In the fast-evolving world of electronic design automation, two industry leaders stand out: Synopsys, Inc. (SNPS) and Cadence Design Systems, Inc. (CDNS). Both companies specialize in advanced software solutions that power integrated circuit design and verification, serving overlapping markets such as automotive, aerospace, and consumer electronics. Their commitment to innovation and comprehensive product portfolios makes this comparison essential. Join me as we explore which company offers the most compelling investment opportunity today.

Table of contents

Companies Overview

I will begin the comparison between Synopsys and Cadence Design Systems by providing an overview of these two companies and their main differences.

Synopsys Overview

Synopsys, Inc. develops electronic design automation software and IP solutions to design and test integrated circuits. The company offers platforms for digital design implementation, verification, and FPGA-based prototyping, as well as security testing and managed services. Headquartered in Mountain View, California, Synopsys serves diverse sectors including electronics, automotive, medicine, and industrial markets.

Cadence Design Systems Overview

Cadence Design Systems, Inc. provides software, hardware, and services for integrated circuit design and verification. Its offerings include functional verification platforms, digital IC design tools, custom IC simulation, and intellectual property products. Based in San Jose, California, Cadence caters to markets such as 5G communications, aerospace, automotive, industrial, and hyperscale computing.

Key similarities and differences

Both Synopsys and Cadence operate in the technology sector, focusing on software and IP solutions for integrated circuit design and verification. Synopsys emphasizes a broad range of design automation, verification, and security services, while Cadence integrates hardware platforms with software for IC design and sign-off. Each company targets diverse industries but differs in product scope, with Synopsys offering extensive FPGA and security products and Cadence providing comprehensive emulation and prototyping hardware.

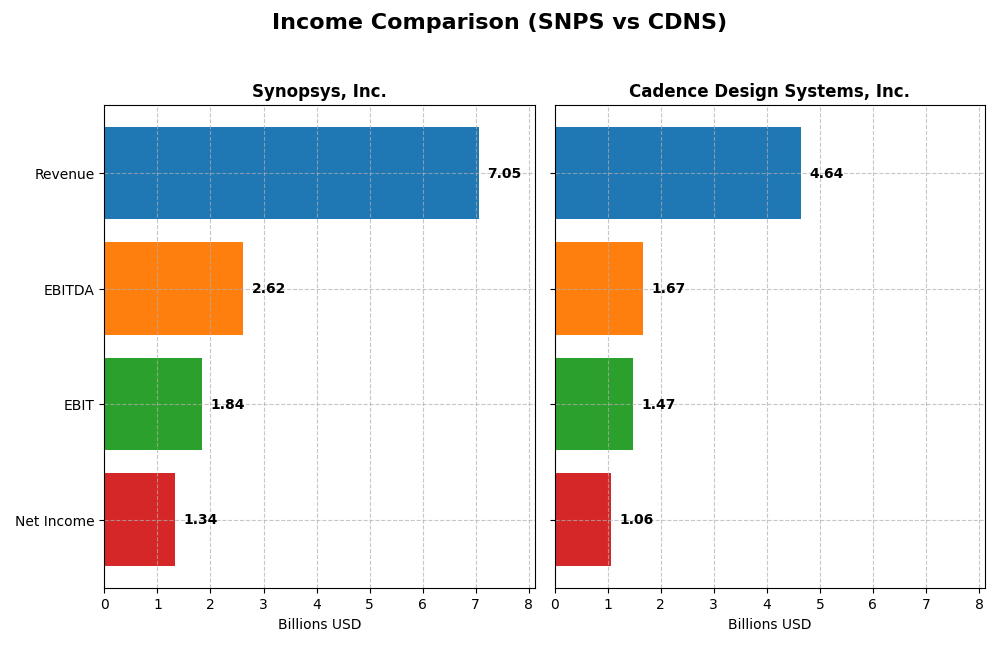

Income Statement Comparison

The following table presents a side-by-side comparison of key income statement metrics for Synopsys, Inc. and Cadence Design Systems, Inc. for their most recent fiscal years.

| Metric | Synopsys, Inc. (SNPS) | Cadence Design Systems, Inc. (CDNS) |

|---|---|---|

| Market Cap | 91.9B | 84.5B |

| Revenue | 7.05B | 4.64B |

| EBITDA | 2.62B | 1.67B |

| EBIT | 1.84B | 1.47B |

| Net Income | 1.34B | 1.06B |

| EPS | 8.13 | 3.89 |

| Fiscal Year | 2025 | 2024 |

Income Statement Interpretations

Synopsys, Inc.

Synopsys exhibited strong revenue growth of 68% from 2021 to 2025, with net income rising 77% over the same period. Margins remained robust, highlighted by a gross margin of 74.3% and an EBIT margin of 26.1% in 2025. However, despite a 15.1% revenue increase in 2025, net margin and EPS declined significantly, indicating margin pressure and earnings volatility in the latest year.

Cadence Design Systems, Inc.

Cadence showed consistent revenue growth of 73% from 2020 to 2024, with net income increasing 79%. Margins are notably strong, with a 2024 gross margin of 86.1% and an EBIT margin of 31.7%. The latest year saw favorable growth in revenue, gross profit, and operating expenses, though net margin slightly contracted by 10.7%, while EPS growth remained stable, reflecting steady profitability.

Which one has the stronger fundamentals?

Both companies demonstrate favorable income statement trends with solid revenue and net income growth alongside strong margins. Cadence holds higher gross and EBIT margins with more stable operating expense management, while Synopsys shows greater volatility in net margin and EPS in the latest year. Overall, each exhibits solid fundamentals but with differing margin stability and growth dynamics.

Financial Ratios Comparison

The table below compares key financial ratios for Synopsys, Inc. (SNPS) and Cadence Design Systems, Inc. (CDNS) based on their most recent fiscal year data available.

| Ratios | Synopsys, Inc. (SNPS) FY 2025 | Cadence Design Systems, Inc. (CDNS) FY 2024 |

|---|---|---|

| ROE | 4.7% | 22.6% |

| ROIC | 2.0% | 13.4% |

| P/E | 54.4 | 77.2 |

| P/B | 2.57 | 17.44 |

| Current Ratio | 1.62 | 2.93 |

| Quick Ratio | 1.52 | 2.74 |

| D/E (Debt-to-Equity) | 0.50 | 0.55 |

| Debt-to-Assets | 29.6% | 28.8% |

| Interest Coverage | 2.05 | 17.77 |

| Asset Turnover | 0.15 | 0.52 |

| Fixed Asset Turnover | 5.04 | 7.68 |

| Payout ratio | 0 | 0 |

| Dividend yield | 0% | 0% |

Interpretation of the Ratios

Synopsys, Inc.

Synopsys shows a balanced profile with 36% favorable and 36% unfavorable ratios, resulting in a neutral overall assessment. Key strengths include a solid current and quick ratio, favorable debt-to-assets, and fixed asset turnover, while concerns arise from low return on equity and invest capital, high P/E, and weak asset turnover. The company does not pay dividends, likely reflecting reinvestment in growth and R&D priorities.

Cadence Design Systems, Inc.

Cadence presents a stronger ratio profile with 57% favorable and 21% unfavorable metrics, indicating a favorable overall financial position. Highlights include robust net margin, high return on equity and capital, strong liquidity, and interest coverage. However, the elevated P/E and price-to-book ratios may signal valuation concerns. The absence of dividends suggests a focus on growth, acquisitions, or share repurchases instead.

Which one has the best ratios?

Cadence Design Systems exhibits a more favorable ratio set compared to Synopsys, with higher returns, liquidity, and coverage ratios, albeit with valuation concerns. Synopsys has a more mixed ratio profile, balancing strengths in liquidity and fixed assets with weaker profitability and efficiency. Overall, Cadence’s ratios suggest stronger financial health relative to its peer.

Strategic Positioning

This section compares the strategic positioning of Synopsys and Cadence, including market position, key segments, and exposure to technological disruption:

Synopsys, Inc.

- Leading in electronic design automation software with strong competitive pressure in infrastructure software.

- Focus on digital design, verification, IP solutions, and SoC infrastructure serving broad industries.

- Exposed to disruption through evolving verification and prototyping technologies impacting design tools.

Cadence Design Systems, Inc.

- Strong presence in software and hardware for IC design with competitive pressure in application software.

- Concentrates on functional verification, digital IC design, custom IC, and system design across diverse markets.

- Faces disruption risks from advancements in emulation, prototyping, and multi-physics system analysis platforms.

Synopsys, Inc. vs Cadence Design Systems, Inc. Positioning

Synopsys adopts a diversified approach with broad electronic design automation and IP offerings, while Cadence concentrates on IC design and verification hardware/software. Synopsys’s wide industry exposure contrasts with Cadence’s focused market segments, each with distinct operational scopes.

Which has the best competitive advantage?

Cadence shows a slightly favorable moat with value creation despite declining profitability, whereas Synopsys has a very unfavorable moat due to value destruction and decreasing returns. Cadence demonstrates a better competitive advantage based on MOAT evaluation.

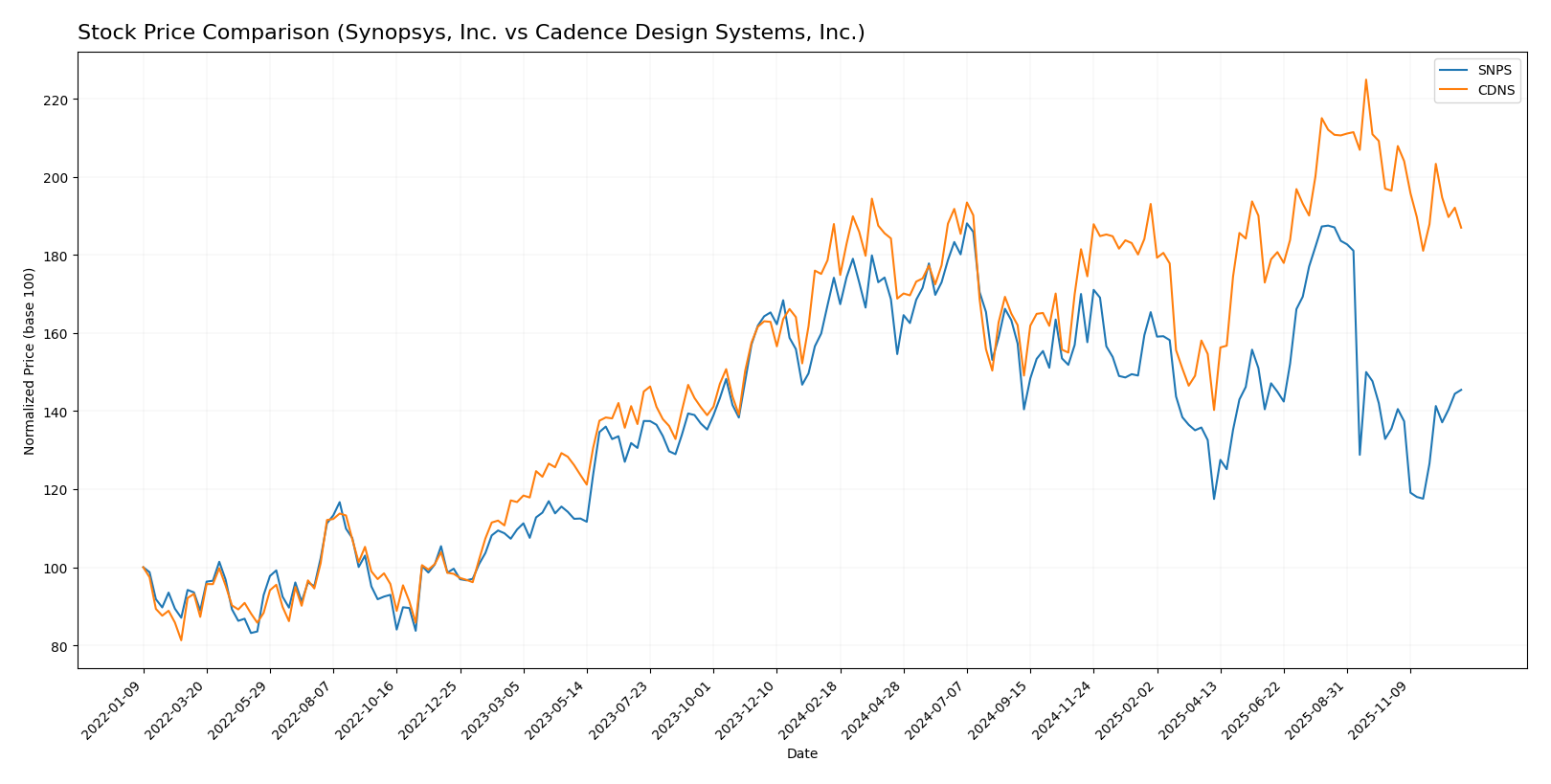

Stock Comparison

The stock price movements of Synopsys, Inc. (SNPS) and Cadence Design Systems, Inc. (CDNS) over the past 12 months reveal contrasting dynamics, with SNPS experiencing a notable decline followed by recent recovery, while CDNS shows overall stability with a recent downturn.

Trend Analysis

Synopsys, Inc. (SNPS) has demonstrated a bearish trend over the past year, with a price decline of 16.49% and accelerating downward momentum. Recent months show a short-term bullish reversal, gaining 7.32% with reduced volatility.

Cadence Design Systems, Inc. (CDNS) has maintained a near-neutral trend with a slight 0.49% price decline over the year, reflecting decelerating bearish pressure. However, recent weeks reveal a renewed bearish trend with a 4.82% drop.

Comparing both, Synopsys, Inc. has experienced the highest overall price decrease but shows recent positive momentum, whereas Cadence Design Systems, Inc. has delivered more stable pricing with less pronounced fluctuations.

Target Prices

The current analyst consensus shows promising upside potential for Synopsys, Inc. and Cadence Design Systems, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| Synopsys, Inc. | 602 | 425 | 541.71 |

| Cadence Design Systems, Inc. | 418 | 275 | 381 |

Analysts expect Synopsys to trade significantly above its current price of 480.42 USD, indicating strong growth potential. Cadence’s consensus target of 381 USD also suggests a substantial upside from its current 310.4 USD price.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for Synopsys, Inc. and Cadence Design Systems, Inc.:

Rating Comparison

SNPS Rating

- Rating: B- with a very favorable status based on financial standing.

- Discounted Cash Flow Score: Moderate score of 3 indicating average valuation based on future cash flows.

- ROE Score: Moderate score of 3 showing average efficiency in generating profit from shareholders’ equity.

- ROA Score: Moderate score of 3 reflecting average asset utilization for earnings generation.

- Debt To Equity Score: Moderate score of 2 reflecting moderate financial risk with some leverage.

- Overall Score: Moderate score of 3 summarizing average financial health and performance.

CDNS Rating

- Rating: B with a very favorable status reflecting a stronger overall financial assessment.

- Discounted Cash Flow Score: Moderate score of 3 suggesting similar valuation assessment as SNPS.

- ROE Score: Favorable score of 4 indicating better efficiency in using equity to generate returns.

- ROA Score: Very favorable score of 5 demonstrating strong effectiveness in using assets to generate earnings.

- Debt To Equity Score: Moderate score of 2 indicating a similar level of financial risk and leverage.

- Overall Score: Moderate score of 3 indicating comparable overall financial health to SNPS.

Which one is the best rated?

Cadence Design Systems (CDNS) is better rated overall, with higher scores in return on equity and return on assets, reflecting superior profitability and asset utilization. Synopsys (SNPS) holds a slightly lower rating but similar overall scores.

Scores Comparison

The following table compares the Altman Z-Score and Piotroski Score of Synopsys, Inc. and Cadence Design Systems, Inc.:

SNPS Scores

- Altman Z-Score: 3.23, indicating a safe zone with low bankruptcy risk.

- Piotroski Score: 4, reflecting average financial strength.

CDNS Scores

- Altman Z-Score: 14.10, indicating a safe zone with very low bankruptcy risk.

- Piotroski Score: 7, reflecting strong financial strength.

Which company has the best scores?

Based strictly on the provided data, CDNS has higher Altman Z-Score and Piotroski Score values than SNPS, indicating stronger financial stability and health in both measures.

Grades Comparison

The following tables display recent grades assigned to Synopsys, Inc. and Cadence Design Systems, Inc. by established grading companies:

Synopsys, Inc. Grades

This table summarizes the latest grades and actions from reputable financial analysts for Synopsys, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Morgan Stanley | Maintain | Overweight | 2025-12-12 |

| B of A Securities | Upgrade | Buy | 2025-12-11 |

| Rosenblatt | Maintain | Buy | 2025-12-11 |

| JP Morgan | Maintain | Overweight | 2025-12-11 |

| Wells Fargo | Maintain | Equal Weight | 2025-12-11 |

| Piper Sandler | Maintain | Overweight | 2025-12-11 |

| Keybanc | Maintain | Overweight | 2025-12-11 |

| Needham | Maintain | Buy | 2025-12-11 |

| Rosenblatt | Upgrade | Buy | 2025-12-09 |

| B of A Securities | Upgrade | Neutral | 2025-12-08 |

Overall, Synopsys has maintained mostly positive grades, with several buy and overweight ratings and some recent upgrades indicating growing analyst confidence.

Cadence Design Systems, Inc. Grades

This table provides recent grades and rating actions for Cadence Design Systems, Inc. from recognized financial institutions:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Needham | Maintain | Buy | 2025-12-22 |

| Oppenheimer | Maintain | Underperform | 2025-10-28 |

| Needham | Maintain | Buy | 2025-10-28 |

| Wells Fargo | Maintain | Overweight | 2025-10-28 |

| Baird | Maintain | Outperform | 2025-10-28 |

| JP Morgan | Maintain | Overweight | 2025-10-28 |

| Rosenblatt | Maintain | Neutral | 2025-10-28 |

| Rosenblatt | Maintain | Neutral | 2025-10-22 |

| Loop Capital | Maintain | Buy | 2025-07-29 |

| Mizuho | Maintain | Outperform | 2025-07-29 |

Cadence’s ratings show a mixed but generally favorable pattern, including several buy and outperform grades, balanced by an underperform rating from Oppenheimer.

Which company has the best grades?

Synopsys, Inc. exhibits a stronger consensus of buy and overweight ratings with recent upgrades, while Cadence Design Systems, Inc. shows a broader range with more neutral and a notable underperform rating. Investors could interpret Synopsys’s grades as reflecting higher analyst confidence, potentially impacting portfolio weighting decisions.

Strengths and Weaknesses

Below is a comparative table highlighting key strengths and weaknesses of Synopsys, Inc. (SNPS) and Cadence Design Systems, Inc. (CDNS) based on their latest financial and market performance data.

| Criterion | Synopsys, Inc. (SNPS) | Cadence Design Systems, Inc. (CDNS) |

|---|---|---|

| Diversification | Moderate: Revenue mainly from License and Maintenance (3.49B) and Technology Services (1.55B) | Moderate: Revenue concentrated in Product & Maintenance (4.21B) and Technology Services (428M) |

| Profitability | Mixed: Net margin 18.96% (favorable), but ROIC 1.97% below WACC 8.31% (unfavorable); value destroying | Strong: Net margin 22.74%, ROIC 13.43% well above WACC 8.54%; value creating, but ROIC declining |

| Innovation | Moderate: High fixed asset turnover (5.04) indicates efficient asset use | High: Better fixed asset turnover (7.68) and higher ROE (22.58%) suggest strong innovation impact |

| Global presence | Established global footprint with steady revenue growth | Similar global reach with larger revenue base and better liquidity ratios |

| Market Share | Significant in EDA software but facing profitability challenges | Leading market position with better financial health and value creation |

Key takeaways: Cadence Design Systems demonstrates stronger profitability and value creation, despite a declining ROIC trend. Synopsys shows decent revenue growth but struggles with efficient capital use and profitability, indicating caution for investors focusing on long-term value.

Risk Analysis

Below is a comparative table highlighting key risk factors for Synopsys, Inc. (SNPS) and Cadence Design Systems, Inc. (CDNS) as of the most recent fiscal years:

| Metric | Synopsys, Inc. (SNPS) | Cadence Design Systems, Inc. (CDNS) |

|---|---|---|

| Market Risk | Beta 1.15 – moderate market volatility exposure | Beta 1.05 – slightly lower market volatility exposure |

| Debt Level | Debt-to-Equity 0.5 – moderate leverage | Debt-to-Equity 0.55 – moderate leverage |

| Regulatory Risk | Moderate – operates in tech with IP and security regulations | Moderate – similar tech industry regulatory exposure |

| Operational Risk | Moderate – complexity in product integration and services | Moderate – broad product portfolio and service demands |

| Environmental Risk | Low – primarily software, limited direct environmental impact | Low – software-focused with minimal environmental footprint |

| Geopolitical Risk | Moderate – global supply chain and client exposure | Moderate – global operations with geopolitical sensitivity |

Synopsys faces moderate market and operational risks with a balanced debt profile, but its relatively higher P/E ratio and moderate profitability metrics suggest caution. Cadence shows stronger profitability and financial health but trades at a higher valuation, indicating risk if growth slows. Both companies are moderately exposed to geopolitical and regulatory risks inherent in the tech sector.

Which Stock to Choose?

Synopsys, Inc. (SNPS) shows favorable income growth with a 15.12% revenue increase in 2025 and a strong gross margin of 74.26%. Financial ratios are mixed, with a moderate rating and favorable liquidity but weak returns on equity and invested capital. The company carries moderate debt and a very unfavorable moat due to declining ROIC below WACC.

Cadence Design Systems, Inc. (CDNS) reports solid income growth with a 13.48% revenue rise in 2024 and a higher gross margin of 86.05%. Its financial ratios are largely favorable, with strong returns on equity and assets, moderate debt levels, and a slightly favorable moat reflecting value creation despite a declining ROIC trend. The company holds a similarly moderate rating.

For investors prioritizing growth and income stability, CDNS might appear more favorable given its stronger profitability ratios and value-creating moat. Conversely, those who consider liquidity and recent revenue growth could find SNPS’s profile worth monitoring despite its weaker profitability metrics and value erosion signals. The choice could depend on an investor’s tolerance for risk and focus on quality metrics versus growth potential.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of Synopsys, Inc. and Cadence Design Systems, Inc. to enhance your investment decisions: