In the fast-evolving world of communications technology, Twilio Inc. and AudioCodes Ltd. stand out as prominent players driving innovation. Twilio, a leader in cloud-based customer engagement platforms, competes alongside AudioCodes, a specialist in advanced communication equipment and voice solutions. Both companies address overlapping market needs with distinct strategies, making their comparison essential. Join me as we explore which of these firms offers the most compelling opportunity for your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Twilio and AudioCodes by providing an overview of these two companies and their main differences.

Twilio Overview

Twilio Inc. offers a cloud communications platform that enables developers to build and operate customer engagement features within software applications globally. Founded in 2008 and headquartered in San Francisco, Twilio provides application programming interfaces for embedding voice, messaging, video, and email capabilities. It operates in the Communication Services sector with a market cap of $21.2B and employs 5,502 people.

AudioCodes Overview

AudioCodes Ltd. delivers advanced communications software, products, and solutions for unified communications, contact centers, and VoiceAI. Founded in 1992 and based in Lod, Israel, it serves telecommunications and networking industries worldwide. Operating in the Technology sector, AudioCodes has a market cap of $255M and 946 employees. It offers hardware and software products alongside managed services for digital workplace communication.

Key similarities and differences

Both companies focus on communication technologies and serve global markets, but Twilio primarily offers cloud-based APIs for software developers, while AudioCodes provides hardware, software, and managed services for unified communications and telephony infrastructure. Twilio operates on a larger scale with a significantly higher market cap and workforce. AudioCodes emphasizes voice network management and Microsoft Teams integrations, distinguishing its business model from Twilio’s developer-centric platform.

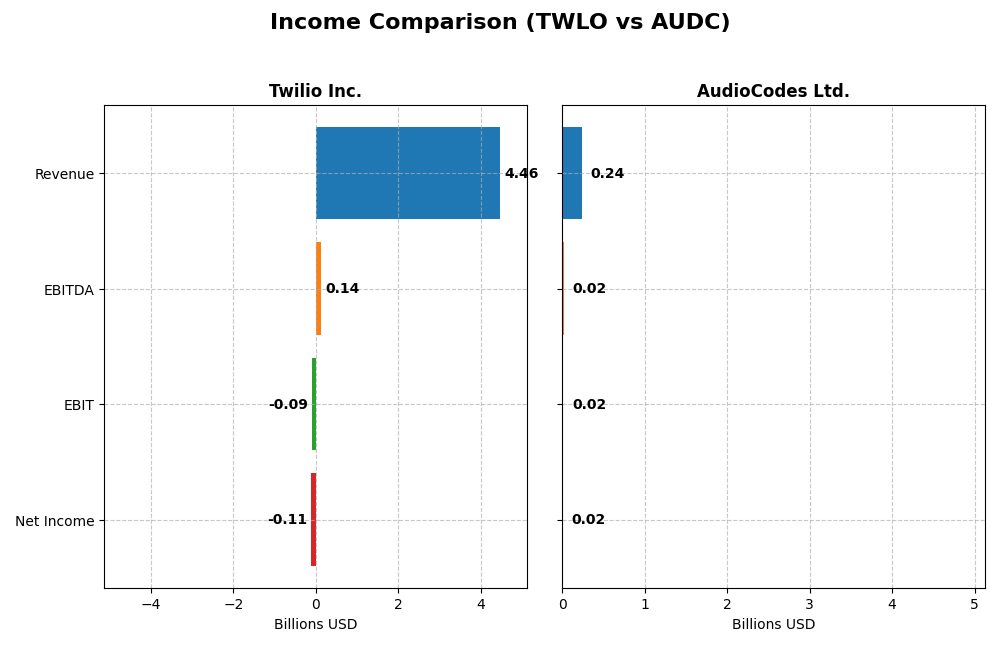

Income Statement Comparison

The table below compares key income statement metrics for Twilio Inc. and AudioCodes Ltd. based on their most recent fiscal year data.

| Metric | Twilio Inc. (TWLO) | AudioCodes Ltd. (AUDC) |

|---|---|---|

| Market Cap | 21.2B | 255M |

| Revenue | 4.46B | 242M |

| EBITDA | 136M | 21.1M |

| EBIT | -88.6M | 17.2M |

| Net Income | -109M | 15.3M |

| EPS | -0.66 | 0.51 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Twilio Inc.

Twilio’s revenue has shown strong growth, rising 153% from 2020 to 2024, with a 7.3% increase in the most recent year. Despite negative net income throughout, the net margin improved significantly, reflecting progress toward profitability. Gross margin remained stable at 50%, while operating expenses grew proportionally, supporting a favorable EBIT margin trajectory in 2024.

AudioCodes Ltd.

AudioCodes reported relatively flat revenue in 2024, declining slightly by 0.9% year-over-year after modest overall growth since 2020. Gross and net margins remained favorable, with a 65.3% gross margin and 6.3% net margin in 2024. The company’s EBIT margin was stable, and net income rebounded sharply in 2024, despite an overall decline in net income across the period.

Which one has the stronger fundamentals?

Twilio demonstrates strong overall revenue and net income growth with improving margins, though it remains unprofitable at the net income level. AudioCodes maintains positive net income and margins but faces challenges with declining net income and revenue stagnation recently. Both companies have favorable income statement profiles, but Twilio’s growth momentum contrasts with AudioCodes’ steadier profitability.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for Twilio Inc. and AudioCodes Ltd. based on their most recent fiscal year data.

| Ratios | Twilio Inc. (TWLO) | AudioCodes Ltd. (AUDC) |

|---|---|---|

| ROE | -1.38% | 7.98% |

| ROIC | -0.55% | 6.51% |

| P/E | -163.9 | 19.2 |

| P/B | 2.25 | 1.53 |

| Current Ratio | 4.20 | 2.09 |

| Quick Ratio | 4.20 | 1.69 |

| D/E (Debt-to-Equity) | 0.14 | 0.19 |

| Debt-to-Assets | 11.3% | 10.9% |

| Interest Coverage | 0 | 58.1 |

| Asset Turnover | 0.45 | 0.72 |

| Fixed Asset Turnover | 18.24 | 4.05 |

| Payout Ratio | 0 | 71.2% |

| Dividend Yield | 0% | 3.70% |

Interpretation of the Ratios

Twilio Inc.

Twilio shows a mixed ratio profile with 35.7% favorable and 50% unfavorable indicators, reflecting operational challenges. Profitability ratios such as net margin (-2.45%) and ROE (-1.38%) are unfavorable, while liquidity is mixed with a high current ratio flagged as unfavorable but a quick ratio favorable. Twilio does not pay dividends, consistent with its negative earnings and possible focus on reinvestment and growth.

AudioCodes Ltd.

AudioCodes demonstrates a more favorable ratio set, with 57.1% favorable and only 7.1% unfavorable. While ROE at 7.98% is slightly unfavorable, other measures like interest coverage (58.08) and dividend yield (3.7%) are positive. The company pays dividends, supported by a moderate payout ratio and stable yield, indicating shareholder returns are backed by solid cash flow.

Which one has the best ratios?

AudioCodes clearly has the stronger ratio profile, with a majority of favorable metrics and a stable dividend. Twilio’s ratios show several weaknesses in profitability and liquidity, reflecting a riskier financial stance. The difference highlights AudioCodes’ better balance of financial health and shareholder returns compared to Twilio’s growth-oriented but less profitable position.

Strategic Positioning

This section compares the strategic positioning of Twilio Inc. and AudioCodes Ltd., focusing on Market position, Key segments, and Exposure to technological disruption:

Twilio Inc.

- Large market cap of 21.2B USD in Internet Content & Information with competitive pressure from cloud communication providers.

- Primarily drives revenue from a cloud communications platform enabling developers to embed voice, messaging, video, and email capabilities.

- Operates in cloud communications, with potential disruption from evolving software APIs and integration technologies in customer engagement.

AudioCodes Ltd.

- Smaller market cap of 255M USD in Communication Equipment facing competition in telecom networking and software solutions.

- Revenue driven by advanced communications software, products, and managed services for unified communications and VoIP networks.

- Exposed to technological disruption in VoIP, VoiceAI, and managed services for Microsoft Teams and unified communications platforms.

Twilio Inc. vs AudioCodes Ltd. Positioning

Twilio pursues a diversified cloud communications platform targeting developers worldwide, while AudioCodes focuses on specialized communication equipment and software solutions primarily for telecom networks. Twilio’s scale offers broad reach, whereas AudioCodes’ niche expertise limits but sharpens its market focus.

Which has the best competitive advantage?

Both companies are currently shedding value as their ROIC falls below WACC; however, Twilio shows a growing ROIC trend, indicating improving profitability, while AudioCodes experiences declining returns, reflecting a weaker competitive moat.

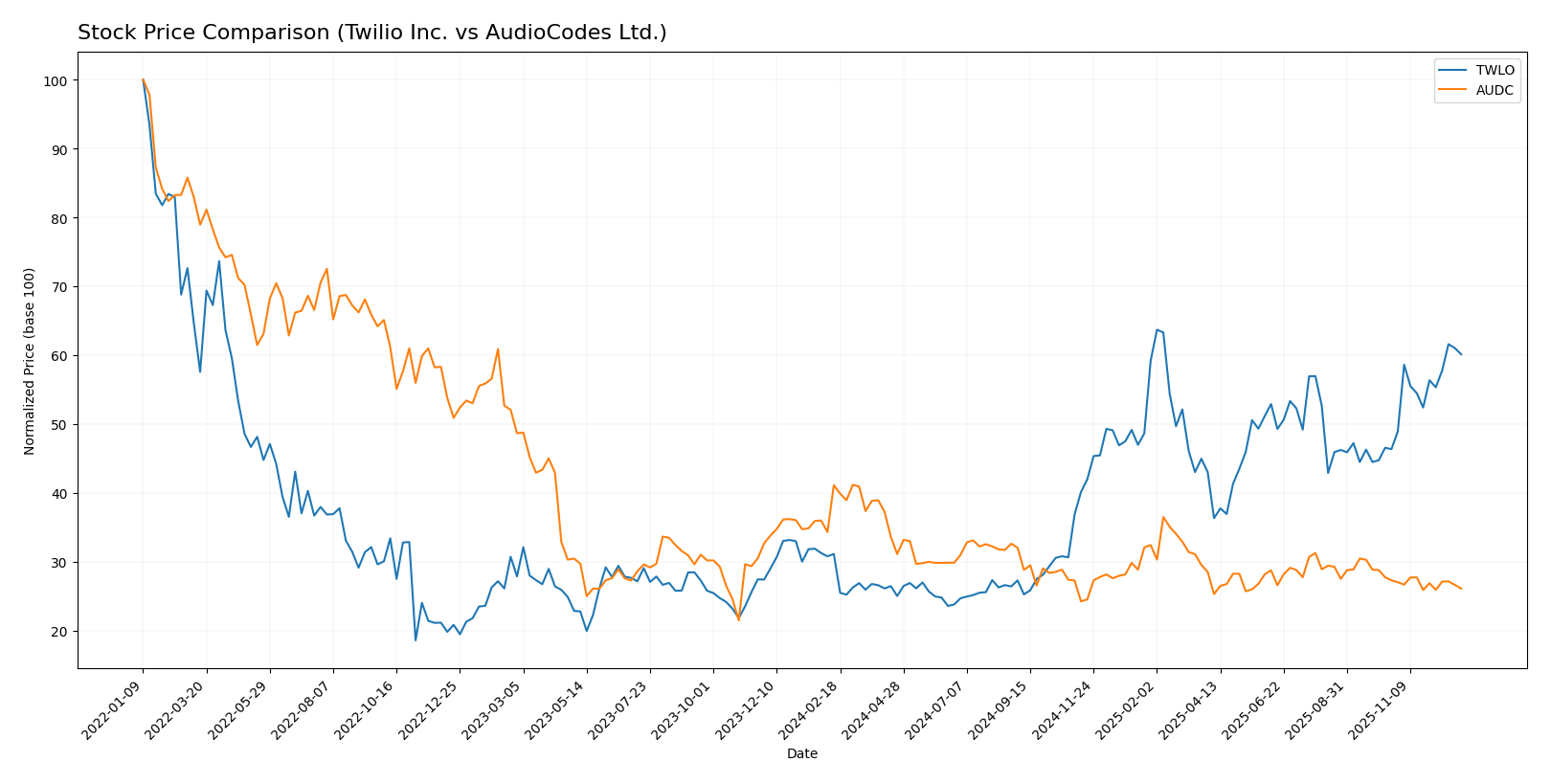

Stock Comparison

The stock price chart illustrates marked divergences in trading dynamics over the past 12 months, with Twilio Inc. showing a strong upward momentum while AudioCodes Ltd. experiences a pronounced decline.

Trend Analysis

Twilio Inc. recorded a 93.24% price increase over the past year, indicating a bullish trend with accelerating gains. The stock fluctuated between a low of 54.24 and a high of 146.58, with notable volatility (std deviation 28.13). Recent months continued this positive momentum.

AudioCodes Ltd. showed a 36.53% price decrease in the same period, reflecting a bearish trend with accelerating losses. Price ranged from 8.12 to 13.79, exhibiting low volatility (std deviation 1.25). Recent performance remained negative but less steep.

Comparing both, Twilio Inc. delivered substantially higher market performance with strong price appreciation, whereas AudioCodes Ltd. experienced a significant downturn.

Target Prices

The analyst consensus presents a confident outlook for Twilio Inc. and AudioCodes Ltd.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Twilio Inc. | 165 | 120 | 147.2 |

| AudioCodes Ltd. | 24 | 14 | 19 |

Analysts expect Twilio’s share price to appreciate above its current 138.36 USD, while AudioCodes shows potential to more than double from its present 8.74 USD, indicating positive growth prospects for both.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Twilio Inc. and AudioCodes Ltd.:

Rating Comparison

TWLO Rating

- Rating: C+ indicating a very favorable overall evaluation from analysts.

- Discounted Cash Flow Score: Moderate at 2, suggesting average valuation outlook.

- ROE Score: Moderate at 2, showing average efficiency in generating equity returns.

- ROA Score: Moderate at 2, indicating average asset utilization effectiveness.

- Debt To Equity Score: Moderate at 3, meaning moderate financial risk exposure.

- Overall Score: Moderate at 2, reflecting an average financial standing.

AUDC Rating

- Rating: A- showing a very favorable overall analyst assessment.

- Discounted Cash Flow Score: Favorable at 4, indicating a positive valuation outlook.

- ROE Score: Moderate at 3, reflecting better efficiency in profit generation from equity.

- ROA Score: Moderate at 3, showing improved effectiveness in asset use.

- Debt To Equity Score: Moderate at 3, indicating similar financial risk levels.

- Overall Score: Favorable at 4, reflecting a stronger financial position.

Which one is the best rated?

Based on the provided data, AudioCodes Ltd. holds a higher overall rating (A-) and stronger scores in discounted cash flow, ROE, ROA, and overall financial standing compared to Twilio Inc., which has a lower rating (C+) and moderate scores.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Twilio Inc. and AudioCodes Ltd.:

Twilio Inc. Scores

- Altman Z-Score: 6.29, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 6, categorized as average financial strength.

AudioCodes Ltd. Scores

- Altman Z-Score: 2.18, indicating a grey zone with moderate bankruptcy risk.

- Piotroski Score: 7, categorized as strong financial strength.

Which company has the best scores?

Twilio has a significantly higher Altman Z-Score, indicating stronger bankruptcy safety, while AudioCodes shows a better Piotroski Score, reflecting stronger financial health. Each company leads in a different scoring metric.

Grades Comparison

Here is a detailed comparison of the latest grades assigned to Twilio Inc. and AudioCodes Ltd.:

Twilio Inc. Grades

The following table shows recent grades for Twilio Inc. from reputable grading companies.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citizens | Maintain | Market Outperform | 2025-12-30 |

| TD Cowen | Maintain | Hold | 2025-10-31 |

| Wells Fargo | Maintain | Overweight | 2025-10-31 |

| Stifel | Maintain | Hold | 2025-10-31 |

| Piper Sandler | Maintain | Overweight | 2025-10-31 |

| Rosenblatt | Maintain | Buy | 2025-10-31 |

| JP Morgan | Maintain | Overweight | 2025-10-31 |

| Mizuho | Maintain | Outperform | 2025-10-31 |

| UBS | Maintain | Buy | 2025-10-31 |

| Needham | Maintain | Buy | 2025-10-31 |

Twilio Inc. consistently receives positive grades, predominantly “Buy,” “Overweight,” and “Outperform,” reflecting a generally favorable consensus.

AudioCodes Ltd. Grades

The following table presents the recent grades for AudioCodes Ltd. from recognized grading firms.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Buy | 2025-05-07 |

| Needham | Maintain | Buy | 2025-02-05 |

| Barclays | Maintain | Underweight | 2025-02-05 |

| Needham | Maintain | Buy | 2025-01-21 |

| Barclays | Maintain | Underweight | 2024-11-07 |

| Needham | Maintain | Buy | 2024-11-07 |

| Needham | Maintain | Buy | 2024-07-31 |

| Needham | Maintain | Buy | 2024-05-09 |

| Barclays | Maintain | Underweight | 2024-05-08 |

| Barclays | Maintain | Underweight | 2024-02-07 |

AudioCodes Ltd. displays a mixed pattern with Needham consistently rating it as “Buy” while Barclays persistently holds an “Underweight” stance, indicating divergent views.

Which company has the best grades?

Twilio Inc. holds stronger and more uniformly positive grades compared to AudioCodes Ltd., whose ratings are split between “Buy” and “Underweight.” Investors may interpret Twilio’s consensus as a sign of higher confidence.

Strengths and Weaknesses

The table below compares key strengths and weaknesses of Twilio Inc. and AudioCodes Ltd. based on their diversification, profitability, innovation, global presence, and market share using the most recent data available.

| Criterion | Twilio Inc. (TWLO) | AudioCodes Ltd. (AUDC) |

|---|---|---|

| Diversification | Focused on communications segment (≈4.16B USD in 2024), limited product range | Balanced between products (≈112M USD) and services (≈130M USD) |

| Profitability | Negative net margin (-2.45%), ROIC below WACC, shedding value but improving | Positive net margin (6.32%), ROIC near WACC, but declining profitability |

| Innovation | Growing ROIC trend indicates improving operational efficiency | Declining ROIC trend suggests challenges in innovation impact |

| Global presence | Strong global footprint as a cloud communications provider | More regional focus with niche networking and technology products |

| Market Share | Large communications market share but facing competitive pressure | Smaller scale with steady niche market presence |

Key takeaways: Twilio shows strong revenue in communications and improving profitability trends but still operates at a loss. AudioCodes maintains steady profitability with a balanced product/service mix but faces declining returns and innovation challenges. Investors should weigh growth potential against current profitability risks.

Risk Analysis

Below is a comparative risk assessment of Twilio Inc. (TWLO) and AudioCodes Ltd. (AUDC) based on recent 2024 financial and market data.

| Metric | Twilio Inc. (TWLO) | AudioCodes Ltd. (AUDC) |

|---|---|---|

| Market Risk | High beta (1.324) indicates above-average volatility; share price dropped ~2.7% recently. | Moderate beta (1.044) with stable recent price performance. |

| Debt level | Low debt-to-equity (0.14), favorable debt ratios; but zero interest coverage signals potential risk servicing debt. | Low debt-to-equity (0.19), strong interest coverage (58.08), signaling good debt management. |

| Regulatory Risk | Exposed to US and international data privacy regulations in cloud communications. | Subject to telecom and tech regulations in multiple regions including Israel, Europe, and Americas. |

| Operational Risk | Negative net margin (-2.45%) and low ROE (-1.38%) highlight operational inefficiencies and unprofitability. | Positive net margin (6.32%) and moderate ROE (7.98%) indicate stable operations. |

| Environmental Risk | Moderate, given tech sector footprint but no major environmental liabilities reported. | Similar moderate risk typical for technology hardware/software companies. |

| Geopolitical Risk | US-based with international exposure; geopolitical tensions may affect global cloud services. | Based in Israel with exposure to Middle East geopolitical risks and global market dependencies. |

Twilio’s most impactful risks stem from operational inefficiencies and market volatility, compounded by weak interest coverage despite low debt. AudioCodes presents a more favorable risk profile, with stronger financial health and manageable geopolitical exposures, though its moderate ROE suggests room for improvement. Caution on Twilio is advised due to its slightly unfavorable financial ratios and moderate rating.

Which Stock to Choose?

Twilio Inc. (TWLO) shows a favorable income statement with strong revenue growth of 153% over 2020-2024 and improving profitability metrics, despite negative returns on assets and equity. Its debt levels are low, with a debt-to-equity ratio of 0.14, but some financial ratios remain unfavorable, resulting in a slightly unfavorable overall ratio evaluation and a “C+” rating.

AudioCodes Ltd. (AUDC) presents a stable income statement with a favorable gross margin of 65.3% and positive net margin of 6.3%, although recent revenue declined slightly. Its financial ratios are generally favorable, supported by a low debt-to-assets ratio of 10.9%, positive interest coverage, and a strong Altman Z-Score, leading to an “A-” rating with mostly favorable ratios.

Considering ratings and financial evaluations, TWLO’s improving profitability and strong growth might appeal to investors with a growth-oriented profile, while AUDC’s stable profitability and sound financial health may appear more suitable for risk-averse or quality-focused investors seeking steadiness.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Twilio Inc. and AudioCodes Ltd. to enhance your investment decisions: