In the fast-evolving technology landscape, Synopsys, Inc. (SNPS) and Teradata Corporation (TDC) stand out as key players in software infrastructure. Both companies focus on innovative solutions—Synopsys in electronic design automation and IP, and Teradata in multi-cloud data analytics platforms. Their market overlap and distinct innovation strategies make them compelling counterparts. This article will help you uncover which of these tech firms holds the most promise for your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between Synopsys and Teradata by providing an overview of these two companies and their main differences.

Synopsys Overview

Synopsys, Inc. operates in the software infrastructure industry, focusing on electronic design automation products for integrated circuits. The company offers advanced platforms for digital design, verification, FPGA design, and intellectual property solutions. Founded in 1986 and headquartered in Mountain View, California, Synopsys serves diverse sectors including electronics, automotive, and medicine, employing approximately 20,000 people.

Teradata Overview

Teradata Corporation provides a multi-cloud data platform tailored for enterprise analytics, helping companies leverage data across various sources. It also delivers consulting and support services to optimize analytical infrastructure and enable cloud migration. Established in 1979, Teradata is headquartered in San Diego, California, with a workforce of around 5,700 employees, serving clients globally across sectors such as financial services, healthcare, and retail.

Key similarities and differences

Both Synopsys and Teradata operate within the technology sector, specifically in software infrastructure, but their business models differ. Synopsys focuses on electronic design automation and intellectual property solutions for hardware design, while Teradata specializes in cloud-based data analytics platforms and consulting services. Synopsys has a significantly larger scale in market capitalization and workforce compared to Teradata, reflecting their differing market focuses.

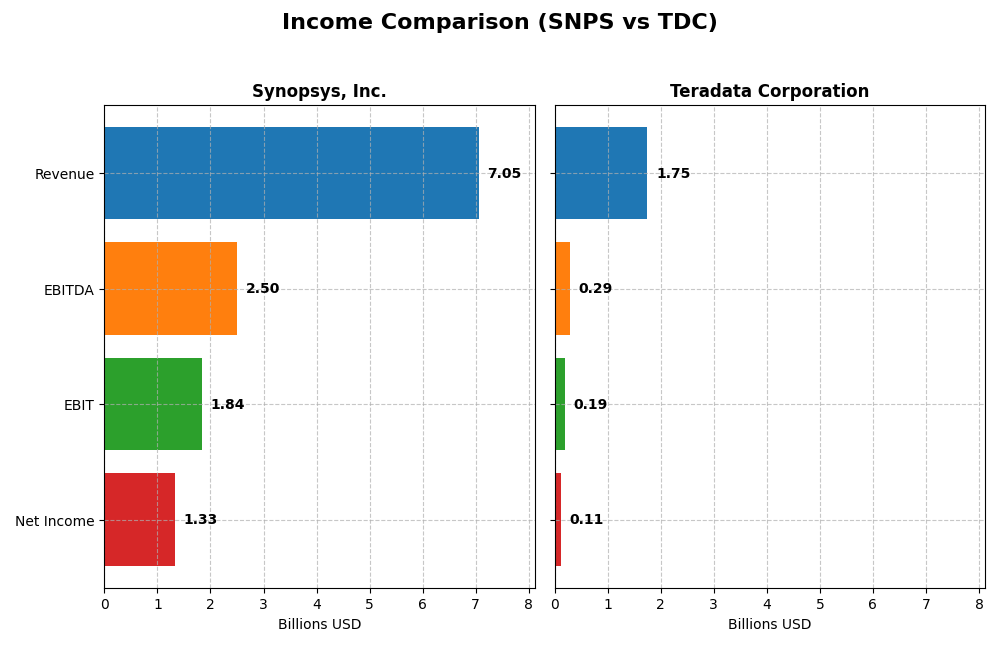

Income Statement Comparison

This table presents a side-by-side comparison of key income statement metrics for Synopsys, Inc. and Teradata Corporation for their most recent fiscal years.

| Metric | Synopsys, Inc. (SNPS) | Teradata Corporation (TDC) |

|---|---|---|

| Market Cap | 98.8B | 2.81B |

| Revenue | 7.05B | 1.75B |

| EBITDA | 2.50B | 293M |

| EBIT | 1.84B | 193M |

| Net Income | 1.33B | 114M |

| EPS | 8.13 | 1.18 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Synopsys, Inc.

Synopsys exhibited strong revenue growth of 15.12% in the latest year, reaching $7.05B with net income of $1.33B, although net margin declined by 48.87%. Margins remain robust with a gross margin near 77% and EBIT margin at 26.08%. However, operating expenses grew in line with revenue, slightly pressuring profitability despite overall positive trends since 2021.

Teradata Corporation

Teradata faced a revenue decline of 4.53% in 2024, down to $1.75B, yet its net income improved significantly to $114M, more than doubling year-on-year. Margins remain modest with a gross margin of 60.46% and EBIT margin of 11.03%. The company achieved strong margin expansion and EPS growth despite top-line contraction, reflecting operational efficiency gains.

Which one has the stronger fundamentals?

Synopsys shows stronger fundamentals with sustained revenue and net income growth over the period, higher margins, and a favorable overall income statement evaluation. Teradata’s recent margin and earnings improvements contrast with revenue decline and negative long-term growth trends. Synopsys’s scale and margin stability provide a more consistent profitability profile despite some short-term margin pressure.

Financial Ratios Comparison

The table below presents the most recent financial ratios for Synopsys, Inc. and Teradata Corporation, offering a clear comparison of their key performance and financial health metrics as of fiscal year 2025 for SNPS and 2024 for TDC.

| Ratios | Synopsys, Inc. (SNPS) | Teradata Corporation (TDC) |

|---|---|---|

| ROE | 4.72% | 85.71% |

| ROIC | 1.97% | 16.89% |

| P/E | 54.36 | 26.34 |

| P/B | 2.57 | 22.58 |

| Current Ratio | 1.62 | 0.81 |

| Quick Ratio | 1.52 | 0.79 |

| D/E (Debt-to-Equity) | 0.50 | 4.33 |

| Debt-to-Assets | 29.64% | 33.80% |

| Interest Coverage | 2.05 | 7.21 |

| Asset Turnover | 0.15 | 1.03 |

| Fixed Asset Turnover | 5.04 | 9.07 |

| Payout ratio | 0% | 0% |

| Dividend yield | 0% | 0% |

Interpretation of the Ratios

Synopsys, Inc.

Synopsys exhibits a mixed ratio profile, with strengths in net margin (18.96%) and liquidity ratios (current ratio 1.62, quick ratio 1.52), but weaknesses in return on equity (4.72%), return on invested capital (1.97%), and price-to-earnings ratio (54.36). The company does not pay dividends, reflecting a potential reinvestment strategy or focus on growth, with no dividend yield and no share buyback programs to report.

Teradata Corporation

Teradata shows favorable returns on equity (85.71%) and invested capital (16.89%), alongside a solid weighted average cost of capital (5.85%) and asset turnover (1.03). However, its liquidity is weak (current ratio 0.81, quick ratio 0.79), and valuation multiples like price-to-book (22.58) are unfavorable. Teradata also does not pay dividends, possibly prioritizing reinvestment or acquisitions as part of its strategy.

Which one has the best ratios?

Both companies present a neutral overall ratio assessment, each with roughly equal proportions of favorable and unfavorable metrics. Synopsys has better liquidity and net margin, while Teradata excels in return measures but struggles with liquidity and valuation. Neither company offers dividends, indicating differing growth or capital allocation priorities.

Strategic Positioning

This section compares the strategic positioning of Synopsys and Teradata in terms of market position, key segments, and exposure to technological disruption:

Synopsys, Inc.

- Leading in electronic design automation software with strong NASDAQ presence and competitive software infrastructure market.

- Revenue driven by License and Maintenance, License, and Technology Services targeting electronics, automotive, and industrial sectors.

- Offers advanced IP and design verification products, including FPGA prototyping and security testing, adapting to chip design innovations.

Teradata Corporation

- Smaller market cap with NYSE listing, focused on multi-cloud data platform and enterprise analytics solutions.

- Revenue concentrated in consulting, recurring product and service licenses, serving financial, government, healthcare, and retail sectors.

- Provides integrated cloud data platform with ecosystem simplification, supporting cloud migration and analytics infrastructure.

Synopsys vs Teradata Positioning

Synopsys operates with a diversified product portfolio across multiple technology segments, leveraging extensive IP and design tools, while Teradata concentrates on cloud analytics and consulting services. Synopsys’s broader market coverage contrasts with Teradata’s focused enterprise data platform approach.

Which has the best competitive advantage?

Teradata holds a very favorable moat with growing ROIC and efficient capital use indicating durable competitive advantage, whereas Synopsys exhibits a very unfavorable moat with declining ROIC and value destruction over recent years.

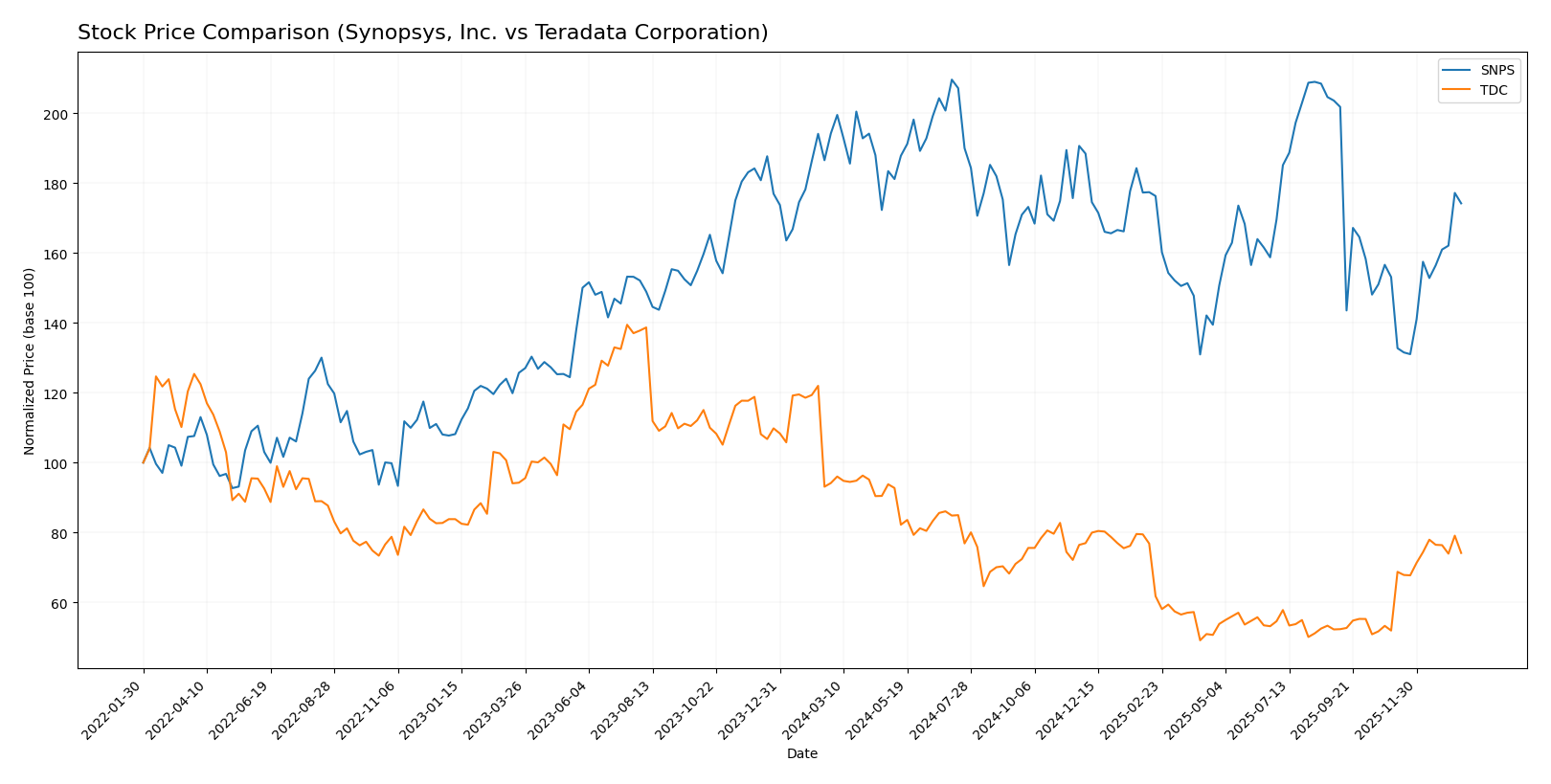

Stock Comparison

The stock price movements of Synopsys, Inc. and Teradata Corporation over the past year reveal distinct bearish trends with recent periods of notable recovery, reflecting differing volatility and acceleration patterns in trading dynamics.

Trend Analysis

Synopsys, Inc. (SNPS) experienced a 10.31% price decline over the past 12 months, indicating a bearish trend with accelerating downward momentum; recent weeks show a 13.77% rebound with high volatility (std dev 44.53).

Teradata Corporation (TDC) recorded a 21.26% price drop over the same period, also bearish with acceleration; its recent 42.78% price increase occurred with lower volatility (std dev 2.81), signaling a steadier recovery phase.

Comparing both stocks, Teradata’s larger negative annual decline contrasts with its stronger recent recovery, but Synopsys remains more volatile; Teradata delivered the highest market performance in the latest months.

Target Prices

The current analyst consensus presents a moderate upside potential for both Synopsys, Inc. and Teradata Corporation.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Synopsys, Inc. | 600 | 425 | 530 |

| Teradata Corporation | 35 | 27 | 31 |

Analysts expect Synopsys to trade modestly above its current price of $516.31, with a consensus target of $530. Teradata’s consensus target price of $31 suggests a slight potential increase from its current $29.77.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Synopsys, Inc. and Teradata Corporation:

Rating Comparison

Synopsys Rating

- Rating: B-, classified as Very Favorable.

- Discounted Cash Flow Score: 3, Moderate valuation.

- ROE Score: 3, Moderate efficiency in equity use.

- ROA Score: 3, Moderate asset utilization.

- Debt To Equity Score: 2, Moderate financial risk.

- Overall Score: 3, Moderate overall financial health.

Teradata Rating

- Rating: B+, classified as Very Favorable.

- Discounted Cash Flow Score: 4, Favorable valuation.

- ROE Score: 5, Very Favorable efficiency in equity.

- ROA Score: 4, Favorable asset utilization.

- Debt To Equity Score: 1, Very Unfavorable financial risk.

- Overall Score: 3, Moderate overall financial health.

Which one is the best rated?

Teradata has a higher rating (B+) compared to Synopsys (B-) and scores better in discounted cash flow, return on equity, and return on assets. However, Teradata has a less favorable debt-to-equity score, indicating higher financial risk than Synopsys. Both share the same overall score.

Scores Comparison

Here is a comparison of the Altman Z-Score and Piotroski Score for Synopsys and Teradata:

Synopsys Scores

- Altman Z-Score: 3.54, safe zone indicating low bankruptcy risk.

- Piotroski Score: 4, average financial strength assessment.

Teradata Scores

- Altman Z-Score: 0.81, distress zone indicating high bankruptcy risk.

- Piotroski Score: 8, very strong financial strength assessment.

Which company has the best scores?

Teradata shows a very strong Piotroski Score of 8, suggesting robust financial strength, but has a high bankruptcy risk indicated by a low Altman Z-Score of 0.81. Synopsys has a safer Altman Z-Score of 3.54 but only an average Piotroski Score of 4.

Grades Comparison

The grades comparison for Synopsys, Inc. and Teradata Corporation based on recent analyst ratings is as follows:

Synopsys, Inc. Grades

Below is a summary of Synopsys, Inc. grades from various reputable grading companies:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Piper Sandler | Downgrade | Neutral | 2026-01-13 |

| Morgan Stanley | Maintain | Overweight | 2025-12-12 |

| Rosenblatt | Maintain | Buy | 2025-12-11 |

| Keybanc | Maintain | Overweight | 2025-12-11 |

| Piper Sandler | Maintain | Overweight | 2025-12-11 |

| Needham | Maintain | Buy | 2025-12-11 |

| B of A Securities | Upgrade | Buy | 2025-12-11 |

| JP Morgan | Maintain | Overweight | 2025-12-11 |

| Wells Fargo | Maintain | Equal Weight | 2025-12-11 |

| Rosenblatt | Upgrade | Buy | 2025-12-09 |

Synopsys, Inc. shows a strong consensus of Buy and Overweight ratings with a recent downgrade to Neutral by Piper Sandler, indicating generally positive but cautious sentiment.

Teradata Corporation Grades

Below is a summary of Teradata Corporation grades from various reputable grading companies:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Barclays | Maintain | Underweight | 2026-01-12 |

| RBC Capital | Maintain | Sector Perform | 2026-01-05 |

| Morgan Stanley | Maintain | Overweight | 2025-12-17 |

| Citizens | Upgrade | Market Outperform | 2025-11-10 |

| Barclays | Maintain | Underweight | 2025-11-05 |

| TD Cowen | Maintain | Hold | 2025-11-05 |

| Evercore ISI Group | Maintain | Outperform | 2025-11-05 |

| UBS | Maintain | Neutral | 2025-08-06 |

| Guggenheim | Maintain | Buy | 2025-05-07 |

| Barclays | Maintain | Underweight | 2025-04-21 |

Teradata Corporation’s grades are mixed, with several Underweight ratings but some Outperform and Buy ratings, reflecting a more cautious or balanced outlook.

Which company has the best grades?

Synopsys, Inc. has received stronger and more consistent Buy and Overweight ratings compared to Teradata Corporation’s mixed Hold and Underweight grades. This suggests Synopsys is viewed more favorably by analysts, potentially indicating better growth or stability prospects for investors.

Strengths and Weaknesses

Below is a comparative overview of Synopsys, Inc. (SNPS) and Teradata Corporation (TDC) focusing on key investment criteria based on the most recent data.

| Criterion | Synopsys, Inc. (SNPS) | Teradata Corporation (TDC) |

|---|---|---|

| Diversification | Strong software licensing and maintenance revenues (~3.49B USD in 2025), with consistent technology services growth | Balanced portfolio with recurring product and service revenues (~2.67B USD recurring in 2024) plus consulting |

| Profitability | Moderate net margin (~19%), but low ROIC (1.97%) below WACC (8.3%), indicating value destruction | Moderate net margin (~6.5%), high ROIC (16.9%) well above WACC (5.85%), indicating strong value creation |

| Innovation | Focus on advanced semiconductor software solutions, but declining ROIC trend signals challenges | Growing ROIC and favorable interest coverage suggest effective innovation and operational efficiency |

| Global presence | Established global player in semiconductor IP and software markets | Wide international reach with steady revenues from U.S. and international markets |

| Market Share | Leading position in semiconductor EDA software with dominant licensing segment | Strong position in data analytics and recurring software services, though smaller licensing share |

Key takeaways: Teradata shows a durable competitive advantage with strong value creation and improving profitability, despite some liquidity concerns. Synopsys maintains solid revenue diversification but faces profitability and capital efficiency challenges, signaling caution for investors.

Risk Analysis

Below is a comparative table summarizing key risk metrics for Synopsys, Inc. (SNPS) and Teradata Corporation (TDC) based on the most recent data available:

| Metric | Synopsys, Inc. (SNPS) | Teradata Corporation (TDC) |

|---|---|---|

| Market Risk | Beta 1.12 (moderate volatility) | Beta 0.57 (lower volatility) |

| Debt level | Debt-to-Equity 0.5 (neutral) | Debt-to-Equity 4.33 (high) |

| Regulatory Risk | Moderate (tech sector regulations) | Moderate (data privacy and cloud regulations) |

| Operational Risk | Medium (complex software products) | Medium (multi-cloud platform complexity) |

| Environmental Risk | Low (software focus) | Low (software focus) |

| Geopolitical Risk | Moderate (global supply chains) | Moderate (global service footprint) |

Synopsys faces moderate market risk with a beta slightly above 1, and maintains a balanced debt profile, reducing financial risk. Teradata shows lower market volatility but carries a significantly higher debt load, increasing financial vulnerability. Both operate in regulated tech environments with moderate operational and geopolitical risks. Teradata’s Altman Z-Score signals financial distress risk, emphasizing the need for caution.

Which Stock to Choose?

Synopsys, Inc. (SNPS) shows a favorable income evolution with 15.12% revenue growth in 2025 and strong gross and EBIT margins. Its financial ratios are mixed, with favorable liquidity and debt metrics but unfavorable ROE and asset turnover. The company has a very favorable rating (B-) but demonstrates a very unfavorable MOAT due to declining ROIC below WACC.

Teradata Corporation (TDC) posts a favorable income statement with positive net margin and EBIT margin, despite a recent revenue decline. Its financial ratios highlight strong profitability and asset efficiency but weak liquidity and high leverage. It holds a very favorable rating (B+) and a very favorable MOAT, showing increasing ROIC well above WACC.

Investors prioritizing durable competitive advantage and rising profitability might find Teradata appealing, while those valuing stable income growth and liquidity could see Synopsys as a potential option. The ratings and MOAT evaluations suggest contrasting profiles that could influence individual risk tolerance and investment strategy.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Synopsys, Inc. and Teradata Corporation to enhance your investment decisions: