Home > Analyses > Technology > Corpay, Inc.

Corpay, Inc. revolutionizes how businesses manage critical expenses like fuel, lodging, and corporate payments worldwide. Its cutting-edge payment solutions streamline vehicle-related costs and automate accounts payable for global enterprises. Corpay’s blend of innovation and operational scale sets a new standard in software infrastructure. As market dynamics evolve, I ask: does Corpay’s robust business model still justify its premium valuation and growth prospects?

Table of contents

Business Model & Company Overview

Corpay, Inc., founded in 1986 and based in Atlanta, Georgia, stands as a leader in the Software – Infrastructure industry. It delivers an integrated payment ecosystem focused on managing vehicle-related and corporate expenses. Its solutions encompass fuel, tolls, parking, and lodging payments, creating a seamless platform for business and consumer clients across multiple sectors.

The company’s revenue engine balances vehicle payment solutions with corporate payment services, including accounts payable automation and virtual cards. Corpay’s footprint spans the Americas, Europe, and Asia, serving diverse markets with tailored payment products. Its competitive advantage lies in a broad, adaptable network that shapes the evolving landscape of payment infrastructure worldwide.

Financial Performance & Fundamental Metrics

I analyze Corpay, Inc.’s income statement, key financial ratios, and dividend payout policy to assess its profitability, efficiency, and shareholder returns.

Income Statement

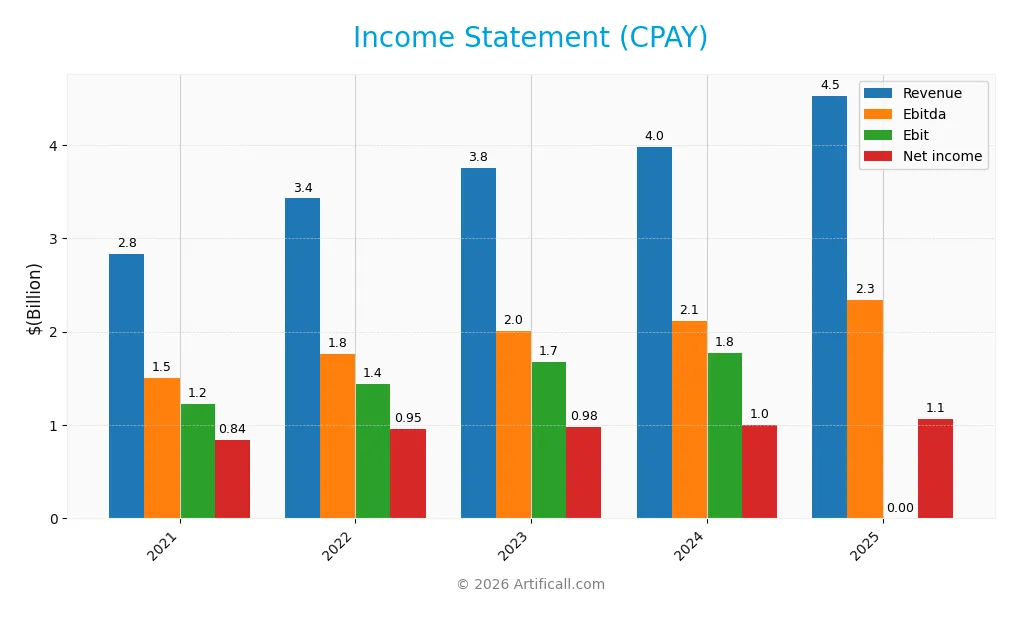

The table below summarizes Corpay, Inc.’s key income statement items for fiscal years 2023 through 2025, reflecting revenue growth and expense trends.

| 2023 | 2024 | 2025 | |

|---|---|---|---|

| Revenue | 3.76B | 3.97B | 4.53B |

| Cost of Revenue | 820M | 869M | 0 |

| Operating Expenses | 1.28B | 1.32B | 2.53B |

| Gross Profit | 2.94B | 3.11B | 0 |

| EBITDA | 2.01B | 2.12B | 2.34B |

| EBIT | 1.67B | 1.77B | 0 |

| Interest Expense | 349M | 383M | 404M |

| Net Income | 982M | 1.00B | 1.07B |

| EPS | 13.42 | 14.27 | 15.03 |

| Filing Date | 2023-12-31 | 2025-02-27 | 2026-02-04 |

Income Statement Evolution

Corpay’s revenue grew 13.9% from 2024 to 2025, continuing a strong upward trend with a 59.8% rise since 2021. However, gross profit and EBIT margins collapsed to zero in 2025, marking a sharp deterioration. Net income rose modestly by 6.5% in the latest year, but net margin declined 20.3% over the period, reflecting margin pressure despite top-line growth.

Is the Income Statement Favorable?

The 2025 income statement shows mixed signals. Revenue and net income growth remain favorable, with EPS rising 7.6%. Yet, the absence of reported gross profit and EBIT margins is a red flag, suggesting cost structure or reporting changes. Interest expense at 8.9% of revenue is neutral. Overall, fundamentals appear unfavorable given margin erosion outweighing growth benefits.

Financial Ratios

The table below presents key financial ratios for Corpay, Inc. over the 2020-2024 fiscal years, offering a snapshot of profitability, valuation, liquidity, leverage, and efficiency:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 29% | 30% | 28% | 26% | 25% |

| ROE | 21% | 29% | 38% | 30% | 32% |

| ROIC | 9% | 10% | 10% | 11% | 11% |

| P/E | 33 | 22 | 15 | 21 | 24 |

| P/B | 6.8 | 6.4 | 5.5 | 6.3 | 7.6 |

| Current Ratio | 1.0 | 1.0 | 1.0 | 1.0 | 1.0 |

| Quick Ratio | 1.0 | 1.0 | 1.0 | 1.0 | 1.0 |

| D/E | 1.3 | 2.1 | 2.8 | 2.0 | 2.6 |

| Debt-to-Assets | 38% | 45% | 50% | 43% | 45% |

| Interest Coverage | 7.5 | 11 | 9 | 5 | 5 |

| Asset Turnover | 0.21 | 0.21 | 0.24 | 0.24 | 0.22 |

| Fixed Asset Turnover | 11.8 | 12.0 | 11.6 | 11.0 | 10.5 |

| Dividend Yield | 0% | 0% | 0% | 0% | 0% |

Evolution of Financial Ratios

Corpay’s Return on Equity (ROE) fluctuated, peaking at 37.5% in 2022, then declining to 32.15% in 2024, indicating a slight profitability slowdown. The Current Ratio hovered near 1.0, showing stable but tight liquidity. Debt-to-Equity Ratio climbed from 1.28 in 2020 to 2.56 in 2024, reflecting increased leverage and financial risk.

Are the Financial Ratios Favorable?

In 2024, Corpay exhibits favorable profitability metrics like a 25.25% net margin and strong fixed asset turnover (10.52). However, liquidity is weak with a current ratio at 1.0 and an unfavorable debt-to-equity ratio of 2.56, indicating elevated leverage. Market valuation ratios such as price-to-book (7.62) appear stretched. Overall, the financial ratios present a slightly unfavorable picture.

Shareholder Return Policy

Corpay, Inc. does not pay dividends, reflecting a strategy focused on reinvestment and growth. The company maintains no dividend payout, supported by positive net income and strong free cash flow coverage, with no share buybacks recorded in recent years.

This approach aligns with long-term value creation by prioritizing operational expansion and capital allocation over immediate shareholder distributions. The absence of dividend payments suggests a reinvestment strategy aimed at sustaining growth rather than returning cash, which may suit investors seeking capital appreciation.

Score analysis

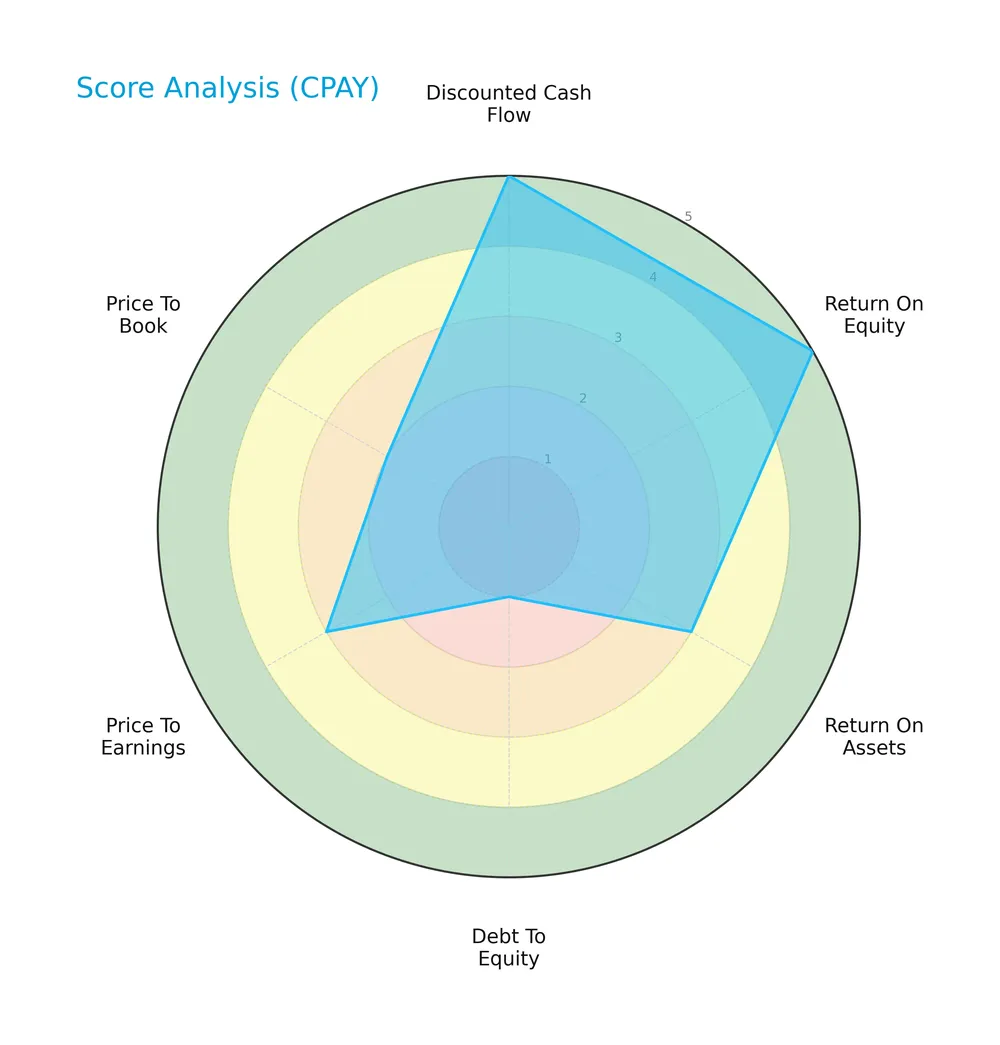

The following radar chart illustrates Corpay, Inc.’s key financial scores across valuation, profitability, and leverage metrics:

Corpay scores very favorably on discounted cash flow and return on equity, signaling strong value and profitability. Return on assets and valuation metrics show moderate performance. Debt to equity is very unfavorable, indicating high leverage risk.

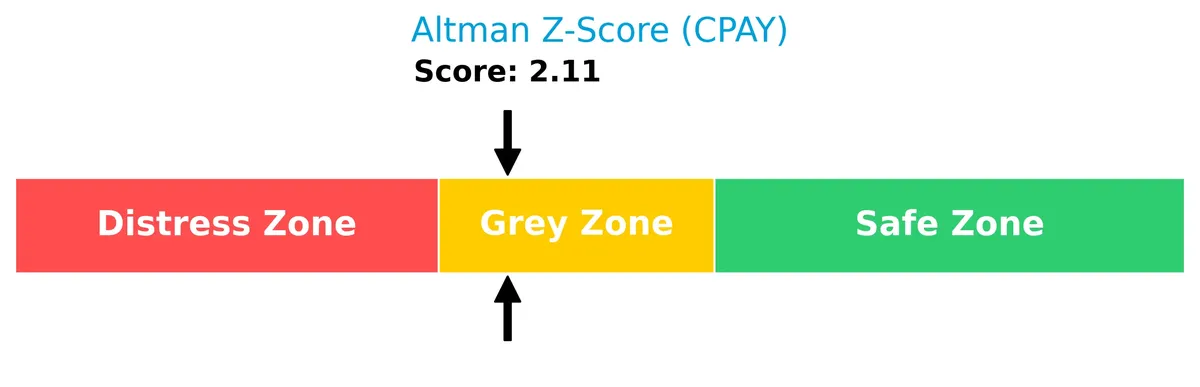

Analysis of the company’s bankruptcy risk

Corpay’s Altman Z-Score places it in the grey zone, suggesting moderate bankruptcy risk and financial uncertainty:

Is the company in good financial health?

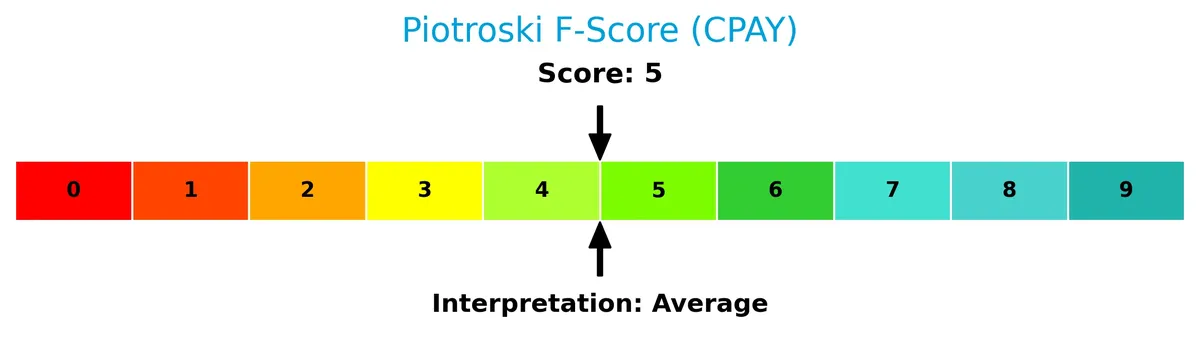

This Piotroski diagram presents Corpay’s financial strength based on nine accounting criteria:

With a Piotroski Score of 5, Corpay displays average financial health. The company shows moderate strength but lacks the robustness seen in stronger scores.

Competitive Landscape & Sector Positioning

This analysis examines Corpay, Inc.’s strategic positioning within the software infrastructure sector. It covers revenue by segment, key products, main competitors, and competitive advantages. I will assess whether Corpay holds a distinct competitive edge over its peers.

Strategic Positioning

Corpay, Inc. concentrates revenue largely in payments (2B) and corporate payments (1.2B), with lodging contributing 489M. Geographically, it spans the US (2.08B), Brazil (594M), and the UK (542M), showing focused yet multinational exposure in payment infrastructure.

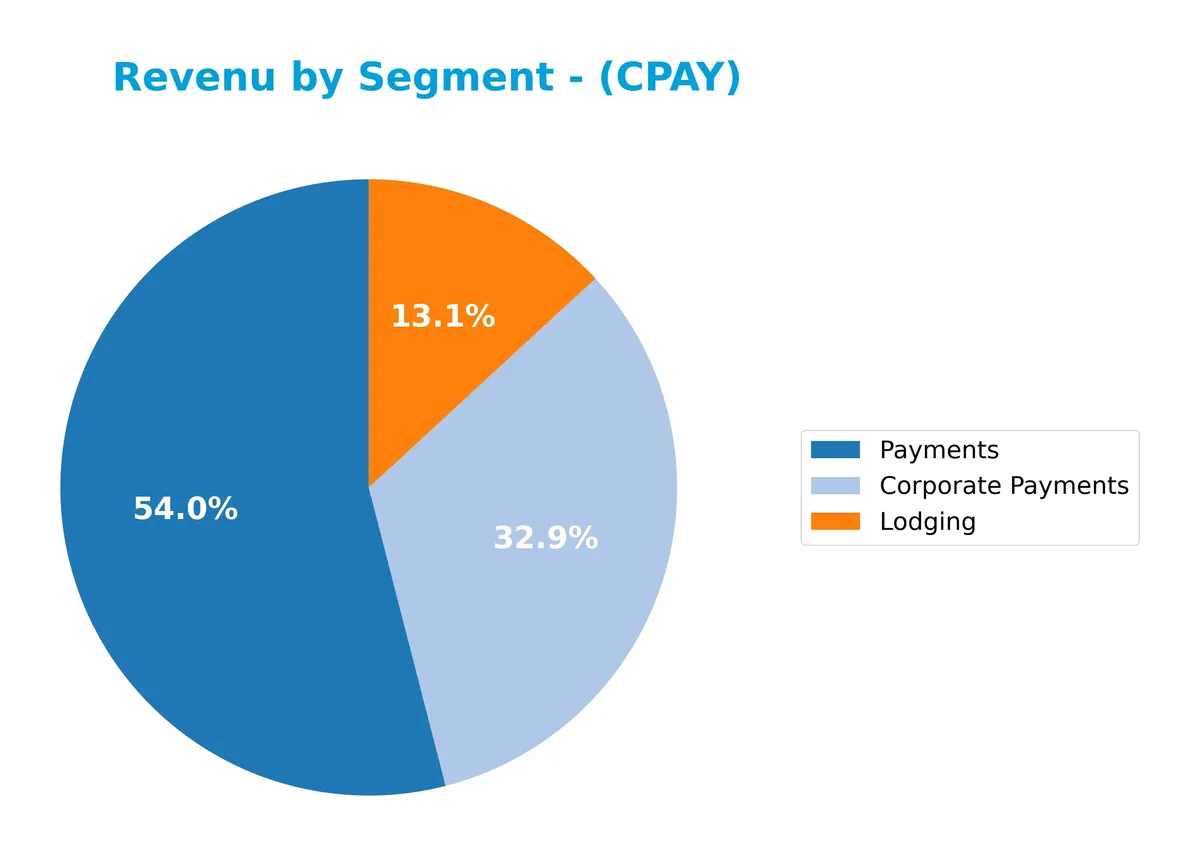

Revenue by Segment

This pie chart illustrates Corpay, Inc.’s revenue distribution by business segment for the fiscal year 2024, highlighting the relative size of each division’s contribution.

Payments dominate Corpay’s revenue with 2B USD, followed by Corporate Payments at 1.22B USD, and Lodging at 489M USD. The Payments segment clearly drives the business, reflecting a strong market foothold. Corporate Payments also contribute significantly, suggesting diversified revenue streams. Lodging, while smaller, remains a notable niche. The data signals stable concentration in Payments, with no sudden shifts in segment weight.

Key Products & Brands

The table below outlines Corpay, Inc.’s main product lines and their core business focus:

| Product | Description |

|---|---|

| Corporate Payments | Accounts payable automation, virtual cards, cross-border solutions, purchasing, travel cards. |

| Lodging | Payment solutions for employees traveling overnight, airline and cruise line crew expenses, and displaced insurance policyholders. |

| Payments | Vehicle-related payments including fuel, tolls, parking, fleet maintenance, and prepaid vouchers. |

Corpay’s portfolio spans diverse payment solutions, targeting vehicle expenses, corporate payments, and lodging services. This breadth supports its position in software infrastructure for business payments globally.

Main Competitors

There are 32 competitors in the sector; below is a table of the top 10 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| Microsoft Corporation | 3.52T |

| Oracle Corporation | 553B |

| Palantir Technologies Inc. | 383B |

| Adobe Inc. | 140B |

| Palo Alto Networks, Inc. | 120B |

| CrowdStrike Holdings, Inc. | 113B |

| Synopsys, Inc. | 92B |

| Cloudflare, Inc. | 69B |

| Fortinet, Inc. | 59B |

| Block, Inc. | 40B |

Corpay, Inc. ranks 16th among 32 competitors, with a market cap just 0.66% of Microsoft’s. It sits below the average top 10 market cap of 508B but above the sector median of 18.8B. The 3.38% gap to its nearest competitor above highlights a narrow margin in its competitive positioning.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does Corpay have a competitive advantage?

Corpay, Inc. presents signs of competitive strength through consistent revenue growth and a favorable net margin near 24%. However, key profitability metrics like gross and EBIT margins remain unfavorable, limiting confirmation of a durable advantage.

Looking ahead, Corpay’s expansion across the U.S., Brazil, and the U.K. and its diversified payment solutions for vehicle, lodging, and corporate expenses could unlock new market opportunities. The company’s growing ROIC trend suggests improving capital efficiency over time.

SWOT Analysis

This SWOT analysis highlights Corpay, Inc.’s key internal and external factors shaping its strategic options.

Strengths

- strong net margin of 25%

- solid revenue growth of 60% over five years

- growing ROIC trend of 17%

Weaknesses

- unfavorable gross and EBIT margins

- weak current ratio at 1.0

- high debt-to-equity ratio of 2.56

Opportunities

- expanding global payment solutions market

- growth in corporate travel and fleet services

- technological innovation in cross-border payments

Threats

- intense competition in payment software

- regulatory risks in multiple jurisdictions

- margin pressure from rising operating expenses

Corpay’s strengths in profitability and growth support a robust foundation. Yet, margin weaknesses and leverage present risks requiring cautious capital management. The company should capitalize on market expansion and innovation while mitigating competitive and regulatory threats.

Stock Price Action Analysis

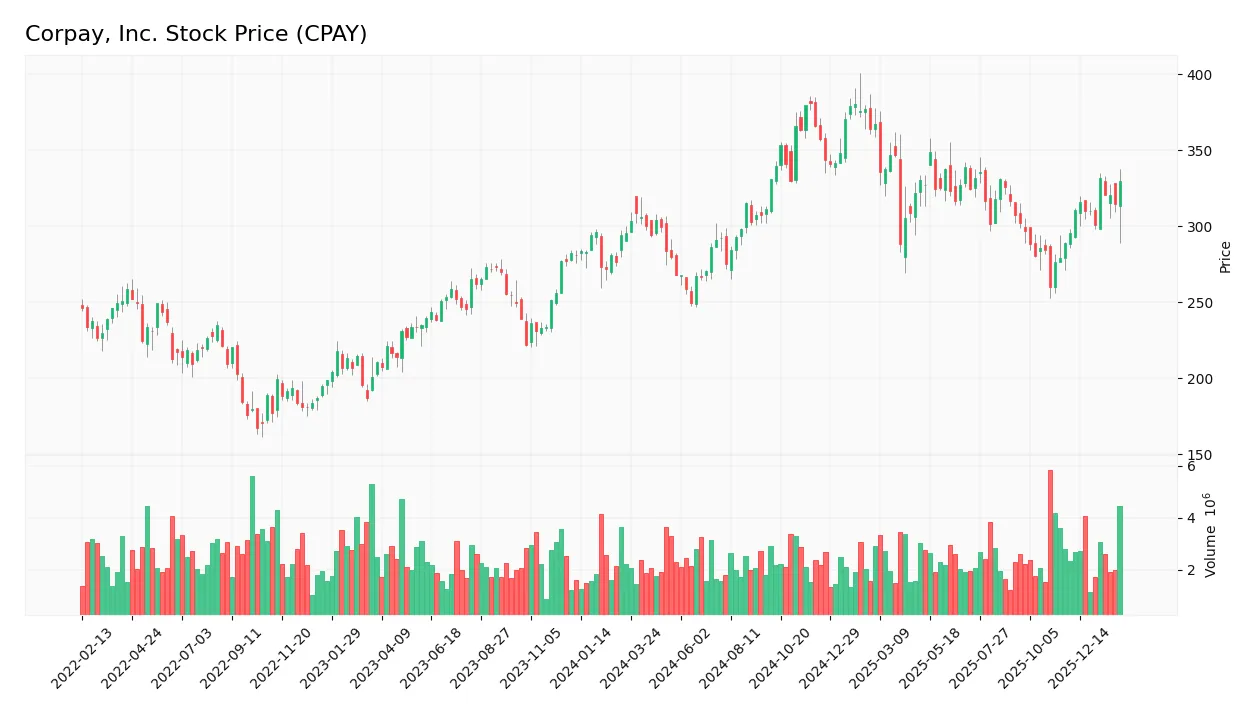

The weekly stock chart illustrates Corpay, Inc.’s price movements, highlighting recent bullish momentum and volatility patterns:

Trend Analysis

Over the past 12 months, CPAY gained 11.45%, indicating a bullish trend. The stock shows acceleration, with a high volatility level (std dev 31.05). Prices ranged from 249.66 to 381.18, confirming strong upward momentum. Recent weeks reflect a 14.08% rise with a positive slope of 2.67, reinforcing this trend.

Volume Analysis

Trading volume has increased, with buyers accounting for 52.26% overall and 60.88% recently. Buyer dominance suggests growing investor confidence and active market participation. This rising volume trend supports the observed bullish price action and indicates sustained demand pressure.

Target Prices

Analysts set a confident target consensus for Corpay, Inc., reflecting robust growth expectations.

| Target Low | Target High | Consensus |

|---|---|---|

| 300 | 392 | 368 |

The target prices suggest bullish sentiment, with a consensus well above current levels, indicating strong upside potential.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section reviews analyst grades and consumer feedback to assess Corpay, Inc.’s market perception and reputation.

Stock Grades

Here are the latest verified stock grades for Corpay, Inc. from leading financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| RBC Capital | Maintain | Sector Perform | 2026-02-05 |

| Morgan Stanley | Maintain | Overweight | 2026-02-05 |

| Morgan Stanley | Upgrade | Overweight | 2026-01-26 |

| Oppenheimer | Maintain | Outperform | 2026-01-12 |

| Oppenheimer | Upgrade | Outperform | 2025-12-05 |

| UBS | Maintain | Neutral | 2025-11-06 |

| JP Morgan | Maintain | Overweight | 2025-11-06 |

| RBC Capital | Maintain | Sector Perform | 2025-11-06 |

| Keefe, Bruyette & Woods | Maintain | Outperform | 2025-10-01 |

| Morgan Stanley | Maintain | Equal Weight | 2025-08-11 |

The overall trend shows steady confidence with multiple upgrades, especially from Morgan Stanley and Oppenheimer. Most grades cluster around Outperform and Overweight, indicating a positive market view with few neutral stances.

Consumer Opinions

Consumer sentiment around Corpay, Inc. (CPAY) reflects a mix of strong service appreciation and concerns over pricing and support responsiveness.

| Positive Reviews | Negative Reviews |

|---|---|

| “Corpay’s platform is intuitive and reliable.” | “Customer service response times are slow.” |

| “Efficient payment processing saves us time.” | “Some fees feel unclear and higher than expected.” |

| “Integration with accounting software is seamless.” | “Occasional glitches during peak usage periods.” |

Overall, users praise Corpay’s efficiency and user-friendly technology. However, recurring complaints focus on customer support delays and cost transparency issues, signaling areas for operational improvement.

Risk Analysis

Below is a table summarizing the key risks facing Corpay, Inc., with their likelihood and potential impact:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Liquidity Risk | Current ratio at 1.0 signals tight liquidity, raising concerns over short-term obligations. | Medium | High |

| Leverage Risk | Debt-to-equity ratio of 2.56 indicates heavy reliance on debt financing, increasing risk. | High | High |

| Interest Coverage | Interest coverage ratio at 0.0 suggests difficulty covering interest expenses. | High | High |

| Valuation Risk | Price-to-book ratio of 7.62 appears expensive relative to industry benchmarks. | Medium | Medium |

| Market Volatility | Beta of 0.808 implies moderate sensitivity to market swings, reducing systemic risk. | Low | Medium |

| Profitability Risk | ROIC unavailable; uncertainty about capital returns versus cost of capital. | Medium | Medium |

The most pressing risks stem from Corpay’s high leverage and inability to cover interest, raising solvency concerns despite solid net margin and ROE. The grey zone Altman Z-score reinforces caution. Investors should monitor debt servicing closely.

Should You Buy Corpay, Inc.?

Corpay, Inc. appears to be a company with improving profitability and a growing ROIC trend, suggesting strengthening operational efficiency. Despite a challenging leverage profile and moderate liquidity, it holds a durable value creation potential, supported by a very favorable B+ rating.

Strength & Efficiency Pillars

Corpay, Inc. delivers a robust profitability profile with a net margin of 25.25% and a return on equity of 32.15%, signaling strong operational control. Its fixed asset turnover at 10.52 reflects efficient asset utilization. The Altman Z-Score of 2.11 places the company in the grey zone, indicating moderate financial stability. The Piotroski score of 5 suggests average financial strength. While ROIC and WACC data are unavailable, the company’s growing ROIC trend of 17.1% hints at improving capital efficiency.

Weaknesses and Drawbacks

Corpay faces notable challenges, including a high debt-to-equity ratio of 2.56, which raises leverage concerns and financial risk. The current ratio stands at 1.0, signaling limited short-term liquidity buffers. Valuation metrics are stretched, with a price-to-book ratio of 7.62 indicating premium pricing relative to book value. Interest coverage is at zero, marking potential distress in meeting interest obligations. Additionally, gross margin and EBIT margin are unfavorable, reflecting operational pressures.

Our Verdict about Corpay, Inc.

Corpay presents a fundamentally favorable long-term profile driven by strong profitability and improving capital efficiency. The bullish overall trend and recent buyer dominance, with 60.88% buyer volume, suggest growing investor confidence. This combination might appear attractive for long-term exposure, though leverage and liquidity risks recommend cautious position sizing. Investors could consider monitoring liquidity improvements before increasing exposure.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Penserra Capital Management LLC Buys 3,653 Shares of Corpay, Inc. $CPAY – MarketBeat (Feb 05, 2026)

- Corpay Inc (NYSE:CPAY) Beats Q4 Estimates and Provides Bullish 2026 Guidance – Chartmill (Feb 04, 2026)

- CPAY Q4 Deep Dive: Acquisitions and Corporate Payments Drive Positive Momentum – Finviz (Feb 05, 2026)

- Compared to Estimates, Corpay (CPAY) Q4 Earnings: A Look at Key Metrics – Yahoo Finance (Feb 04, 2026)

- Corpay, Inc. (NYSE:CPAY) Q4 2025 earnings call transcript – MSN (Feb 04, 2026)

For more information about Corpay, Inc., please visit the official website: corpay.com