Investors seeking exposure to the uranium sector face a choice between Denison Mines Corp. (DNN) and Uranium Royalty Corp. (UROY), two Canadian energy companies with distinct business models. Denison focuses on uranium exploration and development, while Uranium Royalty specializes in acquiring diversified uranium royalties. Both operate in overlapping markets and pursue innovative strategies to benefit from the growing demand for clean energy. This article will help you decide which company offers the most compelling investment opportunity.

Table of contents

Companies Overview

I will begin the comparison between Denison Mines Corp. and Uranium Royalty Corp. by providing an overview of these two companies and their main differences.

Denison Mines Corp. Overview

Denison Mines Corp. focuses on the acquisition, exploration, development, extraction, processing, and selling of uranium properties, primarily in Canada. Its flagship asset is the 95% owned Wheeler River uranium project in Saskatchewan’s Athabasca Basin. Founded in 1997 and based in Toronto, Denison is positioned as an active uranium producer and developer with a market cap of about 3B USD.

Uranium Royalty Corp. Overview

Uranium Royalty Corp. operates as a pure-play uranium royalty company, managing a diverse portfolio of royalty interests across multiple uranium projects in North America and Namibia. Incorporated in 2017 and headquartered in Vancouver, the company focuses on accumulating and managing royalties rather than direct mining, with a market cap near 535M USD.

Key similarities and differences

Both companies operate within the uranium industry and are based in Canada, contributing to the energy sector. Denison engages directly in uranium mining and development, while Uranium Royalty adopts a royalty-based business model, avoiding direct operational risks. Their market capitalizations and employee counts differ significantly, reflecting distinct scales and strategies within the uranium market.

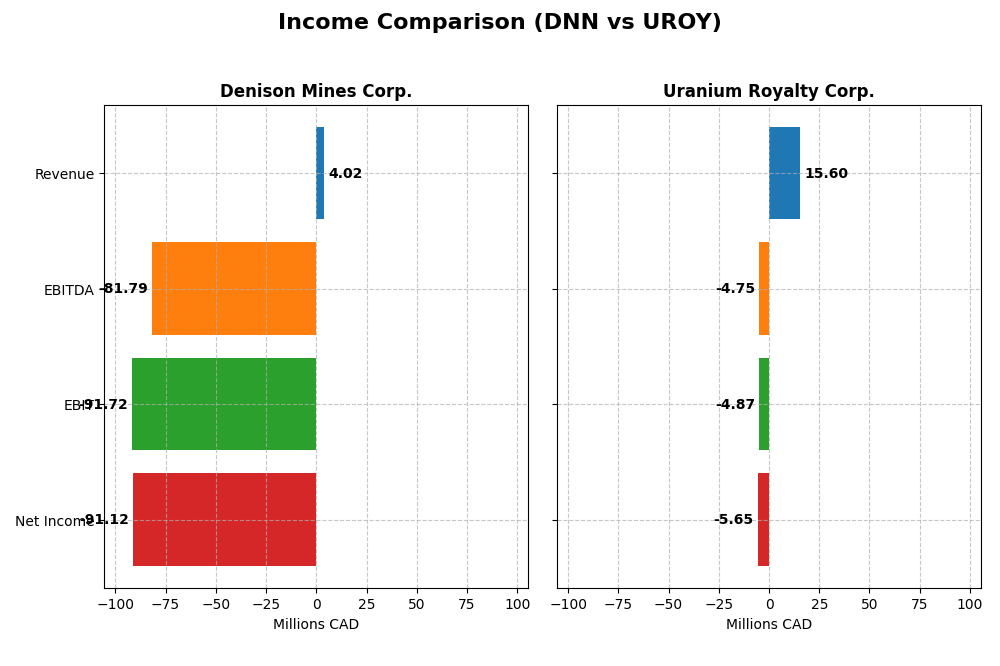

Income Statement Comparison

Below is a side-by-side comparison of key income statement metrics for Denison Mines Corp. and Uranium Royalty Corp. for the most recent fiscal year available.

| Metric | Denison Mines Corp. (DNN) | Uranium Royalty Corp. (UROY) |

|---|---|---|

| Market Cap | 2.97B CAD | 535M CAD |

| Revenue | 4.02M CAD | 15.6M CAD |

| EBITDA | -81.8M CAD | -4.75M CAD |

| EBIT | -91.7M CAD | -4.87M CAD |

| Net Income | -91.1M CAD | -5.65M CAD |

| EPS | -0.10 CAD | -0.0446 CAD |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

Denison Mines Corp.

Denison Mines Corp. experienced a mixed revenue trend from 2020 to 2024, peaking in 2021 at 20M CAD before dropping to 4.02M CAD in 2024. Net income showed significant volatility, with a steep loss of -91.1M CAD in 2024 after a 90.4M CAD profit in 2023. Margins deteriorated markedly, with a negative gross margin of -19.7% in 2024. The recent year saw revenue growth of 116.9% but worsening net margin and EPS, indicating profitability challenges despite top-line improvement.

Uranium Royalty Corp.

Uranium Royalty Corp.’s revenue peaked at 42.7M CAD in 2024 but fell sharply to 15.6M CAD in 2025. Net income followed a downward trajectory, posting a loss of -5.65M CAD in 2025 after a 9.78M CAD profit in 2024. Margins remain under pressure, with a negative net margin of -36.3% in 2025 and a modest gross margin near 10%. The latest year saw revenue and earnings decline substantially, reflecting operational and profitability headwinds.

Which one has the stronger fundamentals?

Both companies display unfavorable income statement trends, but Denison Mines shows a greater recovery in revenue growth despite severe losses in 2024, while Uranium Royalty suffers consistent margin pressures and recent steep declines. Denison’s interest expense ratio is slightly more favorable, but both demonstrate negative net margin trajectories, suggesting weak fundamentals across the board with no clear advantage.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Denison Mines Corp. (DNN) and Uranium Royalty Corp. (UROY) based on their most recent fiscal year data.

| Ratios | Denison Mines Corp. (2024) | Uranium Royalty Corp. (2025) |

|---|---|---|

| ROE | -16.1% | -1.9% |

| ROIC | -10.0% | -1.6% |

| P/E | -25.3 | -56.0 |

| P/B | 4.09 | 1.07 |

| Current Ratio | 3.65 | 233.5 |

| Quick Ratio | 3.54 | 233.5 |

| D/E | 0 | 0.0007 |

| Debt-to-Assets | 0 | 0.0007 |

| Interest Coverage | -586.3 | -11.0 |

| Asset Turnover | 0.0061 | 0.0527 |

| Fixed Asset Turnover | 0.0155 | 82.5 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0 | 0 |

Interpretation of the Ratios

Denison Mines Corp.

Denison Mines shows predominantly weak financial ratios with 71.43% unfavorable indicators. The company struggles with negative net margin (-2264.95%) and return on equity (-16.15%), signaling operational inefficiency and losses. Its current ratio of 3.65 is unfavorable, but debt levels are zero, which is favorable. Denison Mines does not pay dividends, likely due to its negative earnings and focus on reinvestment.

Uranium Royalty Corp.

Uranium Royalty exhibits a mixed ratio profile, with 42.86% favorable ratios but still an overall unfavorable assessment. Its net margin and returns on equity are negative albeit less severe than Denison’s, while the price-to-book ratio of 1.07 and zero debt to equity are positive signs. The extremely high current ratio (233.49) is flagged unfavorable, possibly reflecting excess liquidity. Uranium Royalty also does not pay dividends, consistent with its reinvestment or growth strategy.

Which one has the best ratios?

Neither company presents a fully favorable ratio set, but Uranium Royalty holds a slight edge with more favorable metrics, including a lower price-to-book ratio and better asset turnover. Both face profitability challenges and payout yields are zero. Investors should note that both firms have overall unfavorable financial profiles based on the current ratio analysis.

Strategic Positioning

This section compares the strategic positioning of Denison Mines Corp. and Uranium Royalty Corp. regarding market position, key segments, and exposure to technological disruption:

Denison Mines Corp.

- Operates uranium exploration and development in Canada; faces competitive pressure in mining industry.

- Focuses on uranium property acquisition, exploration, and processing; flagship project Wheeler River in Canada.

- No explicit information on technological disruption exposure provided.

Uranium Royalty Corp.

- Pure-play uranium royalty company with diversified global uranium interests; competitive within royalty space.

- Manages geographically diversified uranium royalty portfolio across North America and Namibia.

- No explicit information on technological disruption exposure provided.

Denison Mines Corp. vs Uranium Royalty Corp. Positioning

Denison concentrates on uranium mining and development primarily in Canada, relying on a flagship project, while Uranium Royalty employs a diversified royalty model across multiple regions. Denison’s approach involves operational risks; Uranium Royalty’s model is asset- and geography-diversified.

Which has the best competitive advantage?

Both companies are currently shedding value with no economic moat established. Denison shows stable profitability but destroys value; Uranium Royalty’s profitability declines, indicating a very unfavorable competitive position.

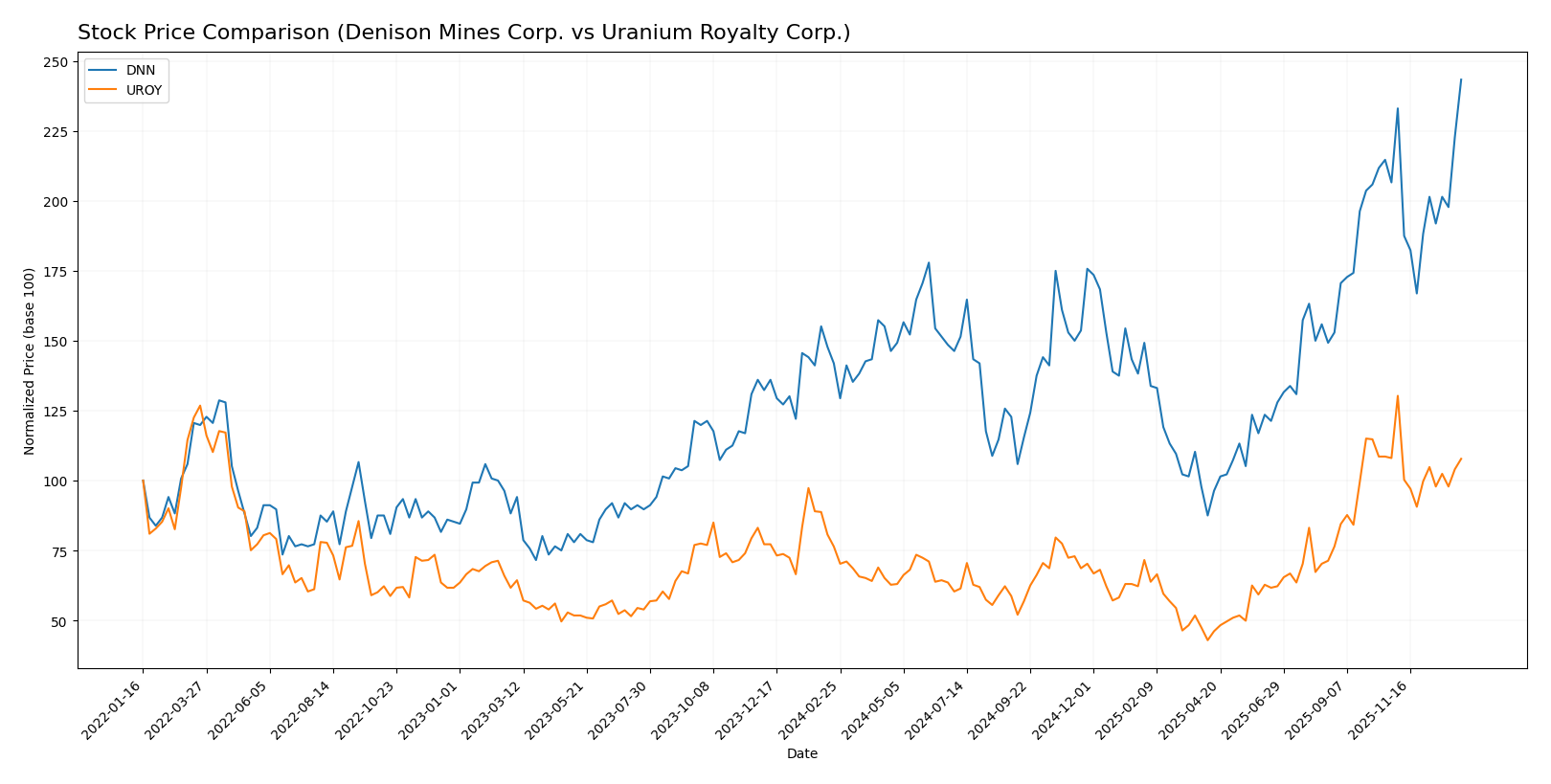

Stock Comparison

The stock price movements of Denison Mines Corp. (DNN) and Uranium Royalty Corp. (UROY) over the past 12 months reveal significant bullish trends with contrasting recent period dynamics in trading activity and price changes.

Trend Analysis

Denison Mines Corp. (DNN) exhibited a strong bullish trend over the last year with a 71.5% price increase, showing acceleration in gains and a moderate volatility level (std deviation 0.44). The stock ranged from a low of 1.19 to a high of 3.31.

Uranium Royalty Corp. (UROY) also experienced a bullish trend with a 41.05% rise over the same period, but with deceleration and higher volatility (std deviation 0.67). The price fluctuated between 1.6 and 4.86, with a slight recent downtrend.

Comparing both, DNN delivered the highest market performance with a substantial 71.5% gain, outpacing UROY’s 41.05% increase during the past year.

Target Prices

The target price consensus for Denison Mines Corp. indicates a clear valuation expectation from analysts.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Denison Mines Corp. | 2.6 | 2.6 | 2.6 |

Analysts set a firm consensus target at $2.6 for Denison Mines, suggesting a valuation below its current price of $3.31, indicating potential downside risk. No verified target price data is available for Uranium Royalty Corp.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Denison Mines Corp. and Uranium Royalty Corp.:

Rating Comparison

Denison Mines Corp. Rating

- Rating: C-, assessed as very favorable overall

- Discounted Cash Flow Score: 3, moderate valuation risk

- ROE Score: 1, showing very unfavorable profitability from equity

- ROA Score: 1, indicating very unfavorable asset utilization

- Debt To Equity Score: 1, reflecting very unfavorable financial risk

- Overall Score: 1, rated very unfavorable

Uranium Royalty Corp. Rating

- Rating: C-, assessed as very favorable overall

- Discounted Cash Flow Score: 1, indicating very unfavorable valuation risk

- ROE Score: 1, showing very unfavorable profitability from equity

- ROA Score: 1, indicating very unfavorable asset utilization

- Debt To Equity Score: 4, reflecting favorable financial risk

- Overall Score: 1, rated very unfavorable

Which one is the best rated?

Both companies share the same overall rating of C- and an overall score of 1, rated very unfavorable. Denison Mines has a better discounted cash flow score, while Uranium Royalty has a stronger debt-to-equity score, indicating differences in valuation and financial risk profiles.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Denison Mines Corp. and Uranium Royalty Corp.:

Denison Mines Corp. Scores

- Altman Z-Score: 0.73, indicating financial distress and high risk.

- Piotroski Score: 4, representing average financial strength.

Uranium Royalty Corp. Scores

- Altman Z-Score: 388.37, well within the safe zone for stability.

- Piotroski Score: 3, indicating very weak financial health.

Which company has the best scores?

Based on these scores, Uranium Royalty Corp. shows a far stronger Altman Z-Score, suggesting better financial stability. However, Denison Mines has a slightly higher Piotroski Score, indicating marginally better financial strength in that measure.

Grades Comparison

I present a comparison of recent reliable grades for Denison Mines Corp. and Uranium Royalty Corp.:

Denison Mines Corp. Grades

The following table summarizes recent grades issued by reputable grading companies for Denison Mines Corp.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Roth MKM | Maintain | Buy | 2024-10-23 |

| TD Securities | Maintain | Speculative Buy | 2023-06-27 |

| Raymond James | Maintain | Outperform | 2023-06-27 |

| TD Securities | Maintain | Speculative Buy | 2023-06-26 |

| Raymond James | Maintain | Outperform | 2023-06-26 |

| Credit Suisse | Downgrade | Underperform | 2017-07-18 |

| Credit Suisse | Downgrade | Underperform | 2017-07-17 |

| Roth Capital | Maintain | Buy | 2016-02-10 |

| Credit Suisse | Upgrade | Neutral | 2014-04-01 |

| Credit Suisse | Upgrade | Neutral | 2014-03-31 |

Denison Mines Corp. grades have mostly been positive recently, with repeated “Buy,” “Speculative Buy,” and “Outperform” ratings, indicating a generally favorable outlook.

Uranium Royalty Corp. Grades

The following table shows recent grades assigned by HC Wainwright & Co. for Uranium Royalty Corp.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| HC Wainwright & Co. | Maintain | Buy | 2025-04-22 |

| HC Wainwright & Co. | Maintain | Buy | 2024-12-19 |

| HC Wainwright & Co. | Maintain | Buy | 2024-09-17 |

| HC Wainwright & Co. | Maintain | Buy | 2024-06-17 |

| HC Wainwright & Co. | Maintain | Buy | 2024-03-11 |

| HC Wainwright & Co. | Maintain | Buy | 2022-01-03 |

| HC Wainwright & Co. | Maintain | Buy | 2021-09-29 |

| HC Wainwright & Co. | Maintain | Buy | 2021-09-28 |

| HC Wainwright & Co. | Maintain | Buy | 2021-07-02 |

| HC Wainwright & Co. | Maintain | Buy | 2021-07-01 |

Uranium Royalty Corp. consistently received “Buy” ratings from the same grading company over several years, reflecting a stable positive assessment.

Which company has the best grades?

Both Denison Mines Corp. and Uranium Royalty Corp. have predominantly positive grades, but Denison Mines shows a more diverse range of ratings including “Outperform” and “Speculative Buy” from multiple firms, while Uranium Royalty maintains steady “Buy” ratings from a single source. This may influence investor perception of Denison’s potential for higher returns balanced with some risk, versus Uranium Royalty’s consistent but narrower consensus.

Strengths and Weaknesses

Below is a comparison of the key strengths and weaknesses of Denison Mines Corp. (DNN) and Uranium Royalty Corp. (UROY) based on their latest financial and strategic data.

| Criterion | Denison Mines Corp. (DNN) | Uranium Royalty Corp. (UROY) |

|---|---|---|

| Diversification | Limited product diversification; focused on uranium mining | Moderate diversification through royalty model in uranium sector |

| Profitability | Negative net margin (-2264.95%), shedding value (ROIC < WACC) | Negative net margin (-36.26%), declining profitability (ROIC < WACC) |

| Innovation | Limited innovation noted; stable but unfavorable ROIC trend | No significant innovation; declining ROIC trend indicates challenges |

| Global presence | Operations primarily in North America | Global royalty interests, broader geographic exposure |

| Market Share | Niche uranium market player with limited scale | Growing presence via royalty agreements, but smaller market share |

Key takeaways: Both companies face profitability challenges with returns below capital costs, signaling value destruction. Denison has a stable but unfavorable profitability trend, while Uranium Royalty shows declining returns. Uranium Royalty’s royalty model offers some diversification and global exposure, somewhat balancing its weaknesses. Investors should exercise caution and consider the high-risk profile of both stocks.

Risk Analysis

Below is a comparative table of key risks for Denison Mines Corp. (DNN) and Uranium Royalty Corp. (UROY) based on the latest available data:

| Metric | Denison Mines Corp. (DNN) | Uranium Royalty Corp. (UROY) |

|---|---|---|

| Market Risk | High beta 1.89 indicates significant price volatility | Higher beta 2.03 implies even greater volatility |

| Debt level | Zero debt, favorable financial leverage | Very low debt at 0.07 debt-to-assets, strong balance sheet |

| Regulatory Risk | Moderate, uranium mining is heavily regulated in Canada | Moderate, exposure to multiple jurisdictions increases complexity |

| Operational Risk | High, negative profitability and low asset turnover | Moderate, diversified royalties reduce direct operational risks |

| Environmental Risk | Elevated due to uranium mining’s environmental impact | Moderate, indirect exposure through royalties |

| Geopolitical Risk | Concentrated in Canada’s Athabasca Basin, relatively stable | Geographic diversification including US and Namibia reduces risk |

The most likely and impactful risks center on market volatility and operational challenges. Denison Mines faces high operational risk with severe negative profitability and distress-level Altman Z-score of 0.73, signaling financial fragility. Uranium Royalty benefits from low leverage and geographic diversification but shows weak profitability and a very weak Piotroski score, implying caution. Regulatory and environmental risks remain material given the uranium sector’s nature.

Which Stock to Choose?

Denison Mines Corp. (DNN) shows a recent income growth of 117% but overall income and profitability remain unfavorable, with negative returns on equity and assets. Its financial ratios indicate mostly unfavorable metrics, though it carries no debt and has a strong quick ratio. The company’s rating is very favorable despite unfavorable scores on key financial metrics.

Uranium Royalty Corp. (UROY) exhibits declining income and profitability, with negative returns on equity and assets. Its financial ratios present a mixed picture with some favorable metrics like low debt-to-equity, but a very high current ratio and a generally unfavorable global rating. The company is rated very favorable overall but with weak financial scores.

For investors, DNN’s strong market cap and recent revenue growth could appeal to those focused on growth opportunities, despite its unfavorable financial ratios and value destruction. UROY’s lower valuation and stronger balance sheet metrics might be more suitable for investors prioritizing financial stability, though its declining profitability and weak scores signal caution. Both companies show unfavorable income and ratio evaluations, implying risk for risk-averse investors.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Denison Mines Corp. and Uranium Royalty Corp. to enhance your investment decisions: