In the dynamic realm of household and personal products, The Estée Lauder Companies Inc. (EL) and The Clorox Company (CLX) stand out as influential players. Both wield strong market presence with innovative approaches—Estée Lauder excelling in luxury cosmetics and skincare, while Clorox leads in cleaning and wellness essentials. Their overlapping consumer focus invites a strategic comparison to uncover which company offers a more compelling investment opportunity. Let’s explore their strengths to guide your portfolio choices.

Table of contents

Companies Overview

I will begin the comparison between The Estée Lauder Companies Inc. and The Clorox Company by providing an overview of these two companies and their main differences.

The Estée Lauder Companies Inc. Overview

The Estée Lauder Companies Inc. is a global leader in the household and personal products industry, specializing in skin care, makeup, fragrance, and hair care products. Founded in 1946 and headquartered in New York City, EL markets a broad portfolio of premium brands including Estée Lauder, Clinique, and MAC. Its products are distributed through department stores, specialty retailers, and online platforms worldwide, establishing a strong presence in the consumer defensive sector.

The Clorox Company Overview

The Clorox Company operates in the household and personal products industry, offering cleaning, health, wellness, and lifestyle products across global markets. Founded in 1913 and based in Oakland, California, CLX’s portfolio includes brands like Clorox, Glad, Brita, and Burt’s Bees. The company sells primarily through mass retailers, grocery outlets, and e-commerce channels, focusing on diverse product segments including household cleaning and natural personal care.

Key similarities and differences

Both EL and CLX operate within the consumer defensive sector, focusing on household and personal products with global footprints. EL emphasizes premium beauty and skincare products, while CLX offers a broader range of household cleaning, wellness, and lifestyle goods. EL’s sales channels lean heavily on department stores and specialty retailers, contrasting with CLX’s reliance on mass retailers and grocery outlets. The companies differ significantly in brand positioning and product diversification strategies.

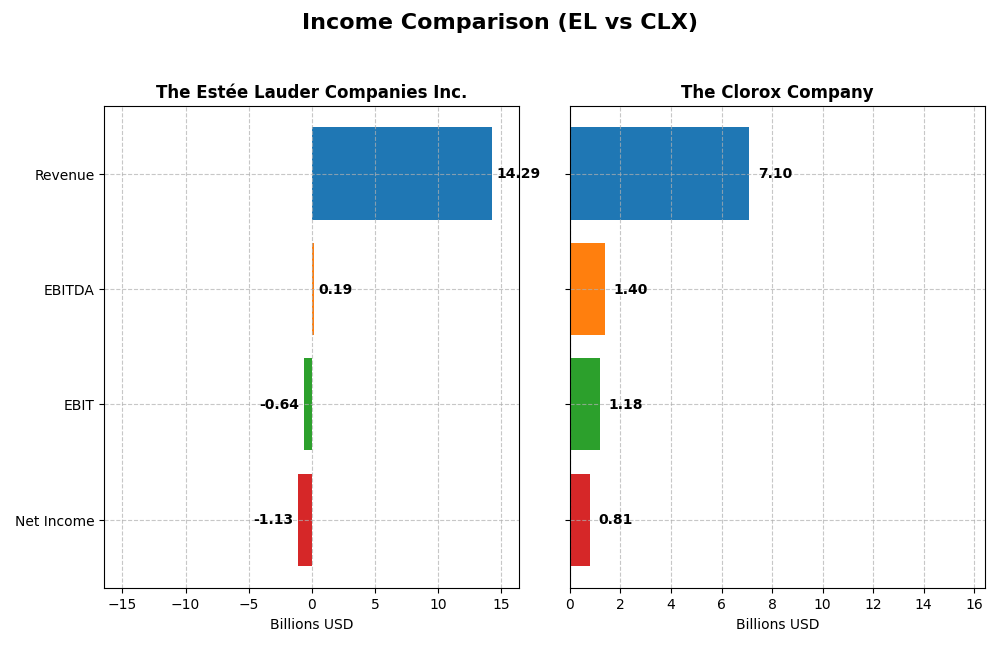

Income Statement Comparison

This table compares the key income statement metrics for The Estée Lauder Companies Inc. and The Clorox Company for the most recent fiscal year available.

| Metric | The Estée Lauder Companies Inc. (EL) | The Clorox Company (CLX) |

|---|---|---|

| Market Cap | 40.7B | 13.0B |

| Revenue | 14.29B | 7.10B |

| EBITDA | 193M | 1.40B |

| EBIT | -636M | 1.18B |

| Net Income | -1.13B | 810M |

| EPS | -3.15 | 6.56 |

| Fiscal Year | 2025 | 2025 |

Income Statement Interpretations

The Estée Lauder Companies Inc.

Over 2021-2025, Estée Lauder’s revenue declined by 11.88%, with net income falling sharply by 139.48%, reflecting worsening profitability. Gross margins remained strong at 73.89%, but EBIT and net margins turned negative in 2025, indicating operational challenges. The latest year saw revenue drop 8.46% and net income swing to a loss of -$1.13B, signaling significant margin deterioration.

The Clorox Company

Clorox experienced relatively stable revenue over the same period, with a slight 3.23% decline. However, net income grew 14.08%, supported by margin improvements. Gross margin stood at 44.96%, EBIT margin improved to 16.6%, and net margin reached 11.4% in 2025. In the most recent year, revenue was flat (+0.16%), while net income surged 189.78%, reflecting better operational efficiency and margin expansion.

Which one has the stronger fundamentals?

Clorox demonstrates stronger fundamentals with favorable income statement metrics, including stable revenue, improved EBIT and net margins, and positive net income growth over the period. Conversely, Estée Lauder shows an unfavorable income trend marked by declining revenue, negative net income, and deteriorating margins, indicating weaker earnings quality and operational strain in recent years.

Financial Ratios Comparison

This table presents a side-by-side comparison of the most recent key financial ratios for The Estée Lauder Companies Inc. (EL) and The Clorox Company (CLX), using their fiscal year 2025 data.

| Ratios | The Estée Lauder Companies Inc. (EL) | The Clorox Company (CLX) |

|---|---|---|

| ROE | -29.3% | 252.3% |

| ROIC | 6.4% | 24.1% |

| P/E | -25.7 | 18.3 |

| P/B | 7.53 | 46.2 |

| Current Ratio | 1.30 | 0.84 |

| Quick Ratio | 0.92 | 0.57 |

| D/E (Debt-to-Equity) | 2.44 | 8.97 |

| Debt-to-Assets | 47.5% | 51.8% |

| Interest Coverage | 2.37 | 11.7 |

| Asset Turnover | 0.72 | 1.28 |

| Fixed Asset Turnover | 2.79 | 4.44 |

| Payout Ratio | -54.5% | 74.3% |

| Dividend Yield | 2.12% | 4.06% |

Interpretation of the Ratios

The Estée Lauder Companies Inc.

The Estée Lauder shows a mixed ratio profile with unfavorable net margin (-7.93%) and return on equity (-29.31%), indicating profitability challenges. Neutral ratings on return on invested capital (6.44%) and current ratio (1.3) reflect moderate operational efficiency and liquidity. The company pays dividends, with a 2.12% yield considered favorable, suggesting some shareholder return despite financial headwinds.

The Clorox Company

Clorox presents strong profitability and efficiency with favorable net margin (11.4%), return on equity (252.34%), and return on invested capital (24.14%). However, liquidity ratios like current (0.84) and quick ratio (0.57) are unfavorable, alongside high debt levels. Its dividend yield at 4.06% is favorable, supporting consistent shareholder returns amid higher leverage risks.

Which one has the best ratios?

Clorox’s ratios are predominantly favorable, especially in profitability and capital returns, despite weaker liquidity and high debt concerns. Estée Lauder faces significant profitability and leverage challenges, with mostly neutral to unfavorable ratios. Overall, Clorox exhibits a stronger financial ratio profile relative to Estée Lauder in 2025.

Strategic Positioning

This section compares the strategic positioning of The Estée Lauder Companies Inc. (EL) and The Clorox Company (CLX), covering market position, key segments, and exposure to technological disruption:

The Estée Lauder Companies Inc.

- Leading global player in personal care, facing intense competition in cosmetics and skincare markets.

- Focuses on skin care, makeup, fragrance, and hair care; skin care and makeup are primary revenue drivers.

- Limited explicit exposure to technological disruption, relying on traditional retail and e-commerce channels.

The Clorox Company

- Mid-sized consumer goods company with stable presence, lower beta indicating less market volatility.

- Operates four segments: Health and Wellness, Household, Lifestyle, and International, with health and wellness leading revenue.

- No specific mention of technological disruption; sells through mass retailers and various e-commerce platforms.

The Estée Lauder Companies Inc. vs The Clorox Company Positioning

EL has a concentrated portfolio focused on personal care and cosmetics, benefiting from strong brand diversity, while CLX shows a more diversified approach across health, household, lifestyle, and international products. EL’s larger scale contrasts with CLX’s broader segment spread.

Which has the best competitive advantage?

Based on MOAT evaluation, CLX has a very favorable competitive advantage with growing ROIC above WACC, indicating durable profitability, whereas EL shows a very unfavorable position with declining ROIC and value destruction.

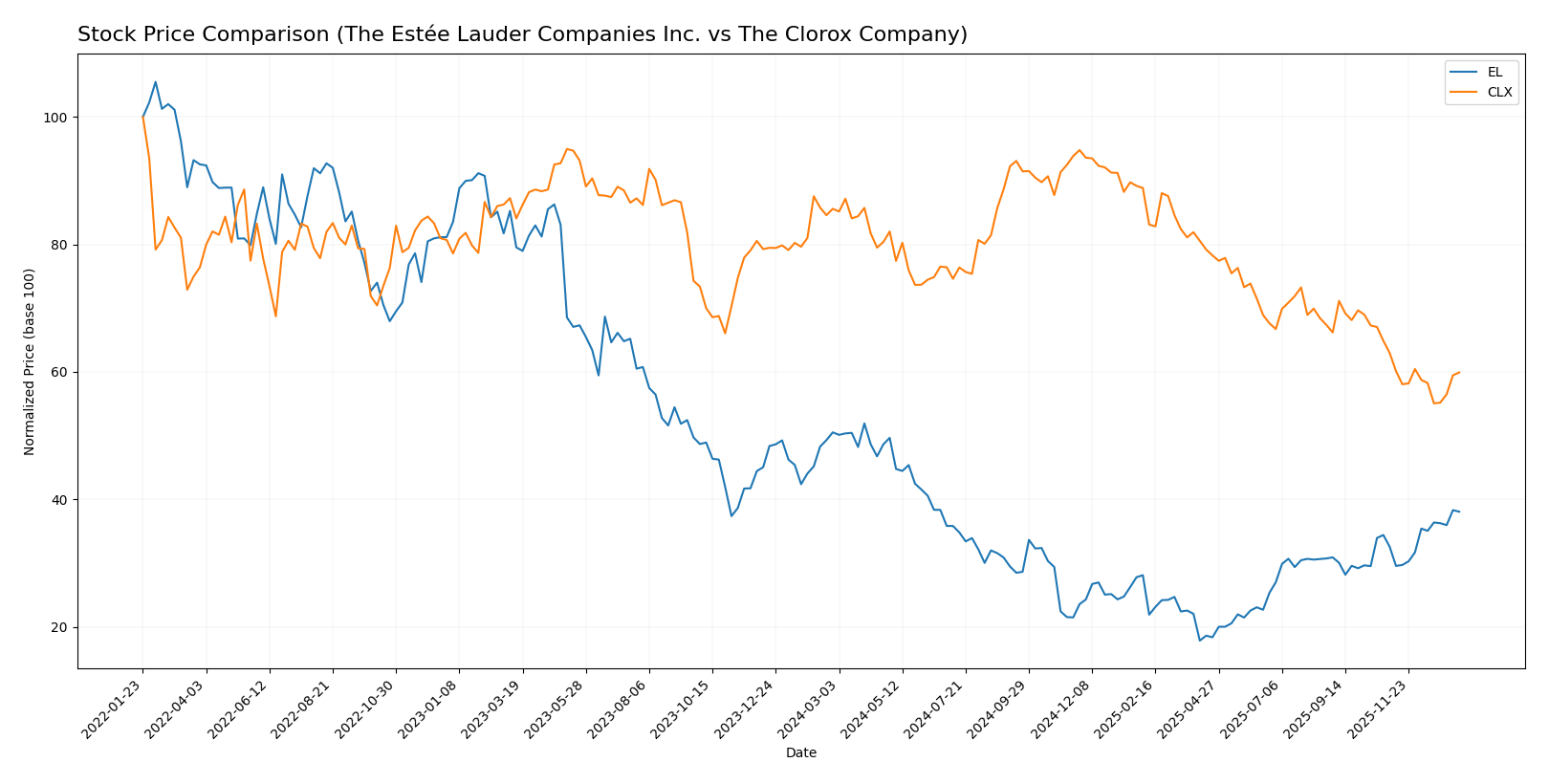

Stock Comparison

The past year has seen both The Estée Lauder Companies Inc. (EL) and The Clorox Company (CLX) experience significant bearish trends, with EL showing signs of recent recovery while CLX continues a decelerating decline.

Trend Analysis

The Estée Lauder Companies Inc. stock declined by 24.65% over the past 12 months, exhibiting a bearish trend with acceleration. The price ranged between 52.93 and 154.15, with recent months showing a 16.89% rebound.

The Clorox Company stock fell by 30.01% over the same period, also bearish but decelerating. Its price moved between 98.31 and 169.3, with recent activity showing a further 4.87% decrease.

Comparatively, EL’s stock delivered a less severe decline and a recent uptrend, outperforming CLX, which showed a deeper overall loss and continued downward momentum.

Target Prices

Analysts show a moderately optimistic consensus for these stocks, reflecting cautious confidence in their future performance.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| The Estée Lauder Companies Inc. | 130 | 70 | 106.67 |

| The Clorox Company | 152 | 94 | 118.33 |

The target consensus for Estée Lauder at 106.67 is slightly below its current price of 113.02, indicating modest downside risk or valuation pressure. Clorox’s consensus target of 118.33 is above the current 106.98 share price, suggesting potential upside for investors.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for The Estée Lauder Companies Inc. (EL) and The Clorox Company (CLX):

Rating Comparison

EL Rating

- Rating: D+, classified as Very Favorable overall rating.

- Discounted Cash Flow Score: 2, indicating a Moderate valuation based on cash flow.

- ROE Score: 1, rated Very Unfavorable for efficiency in generating profit.

- ROA Score: 1, Very Unfavorable, showing low asset utilization efficiency.

- Debt To Equity Score: 1, Very Unfavorable, indicating higher financial risk.

- Overall Score: 1, Very Unfavorable summary of financial standing.

CLX Rating

- Rating: B-, classified as Very Favorable overall rating.

- Discounted Cash Flow Score: 5, indicating a Very Favorable valuation.

- ROE Score: 1, also Very Unfavorable for generating profit from equity.

- ROA Score: 5, Very Favorable, showing strong asset utilization.

- Debt To Equity Score: 1, Very Unfavorable, indicating similar financial risk.

- Overall Score: 3, Moderate summary of financial standing.

Which one is the best rated?

Based on the data, CLX is better rated overall with a B- rating and a Moderate overall score of 3, outperforming EL’s D+ rating and Very Unfavorable overall score of 1. CLX also shows stronger discounted cash flow and asset utilization scores.

Scores Comparison

The comparison of scores for The Estée Lauder Companies Inc. (EL) and The Clorox Company (CLX) is as follows:

EL Scores

- Altman Z-Score: 3.11, indicating a safe zone from bankruptcy risk.

- Piotroski Score: 5, reflecting an average financial strength.

CLX Scores

- Altman Z-Score: 3.19, indicating a safe zone from bankruptcy risk.

- Piotroski Score: 5, reflecting an average financial strength.

Which company has the best scores?

Both EL and CLX have Altman Z-Scores in the safe zone, with CLX slightly higher at 3.19 versus EL’s 3.11. Their Piotroski Scores are equal at 5, indicating comparable average financial strength based on the available data.

Grades Comparison

The following presents a detailed comparison of recent grades for The Estée Lauder Companies Inc. and The Clorox Company:

The Estée Lauder Companies Inc. Grades

This table summarizes recent grades and rating actions by leading financial institutions for EL:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Wells Fargo | Maintain | Equal Weight | 2026-01-05 |

| Raymond James | Upgrade | Strong Buy | 2026-01-05 |

| Citigroup | Maintain | Neutral | 2025-12-17 |

| Evercore ISI Group | Maintain | Outperform | 2025-12-16 |

| Rothschild & Co | Downgrade | Sell | 2025-11-25 |

| Argus Research | Upgrade | Buy | 2025-11-11 |

| JP Morgan | Maintain | Overweight | 2025-10-31 |

| Telsey Advisory Group | Maintain | Market Perform | 2025-10-31 |

| UBS | Maintain | Neutral | 2025-10-31 |

| RBC Capital | Maintain | Outperform | 2025-10-31 |

The overall trend for EL shows a mix of stable and positive upgrades with a consensus rating of “Hold,” reflecting moderate confidence among analysts.

The Clorox Company Grades

This table shows recent grades and rating actions from reputable firms for CLX:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| TD Cowen | Maintain | Hold | 2026-01-08 |

| Goldman Sachs | Maintain | Sell | 2026-01-07 |

| Wells Fargo | Maintain | Equal Weight | 2026-01-05 |

| Citigroup | Maintain | Neutral | 2025-12-17 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-04 |

| JP Morgan | Maintain | Neutral | 2025-11-04 |

| Wells Fargo | Maintain | Equal Weight | 2025-11-04 |

| Citigroup | Maintain | Neutral | 2025-11-04 |

| JP Morgan | Maintain | Neutral | 2025-10-10 |

| Citigroup | Maintain | Neutral | 2025-10-09 |

The grade pattern for CLX is predominantly stable with a consensus rating of “Hold,” indicating a cautious outlook among analysts.

Which company has the best grades?

The Estée Lauder Companies Inc. displays a wider range of upgrades and stronger ratings, including a notable “Strong Buy” from Raymond James, while The Clorox Company’s grades remain mostly neutral or hold. This difference may influence investor sentiment regarding growth potential and risk exposure.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses of The Estée Lauder Companies Inc. (EL) and The Clorox Company (CLX) based on the most recent financial and operational data.

| Criterion | The Estée Lauder Companies Inc. (EL) | The Clorox Company (CLX) |

|---|---|---|

| Diversification | Strong product diversification across skincare ($6.96B), makeup ($4.21B), fragrance ($2.49B), and hair care ($565M) segments. | Diversified product portfolio including Health & Wellness ($2.7B), Household ($2B), International ($1.07B), and Lifestyle ($1.3B). |

| Profitability | Negative net margin (-7.93%) and declining ROIC trend; currently shedding value and facing profitability challenges. | Solid profitability with 11.4% net margin, high ROE (252%), and growing ROIC; creating shareholder value. |

| Innovation | Moderate innovation implied by product range but declining returns indicate challenges in value creation. | Demonstrates innovation through consistent profitability growth and expanding market segments. |

| Global presence | Established global presence but faced revenue declines in some segments recently. | Strong global footprint with stable international revenue and growing segments. |

| Market Share | Leading in premium beauty but facing competitive pressures reflected in declining ROIC and unfavorable leverage ratios. | Strong market position in household and wellness products with favorable asset turnover and interest coverage. |

Key takeaways: Clorox shows a robust financial and operational profile with clear value creation and growth, while Estée Lauder struggles with profitability and value destruction despite its diversified product lines. Investors should weigh Clorox’s durable competitive advantage against Estée Lauder’s current challenges and risks.

Risk Analysis

Below is a comparative risk assessment table for The Estée Lauder Companies Inc. (EL) and The Clorox Company (CLX) based on the latest available data from 2025.

| Metric | The Estée Lauder Companies Inc. (EL) | The Clorox Company (CLX) |

|---|---|---|

| Market Risk | Beta 1.15 – Moderate volatility | Beta 0.58 – Lower volatility |

| Debt level | Debt-to-Equity 2.44 – High risk | Debt-to-Equity 8.97 – Very high risk |

| Regulatory Risk | Moderate – Global cosmetics regulations | Moderate – Household chemicals regulation |

| Operational Risk | Moderate – Complex global supply chains | Moderate – Diverse product segments |

| Environmental Risk | Increasing scrutiny on sustainability | High – Packaging and chemical usage impact |

| Geopolitical Risk | Moderate – Global market exposure | Moderate – International sales exposure |

The most impactful and likely risks include high debt levels for both companies, with Clorox carrying a significantly higher debt burden, increasing financial risk. Estée Lauder’s higher market volatility reflects sensitivity to consumer trends. Environmental risks are significant for Clorox due to chemicals and packaging, while Estée Lauder faces growing regulatory pressures in cosmetics. Both companies operate globally, exposing them to moderate geopolitical risks. Caution on debt management and regulatory compliance is warranted for investors.

Which Stock to Choose?

The Estée Lauder Companies Inc. (EL) shows a declining income trend with a negative net margin of -7.93% and unfavorable profitability ratios including ROE at -29.31%. Its debt level is moderate with a debt-to-equity ratio of 2.44, but interest coverage is negative, and ratings indicate a slightly unfavorable financial position.

The Clorox Company (CLX) presents a favorable income evolution with an 11.4% net margin and strong profitability ratios such as ROE at 252.34%. Despite higher leverage indicated by a debt-to-equity ratio of 8.97, interest coverage is robust, and financial ratings suggest a favorable overall standing.

Depending on investor profiles, CLX might appear more attractive for those prioritizing profitability and durable competitive advantage, while EL’s financial challenges could imply higher risk that might concern risk-averse investors. Growth-focused investors could interpret CLX’s improving income and financial ratios as a sign of quality, whereas EL’s deteriorating metrics might signal caution.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of The Estée Lauder Companies Inc. and The Clorox Company to enhance your investment decisions: