Home > Analyses > Industrials > Core & Main, Inc.

Core & Main, Inc. plays a critical role in sustaining and upgrading the water and fire protection infrastructure that millions rely on daily. As a leading distributor in the industrial sector, the company offers a comprehensive range of pipes, valves, hydrants, and advanced smart meter technologies, serving municipalities and contractors across the United States. Known for its innovation and quality, Core & Main continues to influence essential public services. The key question for investors now is whether its robust fundamentals support further growth and valuation in a competitive market.

Table of contents

Business Model & Company Overview

Core & Main, Inc., founded in 1874 and headquartered in St. Louis, Missouri, stands as a leading distributor in the industrial distribution sector. It offers a comprehensive ecosystem of water, wastewater, storm drainage, and fire protection products alongside related services. Serving municipalities, private water companies, and contractors, its portfolio includes pipes, valves, hydrants, fittings, and smart meter solutions, all integral to maintaining and upgrading critical infrastructure across the United States.

The company’s revenue engine balances product sales with value-added services, including fabrication and software for smart meters, creating diverse streams that support long-term client relationships. Core & Main’s strategic footprint spans key regions in the Americas, leveraging its stronghold in municipal and non-residential markets. Its competitive advantage lies in a robust distribution network and specialized offerings that secure its role in shaping the future of water and fire protection infrastructure.

Financial Performance & Fundamental Metrics

I will analyze Core & Main, Inc.’s income statement, key financial ratios, and dividend payout policy to provide a clear view of its fundamental health.

Income Statement

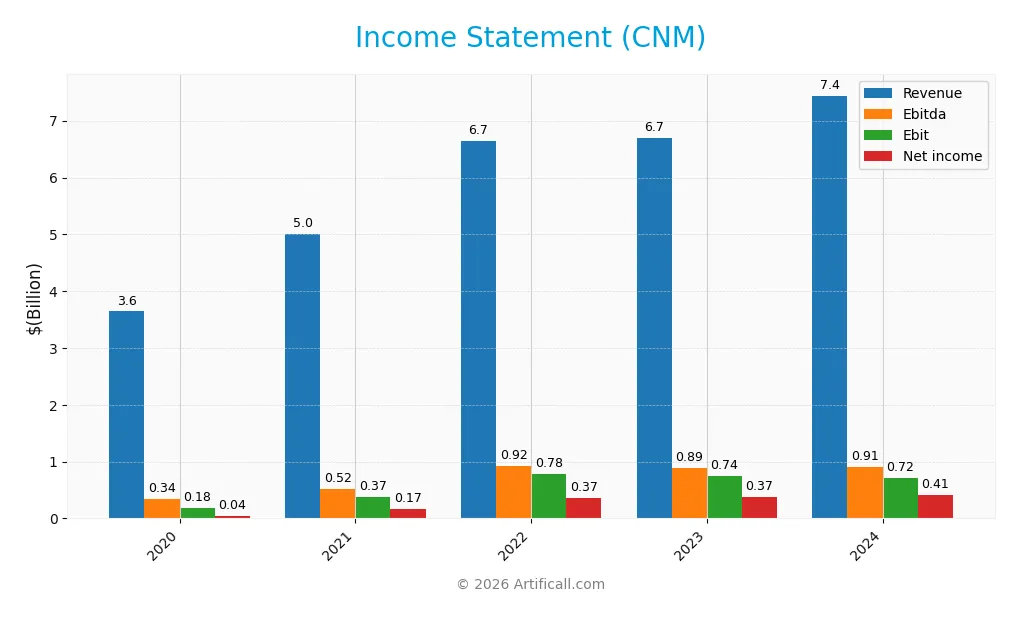

The table below summarizes Core & Main, Inc.’s income statement figures for the fiscal years 2020 through 2024, expressed in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 3.64B | 5.00B | 6.65B | 6.70B | 7.44B |

| Cost of Revenue | 2.76B | 3.72B | 4.86B | 4.88B | 5.46B |

| Operating Expenses | 693M | 855M | 1.02B | 1.08B | 1.26B |

| Gross Profit | 878M | 1.28B | 1.79B | 1.82B | 1.98B |

| EBITDA | 338M | 524M | 924M | 894M | 913M |

| EBIT | 185M | 374M | 775M | 740M | 719M |

| Interest Expense | 139M | 98M | 66M | 81M | 142M |

| Net Income | 37M | 166M | 366M | 371M | 411M |

| EPS | 0.15 | 0.84 | 3.10 | 2.83 | 2.14 |

| Filing Date | 2021-01-31 | 2022-03-30 | 2023-03-28 | 2024-03-19 | 2025-03-25 |

Income Statement Evolution

Core & Main, Inc. (CNM) demonstrated solid revenue growth, increasing by 11.03% in the most recent year and over 104% since 2020. Net income surged more than tenfold over the period, though it declined slightly last year. Gross margin remained favorable at 26.61%, while EBIT margin was neutral at 9.66%, reflecting some pressure on profitability despite revenue gains.

Is the Income Statement Favorable?

For fiscal year 2024, CNM’s fundamentals appear generally favorable. The company maintained a strong gross margin and a net margin of 5.52%, indicating effective cost control relative to revenue. However, EBIT and net margin both showed slight declines year-over-year, accompanied by an unfavorable rise in operating expenses versus revenue. Overall, the income statement reflects positive growth with some margin challenges.

Financial Ratios

The table below presents key financial ratios for Core & Main, Inc. (ticker: CNM) over the fiscal years 2020 to 2024, illustrating profitability, valuation, liquidity, leverage, and efficiency metrics:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 1.0% | 3.3% | 5.5% | 5.5% | 5.5% |

| ROE | 4.6% | 12.5% | 21.0% | 25.6% | 24.2% |

| ROIC | 4.3% | 9.5% | 14.9% | 13.7% | 10.6% |

| P/E | 130.1 | 23.1 | 10.2 | 19.2 | 26.3 |

| P/B | 6.0 | 2.9 | 2.1 | 4.9 | 6.4 |

| Current Ratio | 2.6 | 2.1 | 3.0 | 2.3 | 2.3 |

| Quick Ratio | 1.8 | 1.1 | 1.6 | 1.3 | 1.3 |

| D/E | 3.0 | 1.2 | 0.9 | 1.4 | 1.5 |

| Debt-to-Assets | 61.0% | 37.0% | 33.3% | 40.9% | 42.7% |

| Interest Coverage | 1.3 | 4.3 | 11.7 | 9.1 | 5.1 |

| Asset Turnover | 0.93 | 1.13 | 1.35 | 1.32 | 1.27 |

| Fixed Asset Turnover | 17.0 | 20.3 | 23.8 | 19.5 | 18.1 |

| Dividend Yield | 0.43% | 0.00% | 0.00% | 0.00% | 0.00% |

Evolution of Financial Ratios

Over recent years, Core & Main, Inc. (CNM) exhibited fluctuating trends in key financial ratios. Return on Equity (ROE) improved significantly from 4.6% in 2020 to 24.2% in 2024, reflecting enhanced profitability. The Current Ratio remained relatively stable, ranging near 2.1 to 3.0, indicating consistent liquidity. Debt-to-Equity Ratio initially peaked near 3.0 but declined to 1.48 by 2024, showing reduced financial leverage.

Are the Financial Ratios Favorable?

In 2024, CNM’s profitability ratios such as ROE (24.2%) and Return on Invested Capital (10.6%) were favorable, while net margin (5.52%) was neutral. Liquidity ratios, including Current Ratio (2.34) and Quick Ratio (1.29), were favorable, supporting short-term solvency. However, leverage indicated by Debt-to-Equity (1.48) was unfavorable. Market valuation metrics like P/E (26.31) and P/B (6.37) were also unfavorable. Overall, 57% of ratios were favorable, yielding a generally favorable financial profile.

Shareholder Return Policy

Core & Main, Inc. (CNM) does not pay dividends, with a dividend payout ratio and yield consistently at zero over recent years. The company appears to focus on reinvestment or other uses of capital, as no share buyback programs are reported.

This lack of shareholder distributions suggests an emphasis on internal growth or strategic priorities. Without dividend payments or buybacks, the policy supports sustainable long-term value creation only if reinvestment drives future earnings and cash flow growth.

Score analysis

The radar chart below illustrates Core & Main, Inc.’s key financial scores across multiple valuation and performance metrics:

Core & Main, Inc. demonstrates a favorable discounted cash flow score of 4 and a very favorable return on equity score of 5, highlighting strong profitability. Return on assets is also favorable at 4. However, debt to equity and price to book scores are very unfavorable at 1, indicating leverage and valuation concerns. Price to earnings is moderate at 2, balancing the overall moderate score of 3.

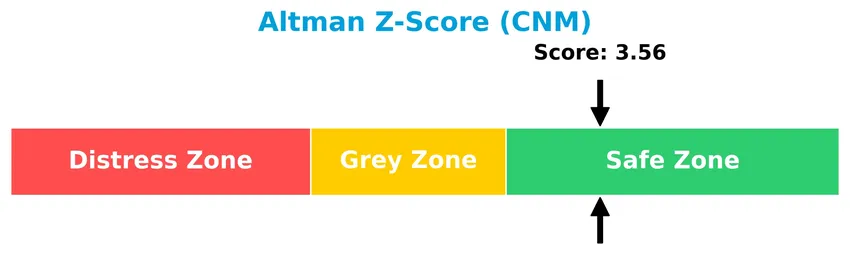

Analysis of the company’s bankruptcy risk

The Altman Z-Score positions Core & Main, Inc. firmly in the safe zone, indicating a low risk of bankruptcy:

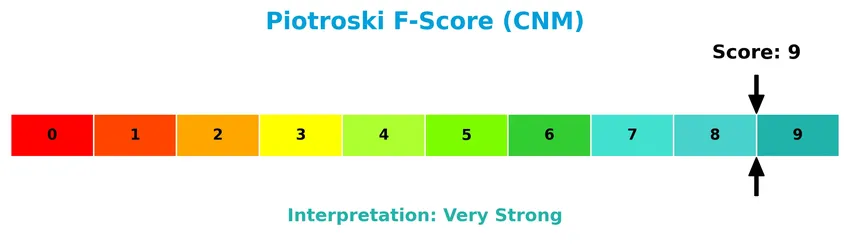

Is the company in good financial health?

The Piotroski Score diagram reflects Core & Main, Inc.’s very strong financial health status:

With a perfect Piotroski Score of 9, the company exhibits robust financial strength according to profitability, leverage, liquidity, and efficiency criteria, signaling excellent fundamentals for investors.

Competitive Landscape & Sector Positioning

This sector analysis will explore Core & Main, Inc.’s strategic positioning, revenue by segment, key products, main competitors, and competitive advantages. I will also examine the company’s strengths, weaknesses, opportunities, and threats in detail. The goal is to determine whether Core & Main holds a competitive advantage over its sector peers.

Strategic Positioning

Core & Main, Inc. maintains a concentrated geographic focus primarily in the US, with minimal non-US revenue reported in 2021. Its product portfolio is diversified across Pipes, Valves & Fittings (dominant with over $5B in 2024), Storm Drainage, Fire Protection, and Meter Products, serving municipal and private water infrastructure markets.

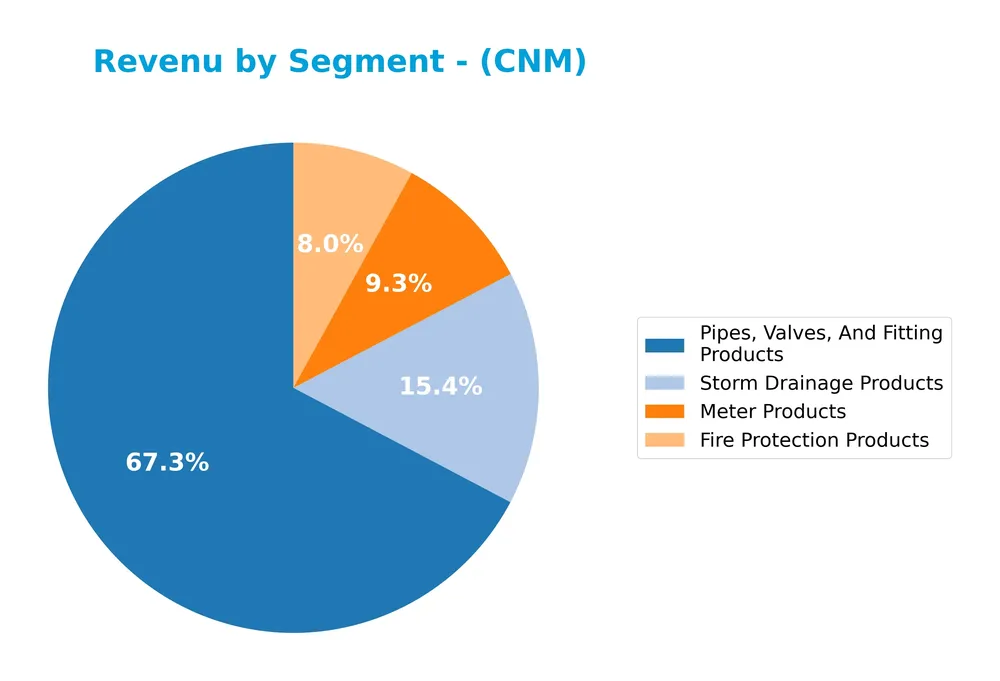

Revenue by Segment

This pie chart illustrates Core & Main, Inc.’s revenue distribution by product segment for the fiscal year 2024, highlighting the company’s diverse portfolio in water infrastructure products.

In 2024, Pipes, Valves, And Fitting Products led revenue with $5B, showing steady growth from prior years and reinforcing its role as the core business driver. Storm Drainage Products also increased to $1.15B, reflecting moderate expansion. Meter Products experienced a rebound to $692M after prior fluctuations, while Fire Protection Products declined to $596M, indicating a slight slowdown. Overall, the business shows concentration in pipes and fittings with some risk in less consistent segments.

Key Products & Brands

The table below summarizes Core & Main, Inc.’s primary products and their descriptions:

| Product | Description |

|---|---|

| Fire Protection Products | Includes fire protection pipes, sprinkler heads, fire suppression systems, accessories, and fabrication services. |

| Meter Products | Comprises smart meter products, installation services, software, and related offerings. |

| Pipes, Valves, And Fitting Products | Consists of pipes, valves, hydrants, fittings, and other related water infrastructure products. |

| Storm Drainage Products | Features corrugated piping systems, retention basins, inline drains, manholes, grates, geosynthetics, and related products. |

Core & Main, Inc. serves municipalities and private water companies with a broad range of water, wastewater, storm drainage, and fire protection products, emphasizing infrastructure maintenance and construction.

Main Competitors

There are 3 main competitors in the Industrials sector, and the table below lists the top 3 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| W.W. Grainger, Inc. | 47.7B |

| Fastenal Company | 46.4B |

| Pool Corporation | 8.6B |

Core & Main, Inc. is not ranked among the top 3 competitors by market capitalization. Its market cap is below both the average market cap of the top 10 competitors (34.2B) and the median market cap in the sector (46.4B). The company’s relative market cap to the leader is 0, and no distance metrics to the nearest competitors are available.

Comparisons with competitors

Check out how we compare the company to its competitors:

Aucun article trouvé pour ces critères.

Does CNM have a competitive advantage?

Core & Main, Inc. presents a competitive advantage as it consistently creates value, with a ROIC exceeding its WACC by nearly 3%, and demonstrates a growing return on invested capital, indicating efficient capital use and increasing profitability. The company’s favorable income statement metrics, including a 26.61% gross margin and over 1000% net income growth over the 2020-2024 period, further support its strong market position in industrial distribution.

Looking ahead, Core & Main’s future outlook includes opportunities tied to its broad product portfolio serving water, wastewater, storm drainage, and fire protection infrastructure across municipal and private sectors in the U.S. Continued expansion in specialty products like smart meters and fire suppression systems suggests potential for growth in evolving infrastructure markets.

SWOT Analysis

This SWOT analysis highlights Core & Main, Inc.’s key internal and external factors to guide strategic investment decisions.

Strengths

- Strong market position in water and fire protection distribution

- Consistently favorable revenue and net income growth

- High ROE of 24.2% indicating efficient capital use

Weaknesses

- Elevated debt-to-equity ratio at 1.48

- Unfavorable price-to-earnings and price-to-book ratios

- Operating expense growth outpacing EBIT growth

Opportunities

- Expansion in smart meter and infrastructure modernization

- Growing demand in municipal and private water sectors

- Potential to leverage digital services and software offerings

Threats

- Economic downturns affecting infrastructure spending

- Competitive pressure in industrial distribution

- Rising raw material and interest costs

Overall, Core & Main demonstrates a solid competitive advantage with strong financial performance and growth potential. However, the company must manage its leverage and cost structure carefully to mitigate risks from economic and market volatility. This balanced SWOT suggests a strategy focused on operational efficiency and selective investment in innovation and market expansion.

Stock Price Action Analysis

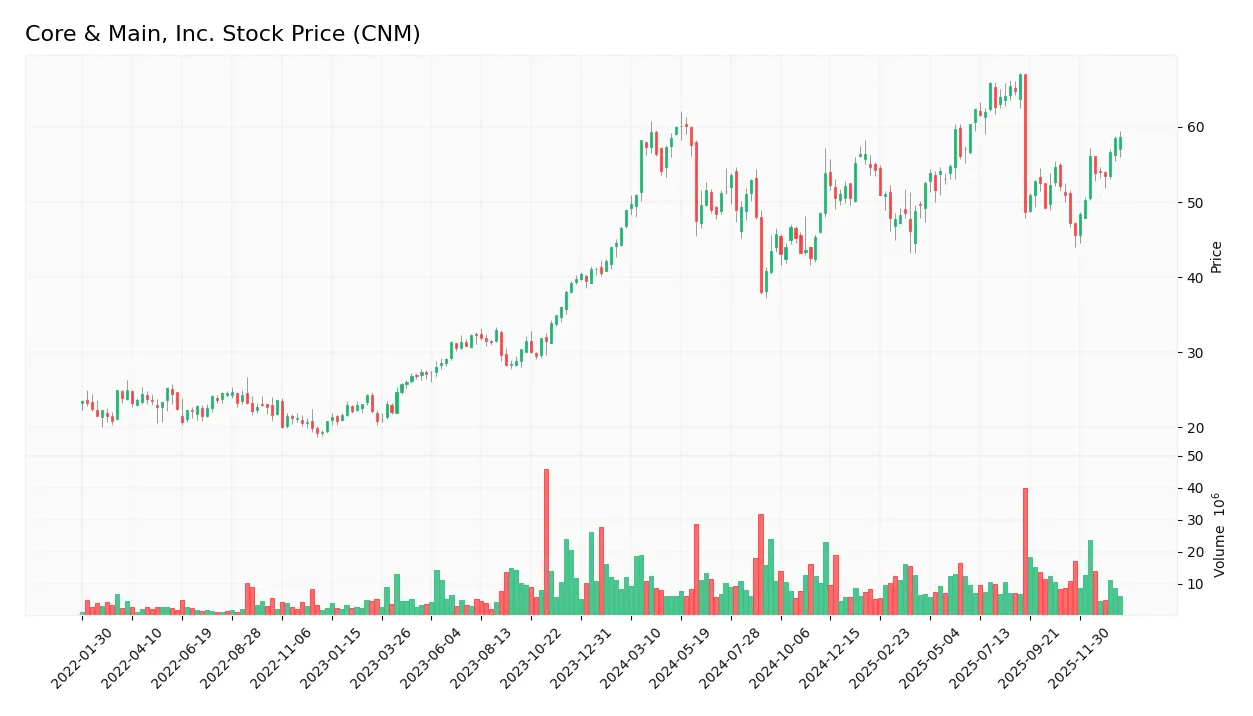

The weekly stock chart for Core & Main, Inc. (CNM) over the past 12 months illustrates price movements, key highs and lows, and trend dynamics:

Trend Analysis

Over the past 12 months, CNM’s stock price increased by 19.62%, indicating a bullish trend with acceleration. The price fluctuated between a low of 38.05 and a high of 66.98, supported by a standard deviation of 5.92, reflecting moderate volatility during this period.

Volume Analysis

Trading volumes over the last three months show a slight buyer dominance at 57.53%, with buyer volume exceeding seller volume. However, the overall volume trend is decreasing, suggesting a reduction in market participation despite sustained buyer interest.

Target Prices

The consensus target prices for Core & Main, Inc. (CNM) indicate moderate optimism among analysts.

| Target High | Target Low | Consensus |

|---|---|---|

| 68 | 63 | 64.71 |

Analysts expect the stock to trade within a relatively narrow range, with a consensus price near 65, reflecting a cautiously positive outlook.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines the latest analyst ratings and consumer feedback regarding Core & Main, Inc. (CNM).

Stock Grades

The latest grades from well-known financial institutions for Core & Main, Inc. are summarized in the following table:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Overweight | 2026-01-14 |

| Citigroup | Maintain | Neutral | 2026-01-08 |

| Deutsche Bank | Maintain | Buy | 2025-12-11 |

| JP Morgan | Maintain | Overweight | 2025-12-10 |

| Wells Fargo | Maintain | Overweight | 2025-12-10 |

| Citigroup | Maintain | Neutral | 2025-12-10 |

| Baird | Maintain | Outperform | 2025-12-10 |

| Wells Fargo | Maintain | Overweight | 2025-12-04 |

| Barclays | Maintain | Overweight | 2025-12-01 |

| JP Morgan | Maintain | Overweight | 2025-10-15 |

Overall, the consensus among these reputable firms leans toward a positive outlook, with multiple “Overweight” and “Buy” ratings and a few “Neutral” grades, reflecting a predominantly favorable sentiment for the stock.

Consumer Opinions

Consumers of Core & Main, Inc. (CNM) express a mix of satisfaction and constructive criticism, providing valuable insights into the company’s market reputation.

| Positive Reviews | Negative Reviews |

|---|---|

| Reliable product quality with durable materials. | Delivery times can be inconsistent, causing project delays. |

| Excellent customer service with knowledgeable staff. | Pricing is sometimes higher compared to competitors. |

| Strong product availability and wide range of options. | Website interface is not very user-friendly for ordering. |

Overall, consumers appreciate Core & Main’s product reliability and customer support, but there are recurring concerns about delivery punctuality and pricing, which could impact long-term customer loyalty if not addressed.

Risk Analysis

Below is a summary table of key risks Core & Main, Inc. faces, considering their likelihood and potential impact on investment value:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Valuation | Elevated P/E (26.31) and P/B (6.37) ratios suggest possible overvaluation risk. | Moderate | High |

| Debt Levels | High debt-to-equity ratio (1.48) indicates leverage risk, potentially increasing interest burden. | Moderate | Moderate |

| Industry Cyclicality | Exposure to municipal and construction spending cycles could affect revenues. | Moderate | Moderate |

| Dividend Policy | No dividend currently paid, which may affect income-focused investors’ appeal. | Low | Low |

| Economic Conditions | Economic downturns or infrastructure spending cuts could reduce demand for products. | Moderate | High |

The most significant risks involve Core & Main’s valuation and leverage. Despite a strong Altman Z-Score (3.56, safe zone) and excellent Piotroski Score (9), elevated valuation multiples and debt levels require careful monitoring. Economic cycles remain a critical external factor impacting future performance.

Should You Buy Core & Main, Inc.?

Core & Main, Inc. appears to be delivering robust profitability with a durable competitive moat supported by growing ROIC well above WACC, suggesting strong value creation; however, its leverage profile could be seen as substantial, resulting in a moderate overall rating of B.

Strength & Efficiency Pillars

Core & Main, Inc. demonstrates solid profitability and financial health, with a return on equity of 24.2% and a net margin of 5.52%. Its return on invested capital (ROIC) stands at 10.61%, surpassing the weighted average cost of capital (WACC) at 7.62%, confirming the company as a clear value creator. Financial stability is underpinned by an Altman Z-score of 3.56, placing it firmly in the safe zone, and a perfect Piotroski score of 9, reflecting very strong financial strength. These metrics collectively indicate efficient capital use and a durable competitive advantage.

Weaknesses and Drawbacks

Despite favorable fundamentals, Core & Main faces valuation challenges, with a high price-to-book ratio of 6.37 and a price-to-earnings ratio of 26.31, both marked as unfavorable. These elevated multiples suggest a premium valuation that could limit upside potential. Leverage is also a concern; the debt-to-equity ratio is 1.48, indicating significant reliance on debt financing, which could elevate financial risk, despite a strong current ratio of 2.34 and interest coverage of 5.06. Investors should be wary of these factors, as they may constrain flexibility in adverse market conditions.

Our Verdict about Core & Main, Inc.

The company’s long-term fundamental profile appears favorable, supported by robust profitability and financial health indicators. Coupled with a bullish overall stock trend and recent slight buyer dominance, the profile may appear attractive for long-term exposure. However, the modestly elevated valuation and leverage could introduce some risk, suggesting investors might consider a cautious, measured approach to entry timing.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- US officially exits World Health Organization, accusing agency of straying ‘from its core mission’ – ABC News (Jan 22, 2026)

- XG leans into radical self-love with debut album ‘The Core’ – latimes.com (Jan 22, 2026)

- Our European Allies Just Exposed Trump’s Core Weakness—and Also America’s – Slate (Jan 23, 2026)

- Intel Confirms ‘Nova Lake’ Core Ultra 400 CPUs Launching This Year – PCMag (Jan 23, 2026)

- DNR Drill Core Library is ‘unbelievable resource’ – wdio.com (Jan 23, 2026)

For more information about Core & Main, Inc., please visit the official website: coreandmain.com