Home > Analyses > Energy > Coterra Energy Inc.

Coterra Energy Inc. powers daily life by tapping into vital oil and natural gas reserves across key U.S. basins, fueling industries and homes alike. As a prominent player in oil and gas exploration and production, Coterra stands out with its extensive footprint in the Marcellus Shale, Permian, and Anadarko Basins, backed by a reputation for operational efficiency and resource development. As energy markets evolve, the question remains: does Coterra’s solid asset base and strategic positioning still support robust growth and justify its current market valuation?

Table of contents

Business Model & Company Overview

Coterra Energy Inc., founded in 1989 and headquartered in Houston, Texas, stands as a significant player in the Oil & Gas Exploration & Production sector. The company operates an integrated portfolio across key U.S. basins, including Marcellus Shale, Permian, and Anadarko, forming a cohesive ecosystem focused on developing and producing oil, natural gas, and liquids. Its strategic footprint spans approximately 665,000 net acres, positioning Coterra as a dominant force in domestic energy resources.

The company’s revenue engine hinges on a balanced mix of upstream production and midstream operations, including natural gas and saltwater disposal gathering systems in Texas. Its sales network spans industrial customers, local distributors, and major energy firms across the Americas. This diversified approach underpins Coterra’s robust market presence, supported by proved reserves of nearly 2.9B barrels of oil equivalent. Such scale and operational integration create a formidable economic moat, setting the stage for long-term industry influence.

Financial Performance & Fundamental Metrics

This section provides a clear analysis of Coterra Energy Inc.’s income statement, key financial ratios, and dividend payout policy to guide informed investment decisions.

Income Statement

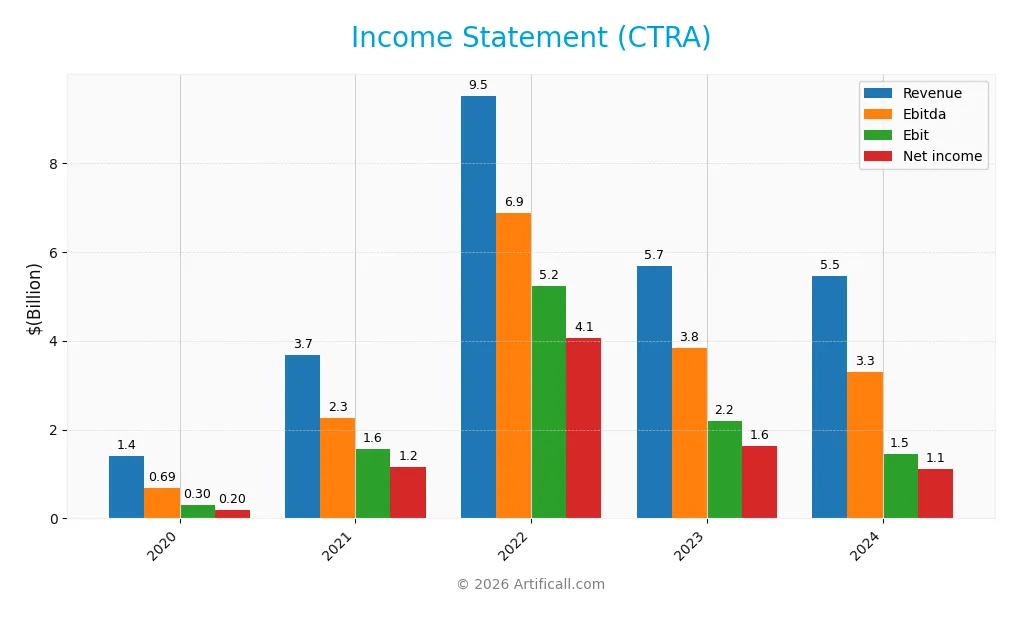

The table below presents Coterra Energy Inc.’s key income statement figures for fiscal years 2020 through 2024, reflecting its financial performance in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 1.41B | 3.67B | 9.51B | 5.68B | 5.46B |

| Cost of Revenue | 1.07B | 1.61B | 3.45B | 3.48B | 3.77B |

| Operating Expenses | 105M | 164M | 327M | 279M | 302M |

| Gross Profit | 340M | 2.06B | 6.07B | 2.20B | 1.69B |

| EBITDA | 690M | 2.26B | 6.87B | 3.84B | 3.30B |

| EBIT | 295M | 1.56B | 5.24B | 2.20B | 1.45B |

| Interest Expense | 54M | 62M | 70M | 73M | 106M |

| Net Income | 201M | 1.16B | 4.07B | 1.63B | 1.12B |

| EPS | 0.5 | 2.3 | 5.1 | 2.14 | 1.51 |

| Filing Date | 2021-02-26 | 2022-03-01 | 2023-02-27 | 2024-02-23 | 2025-02-25 |

Income Statement Evolution

From 2020 to 2024, Coterra Energy Inc.’s revenue showed strong overall growth of 289%, though it declined by 3.9% in the most recent year. Net income increased by 459% over the period but dropped nearly 28% year-over-year. Margins remain favorable, with a gross margin of 31% and a net margin above 20%, despite the recent contraction in profitability.

Is the Income Statement Favorable?

In 2024, Coterra posted revenue of $5.46B and net income of $1.12B, resulting in a net margin of 20.5%. EBIT margin stood at 26.6%, supported by controlled interest expenses at 1.9% of revenue. Despite the year-over-year declines in revenue, profits, and EPS, the overall fundamentals are assessed as favorable, reflecting solid profitability and margin stability.

Financial Ratios

The following table summarizes the key financial ratios for Coterra Energy Inc. over the last five fiscal years, providing a snapshot of profitability, valuation, liquidity, leverage, efficiency, and dividend metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 14% | 32% | 43% | 29% | 21% |

| ROE | 9% | 10% | 32% | 12% | 9% |

| ROIC | 5% | 8% | 24% | 8% | 6% |

| P/E | 32.4 | 8.3 | 4.8 | 11.9 | 16.9 |

| P/B | 2.93 | 0.81 | 1.54 | 1.48 | 1.44 |

| Current Ratio | 1.07 | 1.75 | 1.85 | 1.21 | 2.92 |

| Quick Ratio | 1.03 | 1.72 | 1.80 | 1.18 | 2.88 |

| D/E | 0.53 | 0.30 | 0.21 | 0.19 | 0.29 |

| Debt-to-Assets | 26% | 17% | 13% | 12% | 18% |

| Interest Coverage | 4.3 | 30.5 | 82.0 | 26.4 | 13.1 |

| Asset Turnover | 0.31 | 0.18 | 0.47 | 0.28 | 0.25 |

| Fixed Asset Turnover | 0.34 | 0.21 | 0.53 | 0.31 | 0.30 |

| Dividend Yield | 2.5% | 8.2% | 10.2% | 4.6% | 3.3% |

Evolution of Financial Ratios

Coterra Energy Inc. (CTRA) saw a decline in Return on Equity (ROE) from 32.1% in 2022 to 8.54% in 2024, indicating reduced profitability. Meanwhile, the Current Ratio improved significantly from 1.21 in 2023 to 2.92 in 2024, reflecting stronger liquidity. The Debt-to-Equity Ratio rose slightly but remained low at 0.29 in 2024, suggesting stable leverage.

Are the Financial Ratios Fovorable?

In 2024, CTRA’s profitability shows mixed signals: a favorable net margin of 20.53% contrasts with an unfavorable ROE of 8.54%. Liquidity is strong with current and quick ratios above 2.8, and leverage ratios such as debt-to-equity (0.29) and debt-to-assets (17.58%) are favorable. However, asset and fixed asset turnover ratios are unfavorable, indicating less efficient asset use. Overall, 64% of key ratios are favorable, supporting a generally positive financial position.

Shareholder Return Policy

Coterra Energy Inc. pays dividends with a payout ratio around 55-67% over recent years and a dividend per share declining from $2.50 in 2022 to $0.84 in 2024. The dividend yield decreased from over 10% in 2022 to about 3.3% in 2024, while coverage by free cash flow remains sufficient.

The company also maintains share buyback programs contributing to shareholder returns. This balanced approach of dividend payments and buybacks appears aligned with sustainable long-term value creation, given adequate cash flow coverage and manageable payout levels amid fluctuating profitability.

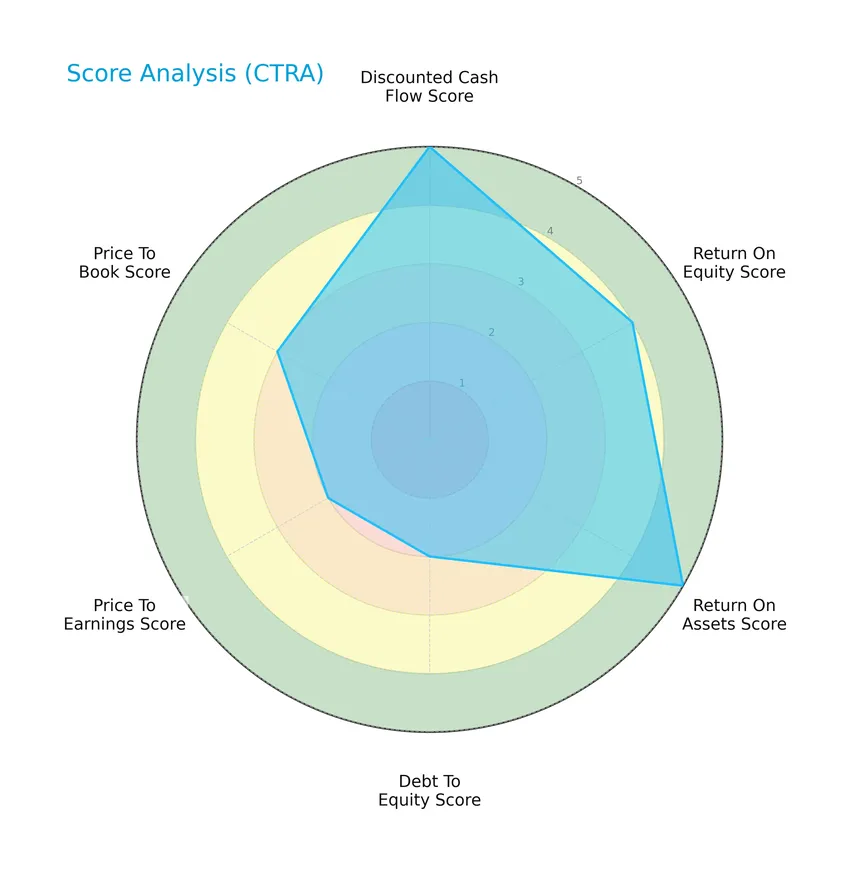

Score analysis

The following radar chart presents an overview of Coterra Energy Inc.’s key financial scores, providing insight into its valuation and profitability metrics:

Coterra Energy Inc. scores very favorably on discounted cash flow and return on assets, indicating strong cash generation and asset efficiency. Return on equity is favorable, while debt-to-equity, price-to-earnings, and price-to-book ratios show moderate scores, reflecting some leverage and valuation caution.

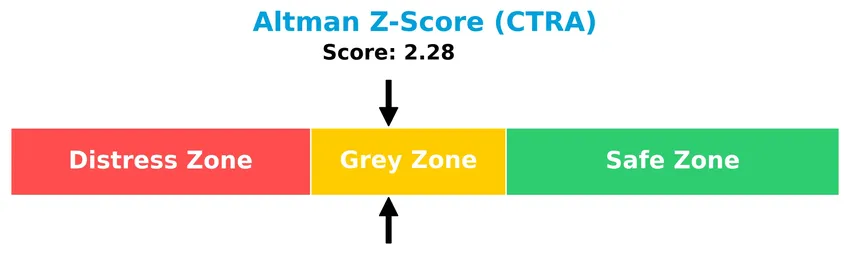

Analysis of the company’s bankruptcy risk

The Altman Z-Score places Coterra Energy Inc. in the grey zone, suggesting a moderate risk of financial distress and bankruptcy potential:

Is the company in good financial health?

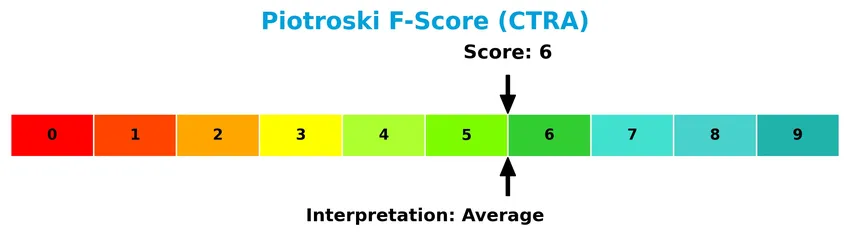

The Piotroski diagram illustrates Coterra Energy Inc.’s financial strength based on its Piotroski Score:

With a Piotroski Score of 6 categorized as average, the company demonstrates moderate financial health, indicating neither strong nor weak operational and financial fundamentals.

Competitive Landscape & Sector Positioning

This sector analysis will explore Coterra Energy Inc.’s strategic positioning, revenue segments, key products, and main competitors in the energy industry. I will assess whether Coterra Energy holds a competitive advantage relative to its peers.

Strategic Positioning

Coterra Energy Inc. concentrates its operations in the U.S. oil and gas sector, focusing on key basins such as the Marcellus Shale, Permian, and Anadarko, with a product portfolio centered on oil, condensate, and natural gas liquids generating multi-billion USD revenues.

Revenue by Segment

This pie chart presents Coterra Energy Inc.’s revenue distribution by segment for the fiscal year 2024, highlighting the contribution of its main products.

In 2024, Oil and Condensate dominated Coterra’s revenue with 2.95B USD, showing steady strength after a dip in 2023. Natural Gas Liquids contributed significantly in prior years but was not reported in 2024. The data indicates a concentration of revenue in Oil and Condensate, reflecting potential concentration risk, while other segments like Oil and Gas, Other have negligible impact. This suggests Coterra’s business is heavily reliant on oil-related products.

Key Products & Brands

The table below outlines Coterra Energy Inc.’s main products and their descriptions:

| Product | Description |

|---|---|

| Oil and Condensate | Hydrocarbon liquids produced from oil reservoirs, representing the largest revenue segment with $2.95B in 2024. |

| Natural Gas Liquids | Liquid hydrocarbons separated from natural gas, contributing up to $964M in revenue in 2022. |

| Oil And Gas, Other | Miscellaneous oil and gas products with minimal revenue reported in early years (2018-2020). |

Coterra Energy’s key products focus primarily on oil and condensate, supported by natural gas liquids, reflecting its operations in major U.S. shale plays and associated hydrocarbon production.

Main Competitors

There are 10 main competitors in the Oil & Gas Exploration & Production industry; below is a table of the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| ConocoPhillips | 120.5B |

| EOG Resources, Inc. | 58.8B |

| Diamondback Energy, Inc. | 44.3B |

| Occidental Petroleum Corporation | 41.8B |

| EQT Corporation | 33.4B |

| Expand Energy Corporation | 26.1B |

| Devon Energy Corporation | 24.2B |

| Texas Pacific Land Corporation | 20.5B |

| Coterra Energy Inc. | 20.3B |

| APA Corporation | 9.0B |

Coterra Energy Inc. ranks 9th among its top 10 competitors, holding about 17.3% of the market cap of the leader, ConocoPhillips. It is positioned below both the average market cap of 39.9B and the median sector market cap of 29.8B. The company is closely trailing Texas Pacific Land Corporation, with a narrow gap of approximately 1.6% to the next competitor above.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does Coterra Energy Inc. have a competitive advantage?

Coterra Energy Inc. currently does not demonstrate a clear competitive advantage as its ROIC is below WACC, indicating value is being shed. However, the company maintains favorable margins and income statement metrics, supporting operational efficiency despite recent revenue declines.

Looking ahead, Coterra’s large acreage in key U.S. shale plays such as Marcellus, Permian, and Anadarko basins offers opportunities for growth in natural gas and liquids production. The company’s expanding ROIC trend suggests improving profitability, which may enhance its competitive positioning over time.

SWOT Analysis

This SWOT analysis highlights Coterra Energy Inc.’s key internal and external factors to guide investment decisions.

Strengths

- strong gross and net margins

- low interest expense and debt levels

- diversified asset base in Marcellus, Permian, Anadarko basins

Weaknesses

- recent revenue and profit declines

- below-average ROE and asset turnover

- moderate Piotroski score indicating average financial strength

Opportunities

- growing natural gas demand

- expansion of natural gas infrastructure

- improving ROIC trend signaling rising profitability

Threats

- volatile commodity prices

- regulatory and environmental risks

- competition from renewable energy sources

Coterra Energy demonstrates solid profitability and financial stability but faces short-term earnings pressure. Its growth prospects hinge on capitalizing on natural gas demand while managing operational risks. Investors should weigh these factors carefully within a balanced portfolio strategy.

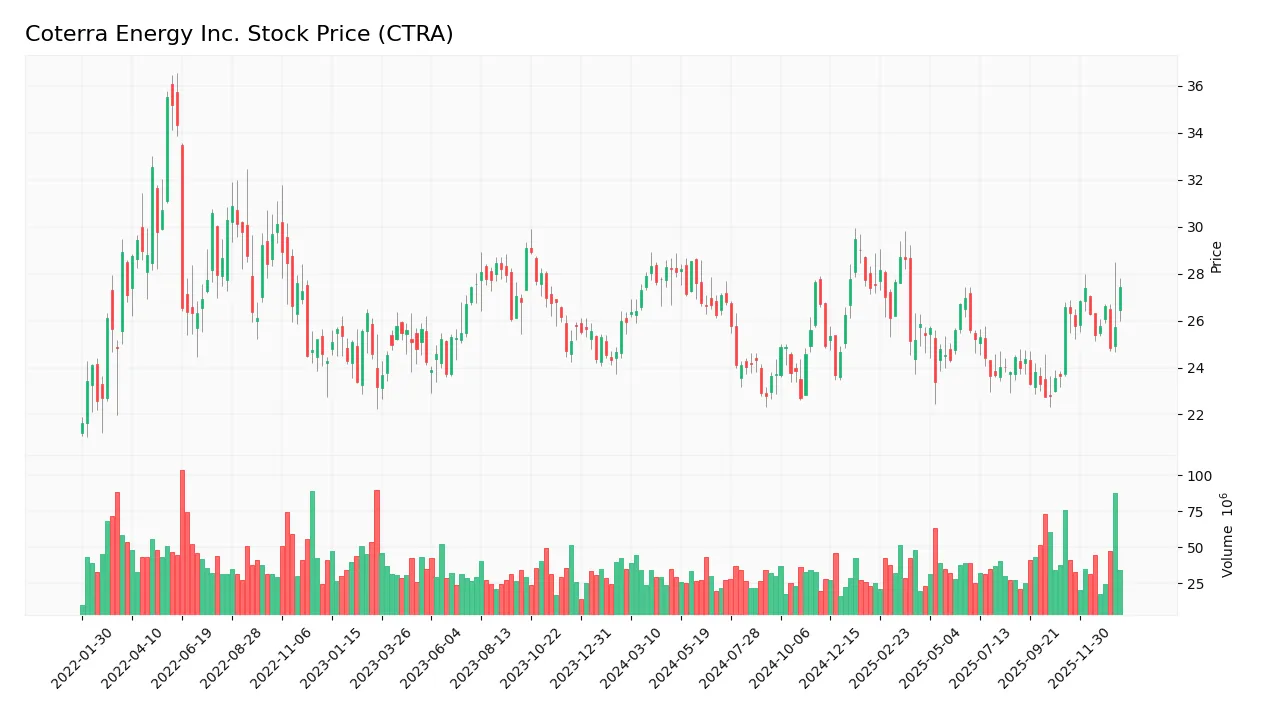

Stock Price Action Analysis

The following weekly stock chart of Coterra Energy Inc. (CTRA) illustrates price movements and trading activity over the past 12 months:

Trend Analysis

Over the past 12 months, CTRA’s stock price increased by 5.62%, indicating a bullish trend. The price ranged between a low of 22.71 and a high of 29.47, with volatility measured by a standard deviation of 1.71. Recent months show a deceleration in upward momentum, with a smaller 3.2% gain and a slight negative slope.

Volume Analysis

Trading volume is increasing, with a total of approximately 3.98B shares traded over the analyzed period. Buyer volume accounts for 51.83%, showing a balanced but slightly buyer-driven market. In the recent period, buyer dominance rose to 59.82%, reflecting growing investor interest and positive market participation.

Target Prices

The consensus target prices for Coterra Energy Inc. indicate moderate upside potential.

| Target High | Target Low | Consensus |

|---|---|---|

| 38 | 27 | 32.6 |

Analysts expect Coterra Energy’s stock to trade between $27 and $38, with a consensus target around $32.6, suggesting cautious optimism in the near term.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines the latest analyst ratings and consumer feedback regarding Coterra Energy Inc. (CTRA).

Stock Grades

Here are the latest verified grades from reputable financial institutions for Coterra Energy Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2026-01-21 |

| JP Morgan | Maintain | Overweight | 2026-01-12 |

| UBS | Maintain | Buy | 2025-12-12 |

| Piper Sandler | Maintain | Overweight | 2025-11-18 |

| Piper Sandler | Maintain | Overweight | 2025-10-21 |

| Susquehanna | Maintain | Positive | 2025-10-20 |

| Morgan Stanley | Maintain | Equal Weight | 2025-10-14 |

| UBS | Maintain | Buy | 2025-10-14 |

| Scotiabank | Maintain | Sector Outperform | 2025-10-09 |

| Mizuho | Maintain | Outperform | 2025-09-15 |

The consensus among these firms indicates a generally positive outlook, with most grades clustered around buy, overweight, or outperform ratings, reflecting steady confidence in Coterra Energy’s prospects.

Consumer Opinions

Consumer sentiment around Coterra Energy Inc. (CTRA) reflects a mix of appreciation for its operational efficiency and concerns about environmental impact.

| Positive Reviews | Negative Reviews |

|---|---|

| Strong focus on sustainable energy practices | Environmental concerns remain significant |

| Efficient production and consistent output | Some delays in project timelines |

| Transparent communication with investors | Volatility in stock price worries consumers |

| Commitment to reducing carbon footprint | Limited diversification beyond core energy |

Overall, consumers praise Coterra Energy’s commitment to sustainability and operational efficiency. However, environmental impact concerns and occasional project delays are recurring issues that investors should monitor carefully.

Risk Analysis

The following table summarizes the main risks associated with investing in Coterra Energy Inc., focusing on their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Risk | Exposure to oil and gas price volatility affecting revenues and profitability | High | High |

| Operational Risk | Challenges in exploration, production, and maintaining large acreage assets | Medium | Medium |

| Financial Risk | Moderate debt levels with a debt-to-equity score rated moderate | Medium | Medium |

| Regulatory Risk | Changes in environmental regulations impacting operations and costs | Medium | High |

| Environmental Risk | Risks related to environmental incidents and sustainability pressures | Medium | High |

| Liquidity Risk | Current and quick ratios are favorable, reducing liquidity concerns | Low | Low |

| Bankruptcy Risk | Altman Z-score in grey zone indicates moderate bankruptcy risk | Medium | High |

Coterra’s most significant risks stem from market volatility in oil and gas prices and regulatory changes, both likely to heavily impact earnings. Operational risks remain moderate due to their diversified acreage, while financial leverage is manageable but should be monitored closely. The Altman Z-score suggests caution but no immediate distress.

Should You Buy Coterra Energy Inc.?

Coterra Energy Inc. appears to be a company with improving profitability and a slightly favorable competitive moat, suggesting growing operational efficiency despite shedding value relative to WACC. Its debt profile could be seen as moderate, while the overall rating of A- indicates a very favorable investment quality from a broad financial perspective.

Strength & Efficiency Pillars

Coterra Energy Inc. displays solid profitability metrics with a net margin of 20.53% and a favorable gross margin of 30.97%, underscoring operational efficiency. The company’s weighted average cost of capital (WACC) stands at 5.04%, slightly below its return on invested capital (ROIC) of 5.62%, indicating it is close to being a value creator, although the margin is narrow. Financial health is robust, supported by a strong current ratio of 2.92 and a debt-to-equity ratio of 0.29, reflecting prudent leverage management. The Altman Z-score at 2.28 places Coterra in the grey zone, suggesting moderate bankruptcy risk, while a Piotroski score of 6 indicates average financial strength.

Weaknesses and Drawbacks

Despite favorable operational results, Coterra faces challenges that temper its investment appeal. The return on equity (ROE) is low at 8.54%, signaling limited shareholder value generation relative to equity. Asset turnover ratios are weak (0.25), pointing to inefficiencies in asset utilization. Valuation metrics such as a price-to-earnings (P/E) ratio of 16.91 and price-to-book (P/B) ratio of 1.44 are moderate but warrant caution given industry cyclicality. While debt levels are manageable, the company’s recent one-year revenue decline of -3.92% and a sharper net margin contraction of -28.2% highlight short-term operational pressures that could impact near-term returns.

Our Verdict about Coterra Energy Inc.

Coterra Energy Inc. presents a fundamentally favorable profile with stable profitability and solid financial health, though it falls short of clear value creation given the marginal ROIC-WACC spread. The overall bullish long-term trend, supported by a slightly buyer-dominant recent period with 59.82% buyer volume, suggests potential for growth. However, recent deceleration in price trend and profitability contraction may imply that investors could consider a wait-and-see approach to secure a more advantageous entry point before committing to long-term exposure.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Rakuten Investment Management Inc. Makes New Investment in Coterra Energy Inc. $CTRA – MarketBeat (Jan 24, 2026)

- Coterra and Devon Explore Merger to Create Major U.S. Shale Player – Yahoo Finance (Jan 19, 2026)

- What you need to know ahead of Coterra Energy’s earnings release – MSN (Jan 20, 2026)

- Kimmeridge to nominate Scott Sheffield to Coterra Energy board, source says – Reuters (Jan 22, 2026)

- What You Need to Know Ahead of Coterra Energy’s Earnings Release – Barchart.com (Jan 20, 2026)

For more information about Coterra Energy Inc., please visit the official website: coterra.com