In the competitive landscape of non-alcoholic beverages, two giants reign supreme: The Coca-Cola Company and PepsiCo, Inc. Both firms not only share the same industry but also engage in an ongoing battle for market dominance through innovative strategies and diverse product offerings. As they strive to capture consumer preferences, understanding their strengths and weaknesses becomes crucial. You will discover which company is better positioned to sustain growth and lead the beverage market in the years ahead.

Table of contents

Company Overview

The Coca-Cola Company Overview

The Coca-Cola Company, founded in 1886 and headquartered in Atlanta, Georgia, is a leading global beverage manufacturer, best known for its iconic soft drinks. The company operates in the non-alcoholic beverages sector, providing a broad range of products that includes sparkling soft drinks, water, juice, and dairy-based beverages. Coca-Cola’s extensive distribution network includes bottling partners and retailers, ensuring a dominant market presence. With a market capitalization of approximately $306 billion, Coca-Cola continues to innovate and adapt to consumer preferences, emphasizing sustainability and health-oriented products under various well-recognized brands.

PepsiCo, Inc. Overview

PepsiCo, founded in 1898 and based in Purchase, New York, is a diversified multinational food and beverage corporation. With a market cap of around $199 billion, PepsiCo operates through various segments, including Frito-Lay and Quaker Foods, alongside its beverage business. The company is recognized for its wide array of snack foods and beverages, combining convenience and nutrition in its offerings. PepsiCo’s strategy includes a strong focus on health and wellness, sustainability initiatives, and e-commerce, positioning itself as a competitive force in the consumer staples industry.

Key Similarities and Differences

Both Coca-Cola and PepsiCo operate in the non-alcoholic beverage sector and share a focus on global distribution networks. However, Coca-Cola’s business model is predominantly beverage-centric, while PepsiCo diversifies its portfolio with significant snack food operations. This difference allows PepsiCo to leverage a broader market strategy, appealing to varying consumer needs beyond beverages.

Income Statement Comparison

The following table compares the income statements of The Coca-Cola Company and PepsiCo, Inc. for the most recent fiscal year, providing insights into their financial performance.

| Metric | The Coca-Cola Company (KO) | PepsiCo, Inc. (PEP) |

|---|---|---|

| Revenue | 47B | 92B |

| EBITDA | 15.8B | 16.7B |

| EBIT | 14.7B | 12.9B |

| Net Income | 10.6B | 9.6B |

| EPS | 2.47 | 6.98 |

Interpretation of Income Statement

In the most recent fiscal year, Coca-Cola experienced a modest revenue increase, reaching $47 billion, while PepsiCo’s revenue rose to $92 billion. Both companies maintained stable EBITDA margins, with Coca-Cola showing slightly higher operating income than PepsiCo. Notably, Coca-Cola’s net income was $10.6 billion, reflecting a slight decline compared to the previous year, indicating potential challenges in cost management. Conversely, PepsiCo’s net income also saw stability but demonstrated strong earnings per share (EPS) growth at $6.98, suggesting effective operational efficiency. This analysis highlights the competitive landscape between these two giants, with Coca-Cola’s performance requiring careful attention to maintain profitability.

Financial Ratios Comparison

The following table presents a comparison of key financial ratios and revenue for The Coca-Cola Company (KO) and PepsiCo, Inc. (PEP) based on the most recent fiscal year data:

| Metric | KO (2024) | PEP (2024) |

|---|---|---|

| ROE | 23.5% | 20.5% |

| ROIC | 14.2% | 12.8% |

| P/E | 25.2 | 21.8 |

| P/B | 10.8 | 11.6 |

| Current Ratio | 1.03 | 0.82 |

| Quick Ratio | 0.84 | 0.65 |

| D/E | 1.84 | 2.49 |

| Debt-to-Assets | 45% | 45% |

| Interest Coverage | 6.03 | 14.0 |

| Asset Turnover | 0.47 | 0.92 |

| Fixed Asset Turnover | 4.10 | 2.93 |

| Payout ratio | 78.6% | 75.5% |

| Dividend yield | 3.12% | 3.46% |

Interpretation of Financial Ratios

Coca-Cola displays stronger liquidity indicators, with better current and quick ratios, indicating a more robust short-term financial position compared to PepsiCo. However, PepsiCo’s interest coverage ratio is notably higher, suggesting better ability to manage debt obligations. Additionally, Coca-Cola’s lower debt-to-equity ratio indicates a less leveraged position. Investors should consider these factors in the context of their risk tolerance and investment strategy.

Dividend and Shareholder Returns

The Coca-Cola Company (KO) offers a solid dividend payout ratio of approximately 78.6%, with a dividend yield around 3.12%. This indicates a commitment to returning value to shareholders, although the high payout ratio may pose risks if earnings falter. Additionally, KO has engaged in share buybacks, enhancing shareholder returns. In contrast, PepsiCo, Inc. (PEP) also pays dividends, but with a slightly lower yield of about 2.86% and a payout ratio of around 73.6%. Both companies’ distributions support sustainable long-term value creation, balancing dividends and growth initiatives.

Strategic Positioning

In the non-alcoholic beverage market, The Coca-Cola Company (KO) holds a significant market share driven by its diverse portfolio of brands, including iconic products like Coca-Cola and Sprite. Conversely, PepsiCo, Inc. (PEP) competes robustly with its extensive offerings, including snacks and beverages. Both companies face competitive pressure from emerging brands and health-conscious trends. Technological advancements in distribution and marketing are reshaping the landscape, necessitating continuous innovation to maintain their market positions.

Stock Comparison

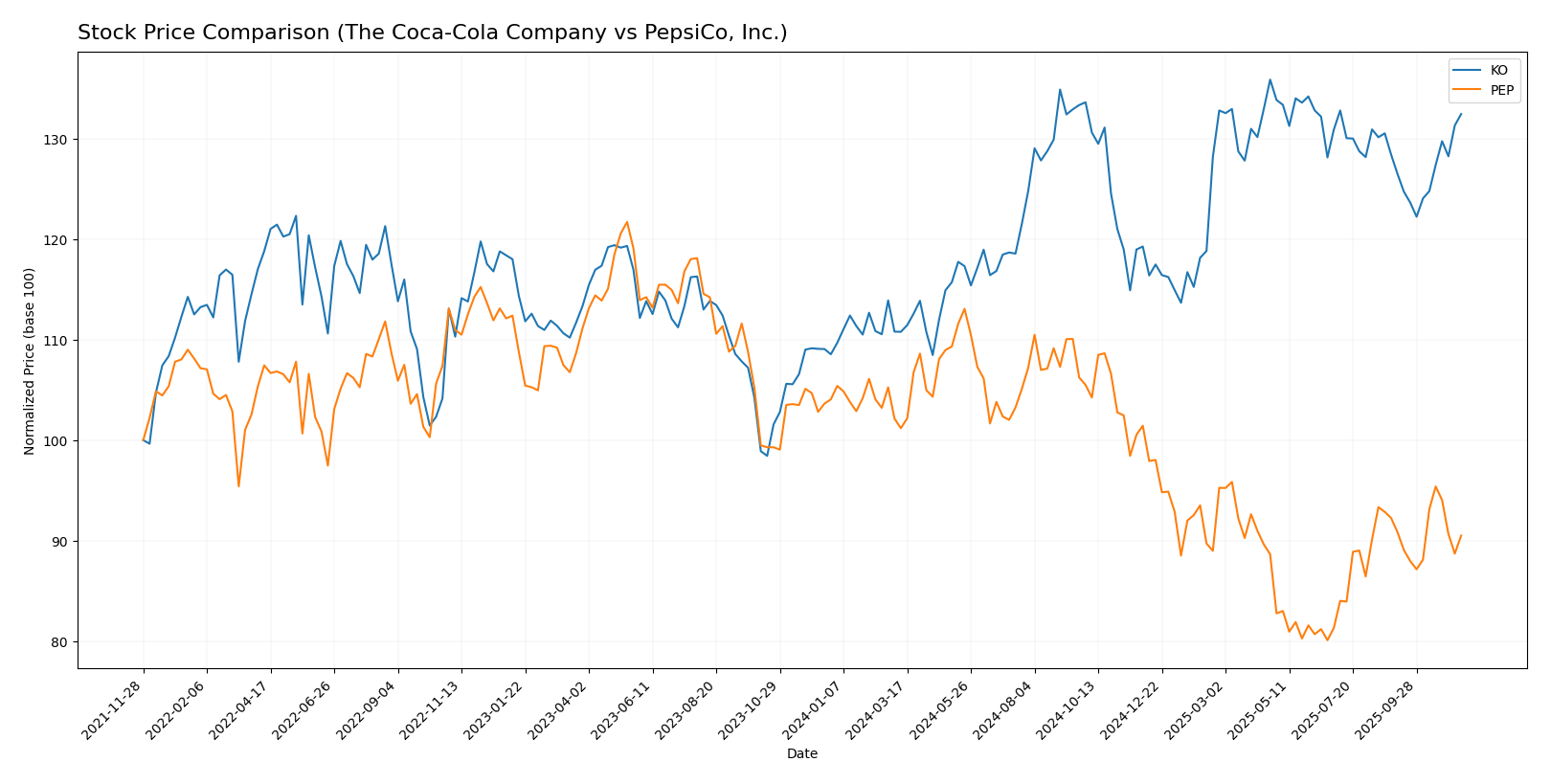

In this section, I will analyze the weekly stock price movements of The Coca-Cola Company (KO) and PepsiCo, Inc. (PEP) over the past year, highlighting key price dynamics and trading behavior that could influence investor decisions.

Trend Analysis

Coca-Cola Company (KO) Over the past year, KO has experienced a price change of +22.02%, indicating a bullish trend. The stock has shown notable acceleration, with the highest price reaching 73.00 and the lowest at 58.28. The standard deviation of 4.43 suggests moderate volatility in price movements. Recently, from August 31 to November 16, 2025, the stock price increased by +3.15%, maintaining a bullish trend with a slight slope of 0.3.

PepsiCo, Inc. (PEP) Conversely, PEP has faced a price decline of -13.02% over the same period, reflecting a bearish trend. The stock has also shown acceleration in this downward movement, with a highest price of 182.19 and a lowest price of 129.07. The standard deviation of 14.75 indicates higher volatility compared to KO. In the recent analysis from August 31 to November 16, 2025, PEP’s stock price decreased by -1.88%, which aligns with its bearish trend, exhibiting a trend slope of 0.19.

In summary, KO appears to be a stronger investment candidate based on its positive trend and lower volatility, while PEP’s declining performance warrants caution for potential investors.

Analyst Opinions

Recent analyst recommendations for both The Coca-Cola Company (KO) and PepsiCo, Inc. (PEP) have been rated as B+. Analysts highlight solid financial health, with strong return on equity and assets for both companies. They emphasize that despite current market challenges, the brands’ resilience and stable cash flows make them attractive in a diversified portfolio. Notably, analysts suggest a cautious approach due to potential market volatility. The consensus for both KO and PEP remains a “buy” for the current year, indicating confidence in their long-term growth potential.

Stock Grades

In the ever-evolving landscape of the stock market, understanding the latest stock ratings is crucial for making informed investment decisions. Below, I present the recent grades for two major companies in the beverage industry: The Coca-Cola Company and PepsiCo, Inc.

The Coca-Cola Company Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| B of A Securities | Maintain | Buy | 2025-11-07 |

| Barclays | Maintain | Overweight | 2025-10-23 |

| TD Cowen | Maintain | Buy | 2025-10-22 |

| Wells Fargo | Maintain | Overweight | 2025-10-22 |

| Piper Sandler | Maintain | Overweight | 2025-10-22 |

| Wells Fargo | Maintain | Overweight | 2025-09-25 |

| UBS | Maintain | Buy | 2025-09-11 |

| JP Morgan | Maintain | Overweight | 2025-07-23 |

| UBS | Maintain | Buy | 2025-07-23 |

| BNP Paribas | Maintain | Outperform | 2025-07-21 |

PepsiCo, Inc. Grades

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Freedom Capital Markets | Downgrade | Hold | 2025-10-23 |

| Wells Fargo | Maintain | Equal Weight | 2025-10-10 |

| JP Morgan | Maintain | Neutral | 2025-10-06 |

| Barclays | Maintain | Equal Weight | 2025-10-03 |

| Citigroup | Maintain | Buy | 2025-09-25 |

| Wells Fargo | Maintain | Equal Weight | 2025-09-25 |

| UBS | Maintain | Buy | 2025-09-11 |

| RBC Capital | Maintain | Sector Perform | 2025-09-03 |

| Barclays | Maintain | Equal Weight | 2025-07-21 |

| Citigroup | Maintain | Buy | 2025-07-18 |

The overall trend for The Coca-Cola Company shows a consistent “Buy” and “Overweight” stance from various reputable analysts, indicating strong investor confidence. Conversely, PepsiCo has experienced a recent downgrade to “Hold,” suggesting a more cautious outlook amid previously stable grades. As always, it’s essential to consider these ratings in the context of your investment strategy and risk tolerance.

Target Prices

Based on the latest consensus from analysts, here are the target prices for The Coca-Cola Company and PepsiCo, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| The Coca-Cola Company | 82 | 76 | 79 |

| PepsiCo, Inc. | 164 | 140 | 150.5 |

The analyst consensus suggests a target price of $79 for Coca-Cola, which is above its current price of $71.16. For PepsiCo, the consensus target is $150.5, compared to its current price of $145.85, indicating moderate growth expectations for both companies.

Strengths and Weaknesses

Below is a comparative analysis of The Coca-Cola Company (KO) and PepsiCo, Inc. (PEP), highlighting their respective strengths and weaknesses.

| Criterion | The Coca-Cola Company (KO) | PepsiCo, Inc. (PEP) |

|---|---|---|

| Diversification | Strong focus on beverages | Diverse food and beverage portfolio |

| Profitability | High net profit margin (22.59%) | Lower net profit margin (10.43%) |

| Innovation | Moderate emphasis on new products | Strong investment in innovation and R&D |

| Global presence | Extensive global reach | Strong international presence across multiple markets |

| Market Share | Leading in soft drinks | Leading in snacks and beverages |

| Debt level | Manageable debt levels | Higher debt levels noted |

Key takeaways indicate that while Coca-Cola boasts a higher profitability margin and a well-established beverage focus, PepsiCo’s diversification into snacks offers resilience and innovation potential. This analysis can guide investors in making informed decisions.

Risk Analysis

The table below outlines various risks associated with The Coca-Cola Company (KO) and PepsiCo, Inc. (PEP). Understanding these risks can help investors make informed decisions.

| Metric | The Coca-Cola Company (KO) | PepsiCo, Inc. (PEP) |

|---|---|---|

| Market Risk | Moderate | Moderate |

| Regulatory Risk | High | High |

| Operational Risk | Moderate | Moderate |

| Environmental Risk | High | High |

| Geopolitical Risk | Moderate | High |

Both companies face significant regulatory and environmental risks, particularly as consumer preferences shift toward sustainability. Recent trends indicate growing scrutiny of their environmental practices, which could impact their operations and reputation. Proper risk management strategies are essential for navigating these challenges.

Which one to choose?

When comparing The Coca-Cola Company (KO) and PepsiCo, Inc. (PEP), both companies exhibit strengths in their financials but diverge in stock performance. KO has a bullish trend with a 22.02% price increase over the last year, while PEP is experiencing a bearish trend, down by 13.02%. KO’s margins are generally higher, with a net profit margin of 22.59% compared to PEP’s 10.43%, indicating better profitability.

Analyst ratings for both are equivalent at B+, with similar overall scores. However, KO’s lower debt ratios and higher dividend yield (around 3.12% for KO versus 2.86% for PEP) may attract income-focused investors.

Investors prioritizing growth may favor KO due to its strong momentum, while those seeking stability with solid dividends might consider PEP. However, both companies face risks related to competition and market dependence.

Disclaimer: This article is not financial advice. Each investor is responsible for their own investment decisions.

Go further

I encourage you to read the complete analyses of The Coca-Cola Company and PepsiCo, Inc. to enhance your investment decisions: