In the competitive realm of household and personal products, The Clorox Company (CLX) and Spectrum Brands Holdings, Inc. (SPB) stand out as influential players. Both companies operate across similar markets, offering diverse product lines that emphasize innovation and consumer needs. Their strategic approaches to growth and brand management invite comparison. This article will help you identify which company presents the most compelling opportunity for your investment portfolio.

Table of contents

Companies Overview

I will begin the comparison between The Clorox Company and Spectrum Brands Holdings, Inc. by providing an overview of these two companies and their main differences.

The Clorox Company Overview

The Clorox Company is a global manufacturer and marketer of consumer and professional products. Operating through Health and Wellness, Household, Lifestyle, and International segments, it offers a diverse range of cleaning, personal care, food, and wellness products under well-known brands like Clorox, Glad, Brita, and Burt’s Bees. Founded in 1913, it holds a strong market position in the Household & Personal Products industry.

Spectrum Brands Holdings, Inc. Overview

Spectrum Brands Holdings, Inc. is a branded consumer products company operating worldwide through Home and Personal Care, Global Pet Care, and Home and Garden segments. Its portfolio includes home appliances, personal care, pet products, and pest control solutions under numerous brands such as Black & Decker, IAMS, and Spectracide. Incorporated in 2009, Spectrum serves various retail and distribution channels in the same industry sector.

Key similarities and differences

Both companies operate in the Consumer Defensive sector with diversified product portfolios across household and personal care categories. Clorox emphasizes cleaning, wellness, and lifestyle products with a strong international footprint, while Spectrum has a broader pet care and home appliance presence. Clorox is larger by market cap and employee count, reflecting its established legacy, whereas Spectrum focuses on multi-segment branded consumer goods with a distinct emphasis on pet care and garden products.

Income Statement Comparison

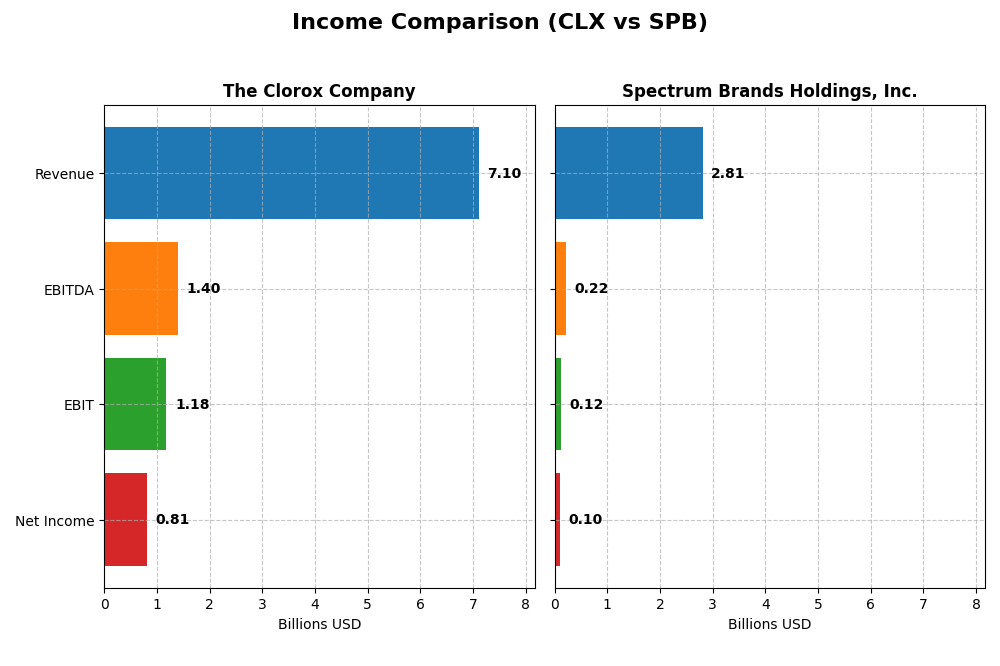

The following table compares key income statement metrics for The Clorox Company and Spectrum Brands Holdings, Inc. for their most recent fiscal year.

| Metric | The Clorox Company (CLX) | Spectrum Brands Holdings, Inc. (SPB) |

|---|---|---|

| Market Cap | 13B | 1.53B |

| Revenue | 7.10B | 2.81B |

| EBITDA | 1.40B | 215M |

| EBIT | 1.18B | 117M |

| Net Income | 810M | 100M |

| EPS | 6.56 | 3.88 |

| Fiscal Year | 2025 | 2025 |

Income Statement Interpretations

The Clorox Company

The Clorox Company’s revenue was relatively stable between 2021 and 2025, peaking at $7.39B in 2023 and slightly declining to $7.10B in 2025. Net income, however, showed strong growth from $149M in 2023 to $810M in 2025, with net margins improving to 11.4%. The latest year saw significant EBIT growth of 135%, evidencing better operational efficiency and margin expansion.

Spectrum Brands Holdings, Inc.

Spectrum Brands experienced a downward trend in revenue, falling from $3.14B in 2022 to $2.81B in 2025, alongside a volatile net income pattern. The net margin remained modest at 3.56% in 2025, with a notable decline in EBIT by 36% in the last year. The overall period was marked by negative growth in revenue, net income, and earnings per share, signaling operational challenges.

Which one has the stronger fundamentals?

The Clorox Company demonstrates stronger fundamentals with consistently favorable gross and EBIT margins, robust net income growth, and improved profitability metrics over the period. In contrast, Spectrum Brands shows unfavorable trends in revenue and earnings accompanied by weaker margin stability. Clorox’s stable margins and positive earnings trajectory position it ahead in fundamental strength based solely on income statement evaluation.

Financial Ratios Comparison

The table below presents a side-by-side comparison of key financial ratios for The Clorox Company (CLX) and Spectrum Brands Holdings, Inc. (SPB) based on their most recent fiscal year data.

| Ratios | The Clorox Company (CLX) | Spectrum Brands Holdings, Inc. (SPB) |

|---|---|---|

| ROE | 2.52% | 5.23% |

| ROIC | 24.14% | 4.95% |

| P/E | 18.31 | 13.51 |

| P/B | 46.20 | 0.71 |

| Current Ratio | 0.84 | 2.26 |

| Quick Ratio | 0.57 | 1.41 |

| D/E (Debt-to-Equity) | 8.97 | 0.34 |

| Debt-to-Assets | 51.79% | 19.36% |

| Interest Coverage | 11.67 | 4.16 |

| Asset Turnover | 1.28 | 0.83 |

| Fixed Asset Turnover | 4.44 | 8.55 |

| Payout Ratio | 74.32% | 48.25% |

| Dividend Yield | 4.06% | 3.57% |

Interpretation of the Ratios

The Clorox Company

The Clorox Company shows strong profitability ratios with a net margin of 11.4% and a very high return on equity at 252.34%, indicating efficient use of equity. However, its liquidity ratios are weak, with a current ratio of 0.84 and a high debt-to-equity ratio of 8.97, raising concerns about short-term financial flexibility. The company pays a dividend yielding 4.06%, supported by favorable coverage ratios, though high leverage may pose risks.

Spectrum Brands Holdings, Inc.

Spectrum Brands exhibits weaker profitability with a net margin of 3.56% and a modest return on equity of 5.23%. Its liquidity position is strong, highlighted by a current ratio of 2.26 and low leverage at 0.34 debt-to-equity, suggesting better short-term solvency. The dividend yield stands at 3.57%, with generally favorable payout metrics, underpinned by a conservative capital structure and solid asset turnover.

Which one has the best ratios?

Comparing the two, The Clorox Company excels in profitability and return metrics but struggles in liquidity and leverage, while Spectrum Brands offers better liquidity and lower debt with moderate profitability. Both maintain favorable overall evaluations, yet their strengths and weaknesses differ significantly, reflecting contrasting financial profiles and risk exposures.

Strategic Positioning

This section compares the strategic positioning of The Clorox Company and Spectrum Brands Holdings, Inc., including market position, key segments, and exposure to technological disruption:

The Clorox Company

- Large market cap of 13B USD with broad competitive presence in household products.

- Diverse segments: Health and Wellness, Household, Lifestyle, International.

- No explicit mention of technological disruption exposure.

Spectrum Brands Holdings, Inc.

- Smaller market cap of 1.5B USD, facing moderate competitive pressure.

- Three main segments: Home and Personal Care, Global Pet Care, Home and Garden.

- No explicit mention of technological disruption exposure.

The Clorox Company vs Spectrum Brands Holdings, Inc. Positioning

The Clorox Company has a diversified portfolio across multiple consumer product categories and international markets, enhancing revenue streams. Spectrum Brands concentrates on pet care, home, and personal care segments, potentially limiting diversification but focusing on specialized markets.

Which has the best competitive advantage?

The Clorox Company demonstrates a very favorable moat with growing ROIC well above WACC, indicating strong value creation and durable competitive advantage. Spectrum Brands shows slightly unfavorable moat status, shedding value despite improving profitability.

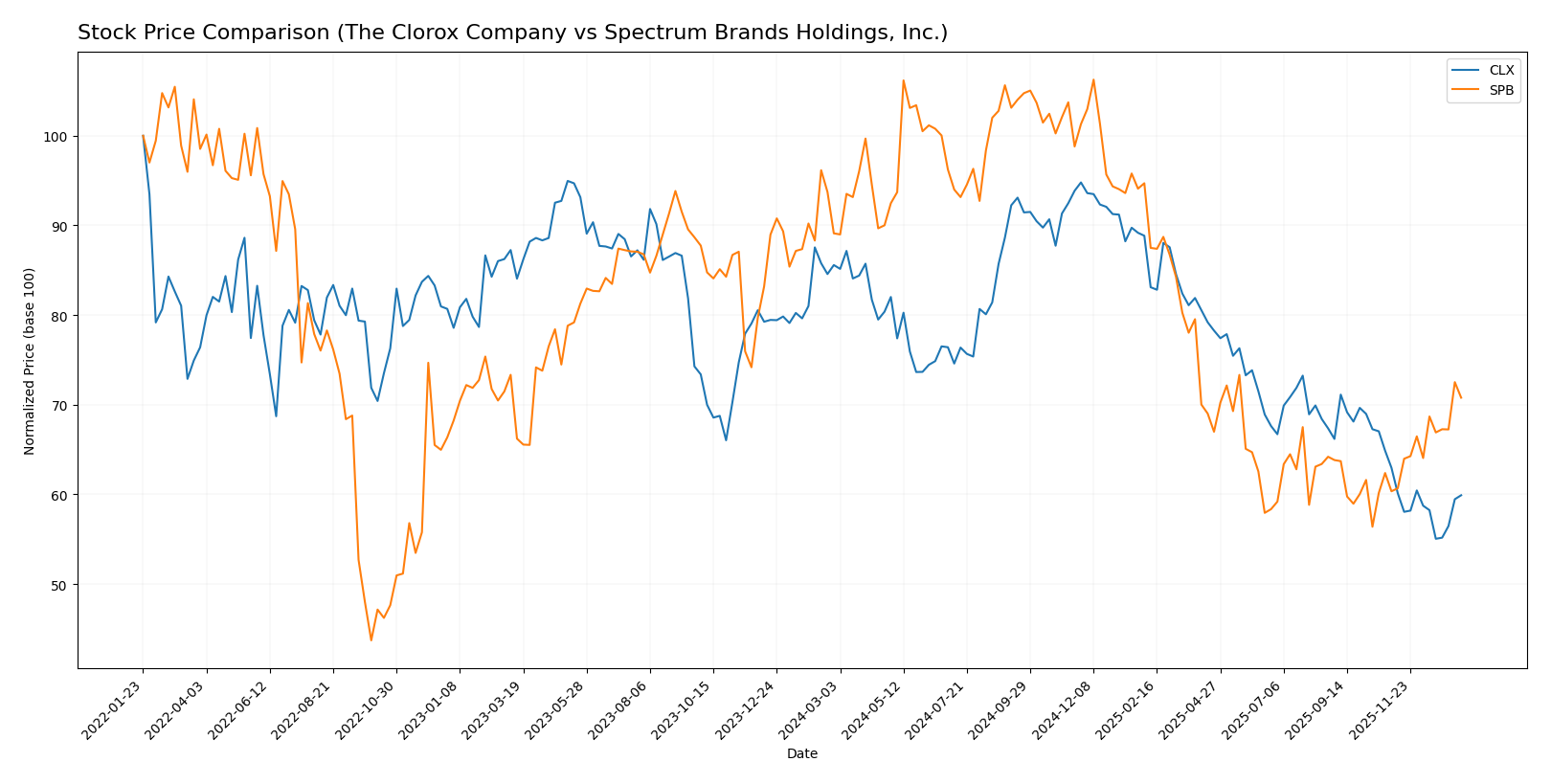

Stock Comparison

The stock price movements over the past 12 months reveal distinct bearish trends for both The Clorox Company and Spectrum Brands Holdings, Inc., with The Clorox Company experiencing greater losses and decelerating declines while Spectrum Brands shows recent bullish momentum amid accelerating losses.

Trend Analysis

The Clorox Company (CLX) shows a -30.01% price change over the past year, confirming a bearish trend with decelerating declines and high volatility (std deviation 19.09). Recent months continue a mild negative slope.

Spectrum Brands Holdings, Inc. (SPB) experienced a -20.57% price change over the same period, also bearish but with accelerating declines. Recently, SPB reversed with a 17.3% gain and a positive slope, indicating short-term bullish momentum.

Comparing both, CLX delivered the largest overall loss, while SPB, despite yearly declines, has shown stronger recent market performance with a notable price recovery.

Target Prices

The current analyst consensus provides clear target price ranges for The Clorox Company and Spectrum Brands Holdings, Inc.

| Company | Target High | Target Low | Consensus |

|---|---|---|---|

| The Clorox Company | 152 | 94 | 118.33 |

| Spectrum Brands Holdings, Inc. | 75 | 75 | 75 |

Analysts expect Clorox’s stock to appreciate moderately from its current price of 106.98, while Spectrum Brands’ target price of 75 suggests upside potential from its current 63.20.

Analyst Opinions Comparison

This section compares analysts’ ratings and grades for The Clorox Company and Spectrum Brands Holdings, Inc.:

Rating Comparison

CLX Rating

- Rating: B- indicating a very favorable evaluation.

- Discounted Cash Flow Score: 5, very favorable, suggests strong future cash flow projections.

- ROE Score: 1, very unfavorable, showing low efficiency in generating profit from equity.

- ROA Score: 5, very favorable, indicating highly effective asset utilization.

- Debt To Equity Score: 1, very unfavorable, implying higher financial risk due to debt levels.

- Overall Score: 3, moderate, reflecting a balanced overall financial standing.

SPB Rating

- Rating: B indicating a very favorable evaluation.

- Discounted Cash Flow Score: 1, very unfavorable, indicating weaker future cash flow projections.

- ROE Score: 2, moderate, showing somewhat better profit generation from equity.

- ROA Score: 3, moderate, indicating average asset utilization effectiveness.

- Debt To Equity Score: 3, moderate, suggesting a balanced approach to financial leverage.

- Overall Score: 3, moderate, reflecting a balanced overall financial standing.

Which one is the best rated?

Based strictly on the provided data, Spectrum Brands holds a slightly better overall rating (B vs. B-) with more moderate scores across key financial metrics, while Clorox shows extremes with strong cash flow and asset use but weak equity returns and higher debt risk.

Scores Comparison

The following table presents a comparison of the Altman Z-Score and Piotroski Score for Clorox and Spectrum Brands Holdings, Inc.:

CLX Scores

- Altman Z-Score: 3.27, indicating a safe zone, low bankruptcy risk.

- Piotroski Score: 5, classified as average financial strength.

SPB Scores

- Altman Z-Score: 1.77, indicating distress zone, higher bankruptcy risk.

- Piotroski Score: 6, classified as average financial strength.

Which company has the best scores?

Based on the provided data, Clorox has a stronger Altman Z-Score, placing it in the safe zone, whereas Spectrum Brands is in the distress zone. Both companies have average Piotroski scores, with Spectrum Brands slightly higher. Overall, Clorox shows better financial stability.

Grades Comparison

Here is a comparison of recent stock grades from recognized grading companies for The Clorox Company and Spectrum Brands Holdings, Inc.:

The Clorox Company Grades

The table below summarizes recent grades from established financial institutions for Clorox:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| TD Cowen | Hold | Hold | 2026-01-08 |

| Goldman Sachs | Sell | Sell | 2026-01-07 |

| Wells Fargo | Hold | Equal Weight | 2026-01-05 |

| Citigroup | Hold | Neutral | 2025-12-17 |

| Morgan Stanley | Hold | Equal Weight | 2025-11-04 |

| JP Morgan | Hold | Neutral | 2025-11-04 |

| Wells Fargo | Hold | Equal Weight | 2025-11-04 |

| Citigroup | Hold | Neutral | 2025-11-04 |

| JP Morgan | Hold | Neutral | 2025-10-10 |

| Citigroup | Hold | Neutral | 2025-10-09 |

Overall, the grades for The Clorox Company are consistently neutral to hold, indicating a stable but cautious outlook.

Spectrum Brands Holdings, Inc. Grades

The table below summarizes recent grades from recognized grading companies for Spectrum Brands:

| Grading Company | Action | New Grade | Date |

|---|---|---|---|

| Canaccord Genuity | Buy | Buy | 2025-11-17 |

| Wells Fargo | Hold | Equal Weight | 2025-11-14 |

| Wells Fargo | Hold | Equal Weight | 2025-09-25 |

| Canaccord Genuity | Buy | Buy | 2025-08-08 |

| Wells Fargo | Hold | Equal Weight | 2025-07-09 |

| Canaccord Genuity | Buy | Buy | 2025-06-25 |

| UBS | Buy | Buy | 2025-05-09 |

| UBS | Buy | Buy | 2025-04-17 |

| Wells Fargo | Hold | Equal Weight | 2025-04-16 |

| Wells Fargo | Hold | Equal Weight | 2025-04-02 |

Spectrum Brands exhibits a stronger bias toward buying recommendations, with multiple buy ratings sustained over time.

Which company has the best grades?

Spectrum Brands Holdings, Inc. has received generally more favorable grades with a consensus of “Buy” supported by multiple buy ratings, compared to The Clorox Company’s consistent “Hold” consensus. This suggests Spectrum may be viewed as offering better growth or value potential by analysts, which could influence investor confidence differently.

Strengths and Weaknesses

Below is a comparative overview of key strengths and weaknesses of The Clorox Company (CLX) and Spectrum Brands Holdings, Inc. (SPB) based on their latest financial and operational data.

| Criterion | The Clorox Company (CLX) | Spectrum Brands Holdings, Inc. (SPB) |

|---|---|---|

| Diversification | Diversified product segments: Health & Wellness (2.7B), Household (2.0B), International (1.1B), Lifestyle (1.3B) | Diversified segments: Global Pet Supplies (1.1B), Home & Personal Care (1.2B), Home & Garden (0.57B) |

| Profitability | High profitability: Net margin 11.4%, ROIC 24.1%, ROE 252.3% | Lower profitability: Net margin 3.6%, ROIC 4.95%, ROE 5.2% |

| Innovation | Strong innovation with growing ROIC (+13.7%) and a very favorable moat | Improving profitability with growing ROIC (+255%), but still shedding value, slightly unfavorable moat |

| Global presence | Significant international revenue (1.1B) indicating global reach | Global presence through pet supplies and home care segments, but smaller international footprint |

| Market Share | Strong market position supported by durable competitive advantage | Market share challenged by value destruction, though improving profitability trends |

The Clorox Company stands out with robust profitability, a durable competitive advantage, and a well-diversified product portfolio with global reach. Spectrum Brands shows promising growth in profitability but currently struggles with value creation and lower margins, signaling higher investment risk despite diversification.

Risk Analysis

Below is a comparative table highlighting key risks for The Clorox Company (CLX) and Spectrum Brands Holdings, Inc. (SPB) based on the most recent data from 2025.

| Metric | The Clorox Company (CLX) | Spectrum Brands Holdings, Inc. (SPB) |

|---|---|---|

| Market Risk | Moderate (Beta 0.575) | Moderate (Beta 0.681) |

| Debt level | High (D/E 8.97, Debt/Assets 51.79%) | Low (D/E 0.34, Debt/Assets 19.36%) |

| Regulatory Risk | Moderate (Consumer products regulations) | Moderate (Consumer products regulations) |

| Operational Risk | Moderate (Global supply chain and brand portfolio) | Moderate (Diverse product lines, global operations) |

| Environmental Risk | Moderate (Sustainability pressures) | Moderate (Sustainability and compliance focus) |

| Geopolitical Risk | Low to Moderate (International segment exposure) | Low to Moderate (Global operations exposure) |

The most impactful risk for Clorox is its high debt level, raising financial leverage concerns despite favorable profitability and liquidity challenges (current and quick ratios below 1). Spectrum Brands shows financial distress potential with an Altman Z-Score in the distress zone, signaling bankruptcy risk, while managing lower debt but facing weaker profitability. Both companies face moderate regulatory and environmental risks typical for consumer goods sectors. Investors should weigh Clorox’s leverage risk against its strong returns and SPB’s financial instability despite lower debt.

Which Stock to Choose?

The Clorox Company (CLX) shows a generally favorable income evolution with strong profitability metrics, including an 11.4% net margin and a 252% ROE, despite slight revenue decline. Its debt profile is less favorable, reflected in a low current ratio and high debt-to-equity ratio, but its overall rating is very favorable with a durable economic moat.

Spectrum Brands Holdings, Inc. (SPB) exhibits an unfavorable income trend marked by declining revenues and net income, coupled with modest profitability metrics such as a 3.56% net margin and 5.23% ROE. However, it benefits from a stronger balance sheet with low leverage and favorable liquidity ratios, and holds a slightly unfavorable moat status with a moderate overall rating.

Investors prioritizing sustainable profitability and competitive advantage might find CLX more favorable due to its strong income statement and economic moat, while those valuing financial stability and lower leverage could perceive SPB as preferable despite its weaker income profile. The choice could depend on whether the investor favors growth and quality or balance sheet strength and risk mitigation.

Disclaimer: Investment carries a risk of loss of initial capital. The past performance is not a reliable indicator of future results. Be sure to understand risks before making an investment decision.

Go Further

I encourage you to read the complete analyses of The Clorox Company and Spectrum Brands Holdings, Inc. to enhance your investment decisions: