In today’s dynamic specialty retail sector, eBay Inc. and Ulta Beauty, Inc. stand out as influential players with distinct business models and innovation strategies. eBay excels as a global online marketplace connecting buyers and sellers, while Ulta Beauty dominates U.S. retail with a strong focus on beauty products and services. This article will help you uncover which company offers the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between eBay and Ulta Beauty by providing an overview of these two companies and their main differences.

eBay Overview

eBay Inc. operates global marketplace platforms connecting buyers and sellers through online, mobile, and offline channels. Founded in 1995 and headquartered in San Jose, California, eBay’s mission focuses on enabling transactions across a wide variety of goods via its ebay.com platform and mobile apps. The company serves diverse commerce participants including retailers, distributors, and auctioneers, positioning itself as a major player in specialty retail.

Ulta Beauty Overview

Ulta Beauty, Inc. is a U.S.-based retailer specializing in beauty products and salon services, with over 1,300 stores nationwide. Established in 1990 and headquartered in Bolingbrook, Illinois, Ulta’s business model combines retail sales of cosmetics, skincare, and haircare with in-store salon services. The company also markets private label products, emphasizing a comprehensive beauty experience both in-store and online.

Key similarities and differences

Both eBay and Ulta Beauty operate within the consumer cyclical sector and specialize in retail, but their models differ significantly. eBay’s platform connects third-party buyers and sellers across various categories, leveraging digital marketplaces. In contrast, Ulta focuses on direct retail and service offerings in beauty products and salons, blending physical stores with e-commerce. While eBay’s model is primarily marketplace-driven, Ulta integrates product sales with experiential services.

Income Statement Comparison

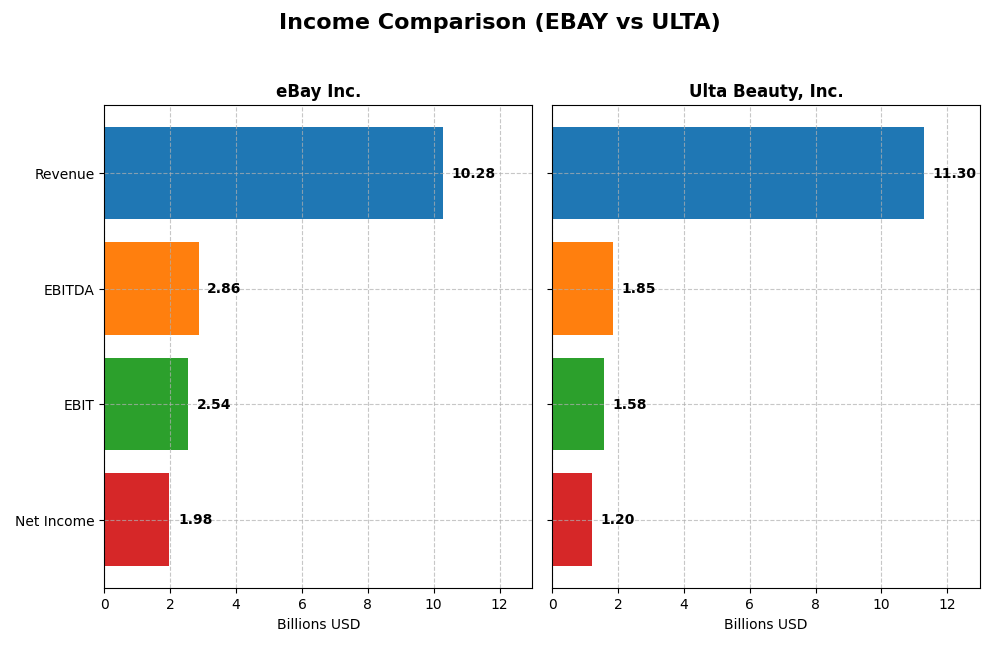

The table below compares the most recent fiscal year income statement metrics of eBay Inc. and Ulta Beauty, Inc., providing a snapshot of their financial performance.

| Metric | eBay Inc. | Ulta Beauty, Inc. |

|---|---|---|

| Market Cap | 41.1B USD | 29.9B USD |

| Revenue | 10.3B USD | 11.3B USD |

| EBITDA | 2.86B USD | 1.85B USD |

| EBIT | 2.54B USD | 1.58B USD |

| Net Income | 1.98B USD | 1.20B USD |

| EPS | 3.98 USD | 25.44 USD |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

eBay Inc.

eBay’s revenue grew moderately by 15.62% over 2020-2024 but declined slightly by 1.69% in the latest year. Net income showed a steep overall drop of 65.15%, with a 29.81% decline in net margin most recently. Margins remain strong, with a favorable gross margin of 71.99% and consistent operating expense control, but recent earnings and EPS contracted notably in 2024.

Ulta Beauty, Inc.

Ulta’s revenue expanded significantly by 83.61% from 2020 to 2024, with a small slowdown to 0.79% growth in 2024. Net income surged over 583% overall, though it dipped 7.69% recently. Margins are positive and stable, with a gross margin of 38.84% and net margin at 10.63%. Operating expenses grew slightly faster than revenue last year, impacting EBIT and EPS growth negatively.

Which one has the stronger fundamentals?

Ulta shows stronger fundamentals with substantial multi-year growth in revenue, net income, and margins, despite a minor recent slowdown. eBay’s revenue growth is modest, and recent net income and margin declines weigh on its income statement strength. Ulta’s favorable overall income statement evaluation contrasts with eBay’s more mixed and unfavorable recent results.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for eBay Inc. and Ulta Beauty, Inc. based on their most recent fiscal year data.

| Ratios | eBay Inc. (2024) | Ulta Beauty, Inc. (2024) |

|---|---|---|

| ROE | 38.3% | 48.3% |

| ROIC | 13.4% | 26.6% |

| P/E | 15.6 | 16.2 |

| P/B | 6.0 | 7.8 |

| Current Ratio | 1.24 | 1.70 |

| Quick Ratio | 1.24 | 0.60 |

| D/E (Debt to Equity) | 1.52 | 0.77 |

| Debt-to-Assets | 40.6% | 32.0% |

| Interest Coverage | 8.95 | 0 (not applicable) |

| Asset Turnover | 0.53 | 1.88 |

| Fixed Asset Turnover | 6.08 | 3.96 |

| Payout Ratio | 27.0% | 0% |

| Dividend Yield | 1.73% | 0% |

Interpretation of the Ratios

eBay Inc.

eBay presents a generally solid ratio profile with favorable net margin at 19.21% and return on equity at 38.29%, indicating strong profitability and efficient capital use. However, the price-to-book ratio of 5.96 and debt-to-equity of 1.52 are less favorable, suggesting valuation concerns and higher leverage. The company pays dividends with a 1.73% yield, supported by moderate payout and free cash flow coverage, though leverage risks persist.

Ulta Beauty, Inc.

Ulta Beauty exhibits strong financial health with favorable net margin of 10.63%, ROE at 48.27%, and excellent return on invested capital at 26.61%. The low debt-to-equity ratio of 0.77 and robust asset turnover reflect operational efficiency. The firm does not pay dividends, likely prioritizing reinvestment and growth, as indicated by its retained earnings and absence of dividend yield.

Which one has the best ratios?

Ulta Beauty holds a more favorable overall ratio profile, with 57.14% ratios rated favorable, compared to eBay’s 42.86%. Ulta’s superior returns, lower leverage, and operational efficiency contrast with eBay’s higher leverage and valuation concerns. However, eBay’s dividend payments provide shareholder returns not present at Ulta, reflecting different capital allocation strategies.

Strategic Positioning

This section compares the strategic positioning of eBay Inc. and Ulta Beauty, Inc. including Market position, Key segments, and disruption:

eBay Inc.

- Established global marketplace platform facing competitive pressure from online and offline commerce channels.

- Revenue driven by marketplaces and advertising services, connecting buyers and sellers internationally.

- Exposure to technological disruption mainly through evolving e-commerce platforms and mobile applications.

Ulta Beauty, Inc.

- US-focused beauty retailer with a strong retail store presence and growing online sales.

- Key segments include cosmetics, skincare, salon services, and private label beauty products.

- Technological disruption focused on e-commerce growth and integration with physical salon services.

eBay Inc. vs Ulta Beauty, Inc. Positioning

eBay offers a diversified global marketplace model, leveraging multiple online channels, while Ulta Beauty concentrates on US retail and beauty services. eBay’s broad platform contrasts with Ulta’s focused product and service segments, reflecting different competitive dynamics and market reach.

Which has the best competitive advantage?

Both companies create value with very favorable moats and growing ROIC trends. Ulta’s substantially higher ROIC compared to WACC suggests a stronger and more rapidly growing competitive advantage than eBay’s.

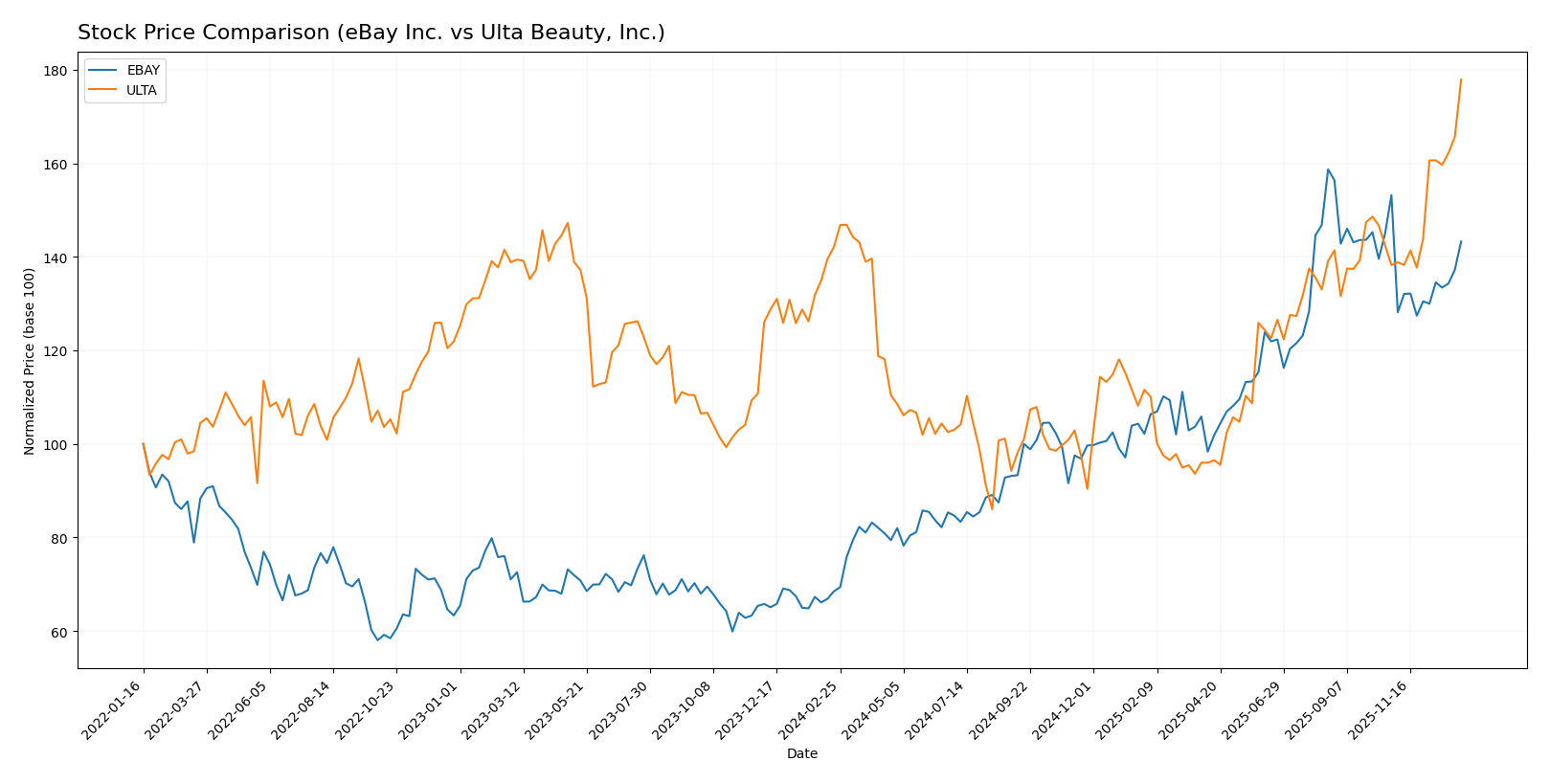

Stock Comparison

The past year revealed significant bullish trends for both eBay Inc. and Ulta Beauty, Inc., with eBay showing strong price appreciation but decelerating momentum, while Ulta demonstrated accelerating gains and higher volatility.

Trend Analysis

Over the past 12 months, eBay’s stock rose by 109.23%, indicating a strong bullish trend with price deceleration. Its trading range spanned from a low of 43.45 to a high of 100.7, with moderate volatility (std dev 14.19).

Ulta Beauty’s stock also posted a bullish trend with a 25.2% increase over 12 months, showing accelerating upward momentum and elevated volatility (std dev 78.09). The recent period saw a 28.69% gain with strong buyer dominance.

Comparing both, eBay delivered the highest market performance with more than four times Ulta’s price appreciation, despite Ulta’s accelerating trend and higher short-term volatility.

Target Prices

The consensus target prices for eBay Inc. and Ulta Beauty, Inc. reflect analysts’ balanced outlooks with potential upside.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| eBay Inc. | 115 | 65 | 96.69 |

| Ulta Beauty, Inc. | 780 | 425 | 648.4 |

Analysts expect eBay’s price to rise moderately above its current 90.91 USD, while Ulta Beauty’s consensus target aligns closely with its current price of 666.18 USD, indicating stable valuation.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for eBay Inc. and Ulta Beauty, Inc.:

Rating Comparison

EBAY Rating

- Rating: B+, considered very favorable by analysts.

- Discounted Cash Flow Score: Moderate, with a score of 3 indicating average valuation.

- ROE Score: Very favorable at 5, indicating strong profit generation.

- ROA Score: Very favorable with high effectiveness at 5.

- Debt To Equity Score: Very unfavorable at 1, suggesting high financial risk.

- Overall Score: Moderate at 3, reflecting average overall financial health.

ULTA Rating

- Rating: A-, also very favorable and higher than EBAY’s.

- Discounted Cash Flow Score: Favorable, scored 4, showing better valuation.

- ROE Score: Also very favorable at 5, matching EBAY’s efficiency.

- ROA Score: Equally very favorable at 5, showing strong asset utilization.

- Debt To Equity Score: Moderate at 2, indicating better financial stability.

- Overall Score: Favorable at 4, showing stronger overall financial standing.

Which one is the best rated?

Based strictly on the provided data, Ulta Beauty holds a better overall rating with an A- and higher overall score of 4 compared to eBay’s B+ and score of 3. Ulta also scores better in discounted cash flow and debt to equity, indicating stronger valuation and financial stability.

Scores Comparison

Here is a comparison of the financial scores for eBay Inc. and Ulta Beauty, Inc.:

EBAY Scores

- Altman Z-Score of 5.84 indicates eBay is in the safe zone, low bankruptcy risk.

- Piotroski Score of 6 reflects average financial strength and investment quality.

ULTA Scores

- Altman Z-Score of 6.64 places Ulta in the safe zone, showing low bankruptcy risk.

- Piotroski Score of 6 also reflects average financial strength and investment quality.

Which company has the best scores?

Both eBay and Ulta Beauty are in the safe zone for Altman Z-Score, with Ulta slightly higher, indicating marginally lower bankruptcy risk. Their Piotroski Scores are equal at 6, showing similar average financial strength.

Grades Comparison

The following tables present recent grades given by reputable financial institutions for eBay Inc. and Ulta Beauty, Inc.:

eBay Inc. Grades

This table summarizes recent grades assigned to eBay by established grading companies.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | maintain | Equal Weight | 2026-01-08 |

| Truist Securities | maintain | Hold | 2025-11-03 |

| Piper Sandler | maintain | Overweight | 2025-10-30 |

| Barclays | maintain | Overweight | 2025-10-30 |

| Wells Fargo | maintain | Equal Weight | 2025-10-30 |

| Benchmark | maintain | Buy | 2025-10-30 |

| UBS | maintain | Neutral | 2025-10-30 |

| Needham | maintain | Buy | 2025-10-30 |

| Cantor Fitzgerald | maintain | Neutral | 2025-10-30 |

| Evercore ISI Group | maintain | In Line | 2025-10-30 |

Grades for eBay show a balanced mix of “Buy,” “Hold,” and “Neutral” ratings, indicating a moderate consensus with no strong directional bias.

Ulta Beauty, Inc. Grades

This table summarizes recent grades assigned to Ulta Beauty by established grading companies.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B of A Securities | maintain | Neutral | 2026-01-08 |

| UBS | maintain | Buy | 2026-01-07 |

| Argus Research | maintain | Buy | 2026-01-02 |

| Oppenheimer | maintain | Outperform | 2025-12-10 |

| TD Cowen | upgrade | Buy | 2025-12-08 |

| Morgan Stanley | maintain | Overweight | 2025-12-08 |

| Guggenheim | maintain | Neutral | 2025-12-05 |

| UBS | maintain | Buy | 2025-12-05 |

| Canaccord Genuity | maintain | Buy | 2025-12-05 |

| Baird | maintain | Outperform | 2025-12-05 |

Ulta Beauty’s grades predominantly favor “Buy” and “Outperform” recommendations, with a single recent upgrade, reflecting a generally positive outlook from analysts.

Which company has the best grades?

Ulta Beauty has received more favorable grades overall, with numerous “Buy” and “Outperform” ratings compared to eBay’s mix of “Hold,” “Neutral,” and fewer “Buy” recommendations. This suggests a stronger analyst confidence in Ulta’s growth prospects, which could influence investor sentiment accordingly.

Strengths and Weaknesses

Below is a comparison table summarizing the strengths and weaknesses of eBay Inc. and Ulta Beauty, Inc. based on their recent financial and operational data.

| Criterion | eBay Inc. | Ulta Beauty, Inc. |

|---|---|---|

| Diversification | Moderate: Mainly marketplaces and advertising revenues, with a focus on e-commerce platforms. | Moderate: Focused on beauty products and salon services, with growing e-commerce sales. |

| Profitability | Strong: Net margin 19.21%, ROIC 13.39%, ROE 38.29%, slightly favorable overall ratios. | Stronger: Net margin 10.63%, ROIC 26.61%, ROE 48.27%, overall favorable financial ratios. |

| Innovation | Steady: Continuous growth in ROIC and value creation indicate effective use of capital, but innovation pace is moderate. | High: Exceptional ROIC growth (+345%), indicating aggressive innovation and expansion in beauty retail. |

| Global presence | Broad: Established global marketplace platform. | Focused: Primarily U.S. market with growing e-commerce presence. |

| Market Share | Significant: Large share in online marketplaces and advertising. | Leading: Dominant player in specialty beauty retail in the U.S. |

In summary, both companies demonstrate durable competitive advantages with strong profitability and growing returns on invested capital. Ulta Beauty shows higher innovation and financial efficiency, while eBay benefits from a broad global marketplace presence. Investors should weigh Ulta’s growth potential against eBay’s established global footprint and stable profitability.

Risk Analysis

Below is a comparison of key risks for eBay Inc. and Ulta Beauty, Inc. based on the most recent 2024 data:

| Metric | eBay Inc. | Ulta Beauty, Inc. |

|---|---|---|

| Market Risk | Beta 1.35 (above 1, higher volatility) | Beta 0.85 (lower volatility) |

| Debt Level | Debt-to-Equity 1.52 (unfavorable) | Debt-to-Equity 0.77 (moderate) |

| Regulatory Risk | Moderate, global e-commerce regulations | Moderate, retail and product compliance |

| Operational Risk | Platform dependency, tech disruptions | Store operations and supply chain |

| Environmental Risk | Moderate, sustainability initiatives | Moderate, packaging and product sourcing |

| Geopolitical Risk | Exposure through international sales | Primarily US-focused, lower exposure |

The most impactful risk for eBay is its elevated debt level combined with higher market volatility, which could affect financial flexibility. Ulta’s risks are more operational and regulatory, though it benefits from lower leverage and stable market volatility. Both companies maintain safe bankruptcy risk scores but investors should monitor eBay’s debt closely.

Which Stock to Choose?

eBay Inc. shows mixed income evolution with a slight revenue growth of 1.69% in 2024 but unfavorable net income trends overall. Its profitability ratios like ROE (38.29%) and net margin (19.21%) remain favorable, while debt levels are relatively high with a debt-to-equity ratio of 1.52, reflecting some financial leverage. The company holds a very favorable B+ rating and a slightly favorable global financial ratios assessment.

Ulta Beauty, Inc. exhibits stronger income growth overall, with 83.61% revenue growth and positive net income trends. Profitability is robust, with a high ROE of 48.27% and solid net margin of 10.63%. Debt is more conservative, with a net debt-to-EBITDA of 0.66 and favorable current ratio of 1.7. Ulta carries a very favorable A- rating and a favorable global ratios evaluation, supported by strong cash flow metrics.

From an investor’s perspective, Ulta may appear more attractive for those prioritizing growth and profitability stability, supported by a durable competitive advantage and favorable ratings. Conversely, eBay might be more suited to risk-tolerant investors focusing on value creation despite recent income challenges and higher leverage. Both companies demonstrate very favorable moats with growing ROICs, indicating sustainable competitive positions.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of eBay Inc. and Ulta Beauty, Inc. to enhance your investment decisions: