In the rapidly evolving software infrastructure sector, Teradata Corporation (TDC) and Informatica Inc. (INFA) stand out as key players driving innovation in data management and analytics. Both companies focus on enabling enterprises to harness multi-cloud data environments, yet they approach this challenge with distinct platforms and strategies. This analysis will help you understand which company presents the more compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Teradata Corporation and Informatica Inc. by providing an overview of these two companies and their main differences.

Teradata Overview

Teradata Corporation provides a connected multi-cloud data platform designed for enterprise analytics. Its flagship product, Teradata Vantage, enables companies to leverage data across enterprises and supports cloud migration via ecosystem simplification. Teradata serves various sectors including financial services, healthcare, and telecommunications through a global direct sales force. Founded in 1979, it is headquartered in San Diego, California.

Informatica Overview

Informatica Inc. develops an AI-powered platform that connects, manages, and unifies data across multi-cloud and hybrid systems at enterprise scale. Its suite includes data integration, API management, data quality, master data management, and governance products. Informatica aims to provide accurate, complete, and compliant data to support analytics and business processes. The company was founded in 1993 and is based in Redwood City, California.

Key similarities and differences

Both Teradata and Informatica operate in the software infrastructure industry focusing on enterprise data management and cloud solutions. Teradata emphasizes analytics and cloud migration with its multi-cloud data platform, while Informatica offers a broader AI-driven data management suite including data quality and governance. Teradata has a longer history and a slightly larger workforce, while Informatica’s platform integrates AI for enhanced data unification and governance.

Income Statement Comparison

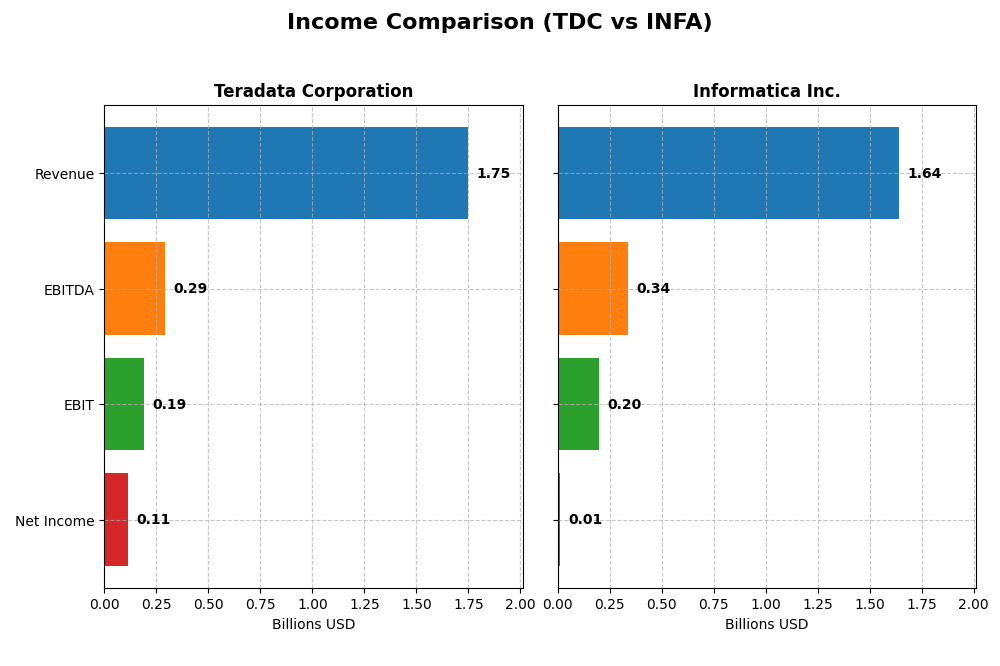

This table presents a side-by-side comparison of the key income statement metrics for Teradata Corporation and Informatica Inc. for the fiscal year 2024.

| Metric | Teradata Corporation (TDC) | Informatica Inc. (INFA) |

|---|---|---|

| Market Cap | 2.82B | 7.54B |

| Revenue | 1.75B | 1.64B |

| EBITDA | 293M | 339M |

| EBIT | 193M | 199M |

| Net Income | 114M | 9.93M |

| EPS | 1.18 | 0.033 |

| Fiscal Year | 2024 | 2024 |

Income Statement Interpretations

Teradata Corporation

Teradata’s revenue showed a slight decline from 2020 to 2024, ending at $1.75B in 2024 with a net income of $114M, down from $147M in 2021. Gross margin remained favorable near 60.46%, while net margin was stable around 6.51%. The latest year saw slower revenue but improved EBIT and net income margins, reflecting better operational efficiency.

Informatica Inc.

Informatica demonstrated consistent revenue growth, reaching $1.64B in 2024, with net income turning positive to $9.9M after prior losses. Gross margin was strong at 80.11%, and EBIT margin improved to 12.15%. Despite a modest net margin of 0.61%, recent growth was robust, with significant improvements in EBIT and EPS, signaling operational progress.

Which one has the stronger fundamentals?

Informatica shows stronger fundamentals with favorable revenue and net income growth over the period, higher gross and EBIT margins, and positive momentum in profitability metrics. Teradata, while profitable with stable margins, faced declining revenue and net income overall. Informatica’s improvement in net margin and EPS growth contrasts with Teradata’s mixed performance, suggesting a more favorable income statement profile.

Financial Ratios Comparison

This table provides a side-by-side comparison of key financial ratios for Teradata Corporation and Informatica Inc. based on their most recent fiscal year data from 2024.

| Ratios | Teradata Corporation (TDC) | Informatica Inc. (INFA) |

|---|---|---|

| ROE | 85.7% | 0.43% |

| ROIC | 16.9% | 0.56% |

| P/E | 26.3 | 788 |

| P/B | 22.6 | 3.39 |

| Current Ratio | 0.81 | 1.82 |

| Quick Ratio | 0.79 | 1.82 |

| D/E (Debt-to-Equity) | 4.33 | 0.81 |

| Debt-to-Assets | 33.8% | 35.2% |

| Interest Coverage | 7.21 | 0.87 |

| Asset Turnover | 1.03 | 0.31 |

| Fixed Asset Turnover | 9.07 | 8.75 |

| Payout Ratio | 0% | 0.12% |

| Dividend Yield | 0% | 0.00015% |

Interpretation of the Ratios

Teradata Corporation

Teradata shows strength in return on equity (85.71%) and return on invested capital (16.89%), supported by favorable interest coverage and asset turnover ratios, indicating efficient use of capital. However, the company’s price-to-earnings (26.34) and price-to-book (22.58) ratios are high, and liquidity ratios are weak with a current ratio of 0.81. Teradata does not pay dividends, implying potential reinvestment or growth focus.

Informatica Inc.

No ratio data is available for Informatica, limiting any financial ratio analysis. The absence of key metrics and income data prevents evaluation of its profitability, leverage, or liquidity. As with Teradata, Informatica does not pay dividends, which may reflect a reinvestment strategy, growth phase, or prioritization of operational expansion.

Which one has the best ratios?

Based on the available data, Teradata presents a mixed but measurable profile with notable strengths in profitability and capital efficiency, albeit with concerns in valuation and liquidity. Informatica’s lack of disclosed ratios precludes comparison, leaving Teradata as the only company with quantifiable financial ratio insights at this time.

Strategic Positioning

This section compares the strategic positioning of Teradata Corporation and Informatica Inc., including market position, key segments, and exposure to technological disruption:

Teradata Corporation

- Mid-cap with moderate beta, facing competitive pressure in software infrastructure

- Focuses on multi-cloud data platforms, consulting, and recurring data services across various industries

- Operates a connected multi-cloud ecosystem with a focus on enterprise analytics and migration support

Informatica Inc.

- Larger market cap with higher beta, active in software infrastructure sector

- AI-powered data management platform emphasizing data integration, quality, and governance

- Emphasizes AI-driven data unification and management across multi-cloud and hybrid environments

Teradata Corporation vs Informatica Inc. Positioning

Teradata shows a diversified approach with consulting, recurring services, and multi-industry reach, while Informatica concentrates on AI-powered data management and integration platforms, offering deep specialization but less diversification.

Which has the best competitive advantage?

Teradata demonstrates a very favorable moat with a growing ROIC above its WACC, indicating durable competitive advantage and value creation; Informatica lacks sufficient data for a similar MOAT evaluation.

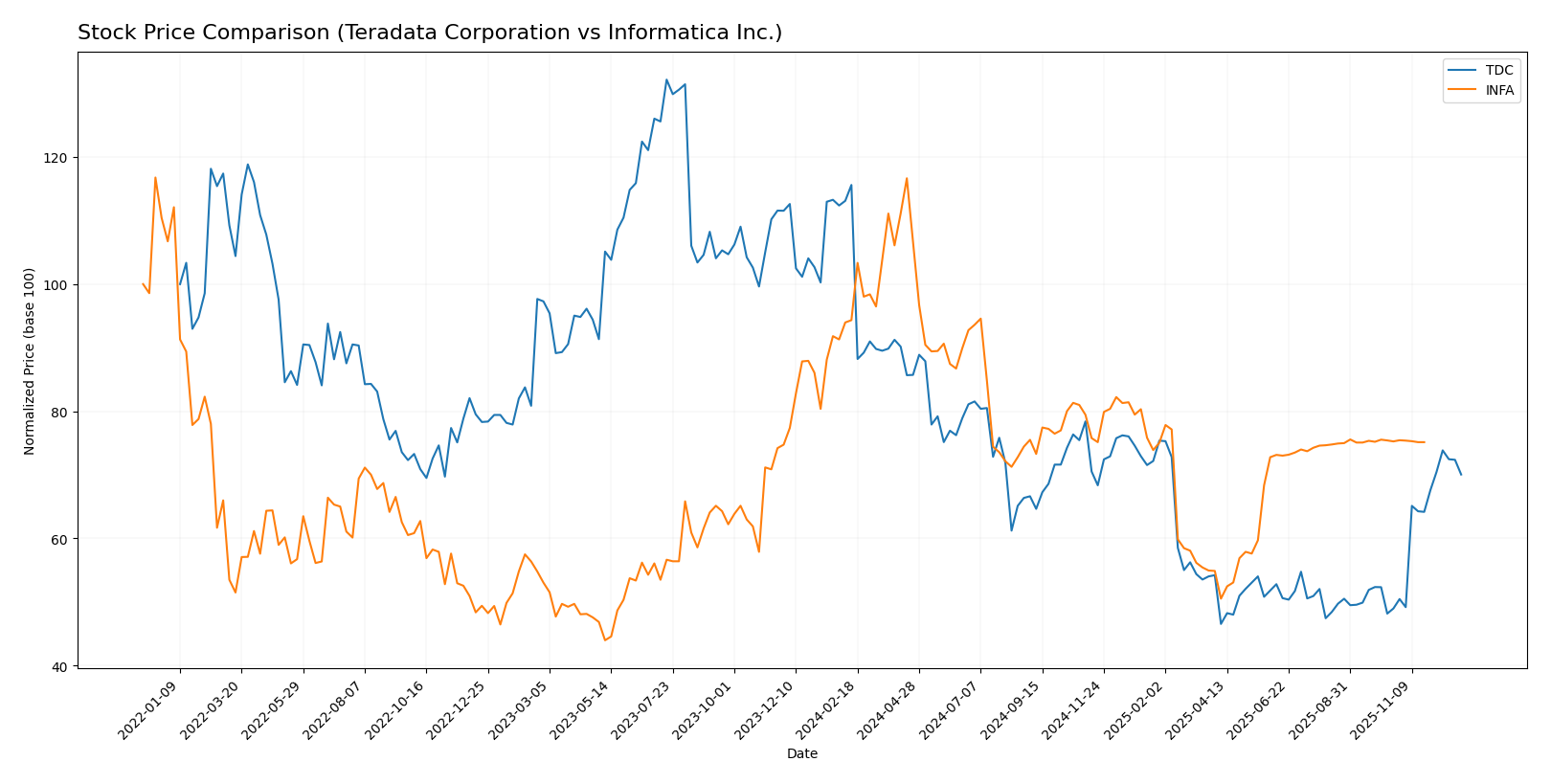

Stock Comparison

The stock price movements of Teradata Corporation (TDC) and Informatica Inc. (INFA) over the past year reflect contrasting bearish trends with differing degrees of recent recovery and trading dynamics.

Trend Analysis

Teradata Corporation’s stock showed a bearish trend over the past 12 months with a -39.4% price change and accelerating downward momentum, despite a recent 43.02% gain from October 2025 to January 2026. The stock experienced significant volatility with a 6.06 standard deviation.

Informatica Inc.’s stock also trended bearish over the same period, declining by -12.68% with accelerating losses. Recent price movement was essentially neutral, rising just 0.08% from September to November 2025, accompanied by very low volatility (0.05 standard deviation).

Comparing both stocks, Teradata’s larger overall decline contrasts with its stronger recent rebound, while Informatica maintained a smaller loss but showed no meaningful recent upward momentum. Teradata delivered the lowest market performance over the past year.

Target Prices

The current analyst consensus indicates a moderate upside potential for both Teradata Corporation and Informatica Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Teradata Corporation | 35 | 24 | 29.5 |

| Informatica Inc. | 27 | 27 | 27 |

Analysts expect Teradata’s price to trade slightly above its current level of $29.69, while Informatica’s target price of $27 suggests a modest increase from its current $24.79 stock price.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Teradata Corporation and Informatica Inc.:

Rating Comparison

Teradata Corporation Rating

- Rating: B+, evaluated as Very Favorable by analysts.

- Discounted Cash Flow Score: 4, indicating a Favorable valuation.

- ROE Score: 5, considered Very Favorable for profitability.

- ROA Score: 4, showing Favorable asset utilization.

- Debt To Equity Score: 1, rated Very Unfavorable, indicating high leverage risk.

- Overall Score: 3, Moderate overall financial standing.

Informatica Inc. Rating

- No rating data available for Informatica.

- No data provided.

- No data provided.

- No data provided.

- No data provided.

- No data provided.

Which one is the best rated?

Based solely on available data, Teradata holds a B+ rating with several favorable scores, while no analyst ratings or scores are provided for Informatica, making Teradata the better rated company in this comparison.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Teradata Corporation and Informatica Inc.:

TDC Scores

- Altman Z-Score: 0.65, in the distress zone, high bankruptcy risk

- Piotroski Score: 8, very strong financial health

INFA Scores

- Altman Z-Score: 1.94, in the grey zone, moderate bankruptcy risk

- Piotroski Score: 6, average financial health

Which company has the best scores?

Teradata shows a very strong Piotroski Score of 8 but a low Altman Z-Score indicating distress. Informatica has a better Altman Z-Score in the grey zone and an average Piotroski Score of 6. Teradata leads in financial strength, while Informatica is less at risk of bankruptcy.

Grades Comparison

Here is a comparison of the most recent reliable grades assigned to Teradata Corporation and Informatica Inc.:

Teradata Corporation Grades

The following table shows recent grades and actions from reputable financial institutions for Teradata Corporation:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Overweight | 2025-12-17 |

| Citizens | Upgrade | Market Outperform | 2025-11-10 |

| Barclays | Maintain | Underweight | 2025-11-05 |

| Evercore ISI Group | Maintain | Outperform | 2025-11-05 |

| TD Cowen | Maintain | Hold | 2025-11-05 |

| UBS | Maintain | Neutral | 2025-08-06 |

| Guggenheim | Maintain | Buy | 2025-05-07 |

| Barclays | Maintain | Underweight | 2025-04-21 |

| Citizens Capital Markets | Maintain | Market Perform | 2025-03-18 |

| JMP Securities | Maintain | Market Perform | 2025-02-13 |

Teradata shows a mixed but generally positive trend, with multiple “Buy,” “Outperform,” and “Overweight” ratings, reflecting cautious optimism among analysts.

Informatica Inc. Grades

The table below lists recent grades and changes provided by established grading firms for Informatica Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Guggenheim | Downgrade | Neutral | 2025-08-07 |

| UBS | Maintain | Neutral | 2025-08-07 |

| Baird | Maintain | Neutral | 2025-05-28 |

| JP Morgan | Downgrade | Neutral | 2025-05-28 |

| RBC Capital | Maintain | Sector Perform | 2025-05-28 |

| Wolfe Research | Downgrade | Peer Perform | 2025-05-28 |

| Wells Fargo | Maintain | Equal Weight | 2025-05-28 |

| Truist Securities | Downgrade | Hold | 2025-05-28 |

| RBC Capital | Maintain | Sector Perform | 2025-05-27 |

| UBS | Maintain | Neutral | 2025-05-16 |

Informatica’s ratings indicate a downward revision trend, with several downgrades and predominantly neutral to hold ratings, signaling moderate analyst caution.

Which company has the best grades?

Teradata Corporation generally holds higher and more optimistic grades than Informatica Inc., with more “Buy,” “Outperform,” and “Overweight” ratings. This suggests stronger analyst confidence in Teradata’s prospects, which could influence investor sentiment and portfolio decisions accordingly.

Strengths and Weaknesses

Below is a comparison table outlining the key strengths and weaknesses of Teradata Corporation (TDC) and Informatica Inc. (INFA) based on the most recent available data.

| Criterion | Teradata Corporation (TDC) | Informatica Inc. (INFA) |

|---|---|---|

| Diversification | Strong diversification with multiple revenue streams: consulting ($248M), recurring product & services ($1.48B), subscription software ($289M). | Moderate diversification: primarily subscription ($1.1B) and professional services ($78M). |

| Profitability | Favorable ROIC (16.9%) well above WACC (5.8%), ROE high at 85.7%, net margin neutral at 6.5%. | Data unavailable for profitability metrics. |

| Innovation | Consistent investment in subscription software licenses and recurring services, moderate innovation presence. | Innovation data unavailable; strong focus on cloud and subscription models. |

| Global presence | Significant international revenue historically; global service offerings through consulting and software. | Global footprint implied by subscription growth but less detailed data. |

| Market Share | Established player with durable competitive advantage and growing ROIC trend. | Market share data unavailable; subscription growth suggests expanding presence. |

Key takeaways: Teradata shows a durable competitive advantage with strong profitability and diversified revenue streams, though some liquidity ratios are weak. Informatica’s data gaps limit full assessment, but its subscription revenue growth indicates a solid position in cloud-based offerings. Investors should weigh Teradata’s proven value creation against Informatica’s potential growth with caution.

Risk Analysis

Below is a comparative table of key risks for Teradata Corporation (TDC) and Informatica Inc. (INFA) based on their most recent data from 2024 and 2026 evaluations.

| Metric | Teradata Corporation (TDC) | Informatica Inc. (INFA) |

|---|---|---|

| Market Risk | Low beta (0.576) indicates lower volatility. | Higher beta (1.135) implies greater market sensitivity. |

| Debt Level | High debt-to-equity (4.33), unfavorable financial leverage. | Insufficient data for precise assessment. |

| Regulatory Risk | Moderate, operating in data analytics with compliance demands. | Moderate, with strong data governance focus. |

| Operational Risk | Medium, reliant on multi-cloud integration and consulting services. | Medium, dependent on AI-driven platform stability. |

| Environmental Risk | Low direct exposure, typical for software sector. | Low exposure, similar industry profile. |

| Geopolitical Risk | Moderate, global client base including EMEA and Asia Pacific. | Moderate, with enterprise focus in US and global cloud environments. |

Teradata’s most impactful risk is its high debt level, which strains financial flexibility despite strong profitability metrics. Informatica faces higher market risk due to greater beta but shows moderate operational and regulatory risks linked to AI and data compliance trends. Teradata’s financial distress signals warrant cautious risk management, while Informatica’s risk profile remains less quantifiable but influenced by its AI platform’s growth and regulatory environment.

Which Stock to Choose?

Teradata Corporation (TDC) shows a mixed income evolution with some recent declines in revenue but strong improvements in net margin and earnings per share. Its financial ratios are balanced, featuring very favorable returns on equity and invested capital, yet some liquidity and valuation ratios appear unfavorable. The company maintains moderate debt levels and holds a very favorable overall rating of B+.

Informatica Inc. (INFA) exhibits favorable income growth and solid gross and EBIT margins, though net margin remains low. Financial ratios data are incomplete, but scores indicate moderate financial distress risk and average operational strength. Debt is comparatively high, and rating details are unavailable, reflecting some uncertainty in its financial standing.

For investors, Teradata’s very favorable rating and demonstrated value creation with growing profitability might appeal to those prioritizing quality and financial robustness. Informatica’s income growth and margin expansion could attract growth-focused investors willing to accept higher risk amid limited ratio data. This analysis could be interpreted as favoring Teradata for stability and Informatica for growth potential depending on risk tolerance.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Teradata Corporation and Informatica Inc. to enhance your investment decisions: