Home > Analyses > Utilities > Constellation Energy Corporation

Constellation Energy Corporation powers millions of homes and businesses across the United States, driving the transition toward a cleaner, more sustainable energy future. As a prominent player in the renewable utilities sector, CEG combines nuclear, wind, solar, natural gas, and hydroelectric assets to deliver reliable energy solutions. Renowned for innovation and operational scale, the company shapes regional grids with 32,400 MW of capacity. The key question is whether Constellation’s strong fundamentals continue to support its premium market valuation and growth prospects.

Table of contents

Business Model & Company Overview

Constellation Energy Corporation, founded in 2021 and headquartered in Baltimore, Maryland, stands as a dominant player in the Renewable Utilities industry in the United States. Its extensive portfolio, including nuclear, wind, solar, natural gas, and hydroelectric assets, forms a cohesive energy ecosystem delivering 32,400 megawatts of generating capacity. Serving a diverse client base—from municipalities to commercial and residential customers—Constellation integrates multiple energy sources to meet evolving demand efficiently.

The company’s revenue engine balances power generation and energy-related services across five regional segments: Mid-Atlantic, Midwest, New York, ERCOT, and Other Power Regions. It capitalizes on sales of natural gas, renewable energy, and ancillary products, positioning itself strategically across key American markets. This diversified approach, combined with its substantial asset base, creates a significant economic moat, solidifying Constellation’s role in shaping the future of sustainable energy supply.

Financial Performance & Fundamental Metrics

I will analyze Constellation Energy Corporation’s income statement, key financial ratios, and dividend payout policy to provide a clear view of its fundamental health.

Income Statement

The table below summarizes Constellation Energy Corporation’s key income statement figures for the fiscal years 2020 through 2024, expressed in USD.

| 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|

| Revenue | 17.6B | 19.6B | 24.4B | 24.9B | 23.6B |

| Cost of Revenue | 14.3B | 16.9B | 22.3B | 21.6B | 17.6B |

| Operating Expenses | 3.02B | 3.09B | 1.64B | 1.69B | 1.64B |

| Gross Profit | 3.28B | 2.75B | 2.14B | 3.30B | 6.00B |

| EBITDA | 4.31B | 3.81B | 2.92B | 4.22B | 6.97B |

| EBIT | 1.63B | 1.22B | 0.49B | 1.71B | 4.27B |

| Interest Expense | 357M | 297M | 251M | 431M | 506M |

| Net Income | 589M | -205M | -160M | 1.62B | 3.75B |

| EPS | 1.80 | -0.63 | -0.49 | 5.02 | 11.9 |

| Filing Date | 2020-12-31 | 2022-02-25 | 2023-02-16 | 2024-02-27 | 2025-02-18 |

Income Statement Evolution

From 2020 to 2024, Constellation Energy Corporation’s revenue increased by 33.9% overall but declined 5.4% in the last year. Net income showed a strong upward trend, growing 536.5% over the period, with a notable 144.2% increase in the most recent year. Margins improved significantly, with gross margin reaching 25.4% and net margin 15.9%, reflecting better profitability despite revenue softness.

Is the Income Statement Favorable?

The 2024 income statement reveals fundamentally favorable conditions. Gross profit surged 81.4% year-over-year, driving a 150.2% rise in EBIT and a net margin growth of 375.4% over five years. Interest expenses remain low at 2.15% of revenue, supporting earnings strength. EPS soared 137.5% in one year to $11.9, confirming improved operational efficiency and profitability, consistent with an overall favorable evaluation.

Financial Ratios

The table below summarizes key financial ratios for Constellation Energy Corporation (CEG) over the last five fiscal years, providing insight into profitability, efficiency, liquidity, leverage, and shareholder returns:

| Ratios | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|

| Net Margin | 3.3% | -1.0% | -0.7% | 6.5% | 15.9% |

| ROE | 4.8% | -1.8% | -1.5% | 14.9% | 28.5% |

| ROIC | 0.41% | 0.47% | 0.37% | 2.26% | 7.65% |

| P/E | 23.3 | -66.9 | -176.7 | 23.3 | 18.8 |

| P/B | 1.11 | 1.22 | 2.57 | 3.46 | 5.35 |

| Current Ratio | 1.33 | 1.00 | 1.19 | 1.31 | 1.57 |

| Quick Ratio | 1.10 | 0.84 | 1.00 | 1.08 | 1.34 |

| D/E | 0.58 | 0.73 | 0.52 | 0.85 | 0.64 |

| Debt-to-Assets | 15.0% | 17.0% | 12.3% | 18.2% | 15.9% |

| Interest Coverage | 0.72 | -1.16 | 1.97 | 3.74 | 8.60 |

| Asset Turnover | 0.37 | 0.41 | 0.52 | 0.49 | 0.45 |

| Fixed Asset Turnover | 0.79 | 1.00 | 1.23 | 1.13 | 1.11 |

| Dividend Yield | 12.6% | 13.4% | 0.65% | 0.97% | 0.63% |

Evolution of Financial Ratios

From 2020 to 2024, Constellation Energy Corporation’s Return on Equity (ROE) showed a marked improvement, rising from 4.75% in 2020 to 28.47% in 2024. The Current Ratio consistently increased, reaching 1.57 in 2024, indicating stronger short-term liquidity. The Debt-to-Equity Ratio fluctuated but remained moderate, settling at 0.64 in 2024. Profitability notably improved, with net profit margins rising from 3.35% in 2020 to 15.91% in 2024.

Are the Financial Ratios Favorable?

In 2024, profitability ratios such as net margin (15.91%) and ROE (28.47%) are favorable, reflecting solid earnings performance. Liquidity ratios, including the current ratio (1.57) and quick ratio (1.34), are also favorable, suggesting adequate short-term financial health. However, asset turnover (0.45) and price-to-book ratio (5.35) are unfavorable, indicating potential inefficiencies and possibly overvalued equity. Leverage ratios like debt-to-equity (0.64) are neutral, while interest coverage (8.44) is favorable. Overall, the financial ratios present a slightly favorable profile.

Shareholder Return Policy

Constellation Energy Corporation (CEG) maintains a moderate dividend payout ratio near 12%, with dividends per share rising from $1.13 in 2023 to $1.41 in 2024, yielding around 0.63%. Despite positive net income, the company’s free cash flow is negative, suggesting dividend coverage relies on operating cash flow. Share buyback activity is not explicitly reported.

This dividend distribution, combined with cautious payout levels, appears aligned with preserving long-term shareholder value amid cash flow challenges. The policy balances shareholder returns and financial sustainability, though negative free cash flow coverage signals a need for ongoing monitoring to avoid distribution risks.

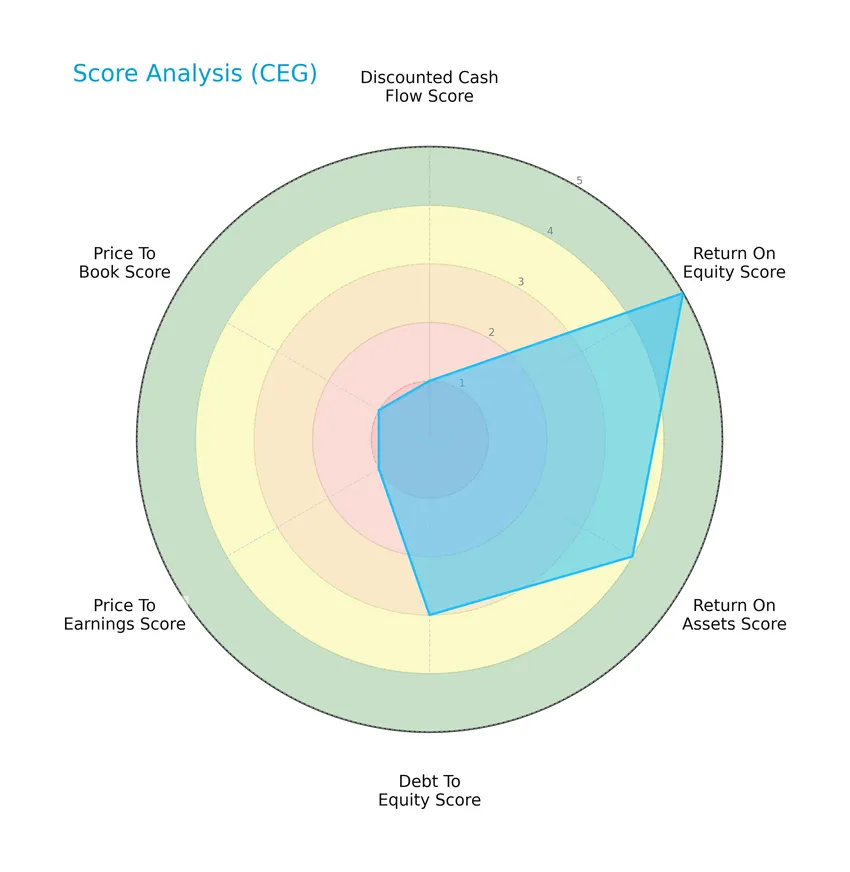

Score analysis

The following radar chart presents an overview of Constellation Energy Corporation’s key financial scores:

The company shows a mixed profile with a very favorable return on equity score of 5 and a favorable return on assets score of 4. However, discounted cash flow, price-to-earnings, and price-to-book scores are all very unfavorable at 1, while debt-to-equity is moderate at 3, reflecting varied financial metrics performance.

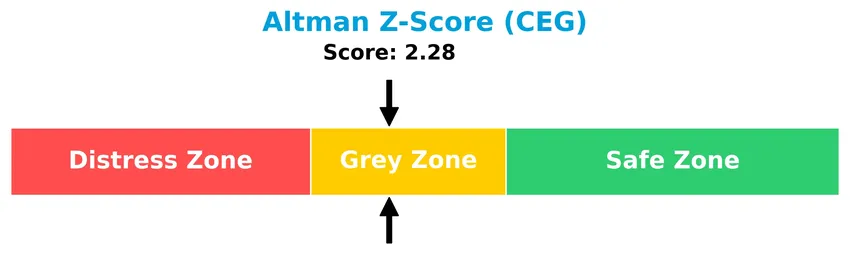

Analysis of the company’s bankruptcy risk

The Altman Z-Score indicates that Constellation Energy Corporation is currently in the grey zone, suggesting a moderate risk of bankruptcy:

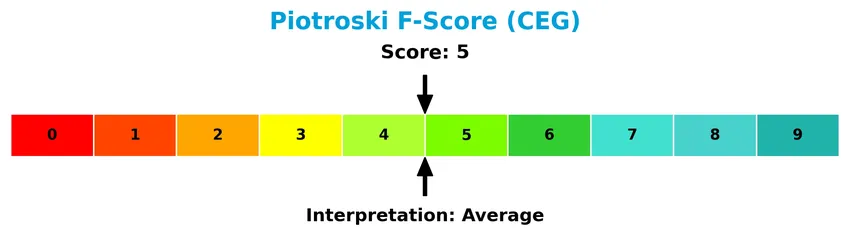

Is the company in good financial health?

The Piotroski diagram below illustrates the financial health of the company based on its Piotroski Score:

With a Piotroski Score of 5, Constellation Energy Corporation is considered to have average financial health, indicating neither strong nor weak fundamentals based on profitability, leverage, liquidity, and efficiency criteria.

Competitive Landscape & Sector Positioning

This sector analysis will examine Constellation Energy Corporation’s strategic positioning, revenue by segment, key products, main competitors, and competitive advantages. I will assess whether the company holds a competitive edge within the renewable utilities industry.

Strategic Positioning

Constellation Energy Corporation operates a diversified geographic portfolio across five U.S. regions, with 2024 revenues ranging from $1.55B in ERCOT to $5.52B in Mid Atlantic. Its product mix includes nuclear, wind, solar, natural gas, and hydroelectric assets, reflecting a broad energy generation strategy within the renewable utilities sector.

Revenue by Segment

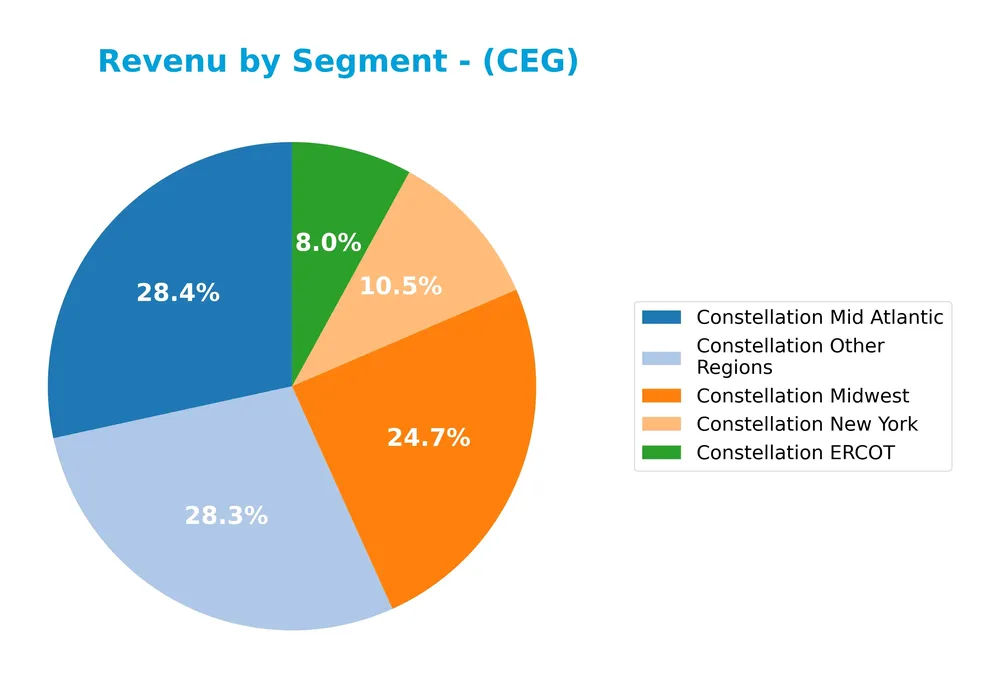

This pie chart illustrates Constellation Energy Corporation’s revenue breakdown by region for the fiscal year 2024, highlighting the company’s diverse market presence through its various geographic segments.

In 2024, Constellation’s revenue was primarily driven by the Mid Atlantic region at 5.5B and Other Regions at 5.5B, closely followed by the Midwest with 4.8B. The New York and ERCOT segments contributed smaller shares of 2.1B and 1.6B, respectively. Compared to 2023, revenue in ERCOT and Mid Atlantic showed modest growth, while Other Regions experienced a slight decline, indicating some regional shifts but overall stable diversification.

Key Products & Brands

The following table presents Constellation Energy Corporation’s main products and brand segments with brief descriptions:

| Product | Description |

|---|---|

| Constellation Mid Atlantic | Electricity generation and sales in the Mid-Atlantic region, including nuclear, natural gas, and renewables. |

| Constellation Midwest | Electricity supply and services in the Midwest, covering diverse energy sources. |

| Constellation New York | Energy products and services tailored to the New York market. |

| Constellation ERCOT | Electricity generation and sales in the ERCOT region of Texas. |

| Constellation Other Regions | Energy generation and sales across various other U.S. power regions. |

| Constellation Natural Gas | Natural gas sales and related energy products and services (noted in 2021-2022 data). |

| Constellation All Other Segments | Miscellaneous energy-related products and services outside core regional segments (noted in 2021-2022). |

Constellation Energy operates through multiple regional segments, offering a diversified portfolio of electricity and natural gas products across the U.S., supported by a generating capacity of 32,400 megawatts spanning nuclear, wind, solar, natural gas, and hydroelectric sources.

Main Competitors

There are 3 main competitors in the Renewable Utilities sector, with the table listing the top 3 leaders by market capitalization:

| Competitor | Market Cap. |

|---|---|

| GE Vernova Inc. | 184B |

| Constellation Energy Corporation | 114B |

| NuScale Power Corporation | 4.2B |

Constellation Energy Corporation ranks 2nd among its competitors with a market cap about 49% that of the leader, GE Vernova Inc. It sits below both the average market cap of the top 10 and the sector median. The company has a significant 104% market cap gap to the next competitor above, highlighting a clear distance from the sector leader.

Comparisons with competitors

Check out how we compare the company to its competitors:

Does CEG have a competitive advantage?

Constellation Energy Corporation shows a slightly unfavorable competitive advantage as its ROIC is below WACC, indicating value destruction despite improving profitability. The company maintains favorable margins and significant growth in net income and EPS over the 2020-2024 period.

Looking ahead, CEG operates a diverse portfolio of 32,400 megawatts capacity across nuclear, wind, solar, natural gas, and hydroelectric assets in multiple U.S. regions. These assets and its ongoing expansion in renewable energy markets may present future opportunities for growth and enhanced competitive positioning.

SWOT Analysis

This SWOT analysis highlights the key internal and external factors influencing Constellation Energy Corporation’s strategic position.

Strengths

- diversified energy mix with 32,400 MW capacity

- strong profitability with 15.91% net margin

- favorable revenue and net income growth over 5 years

Weaknesses

- recent 5.42% revenue decline

- unfavorable price-to-book and dividend yield ratios

- moderate debt-to-equity and asset turnover metrics

Opportunities

- expanding renewable energy demand

- technological advances in clean energy

- regional market growth in ERCOT and Mid-Atlantic

Threats

- regulatory changes in energy sector

- commodity price volatility

- competition from alternative energy providers

Overall, Constellation Energy benefits from a robust asset base and improving profitability but faces near-term revenue pressure and valuation concerns. Strategic focus on renewable expansion and operational efficiency will be critical to mitigate risks and capitalize on growth opportunities.

Stock Price Action Analysis

The weekly stock chart for Constellation Energy Corporation (CEG) over the past 12 months illustrates key price movements and volatility patterns:

Trend Analysis

Over the past 12 months, CEG’s stock price increased by 70.05%, indicating a bullish trend with significant volatility at a standard deviation of 63.72. The price ranged between 165.52 and 389.19, but the recent trend from November 2025 to January 2026 shows a deceleration with a 19.34% decline and a negative slope of -3.48.

Volume Analysis

Trading volume for CEG is increasing overall, with buyers controlling 52.3% of 1.7B shares traded. However, in the recent period (Nov 2025–Jan 2026), sellers dominate with 78% of volume, suggesting a shift toward selling pressure and cautious investor sentiment.

Target Prices

The current analyst consensus for Constellation Energy Corporation (CEG) reflects a moderately optimistic outlook.

| Target High | Target Low | Consensus |

|---|---|---|

| 460 | 375 | 405.63 |

Analysts expect the stock price to range between 375 and 460, with a consensus target of approximately 406, indicating potential moderate appreciation.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

Analyst & Consumer Opinions

This section examines recent analyst ratings and consumer feedback regarding Constellation Energy Corporation (CEG).

Stock Grades

Here is the latest overview of Constellation Energy Corporation’s stock grades from leading financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Overweight | 2026-01-20 |

| UBS | Maintain | Buy | 2025-12-17 |

| JP Morgan | Maintain | Overweight | 2025-12-16 |

| Citigroup | Maintain | Neutral | 2025-11-10 |

| Mizuho | Maintain | Neutral | 2025-10-27 |

| JP Morgan | Maintain | Overweight | 2025-10-20 |

| Keybanc | Maintain | Overweight | 2025-10-15 |

| Seaport Global | Upgrade | Buy | 2025-10-08 |

| Jefferies | Maintain | Hold | 2025-09-09 |

| Raymond James | Maintain | Outperform | 2025-08-11 |

The consensus across these reputable grading companies reflects a generally positive outlook with most maintaining overweight or buy ratings, while a few hold neutral or hold positions, indicating moderate confidence in the stock’s performance.

Consumer Opinions

Consumers of Constellation Energy Corporation (CEG) express a mix of appreciation and concerns, reflecting their varied experiences with the company’s services.

| Positive Reviews | Negative Reviews |

|---|---|

| Reliable energy supply with minimal outages | Customer service can be slow to respond |

| Competitive pricing compared to other providers | Occasional billing inaccuracies reported |

| Transparent communication during service updates | Limited renewable energy options in certain regions |

| Efficient problem resolution when issues arise | Some users find the online account management clunky |

Overall, consumers appreciate Constellation Energy’s reliability and transparent communication but frequently note that customer service responsiveness and billing accuracy could be improved.

Risk Analysis

Below is a summary table presenting key risks associated with Constellation Energy Corporation (CEG), including their likelihood and potential impact on investment value:

| Category | Description | Probability | Impact |

|---|---|---|---|

| Market Volatility | Stock price swings due to energy sector fluctuations and economic cycles. | Medium | Medium |

| Regulatory Risk | Changes in environmental regulations affecting renewable utilities sector. | High | High |

| Operational Risk | Potential disruptions in power generation or supply chain inefficiencies. | Medium | Medium |

| Financial Risk | Moderate debt levels with Altman Z-Score in grey zone indicating caution. | Medium | Medium |

| Valuation Risk | Elevated price-to-book ratio (5.35) and low dividend yield may deter income investors. | High | Medium |

The most critical risks for CEG are regulatory changes impacting the renewable energy sector and valuation concerns, as reflected in its high price-to-book ratio and moderate Altman Z-Score of 2.28, signaling some financial caution. Investors should monitor evolving policies and market conditions closely.

Should You Buy Constellation Energy Corporation?

Constellation Energy Corporation appears to exhibit improving profitability with a growing ROIC, despite a slightly unfavorable moat suggesting value erosion. Its leverage profile seems manageable, supported by a moderate debt rating, culminating in an overall B- rating indicative of moderate financial health.

Strength & Efficiency Pillars

Constellation Energy Corporation exhibits solid profitability, marked by a net margin of 15.91% and a return on equity (ROE) of 28.47%, reflecting efficient capital utilization. Its Altman Z-Score at 2.28 places it in the grey zone, suggesting moderate financial stability without immediate distress. The Piotroski score of 5 further indicates an average but stable financial health. While the return on invested capital (ROIC) of 7.65% slightly trails the weighted average cost of capital (WACC) at 8.72%, the company shows growing profitability trends, underpinning operational improvements.

Weaknesses and Drawbacks

Valuation metrics raise concerns, with a price-to-book ratio of 5.35 flagged as unfavorable, indicating the stock may be overvalued relative to its book value. The price-to-earnings ratio at 18.8 is neutral but suggests a moderate premium. Leverage metrics appear balanced, with a debt-to-equity ratio of 0.64 and a favorable current ratio of 1.57, yet the asset turnover ratio is low at 0.45, signaling inefficiencies in asset utilization. Recent market dynamics show seller dominance at 78%, creating short-term selling pressure that may weigh on price performance.

Our Verdict about Constellation Energy Corporation

The company’s long-term fundamental profile might appear moderately favorable given its profitability and improving margins, though value creation is currently constrained by a ROIC below WACC. Despite a bullish overall stock trend with a 70.05% price increase, recent seller dominance and a 19.34% price decline suggest a wait-and-see approach may be prudent before committing capital, as short-term market pressures could present a better entry point.

Disclaimer: This content is for informational purposes only and does not constitute financial, investment, or other professional advice. Investing in financial markets involves a significant risk of loss, and past performance is not indicative of future results.

Additional Resources

- Constellation Energy (CEG) Completes Acquisition of Calpine Corporation – Yahoo Finance (Jan 20, 2026)

- Constellation Energy Corporation (CEG) Stock Drops Despite Market Gains: Important Facts to Note – Nasdaq (Jan 22, 2026)

- Constellation Energy Corporation (CEG): Analyst Lauds $340 Million Maryland Agreement – MSN (Jan 20, 2026)

- Where Will Constellation Energy Be in 3 Years? – Finviz (Jan 20, 2026)

- Why Constellation Energy Stock Tumbled on Tuesday – The Motley Fool (Jan 20, 2026)

For more information about Constellation Energy Corporation, please visit the official website: constellationenergy.com