In the fast-evolving technology landscape, Teradata Corporation and Pure Storage, Inc. stand out as key players in data management and storage solutions. Teradata specializes in multi-cloud analytics platforms, while Pure Storage leads in innovative flash storage hardware. Both target enterprise clients seeking cutting-edge data strategies, making their comparison essential for investors focused on tech growth and innovation. Join me as we analyze which company offers the most compelling investment opportunity today.

Table of contents

Companies Overview

I will begin the comparison between Teradata Corporation and Pure Storage, Inc. by providing an overview of these two companies and their main differences.

Teradata Overview

Teradata Corporation offers a connected multi-cloud data platform for enterprise analytics, focusing on enabling companies to leverage data across their organizations. Its flagship product, Teradata Vantage, supports data integration and ecosystem simplification, aiding clients in cloud migration and analytic infrastructure optimization. Teradata serves sectors like financial services, healthcare, and telecommunications, operating globally with a direct sales force from its San Diego headquarters.

Pure Storage Overview

Pure Storage, Inc. specializes in data storage technologies and services, delivering enterprise-class solutions with its Purity software across various product lines such as FlashArray and FlashBlade. The company targets both structured and unstructured data workloads and offers subscription-based and cloud-native storage options. Founded in 2009 and based in Santa Clara, California, Pure Storage sells through direct sales and channel partners, serving clients worldwide.

Key similarities and differences

Both Teradata and Pure Storage operate in the technology sector with a focus on data management and infrastructure. Teradata emphasizes multi-cloud analytics platforms and consulting services, while Pure Storage centers on hardware solutions and subscription-based storage services. Teradata’s offerings are software and cloud integration-focused, whereas Pure Storage provides physical storage arrays and cloud-ready infrastructure, reflecting distinct approaches to enterprise data solutions.

Income Statement Comparison

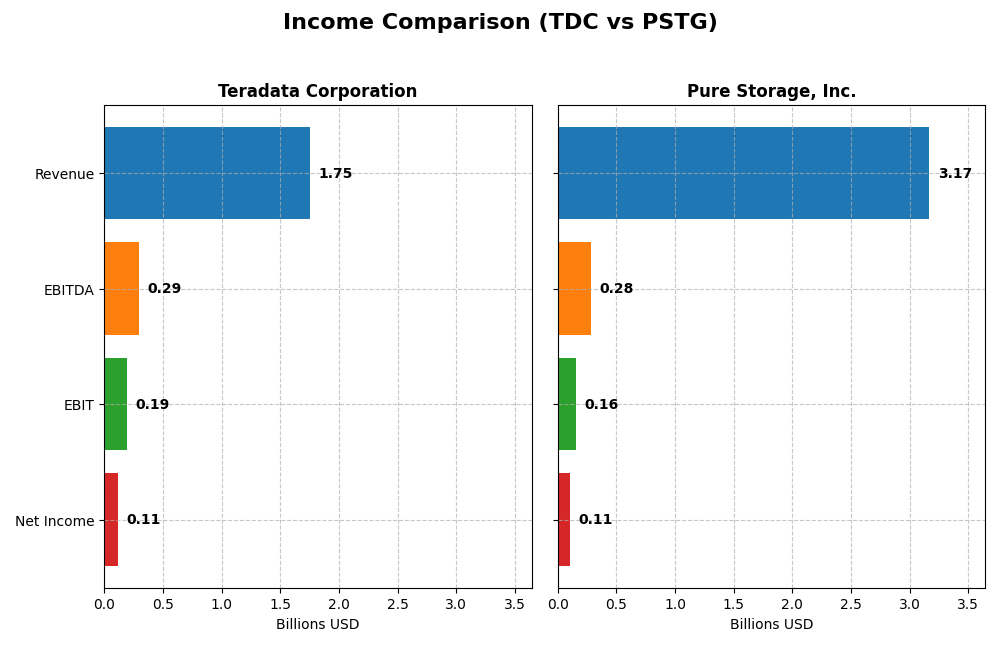

The table below presents a side-by-side comparison of key income statement metrics for Teradata Corporation and Pure Storage, Inc. for their most recent fiscal years.

| Metric | Teradata Corporation (TDC) | Pure Storage, Inc. (PSTG) |

|---|---|---|

| Market Cap | 2.8B | 22.6B |

| Revenue | 1.75B | 3.17B |

| EBITDA | 293M | 282M |

| EBIT | 193M | 156M |

| Net Income | 114M | 107M |

| EPS | 1.18 | 0.33 |

| Fiscal Year | 2024 | 2025 |

Income Statement Interpretations

Teradata Corporation

Teradata’s revenue slightly declined from 2020 to 2024, ending at $1.75B in 2024, with net income decreasing overall to $114M. Margins have seen mixed trends, but gross margin remained favorable around 60.46%. The latest year showed slower revenue and gross profit growth but improved EBIT by 31% and nearly doubled net margin, signaling operational efficiency gains.

Pure Storage, Inc.

Pure Storage exhibited strong revenue growth, reaching $3.17B in 2025, with net income rising substantially to $107M. Gross margin stayed robust near 70%, while EBIT and net margins were more moderate. The most recent year demonstrated accelerated revenue growth of nearly 12%, with significant improvements in EBIT (59%) and net margin (56%), reflecting solid profitability expansion.

Which one has the stronger fundamentals?

Pure Storage presents stronger fundamentals with consistent revenue and net income growth, improving margins, and a favorable overall income statement evaluation of 85.7%. Teradata shows some positive margin stability and EBIT improvement but faces declining revenues and net income. Pure Storage’s growth trajectory and margin expansion position it as the company with more favorable income fundamentals.

Financial Ratios Comparison

Below is a comparison of key financial ratios for Teradata Corporation (TDC) and Pure Storage, Inc. (PSTG) based on their most recent fiscal year data.

| Ratios | Teradata Corporation (2024) | Pure Storage, Inc. (2025) |

|---|---|---|

| ROE | 85.7% | 8.2% |

| ROIC | 16.9% | 2.5% |

| P/E | 26.3 | 206.9 |

| P/B | 22.6 | 16.9 |

| Current Ratio | 0.81 | 1.61 |

| Quick Ratio | 0.79 | 1.58 |

| D/E (Debt-to-Equity) | 4.33 | 0.22 |

| Debt-to-Assets | 33.8% | 7.1% |

| Interest Coverage | 7.21 | 10.9 |

| Asset Turnover | 1.03 | 0.80 |

| Fixed Asset Turnover | 9.07 | 5.21 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0% | 0% |

Interpretation of the Ratios

Teradata Corporation

Teradata’s ratios show a mixed profile with strong returns on equity (85.71%) and invested capital (16.89%), alongside favorable interest coverage and asset turnover. However, valuation multiples like P/E (26.34) and P/B (22.58) are high, and liquidity ratios are weak (current ratio 0.81). The company does not pay dividends, likely focusing on reinvestment and growth initiatives.

Pure Storage, Inc.

Pure Storage presents several unfavorable profitability metrics, including a low net margin (3.37%), ROE (8.17%), and ROIC (2.45%), paired with very high valuation multiples (P/E 206.9, P/B 16.9). Liquidity and leverage ratios are solid, with a current ratio of 1.61 and low debt-to-equity (0.22). It also does not distribute dividends, prioritizing R&D and expansion.

Which one has the best ratios?

Both companies exhibit an equal proportion of favorable and unfavorable ratios, resulting in a neutral overall evaluation. Teradata excels in profitability and asset efficiency but struggles with liquidity and valuation. Pure Storage maintains stronger liquidity and lower debt but shows weaker profitability and very high valuation multiples. Neither company distinctly outperforms the other in ratio quality.

Strategic Positioning

This section compares the strategic positioning of Teradata Corporation and Pure Storage, Inc., including market position, key segments, and exposure to technological disruption:

Teradata Corporation

- Established player in software infrastructure with moderate beta and lower competitive pressure.

- Focused on multi-cloud data platforms and consulting services across diverse sectors like finance and healthcare.

- Moderate exposure to disruption with emphasis on cloud migration and ecosystem simplification.

Pure Storage, Inc.

- Leading in computer hardware with higher beta, facing intense competition in storage technology.

- Specializes in data storage products and subscription services emphasizing flash storage and AI-ready infrastructure.

- High exposure to disruption with innovation in flash arrays, cloud-native data management, and AI infrastructure.

Teradata Corporation vs Pure Storage, Inc. Positioning

Teradata pursues a diversified strategy across software infrastructure, consulting, and multi-cloud platforms, serving multiple industries globally. Pure Storage concentrates on advanced hardware and data storage solutions, focusing on innovation in flash arrays and cloud-native services, reflecting different approaches to market and technology focus.

Which has the best competitive advantage?

Teradata demonstrates a very favorable moat with a durable competitive advantage and growing ROIC above WACC, indicating efficient capital use. Pure Storage shows a slightly unfavorable moat with negative ROIC versus WACC but improving profitability, reflecting challenges in sustaining value creation.

Stock Comparison

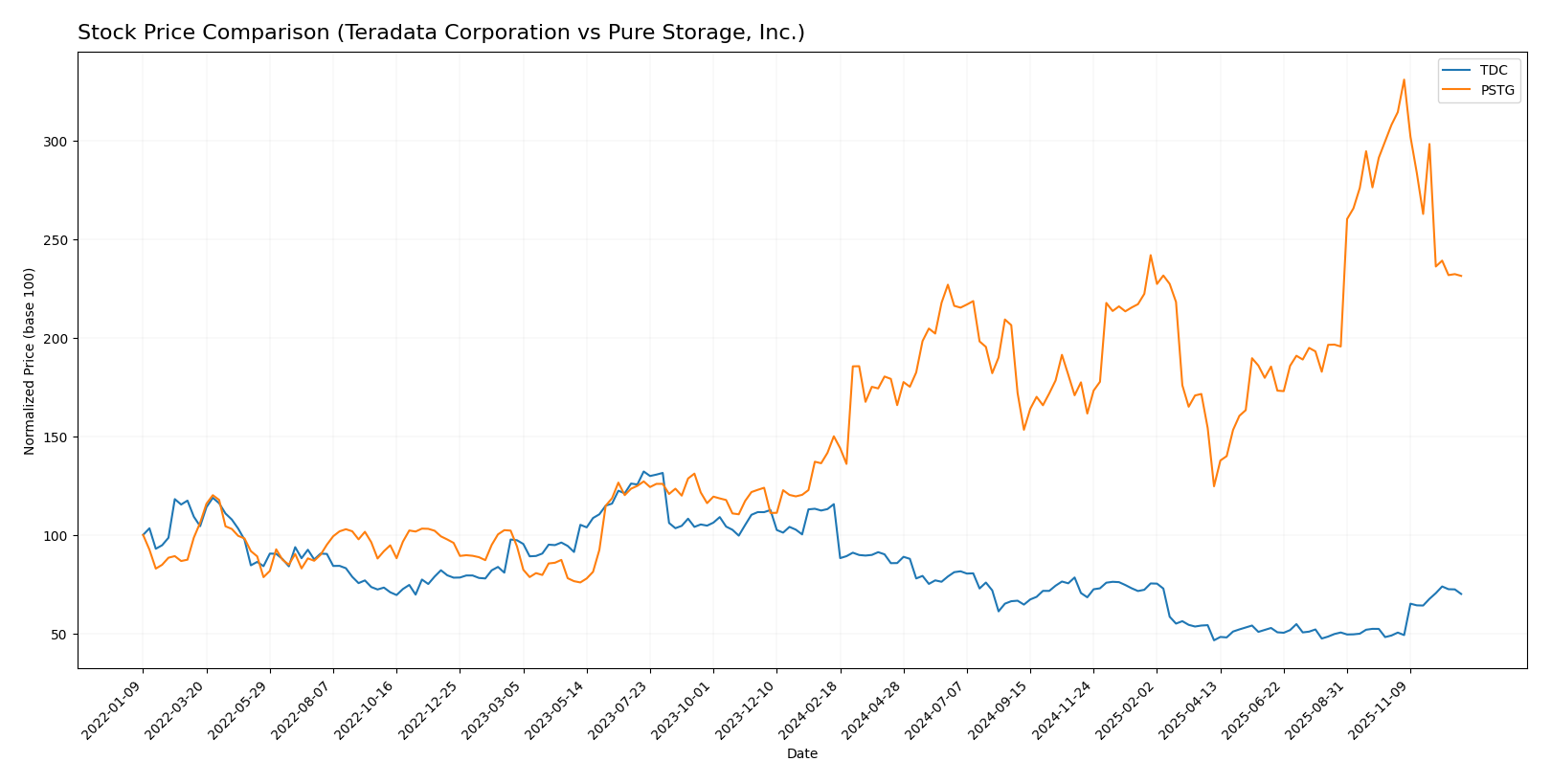

The stock price movements of Teradata Corporation and Pure Storage, Inc. over the past 12 months reveal contrasting dynamics, with Teradata experiencing a significant overall decline but recent recovery, while Pure Storage shows strong growth with a recent pullback.

Trend Analysis

Teradata Corporation’s stock shows a bearish trend over the past year, declining by 39.4% with accelerating downward momentum and a standard deviation of 6.06. The price ranged between 48.99 and 19.73, but recently rebounded by 43.02%.

Pure Storage, Inc. delivered a bullish trend over the same period, rising 54.21% despite decelerating growth and higher volatility at 12.96 standard deviation. The stock hit a high of 98.7 and a low of 37.18, though it declined 24.87% recently.

Comparing the two, Pure Storage has delivered the highest market performance over the past year, outperforming Teradata’s substantial overall loss despite its recent price correction.

Target Prices

The current analyst consensus presents clear target price ranges for Teradata Corporation and Pure Storage, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Teradata Corporation | 35 | 24 | 29.5 |

| Pure Storage, Inc. | 105 | 60 | 91.15 |

Analysts expect Teradata’s price to hover near its current value of $29.69, indicating moderate upside potential. Pure Storage’s consensus target is substantially above its $69.01 stock price, suggesting stronger growth expectations.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Teradata Corporation and Pure Storage, Inc.:

Rating Comparison

TDC Rating

- Rating: B+ indicating a very favorable overall evaluation.

- Discounted Cash Flow Score: 4, considered favorable for future cash flows.

- ROE Score: 5, very favorable efficiency in generating profit from equity.

- ROA Score: 4, favorable asset utilization for earnings generation.

- Debt To Equity Score: 1, very unfavorable, indicating high financial leverage.

- Overall Score: 3, moderate overall financial standing.

PSTG Rating

- Rating: B- with a very favorable overall evaluation.

- Discounted Cash Flow Score: 3, moderate outlook on future cash flows.

- ROE Score: 3, moderate efficiency in generating profit from equity.

- ROA Score: 3, moderate asset utilization for earnings generation.

- Debt To Equity Score: 3, moderate financial leverage and risk.

- Overall Score: 2, moderate overall financial standing.

Which one is the best rated?

Based strictly on the provided data, Teradata Corporation has higher scores for discounted cash flow, ROE, and ROA, but a very unfavorable debt-to-equity score. Pure Storage shows moderate scores across metrics with a better debt-to-equity score. Overall, Teradata presents a stronger rating despite higher financial leverage risk.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Teradata Corporation and Pure Storage, Inc.:

Teradata Corporation Scores

- Altman Z-Score: 0.65, placing it in the distress zone indicating high bankruptcy risk.

- Piotroski Score: 8, categorized as very strong financial health.

Pure Storage, Inc. Scores

- Altman Z-Score: 5.91, in the safe zone indicating low bankruptcy risk.

- Piotroski Score: 5, considered average financial strength.

Which company has the best scores?

Pure Storage has a significantly better Altman Z-Score indicating financial safety, while Teradata excels in Piotroski Score reflecting stronger financial health. Each score highlights different aspects of company stability.

Grades Comparison

The grades comparison for Teradata Corporation and Pure Storage, Inc. is as follows:

Teradata Corporation Grades

This table summarizes the recent grades and rating actions for Teradata Corporation.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Overweight | 2025-12-17 |

| Citizens | Upgrade | Market Outperform | 2025-11-10 |

| Barclays | Maintain | Underweight | 2025-11-05 |

| Evercore ISI Group | Maintain | Outperform | 2025-11-05 |

| TD Cowen | Maintain | Hold | 2025-11-05 |

| UBS | Maintain | Neutral | 2025-08-06 |

| Guggenheim | Maintain | Buy | 2025-05-07 |

| Barclays | Maintain | Underweight | 2025-04-21 |

| Citizens Capital Markets | Maintain | Market Perform | 2025-03-18 |

| JMP Securities | Maintain | Market Perform | 2025-02-13 |

Teradata Corporation’s grades show a mix of moderate to positive ratings, with some upgrades and several maintained positions, indicating a generally stable outlook.

Pure Storage, Inc. Grades

This table summarizes the recent grades and rating actions for Pure Storage, Inc.

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Lake Street | Maintain | Buy | 2025-12-03 |

| Citigroup | Maintain | Buy | 2025-12-03 |

| UBS | Maintain | Sell | 2025-12-03 |

| Wedbush | Maintain | Outperform | 2025-12-03 |

| Susquehanna | Downgrade | Neutral | 2025-12-03 |

| Needham | Maintain | Buy | 2025-12-03 |

| JP Morgan | Maintain | Overweight | 2025-12-03 |

| Barclays | Maintain | Equal Weight | 2025-12-03 |

| Morgan Stanley | Maintain | Equal Weight | 2025-11-17 |

| JP Morgan | Maintain | Overweight | 2025-11-17 |

Pure Storage, Inc.’s ratings are generally positive with multiple buy and overweight grades, though there is some divergence, including a sell rating and a recent downgrade to neutral.

Which company has the best grades?

Pure Storage, Inc. has received generally more positive grades, including several buy and overweight ratings, compared to Teradata Corporation’s more mixed and moderate grades. Investors might interpret Pure Storage’s stronger grades as a sign of higher confidence from analysts, while Teradata’s varied ratings suggest a more cautious outlook.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for Teradata Corporation (TDC) and Pure Storage, Inc. (PSTG) based on their latest financial and operational data.

| Criterion | Teradata Corporation (TDC) | Pure Storage, Inc. (PSTG) |

|---|---|---|

| Diversification | Strong recurring revenue streams across consulting, subscription software, and services (~$2.8B recurring in 2024) | Moderate diversification between product and service revenues ($3.2B total in 2025) but heavily product-focused |

| Profitability | Favorable ROIC at 16.9%, ROE very strong at 85.7%, net margin moderate at 6.5% | Low profitability with ROIC 2.45%, ROE 8.2%, net margin 3.4%, currently shedding value |

| Innovation | Stable product updates with emphasis on data analytics and recurring software licenses | Rapid innovation in storage solutions, growing ROIC trend suggests improving efficiency |

| Global presence | Established international footprint with consistent revenues from US and international markets | Primarily US-based with growing service offerings, less international diversification |

| Market Share | Solid market position in data analytics and enterprise software | Growing share in storage hardware but challenged by high valuation multiples and competition |

Key takeaways: Teradata exhibits a durable competitive advantage with strong profitability and diversified recurring revenues, though liquidity ratios and valuation metrics suggest caution. Pure Storage is improving profitability but remains unprofitable overall, with strengths in innovation and liquidity that may support future growth. Investors should weigh Teradata’s stability against Pure Storage’s growth potential and risks.

Risk Analysis

Below is a comparative table outlining key risks for Teradata Corporation (TDC) and Pure Storage, Inc. (PSTG) based on the most recent data available for 2025-2026.

| Metric | Teradata Corporation (TDC) | Pure Storage, Inc. (PSTG) |

|---|---|---|

| Market Risk | Low beta (0.576) indicates lower volatility, but high P/E (26.34) and P/B (22.58) suggest valuation risk. | Higher beta (1.276) reflects greater market sensitivity; very high P/E (206.9) and P/B (16.9) ratios imply overvaluation risk. |

| Debt level | High debt-to-equity (4.33, unfavorable) and moderate debt-to-assets (33.8%) indicate leverage concerns. | Low debt-to-equity (0.22) and debt-to-assets (7.09%) show strong balance sheet with low leverage. |

| Regulatory Risk | Moderate, operating across multiple sectors with potential data privacy and cloud regulations. | Moderate, with exposure to data storage and cloud governance regulations globally. |

| Operational Risk | Moderate, reliance on multi-cloud platform integration; current and quick ratios (<1) indicate liquidity pressure. | Lower operational risk with better liquidity (current ratio 1.61) and diversified product portfolio. |

| Environmental Risk | Moderate, typical for technology infrastructure companies; focus on energy-efficient cloud solutions. | Moderate, with emphasis on sustainable hardware and data center energy use. |

| Geopolitical Risk | Exposure to global markets including Americas, EMEA, and APAC; risks from trade tensions. | Similar exposure with potential impact from US-China tech tensions and supply chain disruptions. |

Teradata’s most impactful risks include high financial leverage and liquidity constraints, despite strong ROE and operational returns. Pure Storage carries significant market risk due to valuation levels and higher beta but benefits from a solid balance sheet and liquidity position. Investors should weigh Teradata’s bankruptcy risk indicated by a low Altman Z-score against Pure Storage’s premium valuation and moderate Piotroski score.

Which Stock to Choose?

Teradata Corporation (TDC) shows a mixed income evolution with recent net margin growth of 92.59% but an overall revenue decline of -4.68%. Financial ratios reveal strong profitability, including an 85.71% ROE and 16.89% ROIC, yet liquidity and valuation metrics appear unfavorable. Its debt level is moderate, and the company holds a very favorable B+ rating.

Pure Storage, Inc. (PSTG) demonstrates solid income growth, with an 11.92% revenue increase and 55.55% net margin growth over the past year, supported by an 88.11% revenue rise over the overall period. However, profitability ratios such as 8.17% ROE and 2.45% ROIC are weak, though liquidity and debt ratios are favorable. The company carries a very favorable B- rating.

Investors seeking durable profitability and value creation might find TDC’s strong ROIC above WACC and very favorable rating indicative of a competitive advantage. Conversely, those favoring growth potential and improving income metrics may view PSTG’s positive revenue trends and liquidity as attractive despite its lower profitability. The choice could depend on an investor’s risk tolerance and strategy focus.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Teradata Corporation and Pure Storage, Inc. to enhance your investment decisions: