In today’s fast-evolving software landscape, Workday, Inc. and monday.com Ltd. stand out as influential players offering cloud-based enterprise applications. Both companies compete in the Software – Application industry, targeting business efficiency with innovative platforms for workforce and project management. Their overlapping markets and distinct innovation strategies make them compelling candidates for comparison. Join me as we explore which company offers the most promising opportunity for investors in 2026.

Table of contents

Companies Overview

I will begin the comparison between Workday and monday.com by providing an overview of these two companies and their main differences.

Workday Overview

Workday, Inc. is a US-based provider of enterprise cloud applications designed to help customers plan, execute, analyze, and manage business operations. Its suite includes financial management, cloud spend management, Human Capital Management (HCM), planning, and analytics applications. Serving diverse industries such as healthcare, education, and financial services, Workday is headquartered in Pleasanton, California, and employs over 20K staff.

monday.com Overview

monday.com Ltd. is an Israel-based software company offering a cloud-based visual work operating system called Work OS, which enables users to build and manage modular applications for various needs including marketing, CRM, and project management. The company targets organizations, educational institutions, and government entities worldwide. It is headquartered in Tel Aviv and has about 2.5K employees.

Key similarities and differences

Both companies operate in the software application industry and provide cloud-based business solutions targeting a broad range of sectors globally. Workday focuses more on enterprise resource planning with an emphasis on financial and human capital management, while monday.com emphasizes customizable work management and project collaboration tools. Workday is significantly larger in market cap and workforce compared to monday.com, reflecting different scales and market penetrations.

Income Statement Comparison

This table compares key income statement metrics for Workday, Inc. and monday.com Ltd. based on their most recent fiscal year results, providing a snapshot of their financial performance.

| Metric | Workday, Inc. (WDAY) | monday.com Ltd. (MNDY) |

|---|---|---|

| Market Cap | 49.9B | 6.5B |

| Revenue | 8.45B | 972M |

| EBITDA | 1.08B | 58M |

| EBIT | 752M | 40M |

| Net Income | 526M | 32M |

| EPS | 1.98 | 0.65 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Workday, Inc.

From 2021 to 2025, Workday, Inc. showed strong revenue growth, nearly doubling to $8.45B, with net income improving substantially to $526M. Margins generally improved, with a stable gross margin at 75.5%. However, net margin declined sharply in the most recent year, reflecting a 67.3% drop despite a 16.4% revenue increase, indicating margin pressure in 2025.

monday.com Ltd.

monday.com Ltd. experienced rapid revenue growth from $161M in 2020 to nearly $972M in 2024, with net income turning positive to $32M after prior losses. Gross margin remained high at 89.3%, while EBIT margin stayed low but neutral at 4.1%. The latest year saw strong momentum with over 33% revenue growth and substantial net margin expansion, signaling improving profitability.

Which one has the stronger fundamentals?

Both companies present favorable income statement fundamentals, but Workday benefits from larger scale and consistent margin levels despite recent net margin softness. monday.com shows more dramatic growth in revenue and net income margins, reflecting early-stage scaling success. Workday’s stable margins and size contrast with monday.com’s sharper improvement but smaller absolute earnings, reflecting different maturity stages.

Financial Ratios Comparison

This table provides a side-by-side comparison of key financial ratios for Workday, Inc. (WDAY) and monday.com Ltd. (MNDY) based on the most recent fiscal year data available.

| Ratios | Workday, Inc. (WDAY) FY 2025 | monday.com Ltd. (MNDY) FY 2024 |

|---|---|---|

| ROE | 5.82% | 3.14% |

| ROIC | 2.73% | -1.73% |

| P/E | 132.15 | 362.98 |

| P/B | 7.69 | 11.41 |

| Current Ratio | 1.85 | 2.66 |

| Quick Ratio | 1.85 | 2.66 |

| D/E (Debt-to-Equity) | 0.37 | 0.10 |

| Debt-to-Assets | 18.70% | 6.29% |

| Interest Coverage | 3.64 | 0 |

| Asset Turnover | 0.47 | 0.58 |

| Fixed Asset Turnover | 5.36 | 7.13 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

Interpretation of the Ratios

Workday, Inc.

Workday displays a mixed ratio profile with strengths in liquidity and leverage, evidenced by a favorable current ratio of 1.85 and a debt-to-equity ratio of 0.37. However, profitability ratios such as return on equity (5.82%) and return on invested capital (2.73%) are unfavorable, alongside a high price-to-earnings ratio of 132.15, suggesting valuation concerns. Workday does not pay dividends, reflecting a focus on growth and reinvestment in its enterprise cloud applications.

monday.com Ltd.

monday.com exhibits favorable liquidity and solvency ratios, including a strong current ratio of 2.66 and low debt-to-assets at 6.29%, with an infinite interest coverage ratio indicating no interest expense pressure. However, profitability metrics like net margin (3.33%) and return on invested capital (-1.73%) are unfavorable, and valuation appears stretched with a P/E of 362.98. Like Workday, monday.com does not distribute dividends, prioritizing growth and investment in its cloud-based work operating system.

Which one has the best ratios?

Both companies share an equal proportion of favorable and unfavorable ratios, each with 42.86% favorable and 42.86% unfavorable metrics, leading to a neutral overall assessment. Workday shows slightly weaker profitability but stable leverage, while monday.com benefits from stronger liquidity and minimal debt but struggles with profitability and high valuation. Neither clearly outperforms the other on ratio grounds.

Strategic Positioning

This section compares the strategic positioning of Workday, Inc. and monday.com Ltd., covering Market position, Key segments, and Exposure to technological disruption:

Workday, Inc.

- Leading enterprise cloud applications provider with strong competitive pressure in software.

- Focuses on subscription and professional services, mainly in financial management and human capital management.

- Exposure through integration of machine learning and augmented analytics in applications.

monday.com Ltd.

- Smaller market cap with growing presence in cloud-based work operating systems, facing competitive pressures.

- Offers modular cloud software for work management and various business solutions like marketing and CRM.

- Relies on cloud modularity; no explicit mention of advanced tech disruption exposure.

Workday, Inc. vs monday.com Ltd. Positioning

Workday’s strategy is diversified across financial and HR cloud services with a broad industry reach, while monday.com concentrates on modular, visual work management software. Workday’s larger scale contrasts with monday.com’s narrower focus and smaller employee base.

Which has the best competitive advantage?

Both companies are currently shedding value but show growing profitability. Neither holds a clearly favorable moat; Workday’s scale and diversified offering provide some advantage, but both face slightly unfavorable MOAT evaluations.

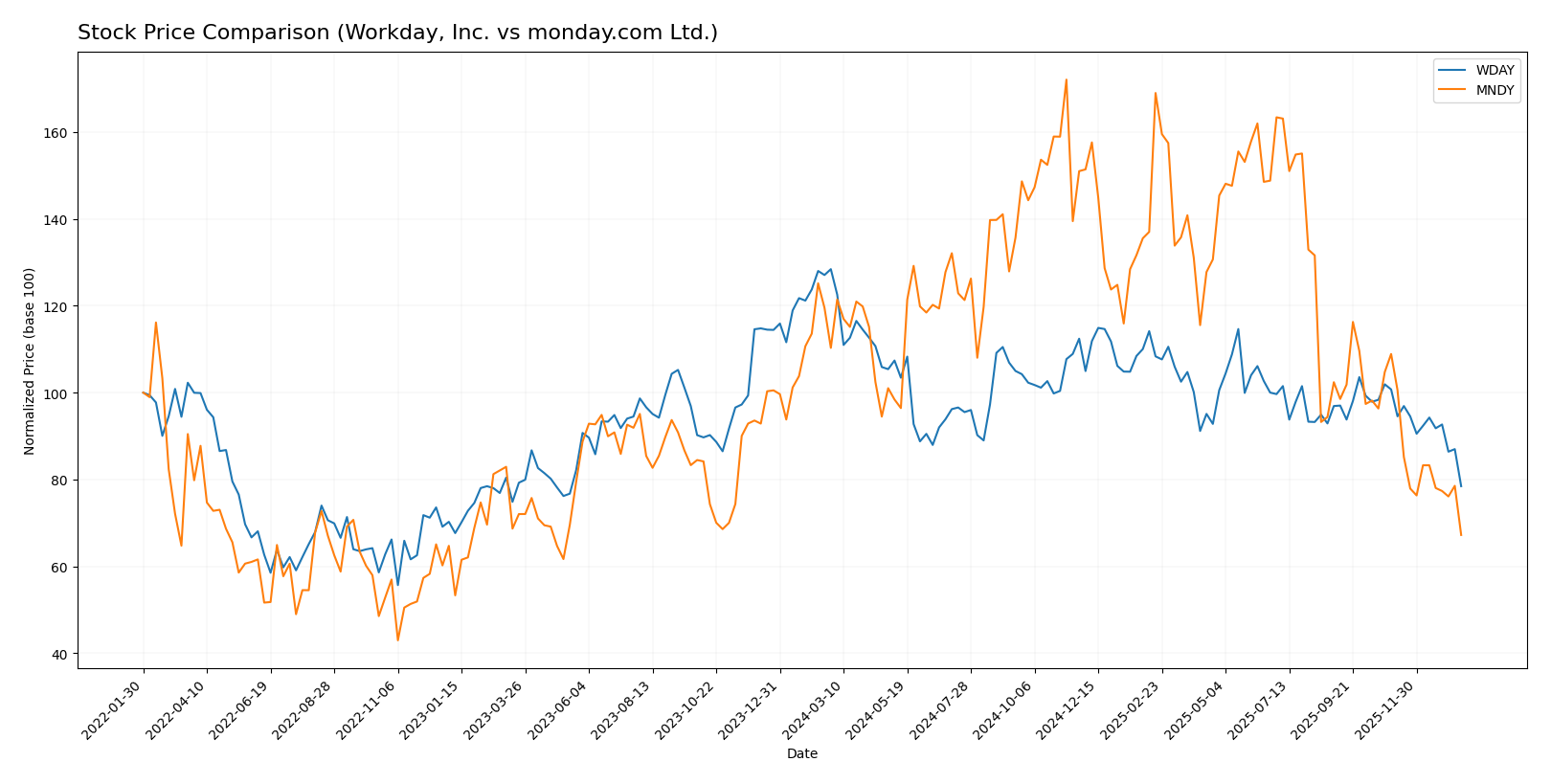

Stock Comparison

The past year has seen both Workday, Inc. (WDAY) and monday.com Ltd. (MNDY) experience significant price declines, with pronounced bearish trends and decelerating momentum, reflecting notable volatility and seller dominance in recent trading sessions.

Trend Analysis

Workday, Inc. (WDAY) showed a bearish trend over the past 12 months, with a price drop of -38.91%. The trend decelerated, with volatility measured by a standard deviation of 20.22, and prices ranged between 186.86 and 305.88.

monday.com Ltd. (MNDY) also experienced a bearish trend, declining by -39.06% over the last year. This trend decelerated, accompanied by higher volatility at a 47.32 standard deviation, with prices fluctuating from 126.7 to 324.31.

Comparing both stocks, monday.com Ltd. and Workday, Inc. delivered similar market performance, with monday.com slightly underperforming but both showing substantial negative returns and decelerating bearish trends.

Target Prices

Analysts present a bullish consensus with significant upside potential for both Workday, Inc. and monday.com Ltd.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Workday, Inc. | 320 | 235 | 274.47 |

| monday.com Ltd. | 330 | 194 | 264.42 |

The consensus target prices for Workday and monday.com indicate expected gains of approximately 47% and 109% respectively from their current prices, reflecting strong analyst optimism.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Workday, Inc. and monday.com Ltd.:

Rating Comparison

WDAY Rating

- Rating: B- with a “Very Favorable” status

- Discounted Cash Flow Score: 4, indicating a favorable DCF

- ROE Score: 3, showing moderate efficiency in profit generation

- ROA Score: 3, reflecting moderate asset utilization

- Debt To Equity Score: 2, moderate financial risk

- Overall Score: 2, moderate financial standing

MNDY Rating

- Rating: B- with a “Very Favorable” status

- Discounted Cash Flow Score: 4, indicating a favorable DCF

- ROE Score: 3, showing moderate efficiency in profit generation

- ROA Score: 3, reflecting moderate asset utilization

- Debt To Equity Score: 3, moderate financial risk but slightly better than WDAY

- Overall Score: 3, moderate financial standing but higher than WDAY

Which one is the best rated?

Based strictly on the provided data, monday.com Ltd. holds a higher overall score (3) compared to Workday, Inc. (2), with a better debt-to-equity score, while both share the same rating and favorable DCF, ROE, and ROA scores.

Scores Comparison

Here is the comparison of key financial scores for Workday, Inc. and monday.com Ltd.:

WDAY Scores

- Altman Z-Score: 4.41, classified in the safe zone, indicating low bankruptcy risk.

- Piotroski Score: 6, considered average financial strength based on nine criteria.

MNDY Scores

- Altman Z-Score: 6.33, classified in the safe zone, indicating very low bankruptcy risk.

- Piotroski Score: 5, considered average financial strength based on nine criteria.

Which company has the best scores?

Both companies are in the safe zone for Altman Z-Score, with MNDY showing a higher score, suggesting stronger financial stability. WDAY has a slightly better Piotroski Score, but both are rated average, reflecting comparable financial health.

Grades Comparison

Here is the comparison of the latest grades and ratings from recognized grading companies for the two companies:

Workday, Inc. Grades

The table below presents recent grades from reputable financial institutions for Workday, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Overweight | 2026-01-12 |

| RBC Capital | Maintain | Outperform | 2026-01-05 |

| TD Cowen | Maintain | Buy | 2025-11-26 |

| DA Davidson | Maintain | Neutral | 2025-11-26 |

| Wells Fargo | Maintain | Overweight | 2025-11-26 |

| Barclays | Maintain | Overweight | 2025-11-26 |

| Keybanc | Maintain | Overweight | 2025-11-26 |

| Citigroup | Maintain | Neutral | 2025-11-26 |

| JP Morgan | Maintain | Overweight | 2025-11-26 |

| UBS | Maintain | Neutral | 2025-11-26 |

Workday’s grades consistently show a strong buy-side bias, with multiple Overweight and Buy ratings and some Neutral assessments.

monday.com Ltd. Grades

The table below presents recent grades from reputable financial institutions for monday.com Ltd.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| BTIG | Maintain | Buy | 2026-01-15 |

| Barclays | Maintain | Overweight | 2026-01-12 |

| Jefferies | Maintain | Buy | 2026-01-05 |

| Citigroup | Maintain | Buy | 2025-12-23 |

| Tigress Financial | Maintain | Buy | 2025-12-11 |

| Baird | Maintain | Outperform | 2025-11-11 |

| Wells Fargo | Maintain | Overweight | 2025-11-11 |

| DA Davidson | Maintain | Buy | 2025-11-11 |

| Morgan Stanley | Maintain | Overweight | 2025-11-11 |

| Piper Sandler | Maintain | Overweight | 2025-11-11 |

monday.com Ltd. shows a strong consensus in favor of buying, with a majority of Buy and Overweight ratings and some Outperform grades.

Which company has the best grades?

Both Workday, Inc. and monday.com Ltd. have strong buy-side consensus ratings, but monday.com Ltd. features a higher proportion of Buy and Overweight grades with fewer Neutral ratings. This suggests a slightly more favorable sentiment among analysts, which may influence investor perception and confidence.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Workday, Inc. (WDAY) and monday.com Ltd. (MNDY) based on recent financial and operational data.

| Criterion | Workday, Inc. (WDAY) | monday.com Ltd. (MNDY) |

|---|---|---|

| Diversification | Revenue mainly from subscription services (7.7B USD in 2025); limited product diversification | Primarily focused on work management software; less diversified product line |

| Profitability | Net margin 6.23% (neutral); ROIC 2.73% (unfavorable); currently shedding value but improving ROIC trend | Net margin 3.33% (unfavorable); ROIC -1.73% (unfavorable); also shedding value though ROIC improving |

| Innovation | Strong professional services supporting subscriptions; fixed asset turnover favorable (5.36) | High fixed asset turnover (7.13); innovation driven but high P/E suggests growth expectations |

| Global presence | Established global SaaS player with growing subscription revenue | Growing international presence but smaller scale than WDAY |

| Market Share | Significant market share in enterprise HCM and financial management | Smaller market share in work management, facing intense competition |

Key takeaways: Both companies are in growth phases with improving profitability trends but currently not creating value above their cost of capital. Workday benefits from a larger, diversified subscription base and strong service support, while monday.com shows promising asset efficiency yet faces challenges in profitability and valuation. Caution and close monitoring of profitability improvements are advised.

Risk Analysis

Below is a comparison table outlining the key risk factors for Workday, Inc. (WDAY) and monday.com Ltd. (MNDY) based on the most recent data from 2025 and 2024 respectively:

| Metric | Workday, Inc. (WDAY) | monday.com Ltd. (MNDY) |

|---|---|---|

| Market Risk | Beta 1.142, moderate market volatility risk | Beta 1.255, slightly higher market volatility risk |

| Debt level | Debt-to-Equity 0.37, favorable low leverage | Debt-to-Equity 0.1, very low leverage, favorable |

| Regulatory Risk | US-based, subject to stringent US tech regulations | Israel-based, exposed to international regulatory variations |

| Operational Risk | Large workforce (20,482), operational complexity | Smaller workforce (2,508), smaller scale but rapid growth |

| Environmental Risk | Moderate; cloud software industry with indirect environmental impact | Moderate; similar industry profile with global footprint |

| Geopolitical Risk | US-centric, relatively stable geopolitical environment | Exposure to Middle East tensions, higher geopolitical risk |

The most impactful risks for both companies are market volatility, as indicated by beta values above 1, and regulatory exposure related to their respective domiciles and international operations. monday.com’s geopolitical risk is elevated due to its location and international presence, while Workday’s operational risk is higher due to its larger scale. Both companies maintain favorable debt levels, which helps mitigate financial risk.

Which Stock to Choose?

Workday, Inc. (WDAY) shows a favorable income statement with 16.35% revenue growth in 2025 and a net margin of 6.23%. Its financial ratios are mixed, with a neutral global rating and favorable liquidity and debt metrics. The company is slightly value-destructive but improving profitability.

monday.com Ltd. (MNDY) also displays a favorable income evolution, with 33.21% revenue growth in 2024 and a 3.33% net margin. Its financial ratios mirror WDAY’s neutral global rating, featuring strong liquidity and low debt. MNDY is slightly value-destructive but shows a growing return on invested capital.

Investors seeking growth might find both stocks appealing due to their favorable income trends and improving profitability. However, those prioritizing balance sheet strength and liquidity may see MNDY’s lower debt ratios and higher current ratios as a positive signal. The choice could depend on the investor’s risk tolerance and preference for income growth versus capital efficiency.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Workday, Inc. and monday.com Ltd. to enhance your investment decisions: