In the fast-evolving technology sector, Synopsys, Inc. (SNPS) and Zscaler, Inc. (ZS) stand out as leaders in software infrastructure, each driving innovation in distinct but overlapping markets. While Synopsys focuses on electronic design automation and semiconductor solutions, Zscaler pioneers cloud security services. Comparing these companies reveals different growth avenues and risk profiles. Join me as we explore which stock offers the most compelling opportunity for your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Synopsys and Zscaler by providing an overview of these two companies and their main differences.

Synopsys Overview

Synopsys, Inc. is a leading provider of electronic design automation software used to design and test integrated circuits. The company offers a comprehensive suite of solutions including digital design implementation, verification, FPGA design, and intellectual property products. Serving diverse sectors such as electronics, automotive, and finance, Synopsys has a strong market position with a $98.8B market cap and over 20K employees headquartered in Mountain View, California.

Zscaler Overview

Zscaler, Inc. operates globally as a cloud security provider, offering solutions for secure access to SaaS applications and internal managed applications. Its platform includes tools for digital experience monitoring and workload segmentation to enhance security and compliance. With a $34.1B market cap and 7.3K employees, Zscaler focuses on industries including healthcare, technology, and public sector, and is based in San Jose, California.

Key similarities and differences

Both Synopsys and Zscaler operate within the software infrastructure industry, serving enterprise customers with technology solutions. Synopsys specializes in electronic design automation and IP, focusing on hardware-related software, while Zscaler provides cloud-based security services emphasizing secure internet access and application security. Their business models differ mainly in product focus—Synopsys on design tools and IP, Zscaler on cloud security platforms.

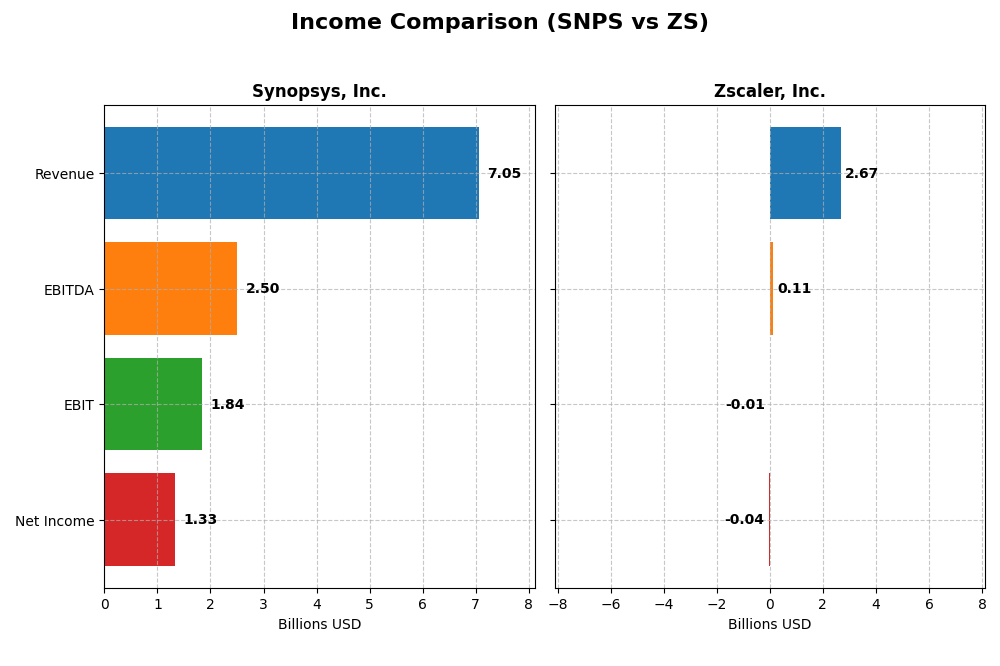

Income Statement Comparison

The table below provides a side-by-side comparison of key income statement metrics for Synopsys, Inc. and Zscaler, Inc. for their most recent fiscal years.

| Metric | Synopsys, Inc. | Zscaler, Inc. |

|---|---|---|

| Market Cap | 98.8B | 34.1B |

| Revenue | 7.05B | 2.67B |

| EBITDA | 2.50B | 112M |

| EBIT | 1.84B | -8.77M |

| Net Income | 1.33B | -41.5M |

| EPS | 8.13 | -0.27 |

| Fiscal Year | 2025 | 2025 |

Income Statement Interpretations

Synopsys, Inc.

Synopsys has shown consistent revenue growth from 4.2B in 2021 to 7.1B in 2025, with net income rising from 757M to 1.33B, despite a dip in 2025. Gross margin remained strong at 77%, while net margin dropped nearly 49% in the last year. The 2025 performance reflects solid revenue and EBIT growth but pressure on net margin and EPS.

Zscaler, Inc.

Zscaler’s revenue expanded significantly from 673M in 2021 to 2.67B in 2025, with net losses narrowing from -262M to -41M. Gross margin stayed favorable near 77%, though EBIT and net margins remain negative but improving. The latest year shows strong revenue and margin growth, signaling improving operational efficiency despite continued net losses.

Which one has the stronger fundamentals?

Synopsys possesses stronger fundamentals with favorable gross, EBIT, and net margins, and positive net income growth over five years. Zscaler demonstrates faster revenue growth and margin improvements but still reports net losses and negative EBIT margins. Synopsys’s consistent profitability contrasts with Zscaler’s improving yet unprofitable income statement.

Financial Ratios Comparison

Below is a comparison of key financial ratios for Synopsys, Inc. (SNPS) and Zscaler, Inc. (ZS) based on their most recent full fiscal year data.

| Ratios | Synopsys, Inc. (SNPS) 2025 | Zscaler, Inc. (ZS) 2025 |

|---|---|---|

| ROE | 4.7% | -2.3% |

| ROIC | 2.0% | -3.2% |

| P/E | 54.4 | -1063.0 |

| P/B | 2.57 | 24.51 |

| Current Ratio | 1.62 | 2.01 |

| Quick Ratio | 1.52 | 2.01 |

| D/E (Debt-to-Equity) | 0.50 | 1.00 |

| Debt-to-Assets | 29.6% | 28.0% |

| Interest Coverage | 2.05 | -13.49 |

| Asset Turnover | 0.15 | 0.42 |

| Fixed Asset Turnover | 5.04 | 4.22 |

| Payout Ratio | 0 | 0 |

| Dividend Yield | 0% | 0% |

Interpretation of the Ratios

Synopsys, Inc.

Synopsys exhibits a balanced ratio profile with favorable net margin (18.96%) and liquidity ratios (current ratio 1.62, quick ratio 1.52), but faces concerns with low returns on equity (4.72%) and invested capital (1.97%), as well as a high price-to-earnings ratio (54.36). The company does not pay dividends, likely prioritizing reinvestment and growth given zero dividend yield and no payout.

Zscaler, Inc.

Zscaler’s ratios reveal challenges, including negative profitability metrics such as net margin (-1.55%), return on equity (-2.31%), and return on capital employed (-3.22%). Liquidity ratios are strong (current and quick ratios at 2.01), but high price-to-book ratio (24.51) and negative interest coverage indicate risk. The company pays no dividends, reflecting a focus on reinvestment and growth during a difficult profitability phase.

Which one has the best ratios?

Both companies show strengths in liquidity and asset turnover; however, Synopsys holds a more favorable profitability position with a positive net margin and less negative returns compared to Zscaler. Synopsys’s valuation metrics are more moderate, while Zscaler faces heavier profitability and coverage challenges, making its overall ratio profile slightly less favorable.

Strategic Positioning

This section compares the strategic positioning of Synopsys and Zscaler, focusing on market position, key segments, and exposure to technological disruption:

Synopsys, Inc.

- Leading software infrastructure provider with strong market capitalization and moderate competitive pressure.

- Key segments include electronic design automation, IP solutions, and technology services across diverse industries.

- Exposure to technological disruption through development of virtual prototyping, FPGA-based systems, and security IP solutions.

Zscaler, Inc.

- Cloud security specialist with smaller market cap and competitive presence in security software.

- Focused on cloud security solutions such as Internet Access, Private Access, and workload segmentation.

- Faces disruption risks in cloud security innovation but leads with advanced cloud workload protection.

Synopsys vs Zscaler Positioning

Synopsys pursues a diversified approach across multiple electronic design and IP product lines, supporting various industries. Zscaler concentrates on cloud security solutions, emphasizing SaaS and cloud workload protection. Synopsys’s broad portfolio contrasts with Zscaler’s focused specialization.

Which has the best competitive advantage?

Both companies are currently shedding value with ROIC below WACC; however, Zscaler shows a growing ROIC trend, indicating improving profitability, while Synopsys faces declining returns, suggesting a weaker moat.

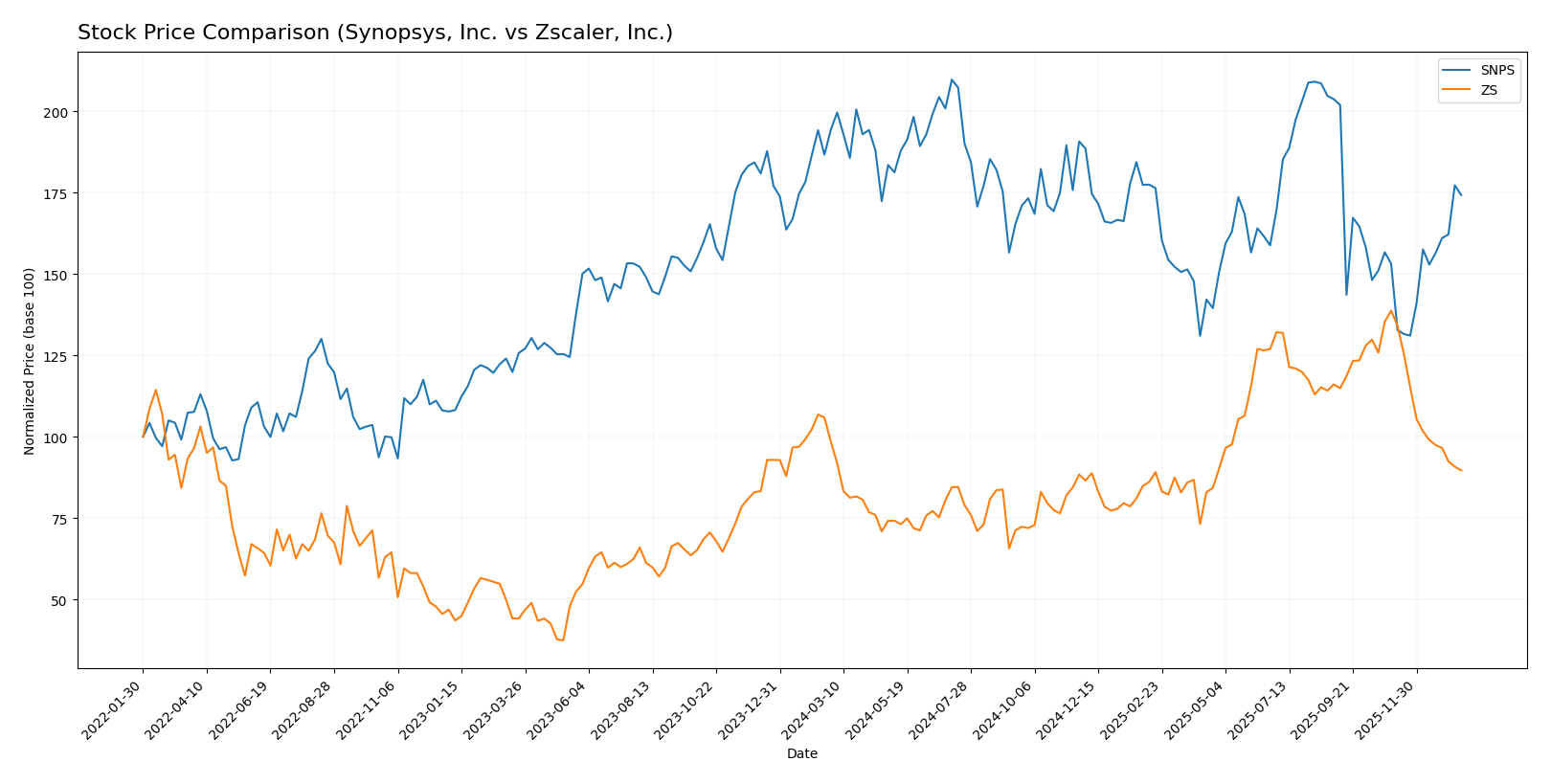

Stock Comparison

The stock prices of Synopsys, Inc. and Zscaler, Inc. have experienced distinct trading dynamics over the past 12 months, with Synopsys showing accelerated bearish movement and recent recovery, while Zscaler displays a decelerating bearish trend with steep recent declines.

Trend Analysis

Synopsys, Inc. (SNPS) exhibited a bearish trend over the past year with a -10.31% price change, marked by acceleration and a high volatility level (std dev 58.85). The recent period shows a rebound of +13.77%.

Zscaler, Inc. (ZS) also trended bearish over the last 12 months, declining by -9.03% with deceleration and moderate volatility (std dev 47.11). Recent weeks reveal a sharp downturn of -35.38%.

Comparing both stocks, Synopsys delivered the higher market performance with a less severe overall drop and a recent positive reversal, whereas Zscaler faced a steeper recent decline and decelerated bearish momentum.

Target Prices

Analysts present a positive consensus on target prices for Synopsys, Inc. and Zscaler, Inc., reflecting moderate upside potential.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Synopsys, Inc. | 600 | 425 | 530 |

| Zscaler, Inc. | 360 | 260 | 311.41 |

The consensus target prices for Synopsys and Zscaler suggest expected price appreciation of approximately 2.6% and 45.6% above current prices, respectively, indicating stronger growth expectations for Zscaler.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Synopsys, Inc. and Zscaler, Inc.:

Rating Comparison

Synopsys, Inc. Rating

- Rating: B-, considered very favorable by analysts.

- Discounted Cash Flow Score: 3, indicating moderate value.

- ROE Score: 3, showing moderate efficiency in equity use.

- ROA Score: 3, reflecting moderate asset utilization.

- Debt To Equity Score: 2, moderate financial risk level.

- Overall Score: 3, moderate overall financial standing.

Zscaler, Inc. Rating

- Rating: C-, also considered very favorable by analysts.

- Discounted Cash Flow Score: 4, indicating favorable value.

- ROE Score: 1, indicating very unfavorable equity returns.

- ROA Score: 1, reflecting very unfavorable asset use.

- Debt To Equity Score: 1, very unfavorable financial risk.

- Overall Score: 1, very unfavorable overall financial standing.

Which one is the best rated?

Based solely on the provided data, Synopsys holds higher ratings and scores across most financial metrics, including overall score, ROE, ROA, and debt-to-equity, making it the better-rated company compared to Zscaler.

Scores Comparison

The following table presents a comparison of the Altman Z-Score and Piotroski Score for Synopsys and Zscaler:

Synopsys Scores

- Altman Z-Score: 3.54, indicating financial safety zone.

- Piotroski Score: 4, representing average financial strength.

Zscaler Scores

- Altman Z-Score: 4.89, indicating financial safety zone.

- Piotroski Score: 3, representing very weak financial strength.

Which company has the best scores?

Zscaler has a higher Altman Z-Score, indicating stronger financial stability and lower bankruptcy risk. Synopsys shows a better Piotroski Score, indicating comparatively stronger financial health.

Grades Comparison

The following sections present the latest reliable grade updates from recognized grading companies for Synopsys, Inc. and Zscaler, Inc.:

Synopsys, Inc. Grades

This table summarizes recent grade actions by major financial institutions for Synopsys, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Downgrade | Neutral | 2026-01-13 |

| Morgan Stanley | Maintain | Overweight | 2025-12-12 |

| Rosenblatt | Maintain | Buy | 2025-12-11 |

| Keybanc | Maintain | Overweight | 2025-12-11 |

| Piper Sandler | Maintain | Overweight | 2025-12-11 |

| Needham | Maintain | Buy | 2025-12-11 |

| B of A Securities | Upgrade | Buy | 2025-12-11 |

| JP Morgan | Maintain | Overweight | 2025-12-11 |

| Wells Fargo | Maintain | Equal Weight | 2025-12-11 |

| Rosenblatt | Upgrade | Buy | 2025-12-09 |

Synopsys shows a predominantly positive rating trend, with most grades at Buy or Overweight, although a recent downgrade to Neutral by Piper Sandler indicates some caution.

Zscaler, Inc. Grades

This table outlines recent grade assessments from reputable analysts for Zscaler, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Citigroup | Maintain | Buy | 2026-01-13 |

| Keybanc | Maintain | Overweight | 2026-01-12 |

| Piper Sandler | Maintain | Neutral | 2026-01-05 |

| RBC Capital | Maintain | Outperform | 2026-01-05 |

| Mizuho | Upgrade | Outperform | 2025-12-16 |

| Bernstein | Downgrade | Market Perform | 2025-12-01 |

| Citigroup | Maintain | Buy | 2025-12-01 |

| JP Morgan | Maintain | Overweight | 2025-11-26 |

| Baird | Maintain | Outperform | 2025-11-26 |

| BTIG | Maintain | Buy | 2025-11-26 |

Zscaler exhibits mostly bullish ratings, with multiple Outperform and Buy grades, though a downgrade to Market Perform by Bernstein reflects some mixed views.

Which company has the best grades?

Both Synopsys and Zscaler have a Buy consensus, but Zscaler has more Outperform and Buy ratings from analysts, suggesting stronger recent enthusiasm. This could signal higher investor confidence in Zscaler’s near-term prospects compared to Synopsys, which faces a recent downgrade to Neutral.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Synopsys, Inc. (SNPS) and Zscaler, Inc. (ZS) based on recent financial and operational data.

| Criterion | Synopsys, Inc. (SNPS) | Zscaler, Inc. (ZS) |

|---|---|---|

| Diversification | Strong product segmentation: licenses, maintenance, technology services totaling over $5.5B in 2025 | Revenue concentrated in one main segment with $2.67B in 2025 |

| Profitability | Positive net margin (18.96%), but low ROIC (1.97%) and ROE (4.72%) indicate modest profitability | Negative net margin (-1.55%), ROIC (-3.18%), and ROE (-2.31%) reflect unprofitable status |

| Innovation | Established leader in electronic design automation with steady technology services growth | Cloud security pioneer with growing ROIC trend despite current losses |

| Global presence | Extensive global reach supporting diversified customer base | Strong global presence in cybersecurity, reflected by solid current and quick ratios |

| Market Share | Large market share in semiconductor design tools with consistent revenue growth | Emerging market player with increasing demand but challenged by profitability |

Key takeaways: Synopsys shows solid diversification and profitability but struggles with efficient capital use and growth in returns. Zscaler demonstrates innovation and improving profitability trends, though it remains unprofitable with concentrated revenue. Investors should weigh Synopsys’s stability against Zscaler’s growth potential amid higher risks.

Risk Analysis

Below is a comparison of key risks associated with Synopsys, Inc. (SNPS) and Zscaler, Inc. (ZS) based on the most recent data from 2025:

| Metric | Synopsys, Inc. (SNPS) | Zscaler, Inc. (ZS) |

|---|---|---|

| Market Risk | Beta 1.12, moderate volatility | Beta 1.02, slightly lower volatility |

| Debt level | Debt-to-Equity 0.5, moderate level | Debt-to-Equity 1.0, higher leverage |

| Regulatory Risk | Moderate, tech sector compliance | Moderate, cloud security regulations evolving |

| Operational Risk | Stable, 20K employees, solid infrastructure | Higher risk due to smaller size (7.3K employees) and rapid growth |

| Environmental Risk | Low, tech sector with limited direct impact | Low, primarily cloud-based services |

| Geopolitical Risk | Moderate, global supply chain exposure | Moderate, reliance on international data centers and clients |

Synopsys shows moderate market and debt risks but benefits from a safer Altman Z-score, indicating low bankruptcy risk. Zscaler faces higher financial leverage and profitability challenges, increasing operational and market risks despite a strong Altman Z-score. Investors should watch Zscaler’s debt and profitability metrics closely.

Which Stock to Choose?

Synopsys, Inc. (SNPS) shows favorable income evolution with 15.12% revenue growth in 2025 and strong profitability metrics, despite some unfavorable trends in net margin growth and ROE. Its financial ratios are balanced, with a neutral global evaluation and moderate debt levels. The company’s economic moat is very unfavorable, indicating value destruction due to declining ROIC compared to WACC, but it holds a very favorable overall rating and is financially stable per Altman Z-score.

Zscaler, Inc. (ZS) exhibits robust income growth, with 23.31% revenue increase in 2025 and a predominantly favorable income statement evaluation. However, it reports negative profitability ratios and a slightly unfavorable overall financial ratios evaluation, alongside a slightly unfavorable moat status reflecting value shedding but improving profitability. Its rating is very favorable overall, despite weak scores on ROE and debt metrics, and it remains in the safe zone for bankruptcy risk.

Investors focused on growth and revenue expansion might find Zscaler appealing due to its strong income growth and improving profitability trend. Conversely, those prioritizing balanced financial ratios and stable creditworthiness might view Synopsys as more aligned with their profile, despite its challenges in value creation. Both stocks present distinct risk-return profiles that could be interpreted differently depending on the investor’s risk tolerance and investment strategy.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Synopsys, Inc. and Zscaler, Inc. to enhance your investment decisions: