Home > Comparison > Industrials > UNP vs WAB

The strategic rivalry between Union Pacific Corporation and Westinghouse Air Brake Technologies Corporation shapes the industrial railroads sector’s evolution. Union Pacific operates as a capital-intensive railroad operator, managing an extensive freight network across the U.S. In contrast, Westinghouse Air Brake excels as a technology-driven components and services provider for freight and transit rail systems. This analysis evaluates which business model offers superior risk-adjusted returns amid shifting industry dynamics for diversified portfolios.

Table of contents

Companies Overview

Union Pacific Corporation and Westinghouse Air Brake Technologies Corporation hold pivotal roles in the U.S. rail industry.

Union Pacific Corporation: North America’s Leading Railroad Network

Union Pacific dominates U.S. freight rail with a 32,452-route-mile network connecting key coasts to the Midwest and East. It generates revenue by transporting diverse commodities including agricultural goods, petroleum, and automotive products. In 2026, the company’s strategic focus remains on enhancing network efficiency and expanding intermodal capabilities to maintain its competitive edge.

Westinghouse Air Brake Technologies Corporation: Rail Technology Innovator

Westinghouse Air Brake Technologies leads in providing technology-driven equipment and services for freight and passenger rail globally. Revenue stems from manufacturing and servicing braking systems, locomotives, and transit components. Its 2026 strategy emphasizes innovation in railway electronics and expanding overhaul services to capture growing demand in transit modernization.

Strategic Collision: Similarities & Divergences

Union Pacific operates a broad transportation network, while Westinghouse specializes in rail technology solutions. They compete indirectly: Union Pacific moves goods; Westinghouse equips and services the rail assets. The primary battleground lies in rail industry modernization. Investors face distinct profiles—Union Pacific offers stable freight transport exposure, Westinghouse presents growth potential through technology and services.

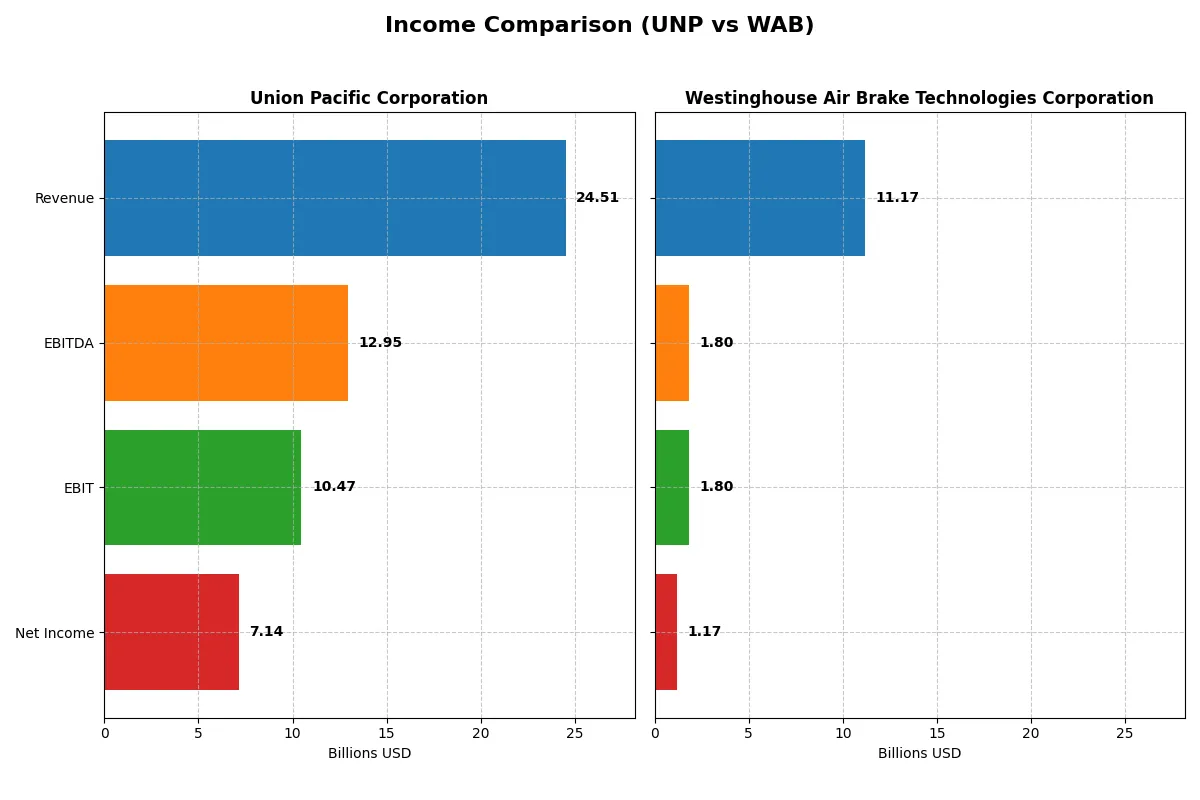

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Union Pacific Corporation (UNP) | Westinghouse Air Brake Technologies Corporation (WAB) |

|---|---|---|

| Revenue | 24.5B | 11.2B |

| Cost of Revenue | 10.0B | 7.4B |

| Operating Expenses | 4.7B | 1.5B |

| Gross Profit | 14.6B | 3.8B |

| EBITDA | 12.9B | 1.8B |

| EBIT | 10.5B | 1.8B |

| Interest Expense | 1.3B | 225M |

| Net Income | 7.1B | 1.2B |

| EPS | 12.01 | 6.86 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company drives superior profitability and operational efficiency through its financial performance.

Union Pacific Corporation Analysis

Union Pacific’s revenue grew modestly to $24.5B in 2025, reflecting steady scale expansion. Net income improved to $7.14B, supported by a robust gross margin of 59.4% and a strong net margin near 29.1%. Its EBIT margin stands at an impressive 42.7%, highlighting excellent cost control and operational leverage. Momentum is positive with EPS up 7.9% year-over-year.

Westinghouse Air Brake Technologies Corporation Analysis

Westinghouse scaled revenue by 7.5% to $11.2B in 2025, showing faster top-line growth than Union Pacific. Net income surged to $1.17B, with a gross margin of 34.1% and a net margin of 10.5%, indicating a leaner but profitable business model. EBIT margin of 16.2% reflects solid operational efficiency. EPS growth of 13.1% signals strong earnings momentum.

Scale and Margin Efficiency: Union Pacific’s Dominance vs. Westinghouse’s Growth

Union Pacific commands superior margins and absolute profits, with nearly triple the net income of Westinghouse. Westinghouse impresses with faster revenue and earnings growth but operates with slimmer margins. For investors prioritizing scale and profitability, Union Pacific offers a more commanding financial profile. Westinghouse appeals more to growth-focused investors seeking expansion potential.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of each company:

| Ratios | Union Pacific Corporation (UNP) | Westinghouse Air Brake Technologies Corporation (WAB) |

|---|---|---|

| ROE | 38.7% | 10.5% |

| ROIC | 11.7% | 7.4% |

| P/E | 19.2 | 31.1 |

| P/B | 7.42 | 3.27 |

| Current Ratio | 0.91 | 1.11 |

| Quick Ratio | 0.91 | 0.57 |

| D/E | 1.72 | 0.50 |

| Debt-to-Assets | 45.6% | 25.1% |

| Interest Coverage | 7.52 | 8.02 |

| Asset Turnover | 0.35 | 0.51 |

| Fixed Asset Turnover | 0.41 | 6.91 |

| Payout Ratio | 45.3% | 14.6% |

| Dividend Yield | 2.36% | 0.47% |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, uncovering operational strengths and hidden risks essential to investors’ decision-making.

Union Pacific Corporation

Union Pacific delivers a strong 38.65% ROE and a robust 29.12% net margin, signaling high profitability. Its P/E at 19.2 appears fair, but a high P/B of 7.42 flags potential overvaluation. The company rewards shareholders with a 2.36% dividend yield, reflecting steady cash returns amid limited reinvestment in R&D.

Westinghouse Air Brake Technologies Corporation

Westinghouse Air Brake shows moderate profitability with a 10.5% ROE and 10.48% net margin. However, it trades at a stretched P/E of 31.11 and a high P/B of 3.27, suggesting market optimism priced in. Dividend yield stands low at 0.47%, indicating limited direct shareholder returns and a growth focus instead.

Balanced Profitability vs. Valuation Stretch

Both firms present slightly favorable overall ratios, but Union Pacific offers superior profitability at a more reasonable valuation. Westinghouse Air Brake carries higher valuation multiples and lower shareholder yield, increasing risk. Investors seeking income and operational strength may prefer Union Pacific, while those favoring growth at a premium might lean toward Westinghouse.

Which one offers the Superior Shareholder Reward?

I compare Union Pacific Corporation (UNP) and Westinghouse Air Brake Technologies Corporation (WAB) on shareholder reward by examining dividend yields, payout ratios, and buyback intensity. UNP yields ~2.36% with a payout ratio near 45%, well-covered by free cash flow (~59%). WAB yields only ~0.47%, with a low payout ratio near 15%, signaling room for reinvestment or buybacks. UNP’s free cash flow per share (~$9.3B) supports steady dividends and buybacks, while WAB’s buyback program is modest, with free cash flow fully covering dividends. I observe UNP’s mature, consistent distribution model offers more sustainable long-term returns versus WAB’s growth-focused reinvestment. Therefore, I judge UNP delivers the more attractive total shareholder return profile in 2026.

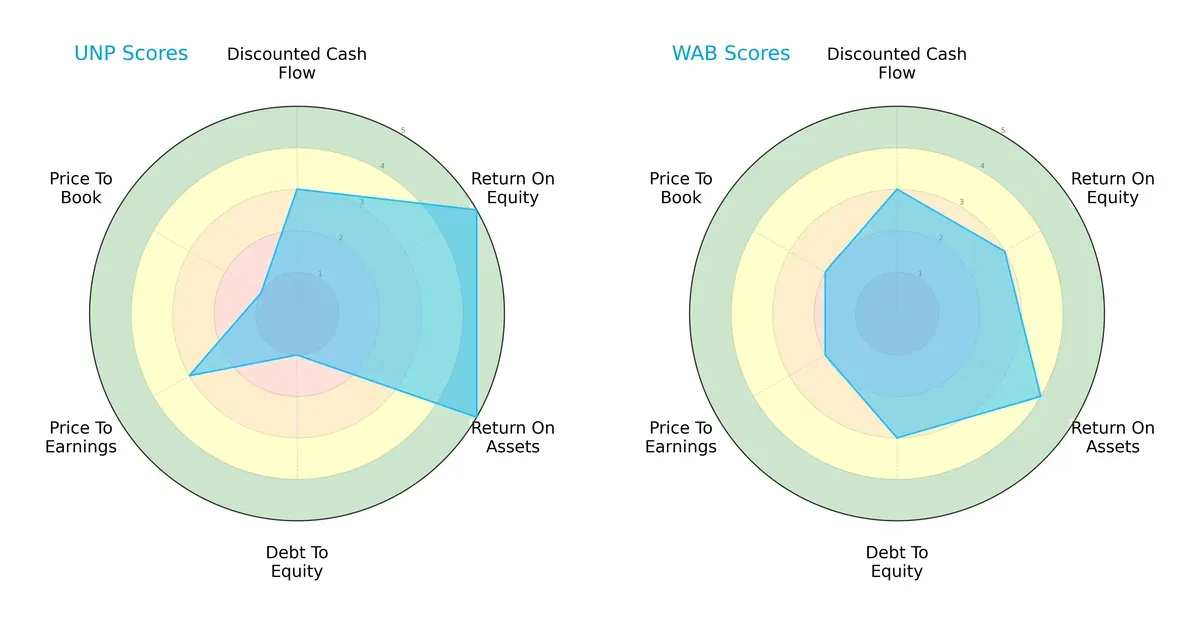

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Union Pacific and Westinghouse Air Brake Technologies, highlighting their strategic strengths and vulnerabilities:

Union Pacific excels in profitability with top ROE and ROA scores (5 each), but shows financial risk with a very unfavorable debt-to-equity score (1). Westinghouse Air Brake posts a more balanced financial risk profile with moderate debt-to-equity (3) and decent asset returns (ROA 4). However, it lacks Union Pacific’s profitability edge, scoring lower in ROE (3). Valuation metrics favor neither, both showing moderate to unfavorable scores. Overall, Union Pacific relies on operational efficiency, while Westinghouse Air Brake maintains steadier financial leverage.

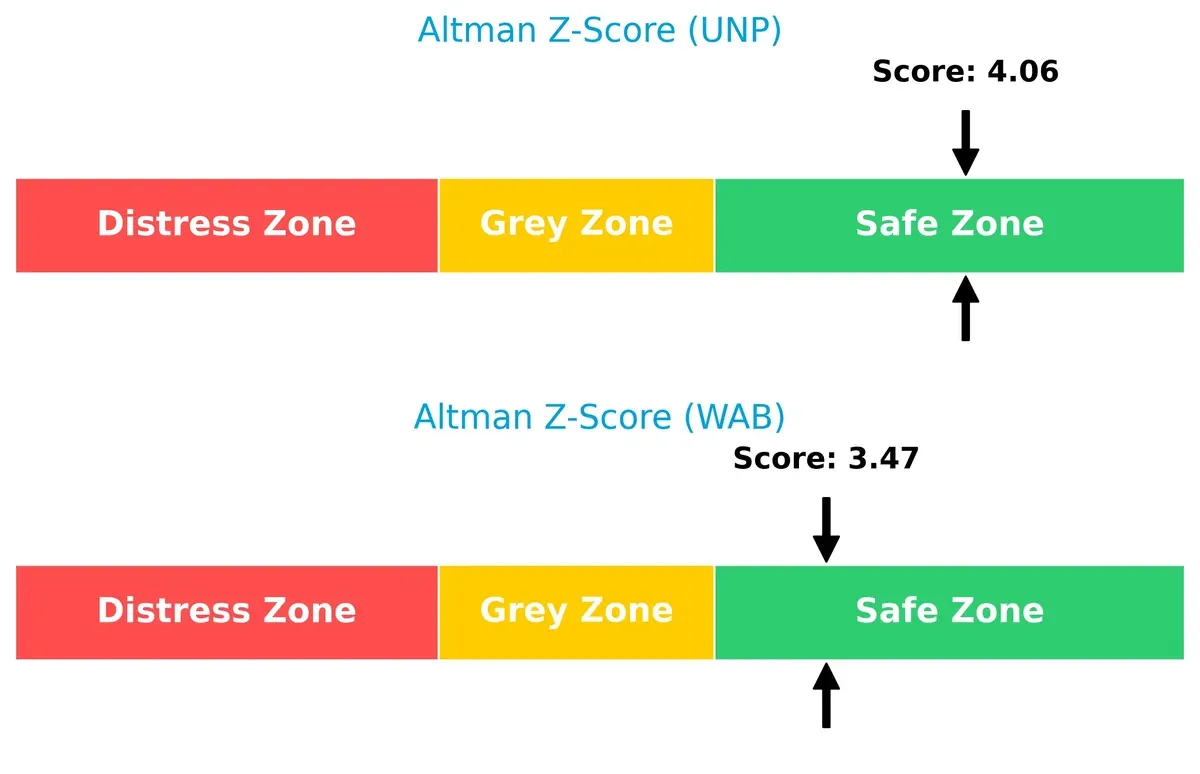

Bankruptcy Risk: Solvency Showdown

Union Pacific’s Altman Z-Score of 4.06 surpasses Westinghouse’s 3.47, indicating stronger solvency and lower bankruptcy risk in the current economic cycle:

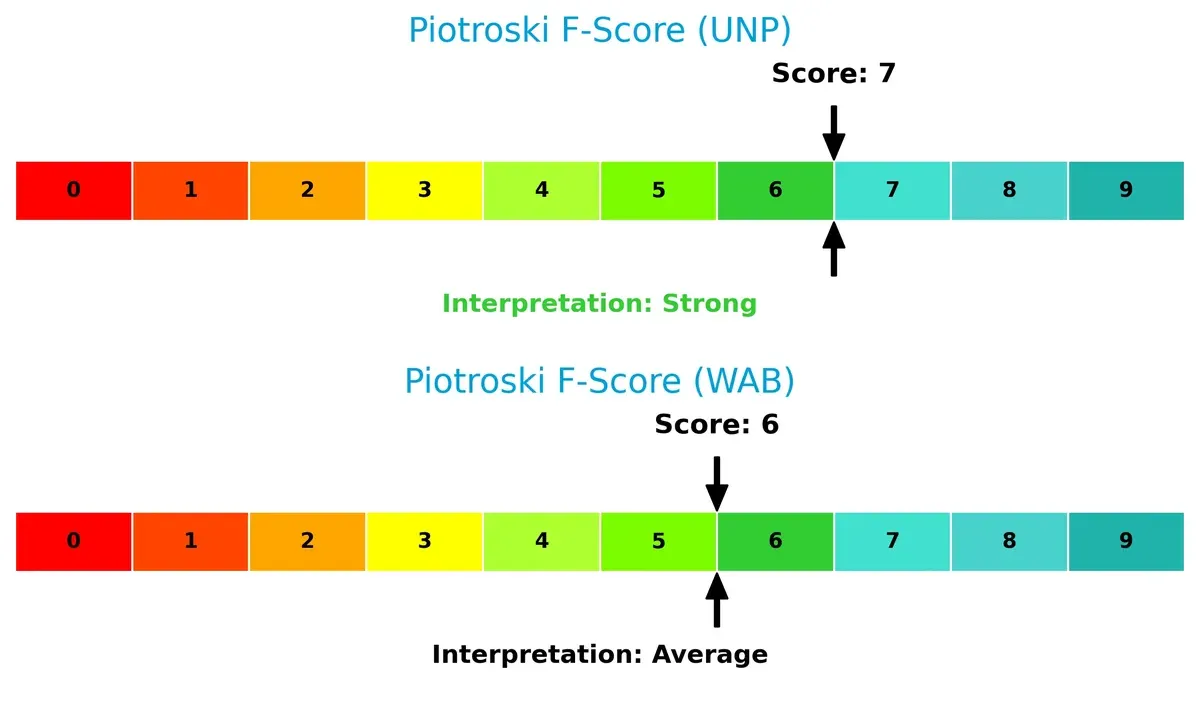

Financial Health: Quality of Operations

Union Pacific’s Piotroski F-Score of 7 signals solid financial health, outperforming Westinghouse’s average score of 6. This suggests fewer red flags in Union Pacific’s internal metrics:

How are the two companies positioned?

This section dissects the operational DNA of Union Pacific and Westinghouse Air Brake by comparing their revenue distribution and internal strengths and weaknesses. The goal is to confront their economic moats and identify which model offers the most resilient, sustainable competitive advantage today.

Revenue Segmentation: The Strategic Mix

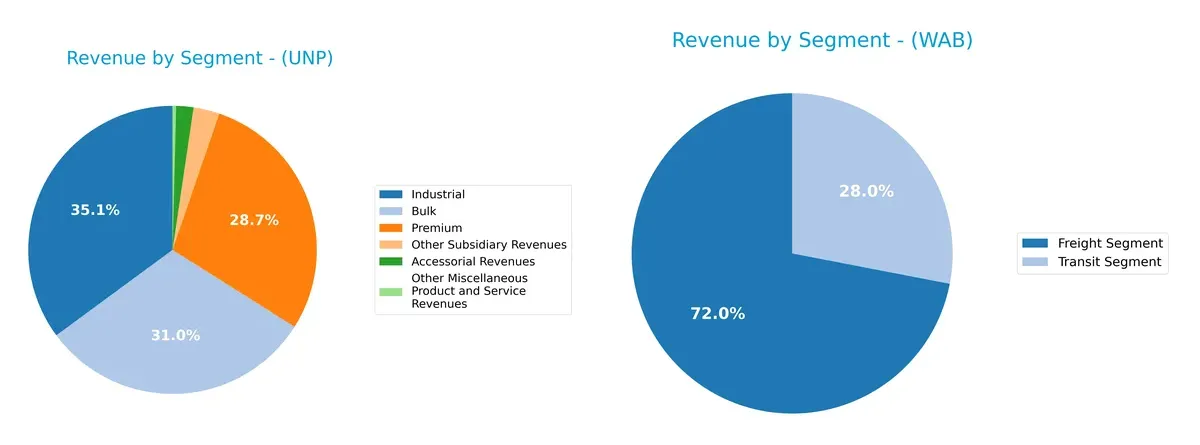

This visual comparison dissects how Union Pacific Corporation and Westinghouse Air Brake Technologies diversify their income streams and where their primary sector bets lie:

Union Pacific anchors its revenue in three robust segments: Industrial at 8.6B, Bulk at 7.6B, and Premium at 7.0B, showing a balanced yet concentrated exposure in transportation logistics. Westinghouse Air Brake leans heavily on its Freight Segment with 8.0B, while its Transit Segment contributes 3.1B, indicating greater reliance on freight but a meaningful secondary business. Union Pacific’s diversity reduces concentration risk; Westinghouse pivots on freight dominance, risking sector cyclicality.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Union Pacific Corporation and Westinghouse Air Brake Technologies Corporation:

UNP Strengths

- High net margin at 29.12%

- Strong ROE of 38.65% indicating efficient capital use

- ROIC (11.7%) exceeds WACC (7.4%) showing value creation

- Favorable interest coverage at 8.0

- Diversified revenue streams across Bulk, Industrial, Premium segments

- Large U.S. and Mexico market presence

WAB Strengths

- Favorable net margin at 10.48%

- Low debt-to-equity ratio (0.5) and debt-to-assets (25.11%) indicating financial prudence

- Strong fixed asset turnover (6.91) showing asset efficiency

- Favorable interest coverage of 8.02

- Global geographic diversification including U.S., Europe, Asia, and others

- Balanced revenue between Freight and Transit segments

UNP Weaknesses

- Current ratio below 1.0 (0.91) signals liquidity risk

- High debt-to-equity ratio (1.72) raises leverage concerns

- High price-to-book at 7.42 indicates potential overvaluation

- Low asset turnover (0.35) and fixed asset turnover (0.41) suggest inefficient asset use

- Significant portion of revenue concentrated in North America

- Dividend yield of 2.36% may limit reinvestment capacity

WAB Weaknesses

- Elevated price-to-earnings ratio at 31.11 may imply expensive valuation

- Price-to-book at 3.27 also signals premium pricing

- Quick ratio at 0.57 suggests short-term liquidity pressure

- Lower ROE (10.5%) and ROIC (7.38%) near WACC (7.8%) imply weaker value creation

- Low dividend yield at 0.47% restricts shareholder returns

Union Pacific demonstrates strong profitability and capital efficiency but faces liquidity and leverage risks. Westinghouse Air Brake shows prudent leverage and asset efficiency yet contends with valuation premiums and moderate profitability. These contrasting profiles may influence their strategic priorities differently.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only thing protecting long-term profits from the erosion of competition. Let’s dissect how these two rail industry players defend their turf:

Union Pacific Corporation: Network Effects and Scale Advantage

Union Pacific’s primary moat is its vast, integrated rail network connecting key U.S. and Mexico corridors. This creates high switching costs and operational scale, reflected in a strong 42.7% EBIT margin and 29.1% net margin. However, its slightly declining ROIC signals pressure to sustain this advantage amid evolving logistics demands in 2026.

Westinghouse Air Brake Technologies Corporation: Innovation and Product Ecosystem

Westinghouse leverages technological innovation in rail and transit braking systems, creating a specialized product ecosystem with growing ROIC. Unlike Union Pacific, WAB’s moat is narrower but deepening through expanding services and global market penetration, supported by 130% EPS growth and improving profitability trends.

Network Scale vs. Innovation Ecosystem: Moat Battle in Rail Industrials

Union Pacific holds a wider moat through its entrenched network and margin stability, but Westinghouse’s accelerating ROIC growth and innovative product portfolio suggest a deepening moat. Union Pacific remains better equipped to defend market share long-term, though WAB’s rising profitability signals a potential challenger in niche segments.

Which stock offers better returns?

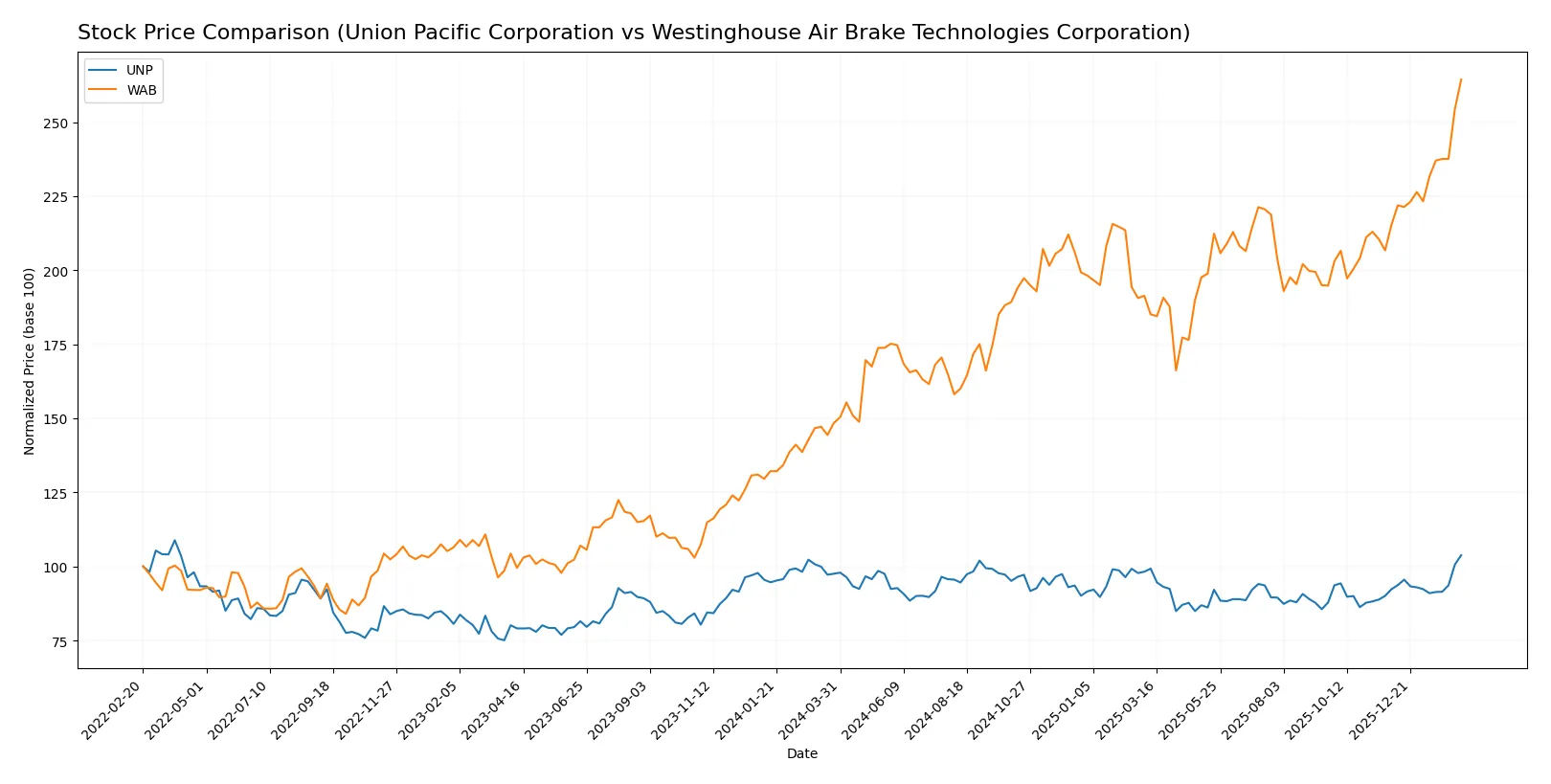

The past year shows distinct price surges for both stocks, marked by strong bullish momentum and accelerating trends. Union Pacific’s gains are steady, while Westinghouse Air Brake exhibits a more pronounced rise.

Trend Comparison

Union Pacific’s stock rose 6.41% over the past year, signaling a bullish trend with accelerating momentum. The price ranged from 213.26 to 260.68, showing moderate volatility (std dev 10.41).

Westinghouse Air Brake surged 78.09% over the same period, also bullish with acceleration. It showed higher volatility (std dev 22.53), with prices swinging between 143.78 and 256.06.

Westinghouse Air Brake outperformed Union Pacific significantly in market returns, reflecting stronger price appreciation and a steeper recent trend slope.

Target Prices

Analysts present a confident target consensus for these railroad industry leaders.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Union Pacific Corporation | 227 | 285 | 260.5 |

| Westinghouse Air Brake Technologies Corporation | 221 | 308 | 267.6 |

The target consensus for Union Pacific closely aligns with its current price of $260.68, signaling balanced expectations. Westinghouse Air Brake trades slightly below its $267.6 consensus, suggesting modest upside potential.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Union Pacific Corporation Grades

The following table summarizes recent grades from major financial institutions for Union Pacific Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-01-28 |

| JP Morgan | Maintain | Neutral | 2026-01-28 |

| JP Morgan | Maintain | Neutral | 2026-01-12 |

| BMO Capital | Downgrade | Market Perform | 2026-01-07 |

| Barclays | Maintain | Overweight | 2025-12-16 |

| Deutsche Bank | Downgrade | Hold | 2025-12-11 |

| BMO Capital | Maintain | Outperform | 2025-10-24 |

| TD Cowen | Maintain | Buy | 2025-10-24 |

| Citigroup | Maintain | Buy | 2025-10-24 |

| JP Morgan | Maintain | Neutral | 2025-10-24 |

Westinghouse Air Brake Technologies Corporation Grades

Below is the summary of recent institutional grades for Westinghouse Air Brake Technologies Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Equal Weight | 2026-02-13 |

| Stephens & Co. | Maintain | Overweight | 2026-02-12 |

| Keybanc | Maintain | Overweight | 2026-02-12 |

| Citigroup | Maintain | Buy | 2026-02-12 |

| Susquehanna | Maintain | Positive | 2026-01-26 |

| JP Morgan | Maintain | Neutral | 2026-01-14 |

| Morgan Stanley | Maintain | Overweight | 2026-01-12 |

| Citigroup | Maintain | Buy | 2026-01-09 |

| Wolfe Research | Upgrade | Outperform | 2026-01-08 |

| Wells Fargo | Maintain | Equal Weight | 2025-12-17 |

Which company has the best grades?

Westinghouse Air Brake Technologies Corporation generally receives stronger grades, notably multiple Overweight and Buy ratings with an upgrade to Outperform. Union Pacific shows mixed ratings, including several downgrades and more Neutral assessments. This contrast suggests Westinghouse may enjoy more optimistic institutional sentiment, potentially affecting investor confidence differently.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Union Pacific Corporation (UNP)

- Faces intense competition in freight transportation but benefits from a vast U.S. rail network.

Westinghouse Air Brake Technologies Corporation (WAB)

- Competes globally in rail technology and services with diversified product segments.

2. Capital Structure & Debt

Union Pacific Corporation (UNP)

- High debt-to-equity ratio of 1.72 signals leverage risk despite solid interest coverage.

Westinghouse Air Brake Technologies Corporation (WAB)

- Maintains moderate leverage with a debt-to-equity of 0.5, indicating stronger financial stability.

3. Stock Volatility

Union Pacific Corporation (UNP)

- Beta near 0.99 suggests market-level volatility, providing relative stability.

Westinghouse Air Brake Technologies Corporation (WAB)

- Slightly higher beta at 1.02 indicates marginally increased sensitivity to market swings.

4. Regulatory & Legal

Union Pacific Corporation (UNP)

- Subject to U.S. transportation regulations and environmental compliance risks.

Westinghouse Air Brake Technologies Corporation (WAB)

- Exposed to complex global regulatory environments, especially in safety and transit sectors.

5. Supply Chain & Operations

Union Pacific Corporation (UNP)

- Operations rely on extensive rail infrastructure, vulnerable to disruptions and maintenance costs.

Westinghouse Air Brake Technologies Corporation (WAB)

- Dependent on global supply chains for components, facing risks from geopolitical tensions and material shortages.

6. ESG & Climate Transition

Union Pacific Corporation (UNP)

- Faces pressure to reduce carbon emissions in rail transportation, investing in renewables and efficiency.

Westinghouse Air Brake Technologies Corporation (WAB)

- Must innovate in sustainable transit technologies amid growing ESG mandates and climate-related regulations.

7. Geopolitical Exposure

Union Pacific Corporation (UNP)

- Primarily U.S.-focused with limited direct geopolitical risks.

Westinghouse Air Brake Technologies Corporation (WAB)

- Global operations expose it to risks from trade tensions and international policy changes.

Which company shows a better risk-adjusted profile?

Union Pacific’s primary risk lies in its elevated financial leverage, risking balance sheet flexibility despite strong cash flow. Westinghouse’s challenge is global regulatory complexity and supply chain exposure, which could pressure margins and operational stability. I see Union Pacific as having a better risk-adjusted profile due to its dominant domestic market position and safer Altman Z-Score of 4.06 versus WAB’s 3.47. However, UNP’s unfavorable current ratio and debt-to-equity warrant caution. Recent data confirms WAB’s higher P/E of 31.1, signaling market concerns over growth sustainability amid external risks.

Final Verdict: Which stock to choose?

Union Pacific’s superpower lies in its robust capital efficiency and high return on equity, signaling a well-established economic moat. Its main point of vigilance is liquidity, with a current ratio below 1, which might pressure short-term flexibility. It suits investors seeking steady, aggressive growth with reliable cash generation.

Westinghouse Air Brake’s strategic moat centers on improving profitability and operational efficiency, evidenced by its rising ROIC despite trailing Union Pacific. Its lower leverage and stronger liquidity profile offer better balance sheet safety. It fits investors favoring growth at a reasonable price with a tolerance for moderate volatility.

If you prioritize proven capital efficiency and consistent value creation, Union Pacific outshines due to its superior returns and scale. However, if you seek improving profitability with enhanced balance sheet stability, Westinghouse Air Brake offers better stability and growth potential, albeit with a less established moat.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Union Pacific Corporation and Westinghouse Air Brake Technologies Corporation to enhance your investment decisions: