In the fast-evolving technology sector, Synopsys, Inc. (SNPS) and Wix.com Ltd. (WIX) stand out as innovators in software infrastructure, yet they serve distinct but overlapping market needs. Synopsys leads in electronic design automation and semiconductor IP, while Wix empowers businesses with cloud-based web development tools. This comparison explores their growth strategies and market positions to help you identify which company offers the most compelling investment opportunity in 2026.

Table of contents

Companies Overview

I will begin the comparison between Synopsys and Wix by providing an overview of these two companies and their main differences.

Synopsys Overview

Synopsys, Inc. is a leader in electronic design automation software, providing tools for designing and testing integrated circuits. Its offerings include digital design and verification platforms, FPGA design products, and various intellectual property solutions for connectivity and embedded applications. Synopsys serves diverse sectors such as electronics, automotive, and medicine, positioning itself as a critical infrastructure provider in semiconductor design.

Wix Overview

Wix.com Ltd. operates a cloud-based platform that enables users worldwide to create websites and web applications easily. The company offers a suite of tools including a drag-and-drop editor, AI-powered site creation, payment processing, and customer engagement solutions. With millions of registered users and premium subscribers, Wix targets small businesses and individuals seeking accessible online presence and operational tools across multiple regions.

Key similarities and differences

Both Synopsys and Wix operate in the technology sector focusing on software infrastructure, yet their business models differ significantly. Synopsys develops specialized software for semiconductor design and testing, targeting industrial and high-tech clients. Wix, by contrast, provides cloud-based website creation and business tools mainly aimed at small to medium enterprises and individual users. While both leverage innovation and platform-based services, their markets and end-user applications diverge considerably.

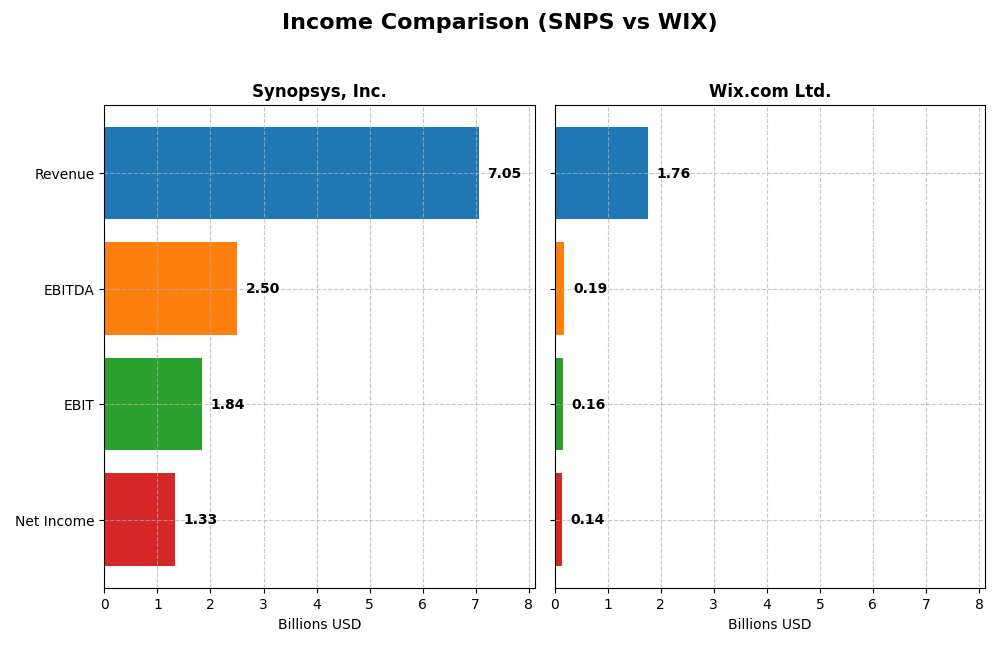

Income Statement Comparison

The table below compares key income statement metrics for Synopsys, Inc. and Wix.com Ltd. for their most recent fiscal years, providing a clear view of their financial performance.

| Metric | Synopsys, Inc. (SNPS) | Wix.com Ltd. (WIX) |

|---|---|---|

| Market Cap | 98.8B | 4.5B |

| Revenue | 7.05B | 1.76B |

| EBITDA | 2.50B | 186M |

| EBIT | 1.84B | 155M |

| Net Income | 1.33B | 138M |

| EPS | 8.13 | 2.49 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Synopsys, Inc.

Synopsys demonstrated consistent revenue growth from 4.2B in 2021 to 7.1B in 2025, with net income rising 75.9% over the period despite a decline in 2025 to 1.33B from 2.26B in 2024. Margins remained strong, with a gross margin near 77% and EBIT margin at 26%. In 2025, revenue growth slowed to 15.1%, while net margin and EPS declined sharply, signaling margin pressure.

Wix.com Ltd.

Wix’s revenue grew steadily from 984M in 2020 to 1.76B in 2024, with net income turning positive and reaching 138M in 2024 after losses in prior years. Gross margin was favorable at 67.9%, and net margin improved significantly to 7.9%. The latest year showed accelerated EBIT and net margin growth above 260%, reflecting improved profitability and operational leverage.

Which one has the stronger fundamentals?

Both companies present favorable income statements, but Wix shows stronger recent profitability momentum with all growth metrics favorable and no unfavorable evaluations. Synopsys has higher margins and scale but faces margin contraction and EPS decline in the latest year. Wix’s consistent margin improvement and positive net income growth indicate stronger recent fundamentals, while Synopsys’s scale and margin base remain notable.

Financial Ratios Comparison

The table below presents a selection of key financial ratios for Synopsys, Inc. (SNPS) and Wix.com Ltd. (WIX) based on their most recent fiscal year data, illustrating profitability, liquidity, leverage, efficiency, and dividend metrics.

| Ratios | Synopsys, Inc. (SNPS) FY 2025 | Wix.com Ltd. (WIX) FY 2024 |

|---|---|---|

| ROE | 4.72% | -175.57% |

| ROIC | 1.97% | 9.13% |

| P/E | 54.36 | 86.21 |

| P/B | 2.57 | -151.35 |

| Current Ratio | 1.62 | 0.84 |

| Quick Ratio | 1.52 | 0.84 |

| D/E (Debt-to-Equity) | 0.50 | -12.31 |

| Debt-to-Assets | 29.64% | 50.70% |

| Interest Coverage | 2.05 | 25.92 |

| Asset Turnover | 0.15 | 0.92 |

| Fixed Asset Turnover | 5.04 | 3.33 |

| Payout Ratio | 0% | 0% |

| Dividend Yield | 0% | 0% |

Interpretation of the Ratios

Synopsys, Inc.

Synopsys presents a mixed ratio profile with strengths in net margin (18.96%), current and quick ratios above 1.5, and a favorable debt-to-assets ratio (29.64%). However, concerns arise from low returns on equity (4.72%) and invested capital (1.97%), a high PE ratio (54.36), and weak asset turnover (0.15). The company does not pay dividends, reflecting a possible reinvestment or growth strategy.

Wix.com Ltd.

Wix shows a weaker financial ratio set, with a moderate net margin (7.86%) and a negative return on equity (-175.57%). Its low current ratio (0.84) and high debt-to-assets ratio (50.7%) raise liquidity and leverage concerns. The price-to-book ratio is notably negative (-151.35), unusual but rated favorable. Wix also does not pay dividends, likely focusing on growth and R&D investments.

Which one has the best ratios?

Synopsys displays a more balanced ratio profile with several favorable liquidity and profitability metrics, despite some weaknesses in returns and valuation. Wix exhibits more unfavorable ratios, particularly in leverage and profitability, alongside liquidity challenges. Overall, Synopsys’s ratios appear comparatively stronger, while Wix’s financials suggest greater risk and volatility.

Strategic Positioning

This section compares the strategic positioning of Synopsys, Inc. and Wix.com Ltd., including market position, key segments, and exposure to technological disruption:

Synopsys, Inc.

- Leading software infrastructure provider with 20K employees; faces competitive pressure in EDA software.

- Revenue driven by License and Maintenance ($3.5B) and Technology Services ($1.55B) focused on electronic design automation.

- Exposure to technological disruption through continuous innovation in integrated circuit design tools and IP solutions.

Wix.com Ltd.

- Smaller market cap with 4.4K employees; competes in cloud website platforms under high competition.

- Revenue mainly from Creative Subscription ($1.26B) and Business Solutions ($0.5B) in cloud-based website creation.

- Faces disruption risks from evolving cloud services and AI-driven web development tools.

Synopsys, Inc. vs Wix.com Ltd. Positioning

Synopsys has a diversified revenue base across multiple software and IP solutions in electronic design, benefiting from scale but facing intense industry competition. Wix concentrates on cloud-based web platforms with growing subscription services but operates in a highly competitive, rapidly evolving market.

Which has the best competitive advantage?

Neither company currently sustains a strong moat, both shedding value versus their cost of capital. Wix shows improving profitability trends, while Synopsys’s declining returns indicate more severe competitive challenges.

Stock Comparison

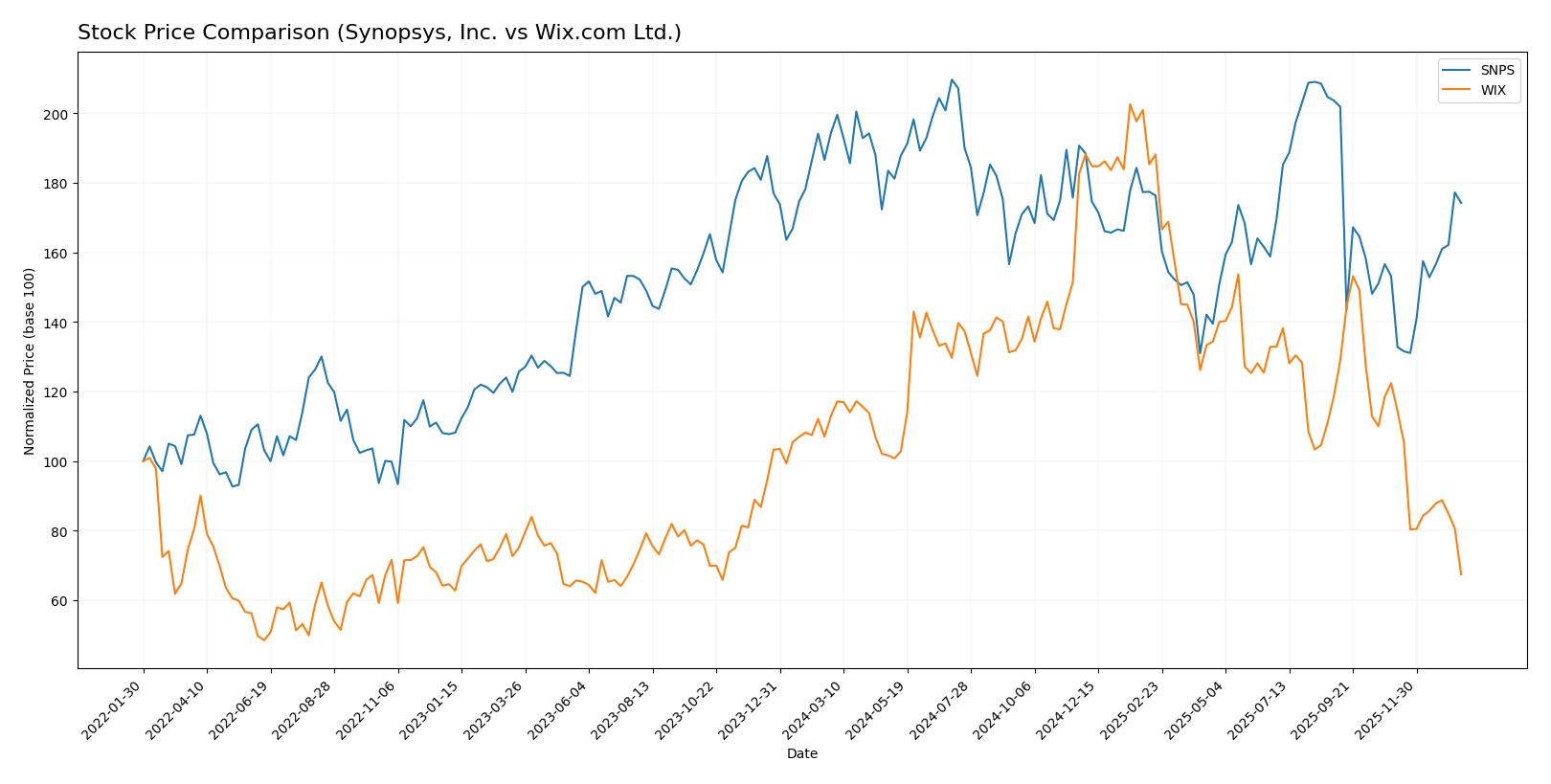

The past year has seen notable price declines for both Synopsys, Inc. and Wix.com Ltd., with Synopsys exhibiting signs of recent recovery while Wix’s downtrend continues with deceleration.

Trend Analysis

Synopsys, Inc. (SNPS) displays a bearish trend over the past 12 months with a -10.31% price change and accelerating downward momentum, despite a recent 13.77% upward rally since November 2025. Volatility is high, with a standard deviation of 58.85.

Wix.com Ltd. (WIX) shows a pronounced bearish trend with a -40.28% decline over the year and decelerating losses. Recent months reveal a further -44.92% drop, accompanied by reduced volatility (std deviation 17.98), indicating persistent weakness.

Comparing the two, Synopsys has delivered a stronger market performance over the last year, with a smaller overall decline and signs of recent price recovery, unlike Wix, which continues to face substantial losses.

Target Prices

The consensus target prices for Synopsys, Inc. and Wix.com Ltd. suggest varied analyst expectations.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Synopsys, Inc. | 600 | 425 | 530 |

| Wix.com Ltd. | 210 | 70 | 160.27 |

Analysts see potential upside for Synopsys, with the consensus target price above its current 516.31 USD stock price. Wix’s consensus target is roughly double its current 80.16 USD price, indicating expectations of significant growth.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Synopsys, Inc. and Wix.com Ltd.:

Rating Comparison

Synopsys, Inc. Rating

- Rating: B-, considered very favorable overall.

- Discounted Cash Flow Score: 3, moderate level.

- ROE Score: 3, moderate efficiency in equity use.

- ROA Score: 3, moderate asset utilization.

- Debt To Equity Score: 2, moderate financial risk.

- Overall Score: 3, moderate overall performance.

Wix.com Ltd. Rating

- Rating: C, also considered very favorable.

- Discounted Cash Flow Score: 3, moderate level.

- ROE Score: 1, very unfavorable efficiency.

- ROA Score: 4, favorable asset utilization.

- Debt To Equity Score: 1, very unfavorable risk.

- Overall Score: 2, moderate overall performance.

Which one is the best rated?

Based strictly on the provided data, Synopsys holds a higher overall score (3 vs. 2) and better ROE and debt-to-equity scores. Wix has a favorable ROA but weaker scores elsewhere, making Synopsys the better rated company.

Scores Comparison

Here is a comparison of the financial scores for Synopsys, Inc. and Wix.com Ltd.:

Synopsys, Inc. Scores

- Altman Z-Score: 3.54, indicating a safe zone status

- Piotroski Score: 4, classified as average

Wix.com Ltd. Scores

- Altman Z-Score: 1.83, indicating a grey zone status

- Piotroski Score: 6, classified as average

Which company has the best scores?

Based strictly on the provided data, Synopsys has a stronger Altman Z-Score in the safe zone, while Wix’s score lies in the grey zone. Wix, however, has a higher Piotroski Score, though both are considered average.

Grades Comparison

Here is the comparison of recent grades assigned to Synopsys, Inc. and Wix.com Ltd. by reputable grading companies:

Synopsys, Inc. Grades

The table below shows the latest grades and actions from recognized financial institutions for Synopsys:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Downgrade | Neutral | 2026-01-13 |

| Morgan Stanley | Maintain | Overweight | 2025-12-12 |

| Rosenblatt | Maintain | Buy | 2025-12-11 |

| Keybanc | Maintain | Overweight | 2025-12-11 |

| Piper Sandler | Maintain | Overweight | 2025-12-11 |

| Needham | Maintain | Buy | 2025-12-11 |

| B of A Securities | Upgrade | Buy | 2025-12-11 |

| JP Morgan | Maintain | Overweight | 2025-12-11 |

| Wells Fargo | Maintain | Equal Weight | 2025-12-11 |

| Rosenblatt | Upgrade | Buy | 2025-12-09 |

Overall, Synopsys has mostly received “Buy” and “Overweight” ratings with a recent downgrade to “Neutral” by Piper Sandler, showing some caution among analysts.

Wix.com Ltd. Grades

The following table summarizes the latest grades from reliable sources for Wix.com:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Overweight | 2026-01-15 |

| Wells Fargo | Maintain | Overweight | 2025-12-19 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-12-11 |

| Citigroup | Maintain | Buy | 2025-11-20 |

| Citizens | Maintain | Market Outperform | 2025-11-20 |

| Cantor Fitzgerald | Maintain | Overweight | 2025-11-20 |

| Scotiabank | Maintain | Sector Outperform | 2025-11-20 |

| Evercore ISI Group | Maintain | Outperform | 2025-11-20 |

| Needham | Maintain | Buy | 2025-11-20 |

| B. Riley Securities | Maintain | Buy | 2025-11-20 |

Wix.com consistently holds “Buy,” “Overweight,” and outperform ratings, indicating strong analyst confidence without recent downgrades.

Which company has the best grades?

Both Synopsys and Wix.com have a consensus “Buy” rating, but Wix.com has maintained a steadier pattern of “Overweight” and outperform grades without recent downgrades. This suggests Wix.com might currently be viewed more favorably by analysts, potentially influencing investor sentiment towards stability and growth expectations.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses for Synopsys, Inc. (SNPS) and Wix.com Ltd. (WIX) based on their latest financial and operational data.

| Criterion | Synopsys, Inc. (SNPS) | Wix.com Ltd. (WIX) |

|---|---|---|

| Diversification | Strong product mix with License & Maintenance revenue at $3.49B and Technology Service at $1.55B (2025) | Revenue concentrated in Creative Subscription ($1.26B) and Business Solutions ($496M) (2024) |

| Profitability | Net margin 18.96% (favorable), but ROIC 1.97% below WACC 8.3% (unfavorable), indicating value destruction | Net margin 7.86% (neutral), ROIC 9.13% slightly below WACC 9.35%, but improving profitability trend |

| Innovation | Established technology leader in semiconductor software, but declining ROIC trend suggests challenges | Growing ROIC trend indicates improving innovation impact despite current value shedding |

| Global presence | Well-established global footprint supporting diverse industries | Expanding global user base but financial leverage and liquidity ratios less favorable |

| Market Share | Significant market share in semiconductor EDA tools with steady revenue growth | Strong presence in web development platforms, yet faces stiff competition impacting margins |

Key takeaways: Synopsys demonstrates strong diversification and profitability in core segments but struggles with declining efficiency in capital use. Wix shows promising growth in profitability and innovation despite current value challenges and liquidity constraints. Investors should weigh Synopsys’s stable market position against Wix’s growth potential balanced by financial risks.

Risk Analysis

Below is a summary table of key risks for Synopsys, Inc. (SNPS) and Wix.com Ltd. (WIX) based on their most recent financial and operational data for 2025 and 2024 respectively:

| Metric | Synopsys, Inc. (SNPS) | Wix.com Ltd. (WIX) |

|---|---|---|

| Market Risk | Moderate (Beta 1.12) | Higher (Beta 1.42) |

| Debt Level | Moderate (Debt/Equity 0.5) | Low/Negative (Debt/Equity -12.31) but high Debt/Assets (50.7%) |

| Regulatory Risk | Moderate (US tech sector) | Elevated (International operations, EU & Israel regulations) |

| Operational Risk | Medium (Complex EDA software) | Medium (Cloud platform dependency, competitive market) |

| Environmental Risk | Low (Software industry) | Low (Cloud services) |

| Geopolitical Risk | Moderate (US-based, global sales) | Elevated (Israeli headquarters, global user base) |

Synopsys shows moderate market and regulatory risks but maintains a solid financial stability profile with a safe Altman Z-score of 3.54. Wix faces higher market volatility and geopolitical risk, with a concerning Altman Z-score of 1.83 in the grey zone, indicating moderate financial distress risk. Wix’s high debt-to-assets ratio and low liquidity ratios increase its financial vulnerability. Investors should weigh Wix’s growth potential against these risks carefully.

Which Stock to Choose?

Synopsys, Inc. (SNPS) shows favorable income evolution with strong revenue and net income growth over 2021-2025, supported by favorable gross and EBIT margins. Its financial ratios are balanced, with notable strengths in current and quick ratios, though some profitability metrics like ROE and ROIC are unfavorable. Debt levels and interest coverage are stable, and the overall rating is very favorable with a moderate score summary.

Wix.com Ltd. (WIX) has demonstrated favorable income growth, especially in recent years, with strong net margin expansion and EPS growth. However, its financial ratios are mixed, featuring unfavorable ROE and debt-to-assets ratios, and weaker liquidity indicated by a low current ratio. Despite these, WIX holds a very favorable rating but with a slightly unfavorable global ratios opinion and moderate financial scores.

For investors, the choice might depend on risk tolerance and investment focus: those prioritizing stable income growth and balanced financial health could find Synopsys attractive, while investors willing to accept higher financial risk for potentially stronger recent profitability gains may view Wix as more appealing. Both companies show challenges in value creation per their MOAT evaluations, with Synopsys shedding value and Wix improving profitability but still slightly unfavorable.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Synopsys, Inc. and Wix.com Ltd. to enhance your investment decisions: