In today’s fast-evolving technology landscape, choosing the right software infrastructure company can significantly impact an investor’s portfolio. Synopsys, Inc. (SNPS) and Veritone, Inc. (VERI) both operate in the software infrastructure sector but differ in scale and innovation focus—Synopsys leads in electronic design automation, while Veritone pioneers AI-driven data insights. This article will help you decide which company offers the most promising investment opportunity.

Table of contents

Companies Overview

I will begin the comparison between Synopsys and Veritone by providing an overview of these two companies and their main differences.

Synopsys Overview

Synopsys, Inc. specializes in electronic design automation software for integrated circuits, offering platforms for digital design implementation, verification, and FPGA prototyping. The company also provides a broad portfolio of intellectual property solutions and security testing services. Founded in 1986 and headquartered in Mountain View, California, Synopsys serves diverse sectors including electronics, automotive, and finance, with a workforce of 20,000 employees and a market cap near 99B USD.

Veritone Overview

Veritone, Inc. delivers artificial intelligence computing solutions through its aiWARE platform, which applies machine learning and cognitive processes to analyze structured and unstructured data. The company also offers media advertising agency services and serves multiple vertical markets such as media, government, and energy. Established in 2014 and based in Denver, Colorado, Veritone employs 469 people and has a market capitalization of approximately 225M USD.

Key similarities and differences

Both Synopsys and Veritone operate in the technology sector within the software infrastructure industry, focusing on advanced computing solutions. Synopsys emphasizes electronic design automation and semiconductor IP, targeting hardware design and verification, while Veritone concentrates on AI-driven data analytics and media services. The companies differ markedly in scale, market capitalization, and employee count, reflecting distinct business models and market reach.

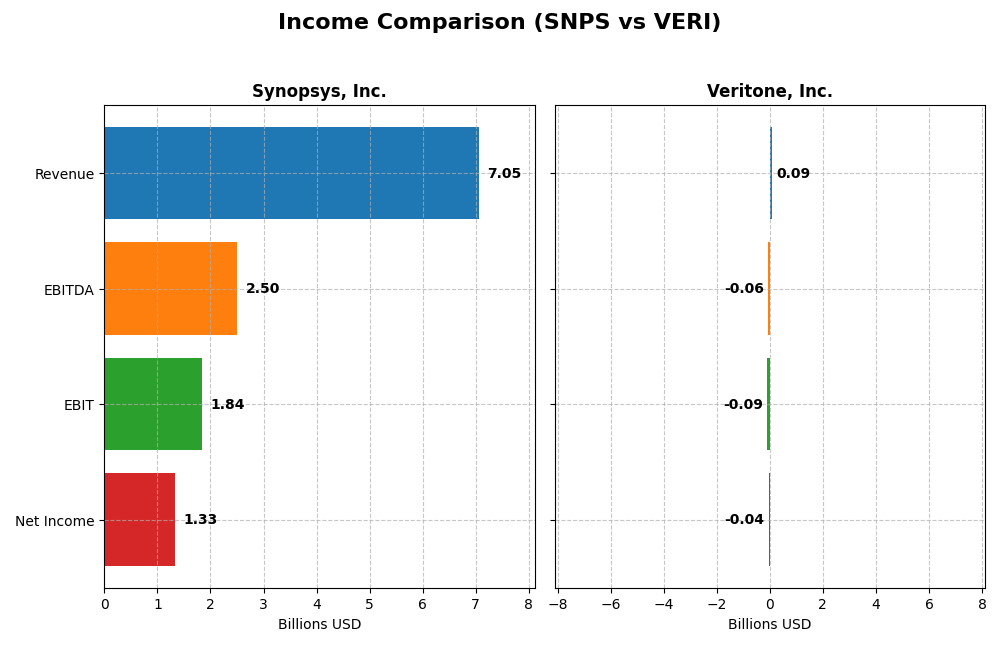

Income Statement Comparison

This table presents a side-by-side comparison of key income statement metrics for Synopsys, Inc. and Veritone, Inc. based on their most recent fiscal year data.

| Metric | Synopsys, Inc. (SNPS) | Veritone, Inc. (VERI) |

|---|---|---|

| Market Cap | 98.8B | 225M |

| Revenue | 7.05B | 93M |

| EBITDA | 2.50B | -59M |

| EBIT | 1.84B | -88M |

| Net Income | 1.33B | -37M |

| EPS | 8.13 | -0.98 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Synopsys, Inc.

Synopsys, Inc. demonstrated consistent revenue and net income growth from 2021 to 2025, with a 67.79% increase in revenue and 75.87% in net income over the period. Gross and EBIT margins remained favorable, at 76.98% and 26.08% respectively. However, the most recent year saw slower net margin and EPS growth, indicating some margin pressure despite a 15.12% revenue growth.

Veritone, Inc.

Veritone, Inc. posted a mixed income statement performance from 2020 to 2024, with a 60.53% revenue increase but negative EBIT margins and net losses through the period. The 2024 fiscal year reflected a 7.35% revenue decline alongside a 40.36% negative net margin. Nonetheless, improvements were seen in net margin and EPS growth rates in 2024, signaling some operational recovery.

Which one has the stronger fundamentals?

Synopsys holds stronger fundamentals with favorable gross, EBIT, and net margins, alongside significant revenue and net income growth. Veritone, while showing revenue growth over the longer term, struggles with consistent profitability and unfavorable EBIT and net margins. Synopsys’s scale and margin stability contrast with Veritone’s ongoing operational challenges.

Financial Ratios Comparison

The table below compares the key financial ratios of Synopsys, Inc. and Veritone, Inc. for their most recent fiscal years, offering insight into their profitability, liquidity, leverage, and operational efficiency.

| Ratios | Synopsys, Inc. (2025) | Veritone, Inc. (2024) |

|---|---|---|

| ROE | 4.7% | -277.9% |

| ROIC | 2.0% | -58.3% |

| P/E | 54.4 | -3.34 |

| P/B | 2.57 | 9.27 |

| Current Ratio | 1.62 | 0.97 |

| Quick Ratio | 1.52 | 0.97 |

| D/E (Debt-to-Equity) | 0.50 | 8.91 |

| Debt-to-Assets | 29.6% | 60.5% |

| Interest Coverage | 2.05 | -7.31 |

| Asset Turnover | 0.15 | 0.47 |

| Fixed Asset Turnover | 5.04 | 8.51 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0 | 0 |

Interpretation of the Ratios

Synopsys, Inc.

Synopsys presents a mixed ratio profile with a strong net margin of 18.96% and favorable liquidity ratios, including a current ratio of 1.62. However, the company shows weaknesses in return on equity (4.72%) and return on invested capital (1.97%), alongside a high price-to-earnings ratio (54.36). Synopsys does not pay dividends, reflecting a potential focus on reinvestment or growth rather than shareholder payouts.

Veritone, Inc.

Veritone’s financial ratios are predominantly weak, with a negative net margin of -40.36% and a severely negative return on equity at -277.91%. The company struggles with high leverage (debt-to-equity of 8.91) and poor liquidity (current ratio 0.97). Veritone also does not pay dividends, likely due to ongoing losses and a strategy prioritizing reinvestment or research and development.

Which one has the best ratios?

Between the two, Synopsys shows a more balanced and generally stronger ratio profile despite some concerns over returns and valuation. Veritone’s ratios indicate significant financial stress and operational challenges, making its overall financial health much weaker compared to Synopsys.

Strategic Positioning

This section compares the strategic positioning of Synopsys and Veritone, including market position, key segments, and exposure to technological disruption:

Synopsys, Inc. (SNPS)

- Large market cap near 99B, operating in software infrastructure with moderate beta indicating balanced competitive pressure.

- Focuses on electronic design automation, IP solutions, and SoC infrastructure, serving diverse sectors including automotive and medicine.

- Positioned in established EDA and IP markets with less emphasis on rapid AI disruption, leveraging mature tech platforms.

Veritone, Inc. (VERI)

- Small market cap around 225M, higher beta of 2.05, facing volatile competitive pressure in software infrastructure.

- Specializes in AI computing solutions and media advertising services, targeting media, government, legal, and energy markets.

- Highly exposed to AI-driven disruption with aiWARE platform applying machine learning for diverse cognitive processes.

Synopsys, Inc. vs Veritone, Inc. Positioning

Synopsys has a diversified product portfolio across electronic design and IP, enabling broad sector coverage but facing intense competition. Veritone’s concentrated focus on AI and media advertising allows niche specialization but in a smaller market with higher volatility.

Which has the best competitive advantage?

Both companies exhibit very unfavorable moat evaluations with declining ROIC and capital inefficiency. Neither currently demonstrates a sustainable competitive advantage based on their value creation and profitability trends.

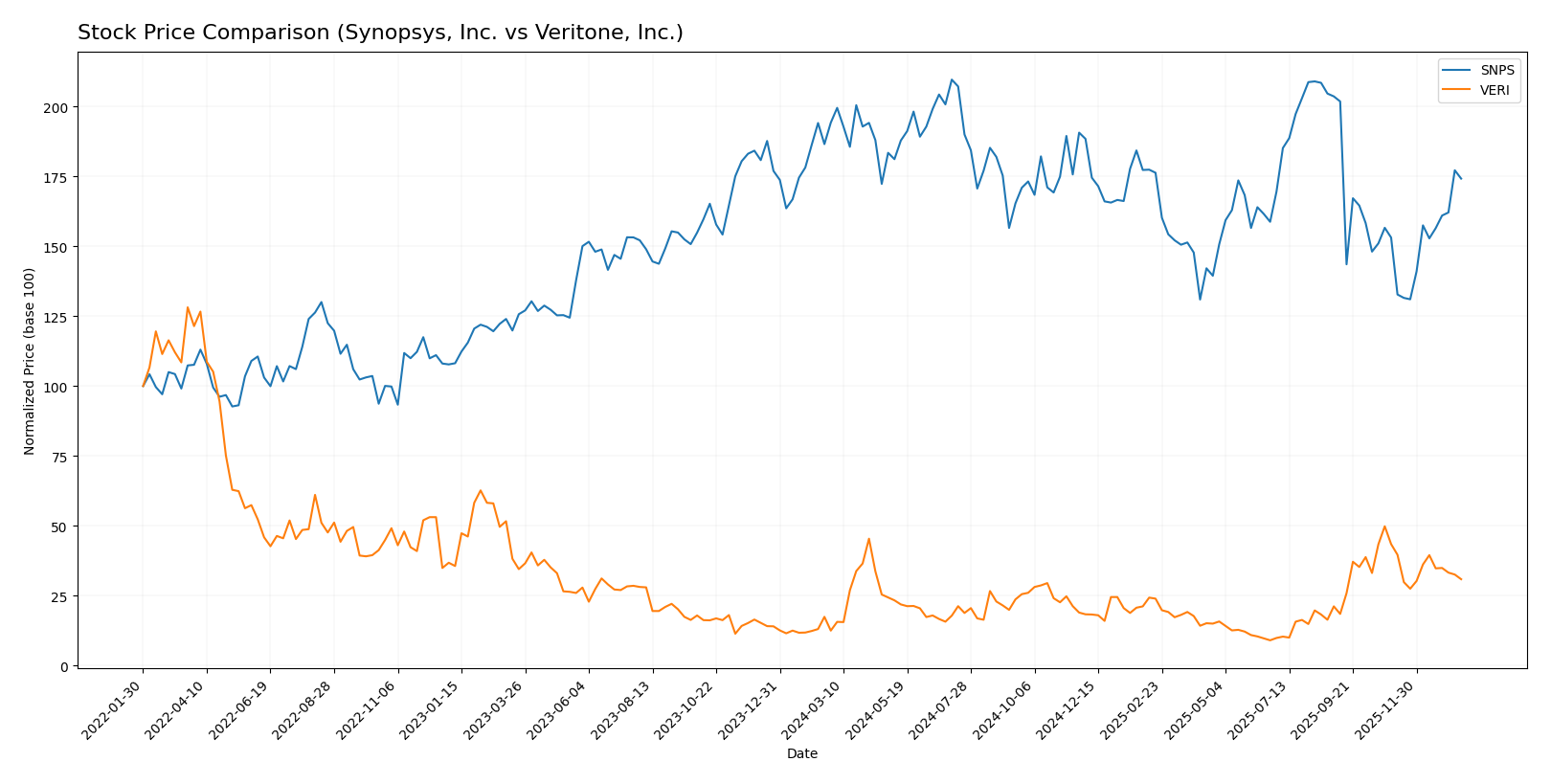

Stock Comparison

The stock price movements of Synopsys, Inc. (SNPS) and Veritone, Inc. (VERI) over the past 12 months reveal contrasting dynamics, with SNPS experiencing an overall decline and recent recovery, while VERI shows strong long-term gains but recent weakness.

Trend Analysis

Synopsys, Inc. (SNPS) stock posted a bearish trend over the past 12 months with a -10.31% price change, showing acceleration in its decline. The price ranged from a high of 621.3 to a low of 388.13, with recent months marking a 13.77% upward correction.

Veritone, Inc. (VERI) exhibited a bullish trend over the same period, gaining 147.22%, though with deceleration. The stock price fluctuated between 1.3 and 7.18. Recently, VERI faced a -28.91% decline, indicating short-term selling pressure.

Comparing the two, VERI delivered the highest market performance with substantial annual gains, whereas SNPS faced a net decline despite recent positive momentum.

Target Prices

The consensus target prices from verified analysts suggest a positive outlook for both Synopsys, Inc. and Veritone, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Synopsys, Inc. | 600 | 425 | 530 |

| Veritone, Inc. | 10 | 9 | 9.5 |

Analysts expect Synopsys to trade moderately above its current price of $516.31, while Veritone’s target consensus at $9.5 is substantially higher than its current price of $4.45, indicating stronger upside potential.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Synopsys, Inc. and Veritone, Inc.:

Rating Comparison

SNPS Rating

- Rating: B- indicating a very favorable overall evaluation.

- Discounted Cash Flow Score: Moderate with a score of 3, reflecting balanced valuation.

- ROE Score: Moderate at 3, showing average efficiency in generating shareholder profit.

- ROA Score: Moderate with a score of 3, demonstrating average asset utilization.

- Debt To Equity Score: Moderate at 2, indicating moderate financial risk.

- Overall Score: Moderate with a score of 3, summarizing balanced financial health.

VERI Rating

- Rating: C with a very favorable overall evaluation.

- Discounted Cash Flow Score: Very favorable at 5, suggesting strong undervaluation.

- ROE Score: Very unfavorable at 1, indicating low profit generation efficiency.

- ROA Score: Very unfavorable at 1, showing poor asset utilization.

- Debt To Equity Score: Very unfavorable at 1, reflecting higher financial risk.

- Overall Score: Moderate at 2, showing somewhat weaker financial standing.

Which one is the best rated?

Based strictly on the provided data, Synopsys holds a higher overall rating (B- vs. C) and better scores in ROE, ROA, and debt-to-equity metrics, while Veritone excels only in discounted cash flow. Synopsys is objectively better rated.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Synopsys and Veritone:

Synopsys Scores

- Altman Z-Score: 3.54, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 4, classified as average financial strength.

Veritone Scores

- Altman Z-Score: -0.07, indicating a distress zone with high bankruptcy risk.

- Piotroski Score: 3, classified as very weak financial strength.

Which company has the best scores?

Synopsys shows stronger financial health with a safe zone Altman Z-Score and an average Piotroski Score. Veritone’s scores indicate distress and very weak financial strength, suggesting higher financial risk.

Grades Comparison

Here is a detailed comparison of the latest grades for Synopsys, Inc. and Veritone, Inc.:

Synopsys, Inc. Grades

The table below summarizes recent analyst grades from reputable grading firms for Synopsys, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Downgrade | Neutral | 2026-01-13 |

| Morgan Stanley | Maintain | Overweight | 2025-12-12 |

| Rosenblatt | Maintain | Buy | 2025-12-11 |

| Keybanc | Maintain | Overweight | 2025-12-11 |

| Piper Sandler | Maintain | Overweight | 2025-12-11 |

| Needham | Maintain | Buy | 2025-12-11 |

| B of A Securities | Upgrade | Buy | 2025-12-11 |

| JP Morgan | Maintain | Overweight | 2025-12-11 |

| Wells Fargo | Maintain | Equal Weight | 2025-12-11 |

| Rosenblatt | Upgrade | Buy | 2025-12-09 |

Overall, Synopsys shows mostly positive ratings with multiple “Buy” and “Overweight” grades, and only one recent downgrade to “Neutral” by Piper Sandler.

Veritone, Inc. Grades

The table below lists the latest analyst grades from established grading companies for Veritone, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| D. Boral Capital | Maintain | Buy | 2025-12-09 |

| D. Boral Capital | Maintain | Buy | 2025-12-04 |

| Needham | Maintain | Buy | 2025-12-02 |

| D. Boral Capital | Maintain | Buy | 2025-12-02 |

| D. Boral Capital | Maintain | Buy | 2025-11-07 |

| D. Boral Capital | Maintain | Buy | 2025-10-28 |

| HC Wainwright & Co. | Maintain | Buy | 2025-10-20 |

| D. Boral Capital | Maintain | Buy | 2025-10-15 |

| D. Boral Capital | Maintain | Buy | 2025-09-24 |

| D. Boral Capital | Maintain | Buy | 2025-09-09 |

Veritone has consistently received “Buy” ratings with no downgrades or negative revisions reported during this period.

Which company has the best grades?

Both Synopsys and Veritone have a consensus “Buy” rating overall. Synopsys has a broader range of grading companies and a few “Overweight” and “Buy” ratings but also one recent downgrade to “Neutral.” Veritone’s grades are uniformly “Buy” but mostly from a single primary grading company. Investors may view Synopsys’s more diverse and slightly mixed grading pattern as reflecting nuanced risk and opportunity, whereas Veritone’s consistent “Buy” ratings suggest steady analyst confidence.

Strengths and Weaknesses

Below is a comparison of key strengths and weaknesses for Synopsys, Inc. (SNPS) and Veritone, Inc. (VERI) based on their latest financial and operational data.

| Criterion | Synopsys, Inc. (SNPS) | Veritone, Inc. (VERI) |

|---|---|---|

| Diversification | Strong product mix: License & Maintenance $3.49B, Technology Service $1.55B | Limited scale; main revenue from Software Products & Services $61M, Managed Services $32M |

| Profitability | Positive net margin 18.96%, but low ROIC 1.97%, company shedding value | Negative net margin -40.36%, ROIC -58.27%, significant value destruction |

| Innovation | High fixed asset turnover (5.04) indicates efficient use of assets in innovation | High fixed asset turnover (8.51) but overall poor financial health limits innovation impact |

| Global presence | Established global footprint with steady revenue growth in licenses | Smaller scale, focused on niche AI and advertising markets, less global reach |

| Market Share | Leading position in semiconductor EDA and IP market | Small market share in AI-driven media and advertising sectors |

Key takeaways: Synopsys demonstrates strong diversification and profitability in licenses and maintenance, but its declining ROIC signals caution in capital efficiency. Veritone faces significant profitability and financial challenges despite niche innovation, reflecting a high-risk profile for investors.

Risk Analysis

Below is a comparison table of key risks for Synopsys, Inc. (SNPS) and Veritone, Inc. (VERI) based on the latest available data:

| Metric | Synopsys, Inc. (SNPS) | Veritone, Inc. (VERI) |

|---|---|---|

| Market Risk | Beta 1.12, moderate volatility | Beta 2.05, high volatility |

| Debt level | Debt-to-Equity 0.5 (neutral) | Debt-to-Equity 8.91 (very high) |

| Regulatory Risk | Moderate, industry stable | Elevated, emerging AI regulations |

| Operational Risk | Established operations, 20K employees | Smaller scale, 469 employees |

| Environmental Risk | Moderate, tech sector typical | Moderate, tech sector typical |

| Geopolitical Risk | US-based, exposure limited | US/UK operations, higher exposure |

In synthesis, Veritone faces the most significant risks, notably very high debt levels and operational challenges, combined with volatile market sensitivity. Synopsys presents a more balanced risk profile with moderate debt and stable operations. Market volatility and debt remain the most impactful risks for these technology infrastructure firms in 2026.

Which Stock to Choose?

Synopsys, Inc. (SNPS) shows a favorable income statement with a 15.12% revenue growth in 2025 and strong gross and EBIT margins above 25%. Despite a neutral global financial ratios evaluation, SNPS maintains moderate profitability, manageable debt, and a very favorable overall rating of B-, though its ROIC is below WACC, indicating value destruction.

Veritone, Inc. (VERI) has a favorable income statement overall, despite recent revenue decline and negative margins. Its financial ratios are very unfavorable, marked by high debt and negative profitability ratios. VERI’s rating is also very favorable (C), but it suffers from a distress-level Altman Z-score and a very weak Piotroski score, reflecting significant financial challenges.

For investors, SNPS might appear more suitable for those prioritizing stable income growth and moderate risk, given its favorable income and rating despite some financial ratio weaknesses. VERI could be considered by more risk-tolerant investors focusing on potential turnaround opportunities, given its strong recent stock price gains but facing substantial financial instability.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Synopsys, Inc. and Veritone, Inc. to enhance your investment decisions: