Ulta Beauty, Inc. and Williams-Sonoma, Inc. are two leading specialty retailers in the consumer cyclical sector, each excelling in distinct lifestyle markets—beauty products and home furnishings, respectively. Both companies leverage omni-channel strategies and innovation to capture evolving consumer preferences. This comparison highlights their market strengths and growth prospects. Join me as we explore which company presents the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Ulta Beauty and Williams-Sonoma by providing an overview of these two companies and their main differences.

Ulta Beauty Overview

Ulta Beauty, Inc. operates as a specialty retailer of beauty products in the US, offering cosmetics, fragrances, skincare, haircare, and salon services. With a market cap of roughly 29.9B USD and 1,308 stores nationwide, Ulta focuses on both retail and professional beauty services. Founded in 1990 and headquartered in Bolingbrook, Illinois, it employs about 20,000 full-time staff and is listed on NASDAQ.

Williams-Sonoma Overview

Williams-Sonoma, Inc. is an omni-channel specialty retailer of home products, including cookware, furniture, and decor under multiple brands like Williams Sonoma and Pottery Barn. It operates 544 stores across several countries, with a market cap near 24.4B USD and approximately 19,600 employees. Founded in 1956 and based in San Francisco, California, Williams-Sonoma trades on the NYSE.

Key similarities and differences

Both companies operate in the consumer cyclical sector as specialty retailers with strong physical and e-commerce presences. Ulta Beauty centers on personal care and salon services, while Williams-Sonoma specializes in home furnishings and kitchenware. Ulta has a larger store footprint in the US, whereas Williams-Sonoma’s operations extend internationally. Their market caps and employee counts are comparable, but they differ in product focus and geographic reach.

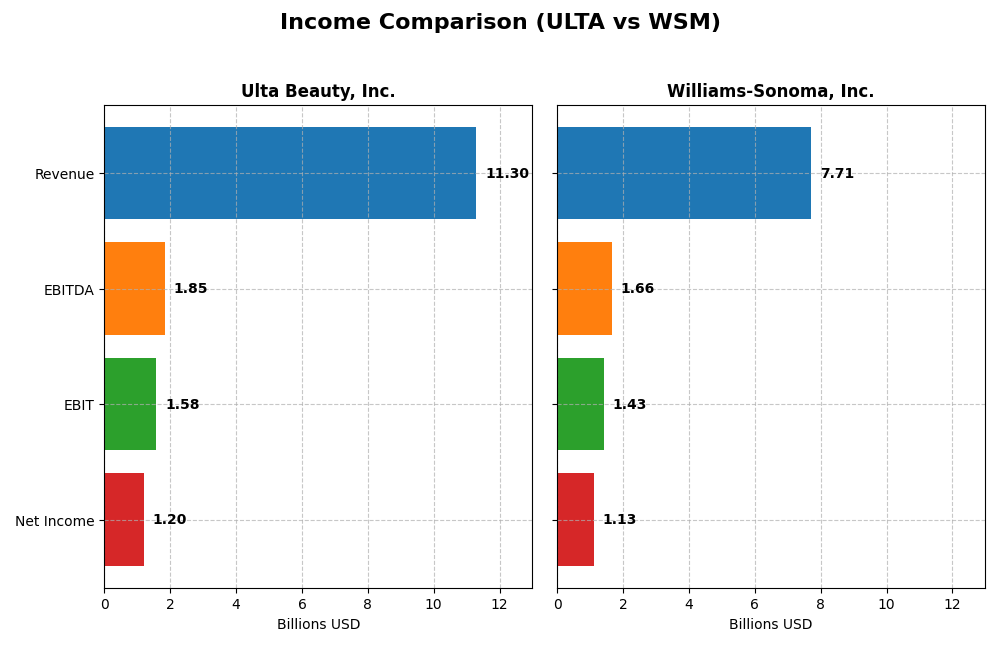

Income Statement Comparison

This table summarizes the key income statement metrics for Ulta Beauty, Inc. and Williams-Sonoma, Inc. for the fiscal year 2024, providing a clear side-by-side financial comparison.

| Metric | Ulta Beauty, Inc. (ULTA) | Williams-Sonoma, Inc. (WSM) |

|---|---|---|

| Market Cap | 29.9B | 24.4B |

| Revenue | 11.30B | 7.71B |

| EBITDA | 1.85B | 1.66B |

| EBIT | 1.58B | 1.43B |

| Net Income | 1.20B | 1.13B |

| EPS | 25.44 | 8.91 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Ulta Beauty, Inc.

Ulta Beauty demonstrated strong revenue growth of 83.6% from 2020 to 2024, with net income increasing over 580% in the same period. Margins improved significantly overall, with a gross margin near 39% and net margin at 10.6% in 2024. However, the latest year showed slowing revenue growth at 0.79% and declines in EBIT and net margin, indicating some recent margin pressure.

Williams-Sonoma, Inc.

Williams-Sonoma’s revenue grew moderately by 13.7% over five years, with net income rising 65.3%. Its 2024 gross margin was strong at 46.5%, and net margin reached 14.6%, both reflecting favorable profitability. The most recent fiscal year showed a slight revenue decline of 0.5%, but gains in gross profit, EBIT, net margin, and EPS suggest improving operational efficiency and profitability.

Which one has the stronger fundamentals?

Williams-Sonoma exhibits higher and more stable margins, with positive momentum in profitability and EPS growth in the latest year. Ulta Beauty shows impressive long-term growth but faces recent margin and earnings declines. Both companies hold favorable income statement evaluations, though Williams-Sonoma’s higher proportion of favorable metrics and recent improvements point to comparatively stronger fundamentals.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Ulta Beauty, Inc. and Williams-Sonoma, Inc. based on their most recent fiscal year 2024 data.

| Ratios | Ulta Beauty, Inc. (ULTA) | Williams-Sonoma, Inc. (WSM) |

|---|---|---|

| ROE | 48.3% | 52.5% |

| ROIC | 26.6% | 29.9% |

| P/E | 16.2 | 23.7 |

| P/B | 7.82 | 12.45 |

| Current Ratio | 1.70 | 1.44 |

| Quick Ratio | 0.60 | 0.74 |

| D/E (Debt-to-Equity) | 0.77 | 0.63 |

| Debt-to-Assets | 32.0% | 25.4% |

| Interest Coverage | 0 (not meaningful) | 0 (not meaningful) |

| Asset Turnover | 1.88 | 1.45 |

| Fixed Asset Turnover | 3.96 | 3.49 |

| Payout ratio | 0% | 24.9% |

| Dividend yield | 0% | 1.05% |

Interpretation of the Ratios

Ulta Beauty, Inc.

Ulta Beauty shows a majority of favorable ratios, including strong net margin (10.63%), ROE (48.27%), and ROIC (26.61%), reflecting efficient use of capital and profitability. Concerns include an unfavorable price-to-book ratio (7.82) and quick ratio (0.6), signaling potential liquidity issues. The company does not pay dividends, likely reinvesting earnings to support growth and operations.

Williams-Sonoma, Inc.

Williams-Sonoma exhibits favorable profitability ratios such as net margin (14.59%), ROE (52.52%), and ROIC (29.89%). However, the higher WACC (10.8%) and elevated price-to-book ratio (12.45) are less favorable. The company pays a dividend with a modest yield of 1.05%, indicating some shareholder returns, balanced by a cautious payout approach given its neutral dividend yield status.

Which one has the best ratios?

Ulta Beauty presents a more favorable overall ratio profile with 57.14% favorable metrics versus Williams-Sonoma’s 50%. Despite some liquidity concerns, Ulta’s strong profitability and capital efficiency suggest higher operational strength. Williams-Sonoma’s slightly favorable rating reflects solid returns but is tempered by cost of capital and valuation challenges.

Strategic Positioning

This section compares the strategic positioning of Ulta Beauty and Williams-Sonoma across Market position, Key segments, and Exposure to technological disruption:

Ulta Beauty, Inc.

- Leading US specialty beauty retailer with 1,308 stores nationwide, facing moderate competition.

- Focuses on beauty products, salon services, and private label cosmetics driving growth.

- Limited exposure explicitly stated; no specific mention of technological disruption impact.

Williams-Sonoma, Inc.

- Omni-channel specialty home retailer with 544 stores in US and international markets, under competitive pressure.

- Diverse home goods segments including Pottery Barn, West Elm, and Williams Sonoma brands.

- Operates a 3-D imaging and augmented reality platform for home furnishings, indicating digital innovation adoption.

Ulta Beauty, Inc. vs Williams-Sonoma, Inc. Positioning

Ulta Beauty concentrates on beauty retail and salon services, leveraging a large US store base, while Williams-Sonoma maintains a diversified brand portfolio across home goods with both domestic and international presence. Ulta’s specialization contrasts with Williams-Sonoma’s broader segment coverage.

Which has the best competitive advantage?

Both companies demonstrate very favorable MOATs with growing ROIC above WACC, indicating durable competitive advantages; Ulta shows stronger ROIC growth, while Williams-Sonoma benefits from diversified revenue streams and digital innovation.

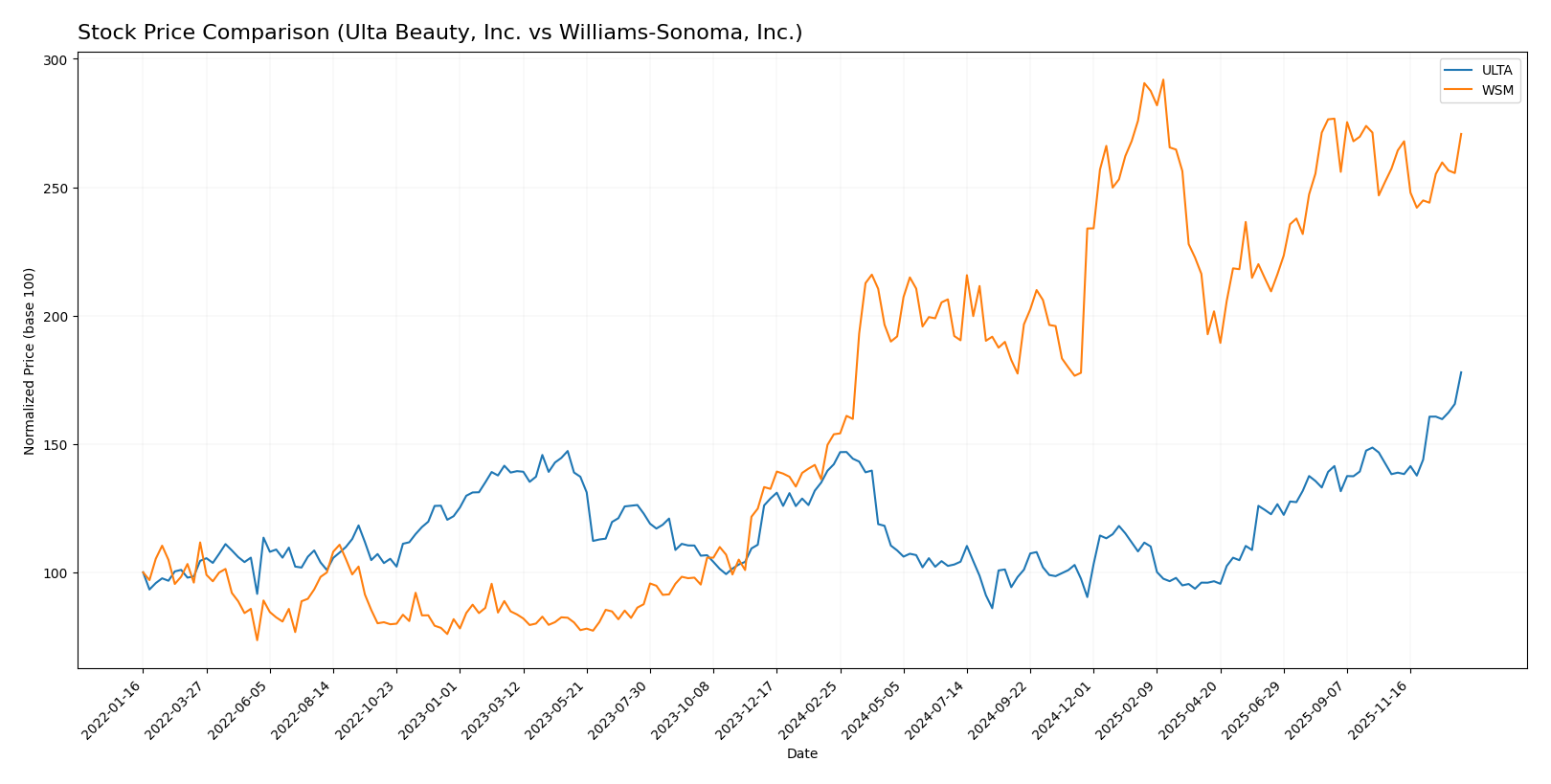

Stock Comparison

The stock prices of Ulta Beauty, Inc. and Williams-Sonoma, Inc. have shown significant bullish trends over the past 12 months, with notable price appreciations and contrasting acceleration patterns.

Trend Analysis

Ulta Beauty’s stock increased by 25.2% over the past year, indicating a bullish trend with accelerating momentum, reaching a high of 666.18 and a low of 322.17, amidst substantial volatility (std deviation 78.09).

Williams-Sonoma’s stock rose by 76.06% over the same period, also bullish but with decelerating momentum, hitting a high of 214.6 and a low of 113.05, exhibiting lower volatility (std deviation 25.4).

Comparing both, Williams-Sonoma delivered the highest market performance with a 76.06% gain, outperforming Ulta Beauty’s 25.2% increase over the past year.

Target Prices

Analyst consensus indicates a moderate upside potential for both Ulta Beauty, Inc. and Williams-Sonoma, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Ulta Beauty, Inc. | 780 | 425 | 648.4 |

| Williams-Sonoma, Inc. | 230 | 175 | 205.75 |

Ulta Beauty’s consensus target is slightly below its current price of 666.18 USD, suggesting limited upside. Williams-Sonoma’s target consensus at 205.75 USD indicates modest growth potential from its current price of 199.04 USD.

Analyst Opinions Comparison

This section compares the analysts’ ratings and financial scores for Ulta Beauty, Inc. (ULTA) and Williams-Sonoma, Inc. (WSM):

Rating Comparison

ULTA Rating

- Rating: A- indicating a very favorable overall evaluation.

- Discounted Cash Flow Score: 4, assessed as favorable for valuation.

- ROE Score: 5, very favorable efficiency in generating profit from equity.

- ROA Score: 5, very favorable asset utilization to generate earnings.

- Debt To Equity Score: 2, moderate financial risk with some reliance on debt.

- Overall Score: 4, a favorable summary of financial standing.

WSM Rating

- Rating: B+ also indicating a very favorable overall evaluation.

- Discounted Cash Flow Score: 3, considered moderate for valuation.

- ROE Score: 5, very favorable in profit generation from equity.

- ROA Score: 5, very favorable asset utilization to generate earnings.

- Debt To Equity Score: 2, moderate financial risk with some reliance on debt.

- Overall Score: 3, a moderate summary of financial standing.

Which one is the best rated?

Based on the provided data, Ulta (ULTA) is better rated overall with an A- rating and higher overall and discounted cash flow scores. Williams-Sonoma (WSM) holds a B+ rating with moderate scores in valuation and overall metrics.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for the two companies:

ULTA Scores

- Altman Z-Score: 6.64, indicating a safe financial zone with low bankruptcy risk.

- Piotroski Score: 6, representing average financial strength.

WSM Scores

- Altman Z-Score: 7.04, indicating a safe financial zone with low bankruptcy risk.

- Piotroski Score: 7, showing strong financial health.

Which company has the best scores?

WSM has both a higher Altman Z-Score and a stronger Piotroski Score than ULTA, suggesting comparatively better financial stability and strength based on these metrics.

Grades Comparison

Here is a comparison of recent grades assigned to Ulta Beauty, Inc. and Williams-Sonoma, Inc.:

Ulta Beauty, Inc. Grades

The table below shows recent reliable grades from recognized financial institutions for Ulta Beauty, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B of A Securities | Maintain | Neutral | 2026-01-08 |

| UBS | Maintain | Buy | 2026-01-07 |

| Argus Research | Maintain | Buy | 2026-01-02 |

| Oppenheimer | Maintain | Outperform | 2025-12-10 |

| TD Cowen | Upgrade | Buy | 2025-12-08 |

| Morgan Stanley | Maintain | Overweight | 2025-12-08 |

| Guggenheim | Maintain | Neutral | 2025-12-05 |

| UBS | Maintain | Buy | 2025-12-05 |

| Canaccord Genuity | Maintain | Buy | 2025-12-05 |

| Baird | Maintain | Outperform | 2025-12-05 |

Ulta Beauty’s grades consistently show a positive trend, with multiple “Buy” and “Outperform” ratings and a recent upgrade from TD Cowen.

Williams-Sonoma, Inc. Grades

The table below summarizes recent grades from reputable grading companies for Williams-Sonoma, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Evercore ISI Group | Maintain | In Line | 2025-12-23 |

| RBC Capital | Maintain | Outperform | 2025-11-21 |

| Telsey Advisory Group | Maintain | Outperform | 2025-11-20 |

| UBS | Maintain | Neutral | 2025-11-20 |

| TD Cowen | Maintain | Buy | 2025-11-20 |

| Citigroup | Maintain | Neutral | 2025-11-20 |

| Telsey Advisory Group | Maintain | Outperform | 2025-11-19 |

| Telsey Advisory Group | Maintain | Outperform | 2025-11-14 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-11 |

| Evercore ISI Group | Maintain | In Line | 2025-10-14 |

Williams-Sonoma’s ratings are more mixed, with several “Outperform” and “Buy” grades balanced by multiple “Neutral,” “In Line,” and “Equal Weight” assessments.

Which company has the best grades?

Ulta Beauty has received stronger and more consistent positive grades, including upgrades and multiple “Buy” and “Outperform” ratings. Williams-Sonoma shows a wider range of opinions with more conservative ratings, potentially indicating higher uncertainty or different risk perceptions for investors.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for Ulta Beauty, Inc. (ULTA) and Williams-Sonoma, Inc. (WSM) based on recent financial and strategic data.

| Criterion | Ulta Beauty, Inc. (ULTA) | Williams-Sonoma, Inc. (WSM) |

|---|---|---|

| Diversification | Focused primarily on beauty products and salon services with growing e-commerce | Diversified home furnishing segments including Pottery Barn, West Elm, and strong e-commerce |

| Profitability | Strong profitability: ROIC 26.6%, net margin 10.63%, favorable ratios overall | Higher profitability: ROIC 29.9%, net margin 14.59%, slightly favorable financial ratios |

| Innovation | High innovation in omnichannel retail and loyalty programs | Innovation in product design and digital shopping experience, sustained brand strength |

| Global presence | Mainly North American market, limited international exposure | Primarily US market with expanding online presence, limited global footprint |

| Market Share | Leading position in prestige beauty retail | Strong market share in upscale home furnishings and lifestyle brands |

In summary, both companies demonstrate durable competitive advantages with growing returns on invested capital. Ulta excels in focused brand strength and omnichannel growth, while Williams-Sonoma benefits from diversified product lines and superior profitability. Investors should weigh Ulta’s specialized market position against Williams-Sonoma’s broader segment exposure and margin profile.

Risk Analysis

The table below summarizes key risk metrics for Ulta Beauty, Inc. (ULTA) and Williams-Sonoma, Inc. (WSM) based on the latest 2024 fiscal year data:

| Metric | Ulta Beauty, Inc. (ULTA) | Williams-Sonoma, Inc. (WSM) |

|---|---|---|

| Market Risk | Beta 0.85 (lower volatility) | Beta 1.58 (higher volatility) |

| Debt level | Debt-to-Equity 0.77 (neutral) | Debt-to-Equity 0.63 (neutral) |

| Regulatory Risk | Moderate, typical retail regulations | Moderate, omni-channel retail regulations |

| Operational Risk | Moderate, reliant on in-store and online sales | Moderate, global supply chain complexity |

| Environmental Risk | Low to Moderate, retail sector exposure | Moderate, furniture and home goods sourcing impacts |

| Geopolitical Risk | Low, US-focused operations | Moderate, international store presence (Canada, Australia, UK) |

In synthesis, Williams-Sonoma faces higher market and geopolitical risks due to its international footprint and higher beta, while Ulta Beauty’s risks are more contained domestically with stable market volatility. Debt levels are manageable for both. The most impactful risks are Williams-Sonoma’s exposure to global supply chain disruptions and currency fluctuations, whereas Ulta’s operational risk hinges on retail sector competition and changing consumer preferences. Both companies are in a strong financial position to manage these risks prudently.

Which Stock to Choose?

Ulta Beauty, Inc. shows a favorable income statement with strong profitability metrics, including a 10.63% net margin and a 48.27% ROE. Despite a recent slight revenue growth slowdown, its debt level remains moderate with a net debt-to-EBITDA of 0.66 and a very favorable A- rating. The company’s financial ratios are mostly favorable, supported by a very favorable moat indicating durable competitive advantage and growing ROIC.

Williams-Sonoma, Inc. exhibits robust profitability with a 14.59% net margin and 52.52% ROE. Its recent income growth is positive, with favorable EBIT and EPS increases. Debt is low relative to EBITDA at 0.08, and the company holds a very favorable B+ rating. Financial ratios are slightly favorable overall, with a very favorable moat reflecting sustained value creation and increasing ROIC.

Considering ratings and comprehensive financial evaluations, Ulta might appear more favorable for investors prioritizing consistent competitive advantage and strong profitability metrics, while Williams-Sonoma could be attractive for those valuing recent income growth and lower leverage. The choice might depend on an investor’s preference for stability versus growth potential.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Ulta Beauty, Inc. and Williams-Sonoma, Inc. to enhance your investment decisions: