Investors seeking opportunities in the packaged foods sector face intriguing choices, notably between The Kraft Heinz Company and The Magnum Ice Cream Company N.V. Both players operate in the consumer defensive industry but focus on distinct yet overlapping markets: Kraft Heinz with diversified food products and Magnum specializing in premium ice cream. Their innovation strategies and market presence make this comparison essential. In this article, I will help you decide which company stands out as the more compelling investment in 2026.

Table of contents

Companies Overview

I will begin the comparison between The Kraft Heinz Company and The Magnum Ice Cream Company N.V. by providing an overview of these two companies and their main differences.

The Kraft Heinz Company Overview

The Kraft Heinz Company is a leading global food and beverage manufacturer headquartered in Pittsburgh, PA. Founded in 1869, it produces a diverse portfolio of products including condiments, cheeses, meals, meats, and beverages. Its distribution spans multiple channels such as grocery stores, foodservice institutions, and e-commerce platforms, positioning it as a key player in the packaged foods industry with a market cap of 27.7B USD.

The Magnum Ice Cream Company N.V. Overview

The Magnum Ice Cream Company N.V., based in Amsterdam, Netherlands, specializes exclusively in the ice cream sector. It operates within the packaged foods industry and employs about 18,582 people. Although younger, having gone public in December 2025, it focuses on a niche market with a market cap of approximately 9.3B USD, under the leadership of CEO Peter Frank Ter Kulve.

Key similarities and differences

Both companies operate in the consumer defensive sector within packaged foods, but their business models differ notably. Kraft Heinz offers a broad product range across multiple food categories and global distribution channels, while Magnum concentrates solely on ice cream products. Kraft Heinz’s mature market presence contrasts with Magnum’s newer status and specific product focus, reflecting different strategic approaches and market scopes.

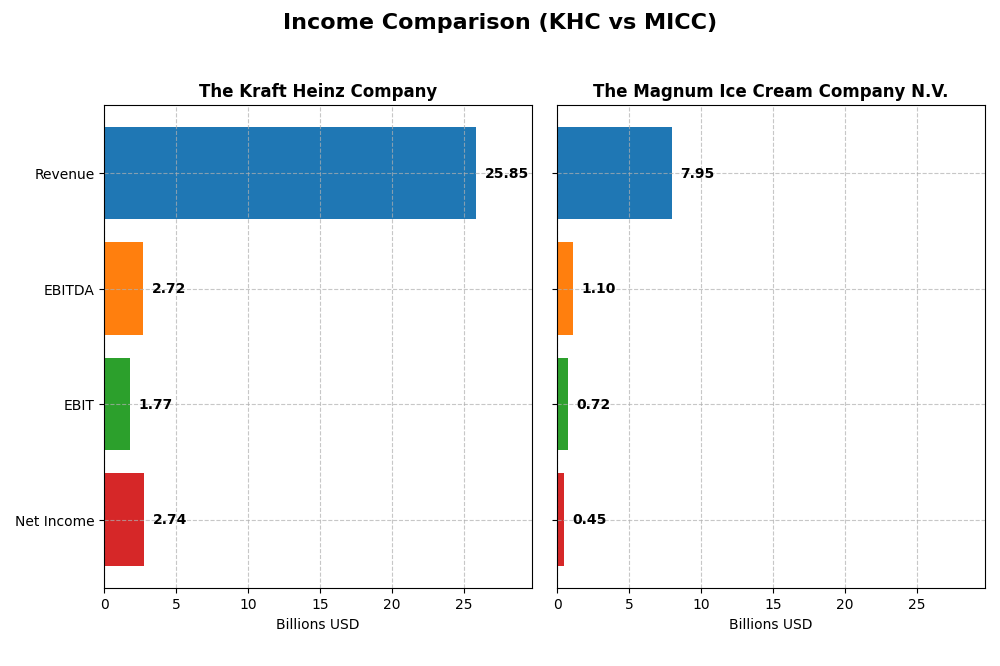

Income Statement Comparison

This table presents a side-by-side comparison of key income statement metrics for The Kraft Heinz Company and The Magnum Ice Cream Company N.V. for the fiscal year 2024.

| Metric | The Kraft Heinz Company (KHC) | The Magnum Ice Cream Company N.V. (MICC) |

|---|---|---|

| Market Cap | 27.7B USD | 9.3B EUR |

| Revenue | 25.8B USD | 7.9B EUR |

| EBITDA | 2.7B USD | 1.1B EUR |

| EBIT | 1.8B USD | 725M EUR |

| Net Income | 2.7B USD | 450M EUR |

| EPS | 2.27 USD | 0.74 EUR |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

The Kraft Heinz Company

The Kraft Heinz Company’s revenue showed a slight decline over 2020-2024, with a 1.29% overall drop and a 2.98% decrease in the latest year. Net income grew significantly by 670.79% over the period, though it fell 3% in 2024. Margins remain generally stable, with a favorable gross margin of 34.7% and net margin of 10.62%, despite a 61.1% EBIT decline last year.

The Magnum Ice Cream Company N.V.

Magnum Ice Cream’s revenue increased moderately by 5.88% from 2022 to 2024, with a 4.32% rise in the latest year. Net income declined by 11.59% overall and 8% last year. Gross margin is favorable at 34.91%, but net margin fell to 5.66%, reflecting pressure on profitability. EBIT margin is steady at 9.12%, with mixed signals in operational expense trends.

Which one has the stronger fundamentals?

Kraft Heinz shows stronger fundamentals with a significant net income growth and favorable margins, despite recent revenue pressure and EBIT decline. Magnum Ice Cream’s revenue growth is neutral but offset by declines in net income and margins. Kraft Heinz’s more favorable interest expense and net margin metrics support a comparatively stronger income statement profile.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for The Kraft Heinz Company (KHC) and The Magnum Ice Cream Company N.V. (MICC) based on their most recent fiscal year data.

| Ratios | The Kraft Heinz Company (KHC) | The Magnum Ice Cream Company N.V. (MICC) |

|---|---|---|

| ROE | 5.58% | 16.20% |

| ROIC | 6.61% | 16.42% |

| P/E | 13.53 | 19.60 |

| P/B | 0.75 | 3.18 |

| Current Ratio | 1.06 | 0.80 |

| Quick Ratio | 0.59 | 0.35 |

| D/E (Debt-to-Equity) | 0.40 | 0.07 |

| Debt-to-Assets | 22.51% | 3.41% |

| Interest Coverage | 1.85 | 5.18 |

| Asset Turnover | 0.29 | 1.44 |

| Fixed Asset Turnover | 3.61 | 3.37 |

| Payout Ratio | 70.37% | 2.44% |

| Dividend Yield | 5.20% | 0.12% |

Interpretation of the Ratios

The Kraft Heinz Company

KHC shows a mixed ratio profile with favorable net margin (10.62%) and valuation metrics like P/E (13.53) and P/B (0.75), but weaker returns on equity (5.58%) and asset turnover (0.29). Liquidity ratios are neutral to unfavorable, with a quick ratio at 0.59. The company pays a dividend yielding 5.2%, supported moderately but with some risk from coverage and interest burden.

The Magnum Ice Cream Company N.V.

MICC presents generally strong profitability ratios, including a favorable ROE (16.2%) and ROIC (16.42%), with solid asset turnover (1.44). However, liquidity appears weak, with a current ratio of 0.8 and a quick ratio of 0.35. MICC does not pay dividends, likely prioritizing reinvestment or growth, as indicated by its low dividend yield (0.12%) and favorable debt metrics.

Which one has the best ratios?

MICC holds a slightly stronger overall ratio profile with higher returns and better asset efficiency, despite weaker liquidity and no dividends. KHC offers a stable dividend and attractive valuation but faces challenges in profitability and liquidity. Both companies have roughly similar unfavorable ratio proportions, but MICC’s favorable profitability and capital structure give it an edge in this comparison.

Strategic Positioning

This section compares the strategic positioning of The Kraft Heinz Company and The Magnum Ice Cream Company N.V., including market position, key segments, and exposure to disruption:

The Kraft Heinz Company

- Large market cap with broad competition in packaged foods industry

- Diversified product portfolio: condiments, cheese, meals, snacks, coffee, beverages

- No explicit data on technological disruption exposure

The Magnum Ice Cream Company N.V.

- Smaller market cap focused exclusively on ice cream segment

- Concentrated business model focused solely on ice cream sales

- No explicit data on technological disruption exposure

The Kraft Heinz Company vs The Magnum Ice Cream Company N.V. Positioning

KHC adopts a diversified approach across multiple food categories, offering broad market reach but facing varied competitive pressures. MICC’s concentrated ice cream focus narrows risk but limits segment diversification and growth drivers.

Which has the best competitive advantage?

KHC shows a very favorable moat with growing ROIC indicating durable competitive advantages. MICC has a favorable moat with stable ROIC, reflecting consistent but less dynamic profitability compared to KHC.

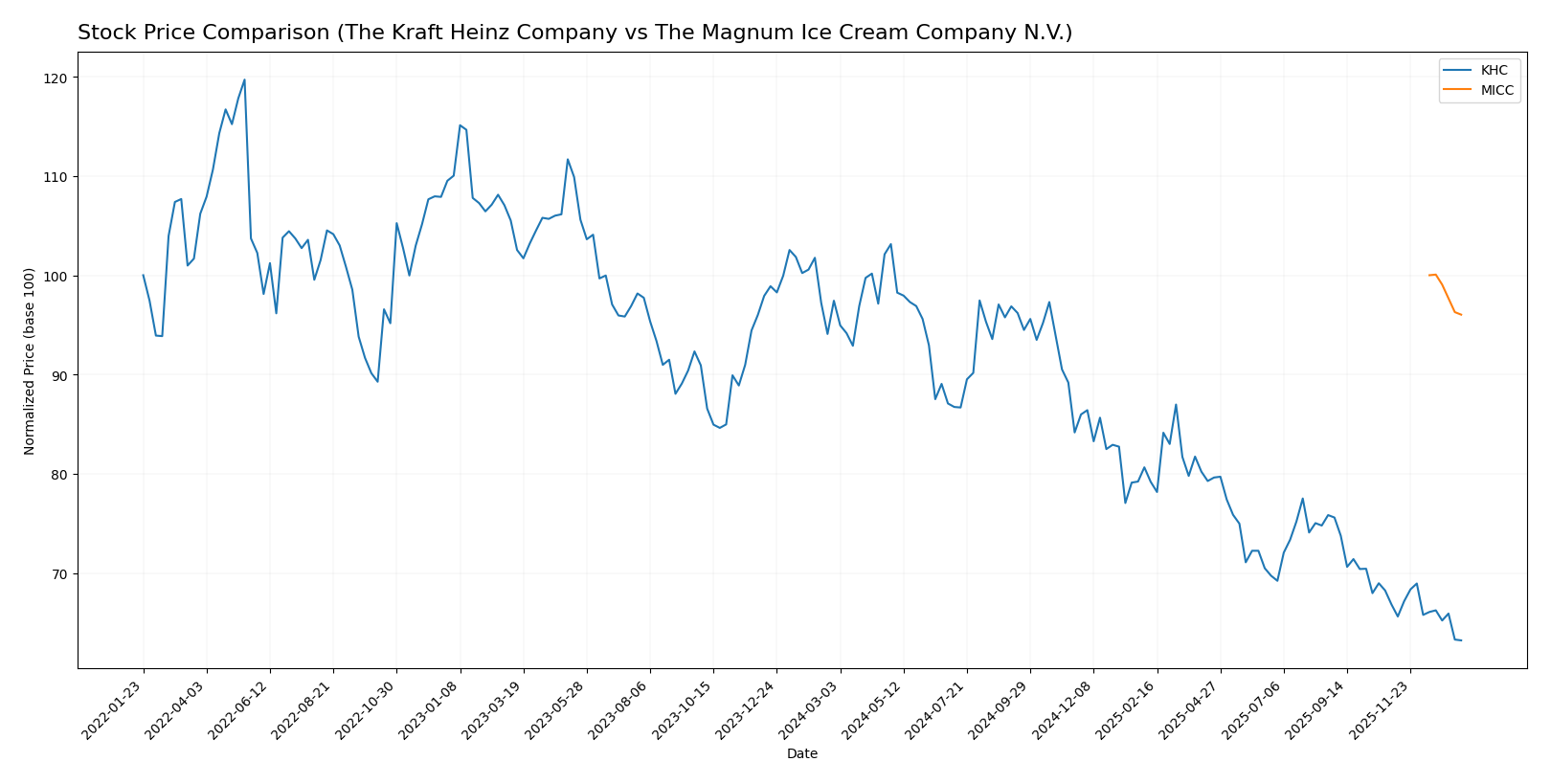

Stock Comparison

The stock prices of The Kraft Heinz Company and The Magnum Ice Cream Company N.V. have shown notable bearish movements over the past 12 months, with distinct volatility and trading volume patterns reflecting diverging investor sentiments.

Trend Analysis

The Kraft Heinz Company (KHC) experienced a significant bearish trend over the past year, with a price decline of -35.12%. This decline accelerated, reaching a low of 23.39 and a high of 38.16, accompanied by a notable volatility of 4.13.

The Magnum Ice Cream Company N.V. (MICC) also showed a bearish trend, with a smaller price decline of -3.97% over the same period. The trend remained stable, fluctuating between 15.24 and 15.88, with lower volatility at 0.26.

Comparing the two, KHC’s stock showed a much steeper decline and higher volatility than MICC, indicating a weaker market performance for Kraft Heinz over the past year.

Target Prices

Analysts present a moderately optimistic consensus on target prices for these companies based on recent evaluations.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| The Kraft Heinz Company | 28 | 24 | 26.29 |

| The Magnum Ice Cream Company N.V. | 16 | 16 | 16 |

The Kraft Heinz Company’s consensus target price of 26.29 suggests a potential upside from its current price of 23.39 USD, indicating cautious optimism. The Magnum Ice Cream Company’s fixed target at 16 USD slightly exceeds its current price of 15.24 USD, showing modest growth expectations.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for The Kraft Heinz Company and The Magnum Ice Cream Company N.V.:

Rating Comparison

KHC Rating

- Rating: B-, considered Very Favorable.

- Discounted Cash Flow Score: 5, Very Favorable, indicating strong future cash flow potential.

- ROE Score: 1, Very Unfavorable, suggesting low efficiency in generating profit from equity.

- ROA Score: 1, Very Unfavorable, reflecting poor asset utilization.

- Debt To Equity Score: 3, Moderate, implying balanced financial risk.

- Overall Score: 3, Moderate overall financial standing.

MICC Rating

- Rating: B-, considered Very Favorable.

- Discounted Cash Flow Score: 1, Very Unfavorable, showing weak cash flow outlook.

- ROE Score: 5, Very Favorable, indicating high efficiency in profit generation.

- ROA Score: 4, Favorable, showing effective asset use.

- Debt To Equity Score: 1, Very Unfavorable, indicating higher financial risk.

- Overall Score: 3, Moderate overall financial standing.

Which one is the best rated?

Both companies share the same overall rating of B- and moderate overall scores. KHC excels in discounted cash flow and debt management, while MICC outperforms in returns on equity and assets but shows higher financial risk.

Scores Comparison

The following table compares the Altman Z-Score and Piotroski Score of The Kraft Heinz Company and The Magnum Ice Cream Company N.V.:

KHC Scores

- Altman Z-Score: 0.44, classified in the distress zone.

- Piotroski Score: 6, indicating average financial strength.

MICC Scores

- No data available.

- No data available.

Which company has the best scores?

Based on the available data, only KHC has reported scores, showing financial distress with a low Altman Z-Score and moderate Piotroski Score. MICC’s scores are unavailable, preventing direct comparison.

Grades Comparison

Here is the grades comparison for The Kraft Heinz Company and The Magnum Ice Cream Company N.V.:

The Kraft Heinz Company Grades

The table below shows recent grades assigned by major financial institutions to The Kraft Heinz Company:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Maintain | Neutral | 2025-12-15 |

| Barclays | Maintain | Equal Weight | 2025-10-31 |

| JP Morgan | Maintain | Neutral | 2025-10-30 |

| UBS | Maintain | Neutral | 2025-10-30 |

| TD Cowen | Maintain | Hold | 2025-10-30 |

| Evercore ISI Group | Maintain | In Line | 2025-10-30 |

| Piper Sandler | Maintain | Neutral | 2025-10-30 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-30 |

| Mizuho | Maintain | Neutral | 2025-10-28 |

| UBS | Maintain | Neutral | 2025-10-08 |

Overall, grades for The Kraft Heinz Company remain consistently neutral to hold, reflecting a cautious but stable market view.

The Magnum Ice Cream Company N.V. has no available reliable grades or consensus data.

Which company has the best grades?

The Kraft Heinz Company has received multiple neutral and hold grades from reputable institutions, indicating a moderate risk profile and steady outlook. The Magnum Ice Cream Company N.V. lacks any grading data, limiting comparative analysis and suggesting higher uncertainty for investors.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for The Kraft Heinz Company (KHC) and The Magnum Ice Cream Company N.V. (MICC) based on the most recent financial and strategic data.

| Criterion | The Kraft Heinz Company (KHC) | The Magnum Ice Cream Company N.V. (MICC) |

|---|---|---|

| Diversification | Highly diversified product portfolio across multiple food categories generating over $11B in Taste Elevation segment alone. | Focused on ice cream segment; less diversified product range. |

| Profitability | Net margin at 10.62% (favorable), ROIC neutral at 6.61%, stable dividend yield of 5.2%. | Moderate net margin at 5.66%, strong ROIC at 16.42%, but very low dividend yield (0.12%). |

| Innovation | Moderate innovation with stable product categories; some segments like Coffee and Desserts stable but less dynamic. | Innovation implied by strong ROIC and asset turnover, but limited product expansion. |

| Global presence | Strong global presence with broad market penetration across multiple food categories. | Competitive advantage with stable profitability but smaller global footprint. |

| Market Share | Large market share in multiple food segments but facing intense competition and slower growth. | Smaller market share but strong niche positioning in premium ice cream. |

Key takeaways: KHC offers strong diversification and solid profitability with a very favorable economic moat supported by growing ROIC, though some liquidity and efficiency ratios are less favorable. MICC delivers higher profitability ratios and a favorable moat but lacks diversification and has a concentrated market focus, which increases risk exposure. Investors should weigh KHC’s stability and size against MICC’s growth efficiency and niche strength.

Risk Analysis

Below is a comparative table highlighting key risk factors for The Kraft Heinz Company (KHC) and The Magnum Ice Cream Company N.V. (MICC) based on the most recent data for 2024.

| Metric | The Kraft Heinz Company (KHC) | The Magnum Ice Cream Company N.V. (MICC) |

|---|---|---|

| Market Risk | Low beta (0.065) indicates low volatility | Beta 0, very low volatility |

| Debt level | Moderate debt-to-equity (0.4), interest coverage low (1.94) | Very low debt level (0.07), strong interest coverage (5.11) |

| Regulatory Risk | US and international food regulations, moderate risk | EU food regulations, moderate risk |

| Operational Risk | Large scale operations with 36K employees; moderate asset turnover (0.29) | Smaller scale (18.5K employees), higher asset turnover (1.44) |

| Environmental Risk | Food industry sustainability pressures, moderate | Ice cream sector, moderate to high due to dairy sourcing |

| Geopolitical Risk | Exposure to US, Canada, UK markets; moderate | Primarily European exposure; moderate |

The most impactful risks are operational inefficiencies and debt service capacity for KHC, as indicated by its low interest coverage and asset turnover. MICC shows stronger financial stability with low debt but faces typical EU regulatory and environmental pressures. Geopolitical exposure remains moderate for both but warrants monitoring amid global trade uncertainties.

Which Stock to Choose?

The Kraft Heinz Company (KHC) shows a mixed income evolution with overall net income growth of 671% over 2020-2024 but recent yearly declines in revenue and EBIT. Its financial ratios are slightly favorable, with a 10.62% net margin, 5.58% ROE, and low debt levels, though some liquidity and efficiency ratios are weaker. The company’s rating is very favorable overall, supported by a very favorable moat indicating durable competitive advantage and growing profitability.

The Magnum Ice Cream Company N.V. (MICC) presents a neutral to unfavorable income evolution, with modest revenue growth but declines in net income and margins over 2022-2024. Its financial ratios are generally favorable, including strong ROE of 16.2%, high ROIC, and low debt, offset by weaker liquidity and valuation metrics. MICC’s rating is also very favorable, with a favorable moat reflecting stable profitability but no ROIC growth trend.

For investors prioritizing stable and durable competitive advantages with a slightly favorable financial ratio profile, KHC might appear more suitable given its growing profitability and very favorable moat. Conversely, those focusing on higher returns on equity and invested capital with a more stable profitability trend might find MICC’s financial ratios and favorable moat appealing despite some valuation and income challenges.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of The Kraft Heinz Company and The Magnum Ice Cream Company N.V. to enhance your investment decisions: