitability ratios such as Net Margin (-0.49%) and ROE (-0.59%) were unfavorable, as was the Price-to-Book ratio at 29.71. Asset turnover was low at 0.45, and no dividends were paid. Overall, the financial ratios present a neutral profile, balancing favorable liquidity and leverage against weak profitability and efficiency.

Shareholder Return Policy

CrowdStrike Holdings, Inc. does not pay dividends, reflecting its negative or modest net income and a focus on reinvestment and growth. The company historically maintains zero dividend payout ratios and yields, while free cash flow coverage remains positive, supporting operational needs.

The firm does not engage in share buybacks either, emphasizing capital allocation toward growth initiatives rather than shareholder distributions. This policy aligns with sustaining long-term value creation amid its evolving financial performance and strategic priorities.

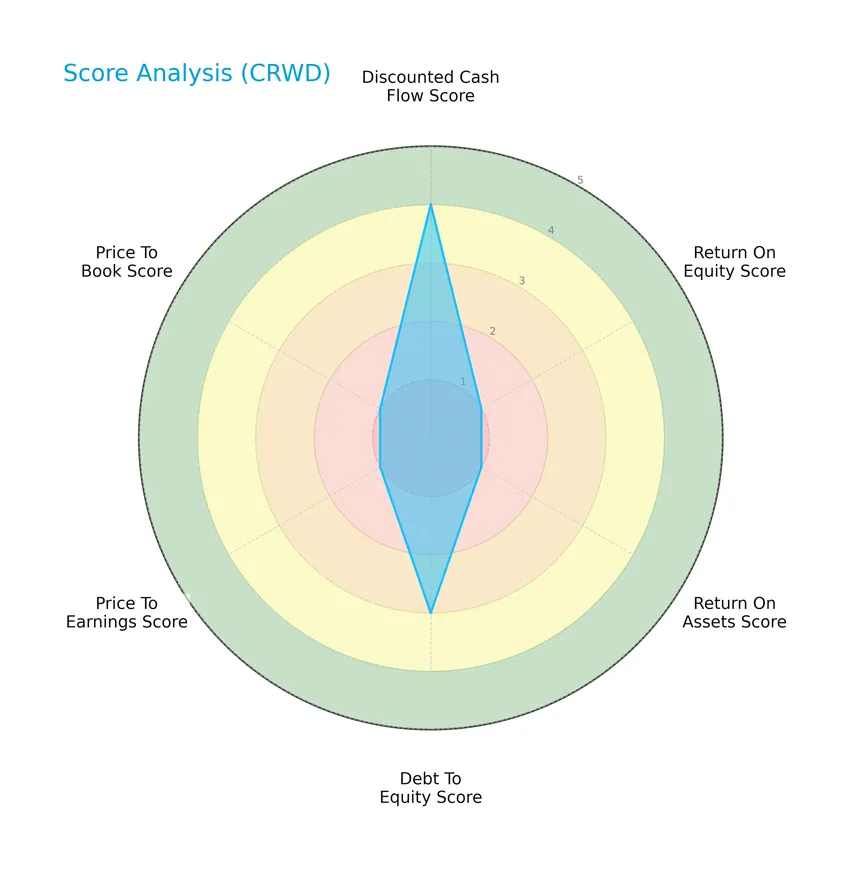

Score analysis

The following radar chart provides a visual overview of CrowdStrike Holdings, Inc.’s key financial scores:

CrowdStrike’s discounted cash flow score is favorable at 4, while profitability metrics such as return on equity and return on assets are very unfavorable, both scoring 1. Its debt-to-equity ratio is moderate with a score of 3, but valuation metrics like price-to-earnings and price-to-book are also very unfavorable at 1 each.

Analysis of the company’s bankruptcy risk

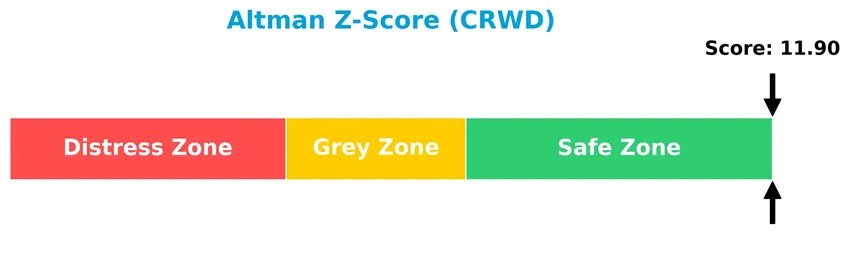

The Altman Z-Score places CrowdStrike Holdings, Inc. firmly in the safe zone, indicating a very low risk of bankruptcy at present:

Is the company in good financial health?

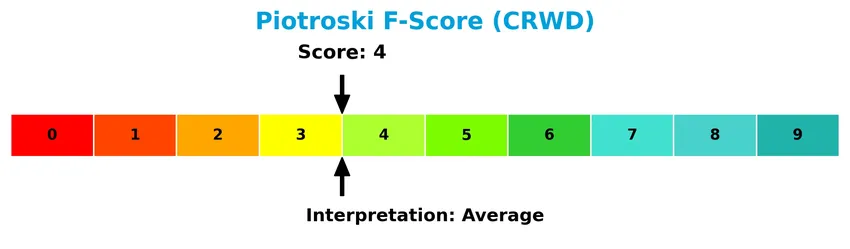

The Piotroski F-Score diagram below illustrates the company’s financial strength based on nine fundamental criteria:

With a Piotroski score of 4, CrowdStrike demonstrates average financial health, reflecting mixed signals in profitability, leverage, and operational efficiency.

Competitive Landscape & Sector Positioning

This section analyzes CrowdStrike Holdings, Inc.’s position within the software infrastructure sector, focusing on its strategic dynamics and market segments. I will assess whether CrowdStrike holds a competitive advantage relative to its main competitors.

Strategic Positioning

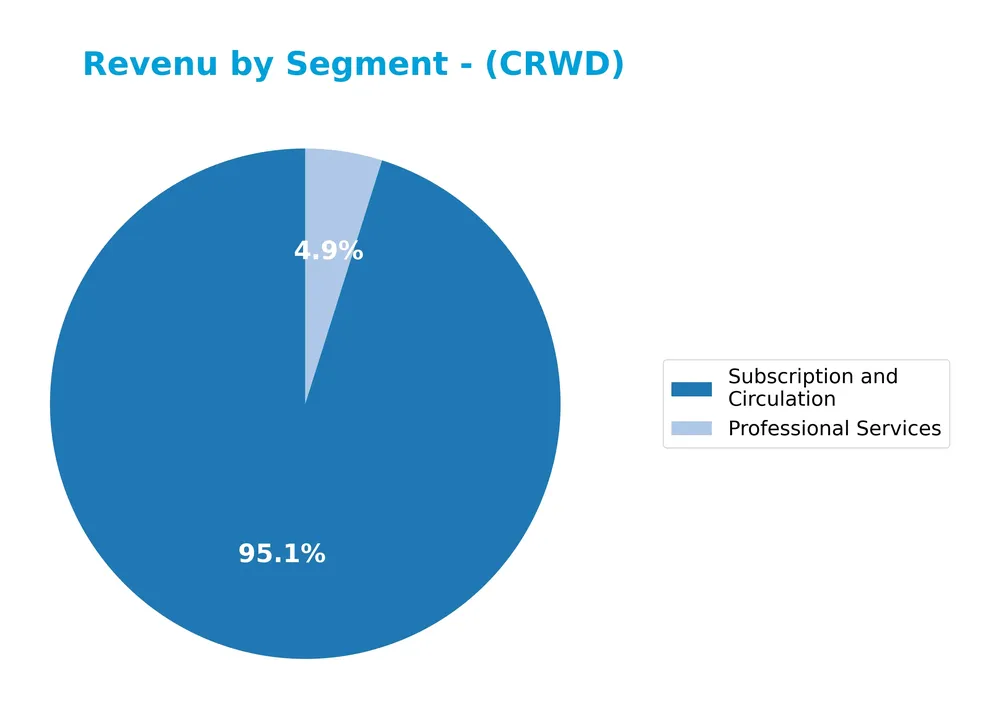

CrowdStrike Holdings, Inc. demonstrates a concentrated product portfolio focused primarily on subscription-based cybersecurity services, generating $3.76B in FY 2025, supplemented by $192M in professional services. Geographically, it maintains a broad exposure with $2.68B revenue from the US and significant growth in EMEA and Asia Pacific markets.

Revenue by Segment

This pie chart illustrates the revenue distribution by segment for CrowdStrike Holdings, Inc. during the fiscal year 2025.

Subscription and Circulation is the dominant revenue driver, reaching 3.76B in 2025, showing strong growth from 436M in 2020. Professional Services contribute significantly less but have steadily increased to 192M. The 2025 data highlights accelerating subscription revenue, indicating a solid shift toward recurring income, while services growth remains consistent but comparatively modest, suggesting a concentration in subscription-based offerings.

Key Products & Brands

The following table summarizes CrowdStrike Holdings, Inc.’s main products and brands along with their descriptions:

| Product | Description |

|---|---|

| Falcon Platform | Cloud-delivered protection platform covering endpoints, cloud workloads, identity, and data security. |

| Subscription and Circulation | Recurring revenue stream from subscriptions to the Falcon platform and cloud security modules. |

| Professional Services | Services including threat intelligence, managed security, IT operations management, and threat hunting. |

CrowdStrike primarily generates revenue through subscription sales of its Falcon cloud security platform, complemented by professional services that support threat detection and IT security management. Subscription revenue has shown strong growth over recent years.

Main Competitors

There are 32 competitors in total, with the following table listing the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Microsoft Corporation | 3.52T |

| Oracle Corporation | 553B |

| Palantir Technologies Inc. | 383B |

| Adobe Inc. | 140B |

| Palo Alto Networks, Inc. | 120B |

| CrowdStrike Holdings, Inc. | 113B |

| Synopsys, Inc. | 92B |

| Cloudflare, Inc. | 69B |

| Fortinet, Inc. | 59B |

| Block, Inc. | 40B |

CrowdStrike Holdings, Inc. ranks 6th among its 32 competitors, with a market cap approximately 3.24% of the leader Microsoft Corporation. The company is positioned below the average market cap of the top 10 competitors (508B) but remains above the sector’s median market cap (19B). CrowdStrike maintains a 5.16% market cap lead over the next competitor above it, indicating a moderate gap.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does CRWD have a competitive advantage?

CrowdStrike Holdings, Inc. shows a slightly unfavorable competitive advantage as it is currently shedding value with a negative ROIC compared to WACC, despite a growing ROIC trend signaling improving profitability. Its gross margin of 74.92% is favorable, but net margin remains negative, indicating challenges in overall profitability.

Looking ahead, CrowdStrike’s expanding geographic footprint and strong revenue growth, particularly in the United States and Asia Pacific, suggest opportunities for market expansion. Continued innovation in its cloud-delivered protection platform and managed security services could support future growth in new products and markets.

SWOT Analysis

This SWOT analysis provides a clear overview of CrowdStrike Holdings, Inc.’s internal strengths and weaknesses, alongside external opportunities and threats to support informed investment decisions.

Strengths

- strong revenue growth of 29.4% in 2025

- leading cloud-delivered security platform

- favorable gross margin at 74.9%

Weaknesses

- negative net margin at -0.49%

- high price-to-book ratio at 29.7

- declining EBIT and EPS growth in the past year

Opportunities

- expansion in global markets, especially Asia Pacific

- increasing demand for cloud security solutions

- growth potential in Zero Trust and identity protection

Threats

- intense competition in cybersecurity sector

- rapid technology changes require constant innovation

- regulatory and geopolitical risks in international markets

Overall, CrowdStrike demonstrates robust growth and solid market positioning but faces profitability challenges and valuation concerns. The company’s strategy should emphasize improving operational efficiency while leveraging expanding global demand for cybersecurity services.

Stock Price Action Analysis

The following weekly stock chart illustrates CrowdStrike Holdings, Inc.’s price movement over the last 100 weeks, highlighting key fluctuations and trends:

Trend Analysis

Over the past 12 months, CrowdStrike’s stock price increased by 43.83%, indicating a bullish trend overall with a deceleration in upward momentum. The price ranged from a low of 217.89 to a high of 543.01. Recent performance from November 2025 to January 2026 shows a -16.18% decline, reflecting a short-term bearish trend.

Volume Analysis

Trading volumes total 2.28B shares with buyer volume at 1.19B (52.21%) over the analyzed period, but volume is decreasing. In the recent period, sellers dominate with only 29.48% buyer volume, suggesting weakening buying interest and increased selling pressure, which may indicate cautious investor sentiment.

Target Prices

Analysts show a strong bullish consensus for CrowdStrike Holdings, Inc. with optimistic price targets ahead.

| Target High | Target Low | Consensus |

|---|---|---|

| 706 | 353 | 553.47 |

The target prices indicate a wide range of expectations, but the consensus suggests substantial upside potential from current levels, reflecting confidence in CrowdStrike’s growth prospects.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines the latest analyst ratings and consumer feedback related to CrowdStrike Holdings, Inc. (CRWD).

Stock Grades

Here is the latest summary of CrowdStrike Holdings, Inc. stock grades from recognized financial institutions and analysts:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| BTIG | Maintain | Buy | 2026-01-13 |

| Citigroup | Maintain | Buy | 2026-01-13 |

| Keybanc | Downgrade | Sector Weight | 2026-01-12 |

| Berenberg | Upgrade | Buy | 2026-01-09 |

| Morgan Stanley | Maintain | Equal Weight | 2025-12-18 |

| Stephens & Co. | Maintain | Overweight | 2025-12-18 |

| Freedom Capital Markets | Upgrade | Buy | 2025-12-11 |

| Citigroup | Maintain | Buy | 2025-12-04 |

| Goldman Sachs | Maintain | Buy | 2025-12-04 |

| Susquehanna | Maintain | Positive | 2025-12-03 |

Overall, the majority of recent grades for CrowdStrike remain positive, with multiple buy ratings maintained or upgraded. A slight divergence appears with Keybanc’s downgrade to sector weight, indicating a mixed but generally favorable outlook.

Consumer Opinions

Consumer sentiment around CrowdStrike Holdings, Inc. reflects a mix of strong appreciation for its cybersecurity solutions and some concerns about pricing and complexity.

| Positive Reviews | Negative Reviews |

|---|---|

| “CrowdStrike’s threat detection is top-notch and reliable.” | “The subscription cost feels quite high for small businesses.” |

| “Excellent customer support and quick response times.” | “Some features have a steep learning curve for new users.” |

| “Seamless integration with existing security platforms.” | “Occasional software updates cause temporary disruptions.” |

Overall, consumers value CrowdStrike’s robust security features and support, but pricing and usability challenges are recurring issues that potential buyers should consider.

Risk Analysis

Below is a detailed table summarizing the key risks associated with investing in CrowdStrike Holdings, Inc., focusing on likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Profitability Risk | Negative net margin (-0.49%) and unfavorable ROE (-0.59%) indicate ongoing profitability issues. | High | High |

| Valuation Risk | Extremely high price-to-book ratio (29.71) suggests overvaluation and possible price correction. | High | Medium |

| Market Volatility | Beta of 1.03 signals stock price moves roughly in line with market, exposing investors to market swings. | Medium | Medium |

| Financial Health | Strong Altman Z-Score (11.9) indicates low bankruptcy risk, but average Piotroski Score (4) suggests moderate financial strength. | Low | Low |

| Competitive Risk | Rapidly evolving cybersecurity landscape demands continual innovation; failure may affect market share. | Medium | High |

| Dividend Risk | Zero dividend yield reflects no income return, increasing reliance on capital gains. | High | Low |

Most significant risks stem from CrowdStrike’s current unprofitable status and high valuation multiples, which could lead to price volatility if growth expectations are not met. Despite solid financial stability indicated by the Altman Z-Score, investors should be cautious given the moderate Piotroski Score and intense competition in the cybersecurity sector.

Should You Buy CrowdStrike Holdings, Inc.?

CrowdStrike Holdings, Inc. appears to be facing a slightly unfavorable moat profile with value destruction despite improving profitability, while maintaining a manageable leverage profile. Supported by a safe Altman Z-score but moderate Piotroski and overall C rating, the investment case suggests cautious interpretation.

Strength & Efficiency Pillars

CrowdStrike Holdings, Inc. exhibits solid financial health as reflected by an Altman Z-Score of 11.90, placing it well within the safe zone and signaling low bankruptcy risk. The firm’s gross margin stands at a robust 74.92%, underscoring efficient core operations. Additionally, the current ratio of 1.67 and debt-to-equity ratio of 0.24 highlight prudent liquidity and leverage management. However, profitability metrics such as ROE (-0.59%) and ROIC (0.7%) fall short, with ROIC trailing the WACC of 8.66%, indicating the company is currently not a value creator despite improving profitability trends.

Weaknesses and Drawbacks

The investment case is tempered by several unfavorable valuation and profitability metrics. CrowdStrike’s price-to-book ratio is elevated at 29.71, suggesting a premium valuation that may expose investors to downside risk. Moreover, net margin remains negative at -0.49%, and earnings metrics have deteriorated recently with net margin growth down -116.67% year-over-year. Market dynamics show seller dominance at 70.52% during the recent period, creating near-term pressure on the stock price, which has declined by 16.18% since November 2025. These factors, combined with a moderate Piotroski score of 4, signal caution.

Our Verdict about CrowdStrike Holdings, Inc.

CrowdStrike’s long-term fundamental profile might appear favorable due to strong revenue growth and solid financial stability. Yet, the recent technical trend is seller dominant, and profitability challenges persist. Despite the company’s improving operational efficiency and safe financial footing, the near-term market pressure suggests investors may want to adopt a wait-and-see approach for a more attractive entry point. The profile suggests potential but is not without notable risks.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- BTIG Remains a Buy on CrowdStrike Holdings, Inc. (CRWD) – Yahoo Finance UK (Jan 23, 2026)

- Why CrowdStrike (CRWD) Stock Is Down Today – Finviz (Jan 20, 2026)

- Migdal Insurance & Financial Holdings Ltd. Sells 1,326 Shares of CrowdStrike $CRWD – MarketBeat (Jan 21, 2026)

- CrowdStrike unveils plans to expand into Saudi Arabia, India, UAE (CRWD:NASDAQ) – Seeking Alpha (Jan 20, 2026)

- CrowdStrike (CRWD) Deep Dive: Resilience, AI Agents, and the Path to $10B ARR – FinancialContent (Jan 22, 2026)

For more information about CrowdStrike Holdings, Inc., please visit the official website: crowdstrike.com