Home > Comparison > Consumer Cyclical > EBAY vs TSCO

The strategic rivalry between eBay Inc. and Tractor Supply Company shapes the consumer cyclical specialty retail landscape. eBay operates a digital marketplace platform connecting global buyers and sellers. In contrast, Tractor Supply runs a capital-intensive network of rural lifestyle retail stores across the U.S. This analysis pits scalable tech-driven commerce against asset-heavy retailing to assess which model offers superior risk-adjusted returns for a diversified portfolio in 2026.

Table of contents

Companies Overview

eBay Inc. and Tractor Supply Company both hold pivotal roles in the specialty retail sector, shaping diverse market niches.

eBay Inc.: Global Marketplace Connector

eBay Inc. dominates the online marketplace by connecting buyers and sellers globally through its flagship platform ebay.com and mobile apps. Its core revenue comes from transaction fees and advertising on these digital channels. In 2026, eBay focuses on enhancing user experience and expanding cross-border commerce to maintain its competitive edge in e-commerce.

Tractor Supply Company: Rural Lifestyle Retailer

Tractor Supply Company leads the rural retail market by selling farm, pet, and outdoor products through over 2,000 stores and e-commerce sites. It generates revenue primarily from retail sales targeting recreational farmers and ranchers. The company’s strategic emphasis in 2026 lies in expanding store footprint and digital integration to deepen its connection with rural customers.

Strategic Collision: Similarities & Divergences

Both firms operate in specialty retail but with contrasting business models—eBay’s digital marketplace versus Tractor Supply’s physical and omnichannel retail stores. They compete indirectly, with eBay leveraging global scale and digital reach, while Tractor Supply focuses on niche rural markets. Their distinct investment profiles reflect different risk-return tradeoffs: eBay embodies tech-driven growth, Tractor Supply offers steady retail resilience.

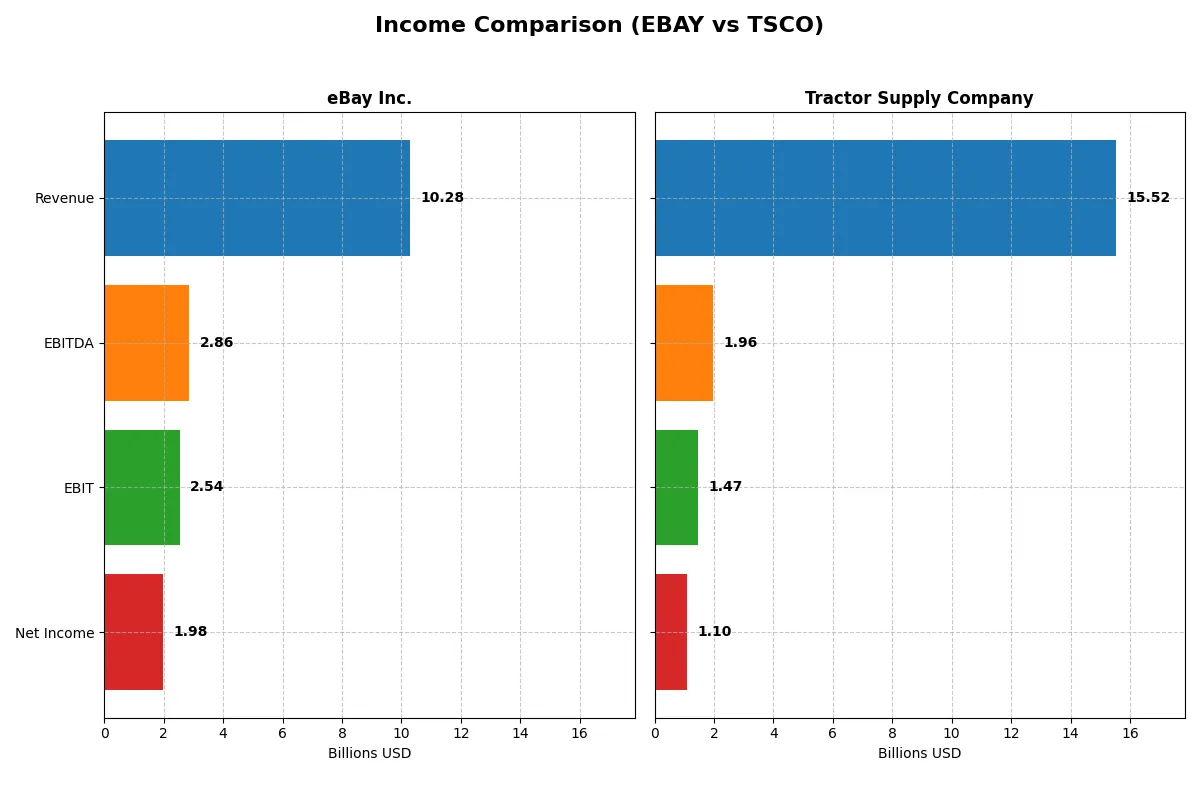

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | eBay Inc. (EBAY) | Tractor Supply Company (TSCO) |

|---|---|---|

| Revenue | 10.3B | 15.5B |

| Cost of Revenue | 2.9B | 10.4B |

| Operating Expenses | 5.1B | 3.7B |

| Gross Profit | 7.4B | 5.2B |

| EBITDA | 2.9B | 2.0B |

| EBIT | 2.5B | 1.5B |

| Interest Expense | 0.3B | 0.07B |

| Net Income | 2.0B | 1.1B |

| EPS | 3.98 | 2.07 |

| Fiscal Year | 2024 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company drives profitability and efficiency more effectively through its core operations.

eBay Inc. Analysis

eBay’s revenue grew modestly to $10.3B in 2024, yet net income declined sharply to $2.0B, reflecting margin pressure. Its gross margin remains robust at 72%, but net margin contracted to 19%, signaling rising expenses or operational challenges. The recent dip in EBIT and EPS highlights weakening momentum despite favorable gross profit stability.

Tractor Supply Company Analysis

Tractor Supply’s revenue climbed steadily to $15.5B in 2025, with net income around $1.1B. Gross margin stands at a solid 33%, while net margin is a slimmer 7%, reflecting a lower margin retail model. EBIT remained stable, and modest revenue growth contrasts with a slight net margin erosion, indicating disciplined cost control amid competitive pressures.

Verdict: High Margin Tech vs. Stable Retail Growth

eBay commands superior margins but struggles with volatile profits and shrinking net income. Tractor Supply posts lower margins but delivers consistent revenue and profit growth. For investors, eBay offers higher profitability potential with elevated risk, while Tractor Supply provides steadier earnings and resilience in a lower-margin sector.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies compared below:

| Ratios | eBay Inc. (EBAY) | Tractor Supply Company (TSCO) |

|---|---|---|

| ROE | 38.3% | 42.5% |

| ROIC | 13.4% | 13.1% |

| P/E | 15.6x | 24.2x |

| P/B | 6.0x | 10.3x |

| Current Ratio | 1.24 | 1.34 |

| Quick Ratio | 1.24 | 0.16 |

| D/E | 1.52 | 3.73 |

| Debt-to-Assets | 40.6% | 88.1% |

| Interest Coverage | 8.95x | 21.2x |

| Asset Turnover | 0.53 | 1.42 |

| Fixed Asset Turnover | 6.08 | 2.23 |

| Payout Ratio | 27.0% | 44.5% |

| Dividend Yield | 1.73% | 1.84% |

| Fiscal Year | 2024 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios serve as a company’s DNA, uncovering hidden risks and revealing operational strengths crucial for investment decisions.

eBay Inc.

eBay exhibits strong profitability with a 38.3% ROE and a healthy 19.2% net margin. Its P/E ratio at 15.6 suggests a fairly valued stock, though a high P/B of 5.96 signals a premium on book value. The company balances shareholder returns with a 1.73% dividend yield, reflecting moderate cash distribution alongside growth investments.

Tractor Supply Company

Tractor Supply posts a robust 42.5% ROE but a modest 7.1% net margin, indicating efficiency in equity use despite lower profitability. The stock’s P/E ratio stands at 24.2, implying a stretched valuation. Shareholders receive a 1.84% dividend yield, supported by ongoing reinvestment in operating assets, though elevated debt levels pose a caution.

Valuation Discipline vs. Equity Efficiency

eBay offers a more balanced valuation with strong profitability and moderate risk, while Tractor Supply shows higher equity returns but at a steeper price and greater leverage. Investors prioritizing valuation discipline may lean toward eBay; those favoring equity efficiency might consider Tractor Supply’s growth profile despite its risks.

Which one offers the Superior Shareholder Reward?

I compare eBay Inc. (EBAY) and Tractor Supply Company (TSCO) on dividends and buybacks. EBAY yields 1.7–2.3% with a conservative payout ratio near 27%, supported by robust free cash flow (FCF) coverage above 80%. TSCO offers a similar dividend yield around 1.6–1.9%, but with a higher payout ratio exceeding 40%, signaling less room for dividend growth. EBAY maintains stronger buyback intensity, reflecting a balanced capital allocation that sustains shareholder value. TSCO’s heavier debt and lower free cash flow ratio (around 45%) raise sustainability concerns. I find EBAY’s distribution philosophy more prudent and sustainable, offering a superior total return profile for 2026 investors.

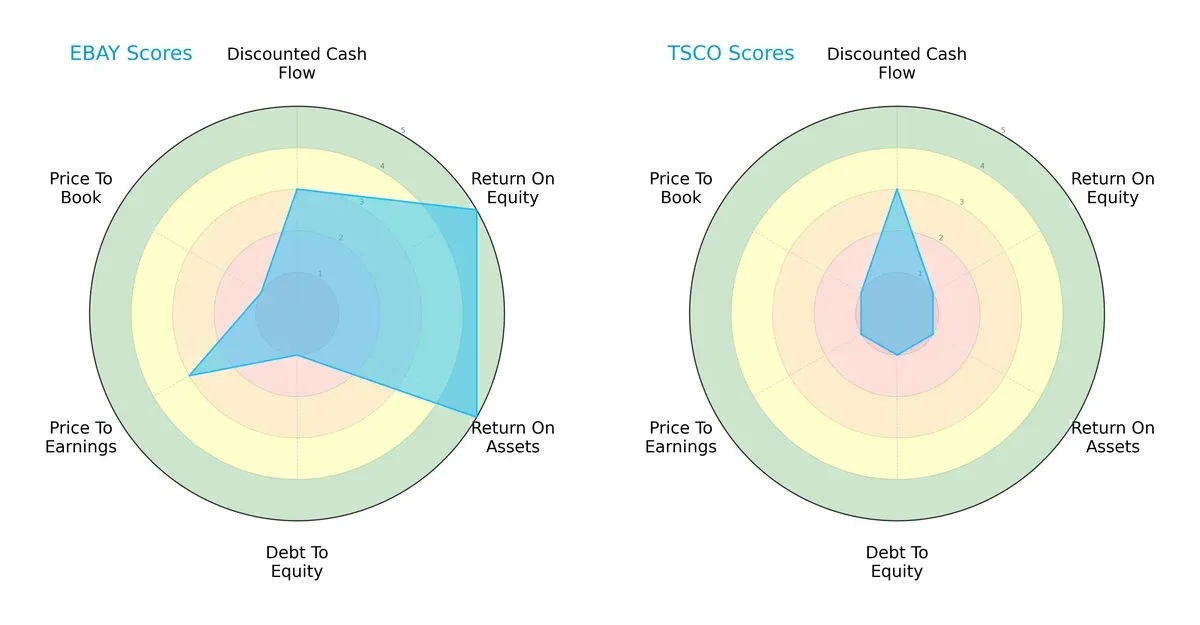

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of eBay Inc. and Tractor Supply Company, exposing their core financial strengths and weaknesses:

eBay demonstrates a balanced profile with very favorable returns on equity and assets (ROE 5, ROA 5). However, it carries high financial risk as seen in its weak debt-to-equity (1) and price-to-book scores (1). Tractor Supply relies on a consistent discounted cash flow score (3) but lags significantly in profitability metrics (ROE 1, ROA 1) and valuation, reflecting a more challenged financial position. eBay’s edge lies in operational efficiency, while Tractor Supply shows no standout strengths.

Bankruptcy Risk: Solvency Showdown

eBay’s Altman Z-Score of 6.1 versus Tractor Supply’s 4.9 confirms both companies reside safely above distress thresholds, but eBay holds a clearer margin of solvency and resilience in this economic cycle:

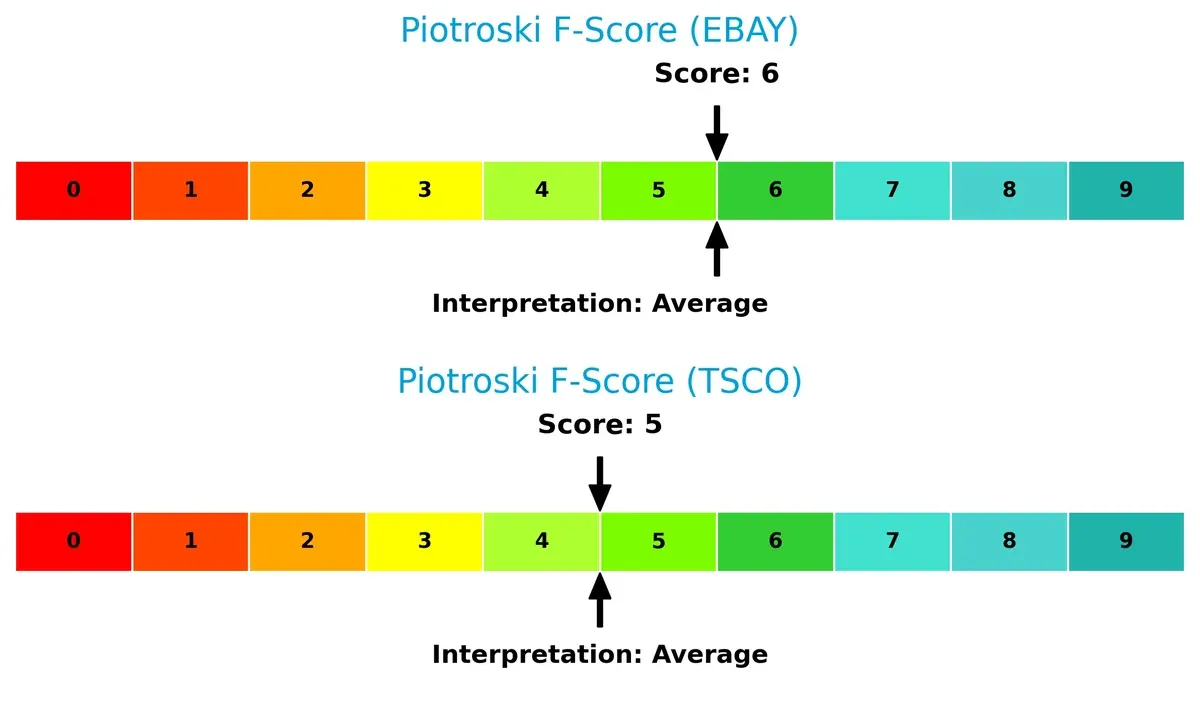

Financial Health: Quality of Operations

With Piotroski scores of 6 for eBay and 5 for Tractor Supply, both firms exhibit average financial health. Neither shows deep red flags, but eBay’s slightly stronger score suggests more robust internal financial controls and profitability metrics:

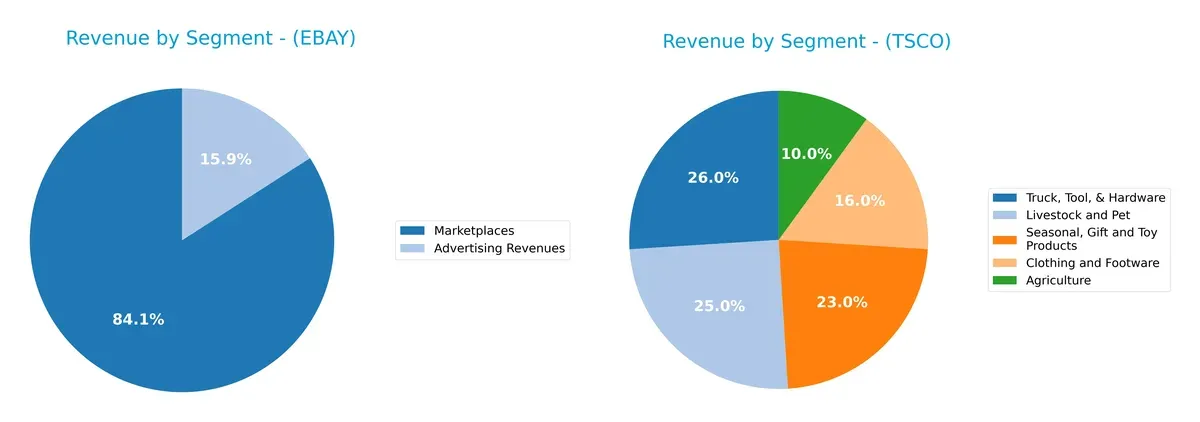

How are the two companies positioned?

This section dissects the operational DNA of eBay and Tractor Supply by comparing their revenue distribution and internal dynamics. The goal is to confront their economic moats and identify which model offers the most resilient, sustainable advantage today.

Revenue Segmentation: The Strategic Mix

This comparison dissects how eBay Inc. and Tractor Supply Company diversify revenues and highlights their dominant sector bets:

eBay anchors its revenue primarily in Marketplaces with $8.65B in 2024, complemented by $1.63B in Advertising. This concentration pivots on digital platform dominance, creating ecosystem lock-in. Tractor Supply diversifies across five segments, with Truck, Tool, & Hardware leading at $3.87B, but Agriculture and Livestock segments also contribute significantly. TSCO’s mix reduces concentration risk but demands managing disparate retail categories. eBay’s focus drives scale; TSCO’s spread demands operational breadth.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of eBay Inc. and Tractor Supply Company based on key financial and market criteria:

eBay Inc. Strengths

- Strong profitability with 19.21% net margin

- High ROE at 38.29%

- Efficient fixed asset turnover at 6.08

- Diverse revenue streams from marketplaces and advertising

- Global presence including US, UK, Germany, China

- Favorable interest coverage ratio at 9.8

Tractor Supply Company Strengths

- High ROE at 42.46%

- Favorable WACC at 6.13% indicating efficient capital use

- Strong asset turnover at 1.42

- Broad product diversification across five segments

- Favorable interest coverage ratio at 21.22

- Consistent dividend yield near 1.84%

eBay Inc. Weaknesses

- Unfavorable high price-to-book ratio at 5.96

- Debt-to-equity ratio elevated at 1.52

- Moderate current ratio at 1.24 limits liquidity cushion

- Neutral WACC at 9.15%

- Neutral asset turnover at 0.53 indicates room for efficiency gains

- Limited segment diversification focused on marketplaces

Tractor Supply Company Weaknesses

- Unfavorable high debt-to-assets at 88.12%

- Very high debt-to-equity ratio at 3.73

- Quick ratio extremely low at 0.16, raising liquidity concerns

- Unfavorable price-to-book ratio at 10.27

- Neutral fixed asset turnover at 2.23

- Net margin moderate at 7.06%

Overall, both companies show slightly favorable financial profiles but differ in capital structure and liquidity. eBay’s strengths lie in profitability and global reach, while Tractor Supply excels in capital efficiency but faces higher leverage and liquidity risk. These factors will shape their strategic priorities in managing growth and financial risk.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only barrier that protects long-term profits from relentless competition erosion. Let’s examine how these two firms defend their turf:

eBay Inc.: Network Effects Powerhouse

eBay’s primary moat stems from powerful network effects connecting millions of buyers and sellers. This drives a high ROIC above WACC by 4.2%, sustaining margin stability. New market expansions could deepen this advantage in 2026.

Tractor Supply Company: Cost-Efficient Rural Retailer

Tractor Supply’s moat relies on cost advantage and specialized rural retail presence. It outperforms WACC by nearly 7%, though its ROIC trend declines, signaling emerging pressures. Expansion into adjacent markets may arrest this slide.

Verdict: Network Effects vs. Cost Leadership

eBay’s growing ROIC and entrenched network effects create a wider, more durable moat than Tractor Supply’s shrinking profitability, despite its higher current ROIC premium. eBay stands better poised to defend market share long term.

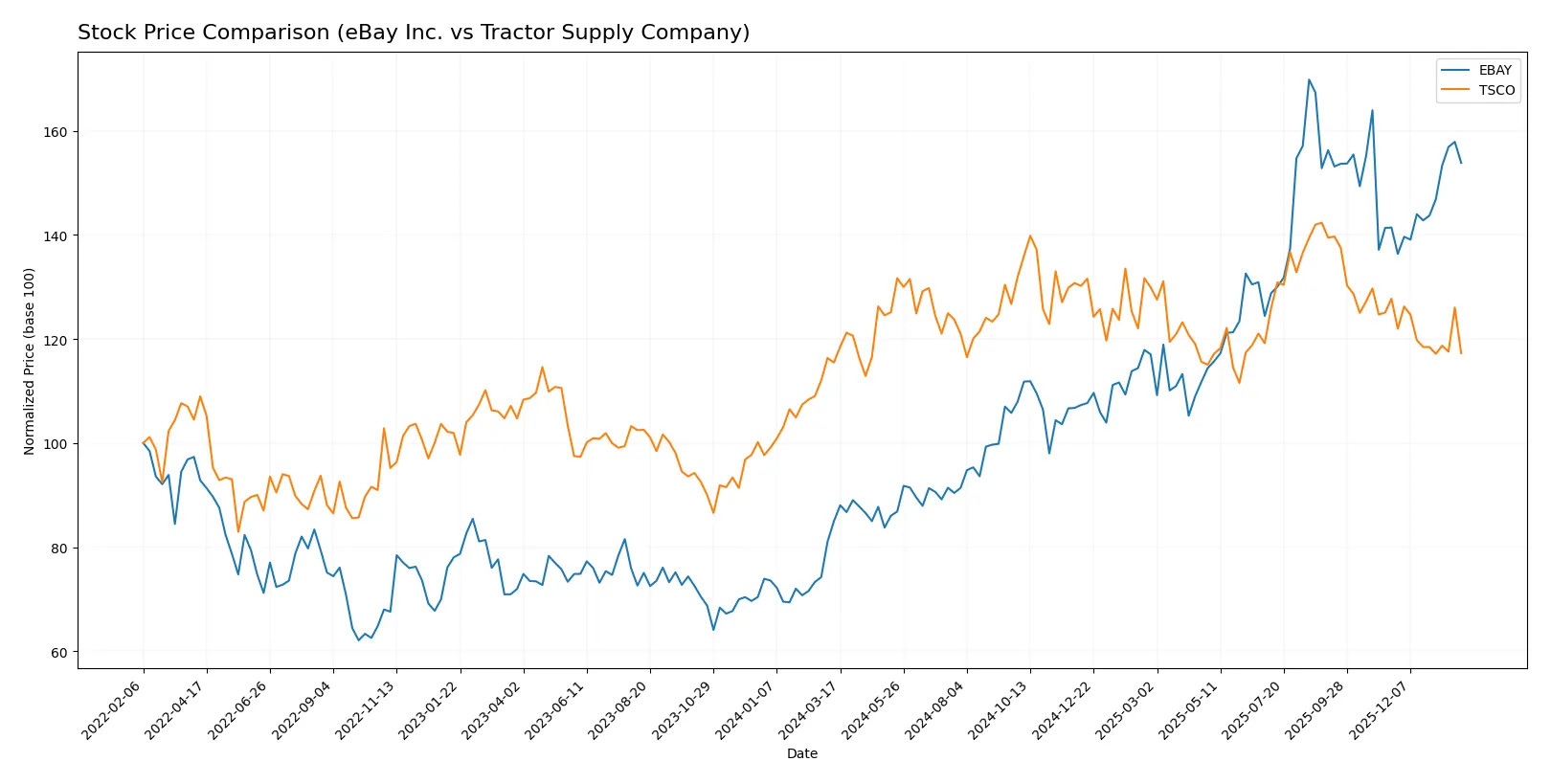

Which stock offers better returns?

The past year reveals strikingly different price dynamics for eBay Inc. and Tractor Supply Company, with eBay showing strong gains amid accelerating momentum, while Tractor Supply’s growth remains subdued and recently reversed.

Trend Comparison

eBay Inc. posted an 81.1% price increase over the past 12 months, marking a bullish trend with accelerating momentum. The stock hit a high of 100.7 and a low of 49.65, with notable volatility (std. dev. 14.17).

Tractor Supply Company’s price rose only 1.56% over the same period, indicating a neutral bullish trend with deceleration. It reached a high of 61.76 and a low of 48.4, showing lower volatility (std. dev. 3.0).

Comparing both, eBay’s stock significantly outperformed Tractor Supply, delivering the highest market returns with sustained acceleration and stronger price appreciation.

Target Prices

Analysts present a well-defined target consensus for both eBay Inc. and Tractor Supply Company.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| eBay Inc. | 65 | 115 | 98 |

| Tractor Supply Company | 50 | 67 | 59 |

The consensus target for eBay at 98 suggests upside from its current price of 91.22. Tractor Supply’s target of 59 also indicates moderate appreciation potential versus its 50.88 share price.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

eBay Inc. Grades

The following table summarizes recent grades from major grading companies for eBay Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citizens | Maintain | Market Outperform | 2026-01-28 |

| Morgan Stanley | Maintain | Overweight | 2026-01-13 |

| Wells Fargo | Maintain | Equal Weight | 2026-01-08 |

| Truist Securities | Maintain | Hold | 2025-11-03 |

| Piper Sandler | Maintain | Overweight | 2025-10-30 |

| Benchmark | Maintain | Buy | 2025-10-30 |

| UBS | Maintain | Neutral | 2025-10-30 |

| Needham | Maintain | Buy | 2025-10-30 |

| Evercore ISI Group | Maintain | In Line | 2025-10-30 |

| Barclays | Maintain | Overweight | 2025-10-30 |

Tractor Supply Company Grades

The following table summarizes recent grades from major grading companies for Tractor Supply Company:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Jefferies | Maintain | Buy | 2026-01-30 |

| JP Morgan | Maintain | Neutral | 2026-01-30 |

| Piper Sandler | Maintain | Overweight | 2026-01-30 |

| Goldman Sachs | Maintain | Buy | 2026-01-30 |

| Mizuho | Maintain | Outperform | 2026-01-30 |

| Morgan Stanley | Maintain | Equal Weight | 2026-01-30 |

| Telsey Advisory Group | Maintain | Outperform | 2026-01-30 |

| TD Cowen | Maintain | Hold | 2026-01-30 |

| DA Davidson | Maintain | Buy | 2026-01-30 |

| Telsey Advisory Group | Maintain | Outperform | 2026-01-29 |

Which company has the best grades?

Tractor Supply Company holds a stronger consensus with multiple “Buy” and “Outperform” ratings compared to eBay’s mixed “Buy,” “Overweight,” and “Hold” grades. Investors may perceive TSCO as having a more favorable outlook based on recent institutional assessments.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

eBay Inc.

- Faces intense e-commerce competition from giants and niche platforms, pressuring market share and margins.

Tractor Supply Company

- Competes in rural retail with limited online presence, but benefits from specialized product offerings and loyal customer base.

2. Capital Structure & Debt

eBay Inc.

- Moderate leverage with D/E of 1.52; interest coverage of 9.8 signals manageable debt risk.

Tractor Supply Company

- High leverage with D/E of 3.73 and debt-to-assets at 88.1%; riskier capital structure despite strong interest coverage of 21.2.

3. Stock Volatility

eBay Inc.

- Beta of 1.35 indicates above-market volatility, reflecting sensitivity to tech and retail cycles.

Tractor Supply Company

- Beta of 0.74 suggests below-market volatility, supporting steadier price movements amid retail sector fluctuations.

4. Regulatory & Legal

eBay Inc.

- Exposed to e-commerce regulations and data privacy laws; international operations add complexity.

Tractor Supply Company

- Mostly subject to U.S. retail regulations and environmental compliance; lower regulatory complexity than eBay.

5. Supply Chain & Operations

eBay Inc.

- Relies on digital platform stability and third-party sellers; sensitive to cyber risks and platform disruptions.

Tractor Supply Company

- Dependent on physical supply chains for rural products; vulnerable to logistics disruptions and inventory management challenges.

6. ESG & Climate Transition

eBay Inc.

- Faces pressure to improve sustainability in packaging and energy use, plus social governance of platform practices.

Tractor Supply Company

- Needs to address sustainable sourcing and environmental impact of agricultural products; ESG metrics less scrutinized but rising in importance.

7. Geopolitical Exposure

eBay Inc.

- Global footprint exposes it to geopolitical risks, trade tensions, and currency fluctuations.

Tractor Supply Company

- Primarily U.S.-focused, limiting direct geopolitical risks but sensitive to domestic policy changes affecting agriculture and retail.

Which company shows a better risk-adjusted profile?

eBay’s biggest risk lies in fierce market competition and platform dependency, while Tractor Supply confronts high leverage risks. Despite eBay’s higher volatility, its safer debt profile and global diversification offer a more balanced risk-adjusted outlook. Tractor Supply’s elevated debt and lower liquidity ratios raise caution.

The standout concern for eBay is intense competitive pressure impacting future growth. For Tractor Supply, excessive debt to assets ratio signals financial vulnerability. eBay’s Altman Z-Score of 6.1 versus Tractor Supply’s 4.9 confirms stronger financial stability.

Final Verdict: Which stock to choose?

eBay Inc. leverages a durable competitive advantage with a strong and growing return on invested capital. Its superpower lies in operational efficiency and robust profitability, despite a point of vigilance regarding elevated leverage ratios. It suits investors aiming for aggressive growth tempered by calculated risk.

Tractor Supply Company’s strategic moat stems from its solid asset turnover and consistent value creation, albeit with a declining ROIC trend. Its safety profile appears weaker than eBay’s, marked by high debt levels and margin pressures. It aligns better with portfolios favoring growth at a reasonable price and income stability.

If you prioritize durable profitability and operational efficiency, eBay outshines Tractor Supply due to its expanding moat and healthier financial leverage. However, if you seek steadier cash flow generation with moderate growth, Tractor Supply offers better stability, though with increased financial risk. Each choice reflects distinct investor risk tolerances and strategic goals.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of eBay Inc. and Tractor Supply Company to enhance your investment decisions: