Home > Comparison > Consumer Cyclical > ULTA vs TSCO

The strategic rivalry between Ulta Beauty, Inc. and Tractor Supply Company shapes the specialty retail landscape in the consumer cyclical sector. Ulta Beauty operates a high-margin beauty products and salon services model, while Tractor Supply focuses on rural lifestyle retail, targeting agricultural and outdoor needs. This analysis pits growth-oriented beauty retail against stable rural merchandise. I will determine which company offers the superior risk-adjusted outlook for a diversified portfolio.

Table of contents

Companies Overview

Ulta Beauty and Tractor Supply Company stand as key players in distinct specialty retail markets in the United States.

Ulta Beauty, Inc.: Leading Beauty Retailer

Ulta Beauty dominates the specialty retail sector focused on cosmetics, skincare, and salon services. Its core revenue engine derives from selling beauty products and providing in-store salon services across 1,308 locations nationwide. In 2026, the company emphasizes expanding its private label offerings and digital sales channels to deepen customer engagement and diversify revenue streams.

Tractor Supply Company: Rural Lifestyle Retail Powerhouse

Tractor Supply Company specializes in rural lifestyle retail, targeting farmers and recreational outdoor consumers. Its primary income comes from selling agricultural, pet, and seasonal products through over 2,000 stores and online platforms. In 2026, Tractor Supply prioritizes broadening its Petsense brand and enhancing supply chain efficiency to support steady store growth and customer loyalty.

Strategic Collision: Similarities & Divergences

Both companies thrive by addressing niche consumer needs with strong brand portfolios and extensive store networks. Ulta Beauty pursues a customer-centric ecosystem blending retail and services, while Tractor Supply focuses on an inventory-driven model serving rural lifestyles. Their competition unfolds in retail innovation and digital expansion but appeals to fundamentally different customer bases. Their distinct market focuses create divergent investment profiles anchored in sector-specific growth dynamics.

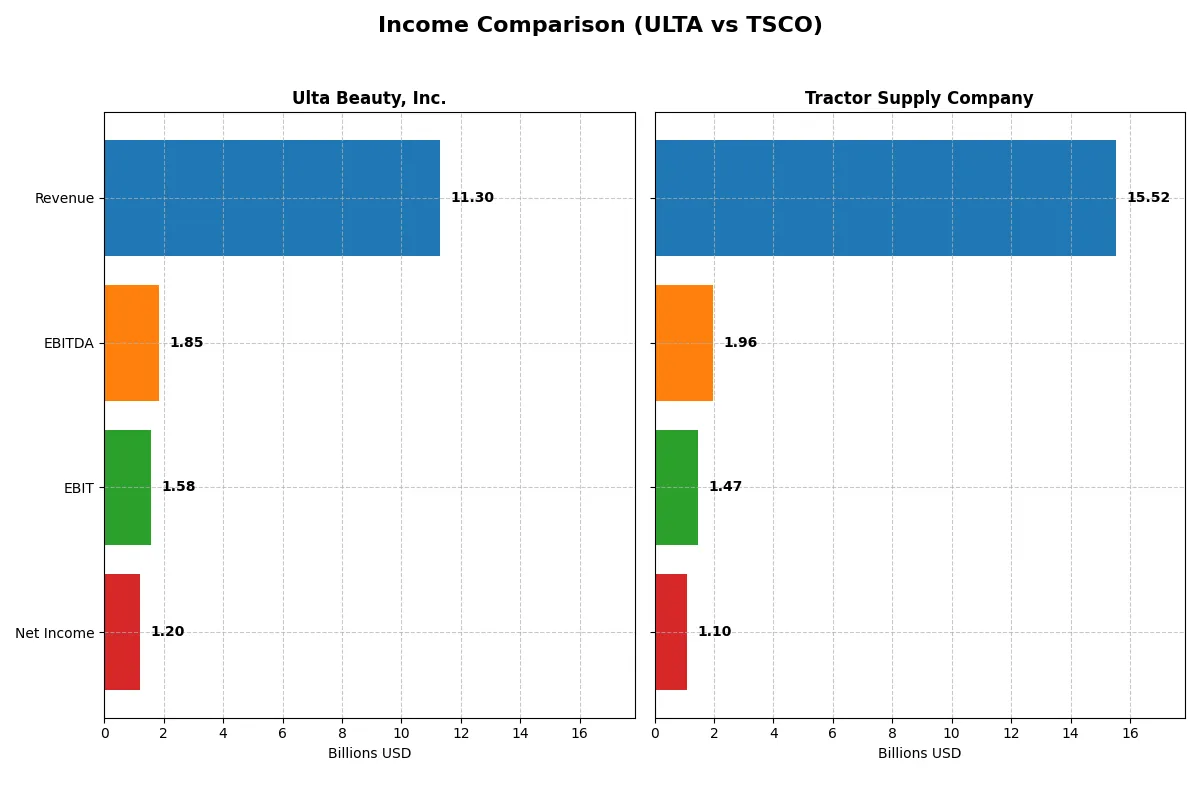

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | Ulta Beauty, Inc. (ULTA) | Tractor Supply Company (TSCO) |

|---|---|---|

| Revenue | 11.3B | 15.5B |

| Cost of Revenue | 6.9B | 10.4B |

| Operating Expenses | 2.8B | 3.7B |

| Gross Profit | 4.4B | 5.2B |

| EBITDA | 1.8B | 2.0B |

| EBIT | 1.6B | 1.5B |

| Interest Expense | 0 | 69M |

| Net Income | 1.2B | 0 |

| EPS | 25.44 | 2.07 |

| Fiscal Year | 2024 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company operates with superior efficiency and profit discipline in their respective markets.

Ulta Beauty, Inc. Analysis

Ulta’s revenue rose steadily from $6.15B in 2020 to $11.3B in 2024, with net income surging from $176M to $1.2B. It maintains a robust gross margin near 38.8% and a net margin above 10.6%, reflecting strong cost control despite slight recent margin compression. The latest year shows mild revenue growth but declining EBIT and net margins, indicating emerging efficiency challenges.

Tractor Supply Company Analysis

Tractor Supply’s revenue climbed from $12.7B in 2021 to $15.5B in 2025, with net income increasing moderately from $997M to $1.1B. Gross margin stands at a solid 33.2%, but EBIT margin is lower at 9.4%. The latest year exhibits revenue growth of 4.3%, yet gross profit and net margin declined, signaling margin pressure despite operational scale.

Margin Strength vs. Revenue Growth

Ulta leads with higher margins and stronger net income growth, growing net income over 580% since 2020. Tractor Supply delivers steadier revenue expansion but faces margin erosion. Ulta’s profile appeals to those prioritizing profitability and margin resilience, while Tractor Supply suits investors favoring consistent top-line growth with moderate efficiency trade-offs.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | Ulta Beauty, Inc. (ULTA) | Tractor Supply Company (TSCO) |

|---|---|---|

| ROE | 48.27% | 42.46% |

| ROIC | 26.61% | 13.11% |

| P/E | 16.20 | 24.18 |

| P/B | 7.82 | 10.27 |

| Current Ratio | 1.70 | 1.34 |

| Quick Ratio | 0.60 | 0.16 |

| D/E (Debt-to-Equity) | 0.77 | 3.73 |

| Debt-to-Assets | 32.0% | 88.1% |

| Interest Coverage | 0 | 21.22 |

| Asset Turnover | 1.88 | 1.42 |

| Fixed Asset Turnover | 3.96 | 2.23 |

| Payout Ratio | 0 | 44.5% |

| Dividend Yield | 0 | 1.84% |

| Fiscal Year | 2024 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as a company’s DNA, uncovering hidden risks and revealing operational strengths behind headline figures.

Ulta Beauty, Inc.

Ulta shows robust profitability with a 48.3% ROE and a 10.6% net margin, indicating strong operational efficiency. Its P/E ratio of 16.2 suggests a fairly valued stock, though a high P/B of 7.8 appears stretched. The company reinvests earnings into growth rather than paying dividends, signaling confidence in future expansion.

Tractor Supply Company

Tractor Supply delivers solid returns with a 42.5% ROE but a more modest 7.1% net margin. The stock trades at a higher P/E of 24.2, reflecting relatively expensive valuation. Its considerable debt levels weigh on financial flexibility, and a dividend yield of 1.8% offers moderate shareholder returns amid ongoing capital expenditures.

Balanced Profitability vs. Elevated Leverage

Ulta offers superior profitability and efficient asset use with manageable leverage, presenting a favorable risk/reward profile. Tractor Supply’s higher valuation and significant debt increase financial risk despite decent returns. Investors prioritizing operational strength may prefer Ulta, while those seeking steady income might lean toward Tractor Supply’s dividend presence.

Which one offers the Superior Shareholder Reward?

I compare Ulta Beauty and Tractor Supply’s shareholder rewards through dividends, payout ratios, and buybacks. Ulta pays no dividends, focusing on reinvestment with solid free cash flow (FCF) of $21B per share and no payout ratio. Tractor Supply yields ~1.8%, with a 43-44% payout ratio, balancing dividends and buybacks. Ulta’s zero dividend and aggressive reinvestment in growth contrast with Tractor Supply’s steady dividend and moderate buybacks. Tractor Supply’s dividend payout is sustainable but coupled with high leverage (debt/equity ~3.7). Ulta shows stronger free cash flow coverage and lower leverage, underpinning durable value creation. I judge Ulta Beauty offers a superior total return profile for 2026 investors due to reinvestment discipline and buyback potential, despite no dividend yield.

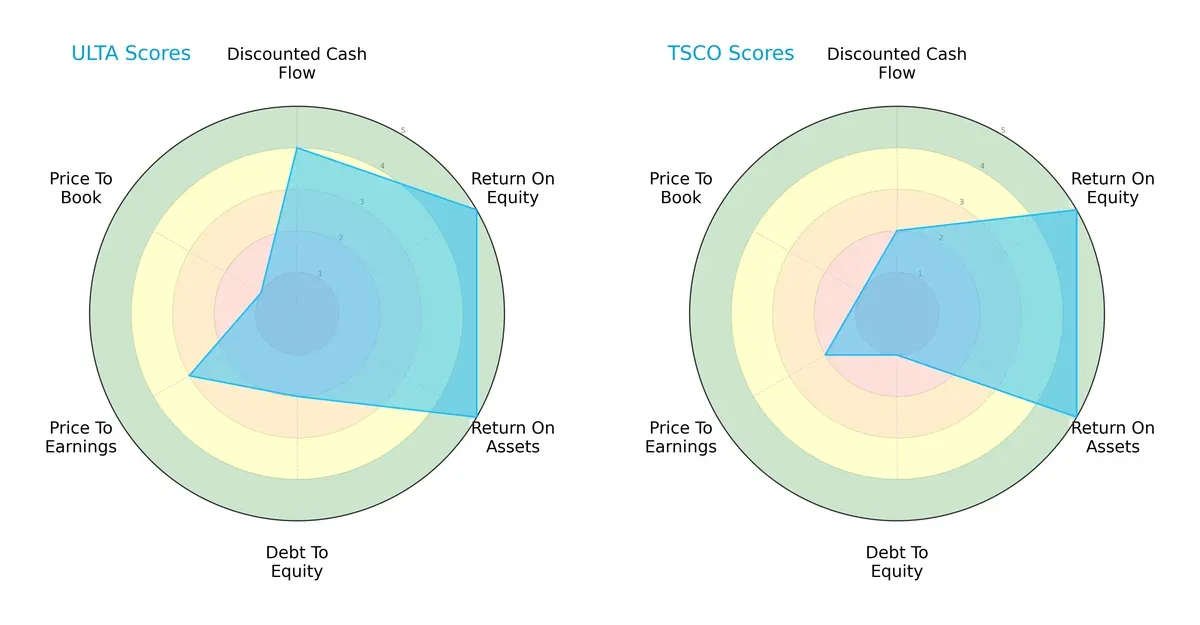

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of Ulta Beauty and Tractor Supply, illustrating their strategic strengths and vulnerabilities:

Ulta Beauty shows a more balanced profile with strong DCF (4), ROE (5), and ROA (5) scores, signaling efficient capital utilization and solid cash flow. However, its moderate debt-to-equity (2) and valuation metrics (PE 3, PB 1) suggest some financial leverage risks and possible overvaluation. Tractor Supply excels in ROE (5) and ROA (5) but lags on DCF (2) and carries a weaker debt position (1), indicating higher financial risk and less favorable cash flow projections. Ulta’s diversified strengths provide a sturdier investment foundation compared to Tractor Supply’s reliance on operational efficiency alone.

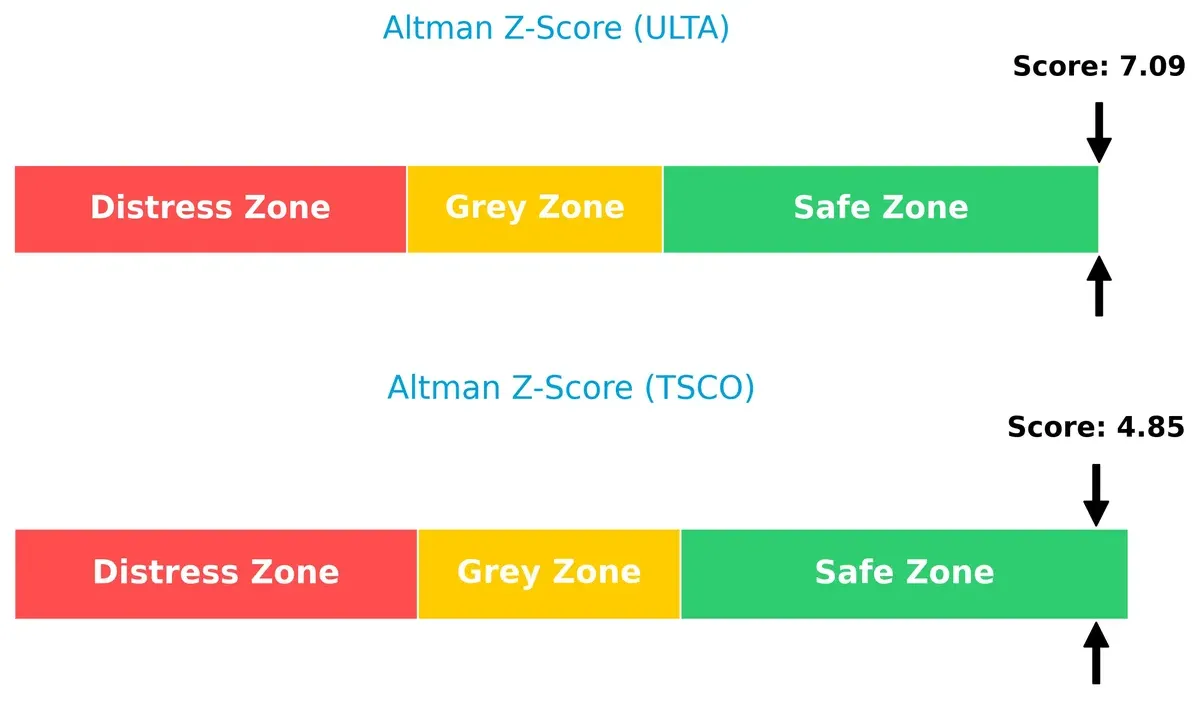

Bankruptcy Risk: Solvency Showdown

Ulta’s Altman Z-Score of 7.09 surpasses Tractor Supply’s 4.85, placing both comfortably in the safe zone but highlighting Ulta’s superior long-term solvency and lower bankruptcy risk in this economic cycle:

Financial Health: Quality of Operations

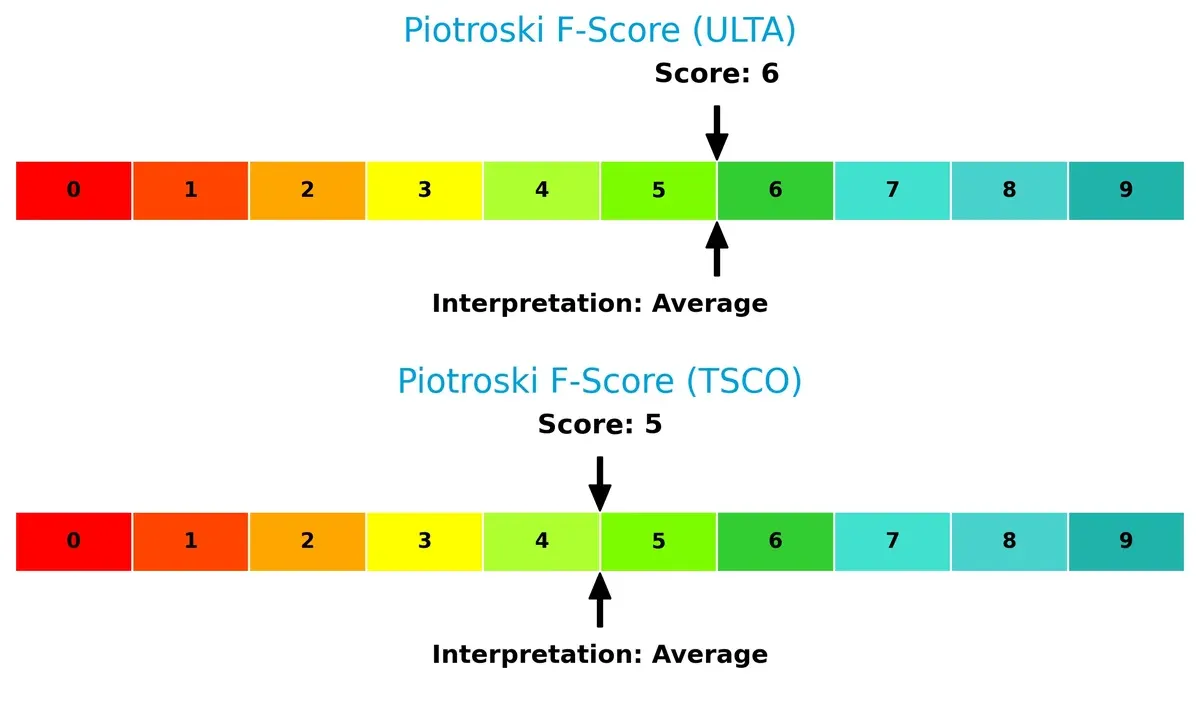

Ulta’s Piotroski F-Score of 6 edges out Tractor Supply’s 5, indicating marginally stronger operational fundamentals. Neither score signals red flags, but Ulta’s slightly better internal metrics suggest more consistent profitability and financial efficiency:

How are the two companies positioned?

This section dissects Ulta and Tractor Supply’s operational DNA by comparing their revenue distribution and internal strengths and weaknesses. The goal is to confront their economic moats to identify which model offers the most resilient competitive advantage today.

Revenue Segmentation: The Strategic Mix

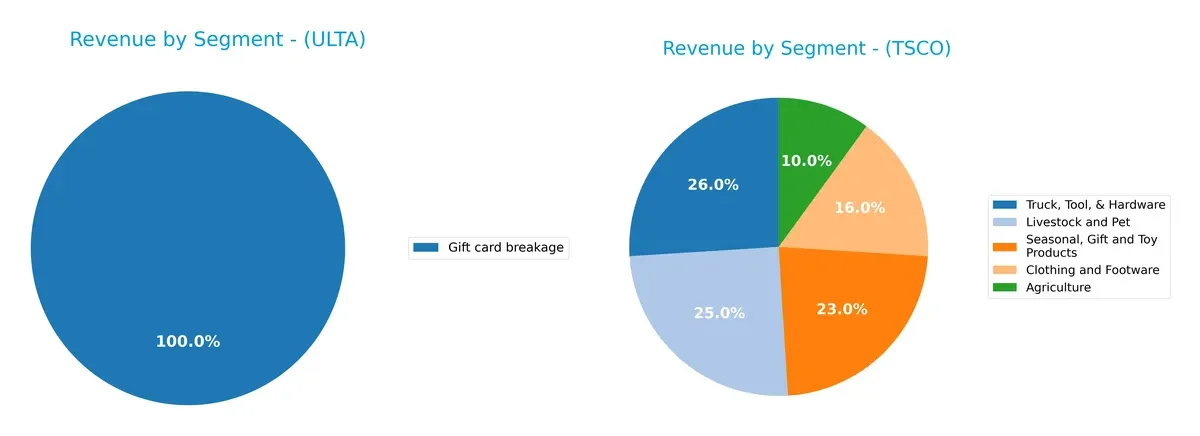

This visual comparison dissects how Ulta Beauty and Tractor Supply diversify their income streams and where their primary sector bets lie:

Ulta Beauty relies heavily on its product and e-commerce sales, with salon services as a secondary stream, showing moderate diversification. Tractor Supply, in contrast, dwarfs Ulta’s segmentation with five robust segments each exceeding $1B, including Truck, Tool & Hardware at $3.87B anchoring its revenue. Tractor’s broad mix mitigates concentration risk, while Ulta’s focus pivots on beauty retail ecosystems, exposing it to sector-specific shocks.

Strengths and Weaknesses Comparison

This table compares the Strengths and Weaknesses of Ulta Beauty and Tractor Supply Company:

Ulta Beauty Strengths

- Strong profitability with 10.63% net margin

- High ROE at 48.27%

- ROIC of 26.61% well above WACC

- Favorable asset turnover ratios

- Solid current ratio at 1.7

Tractor Supply Strengths

- Favorable ROE at 42.46%

- Positive ROIC at 13.11% above WACC

- Good interest coverage at 21.22

- Diversified product segments across five categories

- Steady market share in agriculture and hardware

Ulta Beauty Weaknesses

- Unfavorable price-to-book ratio at 7.82

- Low quick ratio at 0.6

- No dividend yield

- Moderate debt-to-equity at 0.77

- Limited product diversification mainly in beauty

Tractor Supply Weaknesses

- High debt-to-equity ratio at 3.73

- Very high debt-to-assets at 88.12%

- Low quick ratio at 0.16

- Neutral net margin at 7.06%

- Price-to-book ratio unfavorable at 10.27

Ulta Beauty excels in profitability and efficient capital use but faces liquidity and valuation concerns. Tractor Supply shows strong diversification and leverage risks, requiring careful balance sheet management. Both firms’ strengths and weaknesses shape their strategic focus on capital allocation and operational resilience.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only reliable shield protecting long-term profits from relentless competitive erosion:

Ulta Beauty, Inc.: Intangible Assets and Brand Loyalty

Ulta’s moat stems from powerful brand loyalty and exclusive private labels. This drives high ROIC (19%) and margin stability. New salon services and product expansions could deepen this lead in 2026.

Tractor Supply Company: Cost Advantage and Niche Focus

TSCO leverages cost advantage and a specialized rural lifestyle niche, generating positive but declining ROIC (~7%). Its moat is narrower than Ulta’s, but expansion into Petsense stores offers growth potential.

Brand Loyalty vs. Cost Advantage: The Moat Showdown

Ulta’s wider moat combines intangible assets and growing ROIC, signaling durable competitive advantage. TSCO creates value but faces profitability erosion. Ulta stands better positioned to defend market share.

Which stock offers better returns?

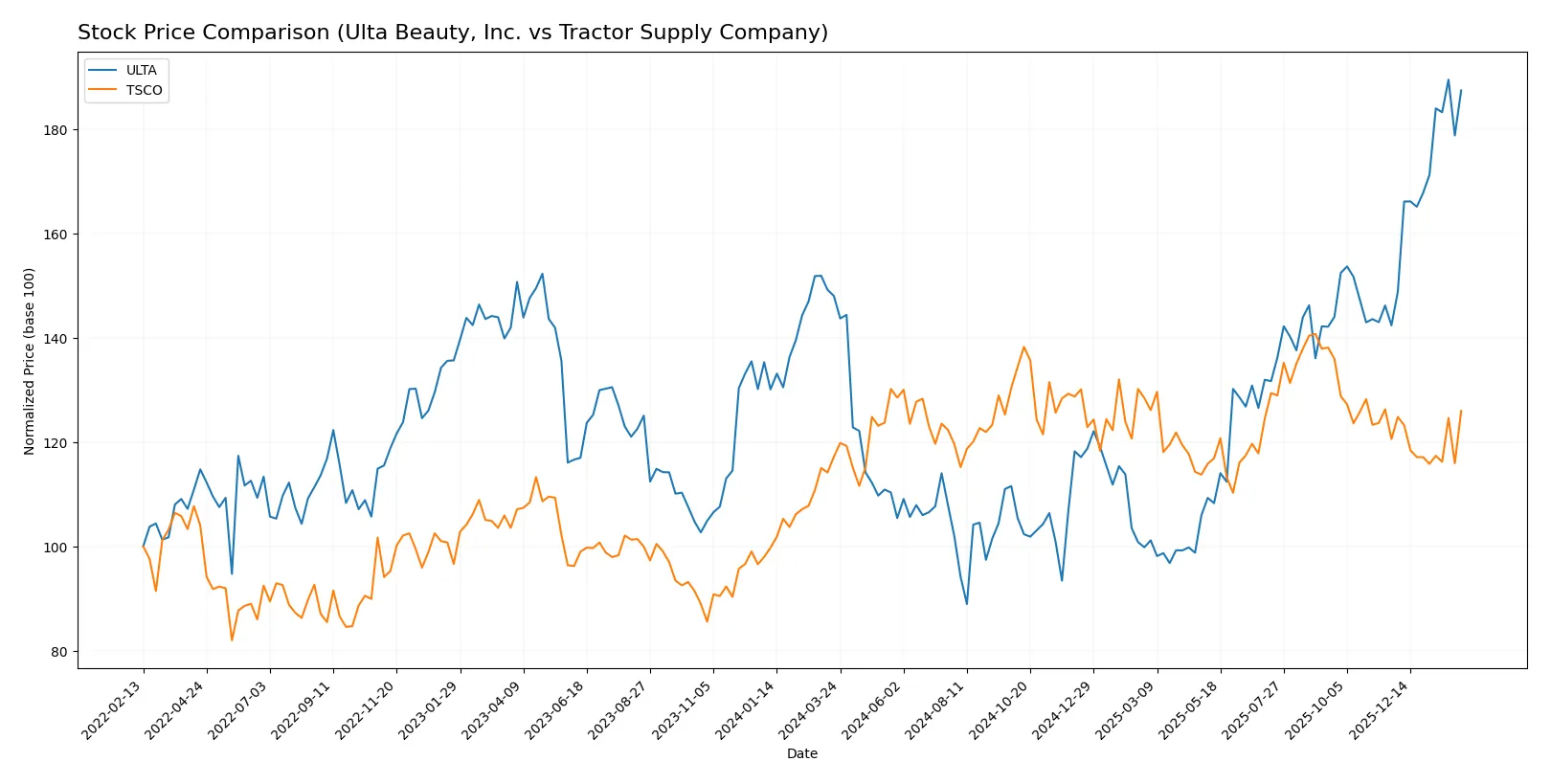

The past year shows Ulta Beauty’s stock surging with accelerating gains, while Tractor Supply’s price rises more modestly but slows down recently.

Trend Comparison

Ulta Beauty’s stock rose 26.62% over the past 12 months, reflecting a bullish trend with accelerating momentum and a wide price range from 322.17 to 686.12. The recent quarter saw a 31.63% gain, confirming strong upward acceleration.

Tractor Supply’s stock gained 7.49% over the same period, maintaining a bullish but decelerating trend. Price fluctuated narrowly between 48.40 and 61.76. The recent quarter shows a 4.46% increase with a slight negative slope, indicating slowing momentum.

Ulta Beauty outperformed Tractor Supply with higher total returns and stronger recent acceleration, delivering the superior market performance in the last year.

Target Prices

Analysts present a bullish consensus for both Ulta Beauty and Tractor Supply, reflecting confidence in their growth prospects.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| Ulta Beauty, Inc. | 425 | 790 | 693.73 |

| Tractor Supply Company | 50 | 67 | 59 |

Ulta Beauty’s target consensus at 694 exceeds its current price of 679, signaling upside potential. Tractor Supply’s consensus at 59 also sits above its current 55, suggesting modest appreciation expected.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

The following tables present recent institutional grades for Ulta Beauty, Inc. and Tractor Supply Company:

Ulta Beauty, Inc. Grades

This table shows the latest grades issued by reputable financial institutions for Ulta Beauty:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| TD Cowen | Maintain | Buy | 2026-01-21 |

| Raymond James | Upgrade | Strong Buy | 2026-01-21 |

| Oppenheimer | Maintain | Outperform | 2026-01-20 |

| Morgan Stanley | Maintain | Overweight | 2026-01-15 |

| B of A Securities | Maintain | Neutral | 2026-01-08 |

| UBS | Maintain | Buy | 2026-01-07 |

| Argus Research | Maintain | Buy | 2026-01-02 |

| Oppenheimer | Maintain | Outperform | 2025-12-10 |

| TD Cowen | Upgrade | Buy | 2025-12-08 |

| Morgan Stanley | Maintain | Overweight | 2025-12-08 |

Tractor Supply Company Grades

This table lists recent institutional grades for Tractor Supply Company from established firms:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Argus Research | Maintain | Buy | 2026-02-02 |

| Goldman Sachs | Maintain | Buy | 2026-01-30 |

| DA Davidson | Maintain | Buy | 2026-01-30 |

| TD Cowen | Maintain | Hold | 2026-01-30 |

| JP Morgan | Maintain | Neutral | 2026-01-30 |

| Telsey Advisory Group | Maintain | Outperform | 2026-01-30 |

| Piper Sandler | Maintain | Overweight | 2026-01-30 |

| Jefferies | Maintain | Buy | 2026-01-30 |

| Mizuho | Maintain | Outperform | 2026-01-30 |

| Morgan Stanley | Maintain | Equal Weight | 2026-01-30 |

Which company has the best grades?

Ulta Beauty holds a stronger consensus, including upgrades to “Strong Buy” and multiple “Buy” ratings. Tractor Supply shows consistent “Buy” and “Outperform” grades but lacks upgrades. Investors may perceive Ulta’s grades as signaling more bullish sentiment.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

Ulta Beauty, Inc.

- Faces intense competition in specialty retail and beauty sectors with evolving consumer preferences.

Tractor Supply Company

- Competes in rural lifestyle retail with strong brand presence but exposed to agricultural market fluctuations.

2. Capital Structure & Debt

Ulta Beauty, Inc.

- Moderate debt levels with a debt-to-equity ratio of 0.77; interest coverage is very strong, signaling manageable debt risk.

Tractor Supply Company

- High leverage with a debt-to-equity ratio of 3.73 and debt-to-assets at 88%; financial risk is a significant concern.

3. Stock Volatility

Ulta Beauty, Inc.

- Beta of 0.83 indicates moderate volatility below market average, suggesting relative stability.

Tractor Supply Company

- Beta of 0.73 shows slightly lower volatility, reflecting defensive characteristics against market swings.

4. Regulatory & Legal

Ulta Beauty, Inc.

- Subject to consumer protection and product safety regulations; risks from evolving cosmetic industry compliance.

Tractor Supply Company

- Faces regulatory scrutiny related to agricultural product safety and environmental compliance, with some regional variability.

5. Supply Chain & Operations

Ulta Beauty, Inc.

- Relies heavily on global cosmetic suppliers; vulnerable to disruptions and rising raw material costs.

Tractor Supply Company

- Operates extensive store network with complex logistics; exposed to supply chain disruptions in rural regions.

6. ESG & Climate Transition

Ulta Beauty, Inc.

- Increasing pressure to adopt sustainable sourcing and reduce carbon footprint in beauty product lifecycle.

Tractor Supply Company

- Faces challenges in reducing environmental impact across agricultural product lines and extensive physical stores.

7. Geopolitical Exposure

Ulta Beauty, Inc.

- Limited direct exposure but vulnerable to import tariffs and international trade tensions affecting suppliers.

Tractor Supply Company

- Primarily domestic focus but sensitive to rural economic policies and trade issues impacting agricultural inputs.

Which company shows a better risk-adjusted profile?

Ulta Beauty’s moderate leverage and favorable liquidity metrics contrast sharply with Tractor Supply’s high debt burden. Both face sector-specific operational risks, yet Ulta’s more robust financial health and stable stock volatility underpin a superior risk-adjusted profile. Tractor Supply’s elevated financial leverage remains a key red flag.

Final Verdict: Which stock to choose?

Ulta Beauty’s superpower lies in its exceptional capital efficiency and robust return on invested capital, signaling a strong economic moat and value creation. Its main point of vigilance is a relatively high price-to-book ratio, which could temper valuation appeal. It fits well in aggressive growth portfolios seeking sustained profitability.

Tractor Supply Company’s strategic moat stems from its niche retail dominance and recurring customer base, providing a stable cash flow foundation. Compared to Ulta, it offers a safer profile but with slower capital returns and a heavier debt load. It suits GARP investors who value balance between growth and stability.

If you prioritize capital efficiency and high-return growth, Ulta outshines with its accelerating profitability and strong moat. However, if you seek steadier income with defensive qualities, Tractor Supply offers better stability despite a decelerating trend. Both present compelling analytical scenarios aligned with distinct investor profiles.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Ulta Beauty, Inc. and Tractor Supply Company to enhance your investment decisions: