Home > Comparison > Technology > STM vs SKYT

The strategic rivalry between STMicroelectronics N.V. and SkyWater Technology, Inc. shapes the semiconductor industry’s evolution. STMicroelectronics, a global semiconductor powerhouse, operates diverse segments from automotive ICs to MEMS sensors. In contrast, SkyWater Technology focuses on specialized semiconductor development and manufacturing services for niche markets. This analysis dissects their competing models to identify which offers superior risk-adjusted returns for a balanced, growth-oriented portfolio in technology.

Table of contents

Companies Overview

STMicroelectronics and SkyWater Technology stand as dynamic players in the semiconductor industry. Both companies drive innovation but pursue distinct paths within technology manufacturing and services.

STMicroelectronics N.V.: Global Semiconductor Powerhouse

STMicroelectronics dominates as a leading semiconductor designer and manufacturer. It generates revenue through diversified segments including automotive ICs, analog and MEMS sensors, and microcontrollers. In 2026, its strategic focus emphasizes innovation in automotive and industrial sectors to capitalize on emerging smart technology trends.

SkyWater Technology, Inc.: Specialty Semiconductor Foundry

SkyWater Technology specializes in semiconductor development and manufacturing services. Its revenue stems from providing engineering support and manufacturing for silicon-based analog, rad-hard, and MEMS integrated circuits. The company’s 2026 strategy targets collaborative technology co-creation with customers across aerospace, defense, and IoT industries.

Strategic Collision: Similarities & Divergences

STMicroelectronics pursues a broad, integrated product portfolio, while SkyWater focuses on customizable foundry services. The primary battleground is advanced semiconductor manufacturing for automotive and industrial applications. Investors face contrasting profiles: STMicroelectronics offers scale and diversification, whereas SkyWater presents a niche, high-beta growth opportunity with elevated volatility.

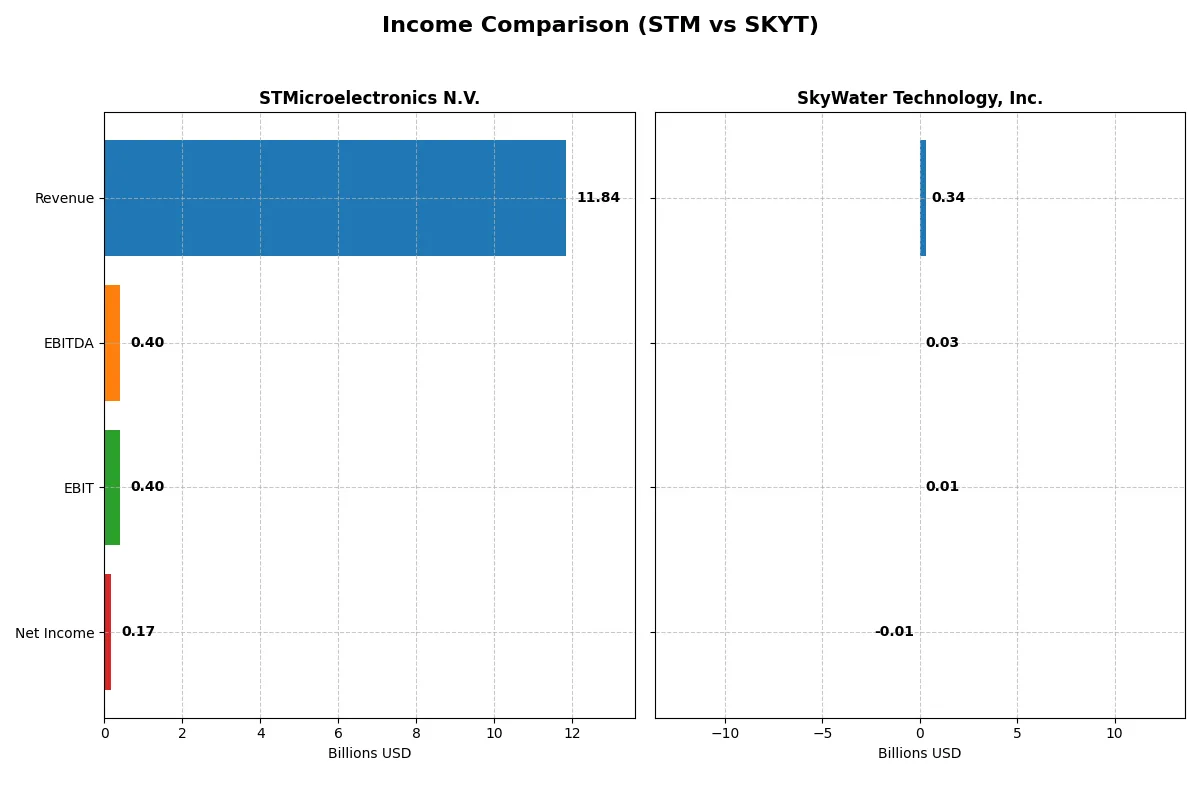

Income Statement Comparison

This data dissects the core profitability and scalability of both corporate engines to reveal who dominates the bottom line:

| Metric | STMicroelectronics N.V. (STM) | SkyWater Technology, Inc. (SKYT) |

|---|---|---|

| Revenue | 11.8B | 342M |

| Cost of Revenue | 7.8B | 273M |

| Operating Expenses | 3.7B | 63M |

| Gross Profit | 4.0B | 70M |

| EBITDA | 401M | 25M |

| EBIT | 401M | 7M |

| Interest Expense | 0 | 9M |

| Net Income | 167M | -7M |

| EPS | 0.19 | -0.14 |

| Fiscal Year | 2025 | 2024 |

Income Statement Analysis: The Bottom-Line Duel

This income statement comparison reveals which company drives stronger efficiency and profitability in their core operations.

STMicroelectronics N.V. Analysis

STMicroelectronics shows a declining trend with revenues dropping 11% from $13.3B in 2024 to $11.8B in 2025. Net income fell sharply by 89% to $167M, compressing net margins to 1.41%. Despite a solid gross margin near 34%, EBIT margin shrank to a weak 3.39%, signaling margin pressure and reduced operational momentum in 2025.

SkyWater Technology, Inc. Analysis

SkyWater boosts revenue 19% to $342M in 2024, with gross profit growing 17% to $70M, sustaining a 20% gross margin. EBIT turns positive at $6.6M, recovering from prior losses, although net income remains negative at -$6.8M. The company’s improving margins and profitability trajectory suggest operational leverage is building despite ongoing net losses.

Margin Resilience vs. Growth Recovery

STMicroelectronics commands scale and historically superior margins but faces steep recent declines in profits and margins. SkyWater operates smaller but exhibits strong revenue growth and margin improvement, though it still posts net losses. Investors favoring stability might lean toward STM’s scale, while those seeking growth momentum may find SKYT’s recovery profile more compelling.

Financial Ratios Comparison

These vital ratios act as a diagnostic tool to expose the underlying fiscal health, valuation premiums, and capital efficiency of the companies analyzed:

| Ratios | STMicroelectronics N.V. (STM) | SkyWater Technology, Inc. (SKYT) |

|---|---|---|

| ROE | 8.9% | -11.8% |

| ROIC | 6.3% | 3.4% |

| P/E | 14.4 | -100.3 |

| P/B | 1.29 | 11.82 |

| Current Ratio | 3.11 | 0.86 |

| Quick Ratio | 2.37 | 0.76 |

| D/E | 0.18 | 1.33 |

| Debt-to-Assets | 12.8% | 24.5% |

| Interest Coverage | 19.7 | 0.74 |

| Asset Turnover | 0.54 | 1.09 |

| Fixed Asset Turnover | 1.22 | 2.07 |

| Payout ratio | 18.5% | 0% |

| Dividend yield | 1.28% | 0% |

| Fiscal Year | 2024 | 2024 |

Efficiency & Valuation Duel: The Vital Signs

Financial ratios act as the company’s DNA, exposing hidden risks and operational strengths critical for sound investment analysis.

STMicroelectronics N.V.

STMicroelectronics reveals weak profitability with ROE at 0.93% and a net margin of 1.41%, signaling operational challenges. The valuation metrics, including P/E and P/B, are favorable, indicating the stock is not stretched. The company maintains a strong liquidity position but offers no dividends, focusing on substantial R&D reinvestment to fuel growth.

SkyWater Technology, Inc.

SkyWater Technology struggles with negative ROE (-11.79%) and net margins (-1.98%), reflecting ongoing profitability issues. Its P/E ratio is favorable due to negative earnings, but the high P/B of 11.82 suggests overvaluation. The company carries heavy debt and poor liquidity, with no dividend payout, likely prioritizing survival and incremental R&D investments.

Balanced Growth vs. High-Risk Speculation

STMicroelectronics offers a more balanced risk-reward profile with solid valuation and a clear growth strategy despite low current profitability. SkyWater’s metrics highlight significant risk due to weak returns and leverage. Investors seeking operational stability may favor STMicroelectronics; risk-tolerant profiles might consider SkyWater’s speculative potential.

Which one offers the Superior Shareholder Reward?

I see STMicroelectronics (STM) pays a modest 1.28% dividend yield with a conservative 18.5% payout, supported by historically strong free cash flow. STM also executes consistent buybacks, enhancing shareholder returns sustainably. SkyWater Technology (SKYT) pays no dividends and has weak cash flow, relying entirely on reinvestment. Its high leverage and lack of buybacks raise risks. I conclude STM offers a more attractive and sustainable total return profile for 2026 investors.

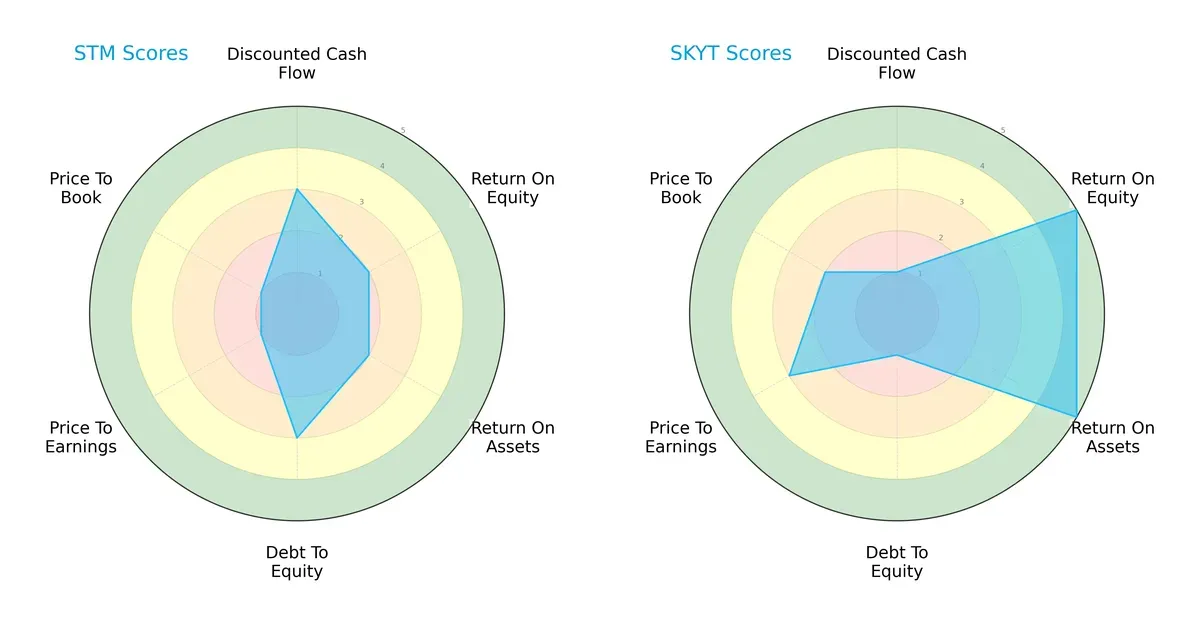

Comparative Score Analysis: The Strategic Profile

The radar chart reveals the fundamental DNA and trade-offs of STMicroelectronics N.V. and SkyWater Technology, Inc., highlighting their financial strengths and weaknesses:

STMicroelectronics shows a balanced debt-to-equity and discounted cash flow profile but struggles with valuation metrics (PE/PB). Conversely, SkyWater excels in return on equity and assets but faces risks from high leverage and weak cash flow valuation. STMicroelectronics offers a steadier, more conservative profile; SkyWater’s edge lies in operational efficiency but with financial risk.

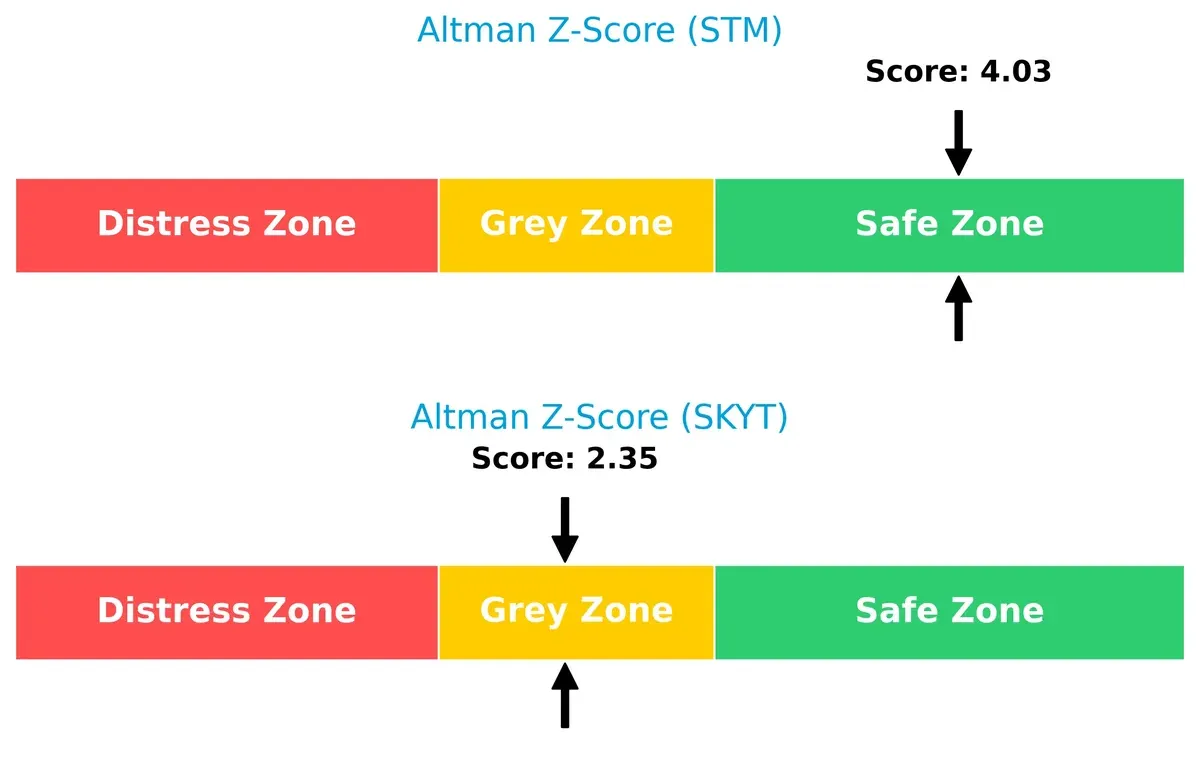

Bankruptcy Risk: Solvency Showdown

SkyWater’s Altman Z-Score of 2.35 places it in the grey zone, signaling moderate bankruptcy risk. STMicroelectronics scores 4.03, safely above distress thresholds, indicating stronger long-term solvency in the current cycle:

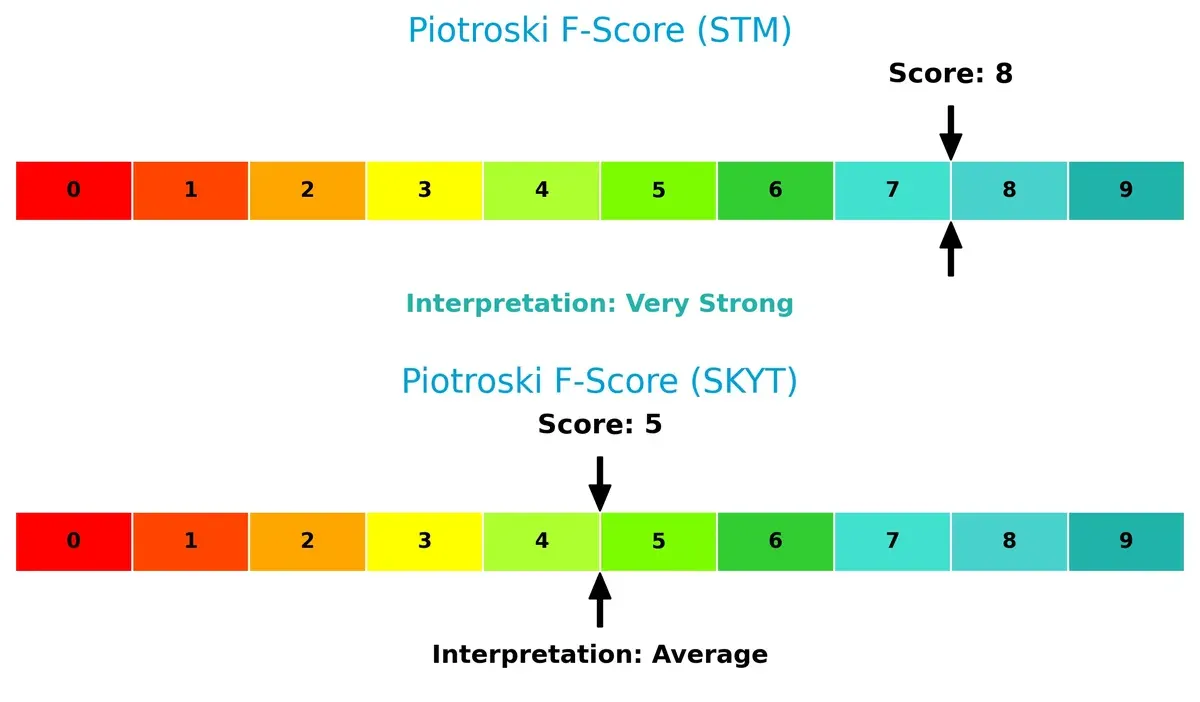

Financial Health: Quality of Operations

STMicroelectronics achieves a Piotroski F-Score of 8, reflecting very strong financial health and operational quality. SkyWater’s score of 5 is average, suggesting some internal metrics need improvement compared to its peer:

How are the two companies positioned?

This section dissects STM and SKYT’s operational DNA by comparing their revenue distribution and internal strengths and weaknesses. The goal is to confront their economic moats to reveal which model offers the most resilient, sustainable advantage today.

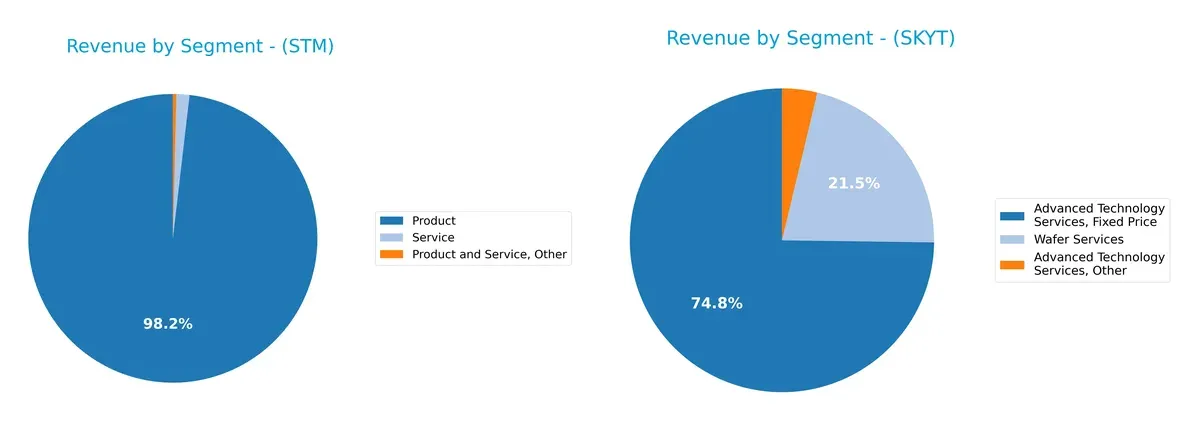

Revenue Segmentation: The Strategic Mix

This visual comparison dissects how STMicroelectronics and SkyWater Technology diversify their income streams and reveals where their primary sector bets lie:

STMicroelectronics anchors its revenue in a dominant Product segment, generating $13.2B in 2024, dwarfing its Service and Other revenues. This concentration signals strong infrastructure dominance but exposes concentration risk. In contrast, SkyWater Technology shows a more balanced mix, with Advanced Technology Services around $140M and Wafer Services at $27M, indicating strategic diversification within semiconductor manufacturing services. SkyWater pivots on service innovation, while STMicroelectronics leverages scale in product sales.

Strengths and Weaknesses Comparison

This table compares the strengths and weaknesses of STMicroelectronics N.V. (STM) and SkyWater Technology, Inc. (SKYT):

STM Strengths

- Diverse product segments with $13.2B product revenue

- Strong global presence across Asia Pacific, Americas, and EMEA

- Favorable debt-to-assets ratio at 8.6%

- Infinite interest coverage ratio

- Favorable P/E and P/B ratios

- Solid asset turnover at 0.48 (neutral fixed asset turnover)

SKYT Strengths

- Favorable asset turnover at 1.09

- Positive ROIC at 3.4% despite unfavorable WACC

- Favorable P/E ratio despite negative net margin

- Favorable debt-to-assets ratio at 24.46%

- Innovation focus on advanced technology and wafer services

- Concentrated US market presence with $329M revenue

STM Weaknesses

- Low profitability metrics: net margin 1.41%, ROE 0.93%, ROIC 0.67% below WACC

- Unfavorable current ratio at 3.36 suggests asset liquidity imbalance

- Unfavorable net margin and ROE indicate weak capital returns

- Zero dividend yield

- Unfavorable asset turnover at 0.48

- Market share pressure in competitive semiconductor segments

SKYT Weaknesses

- Negative net margin at -1.98%, ROE at -11.79%

- Unfavorable WACC at 19.95% indicates costly capital

- Unfavorable current and quick ratios below 1

- High debt-to-equity at 1.33

- Low interest coverage at 0.74

- High P/B at 11.82 signals possible overvaluation risk

STM leverages its broad product diversification and global reach to maintain financial stability despite low profitability. SKYT’s strengths lie in efficient asset use and niche technology focus but face significant financial risks from poor profitability and liquidity. Both companies must address these weaknesses to improve sustainable returns.

The Moat Duel: Analyzing Competitive Defensibility

A structural moat is the only shield protecting long-term profits from relentless competitive erosion:

STMicroelectronics N.V.: Intangible Assets Anchor

STMicroelectronics leverages deep R&D and diversified semiconductor portfolios, reflected in stable gross margins near 34%. Yet, declining ROIC warns of eroding cost advantages heading into 2026.

SkyWater Technology, Inc.: Emerging Process Innovation

SkyWater’s moat stems from bespoke semiconductor manufacturing services and process co-development. Despite current value destruction, its rapidly improving ROIC signals strengthening competitive positioning against STM’s legacy scale.

Legacy Scale vs. Innovation Trajectory

STM’s broad intangible asset moat is deeper but weakening. SkyWater’s narrower moat grows stronger with innovation momentum. I see SkyWater better poised to defend and expand market share long term.

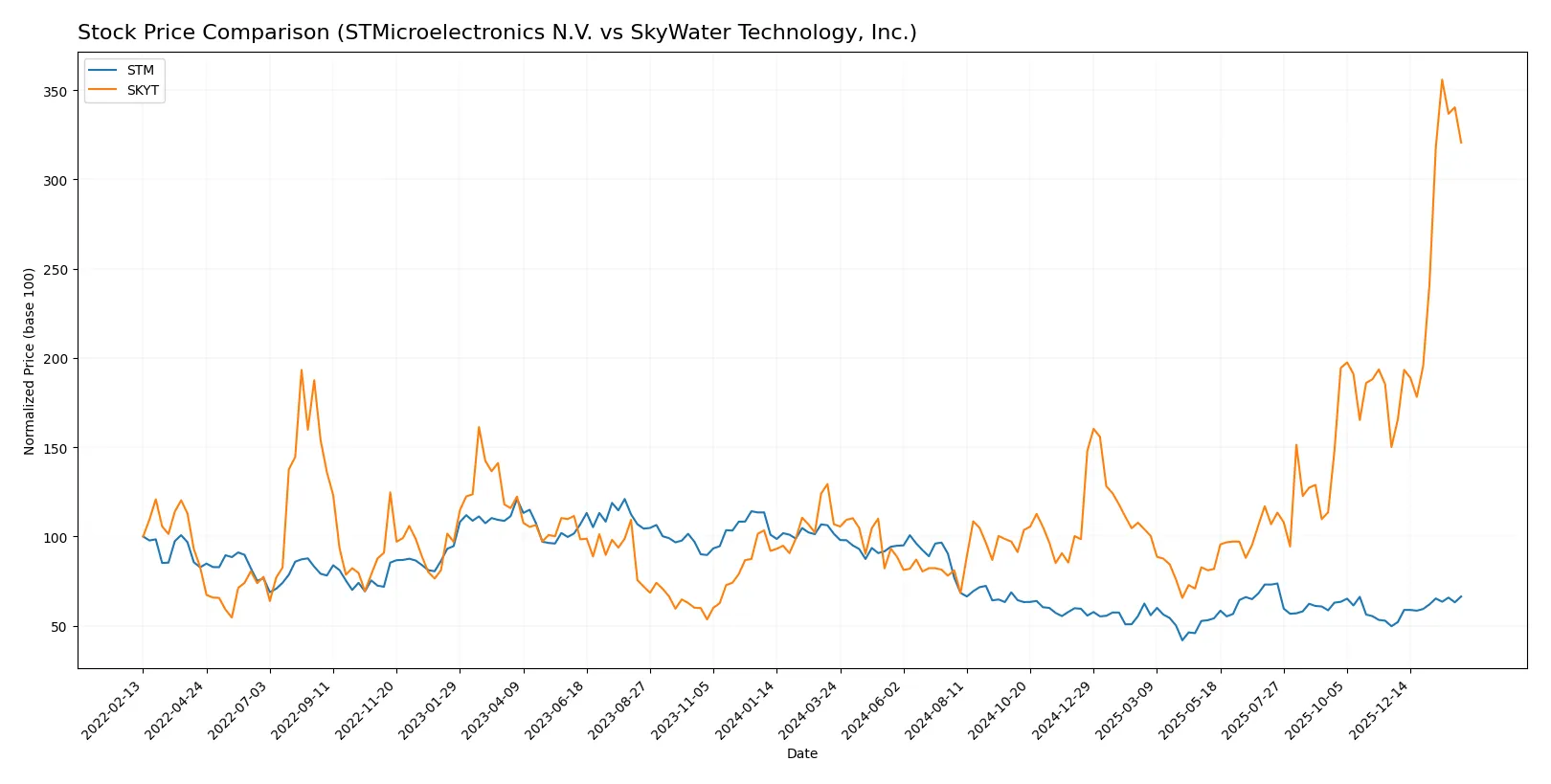

Which stock offers better returns?

Over the past year, STMicroelectronics N.V. experienced a steep decline followed by a recent strong rebound, while SkyWater Technology, Inc. showed a sustained and accelerating price surge with notable buyer dominance.

Trend Comparison

STMicroelectronics N.V. posted a bearish trend over 12 months with a -34.6% price drop, hitting a low of 18.49. The downtrend accelerated, but recent weeks show a 33.5% recovery.

SkyWater Technology, Inc. enjoyed a bullish 200% gain over the year, accelerating upward with a 113.61% rise recently. It reached a high of 33.1 and maintains strong buyer dominance.

SkyWater Technology outperformed STMicroelectronics by a wide margin, delivering the highest market returns with sustained bullish momentum throughout the period.

Target Prices

The current analyst consensus on target prices reflects a cautiously optimistic outlook for both STMicroelectronics N.V. and SkyWater Technology, Inc.

| Company | Target Low | Target High | Consensus |

|---|---|---|---|

| STMicroelectronics N.V. | 28 | 45 | 37.67 |

| SkyWater Technology, Inc. | 35 | 35 | 35 |

Analysts expect STMicroelectronics to trade well above its current price of $29.33, signaling upside potential. SkyWater’s consensus target matches its peak range, indicating a bullish stance despite recent volatility.

Don’t Let Luck Decide Your Entry Point

Optimize your entry points with our advanced ProRealTime indicators. You’ll get efficient buy signals with precise price targets for maximum performance. Start outperforming now!

How do institutions grade them?

Institutional grades for STMicroelectronics N.V. and SkyWater Technology, Inc. are as follows:

STMicroelectronics N.V. Grades

The table below summarizes recent grades from reputable grading companies for STMicroelectronics N.V.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| TD Cowen | Maintain | Buy | 2025-10-24 |

| Susquehanna | Maintain | Positive | 2025-10-22 |

| Susquehanna | Maintain | Positive | 2025-07-25 |

| Baird | Upgrade | Outperform | 2025-07-22 |

| Susquehanna | Maintain | Positive | 2025-07-22 |

| Jefferies | Upgrade | Buy | 2025-02-19 |

| Bernstein | Downgrade | Market Perform | 2025-02-05 |

| Susquehanna | Maintain | Positive | 2025-01-31 |

| Barclays | Downgrade | Underweight | 2025-01-22 |

| JP Morgan | Downgrade | Neutral | 2024-12-09 |

SkyWater Technology, Inc. Grades

The table below summarizes recent grades from reputable grading companies for SkyWater Technology, Inc.:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| TD Cowen | Downgrade | Hold | 2026-01-27 |

| Piper Sandler | Downgrade | Neutral | 2026-01-27 |

| Needham | Downgrade | Hold | 2026-01-27 |

| TD Cowen | Maintain | Buy | 2025-11-06 |

| Needham | Maintain | Buy | 2025-11-06 |

| Piper Sandler | Maintain | Overweight | 2025-11-06 |

| Needham | Maintain | Buy | 2025-08-07 |

| Needham | Maintain | Buy | 2025-05-08 |

| Needham | Maintain | Buy | 2025-02-27 |

| Needham | Maintain | Buy | 2024-11-11 |

Which company has the best grades?

STMicroelectronics N.V. has consistently strong grades, including multiple “Buy” and “Positive” ratings, with some downgrades. SkyWater Technology, Inc. shows recent downgrades but maintained several “Buy” ratings earlier. Investors may view STMicroelectronics as having a more stable and favorable institutional outlook.

Risks specific to each company

The following categories identify critical pressure points and systemic threats facing STMicroelectronics N.V. and SkyWater Technology, Inc. in the 2026 market environment:

1. Market & Competition

STMicroelectronics N.V.

- Operates globally with diversified segments, facing intense semiconductor competition.

SkyWater Technology, Inc.

- Smaller scale, niche focus in semiconductor manufacturing, competing with larger foundries.

2. Capital Structure & Debt

STMicroelectronics N.V.

- Low debt-to-equity at 0.12, strong interest coverage, signaling conservative leverage.

SkyWater Technology, Inc.

- High debt-to-equity at 1.33, weak interest coverage of 0.74, indicating financial risk.

3. Stock Volatility

STMicroelectronics N.V.

- Beta of 1.32 shows moderate volatility, typical for large-cap tech firms.

SkyWater Technology, Inc.

- High beta at 3.51, reflecting significant price swings and higher market risk.

4. Regulatory & Legal

STMicroelectronics N.V.

- Operates internationally, exposed to multi-jurisdictional regulations but with established compliance.

SkyWater Technology, Inc.

- US-focused, subject to evolving domestic regulations in semiconductor manufacturing and defense sectors.

5. Supply Chain & Operations

STMicroelectronics N.V.

- Complex global supply chain may face disruptions but benefits from scale and diversification.

SkyWater Technology, Inc.

- Smaller operation with potential supply chain vulnerabilities and less operational resilience.

6. ESG & Climate Transition

STMicroelectronics N.V.

- Large footprint requires robust ESG management; pressure to meet global sustainability standards.

SkyWater Technology, Inc.

- Emerging firm with opportunities to embed ESG practices early but lacks scale.

7. Geopolitical Exposure

STMicroelectronics N.V.

- Exposure to geopolitical tensions in Asia and Europe; diversified markets mitigate some risk.

SkyWater Technology, Inc.

- Primarily US-based, benefits from domestic policies supporting semiconductor independence.

Which company shows a better risk-adjusted profile?

STMicroelectronics’s most impactful risk lies in its complex global supply chain and geopolitical exposure. SkyWater’s key risk is financial instability due to high leverage and weak liquidity. Despite SkyWater’s growth potential, STMicroelectronics presents a better risk-adjusted profile, supported by a strong Altman Z-score of 4.03 and robust Piotroski score of 8. SkyWater’s grey-zone Z-score at 2.35 and average Piotroski score of 5 reflect moderate financial distress risk, warranting caution.

Final Verdict: Which stock to choose?

STMicroelectronics N.V. (STM) stands out for its robust balance sheet and strong liquidity, signaling a resilient cash machine. However, its declining profitability and value destruction remain points of vigilance. STM suits investors targeting steady, large-cap exposure with a tolerance for cyclical industry pressure.

SkyWater Technology, Inc. (SKYT) exhibits a strategic moat through its growing return on invested capital and accelerating revenue growth. Despite weaker liquidity and higher leverage than STM, SKYT offers a compelling growth story. It fits well within a GARP (Growth at a Reasonable Price) portfolio focused on emerging potential.

If you prioritize balance sheet strength and defensive positioning, STM is the compelling choice due to its liquidity and stable capital structure. However, if you seek growth with improving profitability and are comfortable with higher risk, SKYT outshines by delivering accelerating momentum and expanding margins. Both present analytical scenarios tailored to differing risk appetites and investment horizons.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of STMicroelectronics N.V. and SkyWater Technology, Inc. to enhance your investment decisions: