Home > Analyses > Real Estate > CoStar Group, Inc.

CoStar Group, Inc. revolutionizes how commercial real estate professionals access and analyze critical market data, transforming decision-making across multiple sectors. As a dominant force in real estate services, CoStar leads with innovative platforms like CoStar Property and LoopNet, delivering unmatched inventory, analytics, and marketing tools. Renowned for its comprehensive data and cutting-edge technology, the company shapes industry standards worldwide. The key question now is whether CoStar’s strong fundamentals continue to support its current market valuation and growth outlook.

Table of contents

Business Model & Company Overview

CoStar Group, Inc., founded in 1987 and headquartered in Washington, DC, stands as a dominant force in the real estate services industry. It operates a comprehensive ecosystem of information, analytics, and online marketplaces targeting commercial real estate, hospitality, and residential sectors across the US, Canada, Europe, Asia Pacific, and Latin America. Its integrated suite of property databases, market analytics, and leasing tools forms a vital resource for industry professionals, underpinning its core mission of delivering actionable real estate intelligence.

The company’s revenue engine balances recurring subscription services with data-driven software solutions and advertising platforms, spanning apartment marketing sites and online auction services. This diversified approach fuels its global footprint in the Americas, Europe, and Asia, generating steady cash flow while expanding market reach. CoStar’s robust data infrastructure and entrenched client base create a formidable economic moat, positioning it as a key architect in shaping the future landscape of real estate information and technology.

Financial Performance & Fundamental Metrics

I will analyze CoStar Group, Inc.’s income statement, key financial ratios, and dividend payout policy to provide a clear view of its fundamental health.

Income Statement

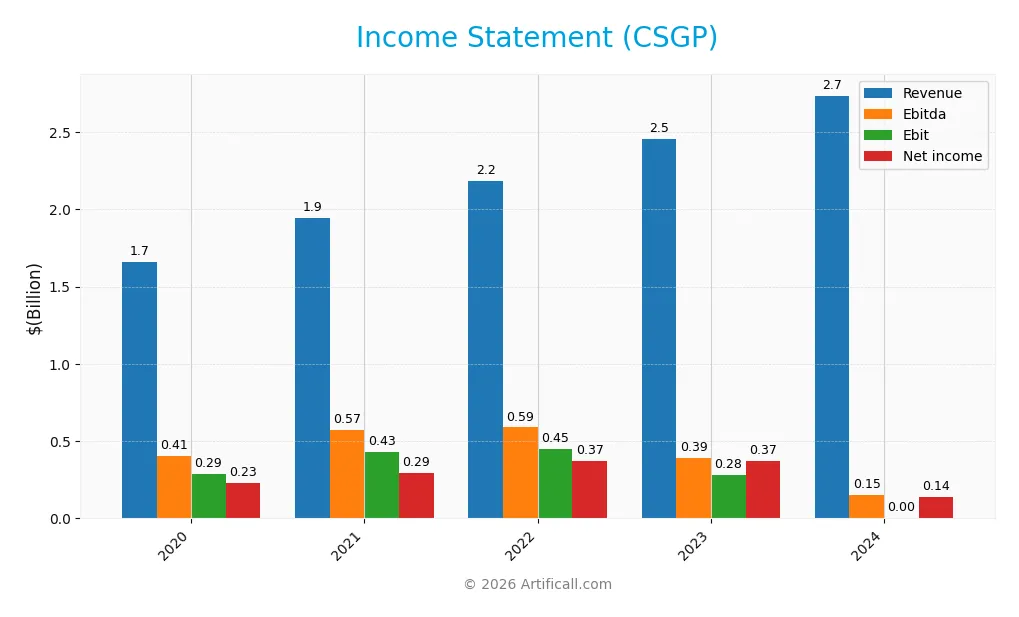

The table below presents CoStar Group, Inc.’s key income statement figures for the fiscal years 2020 through 2024, reflecting trends in revenue, profitability, and earnings per share.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 1.66B | 1.94B | 2.18B | 2.46B | 2.74B |

| Cost of Revenue | 309M | 357M | 414M | 492M | 559M |

| Operating Expenses | 1.06B | 1.15B | 1.32B | 1.68B | 2.17B |

| Gross Profit | 1.35B | 1.59B | 1.77B | 1.96B | 2.18B |

| EBITDA | 406M | 572M | 589M | 390M | 152M |

| EBIT | 289M | 432M | 451M | 282M | 5M |

| Interest Expense | 17M | 32M | 0 | 31M | 27M |

| Net Income | 227M | 293M | 370M | 375M | 139M |

| EPS | 0.60 | 0.74 | 0.93 | 0.92 | 0.34 |

| Filing Date | 2021-02-24 | 2022-02-23 | 2023-02-22 | 2024-02-22 | 2025-02-20 |

Income Statement Evolution

CoStar Group, Inc. showed a favorable revenue growth of 11.45% in 2024, continuing an overall increase of 64.93% since 2020. However, net income declined by nearly 39% over the same period, with a significant 66.79% drop in net margin in the last year. Gross margin remained strong at 79.59%, but EBIT margin fell sharply to 0.17%, indicating margin pressure despite top-line growth.

Is the Income Statement Favorable?

The 2024 income statement reveals mixed fundamentals. While revenue and gross profit growth were favorable, operating expenses grew in line with revenue, eroding EBIT which plunged 98.34%. Net income and EPS both declined substantially, reflecting weaker profitability. Favorable aspects include a solid gross margin and low interest expense, but the overall income statement evaluation is unfavorable due to deteriorating margins and bottom-line performance.

Financial Ratios

The table below presents key financial ratios for CoStar Group, Inc. (CSGP) over the fiscal years 2020 to 2024, reflecting profitability, valuation, liquidity, leverage, efficiency, and dividend metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 14% | 15% | 17% | 15% | 5% |

| ROE | 4.2% | 5.1% | 5.4% | 5.1% | 1.8% |

| ROIC | 3.7% | 4.5% | 4.2% | 2.5% | 0.04% |

| P/E | 155 | 106 | 83 | 95 | 210 |

| P/B | 6.5 | 5.4 | 4.5 | 4.8 | 3.9 |

| Current Ratio | 11.8 | 11.8 | 13.9 | 12.0 | 9.0 |

| Quick Ratio | 11.7 | 11.7 | 13.9 | 12.0 | 9.0 |

| D/E | 0.21 | 0.19 | 0.16 | 0.15 | 0.14 |

| Debt-to-Assets | 16% | 15% | 13% | 12% | 11% |

| Interest Coverage | 16.6 | 13.7 | 0 | 9.0 | 0.17 |

| Asset Turnover | 0.24 | 0.27 | 0.26 | 0.28 | 0.30 |

| Fixed Asset Turnover | 7.1 | 5.2 | 5.4 | 4.4 | 2.4 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Evolution of Financial Ratios

Over the period, CoStar Group, Inc. (CSGP) experienced a marked decline in Return on Equity (ROE), falling to 1.84% in 2024, reflecting a significant slowdown in profitability. The Current Ratio decreased but remained high at 8.96 in 2024, indicating strong liquidity though less than previous years. The Debt-to-Equity Ratio improved slightly to 0.14, signifying stable leverage. Profitability margins notably contracted, with net profit margin down to 5.07%.

Are the Financial Ratios Favorable?

In 2024, CSGP’s financial ratios present a mixed picture. Profitability ratios such as ROE (1.84%) and return on invested capital (0.04%) are unfavorable, suggesting weak earnings efficiency. Liquidity is strong, with a favorable quick ratio of 8.96 but an unfavorable current ratio at the same level. Leverage ratios, including debt-to-equity at 0.14 and debt-to-assets at 11.26%, are favorable, indicating manageable debt levels. Market valuation ratios, notably a high price-to-earnings ratio of 209.71 and price-to-book of 3.85, are unfavorable, reflecting investor expectations and potential overvaluation. Overall, the ratio profile is considered unfavorable.

Shareholder Return Policy

CoStar Group, Inc. (CSGP) has not paid dividends over the past years, reflecting a zero dividend payout ratio and yield. The company’s free cash flow per share was negative in 2024, indicating reinvestment or growth strategies rather than shareholder distributions, with no share buyback activity reported.

This approach aligns with prioritizing long-term value creation through reinvestment rather than immediate returns. The lack of dividends and absence of buybacks suggest a focus on growth or capital allocation to operations, supporting sustainability but requiring ongoing evaluation of cash flow generation and profitability trends.

Score analysis

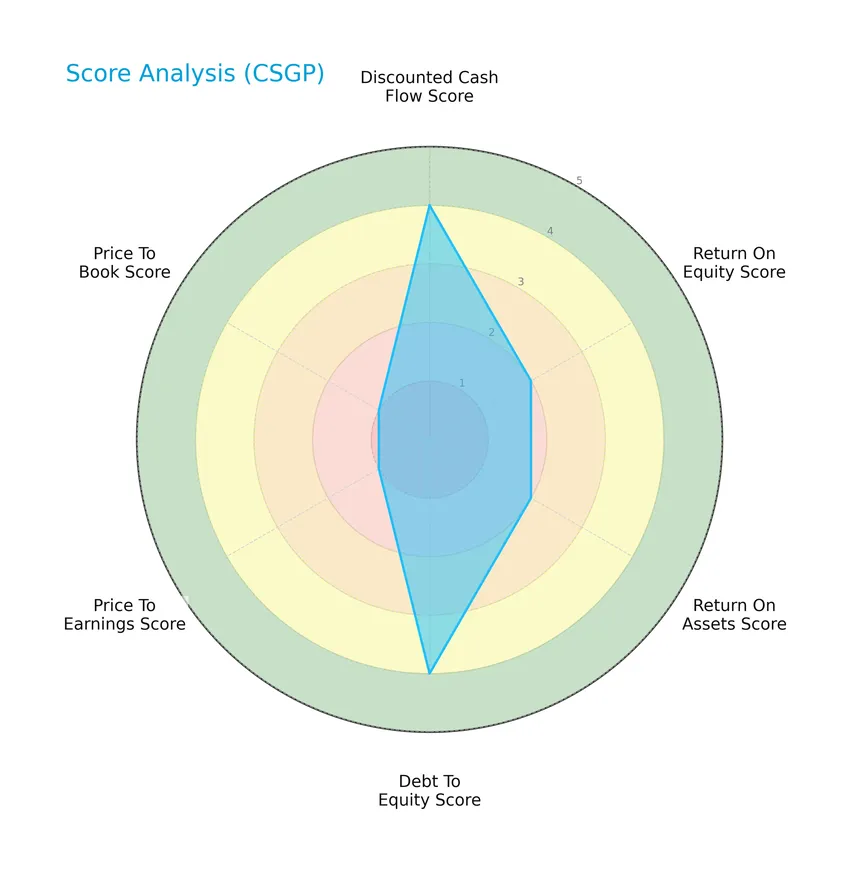

The following radar chart presents the evaluation of key financial metrics for the company:

The discounted cash flow and debt-to-equity scores are favorable at 4 each, indicating solid valuation and capital structure. Return on equity and assets show moderate scores of 2, while price-to-earnings and price-to-book ratios are very unfavorable at 1, reflecting valuation concerns.

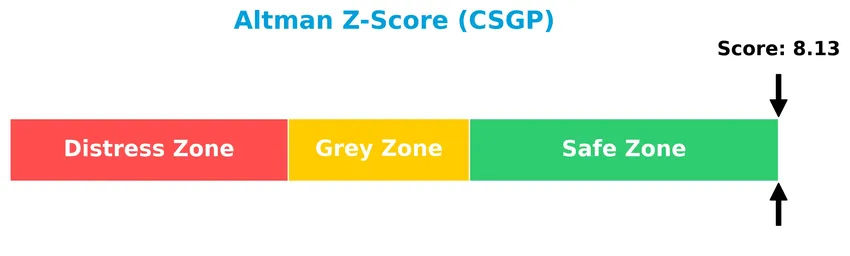

Analysis of the company’s bankruptcy risk

The Altman Z-Score indicates that the company is firmly in the safe zone, suggesting a very low risk of bankruptcy:

Is the company in good financial health?

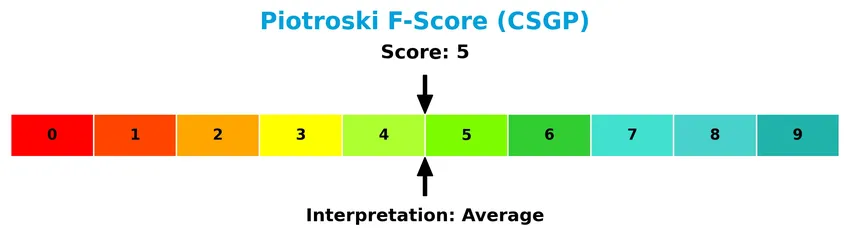

This Piotroski diagram illustrates the company’s financial health based on nine key criteria:

With a Piotroski Score of 5, the company demonstrates average financial strength, reflecting a moderate balance of profitability, leverage, and liquidity factors in its financial statements.

Competitive Landscape & Sector Positioning

This section presents an analysis of CoStar Group, Inc.’s positioning within the real estate services sector, including its strategic focus and revenue breakdown. I will examine whether CoStar Group holds a competitive advantage over its main industry rivals.

Strategic Positioning

CoStar Group, Inc. has a diversified product portfolio focused on real estate information, analytics, and online marketplaces, with key segments like CoStar Suite ($1.02B in 2024) and LoopNet ($282M). Geographically, it concentrates primarily on North America ($2.37B in 2023), with limited but growing non-US exposure ($89M).

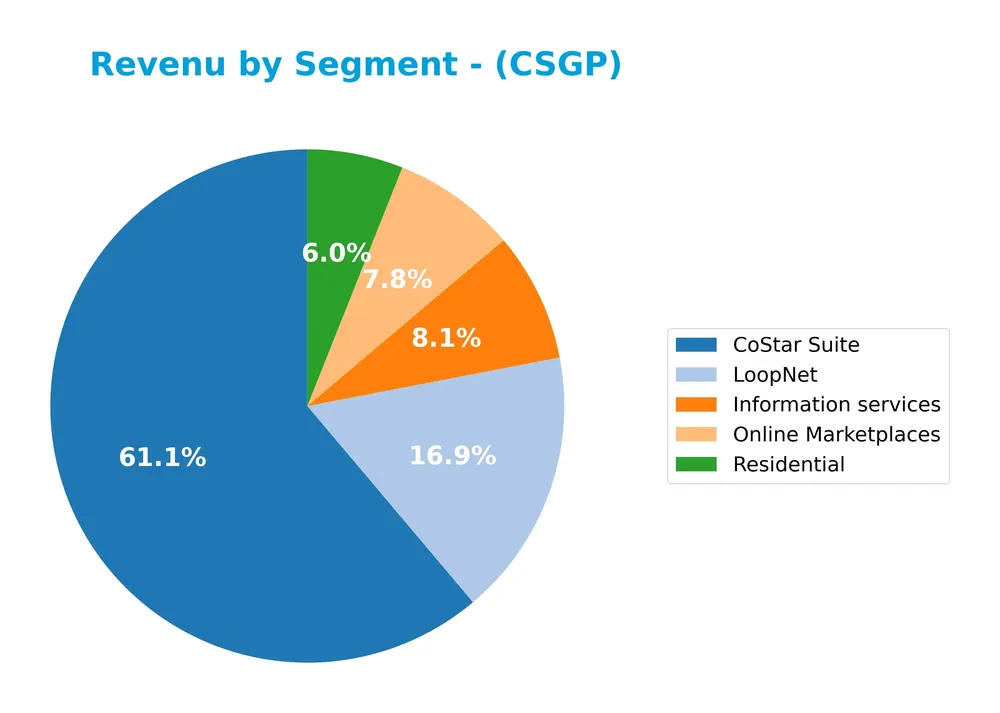

Revenue by Segment

The pie chart illustrates CoStar Group, Inc.’s revenue distribution by segment for the fiscal year 2024, highlighting the contribution of each business line to the total revenue.

In 2024, the CoStar Suite remains the dominant revenue driver with 1.02B, showing steady growth from prior years. LoopNet and Online Marketplaces contribute 282M and 130M respectively, maintaining a solid presence. Information services and Residential segments, though smaller at 136M and 101M, add important diversification. The revenue mix indicates a concentration in the CoStar Suite, signaling reliance on this core product while other segments grow moderately or stabilize.

Key Products & Brands

The table below presents CoStar Group, Inc.’s main products and brands along with their descriptions:

| Product | Description |

|---|---|

| CoStar Suite | Comprehensive commercial real estate information and analytics platform covering office, industrial, retail, multifamily, and more. |

| Information Services | Data and analytical services including market trends, lease comps, and public records for real estate professionals. |

| LoopNet | Online marketplace offering premium listings and advertising services for commercial real estate properties. |

| Online Marketplaces | Digital platforms for various real estate segments including residential rentals and rural land sales. |

| Residential | Apartment marketing websites such as ApartmentFinder.com and ForRent.com targeting residential property rentals and sales. |

CoStar Group’s product portfolio spans data analytics, software solutions, and multiple online marketplaces catering to commercial and residential real estate sectors. Their offerings support a wide range of real estate professionals with market intelligence and transactional platforms.

Main Competitors

There are 2 competitors in the Real Estate – Services industry; the table below lists the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| CBRE Group, Inc. | 47.67B |

| CoStar Group, Inc. | 27.84B |

CoStar Group, Inc. ranks 2nd among its competitors with a market cap at 58.32% of the top player, CBRE Group, Inc. It is positioned below both the average market cap of the top 10 competitors (37.8B) and the median market cap of its sector. CoStar maintains a significant 71.46% market cap gap from its closest rival above.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does CSGP have a competitive advantage?

CoStar Group, Inc. currently does not present a competitive advantage as its return on invested capital (ROIC) is significantly below its weighted average cost of capital (WACC), indicating value destruction and declining profitability. The company shows a very unfavorable moat status with a steep negative ROIC trend over the 2020-2024 period.

Looking ahead, CoStar Group operates in multiple real estate sectors with diverse products like CoStar Property, Market Analytics, and online platforms for property marketing and leasing. Its expanding presence across the US, Canada, Europe, Asia Pacific, and Latin America could offer growth opportunities, although recent financial trends suggest caution in profitability improvements.

SWOT Analysis

This SWOT analysis highlights CoStar Group, Inc.’s key internal and external factors to inform investment decisions.

Strengths

- Strong market position in commercial real estate data

- High gross margin of 79.6%

- Low debt levels with favorable debt-to-assets ratio

Weaknesses

- Declining profitability with negative ROIC trend

- Unfavorable earnings growth and EPS decline

- High valuation multiples (PE 209.7)

Opportunities

- Expansion in international markets

- Growing demand for digital real estate analytics

- Potential for new SaaS product offerings

Threats

- Intense competition in real estate services

- Economic downturns impacting commercial property markets

- Technological disruption from emerging data platforms

CoStar Group shows robust market strength and solid gross margins but faces challenges in profitability and valuation risk. Strategic focus on innovation and market expansion is essential to counteract competitive and economic threats.

Stock Price Action Analysis

The following weekly stock chart for CoStar Group, Inc. (CSGP) illustrates price movements and volume patterns over the past 12 months:

Trend Analysis

Over the past 12 months, CSGP’s stock price declined by 25.68%, indicating a bearish trend. The price range fluctuated between a high of 96.6 and a low of 58.49. The trend shows deceleration in downward momentum, with volatility measured by a standard deviation of 8.02.

Volume Analysis

Trading volume over the last three months is increasing, with seller volume slightly exceeding buyer volume (51.95% vs. 48.05%). Buyer behavior remains neutral, suggesting balanced but cautious market participation without clear dominance from either side.

Target Prices

The consensus target prices for CoStar Group, Inc. indicate a moderately optimistic outlook.

| Target High | Target Low | Consensus |

|---|---|---|

| 105 | 55 | 74.57 |

Analysts expect the stock price to range between 55 and 105, with a consensus target around 74.57, reflecting cautious but positive market sentiment.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews the latest analyst ratings and consumer feedback related to CoStar Group, Inc. (CSGP).

Stock Grades

The latest verified analyst grades for CoStar Group, Inc. from leading financial institutions are presented below:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Keefe, Bruyette & Woods | Maintain | Outperform | 2026-01-12 |

| Citizens | Maintain | Market Outperform | 2026-01-08 |

| Goldman Sachs | Maintain | Buy | 2026-01-08 |

| Needham | Maintain | Buy | 2026-01-08 |

| BMO Capital | Maintain | Market Perform | 2026-01-08 |

| Wells Fargo | Maintain | Underweight | 2026-01-08 |

The consensus rating remains a Buy, supported by 18 buy ratings versus 4 hold and 2 sell ratings. Most analysts maintain a positive outlook, though some caution is reflected in the underweight and market perform assessments.

Consumer Opinions

Consumers of CoStar Group, Inc. (CSGP) express a mix of enthusiasm and constructive criticism, reflecting their real-world experiences with the company’s services.

| Positive Reviews | Negative Reviews |

|---|---|

| Comprehensive and accurate real estate data sets. | High subscription costs deter smaller firms. |

| User-friendly platform with robust analytics tools. | Occasional delays in data updates reported. |

| Excellent customer support and training resources. | Interface can be overwhelming for new users. |

Overall, consumers appreciate CoStar’s detailed data and supportive customer service, but some highlight pricing and usability challenges, signaling areas for improvement in accessibility and cost management.

Risk Analysis

Below is a summary table highlighting key risks associated with CoStar Group, Inc., focusing on their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Valuation Risk | Extremely high P/E ratio (209.7) signals possible overvaluation and price correction risk. | High | High |

| Profitability Risk | Low return on equity (1.84%) and return on invested capital (0.04%) indicate weak profitability. | High | Medium |

| Liquidity Risk | Unfavorable current ratio (8.96) despite a strong quick ratio suggests possible short-term liquidity imbalances. | Medium | Medium |

| Interest Coverage | Very low interest coverage ratio (0.17) raises concerns over debt servicing ability if conditions worsen. | Medium | High |

| Market Volatility | Beta of 0.841 implies moderate sensitivity to market swings; sector cyclicality may amplify this. | Medium | Medium |

| Dividend Risk | No dividend payout increases reliance on capital gains, adding risk if growth stalls. | Medium | Low |

The most critical risks are valuation and profitability concerns, driven by CoStar’s sky-high P/E ratio and weak returns on equity and capital. Despite a strong Altman Z-Score indicating low bankruptcy risk, the company’s profitability and valuation metrics warrant caution, especially in a potentially volatile real estate services market environment.

Should You Buy CoStar Group, Inc.?

CoStar Group, Inc. appears to be characterized by manageable leverage and moderate profitability, though its competitive moat could be seen as eroding given declining returns on invested capital. Despite very unfavorable valuation metrics, the overall rating suggests a cautiously favorable profile.

Strength & Efficiency Pillars

CoStar Group, Inc. (CSGP) exhibits solid financial health, as evidenced by an Altman Z-Score of 8.13, positioning the company firmly in the safe zone and indicating low bankruptcy risk. The Piotroski score of 5 suggests average financial strength. Favorable debt management is reflected in a low debt-to-equity ratio of 0.14 and a debt-to-assets ratio of 11.26%, underscoring prudent leverage. Although return on equity (1.84%) and return on invested capital (0.04%) are modest and below the weighted average cost of capital (7.62%), the company maintains robust gross margins at 79.59%, demonstrating operational efficiency.

Weaknesses and Drawbacks

CSGP faces significant valuation challenges with an elevated price-to-earnings ratio of 209.71 and a price-to-book ratio of 3.85, both flagged as very unfavorable, suggesting a high premium that may not be justified by current earnings. The current ratio is unusually high at 8.96, signaling potential inefficiencies in asset utilization or liquidity management. Additionally, the company’s weak profitability trends—highlighted by negative growth in net margin (-62.97%) and earnings per share (-42.37%)—alongside a bearish stock trend with a 25.68% price decline, suggest persistent market pressure and operational headwinds.

Our Verdict about CoStar Group, Inc.

The long-term fundamental profile of CoStar Group, Inc. may appear unfavorable due to declining profitability and stretched valuation metrics. Despite a stable financial foundation and low bankruptcy risk, the bearish overall trend and modest recent buyer dominance (48.05%) indicate caution. Therefore, despite some structural strengths, recent market dynamics and valuation concerns suggest a wait-and-see approach could be prudent before considering exposure to this stock.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- CoStar Group, Inc. $CSGP Shares Sold by Baillie Gifford & Co. – MarketBeat (Jan 24, 2026)

- CoStar Group, Inc. (CSGP) Price Target Slashed, But Analysts Still See Upside – Yahoo Finance (Jan 15, 2026)

- Homes.com’s 115M monthly visitors and CoStar’s CEO in real estate’s top 10 – Stock Titan (Jan 22, 2026)

- Smart Money Is Betting Big In CSGP Options – Benzinga (Jan 22, 2026)

- Analysts Conflicted on These Real Estate Names: CoStar Group (CSGP) and Big Yellow Group (OtherBYLOF) – The Globe and Mail (Jan 23, 2026)

For more information about CoStar Group, Inc., please visit the official website: costargroup.com