In the dynamic healthcare sector, West Pharmaceutical Services, Inc. (WST) and The Cooper Companies, Inc. (COO) stand out as influential players specializing in medical instruments and supplies. Both companies innovate across overlapping markets, from drug delivery systems to vision care and women’s health. This comparison will dissect their strategies and market positions to help you identify which company offers the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between West Pharmaceutical Services, Inc. and The Cooper Companies, Inc. by providing an overview of these two companies and their main differences.

West Pharmaceutical Services, Inc. Overview

West Pharmaceutical Services, Inc. designs, manufactures, and sells containment and delivery systems for injectable drugs and healthcare products globally. Operating through Proprietary Products and Contract-Manufactured Products segments, it serves pharmaceutical and medical device companies with components, devices, and integrated solutions that enhance drug delivery safety and packaging quality. Founded in 1923, West is headquartered in Exton, Pennsylvania.

The Cooper Companies, Inc. Overview

The Cooper Companies, Inc. develops, manufactures, and markets products for contact lens wearers and family health care through its CooperVision and CooperSurgical segments. It offers vision correction lenses and medical devices focused on fertility, genomics, and women’s health worldwide. Founded in 1958 and based in San Ramon, California, Cooper operates in multiple international markets with a broad healthcare product portfolio.

Key similarities and differences

Both companies operate in the healthcare sector within the medical instruments and supplies industry, serving global markets with specialized medical products. West focuses primarily on injectable drug delivery and packaging systems, while Cooper offers contact lenses and women’s health products. Their business models emphasize innovation and manufacturing, but their end markets and product types differ, with West targeting pharmaceutical companies and Cooper serving vision and reproductive health needs.

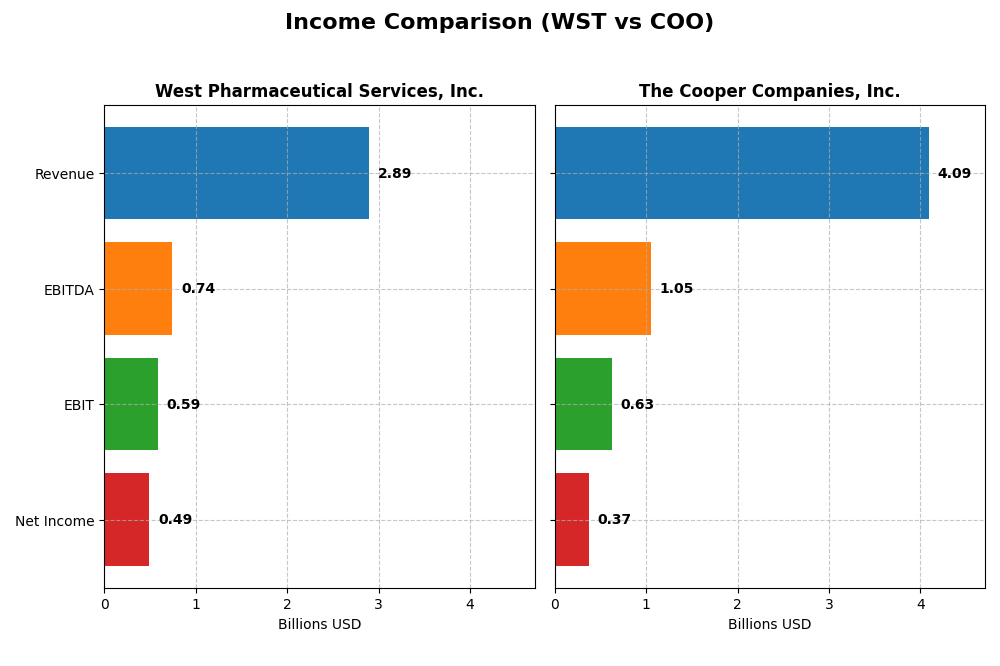

Income Statement Comparison

Below is a side-by-side comparison of key income statement metrics for West Pharmaceutical Services, Inc. (WST) and The Cooper Companies, Inc. (COO) for their most recent fiscal years.

| Metric | West Pharmaceutical Services, Inc. (WST) | The Cooper Companies, Inc. (COO) |

|---|---|---|

| Market Cap | 19.8B | 16.6B |

| Revenue | 2.89B | 4.09B |

| EBITDA | 744M | 1.05B |

| EBIT | 588M | 630M |

| Net Income | 493M | 375M |

| EPS | 6.75 | 1.87 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

West Pharmaceutical Services, Inc.

West Pharmaceutical Services showed overall revenue growth of 34.75% and net income growth of 42.32% over the 2020-2024 period. Margins remained favorable, with a gross margin of 34.65% and net margin of 17.03%. However, in 2024, revenue declined by 1.98% and net income fell 15.29%, indicating a recent slowdown despite generally strong fundamentals.

The Cooper Companies, Inc.

The Cooper Companies experienced a 40.03% revenue increase from 2021 to 2025, but net income declined sharply by 87.27% over the same period. Gross margin remained high at 60.67%, but net margin dropped to 9.16%. The latest year showed a modest 5.06% revenue rise but a 9.04% decrease in net margin, reflecting challenges in profitability despite revenue gains.

Which one has the stronger fundamentals?

West Pharmaceutical Services exhibits stronger overall fundamentals with consistent margin stability and positive net income growth over the medium term, despite recent declines. The Cooper Companies, while showing revenue expansion, has suffered significant net income and margin erosion, undermining profitability. Thus, West Pharmaceutical Services presents a more favorable income statement profile based on the data.

Financial Ratios Comparison

The table below compares key financial ratios for West Pharmaceutical Services, Inc. (WST) and The Cooper Companies, Inc. (COO) based on the most recent fiscal year data available.

| Ratios | West Pharmaceutical Services, Inc. (WST) (2024) | The Cooper Companies, Inc. (COO) (2025) |

|---|---|---|

| ROE | 18.37% | N/A |

| ROIC | 15.69% | N/A |

| P/E | 48.53 | 37.30 |

| P/B | 8.91 | N/A |

| Current Ratio | 2.79 | 0.00 |

| Quick Ratio | 2.11 | 0.00 |

| D/E (Debt-to-Equity) | 0.11 | 0.00 |

| Debt-to-Assets | 8.38% | 0.00 |

| Interest Coverage | 205.03 | 6.83 |

| Asset Turnover | 0.79 | 0.00 |

| Fixed Asset Turnover | 1.72 | 0.00 |

| Payout ratio | 12.00% | 0.00 |

| Dividend yield | 0.25% | 0.00% |

Note: Some ratios for The Cooper Companies, Inc. (COO) in 2025 are reported as zero or unavailable.

Interpretation of the Ratios

West Pharmaceutical Services, Inc.

West Pharmaceutical Services shows strong financial health with favorable net margin (17.03%), ROE (18.37%), and ROIC (15.69%), alongside solid liquidity ratios and low leverage. However, high valuation metrics like PE (48.53) and PB (8.91) raise some concerns about price levels. The company pays a modest dividend with a low yield (0.25%), indicating cautious shareholder returns supported by free cash flow.

The Cooper Companies, Inc.

The Cooper Companies presents mixed ratios; net margin (9.16%) is neutral, but returns on equity and invested capital are unfavorable at zero, suggesting recent profitability challenges. Liquidity ratios are missing or unfavorable, hinting at potential short-term risks. The company does not pay dividends, likely due to reinvestment strategies or operational constraints, with no current buyback programs reported.

Which one has the best ratios?

West Pharmaceutical Services holds a more favorable ratio profile, demonstrating robust profitability, strong liquidity, and manageable debt levels despite some valuation concerns. Conversely, The Cooper Companies faces multiple unfavorable ratios and lacks dividend payouts, reflecting weaker financial fundamentals. Overall, West Pharmaceutical Services appears stronger based on the ratio evaluations.

Strategic Positioning

This section compares the strategic positioning of West Pharmaceutical Services, Inc. and The Cooper Companies, Inc., including their market position, key segments, and exposure to technological disruption:

West Pharmaceutical Services, Inc.

- Established leader in injectable drug containment, facing moderate competition.

- Key segments: Proprietary Products (stoppers, seals, delivery systems) and Contract-Manufactured Products for pharmaceuticals and medical devices.

- Exposure to disruption through advanced drug delivery technologies and integrated lab and regulatory services.

The Cooper Companies, Inc.

- Strong presence in vision care and women’s health, with competitive pressures.

- Key segments: CooperVision contact lenses and CooperSurgical family and women’s healthcare products.

- Exposure via innovation in contact lenses and fertility/genomics medical devices.

West Pharmaceutical Services, Inc. vs The Cooper Companies, Inc. Positioning

West Pharma is diversified across proprietary and contract manufacturing products, focusing on injectable drug delivery, while Cooper Companies concentrate on vision care and women’s health. West Pharma’s integrated solutions contrast with Cooper’s focus on distinct healthcare niches.

Which has the best competitive advantage?

West Pharmaceutical Services shows a very favorable moat with growing ROIC and value creation, indicating a durable competitive advantage. The Cooper Companies exhibit a very unfavorable moat with declining ROIC and value destruction.

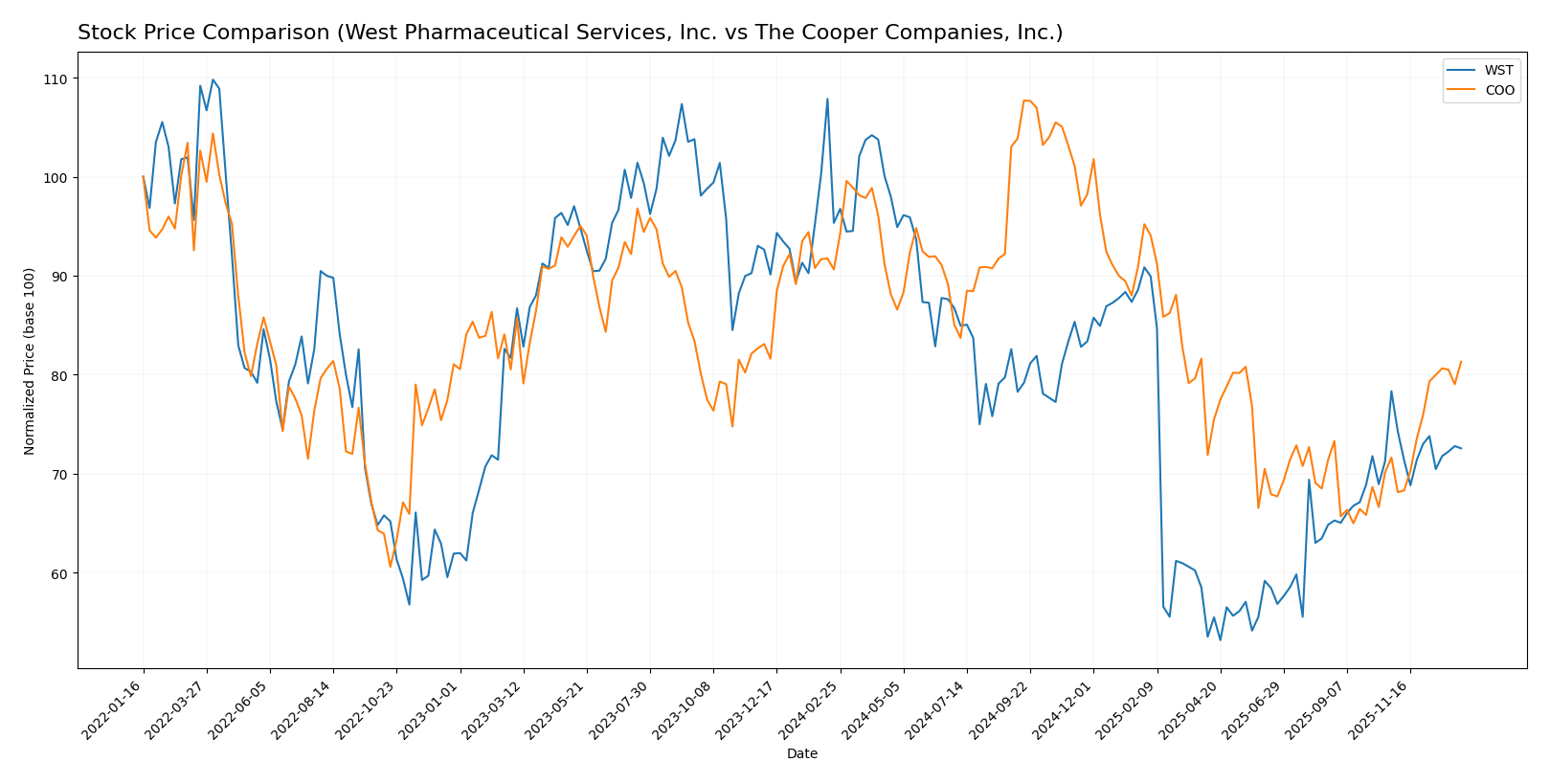

Stock Comparison

The stock prices of West Pharmaceutical Services, Inc. (WST) and The Cooper Companies, Inc. (COO) have experienced notable shifts over the past 12 months, with both exhibiting bearish overall trends but divergent recent performances.

Trend Analysis

West Pharmaceutical Services, Inc. (WST) shows a bearish trend with a -23.9% price change over the past year, accompanied by accelerating decline and high volatility, ranging between 201.9 and 395.71.

The Cooper Companies, Inc. (COO) also presents a bearish trend with a -10.27% yearly decline but recent acceleration upwards with a 13.52% gain over the last few months and lower volatility than WST.

Comparing both, COO delivered higher market performance recently, reversing its yearly losses, while WST continued to decline, marking COO as the stronger stock over the analyzed period.

Target Prices

The current analyst consensus provides a clear outlook on the target prices for West Pharmaceutical Services, Inc. and The Cooper Companies, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| West Pharmaceutical Services, Inc. | 390 | 285 | 335.17 |

| The Cooper Companies, Inc. | 100 | 73 | 90.88 |

Analysts expect West Pharmaceutical Services’ stock to appreciate significantly from its current price of 275.52, with a consensus target of 335.17. The Cooper Companies also shows upside potential, with targets well above the current 83.45 price, indicating positive market sentiment.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for West Pharmaceutical Services, Inc. (WST) and The Cooper Companies, Inc. (COO):

Rating Comparison

WST Rating

- Rating: B+, classified as Very Favorable

- Discounted Cash Flow Score: 3, Moderate valuation view

- ROE Score: 4, indicating favorable profit efficiency

- ROA Score: 5, very favorable asset utilization

- Debt To Equity Score: 3, moderate financial risk

- Overall Score: 3, moderate overall financial standing

COO Rating

- Rating: B, classified as Very Favorable

- Discounted Cash Flow Score: 4, Favorable valuation view

- ROE Score: 3, indicating moderate profit efficiency

- ROA Score: 3, moderate asset utilization

- Debt To Equity Score: 2, moderate financial risk

- Overall Score: 3, moderate overall financial standing

Which one is the best rated?

Based strictly on the provided data, WST holds a higher overall rating (B+) compared to COO’s B rating. WST scores better in ROE and ROA, while COO has a slightly better discounted cash flow score. Both have moderate overall scores.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for both companies:

WST Scores

- Altman Z-Score: 14.29, indicating a safe zone, low bankruptcy risk.

- Piotroski Score: 6, reflecting average financial strength.

COO Scores

- Altman Z-Score: 2.82, in grey zone, moderate bankruptcy risk.

- Piotroski Score: 7, showing strong financial health.

Which company has the best scores?

Based on the scores provided, WST has a much stronger Altman Z-Score indicating lower bankruptcy risk, while COO shows a higher Piotroski Score reflecting better financial strength. Both scores highlight different strengths for each company.

Grades Comparison

The following is a comparison of the recent grades provided by reputable financial institutions for both companies:

West Pharmaceutical Services, Inc. Grades

This table summarizes the latest grades assigned by recognized grading companies to West Pharmaceutical Services, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Equal Weight | 2025-10-27 |

| UBS | Maintain | Buy | 2025-10-24 |

| Keybanc | Maintain | Overweight | 2025-10-24 |

| Evercore ISI Group | Maintain | Outperform | 2025-10-23 |

| Barclays | Maintain | Equal Weight | 2025-10-02 |

| UBS | Maintain | Buy | 2025-07-25 |

| Barclays | Maintain | Equal Weight | 2025-07-25 |

| Evercore ISI Group | Maintain | Outperform | 2025-07-25 |

| Keybanc | Maintain | Overweight | 2025-02-14 |

| B of A Securities | Maintain | Buy | 2024-12-13 |

The overall trend for West Pharmaceutical Services, Inc. shows consistent positive ratings, mainly Buy, Overweight, and Outperform, with Barclays maintaining Equal Weight.

The Cooper Companies, Inc. Grades

This table summarizes the latest grades assigned by recognized grading companies to The Cooper Companies, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Equal Weight | 2025-12-08 |

| Citigroup | Maintain | Neutral | 2025-12-08 |

| Goldman Sachs | Maintain | Sell | 2025-12-08 |

| Wells Fargo | Maintain | Equal Weight | 2025-12-05 |

| Stifel | Maintain | Buy | 2025-12-05 |

| Baird | Maintain | Outperform | 2025-12-05 |

| JP Morgan | Maintain | Neutral | 2025-12-05 |

| Mizuho | Maintain | Outperform | 2025-12-05 |

| Piper Sandler | Maintain | Overweight | 2025-12-05 |

| Needham | Maintain | Buy | 2025-12-05 |

The Cooper Companies, Inc. exhibits a mixed rating pattern with several Buy, Outperform, and Overweight grades but also includes Neutral and a Sell rating from Goldman Sachs.

Which company has the best grades?

West Pharmaceutical Services, Inc. generally receives more consistently positive grades, mainly Buy and Outperform, while The Cooper Companies, Inc. has a broader range including Neutral and one Sell rating. This may indicate more stable analyst confidence in West Pharmaceutical Services, Inc., potentially affecting investor sentiment differently for both companies.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for West Pharmaceutical Services, Inc. (WST) and The Cooper Companies, Inc. (COO) based on the most recent financial and strategic data.

| Criterion | West Pharmaceutical Services, Inc. (WST) | The Cooper Companies, Inc. (COO) |

|---|---|---|

| Diversification | Moderate; revenue split mainly between proprietary products (2.33B) and contract manufactured products (559M) | Moderate; two main segments, Coopervision (2.74B) and Coopersurgical (1.35B) |

| Profitability | High; net margin 17.03%, ROIC 15.69%, ROE 18.37%, creating value with growing ROIC | Low; net margin 9.16%, ROIC and ROE at 0%, destroying value with declining ROIC |

| Innovation | Strong; durable competitive advantage with increasing profitability | Weak; declining profitability and no excess capital for reinvestment |

| Global presence | Established global player in pharmaceutical components and delivery systems | Established global player in vision care and surgical segments |

| Market Share | Strong in pharmaceutical delivery systems, supported by proprietary products | Strong in vision care with Coopervision segment dominant in revenue |

Key takeaways: West Pharmaceutical demonstrates superior profitability, a durable competitive moat, and effective capital use, making it a favorable investment. The Cooper Companies faces challenges with declining returns and value destruction, indicating higher risk for investors.

Risk Analysis

Below is a comparison of key risks facing West Pharmaceutical Services, Inc. (WST) and The Cooper Companies, Inc. (COO) as of the most recent fiscal years.

| Metric | West Pharmaceutical Services, Inc. (WST) | The Cooper Companies, Inc. (COO) |

|---|---|---|

| Market Risk | Beta 1.17, moderate sensitivity to market fluctuations | Beta 1.03, slightly lower volatility |

| Debt level | Low debt-to-equity ratio 0.11, very manageable | Negligible reported debt, strong balance sheet |

| Regulatory Risk | High due to healthcare product regulations globally | High due to medical device and fertility product regulation |

| Operational Risk | Complex manufacturing and supply chain; innovation dependence | Diverse product lines increase operational complexity |

| Environmental Risk | Moderate, with increasing focus on sustainable manufacturing | Moderate, with regulatory focus on product safety |

| Geopolitical Risk | Exposure across Americas, EMEA, Asia Pacific | Global operations with potential geopolitical exposure |

The most likely and impactful risks are regulatory and operational. WST faces challenges keeping pace with evolving injectable drug packaging standards, while COO must navigate regulatory scrutiny in fertility and surgical markets. Both companies show financial resilience, but WST’s higher valuation multiples suggest greater sensitivity to market swings. COO’s Altman Z-Score in the grey zone signals moderate financial caution despite low debt.

Which Stock to Choose?

West Pharmaceutical Services, Inc. (WST) shows a generally favorable income evolution with a 34.75% revenue growth over 2020-2024, despite a slight 1.98% decline in 2024. Its profitability ratios including 18.37% ROE and 15.69% ROIC are strong, supported by low debt levels and a very favorable rating of B+. The company’s durable competitive advantage is reflected in a very favorable MOAT with growing ROIC above WACC.

The Cooper Companies, Inc. (COO) displays mixed income trends, with a 5.06% revenue growth in 2025 but an overall net income decline of 87.27% from 2021-2025. Financial ratios are mostly unfavorable or moderate, with zero reported ROE and ROIC, and its MOAT is very unfavorable due to declining profitability. Nonetheless, COO holds a very favorable rating of B, supported by a strong Piotroski score despite moderate financial stability.

For investors, WST’s robust profitability, favorable financial ratios, and very favorable MOAT might appeal to those seeking quality and durable competitive advantage. Conversely, COO’s profile with recent revenue growth but deteriorating income and profitability ratios could be more aligned with investors tolerant of higher risk and focused on potential turnaround opportunities. The choice could depend on individual risk tolerance and investment strategy.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of West Pharmaceutical Services, Inc. and The Cooper Companies, Inc. to enhance your investment decisions: