Water is a critical resource driving industries and communities alike, making companies in this sector essential investment targets. Xylem Inc. (XYL) and American Water Works Company, Inc. (AWK) both operate within the water industry but focus on different aspects—Xylem leads in engineered water solutions and technology, while American Water Works specializes in regulated water services. This article will explore which company offers the most compelling opportunity for investors seeking growth and stability in water-related markets.

Table of contents

Companies Overview

I will begin the comparison between Xylem Inc. and American Water Works Company, Inc. by providing an overview of these two companies and their main differences.

Xylem Inc. Overview

Xylem Inc. specializes in designing, manufacturing, and servicing engineered products and solutions for water and wastewater applications globally. Operating through segments like Water Infrastructure and Measurement & Control Solutions, it offers pumps, filtration, smart meters, and software services. Positioned in the industrial machinery sector, Xylem serves diverse markets with a focus on innovation and water technology solutions.

American Water Works Company, Inc. Overview

American Water Works provides regulated water and wastewater services across 14 states in the US, serving around 3.4M active customers. It operates numerous water treatment plants and infrastructure assets including pipelines and pumping stations. As a utilities sector leader, the company focuses on delivering essential water services to residential, commercial, industrial, and public sector clients.

Key similarities and differences

Both companies operate in the water sector but with distinct business models: Xylem focuses on engineered products and technology solutions for water management globally, while American Water Works delivers regulated water and wastewater services primarily in the US. Xylem is more product and technology-driven, whereas American Water Works operates as a utility provider managing infrastructure and customer services. Their market focus and operational scopes differ accordingly.

Income Statement Comparison

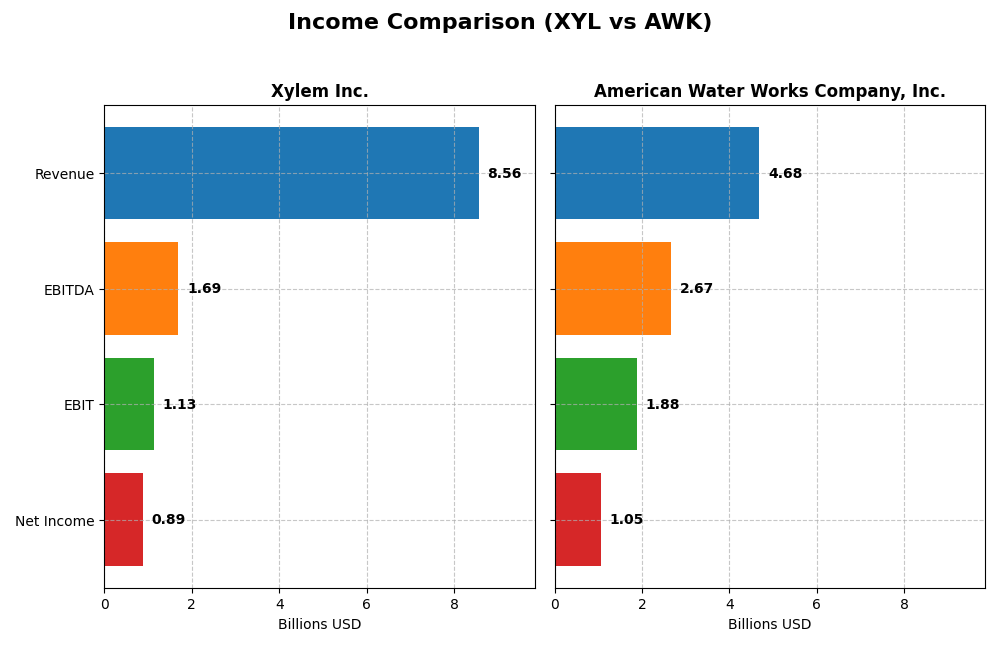

This table presents a side-by-side comparison of the latest fiscal year income statement figures for Xylem Inc. and American Water Works Company, Inc.

| Metric | Xylem Inc. (XYL) | American Water Works (AWK) |

|---|---|---|

| Market Cap | 33.4B | 25.4B |

| Revenue | 8.56B | 4.68B |

| EBITDA | 1.69B | 2.67B |

| EBIT | 1.13B | 1.88B |

| Net Income | 890M | 1.05B |

| EPS | 3.67 | 5.39 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Xylem Inc.

Xylem Inc. demonstrates robust growth from 2020 to 2024, with revenue increasing from $4.88B to $8.56B and net income surging from $254M to $890M. Margins improved significantly, with a net margin of 10.39% in 2024, reflecting enhanced profitability. The fiscal year 2024 showed strong momentum, with revenue growth accelerating by 16.27% and net income growth at 25.69%, supported by favorable margin expansions.

American Water Works Company, Inc.

American Water Works displayed steady revenue growth, reaching $4.68B in 2024 up from $3.78B in 2020. Net income rose substantially from $709M to $1.05B over the same period. Margins remain strong, with a gross margin of 60.33% and net margin of 22.44% in 2024, though interest expense remains relatively high at 11.17%. The latest year saw revenue and earnings growth of approximately 10.63% and 10.22%, respectively, with net margin growth remaining stable.

Which one has the stronger fundamentals?

Xylem Inc. exhibits stronger margin improvements and higher net income growth rates, reflecting enhanced operational efficiency and profitability. Conversely, American Water Works boasts superior gross and net margins but faces a notably higher interest expense, which may affect financial flexibility. Both companies show favorable income trends, yet Xylem’s rapid growth contrasts with American Water’s stable, margin-rich profile.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Xylem Inc. (XYL) and American Water Works Company, Inc. (AWK) based on their most recent fiscal year data for 2024.

| Ratios | Xylem Inc. (XYL) | American Water Works (AWK) |

|---|---|---|

| ROE | 8.36% | 10.17% |

| ROIC | 5.78% | 4.26% |

| P/E | 31.63 | 23.10 |

| P/B | 2.64 | 2.35 |

| Current Ratio | 1.75 | 0.39 |

| Quick Ratio | 1.33 | 0.35 |

| D/E (Debt-to-Equity) | 0.20 | 1.37 |

| Debt-to-Assets | 12.9% | 42.98% |

| Interest Coverage | 22.93 | 3.28 |

| Asset Turnover | 0.52 | 0.14 |

| Fixed Asset Turnover | 7.43 | 0.17 |

| Payout ratio | 39.3% | 55.7% |

| Dividend yield | 1.24% | 2.41% |

Interpretation of the Ratios

Xylem Inc.

Xylem shows a mixed but slightly favorable ratio profile with strong liquidity, low debt levels, and good interest coverage, indicating financial stability. Some concerns arise from a relatively high PE ratio and moderate return on equity. The company pays dividends with a 1.24% yield, supported by manageable payout ratios and free cash flow coverage, suggesting a balanced shareholder return approach without excessive risk.

American Water Works Company, Inc.

American Water Works presents a less favorable ratio set marked by weak liquidity ratios and elevated debt levels, which could signal financial strain. However, it boasts a strong net margin and a decent dividend yield of 2.41%, reflecting reliable income distribution. The company faces challenges with lower asset turnover and moderate interest coverage, which may impact operational efficiency and risk profile.

Which one has the best ratios?

Xylem holds the advantage in ratio quality with more favorable liquidity, leverage, and coverage ratios, despite a higher valuation multiple. American Water Works, while delivering stronger net margins and dividends, suffers from liquidity and debt concerns. Overall, Xylem’s balance of financial health indicators edges out American Water Works’ mixed profile.

Strategic Positioning

This section compares the strategic positioning of Xylem Inc. and American Water Works Company, Inc., including market position, key segments, and exposure to technological disruption:

Xylem Inc.

- Operates globally in industrial machinery, faces moderate competition in water solutions.

- Diverse segments: Water Infrastructure, Applied Water, Measurement & Control Solutions driving revenues.

- Develops smart meters, networked devices, and cloud-based analytics integrating technology.

American Water Works Company, Inc.

- Leading U.S. regulated water utility with stable competitive environment.

- Primarily regulated water business with a smaller market-based segment.

- Limited technological disruption due to regulated utility status and infrastructure focus.

Xylem Inc. vs American Water Works Company, Inc. Positioning

Xylem offers a diversified product portfolio across water infrastructure and technology-driven segments, while American Water focuses on regulated water utility services. Xylem’s broader industrial scope contrasts with American Water’s concentrated utility operations and customer base.

Which has the best competitive advantage?

Both companies are currently shedding value as ROIC is below WACC, but both show improving profitability trends. Neither demonstrates a strong economic moat based on the provided MOAT evaluation.

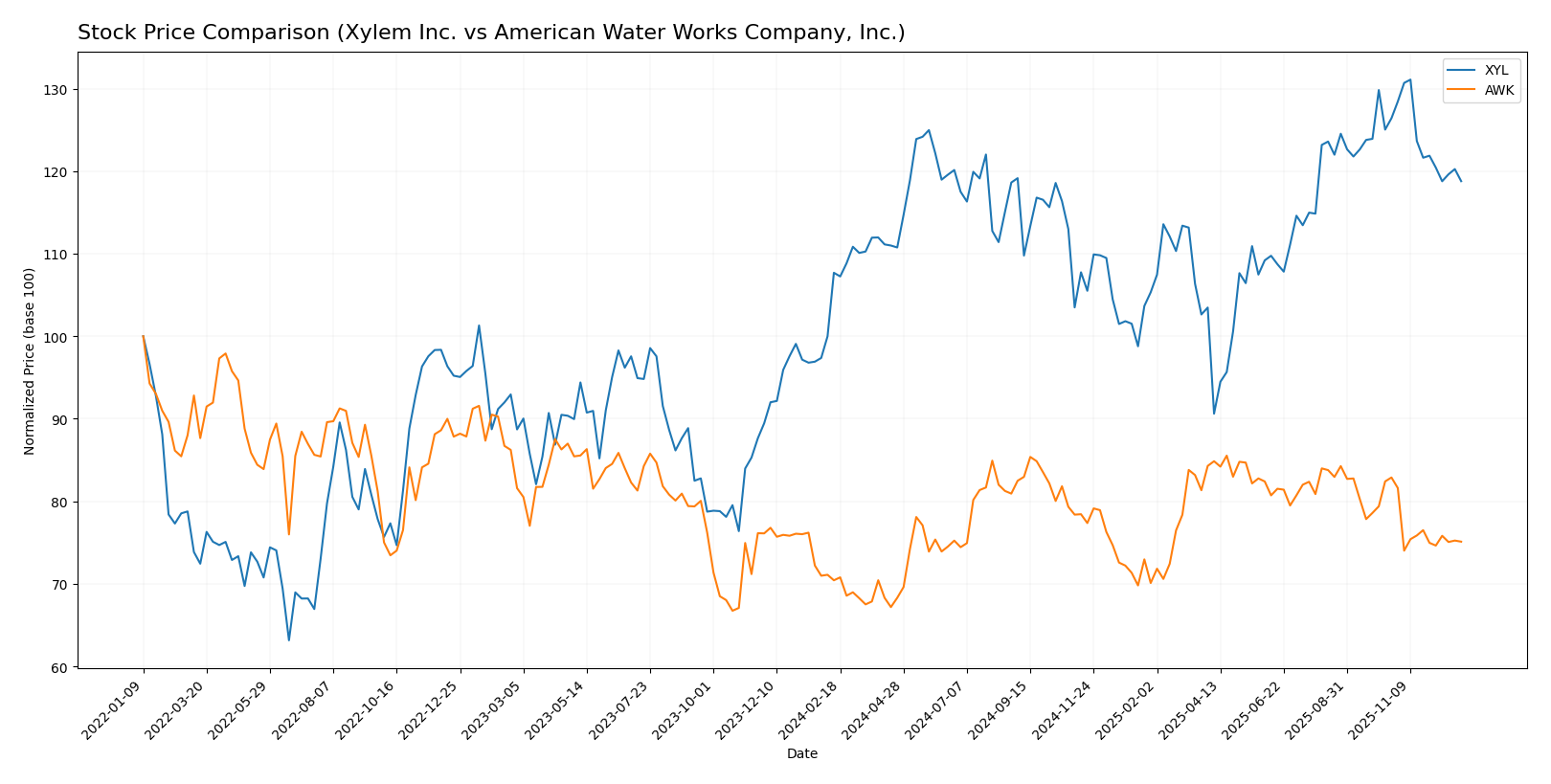

Stock Comparison

The stock price chart highlights notable bullish trends for both Xylem Inc. and American Water Works Company, Inc. over the past 12 months, with decelerating momentum and recent downward corrections in both cases.

Trend Analysis

Xylem Inc. (XYL) stock showed a 10.31% increase over the past year, indicating a bullish trend with decelerating momentum. The price ranged between 104.6 and 151.31, with recent months showing a 6.03% decline.

American Water Works Company, Inc. (AWK) experienced a 6.64% price rise over the same period, also bullish but decelerating. Its price fluctuated from 116.57 to 148.4, followed by a 9.38% recent decrease.

Comparing the two, Xylem Inc. delivered the higher overall market performance with a stronger annual gain, despite both stocks facing recent downward trends.

Target Prices

Analysts present a favorable target price consensus for both Xylem Inc. and American Water Works Company, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Xylem Inc. | 178 | 160 | 171.71 |

| American Water Works Company, Inc. | 149 | 122 | 139.5 |

The target consensus for Xylem Inc. at 171.71 USD suggests upside potential compared to its current price of 137.11 USD. Similarly, American Water Works has a consensus target of 139.5 USD, above its current trading price of 130.32 USD, indicating moderate growth expectations.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Xylem Inc. and American Water Works Company, Inc.:

Rating Comparison

Xylem Inc. Rating

- Rating: B, classified as Very Favorable by analysts.

- Discounted Cash Flow Score: Moderate at 3/5.

- ROE Score: Moderate at 3/5, indicating average efficiency.

- ROA Score: Favorable at 4/5, showing effective asset use.

- Debt to Equity Score: Moderate at 3/5, signaling average financial risk.

- Overall Score: Moderate at 3/5 summarizing financial standing.

American Water Works Company, Inc. Rating

- Rating: B, also classified as Very Favorable by analysts.

- Discounted Cash Flow Score: Favorable at 4/5, higher than Xylem.

- ROE Score: Moderate at 3/5, matching Xylem’s profitability measure.

- ROA Score: Favorable at 4/5, equal to Xylem’s asset utilization.

- Debt to Equity Score: Moderate at 2/5, suggesting slightly lower financial risk than Xylem.

- Overall Score: Moderate at 3/5, equal to Xylem’s overall assessment.

Which one is the best rated?

Both companies share the same overall rating of B and overall score of 3, indicating a similar moderate financial standing. American Water Works scores better in discounted cash flow and has a slightly lower debt-to-equity score, suggesting marginally stronger valuation and financial risk metrics compared to Xylem.

Scores Comparison

The comparison of the companies’ financial health scores is as follows:

Xylem Inc. Scores

- Altman Z-Score: 4.89, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 8, classified as very strong financial health.

American Water Works Company, Inc. Scores

- Altman Z-Score: 1.00, indicating distress zone with high bankruptcy risk.

- Piotroski Score: 6, classified as average financial health.

Which company has the best scores?

Xylem Inc. shows stronger financial health with a safe Altman Z-Score and a very strong Piotroski Score, unlike American Water Works in distress and average categories.

Grades Comparison

The following tables present the most recent reliable grades from recognized financial institutions for both companies:

Xylem Inc. Grades

This table shows the recent grades assigned to Xylem Inc. by well-known grading companies.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| TD Cowen | Maintain | Hold | 2025-12-05 |

| UBS | Maintain | Buy | 2025-11-06 |

| RBC Capital | Maintain | Outperform | 2025-10-29 |

| Citigroup | Maintain | Buy | 2025-10-29 |

| Stifel | Maintain | Buy | 2025-10-29 |

| Barclays | Maintain | Overweight | 2025-10-29 |

| Citigroup | Maintain | Buy | 2025-10-09 |

| Mizuho | Maintain | Neutral | 2025-09-12 |

| TD Cowen | Maintain | Hold | 2025-08-26 |

| UBS | Maintain | Buy | 2025-08-05 |

Overall, Xylem Inc. exhibits a consistent pattern of buy and outperform ratings, with few neutral or hold grades, signaling generally positive analyst sentiment.

American Water Works Company, Inc. Grades

This table shows the recent grades assigned to American Water Works Company, Inc. by well-known grading companies.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Underweight | 2025-12-17 |

| Jefferies | Upgrade | Hold | 2025-11-05 |

| Barclays | Maintain | Underweight | 2025-10-21 |

| Argus Research | Maintain | Buy | 2025-08-14 |

| UBS | Maintain | Neutral | 2025-08-12 |

| Wells Fargo | Maintain | Equal Weight | 2025-08-01 |

| Mizuho | Maintain | Neutral | 2025-08-01 |

| UBS | Maintain | Neutral | 2025-07-11 |

| Barclays | Maintain | Underweight | 2025-07-10 |

| Wells Fargo | Maintain | Equal Weight | 2025-05-02 |

American Water Works Company, Inc. shows a mix of underweight and neutral ratings, with only one buy rating, indicating a more cautious analyst outlook.

Which company has the best grades?

Xylem Inc. has received generally stronger and more positive grades compared to American Water Works Company, Inc., which shows a more defensive stance with multiple underweight ratings. For investors, this contrast may highlight differing expectations about growth and risk profiles between the two companies.

Strengths and Weaknesses

Below is a comparison table highlighting key strengths and weaknesses of Xylem Inc. (XYL) and American Water Works Company, Inc. (AWK) based on the most recent financial and operational data.

| Criterion | Xylem Inc. (XYL) | American Water Works (AWK) |

|---|---|---|

| Diversification | Diverse segments: Water Infrastructure (2.56B), Water Solutions & Services (2.34B), Measurement & Control (1.87B), Applied Water (1.79B) | Less diversified: predominantly Regulated Business (4.30B), smaller Market Based Businesses (388M) |

| Profitability | Net margin 10.39% (favorable), ROIC 5.78% (neutral), but ROIC < WACC indicating value destruction | Net margin 22.44% (favorable), ROIC 4.26% (unfavorable), also ROIC < WACC showing value destruction |

| Innovation | Steady ROIC growth (+31.7%) suggests improving operational efficiency and innovation progress | Moderate ROIC growth (+4.5%) indicates some operational improvement but slower innovation impact |

| Global presence | Global operations with diverse product lines and services | Primarily US-focused with regulated utilities dominating revenue |

| Market Share | Strong in water infrastructure and solutions markets, but facing profitability challenges | Leading in regulated water utilities market, stable but with financial leverage concerns |

Key takeaways: Xylem shows promising growth in return on invested capital and diversified offerings, though it currently destroys value. American Water Works has higher profitability and market stability but struggles with financial leverage and slower ROIC growth. Both require cautious risk management due to value destruction signals.

Risk Analysis

The following table summarizes key risks for Xylem Inc. (XYL) and American Water Works Company, Inc. (AWK) based on the latest financial and operational data from 2024.

| Metric | Xylem Inc. (XYL) | American Water Works (AWK) |

|---|---|---|

| Market Risk | Moderate (Beta 1.17) | Lower (Beta 0.75) |

| Debt level | Low (D/E 0.2) | High (D/E 1.37) |

| Regulatory Risk | Moderate (Industrial sector) | High (Highly regulated utilities) |

| Operational Risk | Moderate (Diverse segments) | Moderate (Large infrastructure base) |

| Environmental Risk | Moderate (Water treatment focus) | Moderate (Water/wastewater services) |

| Geopolitical Risk | Low (Global but US-based) | Low (US-focused operations) |

Xylem presents lower financial leverage and a moderate market risk profile, while American Water Works carries higher debt with more regulatory exposure due to its utility status. The most impactful risks are AWK’s elevated debt levels and regulatory challenges, which could affect financial stability. XYL’s moderate market risk and operational complexity warrant attention but are less concerning currently.

Which Stock to Choose?

Xylem Inc. (XYL) shows strong income growth with a 75.59% revenue increase and 250.39% net income growth over 2020-2024. Its financial ratios are slightly favorable, profitability is solid, debt levels are low, and it holds a very favorable B rating.

American Water Works Company, Inc. (AWK) presents moderate income growth, with 24.01% revenue and 48.24% net income growth over the same period. Its financial ratios are slightly unfavorable due to higher leverage and weaker liquidity, though profitability remains good, with a very favorable B rating.

Investors prioritizing growth might find XYL’s strong income growth and favorable financial ratios appealing, while those valuing income stability and established profitability could view AWK as a suitable option despite its higher debt and less favorable liquidity. Both companies show improving profitability but are currently shedding value based on ROIC versus WACC assessments.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Xylem Inc. and American Water Works Company, Inc. to enhance your investment decisions: