Home > Comparison > Industrials > BA vs TDG

The strategic rivalry between The Boeing Company and TransDigm Group Incorporated shapes the aerospace & defense sector’s evolution. Boeing operates as a capital-intensive aerospace giant, spanning commercial jets, defense, and space systems. TransDigm, by contrast, focuses on high-margin, specialized aircraft components and subsystems. This analysis pits Boeing’s broad industrial scale against TransDigm’s niche precision. The goal: to identify which corporate model delivers superior risk-adjusted returns for diversified portfolios.

Table of contents

Companies Overview

The Boeing Company and TransDigm Group Incorporated stand as pivotal players in aerospace and defense markets.

The Boeing Company: Aerospace & Defense Giant

The Boeing Company dominates aerospace and defense with diversified operations spanning commercial jetliners, military aircraft, satellites, and space systems. It generates revenue primarily from manufacturing and servicing commercial airplanes, defense systems, and global services. In 2026, Boeing focuses strategically on expanding its Global Services segment to enhance customer lifecycle support and digital solutions.

TransDigm Group Incorporated: Specialized Aerospace Components Leader

TransDigm Group excels as a specialized component manufacturer supplying engineered parts for aircraft power, control, and airframe systems globally. Its revenue base centers on proprietary, mission-critical components sold to OEMs, airlines, and military agencies. The company’s 2026 strategic focus targets expanding its portfolio in electro-mechanical actuators and cockpit security systems, reinforcing its niche market dominance.

Strategic Collision: Similarities & Divergences

Boeing pursues a broad aerospace ecosystem, integrating manufacturing and services, while TransDigm emphasizes a focused portfolio of proprietary components. Their primary competition unfolds in commercial and defense aerospace supply chains. Boeing’s scale and scope contrast with TransDigm’s niche specialization, creating distinct investment profiles: one bets on end-to-end aerospace solutions, the other on high-margin, specialized parts with strong pricing power.

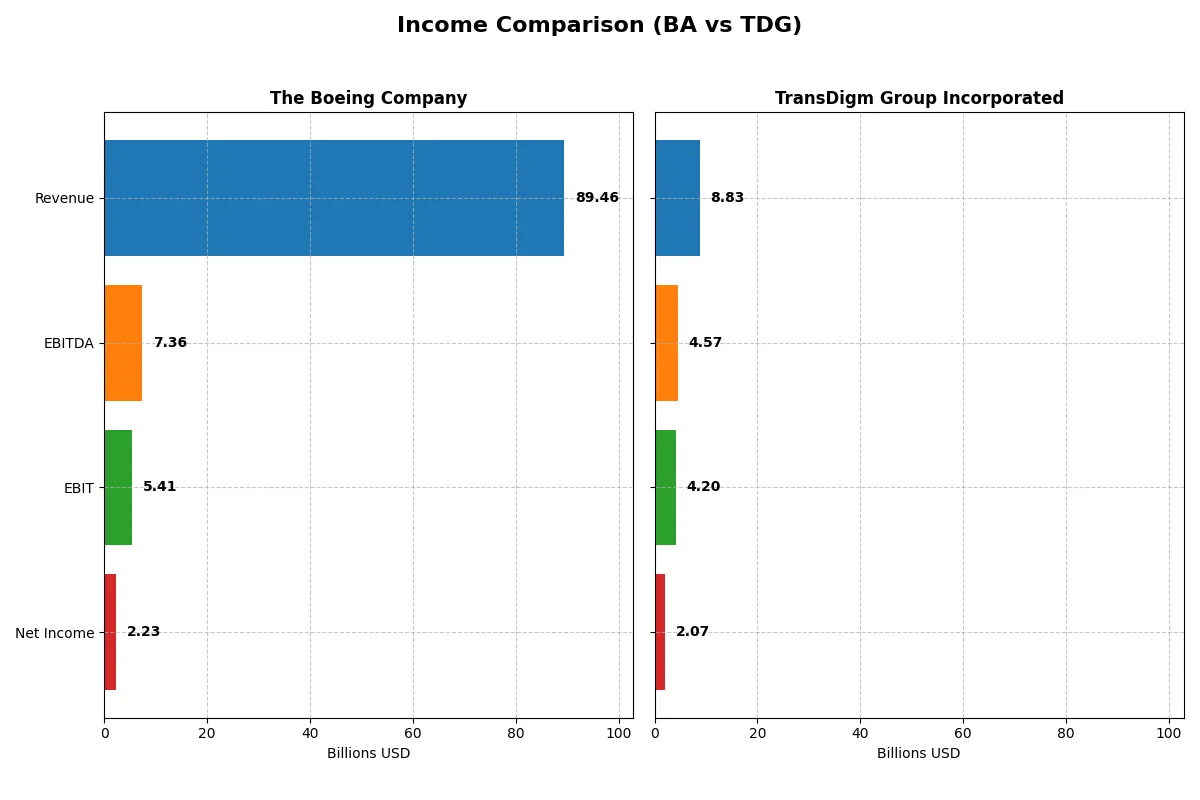

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | The Boeing Company (BA) | TransDigm Group Incorporated (TDG) |

|---|---|---|

| Revenue | 89.5B | 8.8B |

| Cost of Revenue | 85.2B | 3.5B |

| Operating Expenses | 9.7B | 1.1B |

| Gross Profit | 4.3B | 5.3B |

| EBITDA | 7.4B | 4.6B |

| EBIT | 5.4B | 4.2B |

| Interest Expense | 2.8B | 1.6B |

| Net Income | 2.2B | 2.1B |

| EPS | 2.49 | 32.08 |

| Fiscal Year | 2025 | 2025 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals the true efficiency and profitability dynamics powering each company’s financial engine.

The Boeing Company Analysis

Boeing’s revenue rose sharply by 34.5% in 2025, rebounding from prior losses. Its net income turned positive at $2.2B, reflecting a notable margin recovery. Gross margin remains slim at 4.8%, but EBIT margin improved to 6.0%. The company shows momentum in controlling expenses and boosting profitability after several challenging years.

TransDigm Group Incorporated Analysis

TransDigm grew revenue steadily by 11.2% to $8.8B in 2025, maintaining a high gross margin of 60.1%. Its net income climbed 21% to $2.1B, supporting a robust 23.5% net margin. EBIT margin at 47.6% confirms strong operational efficiency. Despite higher interest costs, TransDigm sustains impressive profitability and consistent growth.

Margin Dominance vs. Recovery Surge

TransDigm clearly leads with superior margins and consistent profitability, driven by its efficient cost structure. Boeing’s rapid rebound from losses is impressive but still features narrow margins. For investors prioritizing high operational efficiency and stable returns, TransDigm’s profile appears more attractive, while Boeing’s turnaround offers a higher-risk growth story.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies analyzed below:

| Ratios | Boeing (BA) | TransDigm (TDG) |

|---|---|---|

| ROE | 41.0% | -21.4% |

| ROIC | -6.7% | 15.2% |

| P/E | 74.1 | 37.0 |

| P/B | 30.3 | -7.9 |

| Current Ratio | 1.27 | 3.21 |

| Quick Ratio | 0.49 | 2.25 |

| D/E | 9.92 | -3.10 |

| Debt-to-Assets | 32.2% | 131.1% |

| Interest Coverage | -1.95 | 2.65 |

| Asset Turnover | 0.53 | 0.39 |

| Fixed Asset Turnover | 5.73 | 5.59 |

| Payout Ratio | 14.8% | 464.3% |

| Dividend Yield | 0.20% | 12.55% |

| Fiscal Year | 2025 | 2025 |

Efficiency & Valuation Duel: The Vital Signs

Ratios serve as a company’s DNA, exposing hidden risks and operational strengths critical for investment insight.

The Boeing Company

Boeing shows robust ROE at 41%, signaling strong shareholder equity returns despite weak net margin at 2.5%. The stock trades at a stretched P/E of 74, reflecting high market expectations. Dividend yield is low at 0.2%, indicating limited income; Boeing appears to prioritize reinvestment over distribution, likely into R&D and growth.

TransDigm Group Incorporated

TransDigm delivers a favorable net margin of 23.5% and solid ROIC of 15.2%, highlighting operational efficiency. Its P/E of 37 remains high but less stretched than Boeing’s. A hefty 12.55% dividend yield offers significant shareholder income, balancing moderate leverage and efficient capital use, though debt-to-assets at 131% signals elevated financial risk.

Premium Valuation vs. Operational Safety

Boeing’s high ROE contrasts with stretched valuation and weak profitability metrics, raising risk concerns. TransDigm offers better operational margins and strong cash returns, offset by higher leverage risk. Investors seeking income and operational resilience may lean toward TransDigm, while Boeing suits those favoring growth with caution on valuation.

Which one offers the Superior Shareholder Reward?

I compare Boeing and TransDigm’s distribution strategies. Boeing pays no dividend, focusing on cash flow recovery after recent losses, with negative free cash flow (-$2.5/share in 2025) and no buybacks. TransDigm yields 12.55%, with a modest 4.6% payout ratio but strong free cash flow of $31.2/share and active buybacks. TransDigm’s model blends yield and buybacks sustainably, backed by 47.6% EBIT margin and stable operating cash flow coverage. Boeing’s weak cash flow and high leverage pose risks. I conclude TransDigm offers superior total shareholder reward in 2026.

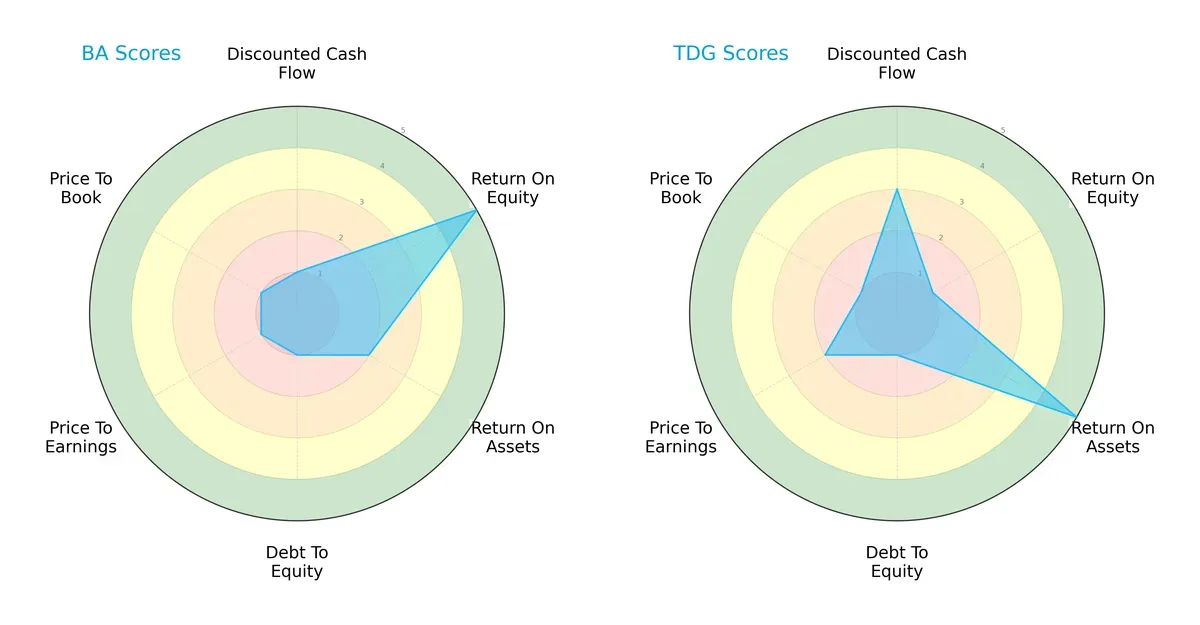

Comparative Score Analysis: The Strategic Profile

The radar chart below reveals the fundamental DNA and trade-offs of The Boeing Company and TransDigm Group Incorporated:

Boeing shows strength in Return on Equity (ROE) with a top score of 5, indicating efficient profit generation from shareholders’ equity. However, it struggles with valuation (P/E and P/B scores of 1) and leverage (Debt/Equity score of 1), signaling financial risk and potential overvaluation concerns. TransDigm, conversely, excels in Return on Assets (ROA) with a score of 5 and a moderate Discounted Cash Flow (DCF) score of 3, reflecting strong asset utilization and fair valuation. Yet, its ROE is weak at 1, showing less efficiency in equity profit generation. Overall, TransDigm presents a more balanced profile, while Boeing relies heavily on equity returns despite valuation and leverage weaknesses.

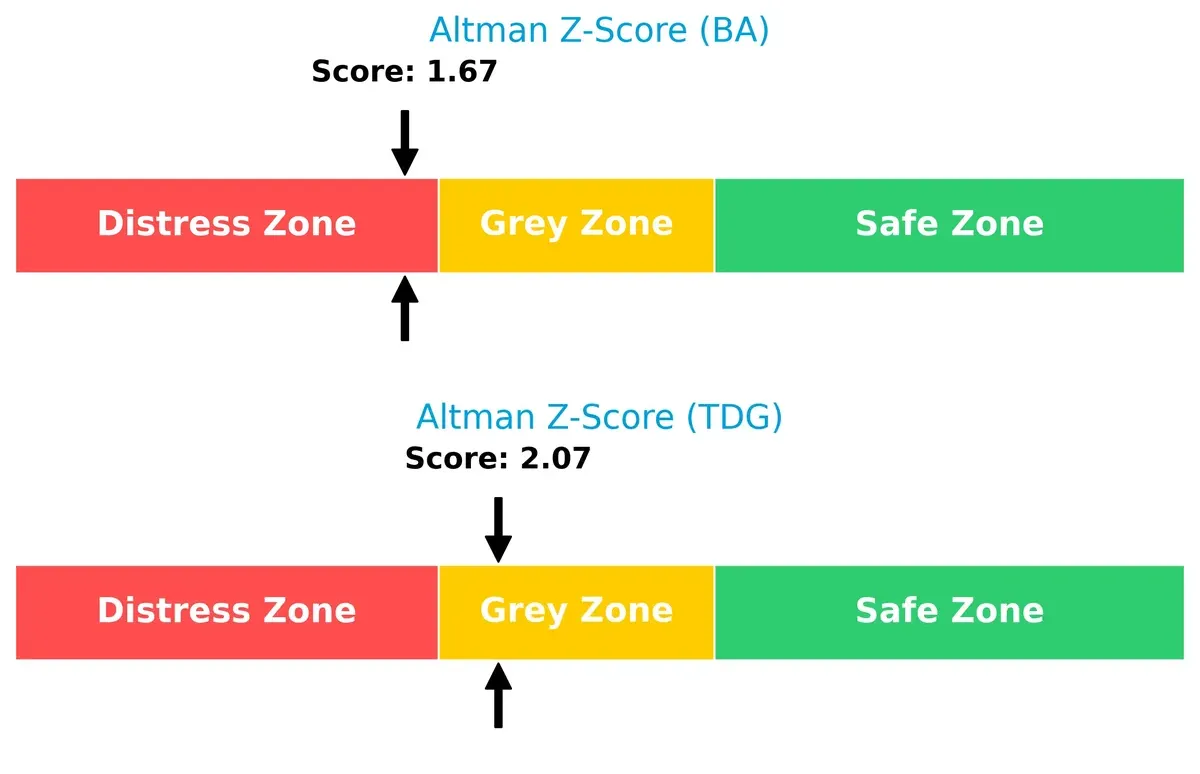

Bankruptcy Risk: Solvency Showdown

The Altman Z-Score gap between Boeing (1.67, distress zone) and TransDigm (2.07, grey zone) highlights a clear solvency concern for Boeing. This suggests Boeing faces a higher risk of financial distress in this cycle, while TransDigm maintains moderate survival prospects:

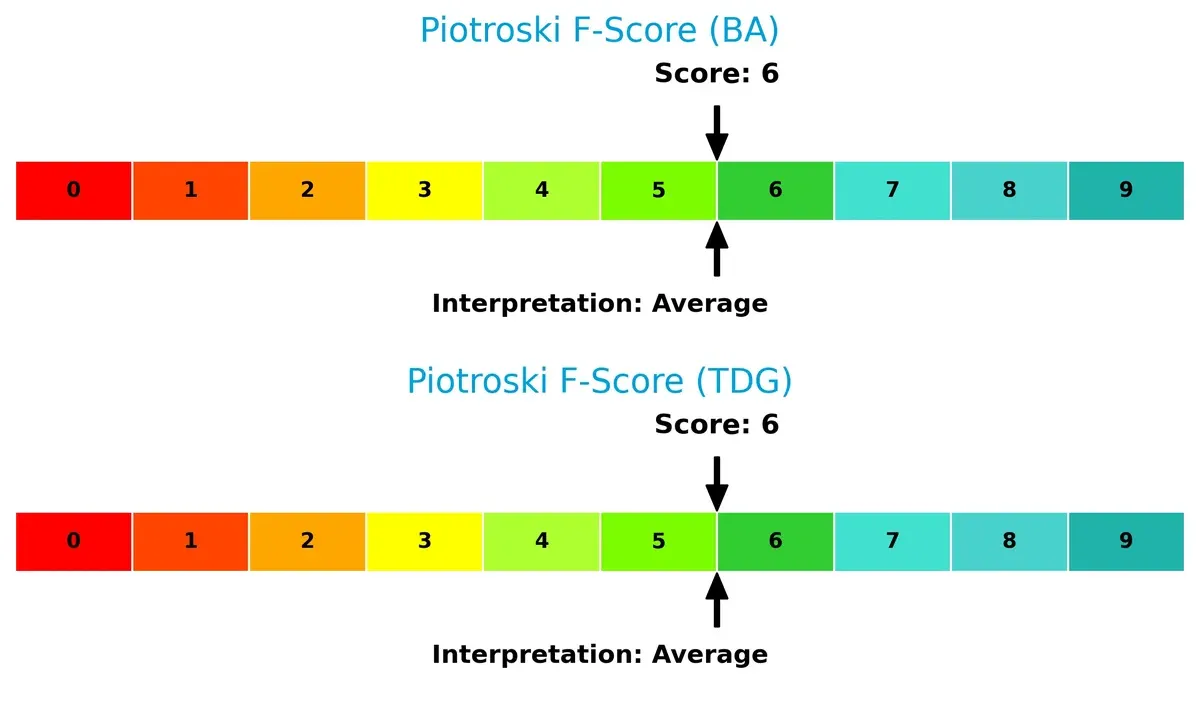

Financial Health: Quality of Operations

Both Boeing and TransDigm score a 6 on the Piotroski F-Score, placing them in average financial health territory. Neither firm shows immediate red flags, but neither achieves a strong score that would indicate peak operational quality:

How are the two companies positioned?

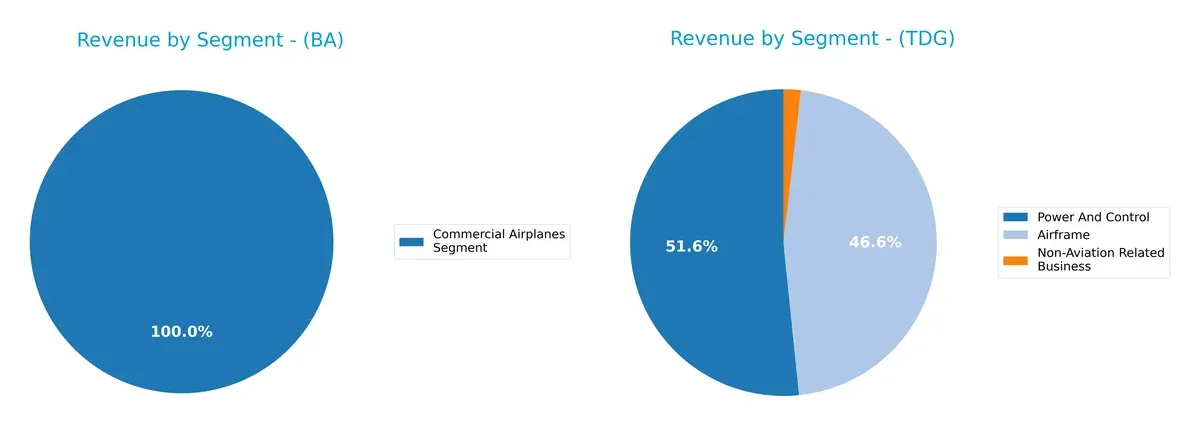

This section dissects BA and TDG’s operational DNA by comparing their revenue distribution by segment and internal dynamics. The goal is to confront their economic moats to reveal which business model delivers the most resilient, sustainable competitive advantage today.

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how Boeing and TransDigm diversify their income streams and where their primary sector bets lie:

Boeing anchors revenue in Commercial Airplanes with $41.5B in 2025, but also earns from Defense ($23.9B in 2024) and Global Services ($19.9B). TransDigm shows a balanced split between Power and Control ($4.56B) and Airframe ($4.11B) in 2025, with minor non-aviation exposure. Boeing’s broader mix hedges aerospace cyclicality, while TransDigm’s focused segments suggest strong niche dominance but higher concentration risk.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of The Boeing Company and TransDigm Group Incorporated:

BA Strengths

- Diversified revenue streams from Commercial Airplanes, Defense, and Global Services

- Strong global presence across multiple continents

- Favorable fixed asset turnover indicating efficient asset use

TDG Strengths

- High net margin and favorable ROIC exceed cost of capital

- Strong quick ratio indicates good liquidity

- Diverse product segments including Airframe and Power and Control

BA Weaknesses

- Low net margin and negative ROIC suggest profitability challenges

- Weak quick ratio and interest coverage raise liquidity concerns

- High P/E and P/B ratios imply overvaluation risk

TDG Weaknesses

- Negative ROE signals shareholder returns issues

- High debt-to-assets ratio reflects leverage risk

- Lower asset turnover may indicate inefficiency

Both companies show distinct profiles: BA’s strengths lie in diversification and global reach, but profitability and liquidity present concerns. TDG excels in profitability metrics and liquidity but faces leverage and efficiency risks. These contrasts shape their strategic challenges and opportunities moving forward.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only durable shield protecting long-term profits from relentless competition erosion. Let’s dissect how two aerospace giants defend their turf:

The Boeing Company: Scale and Legacy Under Pressure

Boeing’s moat hinges on its vast scale and entrenched relationships in commercial and defense aerospace. However, declining ROIC and thin margins signal weakening capital efficiency. New market expansions in space tech offer hope but face stiff competition in 2026.

TransDigm Group Incorporated: Niche Component Dominance

TransDigm leverages specialized aircraft components with high switching costs and pricing power, reflected in stellar ROIC and margin expansion. Its focused product innovation deepens the moat, with expanding global sales positioning it for resilient growth in 2026.

Scale vs. Specialization: Who Holds the Stronger Moat?

TransDigm’s niche specialization delivers a wider, deeper moat with sustained value creation and margin strength. Boeing’s legacy scale faces structural profitability erosion. TransDigm stands better equipped to defend and grow its market share.

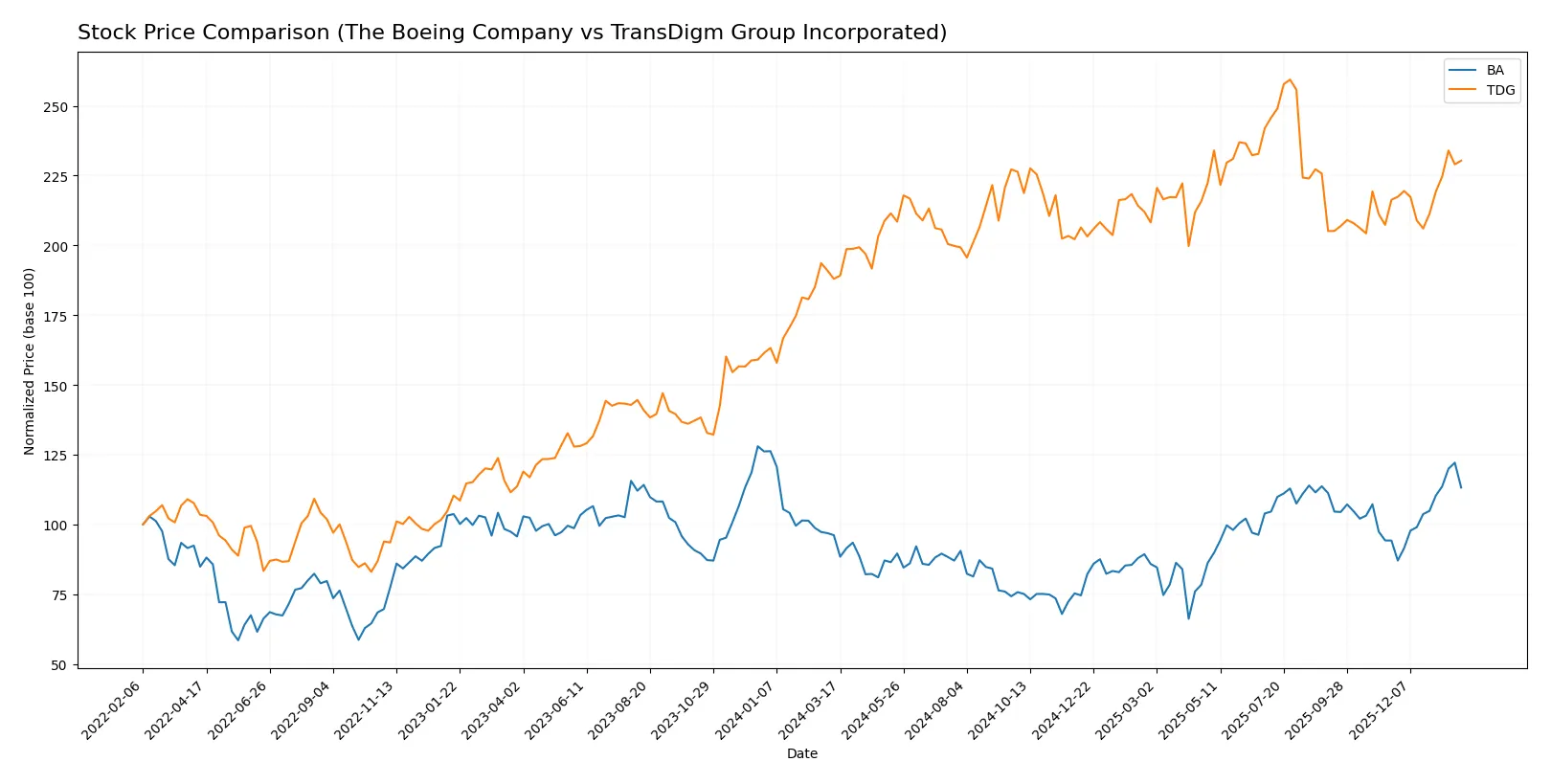

Which stock offers better returns?

The past year shows clear bullish trends for both Boeing and TransDigm, with accelerating price gains and distinct trading volume dynamics shaping their market trajectories.

Trend Comparison

The Boeing Company’s stock rose 17.75% over the past year, showing acceleration and a bullish trend. Its price ranged between 136.59 and 252.15, with moderate volatility (std dev 26.41).

TransDigm Group’s stock gained 22.54% in the same period, also accelerating with a bullish trend. It experienced higher volatility (std dev 87.29) and traded between 1164.99 and 1607.45.

TransDigm outperformed Boeing in total price appreciation, delivering the highest market performance despite greater volatility.

Target Prices

Analysts present a bullish consensus for both The Boeing Company and TransDigm Group Incorporated.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| The Boeing Company | 150 | 298 | 256.73 |

| TransDigm Group Incorporated | 1370 | 1871 | 1601.5 |

The Boeing’s target consensus at $256.73 exceeds its current $233.72 price, signaling upside potential. TransDigm’s consensus target of $1601.5 also surpasses the current $1427.54 price, reflecting strong analyst confidence.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

The Boeing Company Grades

Here are recent institutional grades assigned to The Boeing Company by major financial firms:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-01-28 |

| UBS | Maintain | Buy | 2026-01-28 |

| RBC Capital | Maintain | Outperform | 2026-01-28 |

| JP Morgan | Maintain | Overweight | 2026-01-28 |

| Bernstein | Maintain | Outperform | 2026-01-15 |

| Citigroup | Maintain | Buy | 2026-01-13 |

| JP Morgan | Maintain | Overweight | 2025-12-19 |

| Susquehanna | Maintain | Positive | 2025-11-12 |

| Freedom Capital Markets | Upgrade | Buy | 2025-11-03 |

| JP Morgan | Maintain | Overweight | 2025-10-30 |

TransDigm Group Incorporated Grades

The following table summarizes recent grades on TransDigm Group from recognized financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| UBS | Maintain | Buy | 2026-01-15 |

| Morgan Stanley | Maintain | Overweight | 2025-11-14 |

| JP Morgan | Maintain | Neutral | 2025-11-14 |

| RBC Capital | Maintain | Sector Perform | 2025-11-13 |

| BMO Capital | Maintain | Outperform | 2025-11-13 |

| Stifel | Maintain | Buy | 2025-11-13 |

| UBS | Maintain | Buy | 2025-11-13 |

| Morgan Stanley | Maintain | Overweight | 2025-10-15 |

| Truist Securities | Maintain | Buy | 2025-10-15 |

| Susquehanna | Maintain | Neutral | 2025-10-09 |

Which company has the best grades?

The Boeing Company consistently receives higher-tier ratings like Buy and Outperform, while TransDigm’s grades range from Buy to Neutral. Boeing’s stronger grades may reflect greater institutional confidence, potentially influencing investor sentiment positively.

Risks specific to each company

The following categories identify the critical pressure points and systemic threats facing both firms in the 2026 market environment:

1. Market & Competition

The Boeing Company

- Faces intense competition in commercial and defense aerospace segments, pressured by innovation cycles and global airline demand volatility.

TransDigm Group Incorporated

- Operates in a niche aerospace components market with strong pricing power but risks from customer concentration and technology shifts.

2. Capital Structure & Debt

The Boeing Company

- High debt-to-equity ratio (9.92), moderate debt-to-assets (32.16%), and weak interest coverage (1.95) signal financial leverage risks.

TransDigm Group Incorporated

- Shows unusual negative debt-to-equity ratio but extremely high debt-to-assets (131.08%), raising concerns over balance sheet sustainability.

3. Stock Volatility

The Boeing Company

- Beta at 1.163 indicates higher-than-market volatility, reflecting sensitivity to aerospace sector cycles and geopolitical risks.

TransDigm Group Incorporated

- Lower beta of 0.917 suggests less stock volatility, benefiting from stable aftermarket aerospace components demand.

4. Regulatory & Legal

The Boeing Company

- Exposed to rigorous FAA regulations and ongoing scrutiny post-737 MAX issues, increasing compliance costs and litigation risk.

TransDigm Group Incorporated

- Faces regulatory risks linked to aerospace manufacturing standards and export controls, but less public scrutiny than OEMs.

5. Supply Chain & Operations

The Boeing Company

- Complex global supply chain vulnerable to disruptions, delays, and rising input costs impacting production schedules.

TransDigm Group Incorporated

- More agile supply chain focused on specialized components, but still exposed to raw material price inflation and logistic constraints.

6. ESG & Climate Transition

The Boeing Company

- Under pressure to innovate sustainable aviation technologies, facing rising investor and regulatory ESG expectations.

TransDigm Group Incorporated

- ESG risks moderate but increasing, especially regarding energy consumption in manufacturing and emissions in product lifecycle.

7. Geopolitical Exposure

The Boeing Company

- Significant exposure to U.S.-China tensions and defense budgets, which could disrupt international sales and joint ventures.

TransDigm Group Incorporated

- Less directly exposed to major geopolitical flashpoints but reliant on global aerospace supply chains sensitive to trade policies.

Which company shows a better risk-adjusted profile?

The Boeing Company’s most impactful risk is its strained capital structure and weak liquidity, evidenced by an Altman Z-Score in the distress zone (1.67). TransDigm’s critical risk lies in its excessively high debt-to-assets ratio (131%), posing solvency concerns despite favorable operating margins. I see TransDigm with a slightly better risk-adjusted profile due to stronger profitability and a grey zone Altman Z-Score (2.07). However, Boeing’s broader market diversification and innovation focus partially mitigate its financial risks. Recent ratio trends confirm Boeing’s liquidity challenges, while TransDigm’s leverage remains the key vulnerability.

Final Verdict: Which stock to choose?

The Boeing Company’s superpower lies in its resilient revenue growth and improving profitability metrics. Yet, its declining return on invested capital warns of operational inefficiencies. Boeing fits best in aggressive growth portfolios willing to tolerate volatility for a potential rebound in aerospace demand.

TransDigm Group commands a durable moat with high operating margins and strong free cash flow conversion. Its strategic pricing power and efficient capital use signal superior value creation. Compared to Boeing, TransDigm offers better stability, suiting growth-at-a-reasonable-price (GARP) investors seeking quality earnings.

If you prioritize turnaround potential and deep industry exposure, Boeing is compelling despite its current value destruction. However, if you seek durable competitive advantage and consistent cash generation, TransDigm outshines with superior profitability and a cleaner balance sheet. Each choice aligns with distinct investor risk appetites and time horizons.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of The Boeing Company and TransDigm Group Incorporated to enhance your investment decisions: